444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific GLP-1 agonist market represents one of the fastest-growing pharmaceutical segments in the region, driven by the escalating prevalence of diabetes and obesity across diverse populations. GLP-1 receptor agonists have emerged as revolutionary therapeutic agents that not only manage blood glucose levels but also promote significant weight loss, making them highly sought-after treatments in countries experiencing rapid lifestyle changes and urbanization.

Market dynamics in the Asia-Pacific region are particularly compelling due to the region’s substantial diabetic population, which accounts for approximately 60% of the global diabetes burden. Countries such as China, India, Japan, and South Korea are witnessing unprecedented demand for advanced diabetes management solutions, with GLP-1 agonists experiencing adoption rates exceeding 25% annually in major metropolitan areas.

Regional healthcare systems are increasingly recognizing the dual benefits of GLP-1 receptor agonists in addressing both diabetes and obesity simultaneously. The market encompasses various formulations including daily and weekly injectable options, with once-weekly formulations capturing approximately 70% market preference due to improved patient compliance and convenience factors.

Regulatory landscapes across Asia-Pacific countries have become more favorable, with streamlined approval processes and expanded reimbursement coverage contributing to accelerated market penetration. The growing emphasis on preventive healthcare and chronic disease management has positioned GLP-1 agonists as cornerstone therapies in comprehensive diabetes care protocols.

The Asia-Pacific GLP-1 agonist market refers to the regional pharmaceutical segment encompassing glucagon-like peptide-1 receptor agonists, which are innovative diabetes medications that mimic natural incretin hormones to regulate blood sugar levels and promote weight loss across Asian and Pacific countries.

GLP-1 receptor agonists function by stimulating insulin secretion in a glucose-dependent manner, suppressing glucagon release, slowing gastric emptying, and promoting satiety through central nervous system pathways. These mechanisms collectively provide superior glycemic control while addressing the growing obesity epidemic that frequently accompanies type 2 diabetes in Asian populations.

Market scope includes various drug formulations such as exenatide, liraglutide, dulaglutide, semaglutide, and emerging biosimilar alternatives. The therapeutic applications extend beyond diabetes management to include obesity treatment, cardiovascular risk reduction, and potential neuroprotective benefits that are particularly relevant to aging populations across the region.

Geographic coverage encompasses major markets including China, Japan, India, South Korea, Australia, Thailand, Malaysia, Singapore, and other developing economies where diabetes prevalence continues to rise. The market definition also includes prescription patterns, healthcare provider adoption, patient accessibility programs, and regulatory approval pathways specific to each country’s healthcare infrastructure.

Strategic market positioning of GLP-1 agonists in the Asia-Pacific region reflects a transformative shift toward personalized diabetes care, with these advanced therapeutics demonstrating exceptional efficacy in managing complex metabolic disorders. The regional market exhibits robust growth trajectories driven by increasing disease prevalence, expanding healthcare access, and growing awareness of innovative treatment options.

Key market drivers include the rising incidence of type 2 diabetes, which affects approximately 11.6% of adults in the Asia-Pacific region, coupled with increasing obesity rates and sedentary lifestyles associated with rapid urbanization. Healthcare systems are prioritizing comprehensive diabetes management approaches that address multiple comorbidities simultaneously, positioning GLP-1 agonists as preferred therapeutic choices.

Competitive dynamics feature established pharmaceutical companies alongside emerging biosimilar manufacturers, creating a diverse market landscape that promotes innovation while improving affordability. Major players are investing heavily in region-specific clinical trials, local manufacturing capabilities, and patient support programs to capture market share in this high-growth segment.

Market challenges include varying regulatory requirements across countries, reimbursement limitations in certain markets, and the need for extensive healthcare provider education regarding optimal prescribing practices. However, these challenges are being addressed through collaborative efforts between pharmaceutical companies, healthcare authorities, and medical associations to establish standardized treatment protocols and improve patient access.

Primary market insights reveal significant opportunities for GLP-1 agonist expansion across diverse Asia-Pacific healthcare systems, with particular strength in developed markets and emerging potential in developing economies:

Demographic transitions across Asia-Pacific countries create powerful market drivers for GLP-1 agonist adoption, with aging populations and lifestyle changes contributing to unprecedented diabetes prevalence rates. The region’s rapid economic development has led to dietary shifts toward processed foods and reduced physical activity levels, directly correlating with increased metabolic disorder incidence.

Healthcare infrastructure improvements enable better diabetes diagnosis and management capabilities, with many countries investing heavily in specialized diabetes centers and endocrinology services. Enhanced diagnostic capabilities lead to earlier disease detection and more proactive treatment approaches, creating expanded patient populations eligible for advanced therapies like GLP-1 agonists.

Clinical evidence accumulation continues to strengthen the therapeutic value proposition of GLP-1 receptor agonists, with landmark cardiovascular outcome trials demonstrating significant risk reduction benefits beyond glycemic control. These findings resonate particularly well with Asia-Pacific healthcare providers who increasingly prioritize comprehensive risk management approaches for diabetic patients.

Government health initiatives across the region emphasize chronic disease prevention and management, with specific programs targeting diabetes care improvement. National health policies increasingly recognize the long-term cost-effectiveness of advanced diabetes medications that prevent complications and reduce hospitalization rates, supporting expanded access to GLP-1 agonist therapies.

Patient awareness campaigns and diabetes education programs have significantly improved understanding of treatment options and the importance of optimal glycemic control. Social media platforms and digital health initiatives help disseminate information about innovative therapies, creating informed patient populations that actively seek advanced treatment options.

Economic accessibility challenges remain significant barriers to GLP-1 agonist adoption across many Asia-Pacific markets, particularly in developing countries where healthcare spending limitations restrict access to premium-priced medications. The high cost of these innovative therapies relative to traditional diabetes medications creates affordability gaps that limit market penetration in price-sensitive segments.

Regulatory complexity across diverse Asia-Pacific countries creates challenges for pharmaceutical companies seeking to launch GLP-1 agonists regionally. Varying approval requirements, clinical trial expectations, and post-marketing surveillance obligations necessitate substantial regulatory investment and extended timelines for market entry in multiple jurisdictions.

Healthcare provider education requirements represent ongoing market restraints, as many primary care physicians and general practitioners lack comprehensive knowledge about GLP-1 agonist mechanisms, appropriate patient selection criteria, and optimal prescribing practices. This knowledge gap can limit prescription rates and delay patient access to appropriate therapies.

Cultural treatment preferences in certain Asia-Pacific populations favor traditional medicine approaches or oral medications over injectable therapies, creating resistance to GLP-1 agonist adoption. Patient concerns about injection-based treatments and preferences for familiar therapeutic modalities can slow market acceptance despite clinical efficacy advantages.

Supply chain complexities associated with cold-chain storage and distribution requirements for GLP-1 agonists create logistical challenges in regions with limited pharmaceutical infrastructure. These requirements can restrict availability in remote areas and increase overall distribution costs, limiting market accessibility.

Emerging market expansion presents substantial opportunities for GLP-1 agonist growth across developing Asia-Pacific countries where diabetes prevalence continues rising while healthcare infrastructure improvements create better treatment access. Countries such as Vietnam, Indonesia, and the Philippines represent untapped markets with growing middle-class populations seeking advanced healthcare solutions.

Biosimilar development opportunities enable local pharmaceutical companies to participate in the GLP-1 agonist market through cost-effective generic alternatives. MarkWide Research analysis indicates that biosimilar competition could expand overall market accessibility while maintaining therapeutic efficacy standards, particularly benefiting price-sensitive patient populations.

Digital health integration creates opportunities for enhanced patient monitoring and treatment optimization through connected devices, mobile applications, and telemedicine platforms. These technological solutions can improve treatment adherence, provide real-time glucose monitoring integration, and enable remote patient management capabilities that enhance overall therapeutic outcomes.

Combination therapy development offers opportunities to create synergistic treatment approaches that combine GLP-1 agonists with complementary diabetes medications, insulin formulations, or cardiovascular protective agents. These combination strategies can simplify treatment regimens while providing comprehensive metabolic management solutions.

Preventive care applications represent emerging opportunities to utilize GLP-1 agonists in pre-diabetic populations and high-risk individuals, potentially preventing disease progression and reducing long-term healthcare costs. This preventive approach aligns with regional health policy priorities and creates expanded market opportunities beyond established diabetes treatment indications.

Competitive intensity within the Asia-Pacific GLP-1 agonist market continues escalating as established pharmaceutical companies compete with emerging biosimilar manufacturers and local generic producers. This competitive environment drives innovation in drug delivery systems, patient support programs, and pricing strategies while promoting overall market growth and accessibility improvements.

Regulatory harmonization efforts across Asia-Pacific countries are gradually streamlining approval processes and creating more predictable market entry pathways for GLP-1 agonist manufacturers. These regulatory improvements reduce development costs and accelerate patient access to innovative therapies while maintaining appropriate safety and efficacy standards.

Healthcare system evolution toward value-based care models creates favorable dynamics for GLP-1 agonists, which demonstrate superior long-term outcomes and complication prevention benefits. Healthcare payers increasingly recognize the economic value of therapies that reduce hospitalization rates and prevent costly diabetes complications, supporting expanded reimbursement coverage.

Technology integration transforms market dynamics through digital health solutions that enhance treatment monitoring, patient education, and adherence support. Smart injection devices, glucose monitoring integration, and mobile health applications create comprehensive diabetes management ecosystems that improve therapeutic outcomes and patient satisfaction.

Supply chain optimization efforts focus on improving cold-chain distribution capabilities and expanding geographic reach to underserved markets. Pharmaceutical companies are investing in regional distribution centers and local partnerships to ensure reliable product availability while reducing logistical costs and improving patient access.

Comprehensive market analysis employs multi-faceted research approaches combining primary data collection, secondary source analysis, and expert consultation to provide accurate insights into Asia-Pacific GLP-1 agonist market dynamics. The methodology integrates quantitative market sizing with qualitative trend analysis to deliver actionable intelligence for stakeholders.

Primary research components include structured interviews with healthcare providers, patient surveys, pharmaceutical company executives, and regulatory authority representatives across major Asia-Pacific markets. These primary sources provide real-world insights into prescribing patterns, patient experiences, market challenges, and growth opportunities that supplement secondary data analysis.

Secondary research sources encompass peer-reviewed medical literature, regulatory databases, healthcare statistics, pharmaceutical company reports, and industry publications. This comprehensive secondary analysis provides historical context, clinical evidence evaluation, and competitive landscape assessment that informs market projections and strategic recommendations.

Data validation processes ensure research accuracy through triangulation of multiple information sources, expert review panels, and statistical verification methods. Cross-referencing primary interview findings with secondary data sources helps identify discrepancies and validate key market insights before final analysis compilation.

Geographic coverage methodology addresses market heterogeneity across Asia-Pacific countries through country-specific analysis that considers local healthcare systems, regulatory environments, economic conditions, and cultural factors. This localized approach provides nuanced insights that reflect regional market variations and opportunities.

China dominates the Asia-Pacific GLP-1 agonist market with the world’s largest diabetic population and rapidly expanding healthcare infrastructure supporting advanced diabetes care. The Chinese market benefits from government healthcare reforms, expanded insurance coverage, and growing awareness of innovative diabetes treatments, creating substantial growth opportunities for GLP-1 agonist manufacturers.

Japan represents a mature market characterized by high healthcare standards, comprehensive insurance coverage, and strong physician familiarity with GLP-1 agonist therapies. Japanese patients demonstrate high treatment compliance rates and willingness to adopt innovative therapies, supporting premium pricing strategies and advanced formulation development initiatives.

India presents significant growth potential with its large diabetic population and improving healthcare access, though market development faces challenges related to price sensitivity and healthcare infrastructure limitations. The Indian market shows increasing adoption of GLP-1 agonists in urban areas while rural penetration remains limited by accessibility and affordability constraints.

South Korea exhibits strong market growth driven by high diabetes prevalence, advanced healthcare systems, and government support for innovative medical technologies. Korean healthcare providers demonstrate high adoption rates for new diabetes treatments, with GLP-1 agonists gaining approximately 30% market share among eligible patients in major medical centers.

Australia and New Zealand maintain well-developed markets with comprehensive reimbursement systems and high treatment standards. These markets serve as regional innovation hubs and often provide early access to new GLP-1 agonist formulations before broader Asia-Pacific launches.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia show emerging growth potential as healthcare systems modernize and diabetes awareness increases. These markets benefit from economic development and expanding middle-class populations seeking advanced healthcare solutions.

Market leadership in the Asia-Pacific GLP-1 agonist segment is characterized by intense competition among established pharmaceutical companies and emerging biosimilar manufacturers, creating a dynamic environment that promotes innovation and improves patient access through diverse therapeutic options.

Leading pharmaceutical companies maintain strong market positions through comprehensive product portfolios, extensive clinical development programs, and robust distribution networks across the region:

Competitive strategies focus on differentiation through improved delivery systems, extended dosing intervals, combination formulations, and comprehensive patient support programs. Companies invest heavily in clinical trials specific to Asian populations to demonstrate efficacy and safety in diverse genetic backgrounds and dietary patterns.

Market consolidation trends include strategic partnerships between multinational pharmaceutical companies and local distributors to improve market penetration and regulatory navigation. These collaborations enable global companies to leverage local expertise while providing regional partners access to innovative therapeutic technologies.

Product-based segmentation divides the Asia-Pacific GLP-1 agonist market into distinct categories based on molecular structure, dosing frequency, and delivery mechanisms, providing comprehensive coverage of available therapeutic options for diabetes management across diverse patient populations.

By Drug Type:

By Application:

By End User:

Weekly injection formulations dominate market preferences across Asia-Pacific countries, with patients and healthcare providers favoring the convenience and improved adherence associated with less frequent dosing schedules. These formulations demonstrate superior patient satisfaction scores and reduced treatment discontinuation rates compared to daily injection alternatives.

Cardiovascular outcome benefits create significant differentiation opportunities for GLP-1 agonists with proven heart protection benefits, particularly relevant in Asia-Pacific populations with high cardiovascular risk profiles. Healthcare providers increasingly prescribe these agents specifically for cardiovascular risk reduction, expanding beyond traditional diabetes management indications.

Weight management applications gain prominence as obesity rates increase across the region, with GLP-1 agonists demonstrating substantial weight loss benefits that appeal to both patients and healthcare providers. This dual benefit addressing diabetes and obesity simultaneously creates compelling value propositions for comprehensive metabolic management.

Biosimilar competition emerges as a significant category driver, with local manufacturers developing cost-effective alternatives that maintain therapeutic efficacy while improving affordability. MWR analysis suggests biosimilar penetration could reach 35% market share within the next five years, particularly in price-sensitive markets.

Combination therapy approaches represent growing market segments where GLP-1 agonists are prescribed alongside other diabetes medications, insulin, or cardiovascular protective agents. These combination strategies optimize therapeutic outcomes while addressing multiple comorbidities common in Asia-Pacific diabetic populations.

Digital health integration creates new category opportunities through smart injection devices, mobile applications, and telemedicine platforms that enhance treatment monitoring and patient engagement. These technological enhancements improve adherence rates and enable personalized dosing optimization based on individual patient responses.

Pharmaceutical manufacturers benefit from substantial market growth opportunities driven by increasing diabetes prevalence and expanding healthcare access across Asia-Pacific countries. The region’s large patient populations and improving reimbursement landscapes create attractive revenue potential for companies with comprehensive GLP-1 agonist portfolios and effective market penetration strategies.

Healthcare providers gain access to advanced therapeutic tools that enable superior patient outcomes through improved glycemic control, weight management, and cardiovascular risk reduction. GLP-1 agonists enhance clinical practice capabilities by providing effective treatment options for complex diabetic patients with multiple comorbidities and challenging management requirements.

Patients experience significant clinical benefits including better blood sugar control, substantial weight loss, reduced injection frequency with weekly formulations, and potential cardiovascular protection. These therapeutic advantages translate into improved quality of life, reduced diabetes complications, and enhanced long-term health outcomes for individuals managing chronic metabolic conditions.

Healthcare systems benefit from reduced long-term costs associated with diabetes complications, hospitalizations, and emergency interventions through effective disease management with GLP-1 agonist therapies. The prevention of costly complications such as diabetic nephropathy, retinopathy, and cardiovascular events provides substantial economic value to healthcare payers and government systems.

Regulatory authorities advance public health objectives by facilitating access to innovative diabetes treatments that address growing chronic disease burdens across their populations. Streamlined approval processes and evidence-based reimbursement decisions support optimal patient outcomes while maintaining appropriate safety oversight.

Research institutions benefit from expanded collaboration opportunities with pharmaceutical companies conducting Asia-Pacific specific clinical trials, contributing to medical knowledge advancement while building local clinical research capabilities and expertise in metabolic disorder management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine approaches are transforming GLP-1 agonist prescribing patterns across Asia-Pacific markets, with healthcare providers increasingly utilizing genetic testing, biomarker analysis, and patient-specific factors to optimize treatment selection and dosing strategies. This trend toward individualized therapy enhances treatment outcomes while reducing adverse events and improving patient satisfaction.

Digital therapeutics integration represents a significant trend where GLP-1 agonist treatments are combined with mobile health applications, continuous glucose monitoring systems, and artificial intelligence-powered coaching platforms. These digital solutions provide real-time feedback, medication reminders, and lifestyle guidance that complement pharmaceutical interventions for comprehensive diabetes management.

Combination therapy optimization continues evolving as healthcare providers develop sophisticated treatment protocols that combine GLP-1 agonists with complementary medications, insulin formulations, and cardiovascular protective agents. These multi-drug approaches address complex patient profiles with multiple comorbidities while simplifying treatment regimens through fixed-dose combinations.

Preventive care expansion emerges as healthcare systems recognize the value of early intervention with GLP-1 agonists in pre-diabetic populations and high-risk individuals. This proactive approach aims to prevent disease progression and reduce long-term healthcare costs while expanding market opportunities beyond traditional diabetes treatment indications.

Value-based care adoption influences prescribing decisions as healthcare payers increasingly evaluate long-term outcomes and cost-effectiveness rather than focusing solely on acquisition costs. This trend favors GLP-1 agonists due to their proven benefits in preventing costly diabetes complications and reducing hospitalization rates.

Local manufacturing development gains momentum as countries seek to reduce dependence on imported pharmaceuticals while building domestic biotechnology capabilities. Regional manufacturing initiatives aim to improve supply security and reduce costs while maintaining quality standards for GLP-1 agonist production.

Regulatory milestone achievements across Asia-Pacific countries have accelerated GLP-1 agonist market access through streamlined approval processes and expanded indication approvals. Recent regulatory successes include obesity treatment approvals, cardiovascular risk reduction indications, and pediatric diabetes applications that broaden therapeutic utility and market potential.

Clinical trial breakthroughs continue demonstrating expanded benefits of GLP-1 agonist therapies, with recent studies revealing neuroprotective effects, kidney protection benefits, and potential applications in non-alcoholic fatty liver disease. These emerging clinical applications create new market opportunities and strengthen the overall value proposition for healthcare providers and patients.

Manufacturing capacity expansions by major pharmaceutical companies reflect growing market confidence and commitment to serving Asia-Pacific demand. New production facilities in China, India, and Southeast Asia improve supply chain reliability while reducing distribution costs and enhancing market responsiveness to local needs.

Partnership agreements between multinational pharmaceutical companies and regional distributors have accelerated market penetration and improved patient access across diverse healthcare systems. These strategic collaborations combine global expertise with local market knowledge to navigate regulatory requirements and cultural preferences effectively.

Biosimilar approvals represent significant industry developments that promise to expand market accessibility through cost-effective alternatives to branded GLP-1 agonists. Recent regulatory approvals for biosimilar versions create competitive pressure while potentially increasing overall market size through improved affordability.

Digital health partnerships between pharmaceutical companies and technology firms are creating integrated solutions that combine GLP-1 agonist therapies with comprehensive diabetes management platforms. These collaborations enhance patient engagement, improve adherence, and provide valuable real-world evidence for continued product development.

Market entry strategies should prioritize established markets with favorable reimbursement environments while gradually expanding into emerging economies as healthcare infrastructure develops. Companies should focus on building strong relationships with key opinion leaders and diabetes specialists to drive adoption and establish clinical credibility in new markets.

Product differentiation opportunities exist through improved delivery systems, extended dosing intervals, and combination formulations that address specific patient needs and preferences. MarkWide Research recommends investing in patient-centric innovations that enhance convenience, reduce side effects, and improve overall treatment experience to maintain competitive advantages.

Pricing strategies must balance profitability with accessibility, particularly in price-sensitive markets where government healthcare programs and patient affordability significantly influence adoption rates. Tiered pricing approaches and patient assistance programs can help expand market access while maintaining revenue objectives.

Partnership development with local distributors, healthcare systems, and technology companies can accelerate market penetration while reducing regulatory and operational complexities. Strategic alliances should focus on companies with established relationships with healthcare providers and deep understanding of local market dynamics.

Clinical evidence generation specific to Asia-Pacific populations remains crucial for building prescriber confidence and supporting reimbursement decisions. Companies should invest in regional clinical trials that demonstrate efficacy and safety in diverse genetic backgrounds and dietary patterns common across the region.

Digital health integration represents a critical success factor for future market leadership, with companies needing to develop comprehensive solutions that combine pharmaceutical interventions with technology-enabled patient support and monitoring capabilities.

Market trajectory for Asia-Pacific GLP-1 agonists remains exceptionally positive, with sustained growth expected across all major regional markets driven by increasing diabetes prevalence, expanding healthcare access, and growing recognition of superior therapeutic benefits. The market is projected to experience robust expansion with compound annual growth rates exceeding 15% in key markets over the next five years.

Innovation pipeline developments promise to enhance market growth through next-generation formulations, oral delivery options, and combination therapies that address evolving patient needs and preferences. Emerging technologies including smart injection devices, extended-release formulations, and personalized dosing algorithms will likely drive continued market differentiation and expansion.

Regulatory evolution across Asia-Pacific countries is expected to become more harmonized and streamlined, facilitating faster market access for innovative GLP-1 agonist products while maintaining appropriate safety oversight. These regulatory improvements will likely reduce development costs and accelerate patient access to new therapeutic options.

Competitive landscape will continue evolving with increased biosimilar competition creating pricing pressure while expanding overall market accessibility. This competitive dynamic is expected to drive innovation in patient support services, delivery systems, and combination therapies as companies seek differentiation beyond price competition.

Healthcare system integration will deepen as value-based care models become more prevalent, favoring GLP-1 agonists due to their demonstrated long-term benefits and complication prevention capabilities. This trend supports expanded reimbursement coverage and preferred formulary positioning across regional healthcare systems.

Patient access improvements through government healthcare initiatives, expanded insurance coverage, and pharmaceutical company assistance programs will likely drive broader market penetration, particularly in developing economies where affordability currently limits adoption rates.

The Asia-Pacific GLP-1 agonist market represents one of the most dynamic and promising pharmaceutical segments in the global healthcare landscape, driven by substantial unmet medical needs, favorable demographic trends, and expanding healthcare infrastructure across diverse regional markets. The combination of rising diabetes prevalence, growing obesity rates, and increasing healthcare awareness creates exceptional growth opportunities for innovative therapeutic solutions.

Market fundamentals remain exceptionally strong, with large patient populations, improving reimbursement environments, and growing clinical evidence supporting expanded therapeutic applications. The region’s economic development and healthcare system modernization provide sustainable foundations for continued market expansion, while competitive dynamics promote innovation and improve patient access through diverse therapeutic options.

Strategic success factors for market participants include comprehensive regional strategies that address local market variations, strong clinical evidence generation, effective partnership development, and patient-centric innovation approaches. Companies that successfully navigate regulatory complexities while building strong relationships with healthcare providers and patients will likely capture significant market share in this high-growth segment.

Future market evolution will be characterized by continued innovation in drug delivery systems, expanded therapeutic applications, increased biosimilar competition, and deeper integration with digital health technologies. These trends create opportunities for sustained growth while improving overall patient outcomes and healthcare system value across the Asia-Pacific region, positioning GLP-1 agonists as cornerstone therapies in comprehensive diabetes and metabolic disorder management strategies.

What is GLP 1 Agonist?

GLP 1 Agonists are a class of medications that mimic the action of the glucagon-like peptide-1 hormone, which plays a crucial role in glucose metabolism and appetite regulation. They are primarily used in the treatment of type two diabetes and obesity.

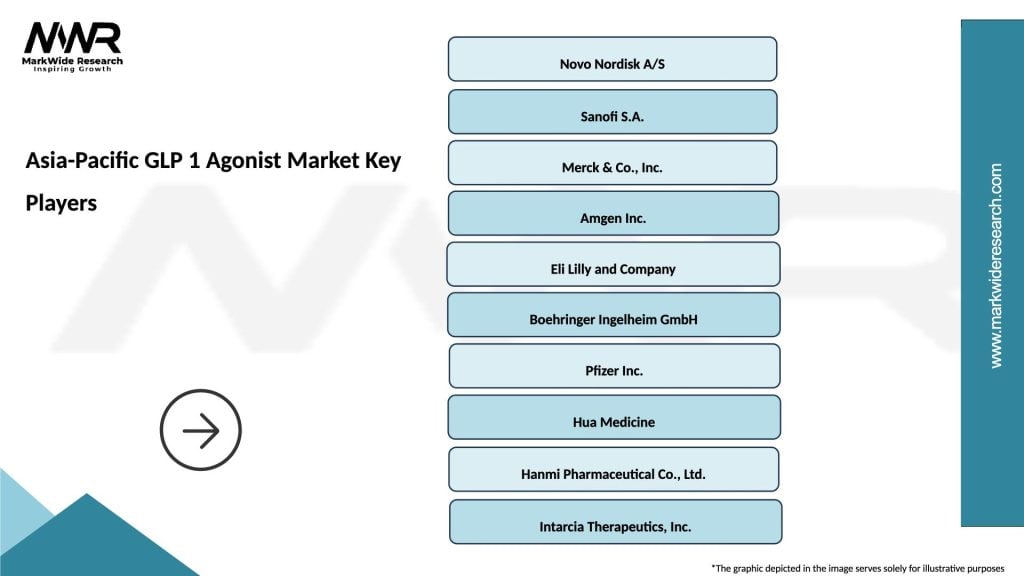

What are the key players in the Asia-Pacific GLP 1 Agonist Market?

Key players in the Asia-Pacific GLP 1 Agonist Market include Novo Nordisk, Eli Lilly, Sanofi, and AstraZeneca, among others. These companies are involved in the development and marketing of various GLP 1 Agonist products.

What are the growth factors driving the Asia-Pacific GLP 1 Agonist Market?

The Asia-Pacific GLP 1 Agonist Market is driven by the rising prevalence of diabetes and obesity, increasing awareness about diabetes management, and advancements in drug formulations. Additionally, the growing geriatric population contributes to market growth.

What challenges does the Asia-Pacific GLP 1 Agonist Market face?

The Asia-Pacific GLP 1 Agonist Market faces challenges such as high treatment costs, potential side effects, and competition from alternative diabetes treatments. Regulatory hurdles and varying healthcare policies across countries also pose challenges.

What opportunities exist in the Asia-Pacific GLP 1 Agonist Market?

Opportunities in the Asia-Pacific GLP 1 Agonist Market include the development of new formulations, expansion into emerging markets, and increasing partnerships between pharmaceutical companies and healthcare providers. There is also potential for growth in personalized medicine approaches.

What trends are shaping the Asia-Pacific GLP 1 Agonist Market?

Trends shaping the Asia-Pacific GLP 1 Agonist Market include the rise of combination therapies, increased focus on patient-centric treatment options, and the integration of digital health technologies. Additionally, there is a growing emphasis on research and development for innovative GLP 1 Agonist therapies.

Asia-Pacific GLP 1 Agonist Market

| Segmentation Details | Description |

|---|---|

| Product Type | Exenatide, Liraglutide, Dulaglutide, Semaglutide |

| Delivery Mode | Subcutaneous Injection, Oral Tablet, Pen Injector, Infusion Pump |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 2 Diabetes, Obesity, Cardiovascular Disease, Metabolic Syndrome |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific GLP 1 Agonist Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at