444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific electric motorcycles and scooters market represents one of the most dynamic and rapidly evolving segments in the global transportation industry. This region has emerged as a powerhouse for electric two-wheeler adoption, driven by increasing environmental consciousness, government initiatives promoting clean mobility, and the growing need for efficient urban transportation solutions. The market encompasses a diverse range of electric two-wheelers, from lightweight electric scooters designed for short-distance commuting to high-performance electric motorcycles capable of long-range travel.

Market dynamics in the Asia Pacific region are particularly favorable for electric two-wheeler adoption, with countries like China, India, Japan, and Southeast Asian nations leading the charge in both manufacturing and consumption. The region benefits from a well-established two-wheeler culture, making the transition to electric variants more natural compared to markets heavily dependent on four-wheelers. Current growth trajectories indicate the market is expanding at a robust CAGR of 12.8%, reflecting strong consumer acceptance and supportive policy frameworks across multiple countries.

Technological advancements in battery technology, charging infrastructure development, and manufacturing capabilities have significantly contributed to market expansion. The region’s manufacturing prowess, particularly in countries like China and Taiwan, has enabled cost-effective production of electric two-wheelers, making them increasingly accessible to a broader consumer base. Additionally, the integration of smart technologies, including IoT connectivity and advanced battery management systems, has enhanced the appeal of electric motorcycles and scooters among tech-savvy consumers.

The Asia Pacific electric motorcycles and scooters market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, and consumption of battery-powered two-wheeled vehicles across the Asia Pacific region. This market includes various categories of electric two-wheelers, ranging from low-speed electric scooters primarily used for urban commuting to high-performance electric motorcycles designed for recreational and long-distance travel purposes.

Electric motorcycles and scooters are defined as two-wheeled vehicles powered entirely or primarily by electric motors, utilizing rechargeable battery systems as their energy source. These vehicles represent a sustainable alternative to traditional internal combustion engine motorcycles and scooters, offering reduced emissions, lower operating costs, and quieter operation. The market encompasses both original equipment manufacturers and aftermarket service providers, creating a comprehensive value chain that supports the electric mobility transition in the region.

The Asia Pacific electric motorcycles and scooters market stands at the forefront of the global electric mobility revolution, characterized by unprecedented growth momentum and technological innovation. The region’s unique combination of high population density, established two-wheeler culture, and supportive government policies has created an ideal environment for electric two-wheeler adoption. Key market drivers include rising fuel costs, increasing environmental awareness, and comprehensive government incentives promoting electric vehicle adoption.

Market segmentation reveals diverse consumer preferences across different countries and demographic groups. Urban commuters represent the largest consumer segment, driving demand for practical, cost-effective electric scooters with moderate range capabilities. Meanwhile, the premium segment is experiencing rapid growth, with consumers increasingly interested in high-performance electric motorcycles offering advanced features and extended range capabilities.

Competitive landscape analysis shows a mix of established automotive manufacturers, specialized electric vehicle startups, and traditional two-wheeler companies transitioning to electric powertrains. Chinese manufacturers currently dominate market share, leveraging their manufacturing scale and cost advantages, while Japanese and Indian companies focus on technology innovation and market-specific customization. The market is witnessing approximately 35% of new entrants being technology-focused startups, indicating strong entrepreneurial interest in the sector.

Consumer adoption patterns across the Asia Pacific region reveal several critical insights that shape market development strategies. The following key insights provide a comprehensive understanding of market dynamics:

Environmental regulations and sustainability initiatives represent the primary catalyst driving electric two-wheeler adoption across the Asia Pacific region. Governments throughout the region have implemented increasingly stringent emission standards and pollution control measures, making electric alternatives more attractive to consumers and businesses alike. These regulatory frameworks create both push and pull factors, discouraging conventional vehicle use while incentivizing electric vehicle adoption through various policy mechanisms.

Economic incentives provided by governments significantly influence consumer purchasing decisions and market growth trajectories. These incentives include direct purchase subsidies, tax exemptions, reduced registration fees, and preferential financing options. Countries like India and China have implemented comprehensive incentive programs that can reduce the effective purchase price of electric two-wheelers by 20-30%, making them competitive with conventional alternatives and accelerating market penetration.

Urbanization trends and increasing traffic congestion in major cities create favorable conditions for electric two-wheeler adoption. As urban populations continue to grow and traffic conditions worsen, consumers seek efficient, maneuverable transportation solutions that can navigate congested streets while providing cost-effective mobility. Electric scooters and motorcycles offer ideal solutions for urban commuting challenges, providing door-to-door connectivity that public transportation cannot match.

Technological advancements in battery technology, motor efficiency, and charging systems continuously improve the value proposition of electric two-wheelers. Improvements in energy density, charging speed, and battery lifespan address traditional concerns about electric vehicle limitations, while smart connectivity features enhance user experience and vehicle functionality. These technological developments create positive feedback loops, attracting more consumers and justifying continued investment in research and development.

High initial costs continue to represent a significant barrier to widespread electric two-wheeler adoption, particularly in price-sensitive markets across the Asia Pacific region. Despite government incentives and improving manufacturing economies of scale, electric motorcycles and scooters typically require higher upfront investment compared to conventional alternatives. This cost differential particularly affects entry-level segments and rural markets where price sensitivity is highest and disposable income levels may be limited.

Charging infrastructure limitations pose ongoing challenges for consumers considering electric two-wheeler purchases, especially for those without dedicated parking spaces or home charging capabilities. While urban areas are experiencing rapid charging infrastructure development, rural and semi-urban regions often lack adequate charging networks, creating range anxiety and limiting market expansion potential. The uneven distribution of charging facilities across different regions creates adoption disparities and influences consumer purchasing decisions.

Battery technology constraints continue to impact consumer acceptance and market growth, despite ongoing improvements in battery performance and reliability. Concerns about battery degradation, replacement costs, and performance in extreme weather conditions influence consumer perceptions and purchasing decisions. Additionally, the limited availability of standardized battery swapping systems in many markets restricts operational flexibility and increases total cost of ownership considerations.

Supply chain vulnerabilities and component availability issues periodically disrupt market growth and manufacturing operations. The concentration of key component manufacturing in specific regions creates potential supply chain risks, while global semiconductor shortages and raw material price volatility impact production costs and delivery schedules. These supply chain challenges can affect product availability and pricing stability, influencing market development trajectories.

Rural market expansion presents substantial growth opportunities as electric two-wheeler manufacturers develop products and strategies tailored to rural and semi-urban consumers. These markets offer significant untapped potential, with growing income levels, improving electricity infrastructure, and increasing awareness of electric vehicle benefits. Manufacturers focusing on affordable, durable electric scooters designed for rural conditions and usage patterns can capture substantial market share in these emerging segments.

Commercial applications and fleet operations represent rapidly growing opportunity segments, driven by the operational advantages of electric two-wheelers in delivery, logistics, and service applications. E-commerce growth, food delivery services, and last-mile logistics create substantial demand for reliable, cost-effective electric two-wheelers. Fleet operators benefit from lower operating costs, reduced maintenance requirements, and improved operational efficiency, creating sustainable business models that drive market expansion.

Battery technology innovations and alternative energy solutions create opportunities for market differentiation and performance improvements. Developments in solid-state batteries, fast-charging technologies, and battery swapping systems can address current market limitations while creating competitive advantages for early adopters. Companies investing in advanced battery technologies and charging solutions can capture premium market segments and establish technology leadership positions.

Export market development offers significant growth potential for Asia Pacific manufacturers, leveraging the region’s manufacturing capabilities and cost advantages to serve global markets. As electric vehicle adoption accelerates worldwide, Asia Pacific manufacturers can expand beyond domestic markets to capture international opportunities. This export potential creates additional revenue streams and economies of scale that support continued market development and innovation investment.

Supply and demand dynamics in the Asia Pacific electric motorcycles and scooters market reflect the complex interplay between consumer preferences, technological capabilities, and regulatory environments across diverse countries and regions. The market experiences seasonal variations in demand, with peak sales typically occurring during favorable weather months and festival seasons when consumer spending increases. Supply-side dynamics are influenced by manufacturing capacity, component availability, and production scaling capabilities of various manufacturers.

Competitive dynamics continue to evolve as traditional automotive manufacturers, motorcycle companies, and electric vehicle startups compete for market share and consumer mindshare. The market is witnessing increased consolidation activities, strategic partnerships, and technology licensing agreements as companies seek to strengthen their competitive positions and expand their product portfolios. Price competition remains intense in entry-level segments, while premium segments focus more on technology differentiation and brand positioning.

Technology adoption cycles significantly influence market dynamics, with rapid improvements in battery technology, motor efficiency, and smart connectivity features creating continuous product evolution. Consumers increasingly expect regular technology updates and feature enhancements, similar to smartphone markets, creating pressure on manufacturers to maintain innovation pace and product freshness. This technology-driven dynamic creates both opportunities for differentiation and challenges for maintaining competitive relevance.

Regulatory dynamics across different countries create varying market conditions and growth trajectories, with some markets experiencing accelerated growth due to supportive policies while others face regulatory uncertainties. The harmonization of standards, safety regulations, and certification processes across the region could significantly impact market development and cross-border trade opportunities. According to MarkWide Research analysis, regulatory alignment could potentially increase market efficiency by 15-20% across participating countries.

Primary research methodologies employed in analyzing the Asia Pacific electric motorcycles and scooters market include comprehensive surveys of consumers, manufacturers, dealers, and industry stakeholders across major markets in the region. These surveys capture quantitative data on purchasing behavior, preferences, satisfaction levels, and future intentions, while also gathering qualitative insights on market perceptions, barriers, and opportunities. The research methodology ensures representative sampling across different demographic segments, geographic regions, and market categories.

Secondary research approaches involve extensive analysis of industry reports, government publications, company financial statements, patent filings, and regulatory documents to understand market trends, competitive landscapes, and technological developments. This research includes monitoring of industry news, trade publications, and expert opinions to capture real-time market developments and emerging trends that may impact future market trajectories.

Data validation processes ensure research accuracy and reliability through triangulation of multiple data sources, cross-verification of key findings, and validation through industry expert interviews. The methodology includes statistical analysis of market data, trend analysis, and forecasting models that account for various market variables and scenarios. Quality assurance procedures ensure data consistency and eliminate potential biases or errors in data collection and analysis processes.

Market modeling techniques utilize advanced analytical tools and statistical methods to project market growth, segment performance, and competitive dynamics. These models incorporate various factors including economic indicators, demographic trends, technological developments, and regulatory changes to provide comprehensive market forecasts and scenario analysis. The modeling approach enables identification of key market drivers, potential risks, and growth opportunities across different market segments and geographic regions.

China dominates the Asia Pacific electric motorcycles and scooters market, accounting for approximately 68% of regional market share due to its massive manufacturing capabilities, supportive government policies, and large consumer base. The Chinese market benefits from well-established supply chains, advanced battery technology development, and comprehensive charging infrastructure in major cities. Leading Chinese manufacturers have achieved significant economies of scale, enabling competitive pricing and rapid market expansion both domestically and internationally.

India represents the second-largest market in the region, experiencing rapid growth driven by government incentives, increasing environmental awareness, and rising fuel costs. The Indian market shows strong potential for continued expansion, with government targets for electric vehicle adoption and substantial investments in charging infrastructure development. Local manufacturers are gaining market share through products designed specifically for Indian conditions and consumer preferences, while international companies establish manufacturing and assembly operations to serve the growing market.

Japan maintains a significant market position focused on high-quality, technology-advanced electric two-wheelers, with consumers willing to pay premium prices for superior performance and reliability. The Japanese market emphasizes innovation, safety features, and integration with smart city initiatives. Japanese manufacturers leverage their technological expertise and brand reputation to compete in premium segments both domestically and internationally, contributing to overall market development and technology advancement.

Southeast Asian countries including Thailand, Vietnam, Indonesia, and Malaysia show strong growth potential, driven by increasing urbanization, rising income levels, and growing environmental consciousness. These markets benefit from established two-wheeler cultures and government initiatives promoting electric vehicle adoption. The region’s strategic location and manufacturing capabilities make it attractive for international companies seeking to establish regional production and distribution hubs.

Market leadership in the Asia Pacific electric motorcycles and scooters market is characterized by a diverse mix of established automotive manufacturers, specialized electric vehicle companies, and traditional two-wheeler manufacturers transitioning to electric powertrains. The competitive landscape continues to evolve rapidly as new entrants challenge established players and technology innovations reshape competitive advantages.

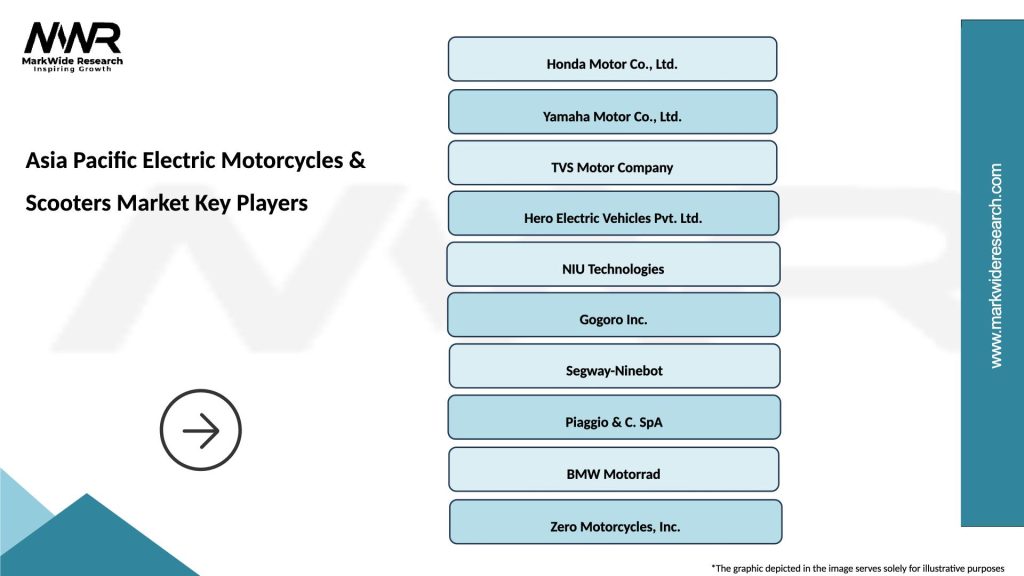

Key market players include:

Competitive strategies vary significantly across different market segments and geographic regions, with companies focusing on various differentiation factors including price competitiveness, technology innovation, brand reputation, distribution network strength, and after-sales service quality. Many companies are pursuing vertical integration strategies to control key components and reduce costs, while others focus on partnerships and collaborations to access complementary capabilities and market reach.

By Vehicle Type: The market segments into electric motorcycles and electric scooters, with scooters currently dominating market share due to their practicality for urban commuting and lower price points. Electric motorcycles represent a smaller but rapidly growing segment, appealing to consumers seeking higher performance and longer range capabilities.

By Battery Type: Lithium-ion batteries dominate the market due to their superior energy density, longer lifespan, and decreasing costs. Lead-acid batteries maintain presence in entry-level segments due to lower initial costs, while emerging battery technologies like solid-state batteries represent future growth opportunities.

By Power Rating:

By End User:

By Price Range: The market spans from budget-friendly options under $1,000 to premium vehicles exceeding $5,000, with mid-range products showing the highest adoption rates due to optimal feature-price balance.

Electric Scooters Category dominates the market with the largest share, driven by their practicality for urban commuting, ease of use, and relatively affordable pricing. This category benefits from lower barriers to adoption, with many consumers viewing electric scooters as natural replacements for conventional scooters. The segment shows strong growth in delivery and commercial applications, where operational cost advantages are most pronounced.

Electric Motorcycles Category represents a premium segment with higher growth potential, appealing to consumers seeking performance, range, and advanced features. This category faces greater competition from conventional motorcycles but offers significant advantages in terms of operating costs and environmental impact. Technology innovations in this segment drive overall market advancement and consumer interest.

Low-Speed Electric Vehicles category serves specific market niches, particularly in regions with relaxed licensing requirements and urban areas with speed restrictions. These vehicles offer affordable entry points into electric mobility while serving practical transportation needs for short-distance travel and specific use cases.

High-Performance Electric Motorcycles represent an emerging category targeting enthusiasts and early adopters willing to pay premium prices for cutting-edge technology and superior performance. This category drives innovation and technology development that eventually filters down to mainstream market segments, contributing to overall market advancement and consumer acceptance.

Manufacturers benefit from growing market demand, government incentives, and opportunities for technology leadership in an emerging industry. The electric two-wheeler market offers manufacturers chances to establish new revenue streams, develop innovative products, and build competitive advantages through technology differentiation. Early market entrants can capture market share and establish brand recognition before markets become saturated.

Consumers gain significant advantages from electric two-wheeler adoption, including reduced operating costs, lower maintenance requirements, and environmental benefits. Electric vehicles offer quieter operation, instant torque delivery, and integration with smart technologies that enhance user experience. Long-term ownership costs are typically lower than conventional alternatives, providing economic benefits beyond environmental advantages.

Governments achieve multiple policy objectives through electric two-wheeler promotion, including reduced urban air pollution, decreased dependence on imported fossil fuels, and development of domestic manufacturing capabilities. Electric vehicle adoption supports climate change mitigation goals while creating economic opportunities in emerging technology sectors.

Infrastructure providers benefit from growing demand for charging solutions, creating new business opportunities in equipment manufacturing, installation, and operation. The development of charging networks creates recurring revenue streams and supports the broader electric mobility ecosystem development.

Financial institutions find new lending opportunities in electric vehicle financing, while insurance companies can develop specialized products for electric two-wheelers. The growing market creates opportunities for innovative financial products and services tailored to electric mobility needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Connectivity Integration represents a major trend transforming electric two-wheelers from simple transportation devices into connected mobility platforms. Modern electric scooters and motorcycles increasingly feature smartphone integration, GPS navigation, remote monitoring, and over-the-air software updates. These smart features enhance user experience while providing manufacturers with valuable data on usage patterns and vehicle performance.

Battery Swapping Technology is gaining momentum as a solution to charging time and infrastructure limitations, particularly in markets with high-density urban environments. Companies like Gogoro have demonstrated successful battery swapping ecosystems, while other manufacturers explore similar approaches to address range anxiety and charging convenience concerns. This trend could reshape the electric two-wheeler market by changing ownership models and operational patterns.

Subscription and Mobility-as-a-Service Models are emerging as alternative ownership approaches, particularly appealing to younger consumers and urban residents. These models reduce upfront costs while providing flexibility and convenience, potentially accelerating electric two-wheeler adoption among price-sensitive consumers. Shared mobility services using electric two-wheelers are expanding in major cities across the region.

Performance Enhancement Focus drives continuous improvement in electric two-wheeler capabilities, with manufacturers investing in higher-performance motors, advanced battery management systems, and improved aerodynamics. This trend addresses consumer concerns about electric vehicle performance compared to conventional alternatives while expanding market appeal to performance-oriented consumers.

Sustainable Manufacturing Practices are becoming increasingly important as manufacturers focus on reducing environmental impact throughout the product lifecycle. This includes using recycled materials, implementing clean manufacturing processes, and developing battery recycling programs. Sustainability initiatives support brand positioning and appeal to environmentally conscious consumers.

Strategic partnerships between traditional automotive manufacturers and electric vehicle startups are reshaping the competitive landscape, combining established manufacturing capabilities with innovative technologies and fresh market approaches. These collaborations accelerate product development timelines while reducing risks associated with entering new market segments.

Manufacturing capacity expansions across the region reflect growing market confidence and demand projections, with multiple companies announcing significant investments in new production facilities and equipment upgrades. These capacity additions support market growth while improving manufacturing efficiency and cost competitiveness.

Technology licensing agreements enable rapid technology transfer and market entry for companies lacking specific technical capabilities, particularly in battery technology and motor systems. These agreements accelerate innovation diffusion while creating new revenue streams for technology developers.

Government policy updates continue to shape market development, with several countries announcing enhanced incentive programs, infrastructure investment plans, and regulatory frameworks supporting electric vehicle adoption. Policy developments create both opportunities and challenges for market participants, requiring adaptive strategies and compliance capabilities.

International expansion initiatives by leading Asia Pacific manufacturers demonstrate growing confidence in their competitive capabilities and market potential beyond domestic markets. These expansion efforts create new growth opportunities while increasing competitive pressure in target markets.

Market entry strategies should focus on understanding local consumer preferences, regulatory requirements, and competitive dynamics in target markets. Companies entering the electric two-wheeler market should consider partnerships with established local players to leverage distribution networks and market knowledge while reducing entry risks and investment requirements.

Product development priorities should emphasize practical features that address real consumer needs, including reliable performance, reasonable pricing, and convenient charging solutions. MarkWide Research analysis suggests that companies focusing on user experience and practical benefits achieve higher market acceptance rates than those prioritizing purely technical specifications.

Investment allocation should balance immediate market opportunities with long-term technology development, ensuring sustainable competitive advantages while capturing current growth potential. Companies should consider investing in charging infrastructure partnerships and service network development to support customer satisfaction and retention.

Risk management approaches should address supply chain vulnerabilities, regulatory uncertainties, and technology obsolescence risks through diversification strategies and flexible business models. Companies should develop contingency plans for various market scenarios while maintaining agility to respond to rapid market changes.

Customer engagement strategies should leverage digital channels and data analytics to understand consumer behavior and preferences, enabling personalized marketing approaches and product customization. Building strong customer relationships through superior service and support can create competitive advantages in increasingly crowded markets.

Market growth projections indicate continued robust expansion of the Asia Pacific electric motorcycles and scooters market, driven by improving technology, supportive policies, and growing consumer acceptance. The market is expected to maintain strong growth momentum with projected CAGR exceeding 10% through 2030, reflecting sustained demand and expanding market penetration across different consumer segments and geographic regions.

Technology evolution will continue to drive market development, with anticipated breakthroughs in battery technology, charging speed, and vehicle performance addressing current limitations and expanding market appeal. Solid-state batteries, wireless charging, and advanced motor technologies represent key areas of development that could significantly impact market dynamics and competitive positioning.

Market maturation patterns suggest that early-adopter markets like China will experience slower growth rates as penetration increases, while emerging markets in Southeast Asia and India will drive regional growth through rapid adoption and market development. This geographic shift in growth drivers will influence manufacturer strategies and investment priorities.

Infrastructure development will play a crucial role in market expansion, with continued investment in charging networks, battery swapping systems, and smart grid integration supporting broader electric vehicle adoption. Public-private partnerships will likely accelerate infrastructure development while creating sustainable business models for charging service providers.

Regulatory evolution will continue to shape market development, with anticipated tightening of emission standards and expansion of electric vehicle mandates creating additional growth drivers. Harmonization of standards across the region could facilitate cross-border trade and technology transfer, supporting overall market efficiency and growth.

The Asia Pacific electric motorcycles and scooters market represents one of the most promising segments in the global transition toward sustainable transportation, characterized by strong growth momentum, technological innovation, and supportive policy environments across multiple countries. The region’s unique combination of manufacturing capabilities, consumer acceptance, and government support creates favorable conditions for continued market expansion and development.

Key success factors for market participants include understanding diverse consumer needs across different countries and segments, developing cost-effective products that balance performance with affordability, and building comprehensive support ecosystems including charging infrastructure and service networks. Companies that can effectively address practical consumer concerns while delivering superior value propositions will capture the greatest market opportunities.

Future market development will be driven by continued technology advancement, expanding infrastructure, and evolving consumer preferences toward sustainable mobility solutions. The market’s growth trajectory appears sustainable, supported by fundamental drivers including urbanization, environmental consciousness, and economic benefits of electric vehicle ownership. As the market matures, competition will intensify, requiring continuous innovation and customer focus to maintain competitive advantages in this dynamic and rapidly evolving industry.

What is Electric Motorcycles & Scooters?

Electric Motorcycles & Scooters refer to two-wheeled vehicles powered by electric motors, designed for personal transportation. They are increasingly popular due to their eco-friendliness and cost-effectiveness compared to traditional gasoline-powered vehicles.

What are the key players in the Asia Pacific Electric Motorcycles & Scooters Market?

Key players in the Asia Pacific Electric Motorcycles & Scooters Market include companies like Honda, Yamaha, and Ather Energy, which are known for their innovative electric vehicle designs and technologies, among others.

What are the growth factors driving the Asia Pacific Electric Motorcycles & Scooters Market?

The growth of the Asia Pacific Electric Motorcycles & Scooters Market is driven by increasing environmental awareness, government incentives for electric vehicles, and advancements in battery technology that enhance vehicle performance and range.

What challenges does the Asia Pacific Electric Motorcycles & Scooters Market face?

Challenges in the Asia Pacific Electric Motorcycles & Scooters Market include limited charging infrastructure, high initial costs compared to conventional vehicles, and consumer concerns regarding battery life and performance.

What future opportunities exist in the Asia Pacific Electric Motorcycles & Scooters Market?

Future opportunities in the Asia Pacific Electric Motorcycles & Scooters Market include the expansion of charging networks, the development of smart electric scooters with connectivity features, and increasing urbanization that drives demand for efficient transportation solutions.

What trends are shaping the Asia Pacific Electric Motorcycles & Scooters Market?

Trends shaping the Asia Pacific Electric Motorcycles & Scooters Market include the rise of shared mobility services, the integration of advanced technologies like IoT for vehicle tracking, and a growing focus on sustainable urban transport solutions.

Asia Pacific Electric Motorcycles & Scooters Market

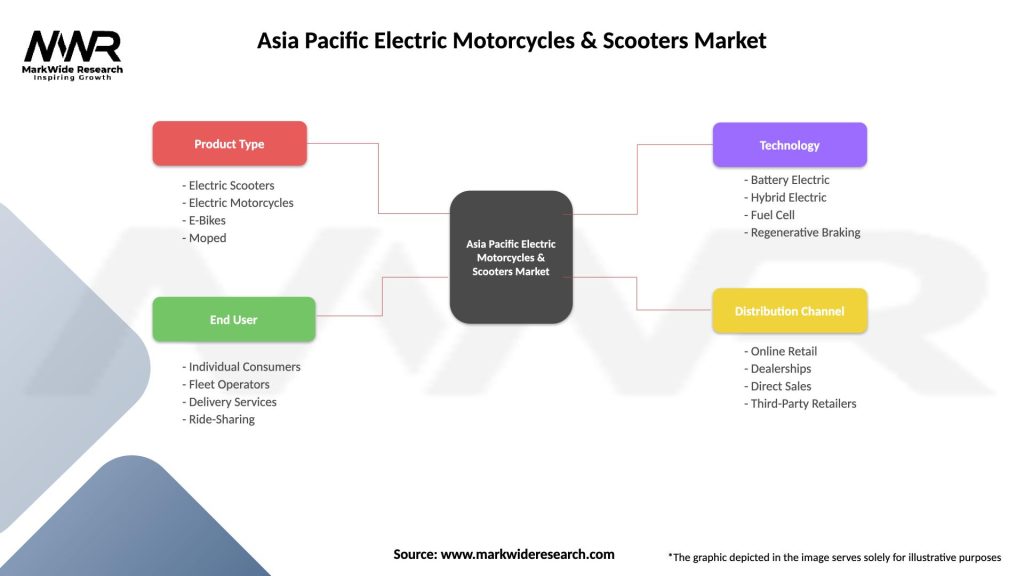

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Scooters, Electric Motorcycles, E-Bikes, Moped |

| End User | Individual Consumers, Fleet Operators, Delivery Services, Ride-Sharing |

| Technology | Battery Electric, Hybrid Electric, Fuel Cell, Regenerative Braking |

| Distribution Channel | Online Retail, Dealerships, Direct Sales, Third-Party Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Electric Motorcycles & Scooters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at