444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific green cement market represents a transformative segment within the construction materials industry, driven by increasing environmental consciousness and stringent regulatory frameworks across the region. Green cement technologies are revolutionizing traditional cement manufacturing processes by incorporating sustainable materials, reducing carbon emissions, and promoting circular economy principles. The region’s rapid urbanization, coupled with growing awareness of climate change impacts, has positioned Asia Pacific as a leading market for environmentally friendly cement alternatives.

Market dynamics in the Asia Pacific region reflect a significant shift toward sustainable construction practices, with countries like China, India, Japan, and Australia leading adoption initiatives. The market encompasses various green cement technologies including fly ash-based cement, slag cement, limestone cement, and innovative bio-based alternatives. Construction industry stakeholders are increasingly recognizing the long-term benefits of green cement adoption, including reduced environmental impact, enhanced durability, and compliance with evolving building codes.

Regional growth patterns indicate robust expansion across key markets, with the sector experiencing a compound annual growth rate of 8.2% driven by government initiatives promoting sustainable infrastructure development. Manufacturing innovations and technological advancements continue to enhance the performance characteristics of green cement products, making them increasingly competitive with traditional Portland cement alternatives.

The Asia Pacific green cement market refers to the comprehensive ecosystem of environmentally sustainable cement manufacturing, distribution, and application across countries in the Asia Pacific region. Green cement encompasses various eco-friendly cement formulations that significantly reduce carbon dioxide emissions during production while maintaining or enhancing structural performance characteristics compared to conventional cement products.

Sustainable cement technologies within this market include supplementary cementitious materials such as fly ash, ground granulated blast furnace slag, silica fume, and natural pozzolans. These materials partially replace traditional Portland cement clinker, resulting in reduced energy consumption and lower greenhouse gas emissions. Innovation drivers include advanced manufacturing processes, alternative fuel utilization, and carbon capture technologies integrated into cement production facilities.

Market scope extends beyond traditional cement applications to include specialized formulations for infrastructure projects, residential construction, commercial buildings, and industrial facilities. The definition encompasses both established green cement technologies and emerging alternatives such as geopolymer cement, bio-cement, and recycled aggregate-based formulations that contribute to circular economy objectives.

Strategic market analysis reveals the Asia Pacific green cement market as a rapidly evolving sector characterized by technological innovation, regulatory support, and increasing environmental awareness among construction industry stakeholders. Key market drivers include government sustainability mandates, carbon reduction targets, and growing demand for LEED-certified and green building projects across the region.

Competitive landscape dynamics show established cement manufacturers investing heavily in green technology upgrades while new market entrants focus on innovative sustainable formulations. Regional market leaders are implementing comprehensive sustainability strategies that encompass raw material sourcing, manufacturing processes, and product lifecycle management. The market benefits from 65% adoption rate of supplementary cementitious materials in major construction projects across developed Asia Pacific markets.

Growth trajectory analysis indicates sustained expansion driven by infrastructure development programs, urbanization trends, and increasing construction activity in emerging economies. Technology advancement continues to improve green cement performance characteristics while reducing production costs, making sustainable alternatives increasingly attractive to cost-conscious construction companies and project developers.

Market intelligence reveals several critical insights shaping the Asia Pacific green cement landscape:

Environmental regulations serve as the primary catalyst driving Asia Pacific green cement market expansion, with governments implementing increasingly stringent carbon emission standards for construction materials. Climate change mitigation policies across major economies are creating mandatory requirements for sustainable building materials in public infrastructure projects, generating substantial demand for green cement alternatives.

Urbanization acceleration throughout the region is creating unprecedented demand for construction materials while simultaneously increasing environmental pressure on traditional manufacturing processes. Smart city initiatives in countries like Singapore, South Korea, and Japan are incorporating sustainability requirements that favor green cement adoption in large-scale development projects. The construction industry’s commitment to achieving net-zero carbon emissions is driving systematic adoption of environmentally friendly cement technologies.

Economic incentives including tax benefits, subsidies, and preferential procurement policies are making green cement increasingly attractive to construction companies and project developers. Corporate sustainability commitments among major construction firms are creating internal mandates for green material usage, while green building certification programs are rewarding projects that incorporate sustainable cement alternatives. Technology advancement continues to improve performance characteristics while reducing production costs, making green cement a viable economic alternative to traditional options.

High initial investment requirements for green cement production facilities represent a significant barrier to market entry, particularly for smaller manufacturers lacking access to substantial capital resources. Technology complexity associated with advanced green cement formulations requires specialized expertise and equipment, creating operational challenges for traditional cement producers transitioning to sustainable alternatives.

Supply chain limitations for key raw materials such as high-quality fly ash and slag can create production bottlenecks and cost volatility in green cement manufacturing. Quality consistency concerns among construction professionals regarding performance variability in green cement products continue to influence adoption decisions, particularly in critical infrastructure applications requiring stringent performance standards.

Market education gaps persist among construction industry stakeholders regarding the long-term benefits and proper application techniques for green cement products. Regulatory fragmentation across different Asia Pacific markets creates compliance complexity for manufacturers seeking regional expansion, while standardization challenges limit interoperability between different green cement formulations and traditional construction practices.

Infrastructure modernization programs across emerging Asia Pacific economies present substantial opportunities for green cement market expansion, with governments prioritizing sustainable construction materials in major development projects. Belt and Road Initiative projects incorporating sustainability requirements are creating demand for environmentally friendly cement alternatives across multiple countries in the region.

Technological innovation opportunities include development of next-generation green cement formulations with enhanced performance characteristics and reduced production costs. Carbon capture integration with cement manufacturing processes offers potential for creating carbon-negative cement products, opening new market segments focused on climate change mitigation. Circular economy applications utilizing industrial waste streams as raw materials present opportunities for cost reduction and environmental impact minimization.

Market expansion into specialized applications such as 3D printing construction, precast manufacturing, and marine infrastructure offers growth potential beyond traditional cement markets. Partnership opportunities with construction technology companies, green building consultants, and sustainability certification organizations can accelerate market penetration and customer adoption. Export potential to other regions seeking sustainable construction materials creates additional revenue streams for Asia Pacific green cement manufacturers.

Supply-demand equilibrium in the Asia Pacific green cement market reflects the complex interplay between increasing environmental awareness, regulatory pressure, and technological advancement. Demand acceleration is driven by construction industry transformation toward sustainable practices, while supply expansion requires significant capital investment and technological expertise from manufacturers.

Competitive dynamics show established cement manufacturers leveraging existing infrastructure and market relationships to introduce green alternatives, while innovative startups focus on breakthrough technologies and specialized applications. Price dynamics indicate gradual convergence between green cement and traditional alternatives as production scales increase and manufacturing efficiency improves. Market consolidation trends suggest larger players acquiring specialized green cement technologies and smaller manufacturers to enhance their sustainability portfolios.

Innovation cycles continue to drive market evolution, with research and development investments yielding improved formulations and manufacturing processes. Regulatory dynamics create both opportunities and challenges, with supportive policies accelerating adoption while compliance requirements increasing operational complexity. Customer behavior evolution shows increasing sophistication in evaluating green cement options, with focus on lifecycle performance and environmental impact rather than initial cost considerations alone.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia Pacific green cement market landscape. Primary research includes extensive interviews with industry executives, construction professionals, regulatory officials, and technology experts across major Asia Pacific markets to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial statements to validate primary findings and identify quantitative market trends. Data triangulation methods ensure consistency and accuracy across multiple information sources, while expert validation processes confirm the reliability of market projections and trend analysis.

Market modeling techniques incorporate econometric analysis, regression modeling, and scenario planning to project future market developments under various economic and regulatory conditions. Qualitative analysis methods including focus groups, case studies, and industry workshops provide deeper understanding of market dynamics and stakeholder perspectives. MarkWide Research analytical frameworks ensure comprehensive coverage of market segments, geographic regions, and competitive landscape dynamics.

China dominates the Asia Pacific green cement market with approximately 45% regional market share, driven by aggressive government sustainability policies and massive infrastructure development programs. Chinese manufacturers are investing heavily in green cement production capacity while implementing advanced manufacturing technologies to reduce environmental impact. The country’s commitment to achieving carbon neutrality by 2060 is accelerating adoption of sustainable cement alternatives across construction projects.

India represents the second-largest market with 22% regional share, characterized by rapid urbanization and increasing environmental awareness among construction industry stakeholders. Indian cement manufacturers are leveraging abundant fly ash resources to develop cost-effective green cement formulations while expanding production capacity to meet growing demand. Government initiatives promoting sustainable construction materials are creating favorable market conditions for green cement adoption.

Japan and Australia collectively account for 18% market share, with both countries implementing stringent environmental regulations that favor green cement adoption in construction projects. Japanese manufacturers focus on high-performance green cement formulations for specialized applications, while Australian companies emphasize sustainable mining practices and circular economy principles in cement production. Southeast Asian markets including Thailand, Vietnam, and Indonesia represent emerging opportunities with 15% combined market share and rapid growth potential driven by infrastructure development and increasing environmental consciousness.

Market leadership in the Asia Pacific green cement sector is characterized by a mix of established multinational cement manufacturers and innovative technology companies specializing in sustainable alternatives. Competitive positioning strategies focus on technological innovation, production capacity expansion, and strategic partnerships with construction industry stakeholders.

Technology-based segmentation reveals distinct market categories based on green cement formulation and manufacturing processes:

By Technology:

By Application:

By End-User:

Fly ash cement dominates the green cement market with 42% category share, benefiting from abundant raw material availability and established manufacturing processes. Performance advantages include improved workability, reduced permeability, and enhanced long-term strength development, making it suitable for various construction applications. Cost competitiveness relative to traditional cement has accelerated adoption among price-sensitive construction projects.

Slag cement represents a rapidly growing category with 28% market share, particularly popular in marine construction and high-performance concrete applications. Technical benefits include superior durability, reduced heat of hydration, and excellent resistance to chemical attack. Supply chain optimization through partnerships with steel manufacturers ensures consistent raw material availability and quality control.

Geopolymer cement emerges as an innovative category with 15% market share and significant growth potential driven by superior environmental performance. Advanced properties include rapid strength development, excellent chemical resistance, and minimal carbon footprint during production. Research and development investments continue to improve formulation consistency and reduce production costs for broader market adoption.

Limestone cement and other emerging categories collectively represent 15% market share, with growth driven by regulatory support and technological advancement. Innovation focus includes bio-based cement alternatives, recycled aggregate integration, and carbon-negative formulations that actively sequester atmospheric carbon dioxide.

Environmental advantages for industry participants include significant carbon footprint reduction, with green cement alternatives achieving 30-50% lower CO2 emissions compared to traditional Portland cement. Regulatory compliance benefits help construction companies meet increasingly stringent environmental standards while avoiding potential penalties and restrictions on traditional cement usage.

Economic benefits encompass long-term cost savings through improved durability and reduced maintenance requirements of green cement structures. Market differentiation opportunities allow construction companies to position themselves as sustainability leaders while accessing premium pricing for green building projects. Risk mitigation includes reduced exposure to carbon pricing mechanisms and future environmental regulations.

Performance advantages include enhanced concrete durability, improved workability, and superior resistance to environmental factors such as chemical attack and freeze-thaw cycles. Innovation opportunities enable manufacturers to develop specialized formulations for emerging applications such as 3D printing construction and high-performance infrastructure projects. Stakeholder benefits extend to improved corporate sustainability ratings, enhanced brand reputation, and increased access to green financing options.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing green cement manufacturing through advanced process control systems, artificial intelligence optimization, and predictive maintenance technologies. Industry 4.0 integration enables real-time monitoring of production parameters, quality control automation, and supply chain optimization for enhanced efficiency and consistency.

Circular economy principles are driving innovation in raw material sourcing, with manufacturers increasingly utilizing diverse industrial waste streams including construction and demolition waste, agricultural residues, and municipal solid waste ash. Waste-to-resource transformation creates new revenue streams while reducing environmental impact and raw material costs.

Carbon capture utilization represents an emerging trend with potential to create carbon-negative cement products that actively remove CO2 from the atmosphere during the curing process. Breakthrough technologies including bio-mineralization and carbonation curing are showing promise for next-generation green cement formulations. Collaborative research between academia, industry, and government is accelerating innovation cycles and technology commercialization.

Customization trends show increasing demand for specialized green cement formulations tailored to specific applications, environmental conditions, and performance requirements. MarkWide Research analysis indicates growing market sophistication with customers seeking optimized solutions rather than generic alternatives.

Strategic partnerships between cement manufacturers and technology companies are accelerating green cement innovation and market deployment. Joint ventures focusing on advanced manufacturing processes, alternative raw materials, and carbon capture technologies are creating new competitive advantages and market opportunities.

Production capacity expansion across major Asia Pacific markets reflects growing confidence in green cement market potential, with manufacturers investing in dedicated sustainable production lines and facility upgrades. Technology licensing agreements are facilitating knowledge transfer and rapid market expansion for proven green cement technologies.

Regulatory developments including updated building codes, environmental standards, and sustainability certification programs are creating favorable market conditions for green cement adoption. Government procurement policies increasingly favor sustainable construction materials in public infrastructure projects, providing stable demand for green cement manufacturers.

Research breakthroughs in bio-based cement alternatives, nanotechnology applications, and advanced curing processes continue to expand the technical possibilities for green cement formulations. Pilot project implementations demonstrate real-world performance of innovative green cement technologies in challenging construction applications.

Strategic recommendations for market participants include prioritizing technology innovation investments to maintain competitive advantages in rapidly evolving green cement markets. Manufacturing efficiency improvements should focus on reducing production costs while maintaining quality consistency to accelerate market adoption among price-sensitive customers.

Partnership strategies should emphasize collaboration with construction industry stakeholders, research institutions, and technology providers to create comprehensive sustainable construction ecosystems. Market education initiatives remain critical for overcoming adoption barriers and building customer confidence in green cement performance characteristics.

Supply chain optimization requires developing reliable sources for supplementary cementitious materials while implementing quality control systems to ensure consistent product performance. Geographic expansion strategies should target emerging markets with supportive regulatory environments and growing construction activity.

Innovation focus should prioritize breakthrough technologies with potential for significant environmental impact reduction and performance enhancement. MWR analysis suggests that companies investing in next-generation green cement technologies will capture disproportionate market share as sustainability requirements intensify across the construction industry.

Long-term market projections indicate sustained growth for the Asia Pacific green cement market, driven by accelerating environmental regulations, construction industry transformation, and technological advancement. Market expansion is expected to continue at a robust pace with projected growth rates of 8-10% annually across major regional markets through the next decade.

Technology evolution will likely yield breakthrough innovations in carbon-negative cement formulations, bio-based alternatives, and advanced manufacturing processes that further improve environmental performance while reducing costs. Market maturation is expected to bring increased standardization, quality consistency, and broader acceptance among construction industry professionals.

Regulatory landscape evolution will continue favoring green cement adoption through carbon pricing mechanisms, building code updates, and sustainability certification requirements. Infrastructure investment programs across emerging Asia Pacific economies will create substantial long-term demand for sustainable construction materials including green cement alternatives.

Competitive dynamics suggest continued market consolidation as larger players acquire specialized technologies and smaller manufacturers to build comprehensive green cement portfolios. Innovation cycles will accelerate as research and development investments yield commercial applications for next-generation sustainable cement technologies.

The Asia Pacific green cement market represents a transformative opportunity within the global construction materials industry, driven by environmental imperatives, regulatory support, and technological innovation. Market fundamentals indicate strong growth potential across diverse applications and geographic regions, with established manufacturers and innovative startups competing to capture emerging opportunities.

Strategic success in this evolving market requires balancing environmental performance, cost competitiveness, and quality consistency while building stakeholder confidence through education and demonstration projects. Technology advancement continues to expand the possibilities for green cement applications while improving economic viability and market accessibility.

Future market development will be shaped by continued regulatory evolution, infrastructure investment programs, and breakthrough innovations in sustainable cement technologies. Industry participants who invest strategically in technology, partnerships, and market development will be best positioned to capitalize on the substantial growth opportunities within the Asia Pacific green cement market as the construction industry continues its transformation toward sustainability and environmental responsibility.

What is Green Cement?

Green Cement refers to a type of cement that is produced with a lower carbon footprint compared to traditional cement. It incorporates materials such as fly ash, slag, and natural pozzolans, making it more sustainable and environmentally friendly.

What are the key players in the Asia Pacific Green Cement Market?

Key players in the Asia Pacific Green Cement Market include companies like ACC Limited, UltraTech Cement, and HeidelbergCement, among others. These companies are actively involved in the production and innovation of green cement solutions.

What are the growth factors driving the Asia Pacific Green Cement Market?

The Asia Pacific Green Cement Market is driven by increasing construction activities, rising environmental awareness, and government initiatives promoting sustainable building practices. Additionally, the demand for eco-friendly materials in infrastructure projects is contributing to market growth.

What challenges does the Asia Pacific Green Cement Market face?

Challenges in the Asia Pacific Green Cement Market include the high cost of production and the need for technological advancements. Additionally, the availability of raw materials and competition from traditional cement products pose significant hurdles.

What opportunities exist in the Asia Pacific Green Cement Market?

The Asia Pacific Green Cement Market presents opportunities for innovation in product development and the expansion of eco-friendly construction practices. There is also potential for increased investment in sustainable infrastructure projects across the region.

What trends are shaping the Asia Pacific Green Cement Market?

Trends in the Asia Pacific Green Cement Market include the growing adoption of alternative raw materials and the integration of advanced technologies in production processes. Additionally, there is a rising focus on circular economy practices within the construction industry.

Asia Pacific Green Cement Market

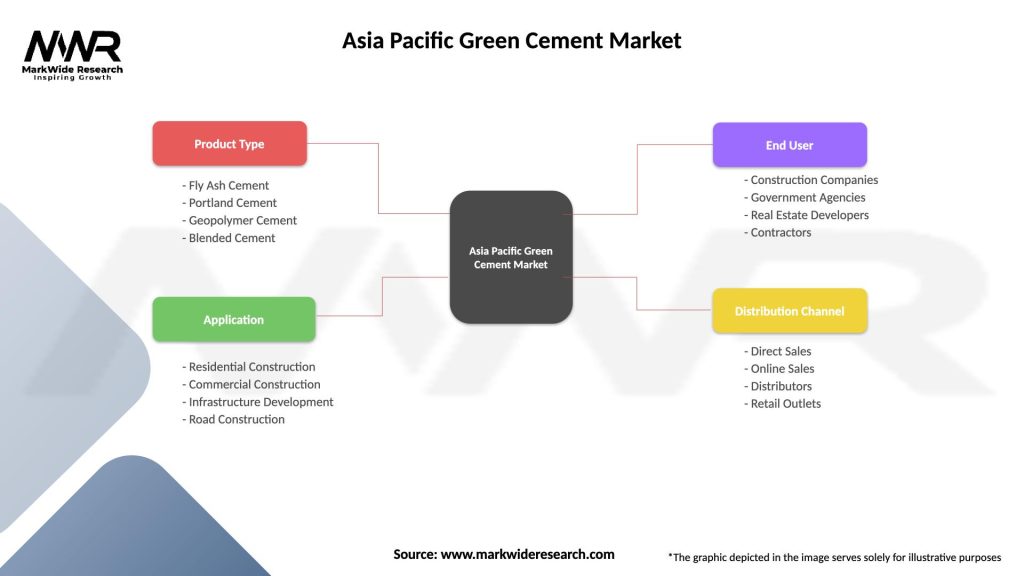

| Segmentation Details | Description |

|---|---|

| Product Type | Fly Ash Cement, Portland Cement, Geopolymer Cement, Blended Cement |

| Application | Residential Construction, Commercial Construction, Infrastructure Development, Road Construction |

| End User | Construction Companies, Government Agencies, Real Estate Developers, Contractors |

| Distribution Channel | Direct Sales, Online Sales, Distributors, Retail Outlets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Green Cement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at