444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific hydraulic devices market represents one of the most dynamic and rapidly expanding sectors within the global industrial machinery landscape. This comprehensive market encompasses a wide range of hydraulic components, systems, and equipment that utilize pressurized fluid power to generate, control, and transmit mechanical force across diverse industrial applications. The region’s robust manufacturing base, coupled with significant infrastructure development initiatives, has positioned Asia Pacific as a dominant force in hydraulic technology adoption and innovation.

Market dynamics in the Asia Pacific region are characterized by substantial growth momentum, driven by increasing industrialization across emerging economies and the modernization of existing manufacturing facilities. The market demonstrates remarkable resilience and adaptability, with hydraulic devices finding applications across construction, manufacturing, automotive, aerospace, and marine industries. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 6.8%, reflecting strong demand fundamentals and technological advancement adoption.

Regional leadership in hydraulic device manufacturing has been established through strategic investments in research and development, advanced manufacturing capabilities, and comprehensive supply chain networks. Countries including China, Japan, South Korea, and India have emerged as key contributors to market growth, each bringing unique strengths in different hydraulic device categories and application segments.

The Asia Pacific hydraulic devices market refers to the comprehensive ecosystem of fluid power systems, components, and equipment that utilize pressurized hydraulic fluid to generate mechanical power and control motion across various industrial applications within the Asia Pacific geographical region. This market encompasses hydraulic pumps, motors, cylinders, valves, filters, accumulators, and integrated hydraulic systems designed to provide precise force multiplication, motion control, and power transmission capabilities.

Hydraulic devices operate on Pascal’s principle, utilizing incompressible fluids under pressure to transmit power efficiently across mechanical systems. These sophisticated engineering solutions enable precise control of heavy machinery, automated manufacturing processes, and complex industrial operations while delivering superior power-to-weight ratios compared to alternative power transmission methods.

Market scope includes both original equipment manufacturer (OEM) applications and aftermarket services, covering maintenance, repair, and replacement components for existing hydraulic installations. The comprehensive nature of this market reflects the critical role hydraulic technology plays in modern industrial operations across the Asia Pacific region.

Strategic positioning of the Asia Pacific hydraulic devices market reflects exceptional growth potential driven by rapid industrialization, infrastructure development, and technological advancement across the region. The market demonstrates strong fundamentals with diverse application segments contributing to sustained demand growth and innovation adoption.

Key growth drivers include expanding construction activities, automotive production increases, and manufacturing sector modernization initiatives. The region’s commitment to infrastructure development, particularly in emerging economies, has created substantial demand for hydraulic-powered construction equipment and industrial machinery. Manufacturing efficiency improvements of up to 35% have been achieved through advanced hydraulic system implementations, driving continued adoption across industrial sectors.

Technology evolution within the market emphasizes smart hydraulic systems, energy-efficient designs, and integrated digital control capabilities. These advancements address growing environmental concerns while delivering enhanced performance characteristics and operational cost reductions for end-users.

Competitive landscape features both established global manufacturers and emerging regional players, creating a dynamic market environment that fosters innovation and competitive pricing strategies. This diversity ensures comprehensive market coverage across different price points and application requirements.

Market intelligence reveals several critical insights that define the Asia Pacific hydraulic devices market trajectory and strategic opportunities:

Primary market drivers propelling the Asia Pacific hydraulic devices market forward encompass multiple interconnected factors that create sustained demand growth and market expansion opportunities.

Infrastructure development initiatives across the region represent the most significant driver, with governments investing heavily in transportation networks, urban development, and industrial facilities. These projects require extensive use of hydraulic-powered construction equipment, creating substantial demand for hydraulic components and systems. Construction activity growth of 8.2% annually in key markets directly translates to increased hydraulic device consumption.

Manufacturing sector expansion continues driving hydraulic system adoption as companies seek to improve production efficiency and automation capabilities. Modern manufacturing facilities increasingly rely on hydraulic-powered machinery for precision operations, material handling, and automated assembly processes. The integration of hydraulic systems with advanced control technologies enables manufacturers to achieve higher productivity levels while maintaining quality standards.

Automotive industry growth throughout the region creates significant demand for hydraulic systems in both vehicle manufacturing and automotive component production. Hydraulic presses, forming equipment, and assembly line machinery utilize hydraulic power for precise control and high-force applications essential to automotive manufacturing processes.

Energy sector investments in renewable energy infrastructure, oil and gas exploration, and power generation facilities require specialized hydraulic equipment for construction and operational activities. These applications demand robust, reliable hydraulic solutions capable of operating in challenging environments while delivering consistent performance.

Market challenges facing the Asia Pacific hydraulic devices market include several factors that may limit growth potential or create operational difficulties for market participants.

High initial investment costs associated with advanced hydraulic systems can deter adoption, particularly among small and medium-sized enterprises with limited capital resources. The sophisticated nature of modern hydraulic equipment requires substantial upfront investment, which may delay implementation decisions despite long-term operational benefits.

Technical complexity of advanced hydraulic systems requires specialized knowledge for installation, operation, and maintenance. The shortage of skilled technicians and engineers familiar with modern hydraulic technology creates implementation challenges and increases operational costs for end-users.

Environmental regulations increasingly focus on hydraulic fluid disposal, system efficiency, and environmental impact considerations. Compliance with evolving environmental standards requires additional investment in eco-friendly hydraulic fluids and energy-efficient system designs, potentially increasing overall system costs.

Supply chain vulnerabilities exposed during recent global disruptions highlight the market’s dependence on international component suppliers and raw material sources. These dependencies can create delivery delays and cost fluctuations that impact market stability and growth predictability.

Alternative technology competition from electric and pneumatic systems in certain applications challenges hydraulic system adoption. While hydraulic systems offer superior power density, alternative technologies may provide advantages in specific applications, particularly where environmental considerations or maintenance requirements are primary concerns.

Strategic opportunities within the Asia Pacific hydraulic devices market present significant potential for growth and market expansion across multiple dimensions and application areas.

Smart hydraulic systems integration with Industry 4.0 technologies creates substantial opportunities for market participants to develop innovative solutions that combine traditional hydraulic power with digital intelligence. These systems offer predictive maintenance capabilities, remote monitoring, and operational optimization features that deliver enhanced value propositions to end-users.

Renewable energy sector expansion presents emerging opportunities for specialized hydraulic applications in wind turbine systems, solar panel positioning mechanisms, and hydroelectric power generation equipment. The region’s commitment to renewable energy development creates new market segments for hydraulic device manufacturers.

Aftermarket services growth opportunities arise from the expanding installed base of hydraulic systems requiring maintenance, repair, and upgrade services. This segment offers recurring revenue potential and higher profit margins compared to original equipment sales.

Regional manufacturing localization opportunities enable companies to establish production facilities closer to end-users, reducing costs and improving supply chain responsiveness. Local manufacturing also helps companies better understand regional market requirements and customize products accordingly.

Emerging market penetration in developing economies within the region offers significant growth potential as these markets experience industrial development and infrastructure modernization. Early market entry in these regions can establish competitive advantages and long-term market positions.

Market dynamics shaping the Asia Pacific hydraulic devices market reflect complex interactions between technological advancement, economic development, and industry evolution patterns that influence market behavior and growth trajectories.

Technology convergence between hydraulic systems and digital technologies creates new market dynamics as traditional hydraulic manufacturers collaborate with technology companies to develop integrated solutions. This convergence enables the development of smart hydraulic systems that offer enhanced functionality and operational insights.

Supply chain evolution toward regional integration and localization reshapes market dynamics by reducing dependence on distant suppliers and improving supply chain resilience. Companies increasingly establish regional manufacturing and distribution networks to better serve local markets and respond to changing demand patterns.

Customer expectations continue evolving toward more efficient, environmentally friendly, and digitally enabled hydraulic solutions. These changing expectations drive innovation and influence product development priorities across the market. Energy efficiency improvements of 20-25% have become standard expectations for new hydraulic system installations.

Competitive intensity increases as both established global players and emerging regional manufacturers compete for market share. This competition drives innovation, improves product quality, and creates more favorable pricing conditions for end-users while challenging companies to differentiate their offerings.

Regulatory environment evolution toward stricter environmental and safety standards influences market dynamics by requiring companies to invest in cleaner technologies and safer operational practices. These regulatory changes create both challenges and opportunities for market participants.

Comprehensive research methodology employed in analyzing the Asia Pacific hydraulic devices market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of market insights.

Primary research activities include extensive interviews with industry executives, technical experts, and end-users across different market segments and geographical regions. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings.

Secondary research encompasses analysis of industry reports, company financial statements, government statistics, and trade association data to establish market baselines and identify trends. This research provides quantitative foundations for market analysis and growth projections.

Market modeling techniques utilize statistical analysis and forecasting methods to project market growth, segment performance, and regional trends. These models incorporate multiple variables including economic indicators, industry growth rates, and technology adoption patterns.

Expert validation processes ensure research findings accuracy through consultation with industry specialists and technical experts who provide insights into market dynamics and validate analytical conclusions. This validation process enhances the credibility and reliability of research outcomes.

Data triangulation methods cross-reference information from multiple sources to verify accuracy and identify potential discrepancies in market data. This approach ensures comprehensive and reliable market intelligence that supports strategic decision-making.

Regional market analysis reveals distinct characteristics and growth patterns across different Asia Pacific markets, with each region contributing unique strengths and opportunities to the overall market landscape.

China dominates the regional market with the largest market share of approximately 42%, driven by extensive manufacturing capabilities, infrastructure development projects, and domestic demand from construction and industrial sectors. The country’s position as a global manufacturing hub creates substantial demand for hydraulic systems across multiple industries.

Japan maintains a strong market position through technological leadership and advanced manufacturing capabilities, particularly in precision hydraulic components and systems. Japanese companies are renowned for innovation and quality, contributing significantly to market development and technology advancement.

South Korea demonstrates robust growth in hydraulic device adoption, particularly in automotive manufacturing and shipbuilding industries. The country’s focus on industrial automation and efficiency improvements drives demand for advanced hydraulic solutions.

India represents one of the fastest-growing markets in the region, with growth rates exceeding 9% annually, driven by infrastructure development initiatives and expanding manufacturing sector. The government’s focus on industrial development creates substantial opportunities for hydraulic device manufacturers.

Southeast Asian markets including Thailand, Indonesia, and Vietnam show strong growth potential as these economies develop their industrial capabilities and infrastructure. These emerging markets offer significant opportunities for market expansion and localization strategies.

Australia and New Zealand contribute to market growth through mining, construction, and agricultural applications, with emphasis on robust, reliable hydraulic solutions suitable for challenging operational environments.

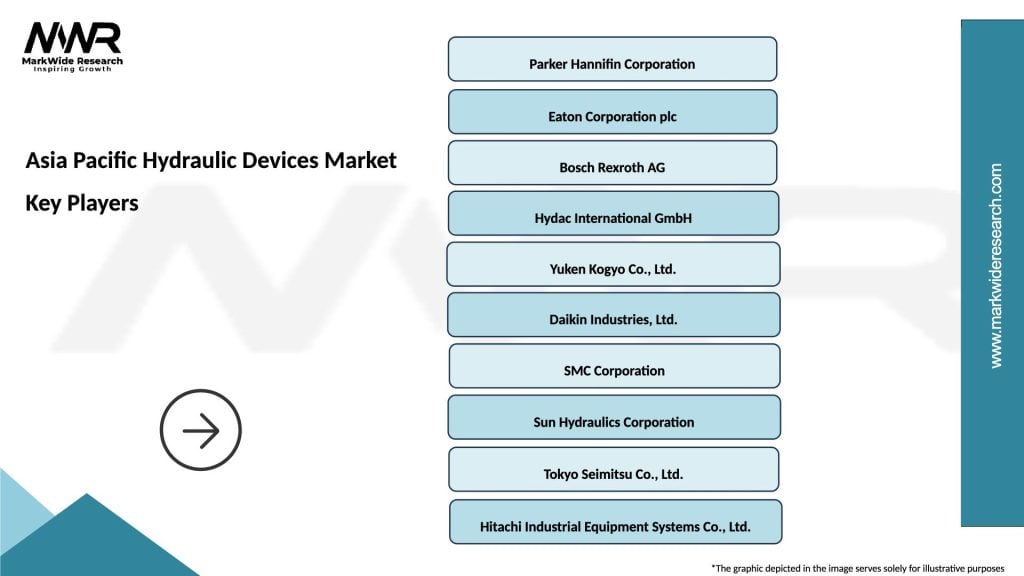

Competitive landscape analysis reveals a dynamic market environment featuring established global leaders, regional specialists, and emerging technology companies competing across different market segments and geographical areas.

Market leaders include several prominent companies that have established strong positions through comprehensive product portfolios, global distribution networks, and technological innovation capabilities:

Regional competitors include numerous companies that focus on specific market segments or geographical areas, often providing competitive alternatives to global leaders through specialized expertise or cost advantages.

Innovation focus among competitors emphasizes smart hydraulic systems, energy efficiency improvements, and integrated digital capabilities that enhance system performance and user experience.

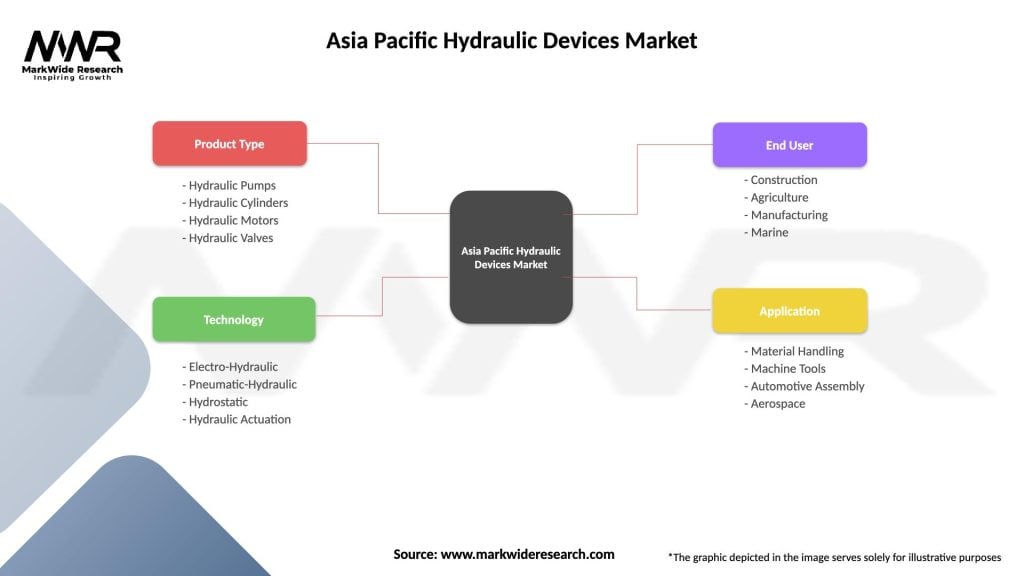

Market segmentation analysis provides detailed insights into different market categories, enabling comprehensive understanding of market structure and growth opportunities across various dimensions.

By Product Type:

By Application:

By End-User Industry:

Category-specific analysis reveals distinct growth patterns, technological trends, and market opportunities across different hydraulic device categories within the Asia Pacific market.

Hydraulic Pumps Category demonstrates strong growth driven by increasing demand for high-efficiency, variable displacement pumps that offer energy savings and precise control capabilities. Advanced pump technologies show adoption rates of 55% in new installations, reflecting market preference for sophisticated solutions.

Hydraulic Cylinders Segment benefits from construction sector growth and industrial automation trends. Custom cylinder solutions for specific applications show particular strength, with manufacturers developing specialized products for unique operational requirements.

Hydraulic Valves Market experiences innovation in smart valve technologies that incorporate electronic controls and diagnostic capabilities. These advanced valves enable precise system control and predictive maintenance, driving premium segment growth.

Mobile Hydraulics Category shows robust performance driven by construction equipment demand and agricultural mechanization trends. This segment emphasizes compact, efficient designs that maximize power density while minimizing environmental impact.

Industrial Hydraulics Segment focuses on integration with manufacturing automation systems and Industry 4.0 technologies. Smart hydraulic systems that provide operational data and remote monitoring capabilities demonstrate strong market acceptance.

Aftermarket Services Category represents a growing segment as the installed base of hydraulic systems expands. This category offers recurring revenue opportunities and higher profit margins, making it increasingly important for market participants.

Strategic benefits available to industry participants and stakeholders in the Asia Pacific hydraulic devices market encompass multiple value creation opportunities and competitive advantages.

For Manufacturers:

For End-Users:

For Investors:

Comprehensive SWOT analysis provides strategic insights into the Asia Pacific hydraulic devices market’s internal strengths and weaknesses, along with external opportunities and threats that influence market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends shaping the Asia Pacific hydraulic devices market reflect technological evolution, changing customer requirements, and industry transformation patterns that influence future market development.

Smart Hydraulic Systems represent the most significant trend, with integration of IoT sensors, predictive analytics, and remote monitoring capabilities transforming traditional hydraulic equipment into intelligent systems. These smart systems provide real-time operational data, enable predictive maintenance, and optimize performance automatically.

Energy Efficiency Focus drives development of more efficient hydraulic components and systems that reduce energy consumption while maintaining performance levels. Energy savings of 30-40% are achievable with latest generation hydraulic systems compared to traditional designs.

Miniaturization Trend enables hydraulic systems to fit into smaller spaces while delivering equivalent power output. This trend supports applications in compact machinery and space-constrained industrial environments.

Electro-Hydraulic Integration combines hydraulic power with electronic control systems to create hybrid solutions that offer the benefits of both technologies. These integrated systems provide precise control with high power density.

Sustainability Emphasis influences hydraulic system design toward biodegradable fluids, recyclable components, and reduced environmental impact throughout the product lifecycle. This trend aligns with growing environmental consciousness across the region.

Customization Demand increases as end-users seek hydraulic solutions tailored to specific application requirements rather than standard, off-the-shelf products. This trend drives development of modular and configurable hydraulic systems.

Service-Oriented Models emerge as companies shift toward providing comprehensive service packages including maintenance, monitoring, and performance optimization rather than just equipment sales.

Recent industry developments demonstrate the dynamic nature of the Asia Pacific hydraulic devices market and highlight significant advances in technology, business models, and market expansion strategies.

Technology Partnerships between hydraulic manufacturers and technology companies accelerate development of smart hydraulic systems with advanced digital capabilities. These collaborations combine hydraulic expertise with digital technology innovation to create next-generation solutions.

Manufacturing Facility Expansions across the region reflect growing market confidence and demand expectations. Several major manufacturers have announced significant investments in regional production capabilities to better serve local markets and reduce supply chain dependencies.

Research and Development Investments focus on breakthrough technologies including advanced materials, energy recovery systems, and artificial intelligence integration. These investments position companies for future market leadership and technological differentiation.

Acquisition Activities consolidate market positions and expand technological capabilities as companies seek to strengthen their competitive positions through strategic acquisitions of specialized technology providers and regional market leaders.

Sustainability Initiatives include development of environmentally friendly hydraulic fluids, energy-efficient system designs, and circular economy approaches to product lifecycle management. These initiatives address growing environmental concerns and regulatory requirements.

Digital Transformation Projects integrate hydraulic systems with broader industrial digitalization efforts, enabling seamless connectivity with enterprise systems and advanced analytics platforms.

Strategic recommendations from MarkWide Research analysis provide actionable insights for market participants seeking to optimize their position and capitalize on growth opportunities in the Asia Pacific hydraulic devices market.

Technology Investment Priority should focus on smart hydraulic systems and digital integration capabilities that align with Industry 4.0 trends. Companies investing in these technologies position themselves for long-term competitive advantage and market leadership.

Regional Market Entry strategies should prioritize emerging markets within the Asia Pacific region where industrial development creates substantial growth opportunities. Early market entry in these regions can establish competitive advantages and long-term market positions.

Partnership Development with local companies, technology providers, and system integrators can accelerate market penetration and enhance competitive positioning. Strategic partnerships provide access to local market knowledge, distribution networks, and complementary capabilities.

Service Business Expansion represents a significant opportunity for revenue diversification and margin improvement. Companies should develop comprehensive service offerings including maintenance, monitoring, and performance optimization services.

Sustainability Integration into product development and business operations addresses growing environmental concerns and regulatory requirements while creating differentiation opportunities in the marketplace.

Customer Education Programs can accelerate adoption of advanced hydraulic technologies by helping end-users understand the benefits and applications of smart hydraulic systems and energy-efficient solutions.

Future market outlook for the Asia Pacific hydraulic devices market indicates continued strong growth driven by technological advancement, industrial development, and infrastructure investment across the region.

Growth trajectory projections suggest the market will maintain robust expansion with projected growth rates of 6.5-7.5% annually over the next five years. This growth reflects sustained demand from key application sectors and continued technological innovation driving market development.

Technology evolution will accelerate toward fully integrated smart hydraulic systems that seamlessly connect with digital infrastructure and provide autonomous operational capabilities. These advanced systems will offer predictive maintenance, self-optimization, and remote management features.

Market consolidation trends may emerge as companies seek to strengthen competitive positions through strategic acquisitions and partnerships. This consolidation could create larger, more capable organizations better positioned to serve global markets and invest in advanced technologies.

Regional market development will continue with emerging economies contributing increasingly to overall market growth. Infrastructure development and industrial modernization in these markets create substantial opportunities for hydraulic device manufacturers.

Sustainability requirements will become more stringent, driving development of environmentally friendly hydraulic solutions and circular economy approaches to product lifecycle management. Companies that proactively address these requirements will gain competitive advantages.

Application diversification will expand hydraulic device usage into new sectors and applications as technology advancement enables solutions for previously unsuitable applications. This diversification reduces market concentration risk and creates new growth opportunities.

The Asia Pacific hydraulic devices market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by industrial development, technological advancement, and infrastructure investment across the region. Market fundamentals remain strong with diverse application segments, robust demand drivers, and continuous innovation creating sustained growth opportunities.

Key success factors for market participants include technology leadership, regional market understanding, strategic partnerships, and comprehensive service capabilities. Companies that effectively combine these elements while addressing sustainability requirements and digital transformation trends will be best positioned for long-term success.

Strategic opportunities abound across multiple dimensions including smart system development, emerging market penetration, aftermarket service expansion, and sustainability-focused innovation. The market’s evolution toward intelligent, connected hydraulic systems aligns with broader industrial digitalization trends and creates substantial value creation potential.

Future market development will be characterized by continued technological advancement, regional market expansion, and increasing integration with digital industrial infrastructure. Companies that proactively invest in these trends while maintaining focus on operational excellence and customer value creation will capture the most significant opportunities in this dynamic and growing market.

What is Hydraulic Devices?

Hydraulic devices are tools and machinery that utilize hydraulic power to perform work. They are commonly used in various applications such as construction, manufacturing, and automotive industries.

What are the key players in the Asia Pacific Hydraulic Devices Market?

Key players in the Asia Pacific Hydraulic Devices Market include Bosch Rexroth, Parker Hannifin, and Eaton Corporation, among others. These companies are known for their innovative hydraulic solutions and extensive product offerings.

What are the main drivers of growth in the Asia Pacific Hydraulic Devices Market?

The growth of the Asia Pacific Hydraulic Devices Market is driven by increasing industrial automation, rising demand for construction equipment, and advancements in hydraulic technology. These factors contribute to the expanding applications of hydraulic devices across various sectors.

What challenges does the Asia Pacific Hydraulic Devices Market face?

The Asia Pacific Hydraulic Devices Market faces challenges such as fluctuating raw material prices, stringent regulations on emissions, and competition from alternative technologies. These factors can impact the profitability and growth of companies in the market.

What opportunities exist in the Asia Pacific Hydraulic Devices Market?

Opportunities in the Asia Pacific Hydraulic Devices Market include the growing demand for energy-efficient hydraulic systems and the expansion of renewable energy projects. Additionally, the rise of smart manufacturing presents new avenues for innovation in hydraulic technology.

What trends are shaping the Asia Pacific Hydraulic Devices Market?

Trends in the Asia Pacific Hydraulic Devices Market include the integration of IoT technology in hydraulic systems, increasing focus on sustainability, and the development of compact and lightweight hydraulic devices. These trends are influencing product design and functionality.

Asia Pacific Hydraulic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydraulic Pumps, Hydraulic Cylinders, Hydraulic Motors, Hydraulic Valves |

| Technology | Electro-Hydraulic, Pneumatic-Hydraulic, Hydrostatic, Hydraulic Actuation |

| End User | Construction, Agriculture, Manufacturing, Marine |

| Application | Material Handling, Machine Tools, Automotive Assembly, Aerospace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Hydraulic Devices Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at