444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific electric vehicle nickel metal hydride battery market represents a dynamic and evolving segment within the broader electric vehicle ecosystem. This specialized battery technology has established itself as a reliable power source for hybrid electric vehicles, particularly in the automotive sector across key Asian markets including Japan, China, South Korea, and India. The region’s commitment to sustainable transportation solutions and stringent emission regulations has created substantial demand for nickel metal hydride (NiMH) batteries in electric vehicle applications.

Market dynamics in the Asia Pacific region are characterized by rapid technological advancement and increasing adoption of hybrid electric vehicles. The NiMH battery technology offers distinct advantages including proven reliability, safety characteristics, and cost-effectiveness compared to other battery chemistries. Major automotive manufacturers in the region have integrated these batteries into their hybrid vehicle platforms, driving consistent market growth at a CAGR of 6.2% over the forecast period.

Regional leadership in electric vehicle adoption has positioned Asia Pacific as the dominant market for NiMH batteries globally. Countries like Japan and China have established comprehensive manufacturing ecosystems supporting both battery production and electric vehicle assembly. The market benefits from strong government support through incentives, subsidies, and regulatory frameworks promoting clean energy transportation solutions.

The Asia Pacific electric vehicle nickel metal hydride battery market refers to the regional industry focused on manufacturing, distributing, and implementing NiMH battery systems specifically designed for electric and hybrid electric vehicles across Asian markets. These batteries utilize nickel metal hydride chemistry to store and deliver electrical energy for vehicle propulsion systems, offering a mature and reliable alternative to newer battery technologies.

NiMH batteries in electric vehicles consist of positive electrodes containing nickel oxyhydroxide and negative electrodes made from hydrogen-absorbing alloys. This configuration enables efficient energy storage and release cycles essential for hybrid vehicle operation. The technology has proven particularly effective in applications requiring moderate energy density combined with exceptional durability and safety characteristics.

Market significance extends beyond simple battery supply, encompassing the entire value chain from raw material sourcing to end-of-life recycling. The Asia Pacific region’s strategic position in global supply chains, combined with abundant rare earth mineral resources, creates competitive advantages for NiMH battery production and deployment in electric vehicle applications.

Strategic positioning of the Asia Pacific electric vehicle NiMH battery market reflects the region’s leadership in hybrid vehicle adoption and manufacturing excellence. The market demonstrates consistent growth driven by established automotive manufacturers’ continued reliance on proven NiMH technology for hybrid electric vehicle platforms. Market penetration remains strong in specific vehicle segments where NiMH batteries provide optimal performance characteristics.

Technological maturity of NiMH battery systems has created stable demand patterns across key regional markets. While newer battery chemistries gain attention, NiMH technology maintains relevance through superior safety profiles, proven longevity, and cost-effective manufacturing processes. The technology’s 85% recycling efficiency aligns with regional sustainability objectives and circular economy initiatives.

Competitive landscape features established players with decades of NiMH battery development experience alongside emerging manufacturers seeking market share. Innovation focuses on improving energy density, reducing weight, and enhancing thermal management capabilities. Regional manufacturing capacity continues expanding to meet growing demand from hybrid vehicle production.

Future trajectory indicates sustained market relevance despite competition from lithium-ion alternatives. Specific applications where NiMH batteries excel, combined with ongoing technological improvements, support continued market viability. The region’s commitment to diverse battery technology portfolios ensures NiMH systems remain integral to electric vehicle strategies.

Market intelligence reveals several critical factors shaping the Asia Pacific electric vehicle NiMH battery landscape:

Government regulations across Asia Pacific nations continue driving demand for electric vehicle NiMH batteries through stringent emission standards and fuel efficiency requirements. Countries like Japan, China, and South Korea have implemented comprehensive policies mandating reduced vehicular emissions, creating sustained demand for hybrid electric vehicles equipped with NiMH battery systems.

Automotive manufacturer preferences for proven battery technologies support continued NiMH adoption in hybrid vehicle platforms. Major automakers value the technology’s established performance characteristics, extensive testing history, and predictable behavior across diverse operating conditions. This preference translates into consistent production volumes and long-term supply agreements.

Cost considerations favor NiMH batteries in specific vehicle segments where total ownership costs remain competitive. The technology’s lower initial manufacturing costs, combined with proven durability and minimal maintenance requirements, create attractive value propositions for both manufacturers and consumers. Economic efficiency becomes particularly important in price-sensitive regional markets.

Infrastructure compatibility with existing manufacturing and service networks provides additional market support. NiMH battery systems integrate seamlessly with established automotive production processes and service procedures, reducing implementation complexity and training requirements. This compatibility accelerates adoption across regional automotive manufacturing hubs.

Resource availability in the Asia Pacific region supports sustainable NiMH battery production. Abundant rare earth mineral deposits, particularly in China, ensure stable raw material supply chains for battery manufacturing. Regional mining and processing capabilities create competitive advantages in global NiMH battery markets.

Technology competition from advanced lithium-ion battery systems presents ongoing challenges for NiMH market growth. Newer battery chemistries offer superior energy density and weight characteristics, making them attractive for fully electric vehicle applications. This competition limits NiMH adoption primarily to hybrid vehicle segments where specific performance characteristics align with technology strengths.

Energy density limitations restrict NiMH battery applications in vehicles requiring extended electric-only range capabilities. While adequate for hybrid applications, the technology’s lower energy density compared to lithium-ion alternatives constrains adoption in plug-in hybrid and fully electric vehicle segments. These limitations become more pronounced as consumer expectations for electric range increase.

Weight considerations impact vehicle efficiency and performance characteristics. NiMH batteries typically weigh more than equivalent lithium-ion systems, affecting vehicle dynamics and fuel efficiency. Automotive manufacturers must balance battery performance requirements against weight penalties, sometimes favoring lighter alternatives despite other NiMH advantages.

Temperature sensitivity affects NiMH battery performance in extreme climate conditions common across diverse Asia Pacific regions. High temperatures can reduce battery life and efficiency, while cold conditions impact power delivery capabilities. These environmental sensitivities require additional thermal management systems, increasing overall system complexity and costs.

Market perception challenges arise from consumer preferences for newer battery technologies. Despite proven performance, NiMH systems may be perceived as outdated compared to lithium-ion alternatives. This perception can influence purchasing decisions and manufacturer marketing strategies, potentially limiting market expansion opportunities.

Emerging markets across Southeast Asia present significant growth opportunities for NiMH battery adoption in electric vehicles. Countries like Thailand, Indonesia, and Vietnam are developing electric vehicle manufacturing capabilities and implementing supportive policies. These markets value proven, cost-effective battery technologies, creating favorable conditions for NiMH system deployment.

Technology advancement opportunities exist in improving NiMH battery performance characteristics through advanced materials and manufacturing processes. Research into enhanced electrode materials, improved electrolyte formulations, and optimized cell designs could address current limitations while maintaining technology advantages. These improvements could expand applicable vehicle segments and extend market relevance.

Recycling initiatives create new value streams and sustainability advantages for NiMH battery systems. The technology’s high recyclability and established recovery processes align with circular economy objectives across the region. Developing comprehensive recycling networks could provide competitive advantages and support long-term market sustainability.

Niche applications in specialized vehicle segments offer targeted growth opportunities. Commercial vehicles, public transportation, and industrial applications may benefit from NiMH battery characteristics including safety, durability, and cost-effectiveness. These segments often prioritize reliability over maximum energy density, favoring NiMH technology strengths.

Strategic partnerships between battery manufacturers and automotive companies could accelerate technology development and market penetration. Collaborative research and development efforts focusing on application-specific optimizations could enhance NiMH battery competitiveness in targeted market segments.

Supply chain integration across the Asia Pacific region creates complex interdependencies affecting NiMH battery market dynamics. Raw material sourcing, component manufacturing, and final assembly operations span multiple countries, requiring coordinated logistics and quality management systems. Regional trade agreements and economic partnerships influence supply chain efficiency and cost structures.

Technological evolution continues shaping market dynamics as manufacturers invest in NiMH battery improvements while simultaneously developing alternative technologies. This dual approach creates competitive pressures while ensuring technology diversity in electric vehicle applications. Innovation cycles typically span 3-5 years, requiring sustained research and development investments.

Regulatory frameworks vary significantly across Asia Pacific markets, creating diverse operating environments for NiMH battery manufacturers and automotive companies. Harmonization efforts aim to streamline standards and certification processes, but regional differences persist. These variations affect market entry strategies and product development priorities.

Consumer preferences evolve based on experience with electric vehicle technologies, environmental awareness, and economic considerations. While early adopters may prefer cutting-edge battery technologies, mainstream consumers often value proven reliability and cost-effectiveness. This preference diversity supports continued NiMH market relevance in specific segments.

Economic factors including currency fluctuations, trade policies, and raw material costs significantly impact market dynamics. The region’s economic diversity creates both opportunities and challenges for battery manufacturers serving multiple markets with varying economic conditions and purchasing power levels.

Comprehensive analysis of the Asia Pacific electric vehicle NiMH battery market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes direct engagement with industry stakeholders, including battery manufacturers, automotive companies, government agencies, and technology developers. These interactions provide current market insights and future trend indicators.

Secondary research encompasses extensive review of industry publications, government reports, patent filings, and academic studies related to NiMH battery technology and electric vehicle markets. This approach ensures comprehensive coverage of technological developments, regulatory changes, and market evolution patterns across the region.

Data validation processes involve cross-referencing information from multiple sources and conducting expert interviews to verify findings. Statistical analysis techniques help identify trends and correlations within market data, while scenario modeling explores potential future developments under various assumptions.

Regional segmentation analysis examines market conditions and opportunities across individual Asia Pacific countries, considering local regulations, economic conditions, and automotive industry characteristics. This granular approach reveals market nuances and growth opportunities that might be obscured in broader regional analysis.

Technology assessment includes detailed evaluation of NiMH battery performance characteristics, manufacturing processes, and competitive positioning relative to alternative battery technologies. This technical analysis supports market projections and identifies areas for potential improvement or differentiation.

Japan dominates the Asia Pacific NiMH battery market with 45% regional market share, leveraging decades of hybrid vehicle development experience and advanced manufacturing capabilities. Japanese automakers pioneered hybrid electric vehicle technology and continue leading NiMH battery integration in commercial vehicles. The country’s established supply chains and technical expertise create competitive advantages in global markets.

China represents the fastest-growing segment with 32% market share and expanding manufacturing capacity. Government policies promoting new energy vehicles drive demand for diverse battery technologies, including NiMH systems for specific applications. Chinese manufacturers are investing in advanced NiMH production facilities while developing domestic supply chains for critical materials.

South Korea maintains a 12% market share through focused development of high-performance NiMH batteries for premium hybrid vehicles. Korean manufacturers emphasize quality and technological advancement, targeting applications where NiMH advantages align with vehicle requirements. The country’s strong automotive industry provides stable demand for advanced battery systems.

Southeast Asian markets collectively account for 8% market share but demonstrate strong growth potential as electric vehicle adoption accelerates. Countries like Thailand and Indonesia are developing local automotive manufacturing capabilities and implementing supportive policies for electric vehicle deployment. These emerging markets value cost-effective, proven battery technologies.

India’s market share of 3% reflects early-stage electric vehicle adoption but shows promise for future growth. Government initiatives promoting electric mobility and domestic manufacturing create opportunities for NiMH battery deployment in cost-sensitive vehicle segments. The country’s large automotive market presents significant long-term potential.

Market leadership in the Asia Pacific electric vehicle NiMH battery sector is characterized by established players with extensive experience and emerging companies seeking market share through innovation and cost competitiveness.

Competitive strategies focus on technological differentiation, cost optimization, and strategic partnerships with automotive manufacturers. Companies invest heavily in research and development to improve battery performance while maintaining competitive pricing structures.

By Vehicle Type:

By Battery Capacity:

By Application:

Passenger vehicle applications represent the largest category for NiMH batteries in Asia Pacific electric vehicles, driven by established hybrid vehicle platforms from major automakers. These applications prioritize proven reliability, safety characteristics, and cost-effectiveness over maximum energy density. Compact and mid-size vehicles particularly benefit from NiMH technology advantages in urban driving conditions.

Commercial vehicle deployment of NiMH batteries focuses on applications where safety, durability, and predictable performance outweigh energy density considerations. Fleet operators value the technology’s established service history and lower total ownership costs. Public transportation systems increasingly adopt NiMH-powered hybrid buses for urban routes.

Industrial applications leverage NiMH battery characteristics including wide operating temperature ranges, robust construction, and minimal maintenance requirements. Material handling equipment and warehouse vehicles benefit from the technology’s proven performance in demanding operating environments. Specialized machinery applications continue expanding as manufacturers recognize NiMH advantages.

Two-wheeler segments present emerging opportunities for NiMH battery deployment, particularly in markets prioritizing cost-effectiveness and proven technology. Electric scooters and motorcycles designed for urban commuting may benefit from NiMH characteristics including safety and reliability. Market penetration in this segment remains limited but shows growth potential.

Aftermarket applications include replacement batteries for existing hybrid vehicles and retrofit solutions for conventional vehicles. This category benefits from NiMH technology maturity and established service networks across the region. Service infrastructure development supports continued market growth in aftermarket segments.

Automotive manufacturers benefit from NiMH battery technology through proven reliability, established supply chains, and cost-effective integration into hybrid vehicle platforms. The technology’s safety characteristics reduce liability concerns while predictable performance enables accurate vehicle development timelines. Manufacturing efficiency improves through standardized processes and established quality control procedures.

Battery suppliers gain advantages through mature technology platforms requiring lower research and development investments compared to emerging battery chemistries. Established manufacturing processes and supply chains create operational efficiencies and predictable cost structures. Market stability in specific segments provides sustainable revenue streams.

Fleet operators realize benefits including lower total ownership costs, predictable maintenance schedules, and proven safety records. NiMH battery systems’ durability and reliability reduce operational disruptions and maintenance expenses. Risk mitigation through proven technology adoption supports fleet management objectives.

Consumers benefit from lower vehicle purchase prices, reduced maintenance costs, and proven technology reliability. NiMH-powered hybrid vehicles offer environmental benefits while maintaining familiar operating characteristics. Value proposition includes long-term durability and established service support networks.

Environmental stakeholders gain through reduced vehicular emissions, high battery recyclability, and sustainable manufacturing processes. NiMH technology supports circular economy objectives through established recycling infrastructure and material recovery systems. Sustainability benefits align with regional environmental protection goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology optimization trends focus on improving NiMH battery performance characteristics while maintaining cost advantages. Manufacturers invest in advanced electrode materials, enhanced electrolyte formulations, and optimized cell designs to increase energy density and reduce weight. These improvements aim to extend NiMH applicability in evolving electric vehicle segments.

Manufacturing automation increases across the region as producers seek efficiency gains and quality improvements. Advanced production systems reduce labor costs while enhancing consistency and reliability. Smart manufacturing technologies enable real-time quality monitoring and predictive maintenance, improving overall operational efficiency.

Sustainability initiatives drive development of comprehensive recycling programs and circular economy approaches. Battery manufacturers collaborate with automotive companies and recycling specialists to create closed-loop material flows. Environmental responsibility becomes increasingly important for market acceptance and regulatory compliance.

Strategic partnerships between battery manufacturers and automotive companies intensify as both sectors seek competitive advantages. Collaborative research and development efforts focus on application-specific optimizations and integrated system designs. Vertical integration strategies aim to control critical supply chain elements and reduce costs.

Market diversification efforts explore new applications beyond traditional automotive segments. Industrial equipment, energy storage systems, and specialized transportation applications present opportunities for NiMH technology deployment. Application engineering becomes crucial for identifying optimal use cases.

Recent technological advances in NiMH battery chemistry have improved energy density by 15-20% compared to previous generations, enhancing competitiveness in specific vehicle applications. These improvements result from advanced electrode materials and optimized manufacturing processes developed through sustained research and development investments.

Manufacturing capacity expansion across key regional markets reflects continued confidence in NiMH technology relevance. Major producers have announced facility upgrades and new production lines dedicated to automotive applications. MarkWide Research indicates these expansions align with projected demand growth in hybrid vehicle segments.

Regulatory developments in several Asia Pacific countries have established specific standards for NiMH battery recycling and end-of-life management. These regulations create structured frameworks for sustainable battery lifecycle management while ensuring environmental protection. Compliance requirements drive industry investment in recycling infrastructure.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to strengthen market positions and expand technological capabilities. Recent transactions focus on combining manufacturing expertise with automotive market access, creating integrated value chains.

Research collaborations between universities, government agencies, and industry participants accelerate technology development and application optimization. These partnerships focus on addressing current limitations while exploring new opportunities for NiMH battery deployment in evolving transportation systems.

Market positioning strategies should emphasize NiMH battery strengths including safety, reliability, and cost-effectiveness rather than competing directly on energy density metrics. Companies should focus on applications where these characteristics provide competitive advantages over alternative battery technologies. Differentiation approaches must clearly communicate value propositions to target market segments.

Technology development investments should prioritize incremental improvements in energy density, weight reduction, and thermal management capabilities. While revolutionary advances may be unlikely, consistent optimization can extend market relevance and expand applicable vehicle segments. Research priorities should align with automotive industry evolution trends.

Regional expansion opportunities exist in emerging Southeast Asian markets where cost-effective, proven battery technologies align with local market requirements. Companies should develop market entry strategies considering local regulations, partnership opportunities, and manufacturing capabilities. Localization strategies may be necessary for successful market penetration.

Partnership development with automotive manufacturers, recycling companies, and technology developers can create synergistic advantages and market access opportunities. Strategic alliances should focus on complementary capabilities and shared objectives. Collaboration frameworks must balance competitive considerations with mutual benefits.

Sustainability initiatives should be integrated into business strategies as environmental considerations become increasingly important for market acceptance and regulatory compliance. Companies should invest in recycling infrastructure, sustainable manufacturing processes, and circular economy approaches. Environmental leadership can provide competitive differentiation.

Long-term market prospects for Asia Pacific electric vehicle NiMH batteries remain positive despite competition from alternative technologies. The technology’s established advantages in specific applications, combined with ongoing improvements, support continued market relevance. MWR projections indicate sustained demand growth in targeted vehicle segments over the next decade.

Technology evolution will likely focus on incremental improvements rather than revolutionary changes, with manufacturers optimizing existing chemistry and manufacturing processes. Advanced materials research and production efficiency gains could enhance competitive positioning while maintaining cost advantages. Innovation cycles are expected to continue delivering measurable performance improvements.

Market segmentation will become increasingly important as NiMH batteries find optimal applications in specific vehicle types and use cases. Hybrid vehicles, commercial fleets, and specialized applications may continue favoring NiMH characteristics over alternatives. Niche positioning strategies could ensure long-term market sustainability.

Regional dynamics will influence market development as different Asia Pacific countries pursue varying electric vehicle strategies and policies. Emerging markets may provide growth opportunities while established markets focus on technology optimization and efficiency improvements. Geographic diversification becomes crucial for market participants.

Sustainability considerations will increasingly influence market dynamics as circular economy principles and environmental regulations shape industry practices. Companies investing in comprehensive recycling capabilities and sustainable manufacturing processes may gain competitive advantages. Environmental stewardship becomes integral to business success.

The Asia Pacific electric vehicle nickel metal hydride battery market represents a mature yet evolving segment within the broader electric vehicle ecosystem. Despite facing competition from newer battery technologies, NiMH systems maintain relevance through proven reliability, safety characteristics, and cost-effectiveness in specific applications. The region’s leadership in hybrid vehicle adoption and manufacturing excellence creates sustained demand for this established technology.

Market fundamentals remain strong, supported by established automotive manufacturer preferences, proven technology performance, and comprehensive supply chain infrastructure. While energy density limitations restrict applications primarily to hybrid vehicle segments, ongoing technological improvements and manufacturing optimizations continue enhancing competitive positioning. The technology’s excellent safety profile and high recyclability align with regional sustainability objectives.

Future success will depend on strategic positioning in applications where NiMH advantages outweigh limitations, continued technology optimization, and adaptation to evolving market requirements. Companies that focus on niche applications, develop strategic partnerships, and invest in sustainability initiatives are best positioned for long-term success. The Asia Pacific electric vehicle nickel metal hydride battery market will continue serving as a reliable foundation for hybrid vehicle adoption while contributing to the region’s sustainable transportation transformation.

What is Electric Vehicle Nickel Metal Hydride Battery?

Electric Vehicle Nickel Metal Hydride Battery refers to a type of rechargeable battery commonly used in hybrid and electric vehicles, known for its ability to store and release energy efficiently. These batteries are characterized by their high energy density and long cycle life, making them suitable for automotive applications.

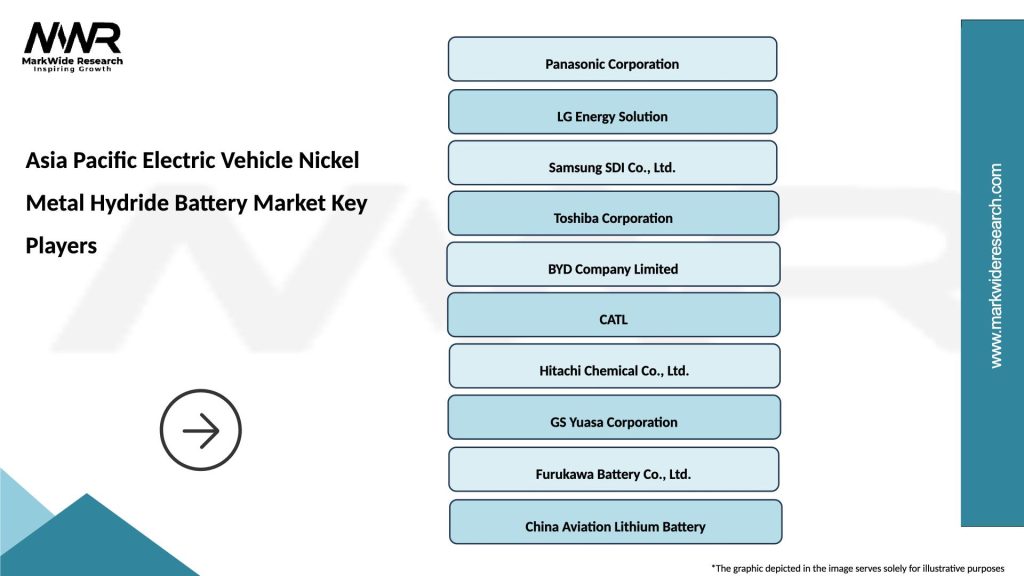

What are the key players in the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market?

Key players in the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market include Panasonic, LG Chem, and BYD, among others. These companies are involved in the production and development of advanced battery technologies for electric vehicles.

What are the growth factors driving the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market?

The growth of the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, rising environmental concerns are pushing consumers towards cleaner energy solutions.

What challenges does the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market face?

The Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market faces challenges such as competition from lithium-ion batteries, which offer higher energy densities, and the limited availability of raw materials. Additionally, recycling and disposal of these batteries pose environmental concerns.

What opportunities exist in the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market?

Opportunities in the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market include the potential for innovation in battery recycling technologies and the expansion of electric vehicle infrastructure. Furthermore, increasing investments in renewable energy sources can enhance the demand for these batteries.

What trends are shaping the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market?

Trends shaping the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market include the growing adoption of hybrid vehicles, advancements in battery management systems, and a shift towards more sustainable manufacturing practices. Additionally, collaborations between automotive manufacturers and battery producers are becoming more common.

Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market

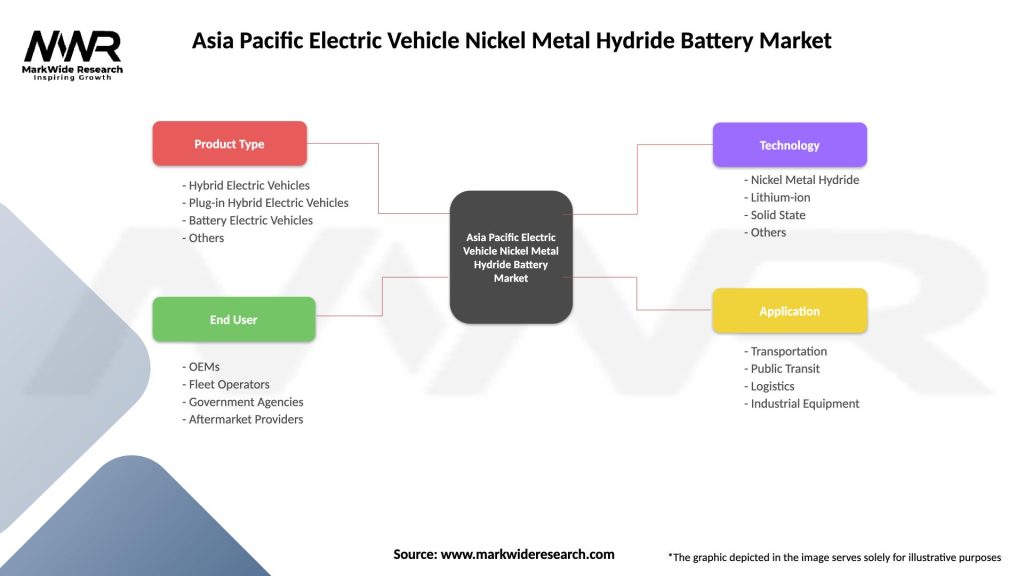

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Battery Electric Vehicles, Others |

| End User | OEMs, Fleet Operators, Government Agencies, Aftermarket Providers |

| Technology | Nickel Metal Hydride, Lithium-ion, Solid State, Others |

| Application | Transportation, Public Transit, Logistics, Industrial Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Electric Vehicle Nickel Metal Hydride Battery Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at