444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific enterprise routers market represents one of the most dynamic and rapidly evolving segments within the global networking infrastructure landscape. This region has emerged as a critical hub for digital transformation initiatives, driving unprecedented demand for sophisticated routing solutions that can handle complex enterprise networking requirements. Enterprise routers serve as the backbone of modern business communications, enabling seamless connectivity between different network segments, remote locations, and cloud-based services.

Market dynamics in the Asia Pacific region are characterized by robust economic growth, increasing digitalization across industries, and the rapid adoption of cloud computing technologies. Countries such as China, Japan, India, South Korea, and Australia are leading the charge in enterprise router deployment, with organizations investing heavily in network infrastructure to support their expanding digital operations. The market is experiencing significant growth driven by the proliferation of Internet of Things (IoT) devices, the expansion of 5G networks, and the increasing need for secure, high-performance connectivity solutions.

Regional adoption patterns indicate that enterprises across various sectors are prioritizing network modernization to support remote work capabilities, enhance operational efficiency, and improve customer experiences. The market is witnessing a 12.5% compound annual growth rate, reflecting the strong demand for advanced routing technologies that can accommodate the increasing complexity of modern enterprise networks. Cloud migration initiatives and the growing emphasis on network security are further accelerating market expansion across the region.

The Asia Pacific enterprise routers market refers to the comprehensive ecosystem of networking hardware, software, and services designed to facilitate high-performance data routing and network management within enterprise environments across the Asia Pacific region. Enterprise routers are sophisticated networking devices that direct data packets between different network segments, ensuring optimal performance, security, and reliability for business-critical communications.

These networking solutions encompass a wide range of products including core routers, edge routers, branch routers, and virtual routing platforms that enable organizations to establish robust, scalable network infrastructures. The market includes both traditional hardware-based routing solutions and emerging software-defined networking approaches that provide greater flexibility and cost-effectiveness for enterprise deployments.

Key characteristics of enterprise routers include advanced traffic management capabilities, comprehensive security features, support for multiple networking protocols, and the ability to handle high-volume data transmission requirements. These devices play a crucial role in enabling digital transformation initiatives, supporting cloud connectivity, and facilitating the integration of emerging technologies such as artificial intelligence and machine learning into enterprise operations.

The Asia Pacific enterprise routers market is experiencing unprecedented growth momentum, driven by the region’s rapid digital transformation and increasing demand for sophisticated networking infrastructure. Organizations across diverse industries are investing significantly in advanced routing solutions to support their evolving connectivity requirements and enhance operational efficiency.

Key market drivers include the widespread adoption of cloud computing services, the proliferation of mobile devices and IoT applications, and the growing emphasis on network security and performance optimization. The market is characterized by intense competition among leading technology vendors, continuous innovation in routing technologies, and increasing customer demand for integrated networking solutions that can support complex enterprise environments.

Regional market dynamics reveal that approximately 35% of enterprise router deployments are concentrated in the manufacturing and technology sectors, while financial services and telecommunications industries account for another 28% of market adoption. The trend toward hybrid cloud architectures and edge computing is creating new opportunities for specialized routing solutions that can effectively manage distributed network environments.

Future market prospects remain highly favorable, with emerging technologies such as 5G, artificial intelligence, and software-defined networking expected to drive continued growth and innovation in the enterprise router segment throughout the Asia Pacific region.

Strategic market analysis reveals several critical insights that are shaping the Asia Pacific enterprise routers landscape. The following key insights provide a comprehensive understanding of market dynamics and growth opportunities:

Digital transformation initiatives across the Asia Pacific region are serving as the primary catalyst for enterprise router market growth. Organizations are modernizing their network infrastructures to support cloud migration, enable remote work capabilities, and facilitate the integration of emerging technologies into their operations. This digital evolution is creating substantial demand for advanced routing solutions that can handle complex, distributed network environments.

The proliferation of IoT devices and smart technologies is generating unprecedented network traffic volumes, requiring enterprises to invest in high-performance routing infrastructure. Manufacturing facilities, smart cities, and connected vehicle initiatives are driving significant demand for routing solutions that can manage massive data flows while maintaining optimal performance and security standards.

5G network deployment across the region is creating new opportunities for enterprise router adoption, as organizations seek to leverage high-speed connectivity for enhanced business applications. The low-latency characteristics of 5G networks are enabling new use cases that require sophisticated routing capabilities to manage traffic efficiently and ensure consistent performance.

Cloud computing adoption continues to accelerate across Asia Pacific enterprises, with organizations requiring robust routing solutions to manage hybrid and multi-cloud environments effectively. The need for seamless connectivity between on-premises infrastructure and cloud services is driving demand for enterprise routers that can optimize traffic routing and ensure secure data transmission.

Cybersecurity concerns are increasingly influencing enterprise router purchasing decisions, with organizations prioritizing solutions that incorporate advanced security features and threat detection capabilities. The growing sophistication of cyber threats is driving demand for routing infrastructure that can provide comprehensive network protection while maintaining optimal performance.

High implementation costs represent a significant barrier to enterprise router adoption, particularly for small and medium-sized enterprises with limited IT budgets. The substantial capital investment required for advanced routing infrastructure, combined with ongoing maintenance and support costs, can create financial challenges for organizations seeking to modernize their network environments.

Technical complexity associated with modern enterprise routing solutions can pose implementation challenges for organizations with limited networking expertise. The sophisticated configuration requirements and ongoing management needs of advanced routing systems may require specialized technical skills that are not readily available in all markets across the Asia Pacific region.

Integration challenges with existing network infrastructure can complicate enterprise router deployments, particularly in organizations with legacy systems and diverse technology environments. The need to ensure compatibility and seamless operation with existing networking components can extend implementation timelines and increase project complexity.

Vendor lock-in concerns may limit enterprise router adoption, as organizations seek to avoid becoming overly dependent on specific technology providers. The proprietary nature of some routing solutions can create long-term flexibility concerns and potentially increase total cost of ownership over time.

Regulatory compliance requirements in certain Asia Pacific markets may create additional complexity for enterprise router deployments, particularly in highly regulated industries such as financial services and healthcare. Organizations must ensure that their routing solutions meet specific regulatory standards while maintaining optimal performance and functionality.

Edge computing expansion presents substantial opportunities for enterprise router vendors, as organizations increasingly deploy distributed computing architectures that require sophisticated routing capabilities. The growing demand for low-latency processing and real-time data analysis is creating new market segments for specialized routing solutions designed to support edge computing environments.

Software-defined networking adoption is opening new avenues for innovation in enterprise routing, with organizations seeking more flexible and programmable networking solutions. The shift toward software-defined approaches enables greater customization, improved resource utilization, and enhanced operational efficiency, creating opportunities for vendors that can deliver comprehensive SDN-enabled routing platforms.

Artificial intelligence integration in networking infrastructure represents an emerging opportunity for enterprise router vendors. Organizations are increasingly interested in routing solutions that can leverage AI and machine learning capabilities for predictive maintenance, automated optimization, and intelligent traffic management.

Small and medium enterprise market expansion offers significant growth potential, as these organizations increasingly recognize the importance of robust networking infrastructure for their digital transformation initiatives. The development of cost-effective, easy-to-deploy routing solutions specifically designed for SME requirements could unlock substantial market opportunities.

Vertical market specialization presents opportunities for vendors to develop industry-specific routing solutions that address unique requirements in sectors such as healthcare, manufacturing, retail, and education. Tailored solutions that incorporate industry-specific features and compliance capabilities could command premium pricing and foster stronger customer relationships.

Competitive intensity in the Asia Pacific enterprise routers market continues to escalate as established networking vendors compete with emerging technology companies and regional players. This competitive environment is driving continuous innovation, price optimization, and enhanced customer service offerings across the market.

Technology convergence is reshaping market dynamics, with traditional routing functionality increasingly integrated with security, analytics, and cloud management capabilities. This convergence is creating opportunities for comprehensive networking platforms while challenging vendors to develop more sophisticated, multi-functional solutions.

Customer expectations are evolving rapidly, with enterprises demanding routing solutions that provide greater visibility, control, and automation capabilities. Organizations are seeking networking infrastructure that can adapt to changing requirements while providing comprehensive performance monitoring and management tools.

Supply chain considerations are becoming increasingly important in market dynamics, with organizations prioritizing vendors that can ensure reliable product availability and support services. The global supply chain disruptions experienced in recent years have heightened awareness of supply chain resilience in technology procurement decisions.

Partnership ecosystems are playing a crucial role in market dynamics, with successful vendors developing comprehensive partner networks that include system integrators, consultants, and technology complementors. These partnerships enable broader market reach and enhanced solution delivery capabilities.

Comprehensive market analysis for the Asia Pacific enterprise routers market employs a multi-faceted research approach that combines primary and secondary research methodologies to ensure accuracy and reliability of market insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a holistic understanding of market dynamics and trends.

Primary research activities include extensive interviews with industry executives, technology vendors, system integrators, and end-user organizations across key Asia Pacific markets. These interviews provide valuable insights into market trends, customer requirements, competitive dynamics, and future growth opportunities. Survey methodologies are employed to gather quantitative data on market adoption patterns, technology preferences, and purchasing behaviors.

Secondary research encompasses comprehensive analysis of industry reports, company financial statements, technology publications, and regulatory documents. This research provides historical market data, competitive intelligence, and industry trend analysis that supports primary research findings and enables comprehensive market modeling.

Market sizing methodologies utilize bottom-up and top-down approaches to ensure accuracy and reliability of market projections. The analysis incorporates regional economic indicators, technology adoption rates, and industry-specific growth drivers to develop robust market forecasts and growth projections.

Data validation processes include cross-referencing multiple data sources, expert review panels, and statistical analysis to ensure the accuracy and reliability of research findings. Quality assurance procedures are implemented throughout the research process to maintain the highest standards of analytical rigor and objectivity.

China dominates the Asia Pacific enterprise routers market, accounting for approximately 42% of regional market share due to its massive manufacturing base, rapid digital transformation initiatives, and substantial government investments in network infrastructure. Chinese enterprises across various sectors are investing heavily in advanced routing solutions to support their expanding digital operations and cloud migration strategies.

Japan represents the second-largest market segment, with 18% market share, driven by the country’s advanced technology adoption and sophisticated enterprise networking requirements. Japanese organizations are particularly focused on high-performance routing solutions that can support their precision manufacturing processes and advanced automation systems.

India’s market presence continues to expand rapidly, capturing 16% of regional market share as the country’s IT services sector and digital transformation initiatives drive substantial demand for enterprise networking infrastructure. The growth of India’s technology sector and increasing foreign investment are creating significant opportunities for routing solution providers.

South Korea and Australia collectively account for 15% of market share, with both countries demonstrating strong adoption of advanced networking technologies. South Korea’s focus on 5G deployment and digital innovation, combined with Australia’s emphasis on network security and cloud adoption, are driving steady market growth in these regions.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia represent emerging opportunities with 9% combined market share. These markets are experiencing rapid economic growth and increasing digitalization, creating substantial potential for enterprise router adoption across various industry sectors.

The competitive landscape in the Asia Pacific enterprise routers market is characterized by intense rivalry among global technology leaders and emerging regional players. Market participants are competing on multiple dimensions including technology innovation, pricing strategies, customer service, and geographic coverage.

Competitive strategies include continuous product innovation, strategic partnerships, aggressive pricing, and enhanced customer support services. Leading vendors are investing heavily in research and development to maintain technological leadership while expanding their geographic presence across key Asia Pacific markets.

By Product Type: The enterprise routers market encompasses various product categories designed to meet different organizational requirements and network architectures. Core routers handle high-volume traffic routing in large enterprise environments, while edge routers manage connectivity between internal networks and external connections.

By Technology: The market includes traditional hardware-based routing solutions alongside emerging software-defined networking approaches that provide greater flexibility and programmability.

By Organization Size: Market segmentation reflects the diverse requirements of different organizational scales, from large enterprises with complex networking needs to small businesses seeking cost-effective solutions.

Manufacturing sector adoption represents the largest category for enterprise router deployment, with organizations requiring robust networking infrastructure to support industrial automation, IoT integration, and supply chain optimization. Manufacturing enterprises are particularly focused on routing solutions that can handle high-volume data transmission while maintaining strict security and reliability standards.

Financial services organizations constitute a critical market category, with banks, insurance companies, and investment firms requiring enterprise routers that provide exceptional security, compliance capabilities, and high-availability performance. The regulatory requirements in financial services are driving demand for specialized routing solutions with comprehensive audit and monitoring capabilities.

Technology and telecommunications companies represent sophisticated users of enterprise routing technology, often requiring cutting-edge solutions that can support their own service delivery and internal operations. These organizations frequently serve as early adopters of emerging routing technologies and influence broader market trends.

Healthcare sector adoption is growing rapidly as medical organizations digitize their operations and implement telemedicine capabilities. Healthcare enterprises require routing solutions that can ensure patient data security while supporting real-time communication and medical device connectivity.

Education institutions are increasingly investing in enterprise routing infrastructure to support online learning, campus connectivity, and research activities. Educational organizations seek cost-effective solutions that can accommodate large numbers of concurrent users while providing reliable performance.

Enterprise organizations benefit significantly from advanced routing solutions through improved network performance, enhanced security capabilities, and greater operational efficiency. Modern enterprise routers enable organizations to optimize their network infrastructure, reduce operational costs, and support digital transformation initiatives more effectively.

Technology vendors gain access to substantial market opportunities through the growing demand for sophisticated networking solutions. The enterprise router market provides vendors with opportunities to develop innovative products, establish long-term customer relationships, and generate recurring revenue through support and maintenance services.

System integrators and partners benefit from the complexity of enterprise router deployments, which create opportunities for professional services, implementation support, and ongoing management services. The technical expertise required for successful router deployments enables partners to develop valuable consulting and support practices.

End users and employees experience improved network performance, better application responsiveness, and enhanced productivity through optimized routing infrastructure. Advanced routing solutions enable seamless connectivity, reduced downtime, and improved user experiences across various business applications.

Regional economies benefit from improved digital infrastructure that supports business growth, innovation, and competitiveness. Investment in enterprise routing infrastructure contributes to overall economic development and technological advancement across Asia Pacific markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined networking adoption is fundamentally transforming the enterprise router market, with organizations increasingly seeking programmable, flexible routing solutions that can adapt to changing business requirements. This trend is driving demand for routing platforms that can be managed through centralized software controllers and provide greater automation capabilities.

Cloud-first networking strategies are influencing enterprise router selection criteria, with organizations prioritizing solutions that can seamlessly integrate with cloud services and support hybrid network architectures. The trend toward cloud-native networking is creating demand for routing solutions optimized for cloud connectivity and management.

Security integration is becoming increasingly important in enterprise router deployments, with organizations seeking solutions that incorporate comprehensive cybersecurity capabilities. The convergence of routing and security functionality is driving demand for unified platforms that can provide both networking and protection capabilities.

Artificial intelligence implementation in networking infrastructure is emerging as a significant trend, with enterprises interested in routing solutions that can leverage AI for predictive maintenance, automated optimization, and intelligent traffic management. This trend is creating opportunities for vendors that can deliver AI-enabled routing platforms.

Edge computing support is becoming a critical requirement for enterprise routers, as organizations deploy distributed computing architectures that require sophisticated routing capabilities. The growth of edge computing is driving demand for routing solutions that can effectively manage traffic between edge locations and centralized data centers.

Strategic acquisitions continue to reshape the enterprise router market landscape, with major vendors acquiring specialized technology companies to enhance their product portfolios and market capabilities. These acquisitions are enabling vendors to integrate advanced technologies such as artificial intelligence, security, and cloud management into their routing solutions.

Product innovation initiatives are accelerating across the market, with vendors investing heavily in research and development to deliver next-generation routing solutions. Recent developments include the introduction of AI-powered routing platforms, enhanced security integration, and improved cloud connectivity capabilities.

Partnership agreements between technology vendors, system integrators, and cloud service providers are creating new opportunities for comprehensive networking solutions. These partnerships enable vendors to deliver integrated solutions that address complex enterprise requirements while expanding their market reach.

Regulatory compliance enhancements are driving product development initiatives, with vendors developing routing solutions that can meet specific regulatory requirements in different Asia Pacific markets. These developments are particularly important in highly regulated industries such as financial services and healthcare.

Sustainability initiatives are influencing product development, with vendors focusing on energy-efficient routing solutions that can help organizations reduce their environmental impact while maintaining high performance standards. According to MarkWide Research analysis, energy efficiency improvements of up to 40% efficiency gains are being achieved in next-generation routing platforms.

Technology vendors should focus on developing comprehensive routing platforms that integrate security, analytics, and cloud management capabilities to meet evolving enterprise requirements. The convergence of networking functionality presents opportunities for vendors that can deliver unified solutions addressing multiple organizational needs.

Enterprise organizations should prioritize routing solutions that provide scalability, security, and cloud integration capabilities to support their long-term digital transformation objectives. Organizations should also consider the total cost of ownership, including implementation, management, and ongoing support costs when evaluating routing solutions.

System integrators and partners should invest in developing specialized expertise in emerging routing technologies such as software-defined networking, AI integration, and edge computing support. These capabilities will be essential for delivering successful enterprise router deployments and maintaining competitive advantage.

Investment considerations should focus on vendors that demonstrate strong innovation capabilities, comprehensive product portfolios, and established market presence across key Asia Pacific regions. Organizations should also evaluate vendor financial stability and long-term strategic direction when making technology investment decisions.

Market entry strategies for new vendors should emphasize differentiation through specialized capabilities, competitive pricing, or superior customer service. Success in the enterprise router market requires substantial investment in technology development, market education, and customer support infrastructure.

Long-term market prospects for the Asia Pacific enterprise routers market remain highly favorable, with continued growth expected across all major regional markets. The ongoing digital transformation initiatives, 5G network deployment, and increasing adoption of cloud computing technologies will continue to drive demand for sophisticated routing solutions throughout the forecast period.

Technology evolution will continue to shape market dynamics, with software-defined networking, artificial intelligence, and edge computing capabilities becoming standard features in enterprise routing solutions. Organizations will increasingly seek routing platforms that can adapt to changing requirements while providing comprehensive performance monitoring and management capabilities.

Market expansion opportunities will emerge in underserved segments such as small and medium enterprises, vertical market specializations, and emerging Asia Pacific economies. Vendors that can develop cost-effective, easy-to-deploy solutions for these segments will be well-positioned to capture significant market share.

Competitive dynamics will continue to intensify, with established vendors competing against emerging technology companies and regional players. Success will depend on continuous innovation, strategic partnerships, and the ability to deliver comprehensive solutions that address complex enterprise networking requirements.

Growth projections indicate that the market will maintain strong momentum, with MWR projecting continued expansion driven by digital transformation initiatives and emerging technology adoption. The integration of 5G, IoT, and edge computing technologies will create new opportunities for specialized routing solutions designed to support these advanced networking requirements.

The Asia Pacific enterprise routers market represents a dynamic and rapidly evolving segment within the global networking infrastructure landscape, characterized by strong growth momentum, continuous technological innovation, and expanding market opportunities. The region’s robust economic development, accelerating digital transformation initiatives, and increasing adoption of advanced technologies are creating substantial demand for sophisticated routing solutions across diverse industry sectors.

Market dynamics indicate that organizations throughout the Asia Pacific region are prioritizing network infrastructure investments to support their digital transformation objectives, cloud migration strategies, and emerging technology integration requirements. The convergence of routing functionality with security, analytics, and cloud management capabilities is creating opportunities for comprehensive networking platforms that can address complex enterprise requirements.

Future market development will be driven by emerging technologies such as 5G networks, artificial intelligence, edge computing, and software-defined networking, which will continue to create new opportunities for innovative routing solutions. Organizations that can successfully navigate the evolving technology landscape while delivering superior customer value will be well-positioned to capture significant market share in this expanding and dynamic market environment.

What is Enterprise Routers?

Enterprise routers are networking devices that manage data traffic between different networks, ensuring efficient communication and connectivity within organizations. They are essential for businesses to connect their internal networks to the internet and other external networks.

What are the key players in the Asia Pacific Enterprise Routers Market?

Key players in the Asia Pacific Enterprise Routers Market include Cisco Systems, Juniper Networks, Huawei Technologies, and Arista Networks, among others. These companies are known for their innovative solutions and extensive product offerings in the enterprise networking space.

What are the growth factors driving the Asia Pacific Enterprise Routers Market?

The growth of the Asia Pacific Enterprise Routers Market is driven by the increasing demand for high-speed internet connectivity, the rise of cloud computing, and the expansion of IoT applications. Additionally, the need for secure and reliable network infrastructure is propelling market growth.

What challenges does the Asia Pacific Enterprise Routers Market face?

The Asia Pacific Enterprise Routers Market faces challenges such as the high cost of advanced networking equipment and the complexity of network management. Additionally, rapid technological changes can lead to obsolescence, making it difficult for companies to keep up.

What opportunities exist in the Asia Pacific Enterprise Routers Market?

Opportunities in the Asia Pacific Enterprise Routers Market include the growing adoption of software-defined networking (SDN) and network function virtualization (NFV). Furthermore, the increasing focus on cybersecurity solutions presents avenues for innovation and growth.

What trends are shaping the Asia Pacific Enterprise Routers Market?

Trends shaping the Asia Pacific Enterprise Routers Market include the shift towards cloud-based networking solutions, the integration of artificial intelligence for network management, and the demand for enhanced security features. These trends are influencing how enterprises design and implement their network infrastructures.

Asia Pacific Enterprise Routers Market

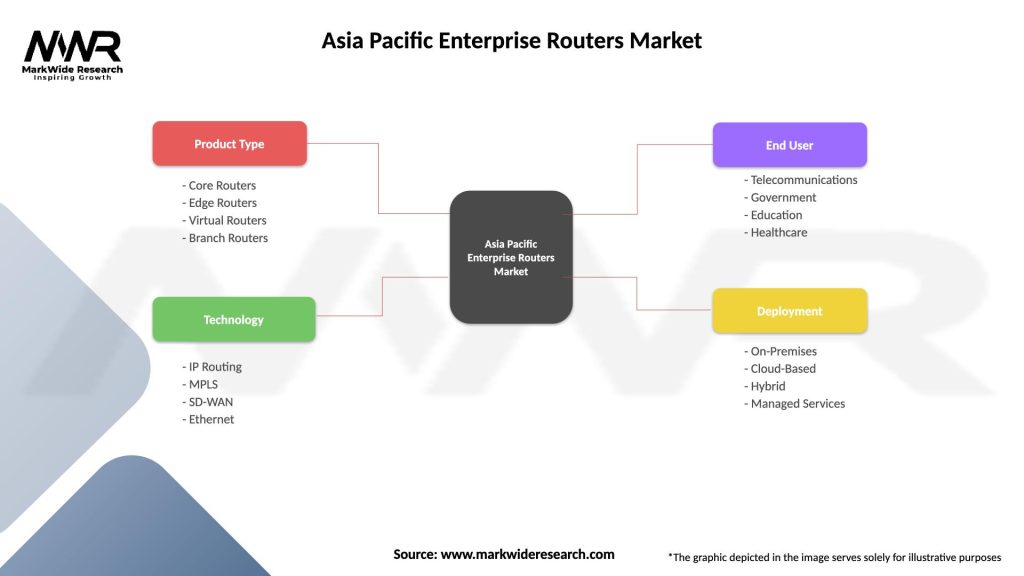

| Segmentation Details | Description |

|---|---|

| Product Type | Core Routers, Edge Routers, Virtual Routers, Branch Routers |

| Technology | IP Routing, MPLS, SD-WAN, Ethernet |

| End User | Telecommunications, Government, Education, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Enterprise Routers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at