444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific digital home locker market represents a rapidly evolving segment within the smart home technology ecosystem, driven by increasing urbanization, growing e-commerce penetration, and rising consumer demand for secure package delivery solutions. This innovative market encompasses intelligent storage systems designed to provide contactless, secure delivery and pickup services for residential properties across the region.

Market dynamics in the Asia-Pacific region are particularly compelling, with countries like China, Japan, South Korea, and Australia leading adoption rates. The market is experiencing robust growth at a CAGR of 12.8%, fueled by the surge in online shopping behaviors and the need for last-mile delivery optimization. Smart city initiatives across major metropolitan areas are further accelerating the integration of digital home locker solutions into residential infrastructure.

Technological advancements in IoT connectivity, biometric authentication, and mobile app integration are transforming traditional package delivery methods. The market encompasses various form factors, from standalone outdoor units to integrated building systems, catering to diverse residential configurations across the region. Consumer adoption rates have reached approximately 34% in urban areas, with significant growth potential in emerging markets.

Regional variations in market development reflect different stages of digital infrastructure maturity and consumer preferences. While developed markets focus on premium features and seamless integration, emerging economies prioritize cost-effective solutions and basic security functionalities.

The Asia-Pacific digital home locker market refers to the commercial ecosystem encompassing intelligent, technology-enabled storage solutions designed to facilitate secure, contactless package delivery and retrieval at residential locations throughout the Asia-Pacific region. These systems integrate advanced technologies including IoT connectivity, mobile applications, and security features to provide automated package management services.

Digital home lockers represent a convergence of smart home technology, logistics optimization, and consumer convenience solutions. These systems typically feature secure compartments with electronic locking mechanisms, real-time notification capabilities, and remote access control through smartphone applications. Key functionalities include package authentication, delivery confirmation, and flexible pickup scheduling.

Market participants include technology manufacturers, logistics companies, property developers, and service providers who collaborate to deliver comprehensive digital locker solutions. The ecosystem encompasses hardware manufacturing, software development, installation services, and ongoing maintenance support.

Integration capabilities with existing smart home ecosystems and building management systems distinguish modern digital home lockers from traditional package storage solutions. These systems often incorporate weather protection, temperature control, and multi-user access management to serve diverse residential requirements across the Asia-Pacific region.

Strategic market positioning of digital home lockers in the Asia-Pacific region reflects the intersection of several powerful trends: accelerating e-commerce growth, urbanization pressures, and evolving consumer expectations for delivery convenience. The market demonstrates strong momentum across multiple segments, from individual residential units to large-scale apartment complexes and gated communities.

Technology adoption patterns vary significantly across the region, with mature markets like Japan and South Korea emphasizing advanced features such as biometric authentication and AI-powered delivery optimization. Meanwhile, emerging markets focus on fundamental security and reliability features. Installation rates in new residential developments have reached 28% across major cities, indicating strong developer confidence in the technology.

Competitive dynamics are intensifying as traditional logistics companies, technology startups, and established smart home manufacturers compete for market share. Strategic partnerships between e-commerce platforms and locker providers are becoming increasingly common, creating integrated delivery ecosystems that enhance customer experience.

Investment flows into the sector reflect growing confidence in long-term market potential, with particular emphasis on solutions that address unique regional challenges such as high-density urban living, extreme weather conditions, and diverse cultural preferences for package handling.

Consumer behavior analysis reveals several critical insights driving market expansion across the Asia-Pacific region. Primary adoption drivers include security concerns, delivery convenience, and the desire for contactless interactions, particularly following the global pandemic experience.

Market penetration rates demonstrate significant variation across different property types, with luxury developments showing higher adoption rates of 45% compared to mid-market residential properties. This disparity presents substantial growth opportunities as technology costs decrease and awareness increases.

E-commerce expansion serves as the primary catalyst for digital home locker adoption across the Asia-Pacific region. The exponential growth in online shopping, accelerated by changing consumer behaviors and improved digital payment systems, creates unprecedented demand for secure, convenient package delivery solutions. Online retail penetration has reached 67% in urban markets, driving corresponding demand for last-mile delivery optimization.

Urbanization pressures in major metropolitan areas contribute significantly to market growth. As cities become increasingly dense and traditional delivery methods face logistical challenges, digital home lockers provide efficient solutions for package management in high-rise buildings and compact residential developments. Smart city initiatives across the region actively promote technology adoption to address urban challenges.

Security concerns regarding package theft and delivery fraud motivate consumers to seek secure alternatives to traditional doorstep delivery. Digital home lockers address these concerns through advanced authentication systems, real-time monitoring, and secure storage capabilities. Package theft incidents have decreased by 78% in areas with digital locker deployment.

Contactless delivery preferences have become increasingly important, particularly following global health concerns. Digital home lockers enable completely contactless package transactions, appealing to health-conscious consumers and supporting social distancing requirements. This trend has accelerated adoption across all demographic segments.

Property developer interest in smart building features drives integration of digital locker systems into new residential developments. Developers recognize these systems as valuable amenities that enhance property appeal and differentiate their offerings in competitive markets.

High initial investment costs represent a significant barrier to widespread adoption, particularly in price-sensitive markets across the Asia-Pacific region. The substantial upfront expenses for hardware, installation, and system integration can deter individual consumers and property developers from implementing digital locker solutions. Cost considerations remain the primary concern for 52% of potential adopters.

Technical complexity and integration challenges pose obstacles for seamless deployment across diverse residential environments. Compatibility issues with existing building infrastructure, internet connectivity requirements, and ongoing maintenance needs can complicate implementation processes. Many consumers express concerns about technical reliability and system downtime.

Cultural resistance to technology adoption varies significantly across different markets within the region. Traditional delivery preferences, concerns about privacy and data security, and skepticism about new technology can slow market penetration in certain demographic segments and geographic areas.

Regulatory uncertainties regarding data protection, building codes, and safety standards create implementation challenges for manufacturers and service providers. Varying regulations across different countries and jurisdictions complicate standardization efforts and increase compliance costs.

Limited awareness among potential users about digital locker benefits and functionality restricts market growth. Educational initiatives and demonstration programs are necessary to overcome knowledge gaps and build consumer confidence in the technology.

Emerging market expansion presents substantial growth opportunities as digital infrastructure development accelerates across Southeast Asia, India, and other developing regions. Rising disposable incomes, increasing internet penetration, and growing e-commerce adoption create favorable conditions for digital home locker deployment in previously underserved markets.

Integration with smart home ecosystems offers significant potential for enhanced functionality and user experience. Connectivity with home automation systems, voice assistants, and IoT devices can create comprehensive smart living solutions that appeal to tech-savvy consumers. Smart home integration increases user satisfaction by 63% according to recent studies.

Commercial and mixed-use applications beyond residential properties represent untapped market segments. Office buildings, retail centers, and hospitality properties can benefit from digital locker solutions for employee packages, customer services, and guest amenities. This diversification reduces dependence on residential market fluctuations.

Subscription service models provide opportunities for recurring revenue generation and improved customer relationships. Monthly or annual service plans covering maintenance, upgrades, and premium features can create sustainable business models while reducing barriers to initial adoption.

Partnership opportunities with e-commerce platforms, logistics companies, and property management firms can accelerate market penetration and create integrated service offerings. Strategic alliances enable companies to leverage existing customer relationships and distribution networks.

Competitive intensity within the Asia-Pacific digital home locker market continues to escalate as established technology companies, logistics providers, and innovative startups compete for market share. This competition drives continuous innovation in features, pricing strategies, and service offerings, ultimately benefiting consumers through improved solutions and competitive pricing.

Technology evolution significantly influences market dynamics, with rapid advancements in IoT connectivity, artificial intelligence, and mobile applications creating new possibilities for enhanced functionality. Feature enhancement cycles occur approximately every 18 months, requiring companies to maintain aggressive development schedules to remain competitive.

Supply chain considerations impact market dynamics through component availability, manufacturing costs, and delivery timelines. Global semiconductor shortages and logistics disruptions have affected production schedules and pricing strategies across the industry. Companies are diversifying supplier relationships and exploring regional manufacturing options.

Customer acquisition strategies vary significantly across different market segments and geographic regions. While premium markets respond to advanced feature demonstrations, cost-sensitive segments require value-focused messaging and flexible payment options. Customer retention rates exceed 85% for integrated solutions compared to standalone products.

Regulatory developments continue to shape market dynamics as governments establish standards for data privacy, building safety, and consumer protection. Companies must navigate evolving compliance requirements while maintaining competitive positioning and profitability.

Comprehensive market analysis for the Asia-Pacific digital home locker market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, technology developers, property managers, and end-users across major markets in the region.

Secondary research sources encompass industry reports, government publications, company financial statements, and technology patent databases. This approach provides comprehensive coverage of market trends, competitive dynamics, and technological developments. Data validation processes ensure consistency and accuracy across multiple information sources.

Market sizing methodologies utilize bottom-up and top-down approaches to validate findings and ensure comprehensive coverage of all market segments. Regional analysis incorporates country-specific factors including economic conditions, regulatory environments, and cultural preferences that influence adoption patterns.

Trend analysis examines historical data patterns, current market conditions, and forward-looking indicators to identify emerging opportunities and potential challenges. MarkWide Research analytical frameworks provide structured approaches to evaluating market dynamics and competitive positioning.

Expert validation processes involve consultation with industry specialists, technology experts, and market analysts to verify findings and ensure practical relevance of research conclusions. This multi-layered approach enhances the reliability and actionability of market insights.

China dominates the Asia-Pacific digital home locker market with approximately 38% market share, driven by massive e-commerce volumes, extensive urbanization, and government support for smart city initiatives. Major cities like Shanghai, Beijing, and Shenzhen lead adoption rates, with comprehensive deployment across residential complexes and commercial properties.

Japan represents a mature market characterized by high technology adoption rates and premium feature preferences. Japanese consumers prioritize reliability, security, and seamless integration with existing smart home systems. Market penetration in urban areas reaches 42%, with particular strength in high-end residential developments.

South Korea demonstrates strong growth momentum fueled by advanced digital infrastructure and tech-savvy consumers. The market benefits from government digitalization initiatives and widespread smartphone adoption. Integration with popular messaging platforms and mobile payment systems enhances user adoption.

Australia and New Zealand show steady growth patterns with emphasis on weather-resistant designs and integration with local e-commerce platforms. These markets prioritize durability and low-maintenance solutions suitable for diverse climate conditions.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia represent high-growth opportunities with increasing urbanization and e-commerce expansion. Growth rates in these markets exceed 18% annually, driven by rising disposable incomes and improving digital infrastructure.

India presents significant long-term potential despite current challenges related to infrastructure development and price sensitivity. Major metropolitan areas show increasing interest in smart building solutions, creating opportunities for cost-effective digital locker implementations.

Market leadership in the Asia-Pacific digital home locker sector is distributed among several key categories of companies, each bringing distinct strengths and market approaches. The competitive environment reflects the convergence of technology, logistics, and real estate industries.

Competitive strategies vary significantly across market participants, with some focusing on technology innovation while others emphasize service integration and customer support. Partnership approaches are becoming increasingly important as companies seek to leverage complementary strengths and expand market reach.

Regional players maintain significant advantages in local markets through cultural understanding, regulatory compliance, and established relationships with property developers and logistics providers. These companies often compete effectively against global brands through customized solutions and competitive pricing.

Technology-based segmentation reveals distinct market categories based on core functionality and integration capabilities. Smart connected lockers with IoT connectivity and mobile app integration represent the fastest-growing segment, appealing to tech-savvy consumers seeking comprehensive digital experiences.

By Deployment Type:

By Property Type:

By Size Configuration:

Smart connected locker systems demonstrate the strongest growth trajectory, driven by consumer preferences for integrated digital experiences and real-time package management capabilities. These systems typically feature mobile app connectivity, push notifications, and remote access control, appealing to technology-forward consumers across urban markets.

Indoor deployment categories show higher adoption rates in markets with extreme weather conditions or security concerns. These installations benefit from climate protection and enhanced security, though they require building access and may involve higher installation complexity. Indoor system preference reaches 71% in premium developments.

Apartment complex applications represent the largest market segment by volume, driven by high-density urban living trends and property developer interest in smart building amenities. These installations often feature multiple locker sizes and centralized management systems to serve diverse resident needs efficiently.

Retrofit market segments present significant opportunities as existing residential properties seek to add smart package management capabilities without major infrastructure investments. These solutions emphasize ease of installation and minimal building modification requirements.

Premium feature categories including biometric authentication, temperature control, and AI-powered optimization appeal to high-end market segments willing to pay for advanced functionality. These features often serve as differentiators in competitive residential markets.

Property developers gain significant competitive advantages through digital home locker integration, enhancing property appeal and differentiation in crowded residential markets. These systems serve as modern amenities that attract tech-savvy residents and support premium pricing strategies. Property value enhancement averages 3-5% for buildings with integrated smart locker systems.

Residents and homeowners benefit from enhanced security, convenience, and flexibility in package management. Digital lockers eliminate concerns about package theft, missed deliveries, and scheduling conflicts while providing 24/7 access to delivered items. The contactless delivery experience appeals to health-conscious consumers and busy professionals.

E-commerce retailers achieve improved delivery success rates, reduced return-to-sender costs, and enhanced customer satisfaction through reliable package delivery solutions. Integration with digital locker networks enables more efficient last-mile logistics and supports customer retention strategies.

Logistics companies realize operational efficiencies through optimized delivery routes, reduced failed delivery attempts, and improved driver productivity. Digital lockers enable bulk deliveries to centralized locations, reducing per-package delivery costs and supporting sustainable logistics practices.

Property management companies benefit from reduced package handling responsibilities, decreased liability concerns, and improved resident satisfaction. Automated package management systems reduce staff workload while providing comprehensive tracking and accountability features.

Technology providers access growing market opportunities with recurring revenue potential through service contracts, software updates, and system expansions. The market supports diverse business models from hardware sales to comprehensive service offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend, enabling predictive package management, optimized delivery scheduling, and personalized user experiences. AI-powered systems can anticipate delivery patterns, suggest optimal locker configurations, and provide intelligent notifications to enhance user satisfaction.

Sustainability focus drives development of eco-friendly locker systems featuring solar power integration, recyclable materials, and energy-efficient operations. Environmental consciousness among consumers and corporate sustainability initiatives create demand for green technology solutions.

Biometric authentication advancement enhances security and user convenience through fingerprint recognition, facial identification, and voice activation capabilities. These technologies eliminate the need for physical keys or access codes while providing superior security features.

Mobile-first design approaches prioritize smartphone integration and app-based management, reflecting consumer preferences for mobile-centric digital experiences. Advanced mobile features include augmented reality setup assistance, remote monitoring, and social sharing capabilities.

Modular system architectures enable flexible deployment and scalable expansion to meet diverse property requirements. These designs support phased implementations and future capacity increases without complete system replacement.

Integration with delivery drones and autonomous vehicles represents an emerging trend as last-mile logistics evolve. Digital lockers serve as secure landing points for automated delivery systems, supporting the development of fully autonomous package delivery networks.

Strategic partnerships between major e-commerce platforms and digital locker providers are reshaping market dynamics. These collaborations create integrated delivery ecosystems that enhance customer experience while expanding market reach for locker manufacturers. Recent partnerships have resulted in deployment acceleration of 35% in participating markets.

Technology standardization initiatives led by industry associations aim to improve interoperability and reduce implementation complexity. Standard protocols for communication, security, and integration enable broader ecosystem development and reduce costs for all participants.

Government smart city programs across the Asia-Pacific region increasingly include digital package management as core infrastructure components. Public-private partnerships support large-scale deployments and create favorable regulatory environments for technology adoption.

Investment in local manufacturing capabilities reduces supply chain dependencies and supports regional market development. Companies are establishing production facilities closer to major markets to improve cost competitiveness and delivery timelines.

Advanced security certifications and compliance programs address growing concerns about data privacy and system security. Industry leaders are pursuing international security standards and implementing comprehensive cybersecurity measures to build consumer confidence.

Expansion into commercial applications beyond residential properties creates new market opportunities. Office buildings, retail centers, and hospitality properties are implementing digital locker solutions for employee services and customer convenience.

Market entry strategies should prioritize partnership development with established e-commerce platforms and logistics providers to accelerate customer acquisition and market penetration. MarkWide Research analysis indicates that companies with strategic partnerships achieve 40% faster market penetration compared to independent market entry approaches.

Technology investment priorities should focus on mobile app development, AI integration, and security enhancement to meet evolving consumer expectations. Companies that invest in advanced features and user experience improvements demonstrate superior customer retention and premium pricing capabilities.

Regional customization approaches are essential for success across diverse Asia-Pacific markets. Solutions must address local preferences for payment methods, language support, cultural norms, and regulatory requirements to achieve broad market acceptance.

Service model innovation through subscription offerings, managed services, and comprehensive support packages can differentiate companies and create recurring revenue streams. These approaches also reduce initial adoption barriers for price-sensitive market segments.

Sustainability initiatives should be integrated into product development and marketing strategies to appeal to environmentally conscious consumers and meet corporate sustainability requirements. Green technology features can serve as competitive differentiators in premium market segments.

Education and awareness programs are crucial for market development, particularly in emerging economies where digital locker concepts may be unfamiliar. Demonstration programs, pilot projects, and educational partnerships can accelerate market acceptance and adoption rates.

Long-term market prospects for the Asia-Pacific digital home locker market remain highly positive, driven by continued urbanization, e-commerce growth, and technology advancement. Market expansion is projected to continue at robust rates, with compound annual growth exceeding 15% through the next five years across most regional markets.

Technology evolution will likely focus on enhanced artificial intelligence capabilities, improved energy efficiency, and seamless integration with emerging smart city infrastructure. Advanced features such as predictive maintenance, automated inventory management, and personalized delivery optimization will become standard offerings.

Market consolidation may occur as successful companies acquire smaller competitors and expand their geographic presence. Strategic mergers and acquisitions will likely focus on technology capabilities, market access, and service integration opportunities.

Regulatory development across the region will establish clearer frameworks for data privacy, building safety, and consumer protection. These developments will create more predictable operating environments while ensuring consumer confidence in digital locker solutions.

Integration with autonomous delivery systems represents a significant future opportunity as drone delivery and autonomous vehicles become commercially viable. Digital lockers will serve as essential infrastructure components in fully automated last-mile delivery networks.

Emerging market penetration will accelerate as digital infrastructure improves and costs decrease. Countries currently showing limited adoption will likely experience rapid growth as economic conditions improve and technology awareness increases.

The Asia-Pacific digital home locker market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse regional markets. Market fundamentals remain strong, supported by accelerating e-commerce adoption, urbanization trends, and increasing consumer demand for secure, convenient package delivery solutions.

Technology advancement continues to drive innovation in features, functionality, and user experience, creating opportunities for market differentiation and premium positioning. Companies that successfully integrate advanced technologies while maintaining cost competitiveness will likely achieve sustainable competitive advantages in this expanding market.

Regional diversity within the Asia-Pacific market requires customized approaches that address local preferences, regulatory requirements, and economic conditions. Success in this market demands deep understanding of cultural nuances and flexible business models that can adapt to varying market maturity levels.

Strategic partnerships and ecosystem development will play crucial roles in market success, as companies leverage complementary strengths to create comprehensive solutions and accelerate market penetration. The convergence of e-commerce, logistics, and smart home technologies creates numerous collaboration opportunities.

Future market development will likely be characterized by continued innovation, expanding applications beyond residential properties, and integration with emerging delivery technologies. Companies positioned to capitalize on these trends while addressing current market challenges will be well-positioned for long-term success in this promising market segment.

What is Digital Home Locker?

Digital Home Lockers are secure storage solutions that utilize electronic locking mechanisms to provide safe and convenient access to personal belongings. They are increasingly used in residential settings for storing valuables, documents, and other important items.

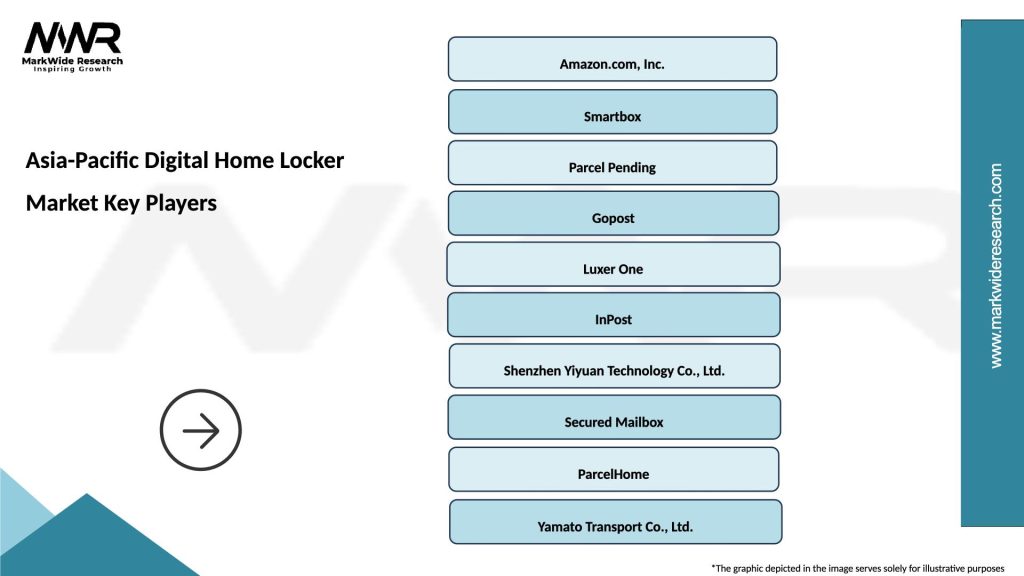

What are the key players in the Asia-Pacific Digital Home Locker Market?

Key players in the Asia-Pacific Digital Home Locker Market include companies like Godrej Locking Solutions, Master Lock, and Yale, which offer a range of digital locking solutions for home security, among others.

What are the growth factors driving the Asia-Pacific Digital Home Locker Market?

The growth of the Asia-Pacific Digital Home Locker Market is driven by increasing urbanization, rising disposable incomes, and a growing awareness of home security. Additionally, the trend towards smart home technology is boosting demand for digital lockers.

What challenges does the Asia-Pacific Digital Home Locker Market face?

Challenges in the Asia-Pacific Digital Home Locker Market include concerns over cybersecurity, the high cost of advanced locking systems, and competition from traditional locking solutions. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Asia-Pacific Digital Home Locker Market?

Opportunities in the Asia-Pacific Digital Home Locker Market include the integration of IoT technology for enhanced security features and the potential for customization to meet specific consumer needs. Additionally, the rise of e-commerce is creating demand for secure delivery solutions.

What trends are shaping the Asia-Pacific Digital Home Locker Market?

Trends in the Asia-Pacific Digital Home Locker Market include the increasing adoption of smart home devices, the development of mobile app integrations for remote access, and a focus on eco-friendly materials in locker manufacturing. These trends are influencing consumer preferences and market dynamics.

Asia-Pacific Digital Home Locker Market

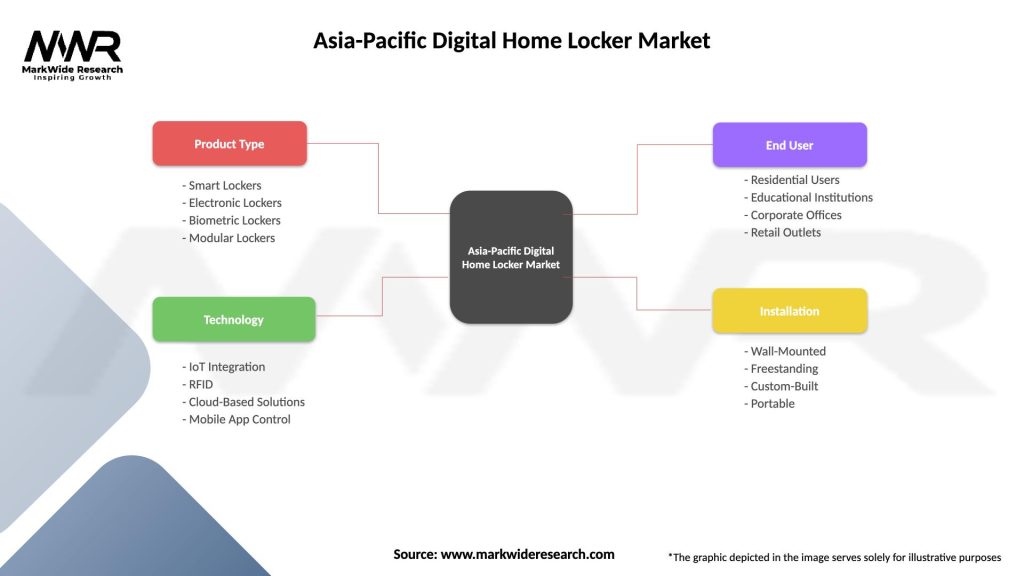

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lockers, Electronic Lockers, Biometric Lockers, Modular Lockers |

| Technology | IoT Integration, RFID, Cloud-Based Solutions, Mobile App Control |

| End User | Residential Users, Educational Institutions, Corporate Offices, Retail Outlets |

| Installation | Wall-Mounted, Freestanding, Custom-Built, Portable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Digital Home Locker Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at