444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific gluten-free foods and beverages market represents one of the fastest-growing segments in the global food industry, driven by increasing health consciousness and rising prevalence of celiac disease across the region. This dynamic market encompasses a comprehensive range of products including gluten-free bakery items, dairy alternatives, snacks, beverages, and ready-to-eat meals specifically formulated to meet the dietary requirements of consumers with gluten sensitivities.

Market expansion across Asia Pacific has been particularly robust, with the region experiencing a 12.8% CAGR over recent years. Countries such as Australia, Japan, South Korea, and Singapore are leading the adoption of gluten-free products, while emerging markets including India, Thailand, and Vietnam are showing significant growth potential. The market’s evolution reflects changing consumer preferences toward healthier lifestyle choices and increased awareness of gluten-related disorders.

Consumer demographics driving this growth include not only individuals diagnosed with celiac disease but also health-conscious consumers seeking perceived wellness benefits from gluten-free alternatives. The market has witnessed substantial innovation in product formulations, with manufacturers investing heavily in research and development to improve taste, texture, and nutritional profiles of gluten-free offerings.

The Asia Pacific gluten-free foods and beverages market refers to the commercial ecosystem encompassing the production, distribution, and consumption of food and beverage products specifically manufactured without gluten-containing ingredients across Asian and Pacific countries. These products are designed to meet the dietary needs of individuals with celiac disease, non-celiac gluten sensitivity, or those choosing gluten-free diets for perceived health benefits.

Gluten-free products in this market context exclude wheat, barley, rye, and their derivatives, utilizing alternative ingredients such as rice flour, quinoa, amaranth, and various starches to create comparable taste and texture profiles. The market encompasses both naturally gluten-free products and those specifically formulated as gluten-free alternatives to traditional wheat-based foods.

Regional characteristics of this market include adaptation to local taste preferences, incorporation of traditional Asian ingredients, and compliance with varying regulatory standards across different countries. The market serves diverse consumer segments ranging from medically diagnosed individuals requiring strict gluten avoidance to lifestyle-conscious consumers seeking healthier food alternatives.

Strategic market positioning within the Asia Pacific region demonstrates exceptional growth momentum, with the gluten-free foods and beverages sector establishing itself as a significant component of the broader health and wellness food industry. The market benefits from increasing urbanization, rising disposable incomes, and growing awareness of dietary-related health conditions across major regional economies.

Key growth drivers include expanding retail distribution networks, innovative product development, and increasing prevalence of gluten-related disorders. The market has experienced a 68% increase in product availability across major retail chains over the past three years, indicating strong commercial viability and consumer acceptance.

Competitive landscape features both international brands expanding their regional presence and local manufacturers developing culturally adapted gluten-free products. Market leaders are investing significantly in supply chain optimization, product innovation, and consumer education initiatives to capture growing market opportunities.

Future projections indicate sustained growth momentum, with emerging markets contributing increasingly to overall market expansion. The sector is expected to benefit from continued health trend adoption, improved product quality, and expanding distribution channels across both urban and rural markets throughout the region.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with health-conscious consumers increasingly prioritizing product quality and nutritional value over price considerations. The market demonstrates strong potential for premium product segments, particularly in developed regional markets.

Market maturity levels vary significantly across the region, with Australia and Japan representing more developed markets while Southeast Asian countries offer substantial growth opportunities. This diversity creates opportunities for tailored market entry and expansion strategies.

Health consciousness trends represent the primary driver of market expansion, with consumers increasingly associating gluten-free products with improved digestive health and overall wellness. This perception extends beyond medically necessary consumption to lifestyle-driven purchasing decisions across diverse demographic segments.

Rising celiac disease prevalence across Asia Pacific countries has created a medically driven demand base, with diagnosis rates increasing by 15% annually in several major markets. Improved medical awareness and diagnostic capabilities are identifying previously undiagnosed cases, expanding the core consumer base requiring gluten-free alternatives.

Urbanization and lifestyle changes contribute significantly to market growth, as urban consumers demonstrate higher willingness to pay premium prices for health-oriented food products. Busy lifestyles drive demand for convenient, ready-to-eat gluten-free options that maintain nutritional quality and taste appeal.

Retail infrastructure development across emerging markets has improved product accessibility, with major retail chains dedicating increased shelf space to gluten-free products. This improved availability reduces barriers to trial and repeat purchase, supporting sustained market growth.

Digital information access enables consumers to research gluten-free diets and products more effectively, driving informed purchasing decisions. Social media platforms and health-focused websites contribute to increased awareness and product discovery among target consumer segments.

Premium pricing challenges continue to limit market penetration, particularly in price-sensitive regional markets where gluten-free products typically cost 40-60% more than conventional alternatives. This price differential restricts adoption among middle-income consumers and limits market expansion potential.

Taste and texture limitations in many gluten-free products create consumer satisfaction challenges, leading to low repeat purchase rates despite initial trial. Manufacturers continue to struggle with replicating the sensory characteristics of traditional wheat-based products using alternative ingredients.

Limited product variety in certain regional markets restricts consumer choice and market development. Many countries lack comprehensive gluten-free product ranges across different food categories, limiting the ability of consumers to maintain varied, satisfying diets.

Supply chain complexities associated with gluten-free manufacturing, including cross-contamination prevention and specialized ingredient sourcing, create operational challenges and cost pressures for manufacturers. These complexities particularly impact smaller regional producers attempting to enter the market.

Regulatory inconsistencies across different Asia Pacific countries create compliance challenges for manufacturers seeking regional expansion. Varying labeling requirements, certification standards, and import regulations complicate market entry strategies and increase operational costs.

Emerging market penetration presents substantial growth opportunities, particularly in Southeast Asian countries where gluten-free awareness is increasing but product availability remains limited. These markets offer first-mover advantages for companies establishing early market presence.

Product innovation potential exists in developing culturally adapted gluten-free products incorporating traditional Asian ingredients and flavors. This approach can create differentiated offerings that appeal to local taste preferences while meeting gluten-free requirements.

E-commerce expansion opportunities enable direct-to-consumer sales channels, particularly valuable in markets with limited retail distribution. Online platforms can overcome geographic barriers and provide access to specialized gluten-free products in underserved areas.

Food service sector development represents an underexplored opportunity, with restaurants, cafes, and institutional food services showing increasing interest in gluten-free menu options. This sector expansion could significantly increase product consumption and market visibility.

Private label development opportunities exist for retailers seeking to capture growing consumer demand while offering competitive pricing. Private label gluten-free products can provide margin advantages while building customer loyalty.

Competitive intensity within the Asia Pacific gluten-free market continues to increase as both international and domestic players recognize growth opportunities. This competition drives innovation, improves product quality, and gradually reduces price premiums through operational efficiencies.

Consumer education initiatives by manufacturers and health organizations are expanding market awareness and driving trial rates. These efforts include cooking demonstrations, nutritional education, and medical professional engagement programs that build consumer confidence in gluten-free products.

Technological advancement in food processing and ingredient development is enabling improved product formulations with better taste, texture, and nutritional profiles. These improvements address key consumer concerns and support market expansion through enhanced product acceptance.

Distribution channel evolution shows mainstream retailers increasingly embracing gluten-free products, moving beyond specialty health food stores to capture broader consumer segments. This mainstream adoption improves product accessibility and normalizes gluten-free consumption patterns.

Regulatory environment development across the region is creating more standardized approaches to gluten-free labeling and certification. These improvements enhance consumer confidence and facilitate cross-border trade within the Asia Pacific region.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes consumer surveys, industry expert interviews, and manufacturer consultations across key Asia Pacific markets to gather firsthand market intelligence.

Secondary research components encompass analysis of industry reports, government statistics, trade association data, and academic research publications. This approach provides historical context and validates primary research findings through triangulation of multiple data sources.

Market sizing methodologies utilize both top-down and bottom-up approaches to ensure accuracy and completeness. Top-down analysis examines overall food industry trends and gluten-free segment penetration, while bottom-up analysis aggregates product category data and regional market information.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research reliability. Quality control measures verify data consistency and identify potential anomalies requiring additional investigation.

Forecasting models incorporate multiple variables including demographic trends, economic indicators, health awareness levels, and regulatory changes to project future market development. These models undergo regular calibration to maintain accuracy as market conditions evolve.

Australia and New Zealand represent the most mature gluten-free markets in the Asia Pacific region, with 78% consumer awareness of gluten-free products and well-established retail distribution networks. These markets demonstrate strong growth in premium product segments and innovative product categories.

Japan’s market development shows significant potential driven by increasing health consciousness and aging population concerns about digestive health. The market benefits from strong retail infrastructure and consumer willingness to pay premium prices for quality health products.

South Korea and Singapore demonstrate rapid market growth supported by high urbanization rates and increasing disposable incomes. These markets show particular strength in gluten-free snack products and ready-to-eat meal categories.

China’s emerging market presents substantial long-term opportunities despite current limited awareness and availability. Urban centers show increasing interest in Western health trends, creating potential for significant market development as consumer education expands.

Southeast Asian markets including Thailand, Malaysia, and Indonesia show early-stage development with growing expatriate populations and increasing health awareness driving initial market formation. These markets offer significant growth potential as economic development continues.

India’s market characteristics include natural dietary preferences that align with gluten-free concepts, particularly in certain regional cuisines. However, market development requires consumer education about gluten-related health issues and product availability expansion.

Market leadership within the Asia Pacific gluten-free foods and beverages sector features a combination of established international brands and emerging regional specialists. Competition focuses on product innovation, distribution expansion, and consumer education initiatives.

Competitive strategies emphasize product quality improvement, local market adaptation, and strategic partnerships with regional distributors. Companies are investing in manufacturing capabilities, supply chain optimization, and consumer education programs to build sustainable competitive advantages.

Product category segmentation reveals diverse market opportunities across multiple food and beverage categories, each with distinct growth characteristics and consumer preferences. Understanding these segments enables targeted marketing and product development strategies.

By Product Type:

By Distribution Channel:

Bakery products category dominates market share with 42% of total consumption, driven by consumer desire for gluten-free alternatives to traditional bread and baked goods. Innovation in this category focuses on improving texture and extending shelf life while maintaining taste quality.

Snacks and confectionery represent the fastest-growing category, benefiting from impulse purchasing behavior and increasing availability in mainstream retail locations. This category shows particular strength in premium and organic product segments.

Ready-to-eat meals demonstrate significant growth potential as busy lifestyles drive demand for convenient, healthy meal solutions. Manufacturers are developing culturally adapted flavors and incorporating local ingredients to appeal to regional taste preferences.

Beverages category shows emerging opportunities, particularly in gluten-free beer and specialty drinks. This category benefits from social consumption patterns and increasing availability in restaurants and bars across the region.

Dairy alternatives segment overlaps with plant-based trends, creating synergistic growth opportunities. Products in this category often appeal to multiple dietary preferences, expanding the potential consumer base beyond gluten-sensitive individuals.

Manufacturers benefit from expanding market opportunities and premium pricing potential in the gluten-free segment. Companies can leverage health trends to build brand differentiation and capture growing consumer segments seeking healthier food alternatives.

Retailers gain advantages through increased customer loyalty and higher margin opportunities associated with gluten-free products. Dedicated gluten-free sections can attract health-conscious consumers and increase overall store traffic and basket size.

Consumers receive benefits including improved product quality, increased availability, and better nutritional options for managing gluten-related health conditions. Market growth drives innovation that enhances taste, texture, and convenience of gluten-free alternatives.

Healthcare providers benefit from improved patient compliance with gluten-free diets due to better product availability and quality. This improvement supports better health outcomes for patients with celiac disease and non-celiac gluten sensitivity.

Ingredient suppliers experience new business opportunities through demand for alternative flours, starches, and binding agents used in gluten-free formulations. This demand drives innovation in ingredient development and processing technologies.

Food service operators can differentiate their offerings and capture health-conscious consumer segments by incorporating gluten-free menu options. This capability can increase customer base and average transaction values.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences gluten-free product development, with consumers increasingly demanding products with simple, recognizable ingredients. This trend drives manufacturers to reformulate products using natural ingredients and avoid artificial additives.

Plant-based convergence creates synergistic opportunities as many gluten-free products naturally align with plant-based dietary preferences. This convergence expands market appeal and creates cross-selling opportunities across multiple health-conscious consumer segments.

Personalized nutrition trends are driving demand for specialized gluten-free products targeting specific health conditions and dietary requirements. Manufacturers are developing products with enhanced nutritional profiles and functional ingredients.

Sustainable packaging initiatives reflect growing environmental consciousness among gluten-free consumers. Companies are investing in eco-friendly packaging solutions to align with consumer values and differentiate their products.

Digital engagement strategies utilize social media, mobile apps, and online communities to build brand loyalty and provide consumer education. These platforms enable direct consumer communication and feedback collection for product development.

Premiumization trends show consumers willing to pay higher prices for superior quality, organic, and artisanal gluten-free products. This trend supports margin improvement and encourages continued product innovation.

Manufacturing capacity expansion across the region reflects growing market confidence, with major manufacturers investing in dedicated gluten-free production facilities. These investments improve supply chain efficiency and reduce cross-contamination risks.

Strategic partnerships between international brands and local distributors are accelerating market penetration in emerging Asia Pacific countries. These collaborations combine global expertise with local market knowledge and distribution capabilities.

Regulatory harmonization efforts across regional markets are improving trade efficiency and consumer confidence. Standardized labeling requirements and certification processes facilitate cross-border commerce and market development.

Technology adoption in manufacturing processes is improving product quality and reducing production costs. Advanced processing techniques enable better texture replication and nutritional enhancement in gluten-free products.

Research and development investments by MarkWide Research and industry participants are driving innovation in ingredient technology and product formulation. These efforts focus on improving sensory characteristics and nutritional profiles of gluten-free alternatives.

Acquisition activity within the industry consolidates market expertise and expands distribution capabilities. Strategic acquisitions enable companies to quickly enter new markets and acquire specialized knowledge.

Market entry strategies should prioritize consumer education and product trial initiatives to build awareness and acceptance in emerging markets. Companies should invest in sampling programs, cooking demonstrations, and healthcare professional engagement to drive adoption.

Product development focus should emphasize taste and texture improvement while incorporating local flavors and ingredients. Successful products must meet both gluten-free requirements and regional taste preferences to achieve market acceptance.

Distribution strategy optimization requires balancing mainstream retail presence with specialized channel development. Companies should secure placement in major supermarket chains while maintaining relationships with health food stores and online platforms.

Pricing strategy considerations must balance premium positioning with market accessibility. Gradual price reduction through operational efficiency improvements can expand market reach while maintaining profitability.

Partnership development with local manufacturers, distributors, and retailers can accelerate market penetration and reduce entry costs. Strategic alliances provide market knowledge and established relationships essential for success.

Investment priorities should focus on supply chain development, quality assurance systems, and consumer education programs. These investments build sustainable competitive advantages and support long-term market growth.

Long-term growth prospects for the Asia Pacific gluten-free foods and beverages market remain highly positive, supported by demographic trends, increasing health awareness, and continued product innovation. The market is expected to maintain robust growth rates as consumer acceptance expands and product quality continues improving.

Emerging market development will drive significant growth over the next decade, with countries like India, Indonesia, and Vietnam showing increasing potential as economic development and urbanization continue. These markets represent substantial opportunities for early-moving companies.

Technology advancement will continue improving product quality and reducing manufacturing costs, making gluten-free products more accessible to broader consumer segments. Innovation in ingredient technology and processing methods will address current product limitations.

Market maturation in developed regional markets will shift focus toward premium products and specialized applications. Companies will need to differentiate through quality, innovation, and brand building rather than simply availability.

Regulatory environment evolution will create more standardized approaches to gluten-free labeling and certification across the region. These improvements will facilitate trade and enhance consumer confidence in product claims.

Consumer behavior evolution indicates sustained interest in health-oriented food products, with gluten-free options becoming increasingly mainstream rather than specialized. According to MarkWide Research projections, market penetration rates are expected to reach 25% of target demographics within the next five years.

The Asia Pacific gluten-free foods and beverages market represents a dynamic and rapidly expanding sector with substantial growth opportunities across diverse regional markets. Strong consumer health trends, improving product quality, and expanding distribution networks create favorable conditions for sustained market development.

Market success factors include product innovation, consumer education, strategic distribution partnerships, and cultural adaptation of products to local preferences. Companies that effectively address taste and texture challenges while building consumer awareness will capture the greatest market opportunities.

Regional diversity within Asia Pacific creates multiple market entry strategies and growth approaches, from mature markets requiring premium positioning to emerging markets needing fundamental consumer education. This diversity enables companies to develop phased expansion strategies aligned with market readiness.

Future market development will be driven by continued health consciousness trends, demographic changes, and ongoing product innovation. The convergence of gluten-free with other health trends creates synergistic growth opportunities that extend beyond traditional celiac disease markets to broader wellness-oriented consumer segments throughout the Asia Pacific region.

What is Gluten-Free Foods and Beverages?

Gluten-Free Foods and Beverages refer to products that do not contain gluten, a protein found in wheat, barley, and rye. These products cater to individuals with celiac disease or gluten sensitivity, offering a variety of options such as gluten-free grains, snacks, and beverages.

What are the key players in the Asia Pacific Gluten-Free Foods and Beverages Market?

Key players in the Asia Pacific Gluten-Free Foods and Beverages Market include companies like General Mills, Kellogg’s, and Dr. Schär, which offer a range of gluten-free products. These companies are focusing on expanding their product lines to meet the growing demand for gluten-free options among consumers.

What are the main drivers of the Asia Pacific Gluten-Free Foods and Beverages Market?

The main drivers of the Asia Pacific Gluten-Free Foods and Beverages Market include the increasing prevalence of gluten intolerance and celiac disease, rising health consciousness among consumers, and the growing availability of gluten-free products in retail outlets. Additionally, the trend towards healthier eating habits is boosting market growth.

What challenges does the Asia Pacific Gluten-Free Foods and Beverages Market face?

Challenges in the Asia Pacific Gluten-Free Foods and Beverages Market include the higher cost of gluten-free ingredients, potential cross-contamination during production, and limited consumer awareness in certain regions. These factors can hinder market penetration and growth.

What opportunities exist in the Asia Pacific Gluten-Free Foods and Beverages Market?

Opportunities in the Asia Pacific Gluten-Free Foods and Beverages Market include the potential for product innovation, such as the development of new gluten-free snacks and beverages. Additionally, increasing online sales channels and expanding distribution networks present significant growth prospects.

What trends are shaping the Asia Pacific Gluten-Free Foods and Beverages Market?

Trends shaping the Asia Pacific Gluten-Free Foods and Beverages Market include the rise of plant-based gluten-free options, the incorporation of superfoods into gluten-free products, and the growing popularity of gluten-free diets among health-conscious consumers. These trends are influencing product development and marketing strategies.

Asia Pacific Gluten-Free Foods and Beverages Market

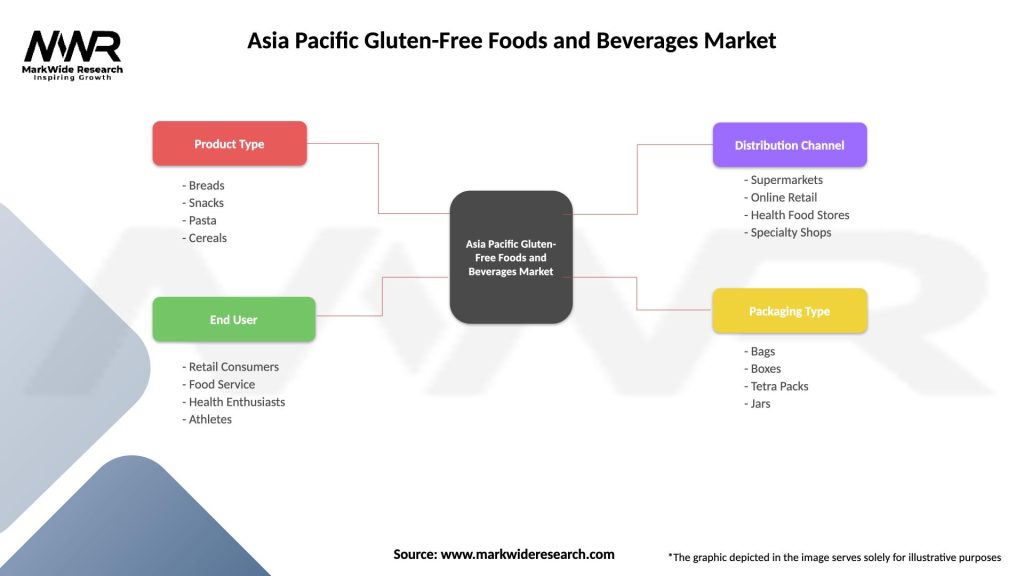

| Segmentation Details | Description |

|---|---|

| Product Type | Breads, Snacks, Pasta, Cereals |

| End User | Retail Consumers, Food Service, Health Enthusiasts, Athletes |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Specialty Shops |

| Packaging Type | Bags, Boxes, Tetra Packs, Jars |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Gluten-Free Foods and Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at