444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific fruits and vegetables ingredients market represents one of the most dynamic and rapidly expanding sectors within the global food processing industry. This comprehensive market encompasses a diverse range of processed fruit and vegetable components, including concentrates, purees, powders, extracts, and dried ingredients that serve as essential building blocks for numerous food and beverage applications. The region’s strategic position as both a major agricultural producer and a significant consumer of processed food products has established it as a critical hub for fruits and vegetables ingredients manufacturing and distribution.

Market dynamics in the Asia Pacific region are characterized by robust growth driven by increasing urbanization, changing dietary preferences, and expanding food processing capabilities. The market benefits from abundant agricultural resources, favorable climatic conditions, and established supply chain networks that support efficient ingredient production and distribution. Regional growth rates consistently outpace global averages, with the market experiencing a compound annual growth rate of 8.2% over recent years, reflecting strong demand across multiple application segments.

Consumer preferences are increasingly shifting toward natural, healthy, and convenient food options, driving significant demand for high-quality fruit and vegetable ingredients. The region’s diverse culinary traditions and growing health consciousness have created substantial opportunities for ingredient manufacturers to develop innovative products that cater to local tastes while meeting international quality standards. Processing capabilities have advanced considerably, with manufacturers adopting sophisticated technologies to preserve nutritional value, enhance flavor profiles, and extend shelf life of ingredient products.

The Asia Pacific fruits and vegetables ingredients market refers to the comprehensive ecosystem of processed agricultural products derived from fresh fruits and vegetables that are manufactured, distributed, and consumed across the Asia Pacific region. These ingredients serve as fundamental components in food and beverage manufacturing, providing essential flavors, nutrients, colors, and functional properties to finished products. The market encompasses various forms of processed ingredients including concentrates, purees, powders, extracts, essences, and dehydrated products that undergo specific processing techniques to enhance stability, concentration, and application versatility.

Ingredient categories within this market span from simple dried fruit pieces to complex flavor systems and nutritional concentrates. Processing methods include freeze-drying, spray-drying, concentration, extraction, fermentation, and various preservation techniques that maintain the inherent qualities of fresh produce while extending usability and storage life. The market serves diverse industries including food manufacturing, beverage production, nutraceuticals, cosmetics, and food service sectors, each requiring specific ingredient specifications and quality parameters.

Strategic positioning of the Asia Pacific fruits and vegetables ingredients market reflects its critical role in supporting the region’s expanding food processing industry and evolving consumer preferences. The market demonstrates exceptional resilience and growth potential, supported by abundant agricultural resources, technological advancement, and increasing demand for natural food ingredients. Key performance indicators show consistent expansion across all major product categories, with particular strength in organic and premium ingredient segments.

Market penetration varies significantly across different countries within the region, with developed markets like Japan, South Korea, and Australia showing high adoption rates of 75% to 85% for processed ingredients in food manufacturing, while emerging markets present substantial growth opportunities. The competitive landscape features a mix of multinational corporations, regional specialists, and local processors, creating a dynamic environment that fosters innovation and market development.

Investment trends indicate strong capital allocation toward processing facility expansion, technology upgrades, and supply chain optimization. Manufacturers are increasingly focusing on sustainable sourcing practices, traceability systems, and quality certification programs to meet growing consumer and regulatory demands. The market’s trajectory suggests continued expansion driven by demographic trends, economic development, and evolving food consumption patterns across the region.

Primary market drivers encompass several interconnected factors that collectively fuel market expansion and development. Understanding these insights provides crucial perspective on market dynamics and future opportunities:

Demographic transformation across the Asia Pacific region serves as a fundamental driver of market growth, with urbanization rates reaching 68% in developed markets and rapidly increasing in emerging economies. Urban populations demonstrate higher consumption of processed foods and beverages, creating sustained demand for fruit and vegetable ingredients. Rising disposable incomes enable consumers to prioritize quality and convenience, supporting premium ingredient segments and value-added products.

Health consciousness has become a dominant consumer trend, with increasing awareness of the connection between diet and wellness driving demand for natural, nutritious ingredients. Consumers actively seek products containing real fruit and vegetable components, creating opportunities for manufacturers to develop clean-label ingredients that meet these preferences. Functional food trends further amplify demand for ingredients with specific health benefits, including antioxidants, vitamins, minerals, and bioactive compounds naturally present in fruits and vegetables.

Food industry expansion throughout the region creates substantial demand for reliable, high-quality ingredients. The growth of food manufacturing, restaurant chains, and food service sectors requires consistent ingredient supplies that meet strict quality and safety standards. Export market development provides additional growth opportunities, as Asia Pacific producers leverage competitive advantages to serve international markets with cost-effective, high-quality ingredient products.

Technological advancement in processing equipment and techniques enables manufacturers to create innovative ingredient products with enhanced functionality and application versatility. These developments support market expansion by enabling new product categories and improving existing ingredient quality and performance characteristics.

Supply chain vulnerabilities present significant challenges for the fruits and vegetables ingredients market, particularly regarding seasonal availability, weather dependency, and agricultural productivity variations. Climate change impacts create uncertainty in raw material supply, affecting both quality and quantity of available produce for processing. Price volatility in agricultural commodities can significantly impact ingredient costs, creating challenges for manufacturers in maintaining consistent pricing and profit margins.

Quality standardization remains a complex challenge, as different regions and suppliers may have varying quality standards and processing capabilities. Ensuring consistent ingredient quality across diverse supply sources requires substantial investment in quality control systems and supplier development programs. Regulatory compliance adds complexity and cost, as manufacturers must navigate different food safety regulations, certification requirements, and import/export restrictions across various countries within the region.

Infrastructure limitations in some emerging markets within the region can constrain market development, including inadequate cold storage facilities, transportation networks, and processing capabilities. These limitations can result in post-harvest losses and reduced ingredient quality, impacting overall market efficiency and growth potential.

Competition intensity from both regional and international players creates pricing pressure and margin compression, particularly in commodity ingredient categories. Market participants must continuously invest in differentiation strategies, innovation, and operational efficiency to maintain competitive positioning and profitability.

Organic ingredient segments present exceptional growth opportunities, with consumer demand for organic products growing at 12.5% annually across major Asia Pacific markets. This trend creates substantial opportunities for manufacturers to develop premium organic ingredient lines that command higher margins and serve growing market segments focused on natural, sustainable products.

Functional ingredient development offers significant potential for market expansion, as food manufacturers increasingly seek ingredients that provide specific health benefits beyond basic nutrition. Opportunities exist for developing specialized ingredients rich in antioxidants, probiotics, fiber, and other functional compounds that support health and wellness positioning in finished products.

Technology integration creates opportunities for operational efficiency improvements and product innovation. Advanced processing technologies, including high-pressure processing, microencapsulation, and enzyme treatments, enable manufacturers to create superior ingredient products with enhanced functionality and stability. Digital transformation opportunities include supply chain optimization, quality monitoring systems, and direct customer engagement platforms.

Export market expansion provides substantial growth potential, particularly for manufacturers who can achieve international quality certifications and develop efficient distribution networks. The region’s competitive cost structure and improving quality standards position Asia Pacific producers to capture increasing shares of global ingredient markets.

Partnership opportunities with food manufacturers, retailers, and agricultural producers can create integrated value chains that improve efficiency, reduce costs, and enhance market positioning. Strategic alliances can provide access to new markets, technologies, and distribution channels while sharing development costs and risks.

Competitive dynamics within the Asia Pacific fruits and vegetables ingredients market reflect a complex interplay of established multinational corporations, regional specialists, and emerging local producers. Market leaders leverage economies of scale, advanced processing capabilities, and established distribution networks to maintain competitive advantages, while smaller players focus on niche segments, specialized products, and regional market expertise.

Innovation cycles are accelerating as manufacturers invest in research and development to create differentiated products that meet evolving consumer preferences and application requirements. Product development focuses on improving nutritional profiles, enhancing flavor characteristics, extending shelf life, and developing new application possibilities. Technology adoption rates vary across the region, with developed markets showing 85% adoption of advanced processing technologies, while emerging markets present opportunities for technology transfer and capability development.

Supply chain evolution emphasizes sustainability, traceability, and quality assurance throughout the production process. Manufacturers are implementing comprehensive supplier management programs, investing in direct sourcing relationships, and developing integrated supply chains that provide greater control over quality and costs. Sustainability initiatives are becoming increasingly important, with companies implementing programs to reduce environmental impact, support sustainable agriculture practices, and minimize waste throughout the production process.

Market consolidation trends are evident as larger companies acquire smaller specialists to expand product portfolios, geographic reach, and technical capabilities. This consolidation creates opportunities for improved operational efficiency and market development while potentially reducing competitive intensity in certain segments.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research activities included extensive interviews with industry executives, manufacturers, suppliers, and end-users across major Asia Pacific markets. These interviews provided valuable insights into market trends, competitive dynamics, technological developments, and future growth prospects.

Secondary research encompassed analysis of industry reports, company financial statements, trade publications, government statistics, and regulatory documents. This research provided quantitative data on market size, growth rates, trade flows, and competitive positioning. Data validation processes included cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and consistency of findings.

Market modeling techniques incorporated historical data analysis, trend extrapolation, and scenario planning to develop realistic growth projections and market forecasts. The methodology considered various factors including economic conditions, demographic trends, regulatory changes, and technological developments that could impact market evolution.

Geographic coverage included detailed analysis of major markets within the Asia Pacific region, including China, India, Japan, South Korea, Australia, Thailand, Indonesia, Malaysia, Philippines, and Vietnam. Country-specific analysis considered local market conditions, consumer preferences, regulatory environments, and competitive landscapes to provide comprehensive regional insights.

China dominates the Asia Pacific fruits and vegetables ingredients market, accounting for approximately 42% of regional market share due to its massive agricultural production capacity, extensive processing infrastructure, and large domestic consumption base. The country’s ingredient industry benefits from government support for agricultural modernization, significant investment in processing technology, and established export capabilities that serve both regional and global markets.

India represents the second-largest market with 18% regional market share, driven by abundant agricultural resources, growing food processing industry, and increasing domestic demand for processed foods. The country’s diverse agricultural production provides raw materials for a wide range of fruit and vegetable ingredients, while government initiatives supporting food processing development create favorable conditions for market expansion.

Japan and South Korea collectively account for 16% of market share, representing mature markets with high-value ingredient segments and sophisticated consumer preferences. These markets emphasize quality, innovation, and premium products, creating opportunities for specialized ingredients and advanced processing technologies. Consumer sophistication in these markets drives demand for functional ingredients, organic products, and innovative flavor profiles.

Southeast Asian markets, including Thailand, Indonesia, Malaysia, and Philippines, contribute 15% of regional market share and demonstrate strong growth potential driven by economic development, urbanization, and expanding food processing industries. These markets benefit from favorable agricultural conditions, competitive production costs, and growing domestic consumption of processed foods.

Australia and New Zealand represent 9% of market share but demonstrate high per-capita consumption and strong export capabilities. These markets focus on premium, high-quality ingredients with emphasis on organic and sustainable production practices. Advanced agricultural technologies and strict quality standards position these countries as suppliers of premium ingredients to regional and global markets.

Market leadership is distributed among several categories of companies, each bringing distinct competitive advantages and market positioning strategies. The competitive environment fosters innovation and market development while providing diverse options for customers across different market segments.

Regional specialists and local producers play crucial roles in serving specific market segments and geographic areas. These companies often possess deep understanding of local preferences, established supplier relationships, and cost advantages that enable them to compete effectively against larger multinational corporations.

Product type segmentation reveals diverse market categories, each serving specific applications and customer requirements. The market encompasses various forms of processed ingredients that provide different functional and nutritional properties:

By Product Type:

By Application:

Fruit concentrates represent the largest product category, driven by extensive use in beverage manufacturing and food processing applications. This segment benefits from established processing technologies, efficient production methods, and strong demand across multiple application areas. Market penetration in beverage applications reaches 78% in developed Asia Pacific markets, reflecting the maturity and acceptance of concentrate-based products.

Vegetable ingredients demonstrate rapid growth potential, particularly in health-focused applications and functional food development. Increasing consumer awareness of vegetable nutrition benefits drives demand for ingredients that provide natural vitamins, minerals, and antioxidants. Innovation opportunities in this category include developing ingredients from underutilized vegetables and creating specialized functional compounds.

Organic ingredient categories show exceptional growth rates, with premium positioning and higher margins attracting manufacturer investment. Consumer willingness to pay premium prices for organic ingredients supports market development and encourages agricultural producers to adopt organic farming practices. Certification requirements create barriers to entry but also provide competitive advantages for established organic ingredient suppliers.

Functional ingredient segments represent emerging opportunities for market expansion, as food manufacturers seek ingredients that provide specific health benefits. These categories require specialized processing techniques and quality control measures but offer higher value positioning and differentiated market positioning.

Manufacturers benefit from consistent, high-quality ingredient supplies that enable year-round production of food and beverage products with standardized flavor profiles and nutritional characteristics. Processed ingredients provide operational efficiency through reduced handling requirements, extended shelf life, and simplified inventory management compared to fresh produce alternatives.

Food processors gain access to specialized ingredients that would be difficult or impossible to produce in-house, enabling product innovation and differentiation. Cost advantages include reduced procurement complexity, minimized waste, and improved production planning through reliable ingredient availability and consistent pricing structures.

Retailers and consumers benefit from improved product quality, extended shelf life, and enhanced nutritional profiles in finished food products. The use of high-quality fruit and vegetable ingredients enables manufacturers to create products that meet consumer demands for natural, healthy options while maintaining convenience and affordability.

Agricultural producers benefit from value-added processing opportunities that provide premium pricing for their crops and reduce post-harvest losses. Supply chain integration creates stable demand for agricultural products and enables farmers to plan production more effectively while accessing technical support and quality improvement programs.

Economic development benefits include job creation in processing facilities, technology transfer, and export revenue generation. The industry supports rural economic development through agricultural linkages while contributing to urban employment in processing and distribution activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to drive significant changes in ingredient selection and product development, with consumers increasingly demanding products with recognizable, natural ingredients. This trend creates opportunities for fruit and vegetable ingredient suppliers who can provide clean-label solutions that replace artificial additives and synthetic ingredients. Transparency requirements are pushing manufacturers to provide detailed information about ingredient sourcing, processing methods, and nutritional profiles.

Sustainability focus is becoming a critical factor in purchasing decisions, with companies implementing comprehensive sustainability programs covering agricultural practices, processing methods, packaging, and distribution. Circular economy principles are being adopted to minimize waste, optimize resource utilization, and develop innovative uses for processing by-products.

Functional food development represents a major trend driving innovation in ingredient formulation and application. Manufacturers are developing specialized ingredients that provide specific health benefits, including immune system support, digestive health, and cognitive function enhancement. Bioactive compound preservation during processing has become a key focus area for maintaining ingredient functionality and health benefits.

Digital transformation is revolutionizing supply chain management, quality control, and customer engagement throughout the industry. Advanced analytics, IoT sensors, and blockchain technology are being implemented to improve traceability, optimize operations, and enhance customer service. E-commerce platforms are expanding market access for both suppliers and customers, creating new business models and distribution channels.

Personalized nutrition trends are creating demand for specialized ingredients that can be customized for specific dietary requirements, health conditions, and consumer preferences. This trend supports the development of niche ingredient products and specialized processing capabilities.

Processing technology advancement continues to drive industry evolution, with companies investing in high-pressure processing, microencapsulation, and enzyme treatment technologies that preserve nutritional value while extending shelf life. These technological developments enable manufacturers to create superior ingredient products that meet increasingly sophisticated customer requirements.

Capacity expansion projects are being implemented across the region as companies respond to growing demand and seek to capture market opportunities. New processing facilities incorporate advanced technologies, sustainability features, and flexible production capabilities that can adapt to changing market requirements. Investment levels in new capacity development have increased by 25% over recent years, reflecting strong market confidence and growth expectations.

Strategic partnerships and joint ventures are becoming increasingly common as companies seek to combine complementary capabilities, share development costs, and access new markets. These collaborations often involve technology transfer, market development, and supply chain integration initiatives that benefit all participants.

Certification and quality programs are being expanded to meet growing customer demands for quality assurance and regulatory compliance. Companies are implementing comprehensive quality management systems, obtaining international certifications, and developing traceability programs that provide complete supply chain visibility.

Research and development initiatives focus on developing innovative ingredient products, improving processing efficiency, and creating sustainable production methods. MarkWide Research indicates that R&D investment levels have increased significantly, with companies allocating substantial resources to innovation programs that support long-term competitive positioning.

Strategic positioning recommendations emphasize the importance of developing differentiated product portfolios that address specific customer needs and market segments. Companies should focus on building capabilities in high-growth areas such as organic ingredients, functional compounds, and specialized processing technologies that provide competitive advantages and premium pricing opportunities.

Supply chain optimization should be a priority for all market participants, with emphasis on developing direct relationships with agricultural producers, implementing quality assurance programs, and creating flexible sourcing strategies that can adapt to changing market conditions. Vertical integration opportunities should be evaluated to improve cost control and quality consistency.

Technology investment strategies should focus on processing technologies that improve product quality, reduce costs, and enable new product development. Companies should evaluate opportunities for automation, digitalization, and advanced processing techniques that provide operational advantages and support market differentiation.

Market expansion approaches should consider both geographic expansion within the Asia Pacific region and product line extensions into related categories. Export market development presents significant opportunities for companies that can achieve international quality standards and develop efficient distribution networks.

Sustainability initiatives should be integrated into all aspects of business operations, from agricultural sourcing to processing methods and packaging solutions. Companies that can demonstrate strong sustainability credentials will be better positioned to serve environmentally conscious customers and meet evolving regulatory requirements.

Market trajectory indicates continued strong growth driven by fundamental demographic and economic trends across the Asia Pacific region. MarkWide Research projections suggest the market will maintain robust expansion rates, with growth accelerating in emerging markets as economic development and urbanization continue. The increasing sophistication of food processing industries throughout the region will drive demand for higher-quality, more specialized ingredient products.

Innovation acceleration is expected to continue as companies invest in research and development programs focused on functional ingredients, sustainable processing methods, and novel product applications. Technology adoption rates will increase as processing equipment becomes more accessible and companies recognize the competitive advantages of advanced manufacturing capabilities.

Regulatory evolution will likely result in more stringent quality and safety requirements, creating both challenges and opportunities for market participants. Companies that proactively invest in quality systems and regulatory compliance will be better positioned to benefit from market consolidation and increased barriers to entry for less capable competitors.

Sustainability requirements will become increasingly important, with customers and regulators demanding greater transparency and environmental responsibility throughout the supply chain. Companies that successfully implement comprehensive sustainability programs will gain competitive advantages and access to premium market segments.

Global integration will continue as Asia Pacific producers expand their presence in international markets while international companies increase their regional investments. This integration will drive technology transfer, quality improvements, and market development that benefits the entire industry ecosystem.

The Asia Pacific fruits and vegetables ingredients market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by favorable demographic trends, economic development, and evolving consumer preferences. The market’s strategic importance extends beyond its current size, as it serves as a critical foundation for the region’s expanding food processing industry and growing export capabilities.

Competitive advantages inherent in the region, including abundant agricultural resources, cost competitiveness, and strategic geographic positioning, provide a strong foundation for continued market expansion and global market share growth. The increasing sophistication of processing technologies and quality standards positions Asia Pacific producers to compete effectively in both regional and international markets.

Future success in this market will depend on companies’ ability to adapt to changing consumer preferences, implement sustainable business practices, and leverage technological innovations to create differentiated product offerings. The market’s evolution toward premium, functional, and organic ingredient segments presents significant opportunities for companies that can develop appropriate capabilities and market positioning strategies. As the Asia Pacific fruits and vegetables ingredients market continues its robust growth trajectory, it will play an increasingly important role in global food systems and ingredient supply chains.

What is Fruits and Vegetables Ingredients?

Fruits and Vegetables Ingredients refer to the various processed and unprocessed products derived from fruits and vegetables used in food and beverage applications, including purees, concentrates, and powders.

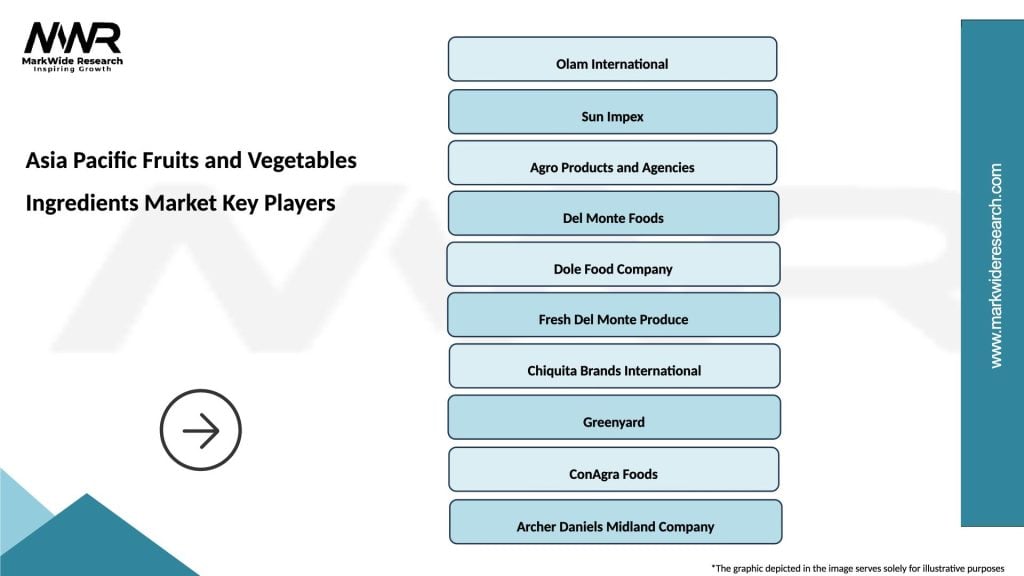

What are the key companies in the Asia Pacific Fruits and Vegetables Ingredients Market?

Key companies in the Asia Pacific Fruits and Vegetables Ingredients Market include Archer Daniels Midland Company, Olam International, and Sun Impex, among others.

What are the growth factors driving the Asia Pacific Fruits and Vegetables Ingredients Market?

The growth of the Asia Pacific Fruits and Vegetables Ingredients Market is driven by increasing health consciousness among consumers, the rising demand for natural and organic products, and the expansion of the food processing industry.

What challenges does the Asia Pacific Fruits and Vegetables Ingredients Market face?

Challenges in the Asia Pacific Fruits and Vegetables Ingredients Market include fluctuating raw material prices, stringent food safety regulations, and competition from synthetic alternatives.

What opportunities exist in the Asia Pacific Fruits and Vegetables Ingredients Market?

Opportunities in the Asia Pacific Fruits and Vegetables Ingredients Market include the growing trend of plant-based diets, innovations in processing technologies, and the increasing use of fruits and vegetables in functional foods.

What trends are shaping the Asia Pacific Fruits and Vegetables Ingredients Market?

Trends in the Asia Pacific Fruits and Vegetables Ingredients Market include the rise of clean label products, the popularity of exotic fruits and vegetables, and advancements in sustainable sourcing practices.

Asia Pacific Fruits and Vegetables Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fresh Produce, Dried Fruits, Frozen Vegetables, Purees |

| Application | Food Processing, Beverage Production, Nutraceuticals, Culinary Uses |

| End User | Food Manufacturers, Restaurants, Retailers, Health Stores |

| Packaging Type | Bulk Packaging, Retail Packaging, Vacuum Sealed, Eco-Friendly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Fruits and Vegetables Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at