444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific Heavy Construction Equipment market refers to the industry involved in the manufacturing, distribution, and sale of various heavy equipment used in construction projects across the Asia-Pacific region. This market encompasses a wide range of machinery and equipment, including excavators, bulldozers, loaders, cranes, and more. The demand for heavy construction equipment in this region is driven by rapid urbanization, infrastructure development, and industrialization.

Meaning

The Asia-Pacific Heavy Construction Equipment market represents the sector dedicated to providing robust and durable machinery for heavy construction purposes. This equipment plays a vital role in enhancing construction efficiency, reducing manual labor, and increasing productivity. The market includes both local and international manufacturers and suppliers, striving to meet the diverse demands of construction companies and contractors.

Executive Summary

The Asia-Pacific Heavy Construction Equipment market has experienced significant growth in recent years due to the region’s infrastructure boom. The market offers a wide array of equipment options to cater to various construction needs, ranging from small-scale projects to large-scale infrastructure developments. Key players in the market continue to invest in research and development to introduce advanced and innovative equipment that improves operational efficiency and minimizes environmental impact.

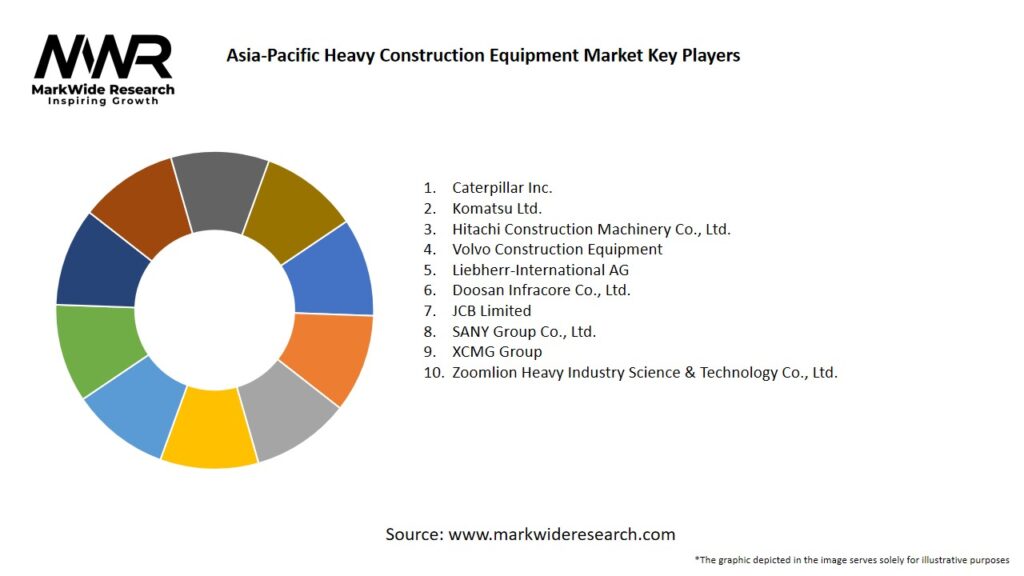

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific Heavy Construction Equipment market operates in a dynamic environment influenced by various factors. These factors include economic conditions, government policies, technological advancements, environmental concerns, and industry trends. The market is characterized by intense competition, with both local and international players vying for market share. Continuous innovation, customer-centric approaches, and strategic partnerships are vital for sustainable growth in this industry.

Regional Analysis

The Asia-Pacific region comprises diverse markets with varying construction requirements, economic conditions, and regulatory landscapes. China, India, Japan, and Southeast Asian countries dominate the heavy construction equipment market in this region. China holds a significant share due to its massive infrastructure projects, urbanization, and manufacturing industry. India, with its ambitious infrastructure development plans, presents immense growth potential. Southeast Asian countries like Indonesia, Vietnam, and Thailand are also witnessing rapid construction activities, driven by urbanization and industrialization.

Competitive Landscape

Leading Companies in the Asia-Pacific Heavy Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

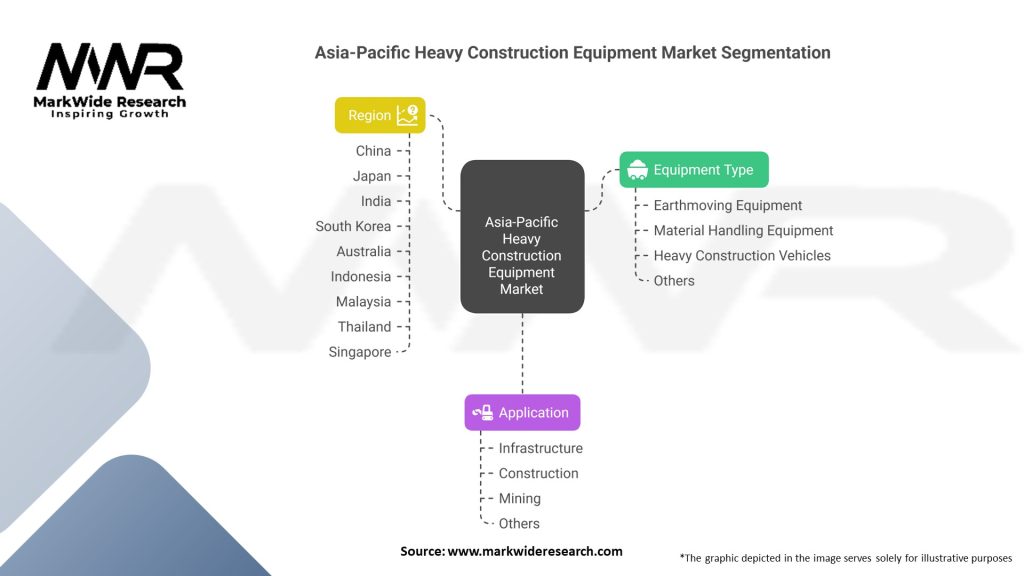

Segmentation

The Asia-Pacific Heavy Construction Equipment market can be segmented based on equipment type, application, and end-user industry. Equipment types include excavators, bulldozers, loaders, cranes, and others. Applications encompass earthmoving, material handling, demolition, and transportation. The end-user industries include construction, mining, oil and gas, and others. This segmentation helps cater to the specific requirements of different industries and enables market players to target their offerings effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Asia-Pacific Heavy Construction Equipment market. The construction sector experienced disruptions due to lockdown measures, supply chain disruptions, and labor shortages. Many construction projects were put on hold or delayed, leading to a decline in equipment demand. However, the industry has shown resilience and adaptability. As countries recover from the pandemic, governments’ stimulus packages, increased infrastructure spending, and renewed construction activities are expected to drive the market’s recovery and growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific Heavy Construction Equipment market is poised for significant growth in the coming years. Factors such as increasing infrastructure investments, urbanization, and technological advancements will drive market expansion. The demand for eco-friendly and energy-efficient equipment is expected to rise, leading to further innovations in the industry. The market’s future will be shaped by continued digital transformation, partnerships, and sustainability initiatives.

Conclusion

The Asia-Pacific Heavy Construction Equipment market is a dynamic and competitive industry driven by infrastructure development, urbanization, and technological advancements. The market offers a wide range of equipment options to meet diverse construction needs. While challenges such as high costs and skilled labor shortages exist, opportunities lie in rental services, emerging markets, and sustainable practices. By embracing digital transformation, investing in training, and focusing on innovation, industry participants can thrive in this growing market. With the recovery from the Covid-19 pandemic and increased infrastructure spending, the future outlook for the market remains promising.

What is Heavy Construction Equipment?

Heavy construction equipment refers to large machines and vehicles used for construction tasks such as excavation, lifting, and transportation of materials. Common types include excavators, bulldozers, and cranes, which are essential in infrastructure development and large-scale construction projects.

What are the key players in the Asia-Pacific Heavy Construction Equipment market?

Key players in the Asia-Pacific Heavy Construction Equipment market include Caterpillar Inc., Komatsu Ltd., and Hitachi Construction Machinery Co., among others. These companies are known for their innovative machinery and extensive product lines catering to various construction needs.

What are the growth factors driving the Asia-Pacific Heavy Construction Equipment market?

The Asia-Pacific Heavy Construction Equipment market is driven by rapid urbanization, increasing infrastructure investments, and the expansion of the construction industry. Additionally, government initiatives to improve transportation networks and housing projects contribute significantly to market growth.

What challenges does the Asia-Pacific Heavy Construction Equipment market face?

Challenges in the Asia-Pacific Heavy Construction Equipment market include fluctuating raw material prices, stringent regulations regarding emissions, and the high cost of equipment maintenance. These factors can hinder market growth and affect profitability for manufacturers.

What opportunities exist in the Asia-Pacific Heavy Construction Equipment market?

Opportunities in the Asia-Pacific Heavy Construction Equipment market include the adoption of advanced technologies such as automation and telematics, which enhance operational efficiency. Additionally, the growing demand for eco-friendly equipment presents a chance for innovation and market expansion.

What trends are shaping the Asia-Pacific Heavy Construction Equipment market?

Trends in the Asia-Pacific Heavy Construction Equipment market include the increasing use of electric and hybrid machinery, advancements in machine connectivity, and a focus on sustainability. These trends are reshaping how construction projects are executed and managed.

Asia-Pacific Heavy Construction Equipment Market:

| Segmentation Details | Information |

|---|---|

| Equipment Type | Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, Others |

| Application | Infrastructure, Construction, Mining, Others |

| Region | Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Heavy Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at