444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific Human Capital Management Software (HCM) market represents one of the fastest-growing segments in the global enterprise software landscape. This dynamic market encompasses comprehensive software solutions designed to manage, optimize, and streamline human resource processes across organizations of all sizes. The region’s rapid digital transformation, coupled with increasing workforce complexity and regulatory requirements, has positioned the Asia Pacific HCM market as a critical component of modern business infrastructure.

Market growth in the Asia Pacific region is being driven by several key factors, including the widespread adoption of cloud-based solutions, increasing emphasis on employee experience, and the need for data-driven HR decision making. The market is experiencing robust expansion with a projected CAGR of 11.2% through the forecast period, significantly outpacing global averages. This growth trajectory reflects the region’s commitment to modernizing human resource management practices and embracing digital transformation initiatives.

Regional dynamics vary significantly across the Asia Pacific landscape, with developed markets like Japan, Australia, and Singapore leading in adoption rates, while emerging economies such as India, Indonesia, and Vietnam present substantial growth opportunities. The market’s evolution is characterized by increasing demand for integrated platforms that combine traditional HR functions with advanced analytics, artificial intelligence, and mobile accessibility.

The Asia Pacific Human Capital Management Software market refers to the comprehensive ecosystem of digital solutions designed to manage, develop, and optimize human resources across organizations throughout the Asia Pacific region. These sophisticated platforms integrate multiple HR functions including talent acquisition, performance management, payroll processing, learning and development, and workforce analytics into unified systems that enhance organizational efficiency and employee engagement.

HCM software solutions encompass a broad spectrum of applications ranging from core HR information systems to advanced talent management platforms. These systems enable organizations to automate routine HR processes, gain insights into workforce trends, ensure regulatory compliance, and create more engaging employee experiences. The software typically includes modules for recruitment, onboarding, performance evaluation, compensation management, succession planning, and employee self-service portals.

Modern HCM platforms leverage cutting-edge technologies such as artificial intelligence, machine learning, and predictive analytics to provide organizations with actionable insights into their human capital. This technological integration allows for more strategic HR decision-making, improved employee retention, and enhanced organizational performance across diverse industry sectors throughout the Asia Pacific region.

Strategic market positioning in the Asia Pacific HCM software landscape reveals a rapidly evolving ecosystem driven by digital transformation imperatives and changing workforce expectations. The market demonstrates exceptional growth potential, with cloud-based solutions capturing approximately 68% market adoption across the region. This shift toward cloud deployment models reflects organizations’ desire for scalable, cost-effective, and accessible HR management solutions.

Key market drivers include the increasing complexity of multi-generational workforces, stringent regulatory compliance requirements, and the growing emphasis on employee experience as a competitive differentiator. Organizations across the region are investing heavily in HCM solutions to address challenges related to talent retention, which has become critical with turnover rates reaching 15.3% in key markets.

Competitive landscape analysis indicates a diverse market structure with global software giants competing alongside regional specialists and emerging technology providers. The market is characterized by continuous innovation, with vendors focusing on mobile-first designs, AI-powered analytics, and industry-specific customizations to meet the unique requirements of Asia Pacific organizations.

Future market trajectory suggests sustained growth driven by increasing adoption among small and medium enterprises, expansion of remote work capabilities, and integration with emerging technologies such as blockchain for secure credential management and IoT for workplace analytics.

Market penetration analysis reveals significant opportunities across various organizational segments and geographic regions within Asia Pacific. The following insights highlight critical market dynamics:

Digital transformation initiatives across Asia Pacific organizations serve as the primary catalyst for HCM software adoption. Companies are recognizing that traditional paper-based and manual HR processes cannot support modern business requirements, leading to increased investment in comprehensive digital solutions. This transformation is particularly pronounced in countries experiencing rapid economic growth and technological advancement.

Workforce demographics evolution presents significant challenges that HCM software addresses effectively. The region’s diverse workforce includes multiple generations with varying technological preferences and work styles. Organizations require sophisticated platforms to manage this complexity while ensuring consistent employee experiences across different demographic groups and geographic locations.

Regulatory compliance requirements continue to drive market growth as governments across the region implement stricter labor laws and data protection regulations. HCM software provides automated compliance monitoring, reporting capabilities, and audit trails that help organizations navigate complex regulatory landscapes while minimizing legal risks and associated costs.

Talent acquisition challenges in competitive job markets necessitate advanced recruitment and retention tools. Organizations are leveraging HCM platforms to streamline hiring processes, improve candidate experiences, and implement data-driven talent management strategies that enhance their ability to attract and retain top performers in increasingly competitive markets.

Remote work adoption accelerated by global events has created demand for cloud-based HCM solutions that support distributed workforces. Organizations require platforms that enable seamless collaboration, performance monitoring, and employee engagement regardless of physical location, driving investment in comprehensive digital HR infrastructure.

Implementation complexity remains a significant barrier for many organizations considering HCM software adoption. The process of migrating from legacy systems, training employees, and customizing platforms to meet specific organizational requirements can be time-consuming and resource-intensive, particularly for smaller companies with limited IT capabilities.

Cost considerations present challenges for organizations with constrained budgets, especially in emerging markets where economic conditions may limit technology investments. While cloud-based solutions have reduced upfront costs, ongoing subscription fees and customization expenses can still represent significant financial commitments for some organizations.

Data security concerns continue to influence adoption decisions, particularly in industries handling sensitive employee information. Organizations must balance the benefits of cloud-based solutions with concerns about data privacy, cybersecurity threats, and compliance with local data protection regulations that vary across Asia Pacific countries.

Cultural resistance to digital transformation within traditional organizations can slow adoption rates. Some companies face internal challenges related to change management, employee acceptance of new technologies, and organizational inertia that favors established processes over innovative solutions.

Integration challenges with existing enterprise systems can create technical barriers that complicate implementation projects. Organizations often struggle with connecting HCM platforms to legacy systems, ensuring data consistency, and maintaining operational continuity during transition periods.

Emerging market expansion presents substantial growth opportunities as developing economies in Southeast Asia and South Asia continue their digital transformation journeys. Countries such as Vietnam, Thailand, and Bangladesh are experiencing rapid economic growth and increasing technology adoption, creating favorable conditions for HCM software market expansion.

Small and medium enterprise segment represents a largely untapped market with significant potential. As cloud-based solutions become more affordable and user-friendly, SMEs are increasingly recognizing the value of professional HR management tools, creating opportunities for vendors to develop targeted solutions for this segment.

Industry-specific solutions offer opportunities for specialization and differentiation. Sectors such as healthcare, manufacturing, retail, and financial services have unique HR requirements that generic platforms may not fully address, creating demand for customized solutions that cater to specific industry needs.

Artificial intelligence integration provides opportunities for innovation and competitive advantage. Vendors that successfully incorporate AI-powered features such as predictive analytics, intelligent automation, and personalized employee experiences can differentiate their offerings and capture market share from traditional providers.

Mobile-first development addresses the growing demand for accessible, user-friendly HR solutions that support increasingly mobile workforces. Organizations across the region are prioritizing platforms that offer comprehensive mobile functionality, creating opportunities for vendors focused on mobile-optimized experiences.

Competitive intensity in the Asia Pacific HCM software market continues to escalate as established global vendors compete with regional specialists and emerging technology providers. This competition drives innovation, improves product quality, and creates more favorable pricing conditions for customers while challenging vendors to differentiate their offerings through unique value propositions.

Technology evolution shapes market dynamics through continuous advancement in cloud computing, artificial intelligence, and mobile technologies. These technological developments enable new features and capabilities that enhance user experiences, improve operational efficiency, and create opportunities for market disruption by innovative vendors.

Customer expectations are evolving rapidly as organizations become more sophisticated in their understanding of HCM software capabilities. Buyers increasingly demand comprehensive platforms that integrate seamlessly with existing systems, provide advanced analytics, and deliver exceptional user experiences across all stakeholder groups.

Regulatory environment changes across different Asia Pacific countries create both challenges and opportunities for market participants. Vendors must adapt their solutions to comply with varying local requirements while maintaining platform consistency and operational efficiency across multiple markets.

Economic factors influence market dynamics through their impact on organizational technology budgets and investment priorities. Economic growth in key markets supports increased HCM software adoption, while economic uncertainty can lead to delayed implementations or reduced feature requirements.

Comprehensive market analysis for the Asia Pacific HCM software market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. The methodology incorporates quantitative and qualitative research techniques to provide a complete understanding of market dynamics, competitive landscape, and growth opportunities.

Primary research activities include extensive interviews with industry executives, technology vendors, end-users, and subject matter experts across key Asia Pacific markets. These interviews provide insights into market trends, customer preferences, competitive dynamics, and future growth prospects that cannot be obtained through secondary sources alone.

Secondary research components encompass analysis of industry reports, company financial statements, government publications, trade association data, and technology research from reputable sources. This information provides historical context, market sizing data, and competitive intelligence that supports primary research findings.

Data validation processes ensure research accuracy through triangulation of multiple sources, cross-verification of key findings, and validation of market estimates through industry expert consultations. This rigorous approach maintains research quality and reliability standards throughout the analysis process.

Market segmentation analysis utilizes advanced analytical techniques to identify distinct market segments, evaluate growth potential, and assess competitive positioning across different customer groups, geographic regions, and technology categories within the Asia Pacific HCM software market.

China market leadership positions the country as the largest HCM software market in Asia Pacific, driven by massive enterprise digitization initiatives and government support for technology adoption. Chinese organizations are increasingly investing in comprehensive HR platforms to manage large, complex workforces while ensuring compliance with evolving labor regulations and data protection requirements.

Japan’s mature market demonstrates high adoption rates of advanced HCM features, with organizations prioritizing integration capabilities and industry-specific functionality. The Japanese market shows strong preference for solutions that support traditional corporate cultures while enabling digital transformation initiatives across diverse industry sectors.

India’s rapid growth reflects the country’s expanding IT services sector and increasing focus on talent management in competitive job markets. Indian organizations are adopting HCM software to address challenges related to high employee turnover, skills development, and workforce scaling in dynamic business environments.

Australia and New Zealand markets exhibit strong adoption of cloud-based solutions with emphasis on employee experience and regulatory compliance. These markets demonstrate willingness to invest in premium HCM platforms that offer comprehensive functionality and strong vendor support capabilities.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia show increasing adoption driven by economic growth and digital transformation initiatives. These markets present significant opportunities for vendors offering cost-effective solutions tailored to local business requirements and regulatory environments.

South Korea’s technology-forward approach drives demand for innovative HCM solutions incorporating artificial intelligence, mobile optimization, and advanced analytics. Korean organizations prioritize platforms that support their technology leadership ambitions while addressing unique cultural and business requirements.

Market leadership in the Asia Pacific HCM software market is characterized by intense competition among global technology giants, regional specialists, and emerging innovative providers. The competitive landscape reflects diverse customer requirements across different market segments and geographic regions.

Regional competitors include local software providers that understand specific market requirements and offer culturally appropriate solutions. These companies often compete effectively against global vendors by providing superior local support, language localization, and compliance with regional regulations.

Competitive strategies focus on product innovation, strategic partnerships, market expansion, and customer experience enhancement. Vendors are investing heavily in artificial intelligence, mobile optimization, and industry-specific solutions to differentiate their offerings in increasingly competitive markets.

By Deployment Model:

By Organization Size:

By Industry Vertical:

By Functionality:

Core HR Systems represent the foundation of HCM software implementations, providing essential employee data management, payroll processing, and administrative functions. These systems serve as the central repository for employee information and enable basic HR operations across organizations of all sizes. The category demonstrates steady growth as organizations modernize legacy systems and adopt integrated platforms.

Talent Management Solutions focus on strategic HR functions including recruitment, performance management, learning and development, and succession planning. This category shows strong growth as organizations recognize the importance of strategic talent management in competitive markets. Advanced features such as AI-powered candidate matching and predictive performance analytics drive premium pricing and customer loyalty.

Workforce Analytics Platforms provide data-driven insights that enable strategic HR decision making and organizational optimization. This rapidly growing category leverages big data, artificial intelligence, and machine learning to deliver actionable insights about workforce trends, employee engagement, and organizational performance. Organizations increasingly view analytics as essential for competitive advantage.

Employee Experience Solutions emphasize user-friendly interfaces, self-service capabilities, and mobile accessibility to enhance employee satisfaction and engagement. This category reflects changing workforce expectations and the recognition that positive employee experiences contribute directly to organizational success and talent retention.

Compliance Management Tools address the complex regulatory requirements across different Asia Pacific markets, providing automated compliance monitoring, reporting, and audit capabilities. This category is particularly important in highly regulated industries and markets with frequently changing labor laws and data protection requirements.

Organizational efficiency improvements represent primary benefits for companies implementing HCM software solutions. These platforms automate routine HR processes, reduce administrative overhead, and enable HR professionals to focus on strategic initiatives that drive business value. Organizations typically experience significant productivity gains and cost reductions following successful implementations.

Enhanced employee experiences result from user-friendly interfaces, self-service capabilities, and mobile accessibility that modern HCM platforms provide. Employees benefit from streamlined processes, improved communication, and greater control over their HR-related activities, leading to higher satisfaction and engagement levels across organizations.

Data-driven decision making capabilities enable HR professionals and business leaders to make informed decisions based on comprehensive workforce analytics and insights. These capabilities support strategic planning, talent optimization, and organizational development initiatives that contribute to improved business performance and competitive advantage.

Compliance assurance benefits help organizations navigate complex regulatory environments while minimizing legal risks and associated costs. Automated compliance monitoring, reporting, and audit capabilities ensure adherence to labor laws, data protection regulations, and industry standards across different markets.

Scalability advantages allow organizations to adapt their HR systems to changing business requirements, workforce growth, and market expansion initiatives. Cloud-based platforms particularly excel in providing flexible, scalable solutions that support organizational evolution without requiring significant additional investments.

Vendor ecosystem benefits include opportunities for technology providers to expand market presence, develop innovative solutions, and build long-term customer relationships in growing markets. The competitive landscape encourages continuous innovation and improvement in product offerings and customer service capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend reshaping HCM software capabilities across the Asia Pacific region. Organizations are increasingly demanding AI-powered features such as intelligent candidate screening, predictive performance analytics, and automated workforce planning. This trend reflects the growing sophistication of HR professionals and their desire for data-driven insights that support strategic decision making.

Mobile-First Design Philosophy drives platform development as organizations recognize the importance of accessible, user-friendly HR solutions. The trend toward mobile optimization reflects changing workforce expectations and the need for flexible, location-independent access to HR services. Vendors are prioritizing responsive design and native mobile applications to meet these evolving requirements.

Employee Experience Focus represents a fundamental shift from traditional HR administration toward comprehensive employee engagement and satisfaction initiatives. Organizations are investing in HCM platforms that prioritize user experience, self-service capabilities, and personalized interactions to improve employee retention and organizational culture.

Cloud-Native Architecture continues to dominate new implementations as organizations seek scalable, cost-effective solutions that support remote work and distributed teams. This trend accelerates migration from legacy on-premises systems toward modern cloud platforms that offer superior flexibility and functionality.

Industry-Specific Customization grows in importance as organizations demand solutions tailored to their unique operational requirements and regulatory environments. Vendors are developing specialized offerings for healthcare, manufacturing, financial services, and other sectors to address specific industry challenges and opportunities.

Integration Platform Emphasis reflects the need for seamless connectivity between HCM systems and other enterprise applications. Organizations prioritize platforms that offer robust API capabilities and pre-built integrations with popular business software to ensure operational efficiency and data consistency.

Strategic acquisitions continue to reshape the competitive landscape as major vendors acquire specialized companies to enhance their platform capabilities and market coverage. Recent acquisitions focus on artificial intelligence, analytics, and industry-specific solutions that strengthen comprehensive HCM offerings.

Partnership agreements between HCM vendors and technology providers create integrated solutions that address complex organizational requirements. These partnerships often focus on areas such as payroll processing, background verification, learning management, and workforce analytics to provide customers with comprehensive platforms.

Product innovation initiatives drive continuous improvement in HCM software capabilities, with vendors investing heavily in research and development to maintain competitive advantages. Recent innovations include conversational AI interfaces, blockchain-based credential verification, and advanced predictive analytics capabilities.

Market expansion strategies see global vendors establishing local presence in key Asia Pacific markets through direct investment, partnerships, and acquisition of regional providers. These strategies aim to better serve local customers while navigating complex regulatory and cultural requirements.

Regulatory compliance enhancements respond to evolving data protection and labor law requirements across different Asia Pacific countries. Vendors are investing in compliance capabilities to help customers navigate complex regulatory environments while maintaining operational efficiency.

Customer success programs emerge as critical differentiators in competitive markets, with vendors investing in implementation support, training, and ongoing customer relationship management to ensure successful deployments and long-term satisfaction.

MarkWide Research recommends that organizations considering HCM software implementations prioritize platforms that offer comprehensive integration capabilities, scalable architecture, and strong vendor support. The complexity of modern HR requirements demands solutions that can adapt to changing business needs while maintaining operational efficiency and user satisfaction.

Vendor selection criteria should emphasize long-term viability, innovation capabilities, and regional expertise rather than focusing solely on initial cost considerations. Organizations benefit from partners that understand local market requirements and can provide ongoing support throughout the implementation and optimization process.

Implementation planning requires careful attention to change management, user training, and data migration processes to ensure successful deployments. Organizations should allocate sufficient resources for these critical activities and establish clear success metrics to measure implementation effectiveness.

Technology roadmap alignment ensures that HCM software investments support broader digital transformation initiatives and integrate effectively with existing enterprise systems. Organizations should consider future requirements and scalability needs when evaluating platform options.

Security and compliance considerations must be prioritized throughout the selection and implementation process, particularly for organizations in regulated industries or those handling sensitive employee data. Vendors should demonstrate robust security capabilities and compliance with relevant regulations.

Return on investment measurement should encompass both quantitative metrics such as cost savings and efficiency gains, as well as qualitative benefits including employee satisfaction and organizational agility improvements. Comprehensive ROI analysis supports ongoing optimization and future investment decisions.

Market growth trajectory indicates sustained expansion across the Asia Pacific HCM software market, driven by continued digital transformation initiatives and evolving workforce management requirements. MWR analysis suggests that the market will maintain strong growth momentum with increasing adoption across all organizational segments and geographic regions.

Technology evolution will continue to reshape HCM software capabilities through advancement in artificial intelligence, machine learning, and automation technologies. These developments will enable more sophisticated workforce analytics, predictive capabilities, and personalized employee experiences that drive organizational value and competitive advantage.

Market consolidation trends may accelerate as larger vendors acquire specialized providers to enhance their platform capabilities and market coverage. This consolidation could lead to more comprehensive solutions while potentially reducing the number of independent vendors in certain market segments.

Emerging market expansion presents significant growth opportunities as developing economies in Southeast Asia and South Asia continue their digital transformation journeys. These markets offer substantial potential for vendors that can provide cost-effective, culturally appropriate solutions tailored to local requirements.

Industry specialization will become increasingly important as organizations demand solutions that address their unique operational challenges and regulatory requirements. Vendors that develop deep industry expertise and specialized functionality will likely capture premium market positions and customer loyalty.

Integration ecosystem development will expand as HCM platforms become central components of broader enterprise technology architectures. This trend will drive demand for platforms with robust API capabilities and extensive partner ecosystems that support comprehensive business process automation.

The Asia Pacific Human Capital Management Software market represents a dynamic and rapidly evolving landscape characterized by strong growth potential, intense competition, and continuous technological innovation. Organizations across the region are recognizing the strategic importance of modern HCM solutions in managing complex workforces, ensuring regulatory compliance, and driving competitive advantage through enhanced employee experiences.

Market fundamentals remain strong, supported by sustained economic growth, increasing digital transformation initiatives, and evolving workforce expectations that demand sophisticated HR management capabilities. The shift toward cloud-based solutions, mobile optimization, and AI-powered analytics reflects broader technology trends that will continue to shape market development in coming years.

Success factors for market participants include the ability to provide comprehensive, integrated platforms that address diverse customer requirements while maintaining user-friendly interfaces and robust security capabilities. Vendors that can combine global expertise with local market knowledge will be best positioned to capture growth opportunities across different Asia Pacific markets.

Future prospects indicate continued market expansion driven by emerging market adoption, SME segment growth, and ongoing innovation in platform capabilities. Organizations that invest in modern HCM solutions today will be better positioned to navigate future workforce challenges while building sustainable competitive advantages through strategic human capital management.

What is Human Capital Management Software (HCM)?

Human Capital Management Software (HCM) refers to a suite of applications designed to manage and optimize an organization’s workforce. It encompasses various functions such as recruitment, payroll, performance management, and employee development.

What are the key players in the Asia Pacific Human Capital Management Software (HCM) Market?

Key players in the Asia Pacific Human Capital Management Software (HCM) Market include SAP, Oracle, Workday, and ADP, among others. These companies offer a range of solutions tailored to meet the diverse needs of businesses in the region.

What are the growth factors driving the Asia Pacific Human Capital Management Software (HCM) Market?

The growth of the Asia Pacific Human Capital Management Software (HCM) Market is driven by increasing demand for automation in HR processes, the need for enhanced employee engagement, and the rising focus on data-driven decision-making in workforce management.

What challenges does the Asia Pacific Human Capital Management Software (HCM) Market face?

The Asia Pacific Human Capital Management Software (HCM) Market faces challenges such as data privacy concerns, integration issues with existing systems, and the need for continuous updates to meet evolving regulatory requirements.

What opportunities exist in the Asia Pacific Human Capital Management Software (HCM) Market?

Opportunities in the Asia Pacific Human Capital Management Software (HCM) Market include the growing adoption of cloud-based solutions, the increasing emphasis on employee wellness programs, and the potential for AI-driven analytics to enhance HR decision-making.

What trends are shaping the Asia Pacific Human Capital Management Software (HCM) Market?

Trends shaping the Asia Pacific Human Capital Management Software (HCM) Market include the rise of remote work solutions, the integration of artificial intelligence for talent acquisition, and a shift towards personalized employee experiences in HR practices.

Asia Pacific Human Capital Management Software (HCM) Market

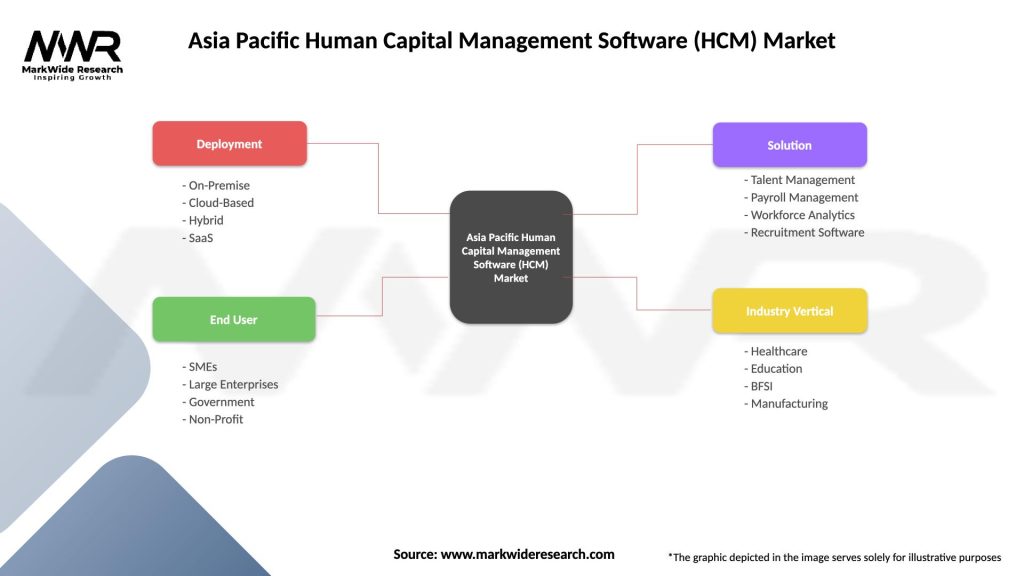

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | SMEs, Large Enterprises, Government, Non-Profit |

| Solution | Talent Management, Payroll Management, Workforce Analytics, Recruitment Software |

| Industry Vertical | Healthcare, Education, BFSI, Manufacturing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Human Capital Management Software (HCM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at