444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific event logistics market represents a dynamic and rapidly expanding sector that encompasses comprehensive planning, coordination, and execution of events across diverse industries throughout the region. Event logistics involves the intricate management of transportation, venue coordination, equipment handling, technology integration, and supply chain optimization for corporate conferences, trade shows, exhibitions, cultural festivals, and sporting events. The region’s robust economic growth, increasing urbanization, and rising disposable income have created substantial demand for professional event management services.

Market dynamics in the Asia Pacific region are characterized by significant growth potential, with the sector experiencing a compound annual growth rate of 8.2% driven by expanding business activities, international trade relationships, and cultural exchange programs. Countries including China, Japan, India, South Korea, Australia, and Singapore serve as major hubs for event logistics operations, each contributing unique strengths in technology adoption, infrastructure development, and service innovation.

Regional diversity presents both opportunities and challenges for event logistics providers, as varying cultural preferences, regulatory frameworks, and technological capabilities require customized approaches to service delivery. The market encompasses multiple service categories including venue management, transportation coordination, equipment rental, catering logistics, technology support, and comprehensive project management solutions.

The Asia Pacific event logistics market refers to the comprehensive ecosystem of services, technologies, and solutions designed to facilitate the planning, coordination, and execution of events across commercial, cultural, and entertainment sectors throughout the Asia Pacific region. This market encompasses specialized service providers who manage complex logistical operations including venue selection, transportation coordination, equipment procurement, technology integration, and supply chain management for diverse event types ranging from corporate conferences to large-scale public gatherings.

Event logistics services involve strategic planning and tactical execution of multiple interconnected components that ensure successful event delivery. These services include pre-event planning, real-time coordination during events, and post-event analysis and reporting. The market serves various stakeholders including corporations, government agencies, non-profit organizations, entertainment companies, and individual clients requiring professional event management expertise.

Technology integration plays a crucial role in modern event logistics, incorporating digital platforms for registration management, mobile applications for attendee engagement, real-time tracking systems for equipment and personnel, and data analytics for performance optimization. The market continues evolving with emerging technologies including artificial intelligence, virtual reality, and Internet of Things applications enhancing service delivery capabilities.

Strategic analysis of the Asia Pacific event logistics market reveals a sector experiencing robust expansion driven by increasing business activities, international trade growth, and rising demand for professional event management services. The market benefits from strong economic fundamentals across key regional economies, with corporate events accounting for approximately 45% of total market demand, followed by trade shows, cultural events, and sporting activities.

Technology adoption represents a critical growth driver, with digital transformation initiatives enabling enhanced service delivery, improved operational efficiency, and better customer experiences. Cloud-based platforms, mobile applications, and data analytics tools are becoming standard components of comprehensive event logistics solutions, allowing providers to offer more sophisticated and responsive services to clients.

Market consolidation trends indicate increasing collaboration between traditional event management companies and technology providers, creating integrated service offerings that combine logistical expertise with digital innovation. This convergence enables more comprehensive solutions addressing complex client requirements while improving operational scalability and cost-effectiveness.

Regional variations in market development reflect different stages of economic maturity, with developed markets like Japan and Australia emphasizing premium services and technological sophistication, while emerging markets focus on capacity building and infrastructure development to support growing event volumes.

Market segmentation analysis reveals distinct patterns in service demand across different event categories and geographic regions. The following key insights emerge from comprehensive market evaluation:

Economic expansion across the Asia Pacific region serves as the primary catalyst for event logistics market growth, with increasing business activities, international trade relationships, and corporate investment driving demand for professional event management services. Rising GDP levels, urbanization trends, and expanding middle-class populations create favorable conditions for both business and consumer events.

Globalization trends continue accelerating demand for international conferences, trade exhibitions, and cultural exchange programs throughout the region. Multinational corporations are establishing stronger regional presence, requiring sophisticated event logistics support for product launches, stakeholder meetings, and brand activation campaigns. This trend is particularly pronounced in technology, manufacturing, and financial services sectors.

Infrastructure development initiatives across major regional economies are creating enhanced capabilities for hosting large-scale events. Modern convention centers, improved transportation networks, and advanced telecommunications infrastructure enable more ambitious event concepts while reducing operational complexity and costs for logistics providers.

Technology advancement is revolutionizing event logistics operations through digital platforms, automation systems, and data analytics capabilities. These innovations enable more efficient resource management, improved customer experiences, and enhanced operational scalability, making professional event logistics services more attractive to potential clients.

Cultural diversity within the region creates opportunities for specialized event logistics services that can navigate complex cultural requirements, language barriers, and regulatory frameworks. Providers with strong local expertise and cultural sensitivity gain competitive advantages in serving international clients and complex multi-country events.

Regulatory complexity across different Asia Pacific countries presents significant challenges for event logistics providers, particularly those operating across multiple jurisdictions. Varying permit requirements, safety regulations, customs procedures, and tax structures create operational complications and increase compliance costs for service providers.

Infrastructure limitations in certain regional markets constrain the types and scales of events that can be effectively supported. Inadequate transportation networks, limited venue availability, and insufficient telecommunications infrastructure in some areas restrict market expansion opportunities and service quality standards.

Skilled workforce shortages affect service delivery capabilities across the region, with talent acquisition challenges impacting 58% of event logistics companies. The specialized nature of event management requires experienced professionals with cultural awareness, language skills, and technical expertise that may be difficult to recruit and retain in competitive labor markets.

Economic volatility and geopolitical uncertainties can significantly impact event planning and logistics operations. Currency fluctuations, trade tensions, and political instability create unpredictable operating conditions that affect client confidence and investment decisions in event activities.

Technology integration costs represent substantial barriers for smaller service providers seeking to compete with larger, well-funded competitors. Advanced digital platforms, automation systems, and data analytics tools require significant capital investments that may be challenging for emerging companies to justify or afford.

Digital transformation initiatives present substantial opportunities for event logistics providers to differentiate their services and improve operational efficiency. Integration of artificial intelligence, machine learning, and Internet of Things technologies can enhance predictive planning, real-time monitoring, and post-event analysis capabilities, creating competitive advantages and premium service offerings.

Sustainability initiatives are creating new market segments focused on environmentally responsible event management. Green logistics practices, carbon footprint reduction, and sustainable supply chain management represent growing client priorities that forward-thinking providers can address through specialized service offerings and partnerships with eco-friendly suppliers.

Emerging market expansion offers significant growth potential as developing economies in Southeast Asia, South Asia, and other regional areas experience rapid economic development. These markets present opportunities for establishing early market presence and building long-term client relationships as local event activity increases.

Hybrid event formats combining physical and virtual elements are creating new service requirements and revenue opportunities. Event logistics providers can develop expertise in managing complex technology integrations, multi-location coordination, and seamless attendee experiences across different participation modes.

Industry specialization enables providers to develop deep expertise in specific sectors such as healthcare, technology, automotive, or financial services. This specialization allows for premium pricing, stronger client relationships, and more effective marketing positioning within targeted industry segments.

Competitive intensity within the Asia Pacific event logistics market is increasing as established providers expand their geographic coverage and service capabilities while new entrants introduce innovative approaches and technologies. This competition drives continuous improvement in service quality, operational efficiency, and customer satisfaction levels across the industry.

Client expectations are evolving toward more comprehensive, technology-enabled solutions that provide greater transparency, flexibility, and measurable outcomes. Event organizers increasingly demand real-time visibility into logistics operations, detailed performance analytics, and seamless integration with their own planning and management systems.

Supply chain optimization has become a critical success factor, with leading providers implementing advanced logistics management systems to improve resource allocation, reduce costs, and enhance service reliability. These systems enable better coordination between multiple service providers, venues, and suppliers involved in complex event operations.

Partnership ecosystems are emerging as providers recognize the benefits of collaborative approaches to service delivery. Strategic alliances between logistics companies, technology providers, venue operators, and specialized suppliers create more comprehensive solutions while enabling individual companies to focus on their core competencies.

Innovation cycles are accelerating as providers invest in research and development to maintain competitive positioning. New service concepts, technology applications, and operational methodologies are continuously being developed and tested to address evolving client needs and market opportunities.

Comprehensive analysis of the Asia Pacific event logistics market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include structured interviews with industry executives, service providers, and key clients across major regional markets to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses extensive review of industry publications, company reports, government statistics, and trade association data to validate primary findings and provide broader market context. This approach ensures comprehensive coverage of market dynamics, competitive landscapes, and regulatory environments across different countries and market segments.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to identify patterns and trends. MarkWide Research employs rigorous quality control measures to ensure data accuracy and reliability throughout the research process.

Market modeling techniques incorporate quantitative analysis of historical trends, current market conditions, and projected future developments to generate reliable forecasts and growth projections. These models consider multiple variables including economic indicators, industry trends, and regulatory changes that may impact market development.

Expert consultation with industry specialists, academic researchers, and regional market experts provides additional validation and insights into market dynamics, emerging trends, and future opportunities. This collaborative approach ensures comprehensive understanding of complex market factors and regional variations.

China dominates the regional event logistics market with approximately 35% market share, driven by massive domestic demand, international business activities, and government support for trade and cultural events. Major cities including Beijing, Shanghai, and Guangzhou serve as primary hubs for large-scale conferences, exhibitions, and corporate events, supported by world-class infrastructure and comprehensive service ecosystems.

Japan represents a mature and sophisticated market characterized by high service standards, advanced technology adoption, and premium pricing structures. The country’s expertise in precision logistics, attention to detail, and cultural protocols makes it a preferred destination for high-profile international events and specialized industry conferences.

India demonstrates rapid growth potential with expanding corporate activities, increasing international trade relationships, and growing domestic consumer markets. Cities like Mumbai, Delhi, and Bangalore are emerging as major event destinations, though infrastructure development and service standardization remain ongoing challenges.

Australia and Singapore serve as regional gateways for international events, offering excellent infrastructure, skilled workforce, and favorable regulatory environments. These markets command premium pricing for their high service standards and strategic geographic positioning for Asia-Pacific business activities.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and the Philippines present significant growth opportunities as their economies develop and business activities increase. These markets offer cost advantages while gradually improving infrastructure and service capabilities to support larger and more complex events.

Market leadership is distributed among several categories of service providers, each bringing distinct capabilities and competitive advantages to the Asia Pacific event logistics market. The competitive environment includes global logistics companies, regional event specialists, and emerging technology-focused providers.

Competitive strategies focus on technology differentiation, geographic expansion, service specialization, and strategic partnerships to capture market share and improve profitability. Leading providers are investing heavily in digital platforms, automation systems, and data analytics capabilities to enhance service delivery and operational efficiency.

By Service Type:

By Event Type:

By End User:

Corporate Events represent the largest and most lucrative segment within the Asia Pacific event logistics market, accounting for substantial revenue generation and consistent demand patterns. This category benefits from increasing international business activities, regional trade relationships, and corporate investment in stakeholder engagement programs. Premium pricing structures reflect the high service standards and specialized requirements typical of corporate clients.

Trade Shows and Exhibitions demonstrate strong growth potential driven by expanding B2B commerce, industry specialization, and international trade promotion activities. This segment requires specialized expertise in display logistics, exhibitor services, and visitor management systems. Technology integration rates exceed 68% in this category as organizers seek enhanced attendee experiences and operational efficiency.

Cultural and Entertainment Events present unique opportunities for providers with cultural expertise and creative capabilities. This segment requires deep understanding of local preferences, regulatory requirements, and community engagement strategies. Growth is driven by increasing disposable income, urbanization trends, and government support for cultural activities.

Sports Events offer high-visibility opportunities with complex logistical requirements including security coordination, crowd management, and specialized equipment handling. This category benefits from growing sports participation, international competitions, and corporate sponsorship activities throughout the region.

Technology-Enabled Services are becoming essential across all event categories, with digital platforms, mobile applications, and data analytics tools enhancing service delivery and client satisfaction. Providers investing in technology capabilities gain competitive advantages and command premium pricing for enhanced service offerings.

Service Providers benefit from expanding market opportunities, technology-enabled operational improvements, and increasing client sophistication that supports premium pricing strategies. The growing complexity of events creates demand for specialized expertise and comprehensive service offerings that established providers are well-positioned to deliver.

Event Organizers gain access to professional expertise, advanced technology platforms, and comprehensive service solutions that reduce operational complexity while improving event quality and attendee satisfaction. Professional logistics support enables organizers to focus on content development and strategic objectives rather than operational details.

Venue Operators benefit from increased utilization rates, enhanced service capabilities, and stronger relationships with event organizers through partnerships with professional logistics providers. These collaborations often result in improved facility management and enhanced customer experiences.

Technology Vendors find expanding opportunities to provide specialized solutions for event logistics applications, including registration systems, mobile applications, real-time tracking platforms, and data analytics tools. The growing sophistication of event requirements creates demand for innovative technology solutions.

Regional Economies benefit from increased business activity, tourism revenue, and international visibility generated by professional events. Well-executed events enhance destination reputation and attract future business opportunities while supporting local service industries and employment.

Attendees and Participants experience improved event quality, enhanced convenience, and better overall satisfaction through professional logistics management. Technology integration enables more personalized experiences and seamless participation across different event formats and locations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration is becoming a fundamental requirement rather than optional consideration, with clients increasingly demanding environmentally responsible logistics solutions. This trend encompasses carbon footprint reduction, waste minimization, sustainable transportation options, and partnerships with eco-friendly suppliers. Green certification programs are gaining importance as competitive differentiators.

Technology Convergence involves integration of multiple digital platforms to create seamless event experiences. Artificial intelligence, machine learning, and Internet of Things applications are being combined to enable predictive planning, real-time optimization, and comprehensive performance analytics. Mobile-first approaches are becoming standard for attendee engagement and operational management.

Hybrid Event Evolution continues transforming traditional event formats by combining physical and virtual elements to expand reach and enhance flexibility. This trend requires new expertise in technology integration, multi-location coordination, and audience engagement across different participation modes. Virtual reality applications are emerging as tools for immersive remote participation.

Data-Driven Decision Making is revolutionizing event planning and logistics management through comprehensive analytics platforms that provide insights into attendee behavior, operational efficiency, and ROI measurement. Real-time data collection and analysis enable dynamic adjustments and continuous improvement in service delivery.

Personalization Demands are increasing as clients seek customized solutions that reflect their specific requirements, brand identity, and cultural preferences. This trend requires flexible service models, cultural expertise, and technology platforms capable of supporting diverse customization options.

Strategic Acquisitions are reshaping the competitive landscape as major providers acquire specialized companies to expand service capabilities, geographic coverage, and technology expertise. These transactions enable rapid market entry, capability enhancement, and economies of scale that improve competitive positioning.

Technology Partnerships between logistics providers and software companies are creating integrated platforms that combine operational expertise with digital innovation. These collaborations enable more sophisticated service offerings while reducing individual companies’ technology development costs and risks.

Infrastructure Investments by governments and private sector organizations are enhancing regional capabilities for hosting large-scale events. New convention centers, improved transportation networks, and advanced telecommunications infrastructure create opportunities for more ambitious event concepts and improved service delivery.

Regulatory Harmonization efforts across certain regional markets are reducing operational complexity and compliance costs for providers operating in multiple countries. These developments facilitate market expansion and enable more efficient resource allocation across different geographic areas.

Sustainability Initiatives are being implemented throughout the industry as providers recognize environmental responsibility as both ethical imperative and competitive advantage. Carbon-neutral event programs and waste reduction initiatives are becoming standard offerings rather than premium services.

Technology Investment should be prioritized by service providers seeking to maintain competitive positioning and meet evolving client expectations. MWR analysis indicates that companies investing in digital platforms, automation systems, and data analytics capabilities achieve superior growth rates and profitability compared to traditional service providers.

Geographic Diversification strategies should focus on emerging markets with strong growth potential while maintaining presence in established markets. Providers should consider partnerships or joint ventures to enter new markets efficiently while minimizing risks associated with unfamiliar regulatory and cultural environments.

Service Specialization enables providers to differentiate their offerings and command premium pricing through deep expertise in specific event types or industry verticals. Companies should evaluate their core competencies and market opportunities to identify optimal specialization strategies.

Sustainability Integration should be incorporated into core business strategies rather than treated as optional add-on services. Environmental responsibility is becoming a fundamental client requirement that affects vendor selection decisions and long-term business relationships.

Partnership Development with technology providers, venue operators, and specialized suppliers creates opportunities for comprehensive service offerings while enabling individual companies to focus on their core competencies. Strategic alliances can accelerate capability development and market expansion.

Market expansion is expected to continue across the Asia Pacific region, driven by sustained economic growth, increasing business activities, and rising demand for professional event management services. Growth projections indicate a 7.5% CAGR over the next five years, with emerging markets contributing disproportionately to overall expansion.

Technology transformation will accelerate as artificial intelligence, machine learning, and Internet of Things applications become mainstream components of event logistics operations. These technologies will enable more sophisticated planning, real-time optimization, and comprehensive performance measurement capabilities that enhance service quality and operational efficiency.

Sustainability requirements will become increasingly stringent as environmental awareness grows and regulatory frameworks evolve. Providers must develop comprehensive green logistics capabilities to meet client expectations and comply with emerging environmental regulations across different regional markets.

Market consolidation trends are likely to continue as larger providers acquire specialized companies to expand capabilities and geographic coverage. This consolidation will create more comprehensive service offerings while potentially reducing competition in certain market segments.

Innovation acceleration will be driven by competitive pressure and client demands for enhanced service delivery. New service concepts, technology applications, and operational methodologies will continuously emerge to address evolving market requirements and create competitive advantages for forward-thinking providers.

The Asia Pacific event logistics market represents a dynamic and rapidly evolving sector with substantial growth potential driven by regional economic expansion, increasing business activities, and rising demand for professional event management services. Technology integration and sustainability considerations are becoming fundamental requirements that shape competitive positioning and client relationships throughout the industry.

Market opportunities abound for providers who can successfully navigate regulatory complexity, cultural diversity, and infrastructure variations while delivering high-quality, technology-enabled services. The convergence of traditional logistics expertise with digital innovation creates possibilities for enhanced service delivery and new business models that address evolving client needs.

Success factors include strategic technology investment, geographic diversification, service specialization, and strong partnership development. Companies that can effectively combine operational excellence with cultural sensitivity and environmental responsibility will be best positioned to capture market opportunities and achieve sustainable growth in this competitive landscape.

What is Event Logistics?

Event logistics refers to the planning, execution, and management of all logistical aspects related to events, including transportation, accommodation, and equipment handling. It ensures that all elements are coordinated effectively to create a seamless experience for attendees.

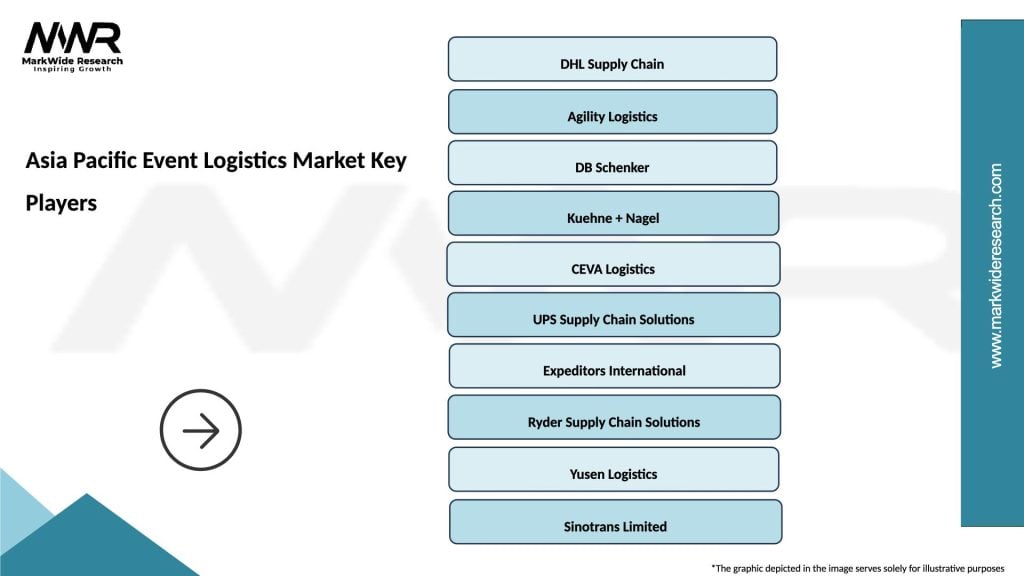

What are the key players in the Asia Pacific Event Logistics Market?

Key players in the Asia Pacific Event Logistics Market include DHL, Kuehne + Nagel, and DB Schenker, which provide comprehensive logistics solutions tailored for events. These companies specialize in managing complex supply chains and ensuring timely delivery of materials, among others.

What are the main drivers of growth in the Asia Pacific Event Logistics Market?

The main drivers of growth in the Asia Pacific Event Logistics Market include the increasing number of corporate events, the rise in international exhibitions, and the growing demand for specialized logistics services. Additionally, advancements in technology are enhancing operational efficiency.

What challenges does the Asia Pacific Event Logistics Market face?

The Asia Pacific Event Logistics Market faces challenges such as fluctuating transportation costs, regulatory compliance issues, and the need for skilled labor. These factors can complicate logistics planning and execution for events.

What opportunities exist in the Asia Pacific Event Logistics Market?

Opportunities in the Asia Pacific Event Logistics Market include the expansion of virtual and hybrid events, which require innovative logistics solutions. Additionally, the growing focus on sustainability presents avenues for eco-friendly logistics practices.

What trends are shaping the Asia Pacific Event Logistics Market?

Trends shaping the Asia Pacific Event Logistics Market include the integration of technology for real-time tracking, the use of data analytics for better decision-making, and an increased emphasis on sustainability in logistics operations. These trends are transforming how events are managed.

Asia Pacific Event Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, On-site Management, Equipment Rental |

| Event Type | Corporate Events, Trade Shows, Concerts, Festivals |

| End User | Event Organizers, Corporations, Government Agencies, Non-profits |

| Technology | RFID Tracking, Event Management Software, Virtual Platforms, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Event Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at