444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific flooring resins market represents a dynamic and rapidly expanding sector within the regional construction and industrial materials landscape. This comprehensive market encompasses various synthetic polymer-based solutions designed for commercial, industrial, and residential flooring applications across diverse industries. The region’s robust economic growth, accelerating urbanization, and increasing infrastructure development have positioned the Asia-Pacific flooring resins market as a critical component of the global flooring solutions industry.

Market dynamics in the Asia-Pacific region reflect strong demand drivers including rapid industrialization, expanding manufacturing capabilities, and growing awareness of advanced flooring technologies. The market demonstrates significant growth potential with an estimated CAGR of 8.2% during the forecast period, driven by increasing adoption across pharmaceutical, food processing, automotive, and commercial construction sectors.

Regional leadership in manufacturing and construction activities has established Asia-Pacific as a key consumption hub for flooring resins. Countries including China, India, Japan, South Korea, and Southeast Asian nations contribute substantially to market expansion through their growing industrial base and infrastructure modernization initiatives. The region’s 65% market share in global flooring resin consumption underscores its strategic importance in the worldwide industry landscape.

The Asia-Pacific flooring resins market refers to the comprehensive ecosystem of synthetic polymer-based flooring solutions manufactured, distributed, and consumed across the Asia-Pacific region. These specialized chemical formulations include epoxy resins, polyurethane resins, methyl methacrylate resins, and other advanced polymer systems designed to create durable, chemical-resistant, and aesthetically appealing floor surfaces for various applications.

Flooring resins serve as essential materials for creating seamless, non-porous surfaces that provide superior performance characteristics compared to traditional flooring materials. These solutions offer enhanced durability, chemical resistance, easy maintenance, and customizable aesthetic properties, making them ideal for demanding industrial environments, commercial spaces, and specialized residential applications.

Market scope encompasses raw material production, resin manufacturing, distribution networks, application services, and end-user consumption across diverse industry verticals. The Asia-Pacific region’s strategic position as a manufacturing hub and growing consumer market establishes it as a critical component of the global flooring resins value chain.

Strategic positioning of the Asia-Pacific flooring resins market reflects robust growth fundamentals driven by accelerating industrialization, infrastructure development, and increasing adoption of advanced flooring technologies. The market demonstrates strong momentum across key application segments including industrial facilities, commercial buildings, healthcare institutions, and residential developments.

Growth trajectory indicates sustained expansion supported by favorable economic conditions, government infrastructure initiatives, and rising quality standards across various industries. The region’s manufacturing capabilities and cost advantages position it as both a major consumption center and export hub for global flooring resin markets.

Technology adoption trends show increasing preference for environmentally sustainable formulations, with 42% growth in demand for low-VOC and water-based resin systems. This shift reflects growing environmental consciousness and regulatory compliance requirements across the region’s diverse markets.

Competitive landscape features both established multinational corporations and emerging regional players, creating a dynamic market environment characterized by innovation, strategic partnerships, and expanding distribution networks. Market consolidation activities and capacity expansion investments demonstrate strong confidence in long-term growth prospects.

Primary growth drivers encompass multiple interconnected factors that collectively support sustained market expansion across the Asia-Pacific region:

Industrial modernization across the Asia-Pacific region serves as a fundamental driver for flooring resin market expansion. Manufacturing facilities require specialized flooring solutions that can withstand heavy machinery, chemical exposure, and intensive operational demands. The region’s position as a global manufacturing hub creates continuous demand for high-performance industrial flooring systems.

Infrastructure investment initiatives by regional governments significantly contribute to market growth through large-scale construction projects including airports, hospitals, educational institutions, and commercial complexes. These developments require advanced flooring solutions that meet stringent performance and aesthetic requirements.

Healthcare sector expansion drives demand for specialized flooring resins that provide antimicrobial properties, easy cleaning, and chemical resistance. The growing healthcare infrastructure across emerging economies creates substantial opportunities for pharmaceutical-grade flooring solutions.

Food processing industry growth necessitates flooring systems that comply with strict hygiene standards and regulatory requirements. The expanding food and beverage sector across the region generates consistent demand for specialized resin-based flooring solutions that prevent contamination and facilitate thorough cleaning.

Automotive manufacturing expansion throughout the region requires flooring solutions that can handle heavy equipment, chemical spills, and high-traffic conditions. The automotive industry’s growth trajectory directly correlates with increased demand for industrial-grade flooring resins.

High initial costs associated with premium flooring resin systems can limit adoption, particularly among small and medium enterprises with constrained capital budgets. The substantial upfront investment required for professional installation and surface preparation may deter cost-sensitive customers from adopting advanced flooring technologies.

Technical complexity in application processes requires skilled labor and specialized equipment, creating barriers to market penetration in regions with limited technical expertise. Improper installation can result in performance failures, leading to customer dissatisfaction and market resistance.

Environmental regulations regarding volatile organic compound emissions and chemical safety may restrict the use of certain resin formulations, particularly in densely populated urban areas with strict environmental standards. Compliance requirements can increase production costs and limit product availability.

Raw material price volatility affects production costs and profit margins for manufacturers, potentially leading to pricing instability that impacts market demand. Fluctuations in petrochemical feedstock prices can significantly influence overall market dynamics.

Competition from alternatives including traditional flooring materials and emerging technologies may limit market share expansion in certain applications. Established flooring solutions with lower costs or familiar installation processes can present competitive challenges.

Sustainable formulations present significant growth opportunities as environmental consciousness increases across the region. Development of bio-based resins, low-emission formulations, and recyclable flooring systems can capture growing demand from environmentally responsible customers and comply with evolving regulatory requirements.

Smart flooring technologies integration offers innovative opportunities through incorporation of sensors, heating elements, and other advanced features. These value-added solutions can command premium pricing while addressing specific customer needs in specialized applications.

Emerging markets within the Asia-Pacific region, including Vietnam, Indonesia, and other Southeast Asian countries, present substantial expansion opportunities as their economies develop and infrastructure needs grow. Early market entry can establish competitive advantages in these developing markets.

Decorative applications in residential and commercial sectors offer opportunities for market diversification beyond traditional industrial uses. Aesthetic flooring solutions for retail spaces, hospitality venues, and residential properties can expand the customer base and application scope.

Service integration opportunities include comprehensive flooring solutions encompassing design consultation, installation services, and maintenance programs. Value-added services can differentiate offerings and create recurring revenue streams while strengthening customer relationships.

Supply chain evolution reflects increasing localization of production capabilities to serve regional demand while reducing transportation costs and delivery times. Regional manufacturing investments by multinational companies demonstrate confidence in long-term market growth and the strategic importance of local presence.

Technology transfer and knowledge sharing between developed and emerging markets within the region accelerate adoption of advanced flooring technologies. Collaborative partnerships between international technology providers and local manufacturers facilitate market development and capacity building.

Regulatory harmonization efforts across the region create opportunities for standardized products and streamlined market entry processes. Common technical standards and certification requirements can reduce compliance costs and facilitate cross-border trade.

Customer sophistication increases as end-users become more knowledgeable about flooring performance characteristics and long-term value propositions. This trend drives demand for higher-quality solutions and creates opportunities for premium product positioning.

Digital transformation impacts market dynamics through online procurement platforms, digital marketing channels, and virtual product demonstration capabilities. Technology adoption enhances customer engagement and streamlines distribution processes.

Comprehensive analysis of the Asia-Pacific flooring resins market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry stakeholders, manufacturers, distributors, and end-users across key regional markets to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses thorough analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and identify trends. This approach provides historical context and supports quantitative analysis of market dynamics.

Market segmentation analysis examines various dimensions including product types, application sectors, end-user industries, and geographical regions to identify specific growth opportunities and market characteristics. Detailed segmentation enables targeted insights for strategic decision-making.

Competitive intelligence gathering involves systematic analysis of key market participants, their product portfolios, strategic initiatives, and market positioning. This research component provides insights into competitive dynamics and market structure evolution.

Trend analysis incorporates examination of technological developments, regulatory changes, and evolving customer preferences to identify future market directions and potential disruptions. Forward-looking analysis supports strategic planning and investment decisions.

China dominates the Asia-Pacific flooring resins market with approximately 38% regional market share, driven by extensive manufacturing activities, infrastructure development, and domestic consumption growth. The country’s position as a global manufacturing hub creates substantial demand across industrial applications while supporting export-oriented production capabilities.

India represents the second-largest regional market with 22% market share, supported by rapid industrialization, infrastructure modernization, and growing healthcare and pharmaceutical sectors. Government initiatives promoting manufacturing and urban development contribute to sustained market expansion.

Japan maintains a significant market position with 15% regional share, characterized by high-quality standards, advanced technology adoption, and strong demand from automotive and electronics industries. The mature market focuses on premium solutions and innovative applications.

South Korea accounts for approximately 8% market share, driven by advanced manufacturing capabilities, technology innovation, and strong industrial base. The country’s emphasis on high-tech industries creates demand for specialized flooring solutions.

Southeast Asian markets collectively represent 12% regional share with strong growth potential driven by economic development, infrastructure investment, and increasing industrial activities. Countries including Thailand, Vietnam, Indonesia, and Malaysia demonstrate robust market expansion prospects.

Australia and New Zealand contribute 5% combined market share with focus on high-quality applications and environmental sustainability. These markets emphasize premium solutions and regulatory compliance in specialized applications.

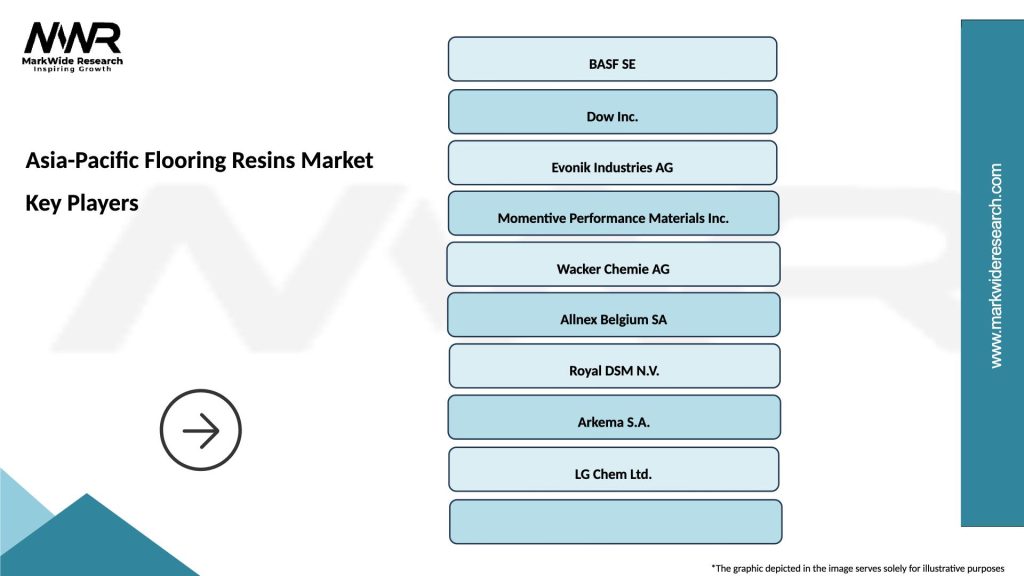

Market leadership is distributed among several key players who have established strong regional presence through strategic investments, local partnerships, and comprehensive product portfolios:

Strategic initiatives among leading players include capacity expansion investments, technology development programs, and strategic acquisitions to strengthen market position and expand geographical coverage. Regional partnerships with local distributors and contractors enhance market penetration and customer service capabilities.

By Product Type:

By Application:

By End-User Industry:

Epoxy resin systems maintain market leadership with approximately 55% segment share due to their versatile performance characteristics and cost-effectiveness across diverse applications. These systems offer excellent adhesion, chemical resistance, and durability, making them suitable for demanding industrial environments and high-traffic commercial spaces.

Polyurethane formulations demonstrate strong growth with 28% segment share, driven by their superior flexibility, impact resistance, and aesthetic properties. These systems are particularly popular in commercial applications where appearance and comfort are important considerations alongside performance requirements.

Water-based systems show increasing adoption with 35% growth rate in demand, reflecting growing environmental consciousness and regulatory compliance requirements. These formulations offer reduced emissions, easier application, and improved workplace safety while maintaining performance standards.

Decorative flooring solutions represent a rapidly expanding category with 45% annual growth, driven by increasing demand for aesthetically appealing surfaces in commercial and residential applications. Advanced coloring systems, metallic effects, and custom designs create differentiation opportunities and premium pricing potential.

Antimicrobial flooring systems gain prominence with 52% growth in healthcare and food processing applications, addressing increasing hygiene requirements and infection control measures. These specialized formulations incorporate active ingredients that inhibit microbial growth and support sanitation protocols.

Manufacturers benefit from expanding market opportunities through product innovation, capacity optimization, and strategic partnerships. The growing demand enables economies of scale, improved profitability, and investment in advanced manufacturing technologies that enhance competitive positioning.

Distributors gain from increasing product demand and expanding application scope, creating opportunities for revenue growth and market share expansion. Strong market fundamentals support inventory investment and distribution network expansion initiatives.

Contractors and applicators benefit from growing project volumes and increasing complexity of flooring installations, supporting business expansion and specialization opportunities. Advanced product technologies create opportunities for value-added services and premium pricing.

End-users realize significant value through improved operational efficiency, reduced maintenance costs, and enhanced workplace safety. High-performance flooring systems provide long-term cost savings through extended service life and reduced downtime for maintenance activities.

Investors find attractive opportunities in a growing market with strong fundamentals, technological innovation, and expanding application scope. The market’s resilience and growth potential support investment strategies focused on long-term value creation.

Regulatory bodies benefit from industry advancement toward more sustainable and safer products, supporting environmental protection and workplace safety objectives. Industry collaboration facilitates development of appropriate standards and certification programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with increasing adoption of bio-based raw materials, recycled content, and low-emission formulations. MarkWide Research analysis indicates growing customer preference for environmentally responsible products that meet performance requirements while minimizing environmental impact.

Smart flooring technologies gain traction through integration of sensors, heating elements, and connectivity features that provide additional functionality beyond traditional flooring performance. These advanced systems create opportunities for premium positioning and recurring service revenues.

Customization demand increases as customers seek unique aesthetic solutions and specialized performance characteristics tailored to specific applications. Advanced coloring systems, texture options, and custom formulations enable differentiation and value-added positioning.

Rapid installation systems become increasingly important as customers prioritize minimal downtime and quick project completion. Fast-cure formulations and simplified application processes address operational efficiency requirements in commercial and industrial settings.

Digital transformation impacts market dynamics through online product selection tools, virtual design capabilities, and digital project management systems. Technology adoption enhances customer experience and streamlines business processes throughout the value chain.

Regional manufacturing expansion continues as companies establish local production capabilities to serve growing regional demand while reducing transportation costs and delivery times. This trend supports supply chain resilience and customer service improvement.

Capacity expansion investments by major manufacturers demonstrate confidence in long-term market growth prospects. Recent facility announcements across China, India, and Southeast Asia indicate substantial capital commitment to serving regional demand growth.

Technology partnerships between international companies and regional manufacturers facilitate knowledge transfer and market development. These collaborations accelerate adoption of advanced technologies while building local capabilities and market presence.

Product innovation activities focus on sustainable formulations, enhanced performance characteristics, and specialized applications. Recent product launches emphasize environmental compliance, improved durability, and aesthetic enhancement capabilities.

Acquisition activities among industry participants reflect market consolidation trends and strategic positioning for growth. Recent transactions demonstrate the value placed on regional market access and specialized technology capabilities.

Regulatory developments across the region influence product formulations and market dynamics. New environmental standards and safety requirements drive innovation toward more sustainable and safer product alternatives.

Distribution network expansion initiatives by leading companies enhance market coverage and customer service capabilities. Strategic partnerships with regional distributors and contractors strengthen market penetration and technical support availability.

Strategic focus on sustainability and environmental compliance will become increasingly critical for long-term market success. Companies should prioritize development of eco-friendly formulations and obtain relevant environmental certifications to meet evolving customer and regulatory requirements.

Regional partnerships with local distributors, contractors, and technical service providers can accelerate market penetration and enhance customer relationships. Strong local presence and technical support capabilities are essential for competing effectively in diverse regional markets.

Technology investment in advanced formulations, application systems, and digital capabilities will differentiate market leaders from competitors. Innovation focus should address customer pain points including installation complexity, environmental concerns, and performance optimization.

Market diversification across multiple application segments and geographical regions can reduce risk and capture growth opportunities. Balanced portfolio approach helps maintain stability while pursuing high-growth market segments.

Customer education and technical support programs can accelerate adoption and build long-term relationships. Investment in training programs, technical documentation, and application support enhances customer success and market development.

Supply chain optimization through regional manufacturing and strategic sourcing can improve cost competitiveness and service levels. Local production capabilities reduce transportation costs and delivery times while enhancing supply chain resilience.

Long-term growth prospects for the Asia-Pacific flooring resins market remain highly favorable, supported by continued economic development, infrastructure investment, and industrial expansion across the region. MWR projections indicate sustained market expansion with growth rates exceeding global averages through the forecast period.

Technology evolution will drive market transformation through development of more sustainable, higher-performing, and easier-to-apply formulations. Advanced materials science and manufacturing technologies will enable new product categories and application possibilities that expand market scope.

Market maturation in developed regional markets will shift focus toward premium solutions, specialized applications, and value-added services. This evolution creates opportunities for differentiation and margin improvement while maintaining volume growth in emerging markets.

Regulatory landscape evolution will continue influencing product development and market dynamics, with increasing emphasis on environmental sustainability and workplace safety. Proactive compliance and innovation leadership will become competitive advantages.

Digital integration will transform customer engagement, product selection, and service delivery processes. Companies that successfully leverage digital technologies will gain competitive advantages in customer acquisition and retention.

Regional integration and trade facilitation will create opportunities for market expansion and supply chain optimization. Harmonized standards and reduced trade barriers will support cross-border business development and economies of scale.

The Asia-Pacific flooring resins market represents a compelling growth opportunity characterized by strong fundamentals, diverse applications, and expanding regional demand. Market dynamics reflect the region’s position as both a major consumption center and manufacturing hub for global flooring resin solutions.

Strategic success factors include technology innovation, sustainability focus, regional partnerships, and comprehensive customer support capabilities. Companies that effectively address these requirements while maintaining cost competitiveness will capture the greatest market opportunities.

Future market evolution will be shaped by technological advancement, environmental considerations, and changing customer preferences toward more sophisticated and sustainable solutions. The market’s resilience and growth potential make it an attractive sector for long-term investment and strategic development initiatives across the dynamic Asia-Pacific region.

What is Flooring Resins?

Flooring resins are synthetic materials used in the production of flooring products, providing durability, flexibility, and resistance to wear and tear. They are commonly used in various applications, including residential, commercial, and industrial flooring solutions.

What are the key players in the Asia-Pacific Flooring Resins Market?

Key players in the Asia-Pacific Flooring Resins Market include BASF SE, Huntsman Corporation, and Dow Inc. These companies are known for their innovative flooring resin solutions and significant market presence, among others.

What are the growth factors driving the Asia-Pacific Flooring Resins Market?

The Asia-Pacific Flooring Resins Market is driven by increasing urbanization, rising construction activities, and growing demand for durable flooring solutions in both residential and commercial sectors. Additionally, advancements in resin technology are enhancing product performance.

What challenges does the Asia-Pacific Flooring Resins Market face?

The Asia-Pacific Flooring Resins Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit the availability of certain resin types.

What opportunities exist in the Asia-Pacific Flooring Resins Market?

Opportunities in the Asia-Pacific Flooring Resins Market include the growing trend towards sustainable and eco-friendly flooring solutions. Additionally, the rise in renovation projects and the increasing popularity of luxury vinyl tiles present significant growth potential.

What trends are shaping the Asia-Pacific Flooring Resins Market?

Trends shaping the Asia-Pacific Flooring Resins Market include the increasing adoption of smart flooring technologies and the development of bio-based resins. These innovations are aimed at improving performance and reducing environmental impact.

Asia-Pacific Flooring Resins Market

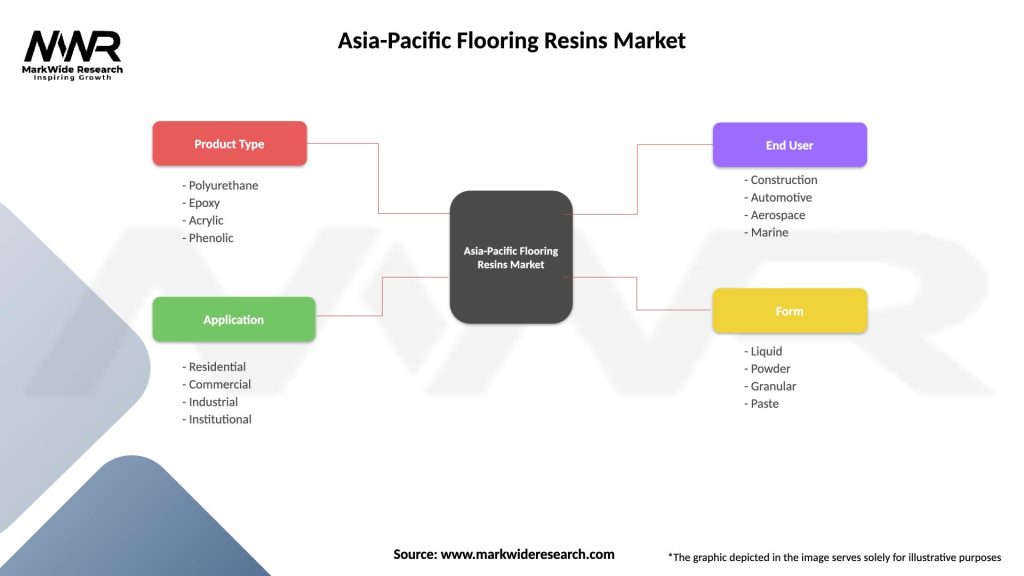

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Epoxy, Acrylic, Phenolic |

| Application | Residential, Commercial, Industrial, Institutional |

| End User | Construction, Automotive, Aerospace, Marine |

| Form | Liquid, Powder, Granular, Paste |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Flooring Resins Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at