444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific Engineering Research and Development (ER&D) Services Market represents one of the most dynamic and rapidly evolving sectors in the global technology landscape. This comprehensive market encompasses a wide range of engineering services, from product design and development to advanced research initiatives across multiple industries. The region has emerged as a global hub for engineering innovation, driven by substantial investments in technology infrastructure, skilled workforce development, and strategic government initiatives supporting research and development activities.

Market dynamics in the Asia-Pacific region demonstrate exceptional growth potential, with the sector experiencing a robust CAGR of 8.2% over the recent forecast period. Countries including India, China, Japan, South Korea, and Singapore have established themselves as leading destinations for ER&D services, attracting multinational corporations seeking cost-effective yet high-quality engineering solutions. The region’s competitive advantage stems from its combination of technical expertise, cost efficiency, and increasingly sophisticated technological capabilities.

Digital transformation initiatives across various industries have significantly accelerated demand for specialized engineering services. The automotive sector leads adoption with approximately 28% market share, followed by aerospace and defense, telecommunications, and healthcare sectors. This diversification reflects the region’s growing capability to handle complex, multi-disciplinary engineering challenges while maintaining competitive pricing structures that appeal to global clients.

The Asia-Pacific Engineering Research and Development Services Market refers to the comprehensive ecosystem of professional services focused on engineering innovation, product development, and technological advancement across the Asia-Pacific region. This market encompasses various specialized services including product design, prototyping, testing, validation, and complete product lifecycle management solutions delivered by both domestic and international service providers.

ER&D services in this context include mechanical engineering, software development, electronics design, systems integration, and advanced research activities. These services support industries ranging from automotive and aerospace to telecommunications, healthcare, and consumer electronics. The market represents a critical component of the global engineering services industry, leveraging the region’s technical talent pool and cost advantages to deliver innovative solutions for worldwide clients.

Service delivery models within this market include offshore development centers, captive engineering centers, joint ventures, and strategic partnerships. The market’s evolution reflects the region’s transformation from a primarily manufacturing-focused economy to a knowledge-based innovation hub capable of handling sophisticated engineering challenges and breakthrough research initiatives.

Strategic positioning of the Asia-Pacific ER&D services market demonstrates remarkable resilience and growth potential amid global economic uncertainties. The market has successfully transitioned from traditional cost-arbitrage models to value-driven innovation partnerships, with service providers increasingly focusing on high-value engineering solutions and cutting-edge research capabilities. This evolution has positioned the region as an indispensable component of global innovation ecosystems.

Technology adoption rates across the region show impressive momentum, with artificial intelligence and machine learning integration reaching 42% adoption among leading service providers. Cloud-based engineering platforms, digital twin technologies, and advanced simulation tools have become standard offerings, enabling service providers to deliver sophisticated solutions that compete directly with established Western engineering firms.

Market consolidation trends indicate increasing collaboration between regional players and global technology leaders. Strategic acquisitions, joint ventures, and technology transfer agreements have accelerated capability development, particularly in emerging areas such as autonomous systems, renewable energy technologies, and advanced materials research. These partnerships have enhanced the region’s reputation as a reliable destination for mission-critical engineering projects.

Investment patterns reveal sustained commitment to infrastructure development and talent acquisition. Government initiatives supporting research and development activities, combined with private sector investments in advanced engineering facilities, have created a robust foundation for continued market expansion and technological advancement.

Technological capabilities across the Asia-Pacific ER&D services market have reached unprecedented levels of sophistication. Service providers now offer comprehensive solutions spanning the entire product development lifecycle, from conceptual design through manufacturing support and post-launch optimization. This end-to-end capability has attracted major global corporations seeking integrated engineering partnerships rather than traditional outsourcing arrangements.

Digital transformation initiatives across global industries serve as the primary catalyst driving demand for Asia-Pacific ER&D services. Organizations worldwide are accelerating their digitalization efforts, requiring specialized engineering expertise to develop connected products, implement IoT solutions, and create intelligent systems. The region’s service providers have positioned themselves as essential partners in these transformation journeys, offering both technical capabilities and cost advantages.

Cost optimization pressures continue to influence corporate decision-making, with companies seeking to maintain engineering excellence while managing operational expenses. The Asia-Pacific region offers compelling value propositions through its combination of skilled talent, advanced infrastructure, and competitive pricing models. This cost-effectiveness extends beyond simple labor arbitrage to include reduced time-to-market and improved resource utilization.

Innovation requirements in emerging technologies such as artificial intelligence, autonomous systems, and renewable energy have created substantial demand for specialized engineering services. Regional service providers have invested heavily in developing capabilities in these high-growth areas, attracting clients seeking cutting-edge solutions and breakthrough innovations.

Regulatory compliance needs across various industries have increased demand for specialized engineering services. Complex regulatory environments in sectors such as automotive, aerospace, and healthcare require deep technical expertise and local market knowledge, areas where Asia-Pacific service providers have developed significant competitive advantages.

Talent competition represents a significant challenge for the Asia-Pacific ER&D services market, as demand for skilled engineers continues to outpace supply in many specialized areas. The rapid growth of domestic technology companies has intensified competition for top talent, leading to increased compensation costs and higher employee turnover rates that can impact service delivery consistency.

Intellectual property concerns remain a persistent challenge for some international clients, despite significant improvements in regional IP protection frameworks. Concerns about technology transfer, data security, and proprietary information protection can limit engagement opportunities, particularly for highly sensitive or strategic engineering projects.

Quality perception issues, while diminishing, still influence some client decisions. Historical perceptions about service quality and reliability can create barriers to entry for new market segments, requiring sustained efforts to demonstrate capabilities and build trust with potential clients.

Infrastructure limitations in certain regions can constrain service delivery capabilities, particularly for projects requiring specialized testing facilities or advanced manufacturing support. While major metropolitan areas offer world-class infrastructure, disparities exist across different locations within the region.

Emerging technologies present substantial growth opportunities for Asia-Pacific ER&D service providers. Areas such as quantum computing, advanced materials, biotechnology, and space technology offer significant potential for service expansion and capability development. The region’s strong research institutions and government support for innovation create favorable conditions for developing expertise in these cutting-edge fields.

Sustainability initiatives across global industries are creating new demand for specialized engineering services focused on environmental solutions, renewable energy systems, and circular economy principles. The region’s commitment to sustainable development goals aligns well with growing client requirements for environmentally responsible engineering solutions.

Industry 4.0 implementation across manufacturing sectors worldwide requires sophisticated engineering support for smart factory development, predictive maintenance systems, and advanced automation solutions. Asia-Pacific service providers are well-positioned to capitalize on this trend given their manufacturing heritage and digital transformation capabilities.

Healthcare technology advancement, accelerated by recent global health challenges, has created substantial opportunities for medical device development, telemedicine solutions, and healthcare infrastructure engineering. The region’s combination of technical expertise and cost advantages makes it an attractive destination for healthcare innovation projects.

Competitive dynamics within the Asia-Pacific ER&D services market have evolved significantly, with traditional cost-based competition giving way to value-driven differentiation strategies. Service providers are increasingly focusing on specialized capabilities, industry expertise, and innovation potential rather than competing solely on price. This shift has elevated the overall market positioning and improved profit margins across the sector.

Client relationship models have transformed from transactional outsourcing arrangements to strategic partnerships characterized by long-term collaboration and shared innovation goals. This evolution has resulted in deeper client engagement, improved project outcomes, and enhanced revenue stability for service providers. Partnership models now account for approximately 35% of total engagements, reflecting this fundamental shift in market dynamics.

Technology integration capabilities have become critical differentiators, with leading service providers investing heavily in advanced engineering tools, simulation platforms, and collaborative technologies. These investments enable seamless integration with client systems and support real-time collaboration across global teams, significantly enhancing service delivery effectiveness.

Geographic expansion strategies among regional service providers have intensified, with companies establishing presence in multiple Asia-Pacific markets to serve diverse client needs and access specialized talent pools. This expansion has created more resilient business models and improved service delivery capabilities across different time zones and regulatory environments.

Comprehensive analysis of the Asia-Pacific ER&D services market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability of market insights. The methodology incorporates quantitative analysis of market trends, qualitative assessment of industry dynamics, and expert interviews with key stakeholders across the value chain.

Primary research activities include structured interviews with senior executives from leading service providers, detailed surveys of client organizations, and focus group discussions with industry experts. These primary sources provide current market perspectives, emerging trend identification, and validation of secondary research findings.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and academic research papers. This comprehensive secondary research foundation ensures broad market coverage and historical trend analysis essential for accurate market assessment and forecasting.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. The methodology emphasizes triangulation of findings across different data sources to minimize bias and enhance confidence in research conclusions.

India dominates the Asia-Pacific ER&D services market with approximately 45% regional market share, leveraging its large pool of English-speaking engineers, established service delivery infrastructure, and strong relationships with global technology companies. The country’s ER&D sector has evolved from basic engineering support to sophisticated research and innovation capabilities, with major cities like Bangalore, Hyderabad, and Pune serving as primary service delivery hubs.

China represents the second-largest market segment with 22% market share, driven by rapid industrialization, substantial government investment in research and development, and growing domestic demand for engineering services. Chinese service providers have developed particular strength in manufacturing engineering, electronics design, and emerging technologies such as artificial intelligence and renewable energy systems.

Japan maintains a significant market position with 15% share, focusing on high-value engineering services in automotive, robotics, and precision manufacturing sectors. Japanese companies excel in quality-driven engineering solutions and have established strong partnerships with global automotive and electronics manufacturers seeking advanced engineering capabilities.

South Korea accounts for approximately 10% market share, with particular strength in telecommunications, semiconductor design, and consumer electronics engineering. The country’s advanced technology infrastructure and strong research institutions support sophisticated engineering service delivery across multiple industry sectors.

Other regional markets including Singapore, Malaysia, Philippines, and Australia collectively represent the remaining 8% market share, each developing specialized capabilities in specific engineering domains and serving as regional hubs for multinational corporations seeking localized engineering support.

Market leadership in the Asia-Pacific ER&D services sector is characterized by a diverse mix of global technology companies, regional service providers, and specialized engineering firms. The competitive environment has intensified significantly as companies compete on innovation capabilities, industry expertise, and service delivery excellence rather than traditional cost advantages.

Service type segmentation reveals diverse market composition with product engineering services representing the largest segment, followed by embedded software development, mechanical engineering, and research and development services. This segmentation reflects the market’s evolution toward comprehensive engineering solutions rather than discrete service offerings.

By Service Type:

By Industry Vertical:

Automotive engineering services dominate the Asia-Pacific ER&D market, driven by the region’s position as a global automotive manufacturing hub and increasing focus on electric vehicle development. Service providers have developed sophisticated capabilities in vehicle electrification, autonomous driving systems, and connected car technologies, attracting major automotive manufacturers seeking innovation partnerships.

Aerospace and defense engineering represents a high-value market segment with stringent quality requirements and complex regulatory compliance needs. Regional service providers have invested substantially in certification processes and specialized facilities to serve this demanding market, resulting in long-term client relationships and premium pricing models.

Telecommunications engineering services have experienced significant growth driven by 5G network deployment and increasing demand for advanced communication solutions. The market segment benefits from the region’s strong telecommunications infrastructure and expertise in network optimization and system integration.

Healthcare engineering has emerged as a rapidly growing category, accelerated by global health challenges and increasing demand for medical technology innovation. Service providers are developing specialized capabilities in medical device design, regulatory compliance, and healthcare system integration to serve this expanding market.

Cost optimization remains a fundamental benefit for organizations engaging Asia-Pacific ER&D service providers, with typical cost savings ranging from 30-50% compared to in-house development or Western service providers. These savings extend beyond labor costs to include reduced infrastructure investments, faster time-to-market, and improved resource utilization efficiency.

Access to specialized talent represents a critical advantage, particularly for organizations requiring expertise in emerging technologies or niche engineering domains. The region’s large pool of technically skilled professionals enables clients to access capabilities that may be difficult or expensive to develop internally.

Scalability advantages allow organizations to rapidly expand or contract engineering resources based on project requirements without the overhead of permanent staff management. This flexibility is particularly valuable for companies with fluctuating engineering demands or those entering new market segments.

Innovation acceleration through collaboration with regional service providers exposes clients to diverse perspectives, emerging technologies, and innovative approaches that can enhance product development outcomes. Many service providers maintain dedicated innovation centers and research partnerships that benefit client projects.

Risk mitigation through geographic diversification helps organizations reduce dependency on single locations or talent pools while maintaining business continuity during disruptions. The region’s multiple service delivery locations provide redundancy and resilience for critical engineering projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital engineering transformation has emerged as the most significant trend reshaping the Asia-Pacific ER&D services market. Service providers are investing heavily in digital tools, cloud-based platforms, and collaborative technologies that enable seamless integration with client systems and support distributed engineering teams. This transformation has improved service delivery efficiency by approximately 25-30% while enhancing collaboration capabilities.

Sustainability focus is driving demand for engineering services related to renewable energy, environmental solutions, and sustainable product development. Clients increasingly require service providers to demonstrate environmental responsibility and support sustainability goals through engineering solutions and operational practices.

Industry specialization continues to intensify as service providers develop deep domain expertise in specific sectors rather than maintaining broad generalist capabilities. This specialization enables higher value service delivery and stronger client relationships but requires substantial investments in sector-specific knowledge and capabilities.

Partnership models are evolving beyond traditional outsourcing arrangements toward strategic alliances characterized by shared innovation goals, joint investment in capabilities, and collaborative intellectual property development. These partnerships provide greater revenue stability and enable access to cutting-edge technologies and market opportunities.

Automation integration within service delivery processes is improving efficiency and quality while enabling service providers to focus human resources on higher-value activities. Robotic process automation, AI-assisted design tools, and automated testing platforms are becoming standard components of service delivery infrastructure.

Strategic acquisitions have accelerated across the Asia-Pacific ER&D services market as companies seek to expand capabilities, enter new market segments, and strengthen competitive positioning. Major service providers are acquiring specialized firms with expertise in emerging technologies, particular industry domains, or specific geographic markets to enhance their comprehensive service offerings.

Technology partnerships between regional service providers and global technology leaders have intensified, creating opportunities for knowledge transfer, capability development, and market access. These partnerships often involve joint development of innovative solutions, shared research initiatives, and collaborative go-to-market strategies.

Innovation center establishment has become a key strategy for service providers seeking to demonstrate advanced capabilities and attract high-value clients. These centers focus on emerging technologies, breakthrough research, and collaborative innovation projects that showcase technical expertise and innovation potential.

Certification achievements in industry-specific standards and quality frameworks have enhanced service provider credibility and enabled access to regulated market segments. Aerospace, automotive, and healthcare certifications have become essential requirements for serving major clients in these demanding sectors.

Government initiatives supporting research and development activities have created favorable conditions for market growth, including tax incentives, infrastructure development, and educational program funding that enhance the region’s engineering capabilities and competitiveness.

MarkWide Research analysis indicates that service providers should prioritize investment in emerging technology capabilities, particularly artificial intelligence, machine learning, and sustainable engineering solutions. These areas represent the highest growth potential and offer opportunities for premium pricing and differentiated service positioning.

Talent development strategies require immediate attention given the intensifying competition for skilled engineers. Service providers should implement comprehensive training programs, career development pathways, and retention incentives to maintain competitive advantage in talent acquisition and retention.

Client relationship evolution toward strategic partnerships demands fundamental changes in service delivery models, pricing structures, and engagement approaches. Organizations should develop partnership capabilities, collaborative innovation processes, and shared value creation mechanisms to capitalize on this market trend.

Geographic diversification within the Asia-Pacific region can provide risk mitigation and access to specialized talent pools. Service providers should consider establishing presence in multiple regional markets to enhance service delivery resilience and capture diverse market opportunities.

Digital transformation investments in service delivery infrastructure, collaborative platforms, and automation tools are essential for maintaining competitiveness and meeting evolving client expectations. These investments should focus on improving efficiency, enhancing collaboration, and enabling innovative service delivery models.

Market expansion prospects for the Asia-Pacific ER&D services sector remain exceptionally positive, with continued growth expected across all major market segments. The region’s evolution toward higher-value engineering services and innovation partnerships positions it well for sustained growth despite global economic uncertainties and competitive pressures.

Technology integration will continue driving market transformation, with artificial intelligence, machine learning, and advanced simulation tools becoming standard components of service delivery. These technologies will enable more sophisticated engineering solutions while improving efficiency and reducing development timelines for client projects.

Industry convergence trends will create new opportunities for service providers capable of working across traditional sector boundaries. The intersection of automotive and technology, healthcare and engineering, and manufacturing and digital solutions will generate demand for multidisciplinary engineering expertise.

Sustainability requirements will increasingly influence service provider selection and project requirements. Organizations with strong environmental credentials and expertise in sustainable engineering solutions will gain competitive advantages in client acquisition and retention.

MWR projections suggest that the market will experience continued growth at a CAGR of 8.5% over the next five years, driven by digital transformation initiatives, emerging technology adoption, and increasing demand for specialized engineering expertise. This growth will be supported by continued investment in regional infrastructure, talent development, and technology capabilities.

The Asia-Pacific Engineering Research and Development Services Market stands at a pivotal juncture, having successfully transformed from a cost-focused outsourcing destination to a sophisticated innovation hub capable of delivering world-class engineering solutions. The market’s evolution reflects broader regional economic development trends and demonstrates the successful integration of advanced technologies, skilled talent, and strategic partnerships.

Sustained growth prospects are supported by fundamental market drivers including digital transformation acceleration, emerging technology adoption, and increasing demand for specialized engineering expertise. The region’s competitive advantages in talent availability, cost effectiveness, and technology infrastructure provide a strong foundation for continued market expansion and capability development.

Strategic positioning of regional service providers has evolved significantly, with leading companies now competing on innovation capabilities, industry expertise, and partnership value rather than traditional cost advantages. This transformation has elevated the overall market positioning and created opportunities for premium service delivery and long-term client relationships.

Future success in this dynamic market will require continued investment in emerging technologies, talent development, and client relationship evolution. Organizations that successfully navigate these requirements while maintaining operational excellence will be well-positioned to capitalize on the substantial growth opportunities ahead in the Asia-Pacific Engineering Research and Development Services Market.

What is Engineering Research And Development (ER&D) Services?

Engineering Research And Development (ER&D) Services encompass a range of activities aimed at developing new products and improving existing ones. These services are crucial for industries such as automotive, aerospace, and electronics, where innovation and efficiency are key.

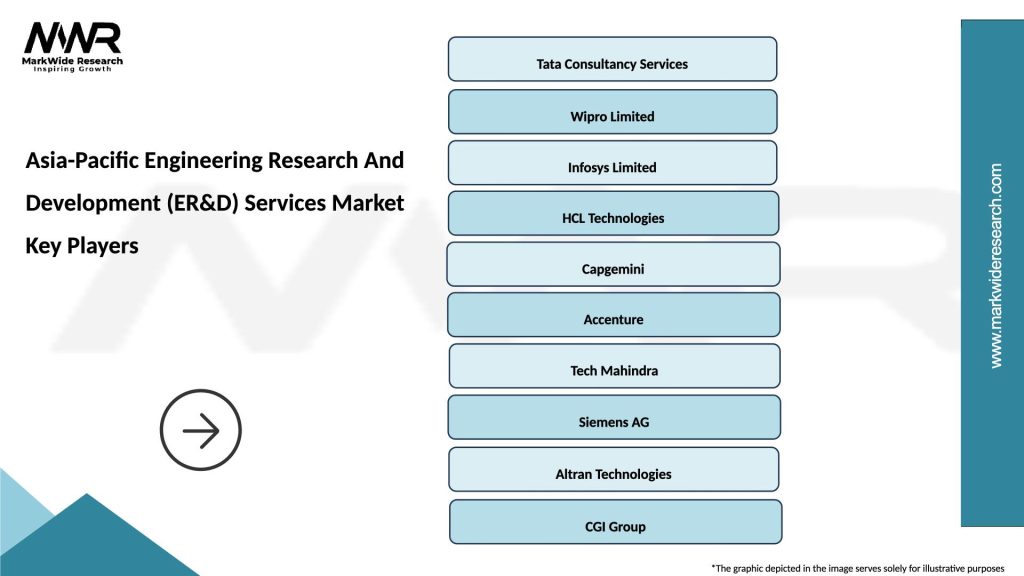

What are the key players in the Asia-Pacific Engineering Research And Development (ER&D) Services Market?

Key players in the Asia-Pacific Engineering Research And Development (ER&D) Services Market include Tata Consultancy Services, Wipro, and Infosys, among others. These companies provide a variety of engineering services, including product design, prototyping, and testing.

What are the growth factors driving the Asia-Pacific Engineering Research And Development (ER&D) Services Market?

The growth of the Asia-Pacific Engineering Research And Development (ER&D) Services Market is driven by increasing demand for innovative products, advancements in technology, and the need for cost-effective solutions. Industries such as automotive and healthcare are particularly focused on enhancing their R&D capabilities.

What challenges does the Asia-Pacific Engineering Research And Development (ER&D) Services Market face?

The Asia-Pacific Engineering Research And Development (ER&D) Services Market faces challenges such as a shortage of skilled labor, high competition among service providers, and the rapid pace of technological change. These factors can hinder the ability of companies to deliver timely and effective solutions.

What opportunities exist in the Asia-Pacific Engineering Research And Development (ER&D) Services Market?

Opportunities in the Asia-Pacific Engineering Research And Development (ER&D) Services Market include the growing emphasis on digital transformation and the integration of artificial intelligence in engineering processes. Additionally, sectors like renewable energy and smart manufacturing are expected to drive demand for ER&D services.

What trends are shaping the Asia-Pacific Engineering Research And Development (ER&D) Services Market?

Trends shaping the Asia-Pacific Engineering Research And Development (ER&D) Services Market include the increasing adoption of automation and digital tools, a focus on sustainability in product development, and collaborative R&D efforts among companies. These trends are influencing how engineering services are delivered and optimized.

Asia-Pacific Engineering Research And Development (ER&D) Services Market

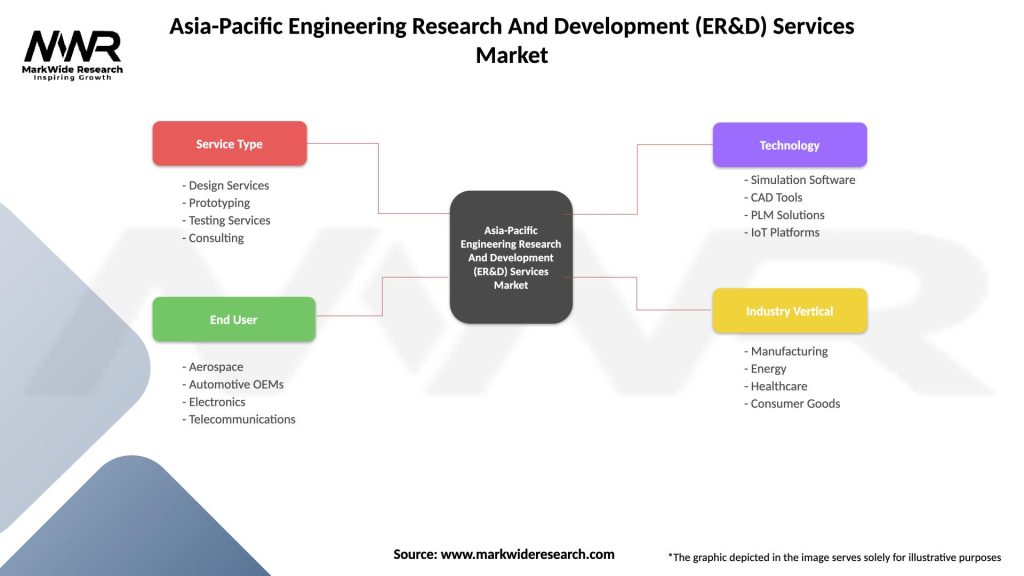

| Segmentation Details | Description |

|---|---|

| Service Type | Design Services, Prototyping, Testing Services, Consulting |

| End User | Aerospace, Automotive OEMs, Electronics, Telecommunications |

| Technology | Simulation Software, CAD Tools, PLM Solutions, IoT Platforms |

| Industry Vertical | Manufacturing, Energy, Healthcare, Consumer Goods |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Engineering Research And Development (ER&D) Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at