444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking market stands at the forefront of technological innovation, transforming the banking landscape across the region. Intelligent Virtual Assistants, powered by artificial intelligence and natural language processing, are redefining customer interactions, operational efficiency, and the overall banking experience. This comprehensive market overview delves into the key dynamics, trends, and challenges shaping the adoption and evolution of Intelligent Virtual Assistants in the banking sector in Asia-Pacific.

Meaning: Intelligent Virtual Assistants in banking refer to advanced digital entities that leverage artificial intelligence to understand and respond to user queries and commands. These virtual assistants, often driven by sophisticated natural language processing algorithms, are designed to enhance customer engagement, streamline banking processes, and provide personalized services in the Asia-Pacific region.

Executive Summary: The executive summary encapsulates the transformative impact of Intelligent Virtual Assistants on the banking landscape in Asia-Pacific. From elevating customer experiences and improving operational efficiency to fostering financial inclusivity, the summary provides a succinct overview of the multifaceted benefits that Intelligent Virtual Assistants bring to the banking industry in the region.

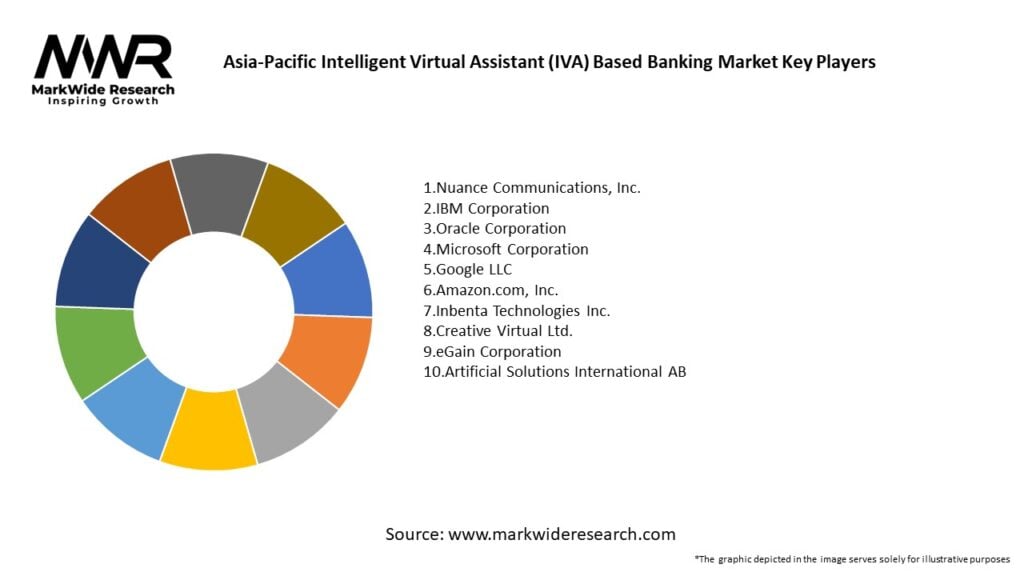

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The dynamics of the Asia-Pacific Intelligent Virtual Assistant Based Banking market are shaped by a combination of technological innovations, regulatory frameworks, customer expectations, and the strategic imperatives of banks looking to stay ahead in a rapidly evolving industry. Navigating these dynamics is pivotal for stakeholders aiming to leverage Intelligent Virtual Assistants effectively.

Regional Analysis: The adoption of Intelligent Virtual Assistants in banking varies across regions in Asia-Pacific, influenced by factors such as technological infrastructure, regulatory environments, and cultural nuances.

Competitive Landscape:

Leading Companies in Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Intelligent Virtual Assistant Based Banking market in Asia-Pacific can be segmented based on various factors:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides a strategic understanding of the Asia-Pacific Intelligent Virtual Assistant Based Banking market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic accelerated the adoption of Intelligent Virtual Assistants in banking, with a heightened focus on contactless solutions, remote customer support, and the need for resilient and automated banking services.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Asia-Pacific Intelligent Virtual Assistant Based Banking market is optimistic, with sustained growth anticipated as banks continue to invest in cutting-edge technologies. The evolution of Intelligent Virtual Assistants towards more sophisticated, user-centric, and secure solutions will shape the banking landscape across the Asia-Pacific region.

Conclusion: In conclusion, the Asia-Pacific Intelligent Virtual Assistant Based Banking market represents a pivotal intersection of technological innovation, customer-centricity, and financial inclusivity. As these virtual assistants continue to redefine the banking experience, stakeholders in the region have the opportunity to navigate challenges, capitalize on emerging trends, and contribute to a future where banking services are not just efficient but also highly personalized and accessible. The dynamic landscape of the Asia-Pacific Intelligent Virtual Assistant Based Banking market promises a transformative journey towards a more digitally integrated and customer-focused banking ecosystem.

What is Intelligent Virtual Assistant (IVA) Based Banking?

Intelligent Virtual Assistant (IVA) Based Banking refers to the use of AI-driven virtual assistants in the banking sector to enhance customer service, streamline operations, and provide personalized financial advice. These systems can handle inquiries, process transactions, and assist with account management, improving overall customer experience.

What are the key players in the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market?

Key players in the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market include banks and technology firms such as HSBC, Bank of America, Infosys, and Nuance Communications, among others. These companies are leveraging AI technologies to develop innovative solutions for banking services.

What are the growth factors driving the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market?

The growth of the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market is driven by increasing demand for enhanced customer service, the need for operational efficiency, and the rising adoption of AI technologies in financial services. Additionally, the growing trend of digital banking is contributing to the market’s expansion.

What challenges does the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market face?

Challenges in the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market include concerns over data privacy and security, the complexity of integrating AI systems with existing banking infrastructure, and the need for continuous updates to keep up with evolving customer expectations.

What opportunities exist in the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market?

Opportunities in the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market include the potential for expanding services to underserved populations, the ability to offer personalized financial products, and the integration of advanced analytics for better customer insights. These factors can lead to increased customer loyalty and market share.

What trends are shaping the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market?

Trends shaping the Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market include the rise of conversational AI, the integration of voice recognition technology, and the growing use of chatbots for customer engagement. These innovations are enhancing user experience and driving the adoption of virtual assistants in banking.

Asia-Pacific Intelligent Virtual Assistant (IVA) Based Banking Market

| Segmentation Details | Description |

|---|---|

| End User | Retail Banking, Commercial Banking, Investment Banking, Online Banking |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

| Technology | Natural Language Processing, Machine Learning, Speech Recognition, Chatbot |

| Service Type | Customer Support, Personal Finance Management, Fraud Detection, Account Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at