444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific industrial communication market represents a dynamic and rapidly evolving sector that encompasses the technologies, protocols, and systems enabling seamless data exchange across manufacturing and industrial environments. This market has experienced substantial growth driven by the region’s aggressive industrialization initiatives, digital transformation programs, and the widespread adoption of Industry 4.0 technologies. Manufacturing powerhouses across China, Japan, South Korea, India, and Southeast Asian nations are investing heavily in advanced communication infrastructure to enhance operational efficiency and maintain competitive advantages in global markets.

Regional dynamics indicate that the Asia Pacific industrial communication landscape is characterized by diverse technological adoption patterns, with developed economies leading in sophisticated protocol implementations while emerging markets focus on foundational communication infrastructure development. The market demonstrates robust expansion across multiple industrial verticals, including automotive manufacturing, electronics production, chemical processing, and energy generation facilities. Growth trajectories suggest the market is expanding at a compound annual growth rate of 8.2%, reflecting the region’s commitment to industrial modernization and smart manufacturing initiatives.

Technology integration patterns reveal increasing convergence between traditional industrial communication protocols and emerging technologies such as 5G networks, edge computing, and artificial intelligence-driven communication systems. Market participants are witnessing accelerated demand for wireless communication solutions, real-time data transmission capabilities, and interoperable systems that can seamlessly integrate with existing industrial infrastructure while supporting future technological advancements.

The Asia Pacific industrial communication market refers to the comprehensive ecosystem of technologies, protocols, devices, and services that facilitate data exchange, control signals, and information flow within industrial environments across the Asia Pacific region. This market encompasses both wired and wireless communication solutions designed specifically for harsh industrial conditions, including fieldbus systems, industrial Ethernet protocols, wireless sensor networks, and advanced communication gateways that enable seamless connectivity between operational technology and information technology systems.

Industrial communication systems serve as the nervous system of modern manufacturing facilities, enabling real-time monitoring, control, and optimization of production processes. These systems support critical functions including machine-to-machine communication, human-machine interfaces, supervisory control and data acquisition systems, and enterprise resource planning integration. Communication protocols within this market range from traditional fieldbus technologies like PROFIBUS and DeviceNet to modern industrial Ethernet solutions such as EtherNet/IP, PROFINET, and EtherCAT, as well as emerging wireless technologies including WirelessHART, ISA100.11a, and private 5G networks.

Market dynamics in the Asia Pacific industrial communication sector reflect a transformative period characterized by rapid technological advancement, increasing automation adoption, and growing emphasis on smart manufacturing capabilities. The region’s industrial communication infrastructure is undergoing significant modernization as manufacturers seek to enhance productivity, reduce operational costs, and improve product quality through advanced connectivity solutions. Key growth drivers include government-led Industry 4.0 initiatives, rising labor costs prompting automation adoption, and increasing demand for real-time production visibility.

Technology trends indicate a shift toward more flexible, scalable, and intelligent communication systems capable of supporting diverse industrial applications. Wireless communication adoption is accelerating at 15.3% annually, driven by the need for greater mobility, reduced installation costs, and improved system flexibility. Industrial Ethernet protocols continue to dominate wired communication segments, accounting for approximately 68% of new installations across major manufacturing facilities in the region.

Regional leadership patterns show China maintaining the largest market presence, followed by Japan, South Korea, and India, with emerging Southeast Asian markets demonstrating the highest growth rates. Competitive dynamics feature a mix of global technology leaders and regional specialists, with increasing collaboration between communication technology providers and industrial automation vendors to deliver integrated solutions that address specific regional requirements and industry needs.

Strategic insights reveal several critical factors shaping the Asia Pacific industrial communication market landscape:

Primary growth drivers propelling the Asia Pacific industrial communication market include the region’s comprehensive digital transformation initiatives and government-supported Industry 4.0 programs. Manufacturing modernization efforts across major economies are creating substantial demand for advanced communication infrastructure capable of supporting smart factory operations, predictive maintenance systems, and real-time production optimization. Labor cost pressures in traditional manufacturing hubs are accelerating automation adoption, which requires sophisticated communication systems to coordinate complex automated processes.

Technological advancement in communication protocols and devices is enabling new applications and use cases that were previously impractical or cost-prohibitive. Industrial IoT adoption is driving demand for communication systems capable of handling massive data volumes from connected sensors, devices, and equipment throughout manufacturing facilities. Quality control requirements are becoming increasingly stringent, necessitating real-time communication systems that can provide immediate feedback and enable rapid response to production anomalies.

Supply chain optimization initiatives are creating demand for communication systems that can provide end-to-end visibility and coordination across complex manufacturing networks. Regulatory compliance requirements in industries such as pharmaceuticals, food processing, and automotive manufacturing are driving adoption of communication systems with comprehensive data logging and traceability capabilities. Energy efficiency mandates are encouraging manufacturers to implement communication systems that enable optimal resource utilization and waste reduction.

Implementation challenges represent significant barriers to market growth, particularly the complexity of integrating new communication systems with existing industrial infrastructure. Legacy system compatibility issues create substantial technical and financial obstacles for manufacturers seeking to upgrade their communication capabilities while maintaining operational continuity. High initial investment requirements for comprehensive industrial communication system deployments can be prohibitive for smaller manufacturers and those operating in cost-sensitive industries.

Cybersecurity concerns are increasingly constraining market growth as manufacturers become more aware of the potential risks associated with connected industrial systems. Skills shortages in industrial communication system design, implementation, and maintenance are limiting the pace of technology adoption across the region. Standardization challenges continue to create uncertainty for manufacturers evaluating different communication protocol options and system architectures.

Regulatory complexity across different Asia Pacific markets creates additional barriers for communication system vendors and end-users, particularly regarding wireless spectrum allocation and industrial safety requirements. Technology obsolescence risks make manufacturers hesitant to invest in communication systems that may become outdated as new standards and protocols emerge. Integration complexity between operational technology and information technology systems continues to challenge organizations seeking comprehensive industrial communication solutions.

Emerging opportunities in the Asia Pacific industrial communication market are substantial, particularly in the development of next-generation wireless communication solutions tailored for industrial applications. 5G technology deployment presents unprecedented opportunities for ultra-reliable, low-latency communication systems that can support advanced applications such as remote control of critical industrial processes and real-time augmented reality maintenance support. Edge computing integration opportunities are expanding as manufacturers seek to process data closer to production equipment for faster response times and reduced bandwidth requirements.

Artificial intelligence integration within communication systems offers significant potential for predictive maintenance, automated network optimization, and intelligent traffic management across industrial networks. Sustainability-focused solutions represent growing opportunities as manufacturers prioritize energy-efficient communication systems and environmentally responsible technology choices. Small and medium enterprise market segments present substantial untapped potential for cost-effective, scalable communication solutions designed for smaller manufacturing operations.

Vertical-specific solutions offer opportunities for specialized communication systems tailored to unique requirements in industries such as semiconductor manufacturing, renewable energy, and smart logistics. Service-based business models are creating new revenue opportunities through communication-as-a-service offerings, managed network services, and comprehensive system maintenance programs. Cross-border collaboration opportunities are emerging as regional manufacturers seek standardized communication solutions that can support multinational operations and supply chain coordination.

Dynamic market forces are reshaping the Asia Pacific industrial communication landscape through the interplay of technological innovation, regulatory evolution, and changing customer requirements. Technology convergence between traditional industrial automation and modern information technology is creating new market segments and business opportunities while challenging established vendor relationships and competitive positions. Customer expectations are evolving rapidly, with manufacturers demanding more flexible, scalable, and intelligent communication solutions that can adapt to changing production requirements.

Competitive intensity is increasing as traditional industrial communication vendors face competition from IT companies, telecommunications providers, and emerging technology startups offering innovative solutions. Partnership dynamics are shifting toward more collaborative approaches, with communication technology providers working closely with system integrators, automation vendors, and end-users to develop comprehensive solutions. Innovation cycles are accelerating, with new communication protocols, devices, and system architectures emerging at an unprecedented pace.

Regional variations in market dynamics reflect different levels of industrial development, regulatory environments, and technology adoption patterns across Asia Pacific countries. Investment patterns show increasing focus on communication infrastructure that can support long-term digital transformation goals rather than short-term operational improvements. Market consolidation trends are evident as larger vendors acquire specialized communication technology companies to expand their solution portfolios and regional presence.

Comprehensive research methodology employed in analyzing the Asia Pacific industrial communication market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, technology vendors, system integrators, and end-user organizations across major Asia Pacific markets to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of industry publications, technical standards documentation, regulatory filings, and company financial reports to validate primary findings and identify additional market dynamics.

Data triangulation methods are employed to cross-verify information from multiple sources and ensure consistency in market assessments. Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing calculations based on verified data points from reliable industry sources. Qualitative analysis incorporates expert opinions, industry best practices, and technology roadmap assessments to provide context for quantitative findings and identify emerging market trends.

Market segmentation analysis utilizes both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market segments and applications. Regional analysis incorporates country-specific factors including regulatory environments, industrial development levels, and technology adoption patterns to provide accurate regional market assessments. Competitive analysis combines public information, industry intelligence, and expert insights to develop comprehensive vendor profiles and market positioning assessments.

China dominates the Asia Pacific industrial communication market, representing approximately 42% of regional demand, driven by massive manufacturing capacity, government-led Industry 4.0 initiatives, and substantial investments in industrial automation infrastructure. Chinese manufacturers are rapidly adopting advanced communication systems to maintain competitiveness in global markets and comply with increasingly stringent quality and environmental regulations. Technology development in China focuses on both implementing established international standards and developing indigenous communication protocols tailored to local industrial requirements.

Japan maintains a strong market position with approximately 18% market share, characterized by high adoption rates of advanced communication technologies and strong emphasis on precision manufacturing applications. Japanese industrial communication market demonstrates particular strength in automotive manufacturing, electronics production, and robotics applications, with manufacturers prioritizing high-reliability, low-latency communication solutions. Innovation leadership in Japan continues through development of next-generation industrial communication protocols and integration with artificial intelligence systems.

South Korea accounts for approximately 12% of regional market activity, with significant growth driven by semiconductor manufacturing, shipbuilding, and steel production industries. Indian market expansion is accelerating rapidly, representing about 10% of current market size but demonstrating the highest growth rates in the region as manufacturing capabilities expand and government initiatives promote industrial modernization. Southeast Asian markets collectively represent 18% of regional demand, with particularly strong growth in Vietnam, Thailand, Indonesia, and Malaysia as these countries develop their manufacturing capabilities and attract foreign investment in industrial facilities.

Market leadership in the Asia Pacific industrial communication sector is characterized by a diverse ecosystem of global technology providers, regional specialists, and emerging innovators competing across different technology segments and application areas. Established leaders maintain strong positions through comprehensive product portfolios, extensive regional presence, and long-standing relationships with major industrial customers.

Technology-based segmentation reveals distinct market dynamics across different communication protocol categories and implementation approaches:

By Communication Type:

By Protocol Type:

By Industry Vertical:

Industrial Ethernet category demonstrates the strongest growth momentum, with adoption rates increasing by 12.4% annually as manufacturers prioritize high-bandwidth, low-latency communication capabilities. EtherNet/IP protocol maintains market leadership in discrete manufacturing applications, while PROFINET shows particular strength in automotive and machinery manufacturing sectors. EtherCAT technology is gaining traction in high-performance motion control applications requiring microsecond-level synchronization.

Wireless communication category represents the fastest-growing segment, with private 5G networks emerging as a transformative technology for large-scale industrial facilities. WirelessHART adoption continues to expand in process industries where retrofitting wired systems is impractical or cost-prohibitive. Wi-Fi 6 technology is gaining acceptance for industrial applications requiring high-density device connectivity and improved network efficiency.

Fieldbus systems category maintains stable market presence in established industrial installations, with PROFIBUS demonstrating particular resilience in European-designed manufacturing facilities across Asia Pacific. DeviceNet protocol continues to serve specialized applications in automotive manufacturing, while Foundation Fieldbus remains prevalent in process control applications. Migration strategies from fieldbus to Ethernet-based systems are creating opportunities for hybrid communication solutions that support both protocol types.

Cybersecurity integration across all categories is becoming increasingly important, with security-by-design approaches now standard requirements for new industrial communication system deployments. Edge computing capabilities are being integrated into communication infrastructure to enable local data processing and reduce dependence on centralized systems.

Manufacturing organizations realize substantial operational benefits through advanced industrial communication systems, including improved production efficiency, enhanced quality control, and reduced operational costs. Real-time visibility into production processes enables faster decision-making and more responsive manufacturing operations. Predictive maintenance capabilities supported by comprehensive communication systems help minimize unplanned downtime and extend equipment lifecycle.

System integrators benefit from expanding market opportunities as manufacturers seek comprehensive communication solutions that integrate seamlessly with existing automation infrastructure. Technology vendors gain access to growing markets and opportunities for innovation in next-generation communication protocols and devices. Service providers can develop new revenue streams through managed communication services and ongoing system optimization support.

End-user advantages include:

Strengths:

Weaknesses:

Opportunities:

Threats:

Convergence acceleration between operational technology and information technology is fundamentally reshaping industrial communication architectures, with manufacturers increasingly demanding unified platforms that support both traditional control functions and modern data analytics capabilities. Cloud integration trends show growing adoption of hybrid communication architectures that combine on-premises industrial networks with cloud-based management and analytics platforms.

Artificial intelligence integration within communication systems is enabling predictive network optimization, automated troubleshooting, and intelligent traffic management across complex industrial networks. Digital twin technology is driving demand for communication systems capable of supporting real-time synchronization between physical assets and their digital representations. Sustainability considerations are influencing technology choices, with manufacturers prioritizing energy-efficient communication protocols and systems that support environmental monitoring and optimization.

Wireless technology evolution continues with private 5G networks gaining momentum for large-scale industrial deployments requiring ultra-reliable, low-latency connectivity. Time-sensitive networking standards are being implemented to ensure deterministic communication performance for critical industrial applications. Cybersecurity integration is becoming standard practice, with security features built into communication protocols rather than added as separate layers.

Service-oriented architectures are emerging as manufacturers seek more flexible, scalable communication solutions that can adapt to changing business requirements. Interoperability focus is driving development of communication gateways and translation systems that enable seamless integration across diverse industrial equipment and protocols.

Recent technological breakthroughs in the Asia Pacific industrial communication market include the successful deployment of private 5G networks in major manufacturing facilities across China and South Korea, demonstrating the viability of ultra-reliable wireless communication for critical industrial applications. Standards evolution has seen the release of updated industrial Ethernet specifications that enhance cybersecurity features and improve interoperability across different vendor platforms.

Strategic partnerships between communication technology providers and cloud service companies are creating new opportunities for hybrid industrial communication solutions that combine on-premises reliability with cloud-based analytics and management capabilities. Acquisition activities in the market include major automation vendors acquiring specialized communication technology companies to expand their solution portfolios and strengthen their competitive positions.

Government initiatives across the region continue to support industrial communication infrastructure development through funding programs, tax incentives, and regulatory frameworks that encourage technology adoption. Research and development investments are focusing on next-generation communication protocols that can support emerging applications such as autonomous manufacturing systems and real-time supply chain coordination.

Industry collaboration efforts are advancing standardization initiatives that aim to improve interoperability and reduce complexity for end-users implementing multi-vendor communication systems. Cybersecurity developments include the introduction of new security frameworks specifically designed for industrial communication systems, addressing the unique requirements of manufacturing environments.

Strategic recommendations for market participants emphasize the importance of developing comprehensive communication solutions that address the full spectrum of industrial requirements, from basic connectivity to advanced analytics and artificial intelligence integration. Technology vendors should focus on creating platforms that support multiple communication protocols while providing migration paths for customers with legacy systems. Investment priorities should include cybersecurity capabilities, edge computing integration, and wireless technology development to address evolving market demands.

Market entry strategies for new participants should focus on specialized vertical applications or emerging technology segments where established vendors may have limited presence. Partnership approaches are recommended for companies seeking to expand their regional presence or technology capabilities through collaboration with local system integrators and technology providers. Customer engagement strategies should emphasize education and support services to help manufacturers navigate the complexity of modern industrial communication systems.

MarkWide Research analysis suggests that successful market participants will need to balance technology innovation with practical implementation considerations, ensuring that advanced communication solutions can be deployed and maintained effectively in real-world industrial environments. Long-term success will depend on developing sustainable business models that support ongoing technology evolution while providing customers with reliable, cost-effective communication solutions that deliver measurable operational benefits.

Long-term market projections indicate continued robust growth for the Asia Pacific industrial communication market, with expansion driven by ongoing industrialization, technology advancement, and increasing emphasis on smart manufacturing capabilities. Technology evolution will likely focus on further integration of artificial intelligence, machine learning, and advanced analytics capabilities within communication systems to enable autonomous industrial operations and predictive optimization.

5G technology deployment is expected to accelerate significantly over the next five years, with private industrial networks becoming mainstream for large manufacturing facilities requiring ultra-reliable, low-latency connectivity. Edge computing integration will become standard practice, enabling real-time processing and decision-making at the network edge to reduce latency and improve system responsiveness. Sustainability considerations will increasingly influence technology choices, with energy-efficient communication protocols and systems becoming competitive differentiators.

Market consolidation trends are likely to continue as larger vendors acquire specialized technology companies to expand their solution portfolios and strengthen their competitive positions. Regional market development will see continued growth in emerging Asia Pacific economies as they develop their manufacturing capabilities and attract foreign investment in industrial facilities. Skills development initiatives will become increasingly important to address the growing demand for professionals capable of designing, implementing, and maintaining advanced industrial communication systems.

MWR projections suggest that the market will experience sustained growth rates exceeding 8% annually through the next decade, with wireless communication segments demonstrating the highest expansion rates and traditional fieldbus systems maintaining stable but declining market shares as facilities modernize their communication infrastructure.

The Asia Pacific industrial communication market represents a dynamic and rapidly evolving sector that plays a critical role in the region’s industrial transformation and digital modernization initiatives. Market fundamentals remain strong, supported by robust manufacturing growth, government policy support, and continuous technology innovation that enables new applications and use cases across diverse industrial sectors.

Technology convergence between traditional industrial automation and modern information technology is creating unprecedented opportunities for communication system providers while challenging established market dynamics and competitive relationships. Wireless communication adoption is accelerating rapidly, with private 5G networks and advanced wireless protocols offering new possibilities for flexible, scalable industrial connectivity solutions.

Future success in this market will depend on the ability of technology providers to deliver comprehensive solutions that address the full spectrum of industrial communication requirements while providing clear migration paths for customers with existing infrastructure investments. Cybersecurity integration, edge computing capabilities, and artificial intelligence features will become standard requirements rather than optional enhancements as manufacturers seek communication systems that can support their long-term digital transformation goals.

The Asia Pacific industrial communication market is positioned for continued strong growth, driven by the region’s commitment to industrial modernization, smart manufacturing adoption, and the development of next-generation communication technologies that will enable the factories of the future.

What is Industrial Communication?

Industrial Communication refers to the systems and technologies used for data exchange and communication in industrial environments. This includes protocols, networks, and devices that facilitate automation, control, and monitoring in sectors such as manufacturing, energy, and transportation.

What are the key players in the Asia Pacific Industrial Communication Market?

Key players in the Asia Pacific Industrial Communication Market include Siemens, Rockwell Automation, Schneider Electric, and Mitsubishi Electric, among others. These companies provide a range of solutions for industrial networking, automation, and communication technologies.

What are the main drivers of the Asia Pacific Industrial Communication Market?

The main drivers of the Asia Pacific Industrial Communication Market include the increasing demand for automation in manufacturing, the growth of the Internet of Things (IoT), and the need for real-time data communication in industrial processes. These factors are pushing industries to adopt advanced communication technologies.

What challenges does the Asia Pacific Industrial Communication Market face?

The Asia Pacific Industrial Communication Market faces challenges such as cybersecurity threats, the complexity of integrating new technologies with legacy systems, and the high costs associated with upgrading communication infrastructure. These issues can hinder the adoption of advanced industrial communication solutions.

What opportunities exist in the Asia Pacific Industrial Communication Market?

Opportunities in the Asia Pacific Industrial Communication Market include the expansion of smart factories, the rise of Industry Four Point Zero, and the increasing investment in renewable energy sectors. These trends are likely to drive demand for innovative communication solutions.

What trends are shaping the Asia Pacific Industrial Communication Market?

Trends shaping the Asia Pacific Industrial Communication Market include the adoption of wireless communication technologies, the integration of artificial intelligence in industrial processes, and the growing emphasis on data analytics for operational efficiency. These trends are transforming how industries communicate and operate.

Asia Pacific Industrial Communication Market

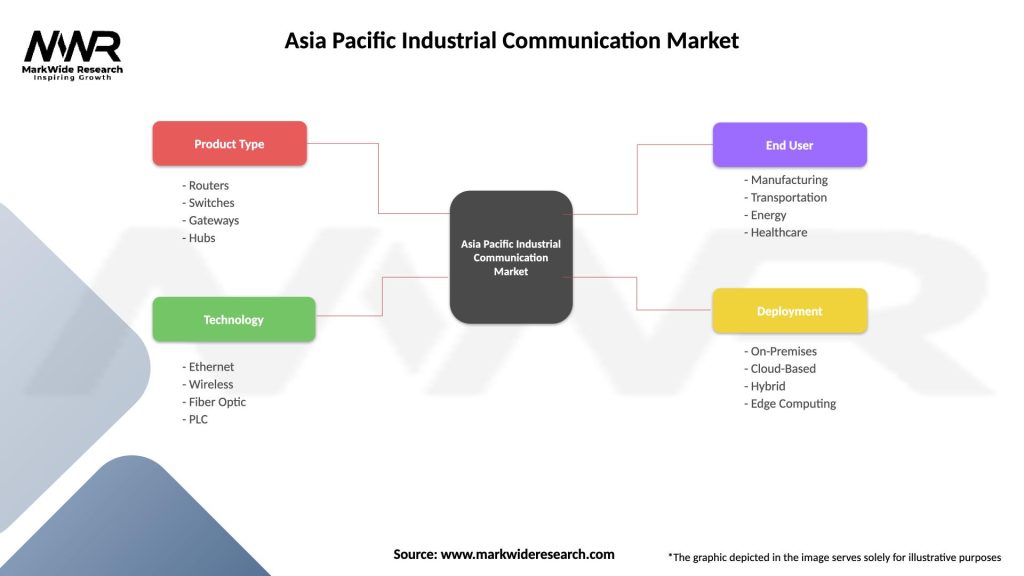

| Segmentation Details | Description |

|---|---|

| Product Type | Routers, Switches, Gateways, Hubs |

| Technology | Ethernet, Wireless, Fiber Optic, PLC |

| End User | Manufacturing, Transportation, Energy, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Industrial Communication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at