444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific industrial waste management market represents one of the most dynamic and rapidly evolving sectors in the global environmental services industry. This comprehensive market encompasses the collection, treatment, recycling, and disposal of industrial waste generated across diverse manufacturing sectors throughout the Asia-Pacific region. Industrial waste management has become increasingly critical as countries like China, India, Japan, South Korea, and Southeast Asian nations continue to experience robust industrial growth while simultaneously implementing stricter environmental regulations.

Market dynamics in the Asia-Pacific region are characterized by significant growth potential, driven by expanding manufacturing activities, urbanization trends, and heightened environmental awareness. The region’s industrial waste management sector is experiencing substantial transformation, with traditional disposal methods giving way to advanced treatment technologies and circular economy principles. Growth rates in this market are projected to maintain a strong 8.2% CAGR over the forecast period, reflecting the increasing demand for comprehensive waste management solutions.

Regional variations across the Asia-Pacific landscape present unique opportunities and challenges for industrial waste management providers. Developed markets such as Japan and Australia demonstrate sophisticated waste treatment infrastructure, while emerging economies including Vietnam, Thailand, and Indonesia are rapidly modernizing their industrial waste management capabilities. This diversity creates a complex but rewarding market environment for service providers and technology companies.

The Asia-Pacific industrial waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to handling industrial waste generated by manufacturing, processing, and production facilities across the Asia-Pacific region. This market encompasses various waste streams including hazardous chemicals, electronic waste, construction debris, manufacturing byproducts, and industrial sludge.

Industrial waste management involves multiple integrated processes designed to minimize environmental impact while maximizing resource recovery. These processes include waste characterization, collection and transportation, treatment and processing, recycling and recovery, and final disposal. The market serves diverse industrial sectors including automotive, electronics, pharmaceuticals, chemicals, textiles, food processing, and heavy manufacturing.

Stakeholders in this market include waste management service providers, technology vendors, regulatory authorities, industrial generators, recycling companies, and environmental consultants. The market’s scope extends beyond traditional waste disposal to encompass innovative solutions such as waste-to-energy conversion, material recovery, and circular economy initiatives that transform waste streams into valuable resources.

Market leadership in the Asia-Pacific industrial waste management sector is being redefined by technological innovation, regulatory compliance, and sustainability imperatives. The region’s industrial waste management market demonstrates exceptional growth potential, supported by increasing industrial production, stricter environmental regulations, and growing corporate sustainability commitments. Key drivers include rapid industrialization, urbanization trends, and the implementation of circular economy principles across major economies.

Technology adoption is accelerating throughout the region, with advanced treatment methods, digitalization, and automation transforming traditional waste management practices. Smart waste management systems, IoT-enabled monitoring, and artificial intelligence applications are becoming increasingly prevalent, improving operational efficiency by approximately 35% in leading facilities. These technological advances are enabling more precise waste characterization, optimized collection routes, and enhanced treatment processes.

Regulatory frameworks across Asia-Pacific countries are becoming increasingly stringent, driving demand for compliant waste management solutions. Countries such as China, Japan, and South Korea have implemented comprehensive waste management policies that require industrial generators to adopt best practices in waste handling and disposal. This regulatory evolution is creating significant opportunities for specialized service providers and technology companies.

Market segmentation reveals diverse opportunities across waste types, treatment methods, and end-user industries. Hazardous waste management represents the fastest-growing segment, while electronic waste recycling is gaining prominence due to the region’s position as a global electronics manufacturing hub. The integration of waste-to-energy technologies is also driving market expansion, particularly in countries with limited landfill capacity.

Strategic insights from comprehensive market analysis reveal several critical trends shaping the Asia-Pacific industrial waste management landscape:

Market penetration varies significantly across the region, with developed markets showing 75% adoption rates for advanced waste management practices, while emerging markets present substantial growth opportunities as they modernize their industrial waste management capabilities.

Industrial expansion across the Asia-Pacific region serves as the primary driver for waste management market growth. Rapid industrialization in countries such as India, Vietnam, and Indonesia is generating increasing volumes of industrial waste, creating sustained demand for comprehensive management solutions. Manufacturing growth in key sectors including electronics, automotive, pharmaceuticals, and chemicals is particularly significant in driving market expansion.

Regulatory enforcement represents another critical driver, as governments throughout the region implement stricter environmental standards and waste management requirements. China’s National Sword policy, Japan’s circular economy initiatives, and India’s Plastic Waste Management Rules exemplify the regulatory trends driving market growth. These policies are compelling industrial generators to invest in compliant waste management solutions and professional services.

Environmental awareness among corporations and consumers is accelerating demand for sustainable waste management practices. Corporate sustainability commitments, ESG reporting requirements, and stakeholder pressure are driving companies to adopt comprehensive waste management strategies that minimize environmental impact. This trend is particularly pronounced among multinational corporations operating in the region.

Urbanization trends are creating concentrated industrial zones that require sophisticated waste management infrastructure. As cities expand and industrial parks develop, the need for efficient waste collection, treatment, and disposal systems becomes increasingly critical. Urban planning initiatives increasingly incorporate waste management considerations, creating opportunities for integrated solutions.

Technology advancement is enabling more efficient and cost-effective waste management solutions, making professional services more attractive to industrial generators. Innovations in waste treatment, recycling technologies, and digital management systems are improving service quality while reducing costs, driving increased market adoption.

High capital requirements for establishing comprehensive waste management infrastructure represent a significant market restraint, particularly in emerging economies. The substantial investments required for treatment facilities, transportation fleets, and technology systems can limit market entry for smaller service providers and delay infrastructure development in underserved regions.

Regulatory complexity across different countries creates challenges for regional service providers seeking to expand their operations. Varying environmental standards, permitting requirements, and compliance procedures can complicate business expansion and increase operational costs. Cross-border regulations for waste transportation and treatment add additional complexity to regional operations.

Technical expertise shortages in specialized waste treatment and management represent a constraint on market growth. The need for qualified personnel to operate advanced treatment systems, ensure regulatory compliance, and manage complex waste streams can limit service provider capabilities and expansion plans.

Infrastructure limitations in some regions restrict the development of comprehensive waste management networks. Inadequate transportation infrastructure, limited treatment facility capacity, and insufficient disposal sites can constrain market growth and service quality in certain areas.

Economic volatility can impact industrial production levels and waste generation volumes, creating uncertainty for waste management service providers. Economic downturns may lead to reduced industrial activity and corresponding decreases in waste management service demand.

Circular economy initiatives present substantial opportunities for innovative waste management solutions that transform waste streams into valuable resources. The growing emphasis on resource recovery, material recycling, and waste-to-energy conversion creates new revenue streams and business models for market participants. Resource recovery technologies are showing potential for 60% efficiency improvements in material utilization.

Digital transformation opportunities are emerging as industrial generators seek smart waste management solutions that provide real-time monitoring, predictive analytics, and optimized operations. IoT-enabled waste management systems, blockchain-based tracking, and AI-powered optimization represent significant growth areas for technology-focused service providers.

Regional expansion opportunities exist as emerging economies modernize their industrial waste management capabilities. Countries such as Bangladesh, Myanmar, and Cambodia present untapped markets for comprehensive waste management services as their industrial sectors develop and environmental regulations strengthen.

Specialized services for high-value waste streams such as electronic waste, pharmaceutical waste, and rare earth materials offer premium pricing opportunities. The Asia-Pacific region’s position as a global manufacturing hub creates substantial volumes of specialized waste requiring expert handling and processing.

Public-private partnerships are creating opportunities for collaborative infrastructure development and service delivery models. Government initiatives to improve waste management capabilities through private sector expertise and investment are opening new market segments and revenue opportunities.

Competitive dynamics in the Asia-Pacific industrial waste management market are characterized by intense competition among regional and international service providers. Market leaders are differentiating themselves through technological innovation, comprehensive service offerings, and regulatory expertise. Market consolidation trends are evident as larger companies acquire specialized providers to expand their capabilities and geographic reach.

Technology evolution is reshaping market dynamics by enabling new service delivery models and improving operational efficiency. Advanced treatment technologies, digital management systems, and automation are creating competitive advantages for early adopters while challenging traditional service providers to modernize their operations.

Customer expectations are evolving toward comprehensive, integrated waste management solutions that provide transparency, compliance assurance, and sustainability benefits. Industrial generators increasingly prefer single-source providers capable of handling diverse waste streams while ensuring regulatory compliance and environmental responsibility.

Pricing dynamics reflect the balance between service quality, regulatory compliance, and cost efficiency. Premium pricing is sustainable for specialized services and advanced technologies, while commodity waste streams face pricing pressure from competition and economic cycles.

Supply chain integration is becoming increasingly important as waste management providers seek to optimize collection routes, treatment processes, and resource recovery operations. Vertical integration and strategic partnerships are common strategies for improving operational efficiency and service quality.

Comprehensive research methodology employed for this market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include extensive interviews with industry executives, regulatory officials, and key stakeholders across major Asia-Pacific markets. Survey data from industrial waste generators provides insights into service requirements, satisfaction levels, and future needs.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and company financial statements. Market data validation involves cross-referencing multiple sources and conducting expert interviews to verify key findings and projections.

Quantitative analysis includes statistical modeling, trend analysis, and forecasting methodologies to project market growth and identify key drivers. Qualitative research provides context for market dynamics, competitive positioning, and strategic implications.

Regional analysis methodology involves country-specific research to understand local market conditions, regulatory environments, and competitive landscapes. This approach ensures that regional variations and unique market characteristics are accurately captured and analyzed.

Data triangulation techniques are employed to validate findings and ensure research reliability. Multiple analytical approaches and data sources are used to confirm key insights and market projections.

China dominates the Asia-Pacific industrial waste management market, accounting for approximately 45% of regional market share. The country’s massive industrial base, strict environmental regulations, and government investment in waste management infrastructure drive substantial market activity. Chinese market characteristics include advanced treatment technologies, significant government support, and growing emphasis on circular economy principles.

Japan represents the most mature market in the region, with sophisticated waste management infrastructure and advanced recycling capabilities. The Japanese market demonstrates 85% adoption rates for advanced waste treatment technologies and serves as a technology leader for the broader region. Innovation focus in Japan emphasizes resource recovery, waste-to-energy conversion, and digital management systems.

India presents exceptional growth opportunities as the country modernizes its industrial waste management capabilities. Rapid industrialization, urbanization, and strengthening environmental regulations are driving significant market expansion. Indian market growth is supported by government initiatives, foreign investment, and increasing corporate sustainability commitments.

South Korea demonstrates advanced waste management practices with strong government support for circular economy initiatives. The country’s focus on technology innovation and environmental sustainability creates opportunities for advanced waste management solutions and resource recovery technologies.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Malaysia show strong growth potential as their industrial sectors expand and environmental regulations strengthen. These markets present opportunities for both basic infrastructure development and advanced technology deployment.

Australia and New Zealand represent mature markets with sophisticated regulatory frameworks and advanced waste management practices. These countries serve as testing grounds for innovative technologies and sustainable waste management approaches.

Market leadership in the Asia-Pacific industrial waste management sector is distributed among several categories of companies, including multinational service providers, regional specialists, and technology companies. Competitive positioning is based on service capabilities, geographic coverage, technological innovation, and regulatory expertise.

Leading companies in the market include:

Competitive strategies focus on technological innovation, geographic expansion, service diversification, and strategic partnerships. Companies are investing heavily in digital technologies, advanced treatment systems, and sustainable solutions to differentiate their offerings and capture market share.

Market consolidation trends are evident as larger companies acquire specialized providers to expand their capabilities and market presence. Strategic partnerships between technology companies and service providers are also common, enabling rapid deployment of innovative solutions.

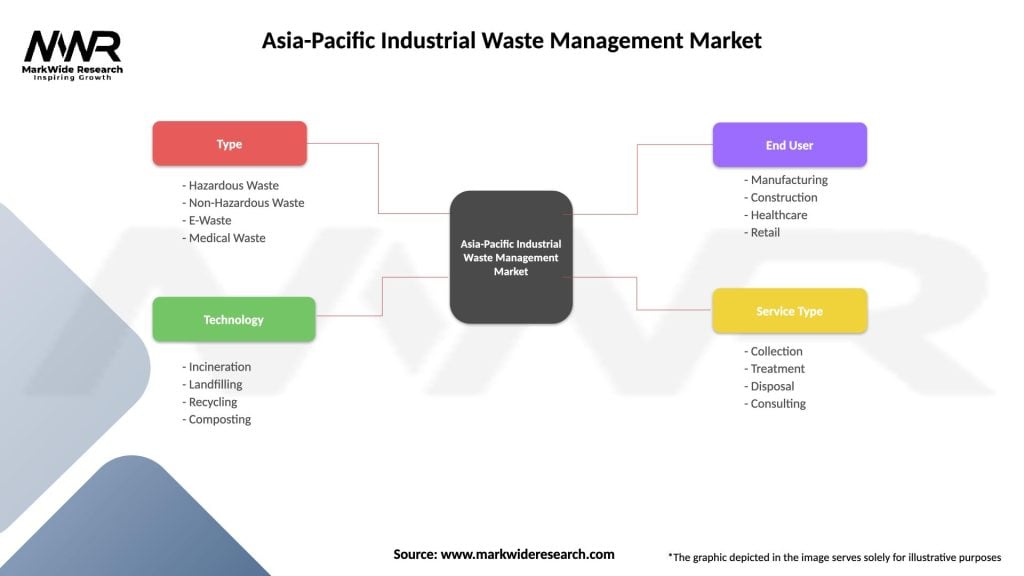

By Waste Type:

By Treatment Method:

By End-User Industry:

By Service Type:

Hazardous waste management represents the highest-value segment of the Asia-Pacific industrial waste management market, driven by strict regulatory requirements and specialized handling needs. This category shows strong growth potential with increasing industrial chemical production and tightening environmental regulations. Treatment technologies for hazardous waste are becoming increasingly sophisticated, incorporating advanced chemical treatment, thermal processing, and secure disposal methods.

Electronic waste recycling is experiencing rapid growth due to the region’s position as a global electronics manufacturing hub and increasing consumer electronics consumption. The segment benefits from valuable material recovery opportunities and growing regulatory focus on e-waste management. Recovery rates for precious metals and rare earth elements are improving with advanced processing technologies.

Manufacturing waste represents the largest volume segment, encompassing diverse waste streams from automotive, textiles, food processing, and general manufacturing industries. This category is characterized by opportunities for resource recovery, recycling, and waste-to-energy conversion. Circular economy principles are increasingly applied to manufacturing waste streams.

Biomedical and pharmaceutical waste requires specialized handling and treatment due to regulatory requirements and safety considerations. This high-value segment is growing with expanding pharmaceutical manufacturing in the region and increasing healthcare industry development.

Construction and demolition waste presents significant opportunities for material recovery and recycling, particularly in rapidly urbanizing markets. Advanced sorting and processing technologies are enabling higher recovery rates for construction materials.

Industrial generators benefit from comprehensive waste management solutions that ensure regulatory compliance, reduce environmental liability, and support sustainability goals. Professional waste management services provide expertise, infrastructure, and technology that would be costly for individual companies to develop internally. Cost optimization through efficient waste handling and resource recovery can reduce overall waste management expenses.

Service providers benefit from growing market demand, opportunities for service expansion, and premium pricing for specialized capabilities. The market offers multiple revenue streams including collection services, treatment operations, consulting, and technology solutions. Market growth provides opportunities for geographic expansion and service diversification.

Technology companies benefit from increasing demand for advanced waste treatment systems, digital management platforms, and monitoring technologies. Innovation opportunities in areas such as IoT, artificial intelligence, and advanced materials processing create competitive advantages and premium pricing opportunities.

Government agencies benefit from improved environmental outcomes, regulatory compliance, and public health protection through professional waste management services. Public-private partnerships enable efficient infrastructure development and service delivery while leveraging private sector expertise and investment.

Communities and society benefit from reduced environmental impact, improved public health outcomes, and resource conservation through professional waste management practices. Environmental benefits include reduced pollution, conserved natural resources, and climate change mitigation through waste-to-energy and recycling programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing industrial waste management through IoT sensors, data analytics, and automated systems. Smart waste management platforms provide real-time monitoring, predictive maintenance, and optimized operations, improving efficiency by approximately 40% in advanced facilities. Blockchain technology is being implemented for waste tracking and compliance documentation.

Circular economy adoption is driving fundamental changes in waste management approaches, emphasizing resource recovery, material recycling, and waste-to-energy conversion. Industrial generators are increasingly seeking waste management partners that can support their circular economy initiatives and sustainability goals.

Regulatory harmonization efforts across the region are creating more consistent standards and requirements, facilitating regional service provider expansion and improving compliance efficiency. International cooperation on waste management standards is reducing regulatory complexity for multinational operations.

Technology integration is enabling more sophisticated waste treatment and processing capabilities. Advanced sorting systems, chemical treatment processes, and energy recovery technologies are improving waste management outcomes while creating new revenue opportunities.

Sustainability focus is driving demand for environmentally responsible waste management solutions that minimize environmental impact and support corporate ESG goals. Companies are increasingly evaluating waste management providers based on their sustainability performance and environmental credentials.

Public-private partnerships are becoming more common as governments seek to leverage private sector expertise and investment to improve waste management infrastructure and services. These partnerships are accelerating infrastructure development and service quality improvements.

Infrastructure investments across the region are expanding waste treatment capacity and improving service capabilities. Major facility developments in China, India, and Southeast Asia are addressing capacity constraints and enabling service expansion. Government funding and private investment are supporting these infrastructure improvements.

Technology partnerships between waste management companies and technology providers are accelerating innovation deployment. Collaborative development of advanced treatment systems, digital platforms, and monitoring technologies is improving service quality and operational efficiency.

Regulatory updates in major markets are strengthening environmental standards and waste management requirements. China’s updated environmental protection laws, India’s waste management rules, and Japan’s circular economy initiatives are reshaping market dynamics and creating new opportunities.

Market consolidation activities include strategic acquisitions, mergers, and partnerships that are reshaping the competitive landscape. Larger companies are acquiring specialized providers to expand their capabilities and geographic reach, while technology companies are partnering with service providers to deploy innovative solutions.

International expansion by leading service providers is increasing competition and improving service standards across the region. Global companies are establishing local operations and partnerships to serve multinational clients and capture growth opportunities.

Sustainability initiatives by major corporations are driving demand for comprehensive waste management solutions that support environmental goals. Corporate commitments to zero waste, carbon neutrality, and circular economy principles are creating new requirements for waste management services.

MarkWide Research analysis indicates that companies should prioritize technology investment and digital transformation to remain competitive in the evolving market landscape. Organizations that successfully integrate IoT, data analytics, and automation into their operations will achieve significant competitive advantages through improved efficiency and service quality.

Strategic partnerships are recommended for companies seeking to expand their capabilities and geographic reach. Collaborations between service providers, technology companies, and regional specialists can accelerate market entry and capability development while sharing investment risks and expertise.

Regulatory compliance capabilities should be strengthened as environmental standards continue to tighten across the region. Companies that develop deep regulatory expertise and compliance systems will be better positioned to serve multinational clients and expand into new markets.

Sustainability positioning is becoming increasingly important for market success. Companies should develop comprehensive sustainability strategies that demonstrate environmental responsibility and support client ESG goals. Circular economy capabilities will become essential for long-term competitiveness.

Market specialization in high-value waste streams such as electronic waste, pharmaceutical waste, and hazardous materials can provide competitive differentiation and premium pricing opportunities. Developing specialized capabilities requires significant investment but offers attractive returns.

Regional expansion strategies should focus on emerging markets with growing industrial bases and strengthening environmental regulations. Early market entry can provide competitive advantages and establish market leadership positions before competition intensifies.

Long-term growth prospects for the Asia-Pacific industrial waste management market remain highly positive, supported by continued industrialization, urbanization, and environmental regulation strengthening. MWR projections indicate sustained growth momentum with increasing demand for comprehensive waste management solutions across all major regional markets.

Technology evolution will continue to reshape the market through advanced treatment systems, digital platforms, and automation technologies. Artificial intelligence, machine learning, and robotics applications will become increasingly common, improving operational efficiency and service quality while reducing costs.

Circular economy principles will become mainstream, fundamentally changing waste management approaches and business models. The transition from waste disposal to resource recovery will create new revenue streams and competitive dynamics, with successful companies developing comprehensive circular economy capabilities.

Regional integration is expected to increase as trade relationships strengthen and regulatory frameworks harmonize. Cross-border waste management services and regional treatment networks will become more common, creating opportunities for companies with regional capabilities and expertise.

Sustainability requirements will intensify as climate change concerns and environmental awareness continue to grow. Waste management providers that can demonstrate significant environmental benefits and support client sustainability goals will achieve competitive advantages and premium positioning.

Market maturation in developed countries will drive innovation and efficiency improvements, while emerging markets will continue to offer substantial growth opportunities. The overall market is expected to maintain strong growth momentum with projected CAGR exceeding 8% over the next decade.

The Asia-Pacific industrial waste management market represents one of the most dynamic and promising sectors in the global environmental services industry. Driven by rapid industrialization, strengthening environmental regulations, and growing sustainability awareness, this market offers substantial opportunities for service providers, technology companies, and investors. Market fundamentals remain strong with sustained demand growth, technological innovation, and regulatory support creating favorable conditions for long-term expansion.

Key success factors in this market include technological capabilities, regulatory expertise, operational efficiency, and sustainability positioning. Companies that successfully integrate advanced technologies, develop comprehensive service offerings, and maintain strong regulatory compliance will be best positioned to capture market opportunities and achieve sustainable growth.

Regional diversity across the Asia-Pacific landscape creates both opportunities and challenges, requiring companies to develop flexible strategies that can adapt to local market conditions while leveraging regional synergies. The combination of mature markets providing stability and emerging markets offering growth potential creates an attractive overall market environment.

Future prospects for the Asia-Pacific industrial waste management market remain highly positive, with continued growth expected across all major segments and regions. The ongoing transition toward circular economy principles, digital transformation, and sustainability focus will continue to drive market evolution and create new opportunities for innovative companies. As the region continues to industrialize and environmental standards strengthen, the industrial waste management market will play an increasingly critical role in supporting sustainable economic development and environmental protection throughout Asia-Pacific.

What is Industrial Waste Management?

Industrial Waste Management refers to the processes and practices involved in the collection, treatment, and disposal of waste generated by industrial activities. This includes hazardous and non-hazardous waste, recycling, and compliance with environmental regulations.

What are the key players in the Asia-Pacific Industrial Waste Management Market?

Key players in the Asia-Pacific Industrial Waste Management Market include Veolia Environnement, SUEZ, Waste Management, and Clean Harbors, among others. These companies provide a range of services including waste collection, recycling, and treatment solutions.

What are the main drivers of the Asia-Pacific Industrial Waste Management Market?

The main drivers of the Asia-Pacific Industrial Waste Management Market include increasing industrialization, stringent environmental regulations, and the growing emphasis on sustainable waste management practices. Additionally, the rise in awareness about environmental protection is fueling market growth.

What challenges does the Asia-Pacific Industrial Waste Management Market face?

The Asia-Pacific Industrial Waste Management Market faces challenges such as inadequate waste management infrastructure, high operational costs, and regulatory compliance issues. These factors can hinder the effective management of industrial waste in the region.

What opportunities exist in the Asia-Pacific Industrial Waste Management Market?

Opportunities in the Asia-Pacific Industrial Waste Management Market include the development of advanced waste treatment technologies, increased investment in recycling facilities, and the potential for public-private partnerships. These factors can enhance waste management efficiency and sustainability.

What trends are shaping the Asia-Pacific Industrial Waste Management Market?

Trends shaping the Asia-Pacific Industrial Waste Management Market include the adoption of circular economy principles, increased automation in waste processing, and the integration of digital technologies for better waste tracking and management. These trends are driving innovation and efficiency in the sector.

Asia-Pacific Industrial Waste Management Market

| Segmentation Details | Description |

|---|---|

| Type | Hazardous Waste, Non-Hazardous Waste, E-Waste, Medical Waste |

| Technology | Incineration, Landfilling, Recycling, Composting |

| End User | Manufacturing, Construction, Healthcare, Retail |

| Service Type | Collection, Treatment, Disposal, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Industrial Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at