444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific hair shampoo industry market represents one of the most dynamic and rapidly evolving segments within the global personal care industry. This expansive market encompasses diverse consumer preferences, cultural hair care traditions, and varying economic conditions across multiple countries including China, Japan, India, South Korea, Australia, and Southeast Asian nations. Market dynamics in this region are characterized by increasing urbanization, rising disposable incomes, and growing awareness of premium hair care products.

Regional diversity plays a crucial role in shaping market trends, with each country presenting unique consumer behaviors and preferences. The market demonstrates robust growth potential, driven by a young demographic profile and increasing emphasis on personal grooming. Innovation in formulations continues to drive market expansion, with manufacturers focusing on natural ingredients, sulfate-free formulas, and specialized solutions for different hair types prevalent in Asian populations.

Consumer spending patterns indicate a significant shift toward premium and specialized hair care products, with growth rates reaching 8.5% annually in key segments. The market benefits from strong distribution networks, including traditional retail channels, e-commerce platforms, and direct-to-consumer models that cater to diverse consumer preferences across urban and rural areas.

The Asia-Pacific hair shampoo industry market refers to the comprehensive ecosystem of hair cleansing products, manufacturing processes, distribution channels, and consumer engagement strategies operating across the Asia-Pacific region. This market encompasses various product categories including daily-use shampoos, specialized treatments, organic formulations, and premium hair care solutions designed specifically for Asian hair types and consumer preferences.

Market scope includes both mass-market and premium segments, covering products manufactured by multinational corporations, regional brands, and emerging local players. The industry involves complex supply chains, from raw material sourcing to final product delivery, incorporating traditional ingredients alongside modern cosmetic science innovations.

Cultural significance within this market extends beyond basic hair cleansing, encompassing traditional hair care practices, beauty standards, and evolving lifestyle preferences that influence product development and marketing strategies across different Asia-Pacific countries.

Strategic market positioning in the Asia-Pacific hair shampoo industry reveals exceptional growth opportunities driven by demographic trends, economic development, and changing consumer behaviors. The market demonstrates remarkable resilience and adaptability, with manufacturers successfully navigating diverse regulatory environments and cultural preferences across multiple countries.

Key growth drivers include urbanization rates exceeding 65% in major markets, increasing female workforce participation, and rising awareness of hair health and styling. Premium segment adoption shows particularly strong momentum, with natural and organic formulations capturing 23% market share in developed Asia-Pacific markets.

Competitive landscape features both established multinational brands and innovative local players, creating dynamic market conditions that foster continuous product innovation and competitive pricing strategies. E-commerce penetration has reached 42% of total sales in key markets, fundamentally transforming traditional distribution models and consumer engagement approaches.

Future projections indicate sustained growth momentum, supported by expanding middle-class populations, increasing disposable incomes, and growing emphasis on personal care and wellness across the region.

Consumer behavior analysis reveals significant insights that shape market development across the Asia-Pacific region:

Economic prosperity across major Asia-Pacific markets serves as a fundamental driver for hair shampoo industry growth. Rising disposable incomes enable consumers to upgrade from basic hair care products to premium formulations, creating substantial market expansion opportunities for manufacturers and retailers.

Urbanization trends significantly impact consumer behavior and product demand patterns. Urban populations demonstrate higher consumption rates of specialized hair care products, driven by lifestyle factors including pollution exposure, stress-related hair concerns, and professional appearance requirements. Urban market penetration continues expanding as rural populations migrate to cities seeking economic opportunities.

Digital transformation revolutionizes consumer engagement and product discovery processes. Social media platforms, beauty influencers, and online tutorials create awareness about hair care routines and product benefits, driving demand for specialized shampoo formulations. E-commerce platforms provide convenient access to diverse product ranges, particularly benefiting premium and niche brands.

Health and wellness consciousness motivates consumers to seek products with beneficial ingredients and avoid potentially harmful chemicals. This trend supports growth in natural, organic, and dermatologically-tested shampoo categories, creating opportunities for brands emphasizing safety and efficacy.

Professional beauty industry growth contributes to market expansion through salon recommendations, professional product lines, and consumer education about proper hair care practices.

Price sensitivity remains a significant constraint in several Asia-Pacific markets, particularly in developing economies where consumers prioritize basic necessities over premium personal care products. Economic fluctuations and currency volatility can impact consumer spending on non-essential items, affecting premium segment growth.

Regulatory complexity across different countries creates challenges for manufacturers seeking regional market expansion. Varying ingredient approval processes, labeling requirements, and safety standards increase compliance costs and market entry barriers, particularly for smaller brands and new market entrants.

Cultural resistance to certain product categories or ingredients may limit market penetration in specific regions. Traditional hair care practices and skepticism toward chemical formulations can slow adoption of modern shampoo products in rural or conservative market segments.

Supply chain disruptions pose ongoing challenges, particularly for imported ingredients and finished products. Geopolitical tensions, trade restrictions, and logistics constraints can impact product availability and pricing stability across the region.

Counterfeit products undermine brand trust and market growth, particularly affecting premium brands in markets with weak intellectual property protection. Fake products not only reduce legitimate sales but also create safety concerns that can damage overall category reputation.

Emerging market expansion presents substantial growth opportunities as developing Asia-Pacific countries experience economic growth and rising consumer spending power. Markets such as Vietnam, Indonesia, and Philippines demonstrate strong potential for both mass-market and premium hair care products as urbanization accelerates.

Natural and organic segments offer significant growth potential, driven by increasing health consciousness and environmental awareness. Brands developing innovative formulations using traditional Asian ingredients can capture growing consumer interest in authentic, culturally-relevant products with modern efficacy.

Male grooming market represents an underexplored opportunity with substantial growth potential. Changing masculine beauty standards and increased male participation in personal care routines create demand for specialized men’s hair care products and targeted marketing approaches.

Technology integration enables innovative product development and consumer engagement strategies. Smart packaging, personalized formulations based on hair analysis, and augmented reality try-on experiences can differentiate brands and enhance consumer experiences.

Sustainability initiatives create competitive advantages and appeal to environmentally conscious consumers. Brands investing in eco-friendly packaging, sustainable sourcing, and carbon-neutral manufacturing processes can capture growing market segments prioritizing environmental responsibility.

Competitive intensity continues escalating as both established multinational brands and emerging local players compete for market share across diverse Asia-Pacific markets. This competition drives continuous innovation in product formulations, packaging design, and marketing strategies, ultimately benefiting consumers through improved product quality and competitive pricing.

Consumer empowerment through digital platforms fundamentally alters market dynamics, enabling direct brand-consumer relationships and reducing traditional retailer influence. Social media reviews, beauty blogger recommendations, and peer-to-peer product sharing create new pathways for brand discovery and consumer education.

Supply chain evolution reflects changing market demands and technological capabilities. Manufacturers increasingly adopt flexible production systems, local sourcing strategies, and direct-to-consumer distribution models to improve responsiveness and reduce costs. Operational efficiency improvements of 15-20% are commonly achieved through supply chain optimization.

Innovation cycles accelerate as brands seek differentiation in crowded markets. Product development timelines compress while formulation complexity increases, driven by consumer demands for multi-functional products addressing specific hair concerns prevalent in Asian populations.

Regulatory harmonization efforts across some Asia-Pacific markets create opportunities for streamlined product development and market entry strategies, though significant variations persist between countries requiring localized approaches.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia-Pacific hair shampoo industry market. Primary research involves extensive consumer surveys, industry expert interviews, and retailer feedback collection across key markets including China, Japan, India, South Korea, and Southeast Asian countries.

Data collection processes incorporate both quantitative and qualitative research approaches. Consumer behavior studies utilize structured questionnaires and focus group discussions to understand purchasing patterns, brand preferences, and product satisfaction levels. Industry stakeholder interviews provide insights into market trends, competitive dynamics, and future growth projections.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and trade association publications. Market data validation occurs through cross-referencing multiple sources and conducting expert reviews to ensure accuracy and reliability.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, and trend identification processes. Statistical modeling techniques help project future market developments and identify growth opportunities across different product segments and geographic regions.

Quality assurance measures ensure research integrity through systematic data verification, expert panel reviews, and continuous methodology refinement based on market feedback and evolving industry conditions.

China dominates the Asia-Pacific hair shampoo market, representing approximately 35% of regional consumption driven by massive population, rapid urbanization, and growing consumer sophistication. Chinese consumers increasingly favor premium and specialized products, with natural ingredient formulations showing particularly strong growth momentum.

Japan maintains its position as a mature, high-value market characterized by consumer preference for innovative formulations and premium positioning. Japanese brands excel in product development and quality standards, influencing trends across the broader Asia-Pacific region. Premium segment penetration reaches 58% of total market volume in Japan.

India presents exceptional growth opportunities with its large, young population and increasing disposable incomes. The market demonstrates strong demand for both traditional Ayurvedic formulations and modern hair care solutions, creating opportunities for brands offering culturally-relevant products.

South Korea leads innovation in beauty and personal care, with Korean brands gaining international recognition for advanced formulations and effective marketing strategies. The market shows strong preference for multi-step hair care routines and specialized treatments.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and Philippines demonstrate robust growth potential, with market expansion rates averaging 12-15% annually in key segments. These markets benefit from young demographics, increasing urbanization, and growing beauty consciousness.

Australia and New Zealand represent mature markets with strong emphasis on natural and organic products, sustainability, and premium positioning, influencing broader regional trends toward environmentally conscious consumption.

Market leadership in the Asia-Pacific hair shampoo industry involves both global multinational corporations and strong regional players, creating a dynamic competitive environment that fosters innovation and consumer choice.

Competitive strategies focus on product innovation, cultural adaptation, digital marketing excellence, and strategic partnerships with local distributors and retailers to maximize market penetration and consumer engagement.

By Product Type:

By Hair Type:

By Distribution Channel:

Anti-dandruff shampoos represent a significant category within the Asia-Pacific market, driven by climate conditions and lifestyle factors that contribute to scalp issues. This segment demonstrates consistent growth with market penetration rates reaching 28% in tropical markets where humidity and pollution create favorable conditions for dandruff formation.

Hair strengthening formulations gain popularity across the region, particularly among consumers experiencing hair thinning due to stress, pollution, or genetic factors. Products incorporating traditional Asian ingredients like ginseng, rice protein, and herbal extracts show strong consumer acceptance and loyalty.

Color protection shampoos experience robust growth as hair coloring becomes increasingly popular across Asia-Pacific markets. This category benefits from rising fashion consciousness and professional salon services expansion, particularly in urban markets.

Baby and children’s shampoos maintain steady demand driven by safety concerns and gentle formulation requirements. Parents increasingly seek products with minimal chemical content and dermatologically-tested formulations for their children’s sensitive skin and hair.

Men’s grooming shampoos emerge as a high-growth category, reflecting changing masculine beauty standards and increased male participation in personal care routines. This segment shows particular strength in developed markets like Japan, South Korea, and urban China.

Manufacturers benefit from expanding market opportunities, diverse consumer segments, and growing demand for innovative formulations. The region’s manufacturing capabilities and cost advantages enable efficient production and competitive pricing strategies for both domestic and export markets.

Retailers gain from strong consumer demand, high product turnover rates, and opportunities for premium positioning. The hair shampoo category provides consistent revenue streams and opportunities for private label development and exclusive brand partnerships.

Consumers enjoy increased product variety, improved formulation quality, and competitive pricing resulting from market competition. Access to both traditional and innovative hair care solutions enables personalized approaches to hair health and styling preferences.

Distributors capitalize on growing market demand and expanding distribution channels, particularly in e-commerce and specialty retail segments. Strong logistics networks and local market knowledge create competitive advantages in product placement and market penetration.

Ingredient suppliers benefit from growing demand for natural, organic, and specialized ingredients. The trend toward premium formulations creates opportunities for innovative ingredient development and value-added supply relationships.

Investment stakeholders find attractive opportunities in a growing market with strong demographic support, increasing consumer spending power, and continuous innovation driving market expansion and profitability potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution transforms consumer expectations and product development approaches across the Asia-Pacific hair shampoo market. Brands increasingly offer customized formulations based on individual hair analysis, lifestyle factors, and specific concerns, leveraging technology to create unique consumer experiences and enhanced product efficacy.

Sustainable packaging initiatives gain momentum as environmental consciousness grows among consumers and regulatory pressure increases. Brands adopt refillable containers, biodegradable materials, and reduced packaging designs to appeal to environmentally-aware consumers and reduce environmental impact.

Ingredient transparency becomes increasingly important as consumers demand clear information about product formulations and ingredient sourcing. Brands respond by providing detailed ingredient lists, sourcing information, and educational content about product benefits and safety.

Multi-functional formulations address consumer desires for simplified routines and enhanced value. Products combining cleansing, conditioning, treatment, and styling benefits in single formulations gain popularity, particularly among busy urban consumers seeking efficiency.

Cultural fusion in product development combines traditional Asian hair care wisdom with modern cosmetic science, creating authentic products that resonate with local consumers while meeting contemporary performance expectations. Traditional ingredient adoption shows 35% growth in premium segments.

Digital-first marketing strategies prioritize social media engagement, influencer partnerships, and online community building over traditional advertising approaches, reflecting changing consumer media consumption patterns and preference for peer recommendations.

Innovation partnerships between multinational brands and local ingredient suppliers create unique formulations incorporating traditional Asian botanicals with modern delivery systems. These collaborations enable authentic product positioning while meeting international quality and safety standards.

Acquisition activities intensify as major players seek to expand regional presence and acquire local market expertise. Strategic acquisitions of successful regional brands provide established distribution networks and consumer loyalty, accelerating market penetration strategies.

Manufacturing investments in sustainable production technologies and local facility expansion demonstrate long-term commitment to Asia-Pacific markets. Companies invest in clean energy, water conservation, and waste reduction technologies to meet environmental standards and consumer expectations.

Digital transformation initiatives revolutionize consumer engagement through virtual try-on technologies, AI-powered product recommendations, and personalized marketing campaigns. MarkWide Research indicates that digital engagement strategies improve customer retention rates by 40-45% across key markets.

Regulatory harmonization efforts in some markets create opportunities for streamlined product development and approval processes, though significant variations persist requiring localized compliance strategies and market-specific formulations.

Research and development investments focus on advanced delivery systems, sustainable ingredients, and efficacy enhancement technologies. Companies allocate increasing resources to innovation centers and consumer research facilities across the region.

Market entry strategies should prioritize cultural understanding and local partnership development over standardized global approaches. Successful brands invest in deep consumer research, local ingredient sourcing, and culturally-relevant marketing messages that resonate with specific market segments and traditional beauty practices.

Product portfolio optimization requires balancing mass-market accessibility with premium positioning opportunities. Brands should develop tiered product offerings that address diverse consumer needs and price points while maintaining consistent quality standards and brand identity across all segments.

Digital marketing excellence becomes essential for competitive success, particularly in reaching younger demographics and urban consumers. Companies should invest in social media capabilities, influencer partnerships, and e-commerce optimization to maximize market reach and consumer engagement effectiveness.

Supply chain resilience demands diversification strategies and local sourcing capabilities to mitigate risks from geopolitical tensions, trade disruptions, and logistics challenges. Building flexible supply networks with multiple supplier relationships ensures consistent product availability and cost stability.

Innovation focus should emphasize natural ingredients, sustainability, and multi-functional benefits that address specific Asian hair types and concerns. MWR analysis suggests that brands investing in culturally-relevant innovation achieve 25-30% higher consumer loyalty rates than those using standardized formulations.

Regulatory compliance requires proactive monitoring and adaptation strategies as standards evolve across different markets. Companies should establish dedicated regulatory teams and maintain close relationships with local authorities to ensure smooth market operations and product approvals.

Long-term growth prospects for the Asia-Pacific hair shampoo industry remain exceptionally positive, supported by favorable demographic trends, economic development, and evolving consumer preferences toward premium personal care products. The market is projected to maintain robust expansion with annual growth rates averaging 7-9% across key segments over the next decade.

Technology integration will increasingly influence product development, consumer engagement, and market dynamics. Artificial intelligence, personalization algorithms, and smart packaging technologies will create new opportunities for differentiation and consumer value creation, particularly in developed markets with high technology adoption rates.

Sustainability imperatives will reshape industry practices, from ingredient sourcing and manufacturing processes to packaging design and distribution strategies. Brands prioritizing environmental responsibility and circular economy principles will gain competitive advantages as consumer awareness and regulatory pressure increase.

Market consolidation may accelerate as smaller brands struggle to compete with established players’ resources and capabilities, while successful regional brands become attractive acquisition targets for multinational corporations seeking local market expertise and consumer loyalty.

Emerging market development will drive significant growth opportunities as developing Asia-Pacific countries experience continued economic growth, urbanization, and rising consumer sophistication. These markets present substantial potential for both mass-market and premium product categories.

Innovation cycles will continue accelerating, driven by consumer demands for novel ingredients, enhanced efficacy, and personalized solutions. Brands investing in research and development capabilities and consumer insights will maintain competitive advantages in rapidly evolving market conditions.

The Asia-Pacific hair shampoo industry market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by favorable demographics, economic development, and changing consumer preferences. Market fundamentals remain strong across the region, supported by rising disposable incomes, urbanization trends, and increasing emphasis on personal care and wellness.

Competitive dynamics continue intensifying as both established multinational brands and innovative local players compete for market share through product innovation, cultural adaptation, and digital marketing excellence. Success in this market requires deep understanding of local consumer preferences, cultural nuances, and regulatory requirements across diverse Asia-Pacific countries.

Future opportunities are particularly promising in natural and organic segments, male grooming categories, and emerging markets with growing consumer sophistication. Brands that successfully combine traditional Asian hair care wisdom with modern formulation science while embracing sustainability and personalization trends will be best positioned for long-term success.

Strategic recommendations emphasize the importance of cultural authenticity, digital engagement capabilities, and supply chain resilience in building sustainable competitive advantages. As MarkWide Research analysis indicates, companies investing in localized innovation and consumer-centric approaches achieve superior performance and market positioning across this diverse and dynamic regional market.

What is Hair Shampoo?

Hair shampoo is a hair care product used for cleaning the hair and scalp, typically formulated with surfactants and other ingredients to remove dirt, oil, and product buildup. It plays a crucial role in personal grooming and hygiene.

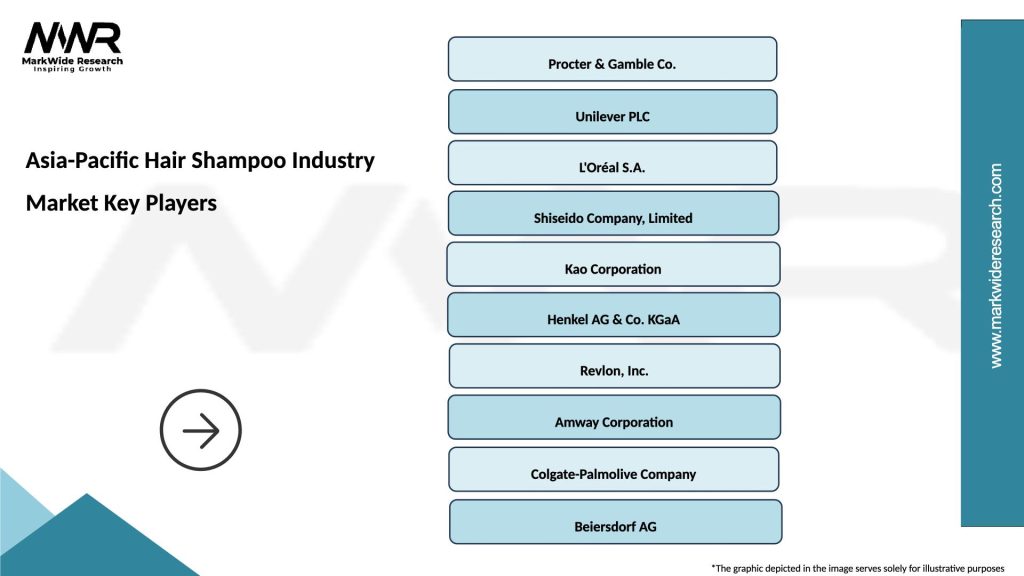

What are the key players in the Asia-Pacific Hair Shampoo Industry Market?

Key players in the Asia-Pacific Hair Shampoo Industry Market include Procter & Gamble, Unilever, L’Oréal, and Shiseido, among others. These companies are known for their diverse product offerings and strong market presence in the region.

What are the growth factors driving the Asia-Pacific Hair Shampoo Industry Market?

The growth of the Asia-Pacific Hair Shampoo Industry Market is driven by increasing consumer awareness of personal grooming, rising disposable incomes, and the growing demand for organic and natural hair care products. Additionally, the influence of social media on beauty trends contributes to market expansion.

What challenges does the Asia-Pacific Hair Shampoo Industry Market face?

The Asia-Pacific Hair Shampoo Industry Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards sustainable products. These factors can impact profitability and market dynamics.

What opportunities exist in the Asia-Pacific Hair Shampoo Industry Market?

Opportunities in the Asia-Pacific Hair Shampoo Industry Market include the rising trend of e-commerce for beauty products, the demand for customized hair care solutions, and the growth of the men’s grooming segment. These trends present avenues for innovation and market penetration.

What trends are shaping the Asia-Pacific Hair Shampoo Industry Market?

Trends shaping the Asia-Pacific Hair Shampoo Industry Market include the increasing popularity of sulfate-free and paraben-free formulations, the rise of eco-friendly packaging, and the incorporation of advanced technologies in product development. These trends reflect changing consumer preferences towards health and sustainability.

Asia-Pacific Hair Shampoo Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoo for Oily Hair, Shampoo for Dry Hair, Anti-Dandruff Shampoo, Color Protection Shampoo |

| End User | Men, Women, Children, Salons |

| Distribution Channel | Supermarkets, Online Retail, Specialty Stores, Pharmacies |

| Form | Liquid, Gel, Cream, Solid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Hair Shampoo Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at