444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific cosmeceuticals market represents one of the most dynamic and rapidly expanding segments within the global beauty and personal care industry. This region has emerged as a powerhouse for innovative skincare solutions that bridge the gap between cosmetics and pharmaceuticals, offering consumers scientifically-backed products with proven efficacy. Market dynamics in the Asia Pacific region are characterized by increasing consumer awareness about skin health, rising disposable incomes, and a growing preference for premium beauty products with active ingredients.

Regional growth patterns indicate that the Asia Pacific cosmeceuticals market is experiencing robust expansion, driven by countries such as China, Japan, South Korea, India, and Australia. The market is projected to grow at a compound annual growth rate (CAGR) of 8.2% over the forecast period, significantly outpacing global averages. This growth trajectory is supported by demographic shifts, urbanization trends, and the increasing influence of social media on beauty standards and product awareness.

Consumer behavior patterns across the Asia Pacific region show a marked preference for products that combine aesthetic benefits with therapeutic properties. The region’s consumers are becoming increasingly sophisticated in their understanding of skincare ingredients, leading to higher demand for products containing active compounds such as retinoids, peptides, antioxidants, and botanical extracts. Market penetration rates vary significantly across different countries, with developed markets like Japan and South Korea showing penetration rates exceeding 45%, while emerging markets present substantial growth opportunities.

The Asia Pacific cosmeceuticals market refers to the regional segment encompassing the development, manufacturing, distribution, and sale of hybrid beauty products that combine cosmetic and pharmaceutical properties across Asia Pacific countries. These products are formulated with active ingredients that provide measurable benefits beyond traditional cosmetics, including anti-aging effects, skin repair, pigmentation correction, and therapeutic treatments for various skin conditions.

Cosmeceuticals in the Asia Pacific context represent a sophisticated category of skincare products that undergo rigorous testing and contain clinically proven ingredients. Unlike conventional cosmetics, these products are designed to penetrate deeper skin layers and deliver targeted therapeutic benefits. The market encompasses various product categories including serums, creams, cleansers, masks, and specialized treatments that address specific skin concerns prevalent in Asian populations.

Regulatory frameworks across Asia Pacific countries define cosmeceuticals as products that fall between cosmetics and pharmaceuticals, requiring specific compliance standards while maintaining accessibility to consumers without prescription requirements. This unique positioning allows manufacturers to incorporate potent active ingredients while ensuring product safety and efficacy through scientific validation and clinical testing protocols.

Strategic market positioning reveals that the Asia Pacific cosmeceuticals market has established itself as a critical growth engine for the global beauty industry. The region’s unique combination of traditional beauty practices and modern scientific innovation has created a distinctive market landscape characterized by high consumer engagement and premium product adoption. Market leaders are leveraging advanced research capabilities and local consumer insights to develop products specifically tailored to Asian skin types and beauty preferences.

Key performance indicators demonstrate exceptional market vitality, with the anti-aging segment capturing approximately 38% of total market share, followed by skin brightening products at 24% market share. The professional and clinical channels account for 42% of distribution volume, while e-commerce platforms are rapidly gaining traction with growth rates exceeding 15% annually. Consumer spending patterns indicate a willingness to invest in premium cosmeceutical products, with average purchase values increasing consistently across all major markets.

Innovation trends are driving market evolution, with manufacturers focusing on personalized skincare solutions, sustainable packaging, and ingredient transparency. The integration of artificial intelligence and skin analysis technologies is creating new opportunities for customized product recommendations and treatment protocols. Market consolidation activities and strategic partnerships are reshaping the competitive landscape, enabling companies to expand their technological capabilities and market reach across the diverse Asia Pacific region.

Consumer demographic analysis reveals several critical insights driving market growth across the Asia Pacific region. The following key insights highlight the most significant market dynamics:

Market maturity levels vary significantly across Asia Pacific countries, with developed markets showing sophisticated consumer behavior and emerging markets presenting substantial growth potential. Cross-border shopping trends and medical tourism are creating additional market dynamics, particularly for premium and specialized cosmeceutical products.

Primary growth drivers propelling the Asia Pacific cosmeceuticals market forward encompass a complex interplay of demographic, economic, and cultural factors. Rising disposable incomes across the region have enabled consumers to invest in premium skincare products, with middle-class expansion creating a substantial customer base for cosmeceutical products. The increasing awareness of skin health and preventive care has shifted consumer preferences from reactive to proactive skincare approaches.

Technological advancement in product formulation and delivery systems has significantly enhanced product efficacy and consumer confidence. Advanced ingredients such as nanotechnology-based delivery systems, bioactive peptides, and plant stem cells are attracting tech-savvy consumers seeking cutting-edge skincare solutions. Research and development investments by major cosmeceutical companies have resulted in innovative products specifically designed for Asian skin types and environmental conditions.

Cultural beauty standards emphasizing flawless, youthful skin continue to drive demand for effective anti-aging and skin perfecting products. The influence of K-beauty and J-beauty trends has elevated consumer expectations for product performance and ingredient quality. Social media proliferation and beauty influencer culture have accelerated product awareness and adoption, particularly among younger demographics who view skincare as an essential lifestyle component.

Aging population demographics across developed Asia Pacific markets are creating sustained demand for anti-aging and skin repair products. Simultaneously, pollution concerns in major urban centers are driving demand for protective and reparative cosmeceutical formulations. The growing acceptance of professional aesthetic treatments has created synergistic demand for at-home cosmeceutical products that complement clinical procedures.

Regulatory complexities across different Asia Pacific countries present significant challenges for cosmeceutical manufacturers and distributors. Varying approval processes, ingredient restrictions, and labeling requirements create barriers to market entry and product standardization. Compliance costs associated with meeting diverse regulatory standards can be substantial, particularly for smaller companies seeking regional expansion.

Price sensitivity in emerging markets remains a considerable constraint, as premium cosmeceutical products may be inaccessible to large consumer segments. Economic volatility and currency fluctuations can impact purchasing power and market stability. Cultural resistance to new beauty concepts in traditional markets may slow adoption rates for innovative cosmeceutical products, requiring extensive consumer education and marketing investments.

Counterfeit products pose a significant threat to market integrity and consumer safety, particularly in markets with limited regulatory enforcement. The proliferation of fake cosmeceutical products undermines consumer confidence and creates unfair competition for legitimate manufacturers. Supply chain disruptions and raw material availability issues can impact product consistency and market supply, particularly for products containing specialized active ingredients.

Professional skepticism from some dermatologists and healthcare providers regarding cosmeceutical efficacy may limit professional channel growth. Ingredient safety concerns and potential adverse reactions require careful product development and comprehensive safety testing, increasing development timelines and costs. Market saturation in certain product categories may limit growth opportunities and intensify competitive pressures.

Emerging market expansion presents substantial growth opportunities as developing Asia Pacific countries experience economic growth and rising consumer sophistication. Countries such as Vietnam, Thailand, and Indonesia offer untapped potential for cosmeceutical market development. Rural market penetration through innovative distribution strategies and affordable product lines could significantly expand the customer base.

Personalized skincare solutions represent a transformative opportunity, leveraging artificial intelligence, genetic testing, and skin analysis technologies to create customized cosmeceutical products. Digital integration through mobile apps, virtual consultations, and augmented reality try-on experiences can enhance customer engagement and drive online sales growth.

Natural and organic formulations align with growing consumer preferences for clean beauty and sustainable products. The integration of traditional Asian botanical ingredients with modern cosmeceutical science offers unique positioning opportunities. Men’s cosmeceuticals represent a rapidly growing segment with significant untapped potential across all Asia Pacific markets.

Professional channel expansion through partnerships with dermatology clinics, medical spas, and aesthetic centers can drive premium product sales and brand credibility. Cross-border e-commerce platforms enable access to international markets and niche consumer segments. The growing medical tourism industry creates opportunities for specialized cosmeceutical products targeting international visitors seeking advanced skincare treatments.

Competitive intensity within the Asia Pacific cosmeceuticals market continues to escalate as both international and domestic players vie for market share. Innovation cycles are accelerating, with companies investing heavily in research and development to differentiate their product offerings. The market exhibits dynamic pricing strategies, with premium positioning becoming increasingly important for brand differentiation and profitability.

Consumer behavior evolution is reshaping market dynamics, with increasing demand for transparency, sustainability, and proven efficacy. Digital transformation has fundamentally altered how consumers discover, research, and purchase cosmeceutical products. Social commerce and influencer marketing have become critical components of successful market strategies, particularly for reaching younger demographics.

Supply chain optimization has become a key competitive advantage, with companies focusing on local sourcing, sustainable practices, and efficient distribution networks. Regulatory harmonization efforts across some Asia Pacific countries are creating opportunities for streamlined product development and market entry strategies. The integration of traditional medicine principles with modern cosmeceutical science is creating unique market positioning opportunities.

Technology adoption in manufacturing, formulation, and customer engagement is driving operational efficiency and product innovation. Market consolidation trends through mergers, acquisitions, and strategic partnerships are reshaping the competitive landscape and creating new market leaders. The emergence of direct-to-consumer brands is challenging traditional distribution models and creating new competitive dynamics.

Comprehensive market analysis for the Asia Pacific cosmeceuticals market employs a multi-faceted research approach combining primary and secondary data sources. Primary research methodologies include structured interviews with industry executives, consumer surveys across major Asia Pacific markets, and focus group discussions with target demographic segments. Expert consultations with dermatologists, cosmetic chemists, and retail professionals provide specialized insights into market trends and consumer behavior patterns.

Secondary research components encompass extensive analysis of industry reports, regulatory filings, company financial statements, and trade association publications. Market data validation processes involve cross-referencing multiple sources and employing statistical analysis techniques to ensure accuracy and reliability. Quantitative analysis includes market sizing, growth rate calculations, and competitive positioning assessments based on verified data sources.

Regional market segmentation analysis covers country-specific market dynamics, regulatory environments, and consumer preferences across major Asia Pacific markets. Trend analysis methodologies incorporate historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market constraints. MarkWide Research analytical frameworks ensure comprehensive coverage of market dynamics and strategic implications for industry stakeholders.

China dominates the Asia Pacific cosmeceuticals market with approximately 35% regional market share, driven by massive consumer base, rising disposable incomes, and increasing beauty consciousness. Chinese consumers demonstrate strong preferences for anti-aging and skin brightening products, with e-commerce platforms facilitating rapid market growth. The integration of traditional Chinese medicine ingredients with modern cosmeceutical formulations creates unique market opportunities.

Japan maintains its position as a mature and sophisticated market, accounting for 22% of regional market share. Japanese consumers exhibit high brand loyalty and willingness to pay premium prices for innovative, high-quality products. The country’s advanced research capabilities and regulatory framework support continuous product innovation and market development.

South Korea represents approximately 18% of the regional market, with exceptional growth in premium cosmeceutical segments. K-beauty influence has elevated global awareness of Korean cosmeceutical innovations, creating export opportunities and attracting international investment. The country’s focus on cutting-edge ingredients and advanced delivery systems positions it as a regional innovation leader.

India emerges as a high-growth market with 12% regional market share and exceptional growth potential. Rising middle class demographics and increasing urbanization drive demand for premium skincare products. The integration of Ayurvedic principles with modern cosmeceutical science creates unique positioning opportunities for both domestic and international brands.

Australia and Southeast Asian markets collectively represent the remaining 13% market share, with countries like Thailand, Malaysia, and Singapore showing strong growth trajectories. Tropical climate considerations drive demand for specialized formulations addressing humidity, UV protection, and pollution-related skin concerns.

Market leadership in the Asia Pacific cosmeceuticals market is characterized by a diverse mix of international corporations, regional specialists, and emerging local brands. The competitive environment demonstrates significant innovation and strategic positioning across multiple market segments.

Competitive strategies focus on product innovation, digital marketing, strategic partnerships, and localization of product offerings. Market consolidation through acquisitions and joint ventures continues to reshape the competitive landscape, enabling companies to expand their technological capabilities and market reach.

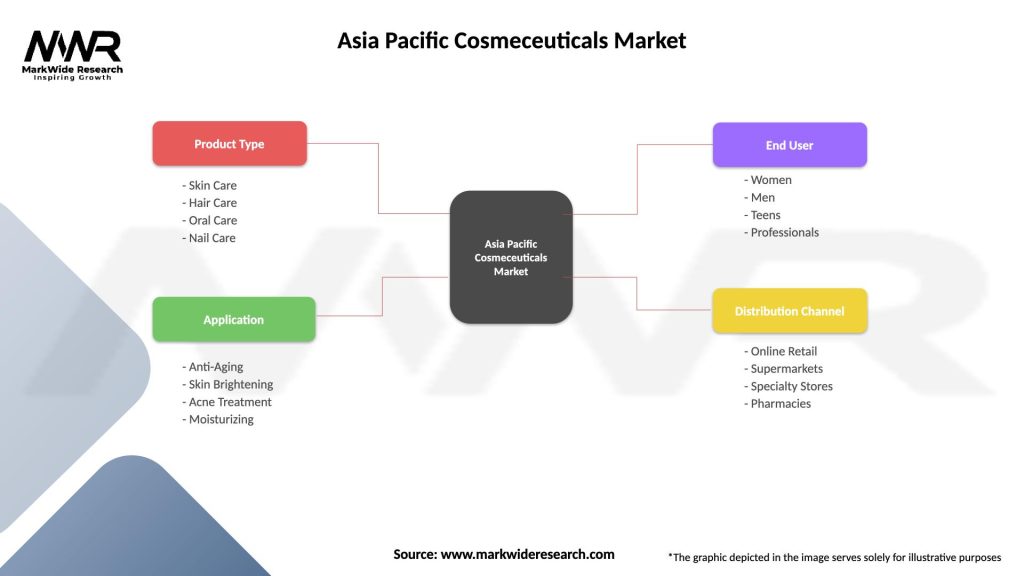

Product category segmentation reveals distinct market dynamics across various cosmeceutical product types. By Product Type:

By Application Method:

By Distribution Channel:

Anti-aging category dominance reflects the primary consumer concern across Asia Pacific markets, with products targeting fine lines, wrinkles, and skin elasticity showing consistent growth. Advanced formulations incorporating retinoids, peptides, and growth factors command premium pricing and demonstrate strong consumer loyalty. The category benefits from continuous innovation in delivery systems and ingredient combinations.

Skin brightening products address specific cultural beauty preferences in Asian markets, with consumers seeking even skin tone and radiance enhancement. Vitamin C derivatives, niacinamide, and botanical extracts represent key active ingredients driving product efficacy. Regulatory considerations around skin lightening ingredients require careful formulation and marketing approaches.

Acne treatment cosmeceuticals serve a significant market need, particularly among younger demographics in urban environments. Salicylic acid, benzoyl peroxide, and retinoid-based formulations provide therapeutic benefits while maintaining cosmetic elegance. The category shows strong growth potential as awareness of acne treatment options increases.

Sun protection category evolution incorporates anti-aging benefits and environmental protection features beyond basic UV filtering. Broad-spectrum protection combined with antioxidants and anti-pollution ingredients creates differentiated product positioning. Consumer education about daily sun protection drives category expansion.

Moisturizing products with barrier repair properties address climate-related skin concerns across diverse Asia Pacific environments. Hyaluronic acid, ceramides, and botanical moisturizing factors provide both immediate and long-term skin benefits. The category shows innovation in texture and absorption properties.

Manufacturers benefit from the Asia Pacific cosmeceuticals market through access to rapidly growing consumer segments with increasing purchasing power and sophistication. Innovation opportunities abound in developing products specifically tailored to Asian skin types, environmental conditions, and cultural preferences. The market’s premium positioning enables higher profit margins compared to conventional cosmetics.

Retailers and distributors gain from strong consumer demand and high product turnover rates in cosmeceutical categories. Professional channels benefit from the credibility and efficacy positioning of cosmeceutical products, enabling premium pricing and customer loyalty. E-commerce platforms capitalize on the research-intensive nature of cosmeceutical purchases and the importance of detailed product information.

Healthcare professionals including dermatologists and aestheticians benefit from cosmeceutical products that complement clinical treatments and provide ongoing patient care solutions. Professional recommendations carry significant weight in consumer purchase decisions, creating partnership opportunities with manufacturers.

Consumers receive scientifically-backed skincare solutions that deliver measurable results and address specific skin concerns. Product efficacy and safety profiles provide confidence in investment in premium skincare regimens. The availability of professional guidance and support enhances the overall consumer experience and treatment outcomes.

Investors and stakeholders benefit from the market’s strong growth trajectory and resilience to economic fluctuations. Innovation potential and expanding market opportunities create attractive investment prospects across the cosmeceutical value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution is transforming the cosmeceuticals landscape through AI-powered skin analysis, genetic testing, and customized formulation services. Technology integration enables brands to offer tailored solutions based on individual skin profiles, environmental factors, and lifestyle considerations. This trend is driving premium pricing and enhanced customer loyalty through personalized experiences.

Clean beauty movement continues gaining momentum, with consumers demanding transparency in ingredient sourcing, formulation processes, and environmental impact. Natural and organic ingredients are increasingly incorporated into cosmeceutical formulations, requiring innovative approaches to maintain product efficacy while meeting clean beauty standards.

K-beauty and J-beauty influence extends beyond product formulations to encompass skincare routines, ingredient innovations, and beauty philosophies. Multi-step skincare regimens and specialized products for specific skin concerns reflect this cultural influence on global cosmeceutical trends.

Professional-grade home treatments are bridging the gap between clinical procedures and daily skincare routines. Advanced delivery systems and potent active ingredients previously available only in professional settings are becoming accessible for home use, creating new market opportunities.

Sustainability focus encompasses packaging innovations, carbon footprint reduction, and ethical sourcing practices. Refillable packaging and concentrated formulations address environmental concerns while maintaining product performance and consumer convenience.

Strategic acquisitions and partnerships are reshaping the competitive landscape, with major corporations acquiring innovative smaller brands to expand their cosmeceutical portfolios. Technology partnerships between beauty companies and tech firms are accelerating innovation in personalized skincare and digital customer engagement platforms.

Regulatory developments across Asia Pacific countries are creating more standardized frameworks for cosmeceutical products, facilitating market entry and product development. Ingredient approvals for new active compounds are expanding formulation possibilities and driving innovation in product efficacy.

Research breakthroughs in dermatological science and cosmetic chemistry are enabling new approaches to skin aging, pigmentation, and barrier function. Clinical validation of cosmeceutical efficacy through rigorous testing protocols is enhancing product credibility and professional acceptance.

Distribution channel evolution includes the emergence of beauty-focused e-commerce platforms, subscription services, and virtual consultation capabilities. Omnichannel strategies integrate online and offline touchpoints to create seamless customer experiences and drive sales growth.

Manufacturing innovations in sustainable production processes, quality control systems, and supply chain optimization are improving operational efficiency and product consistency. Local manufacturing initiatives in key markets are reducing costs and improving supply chain resilience.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and competitive dynamics in target Asia Pacific markets. MarkWide Research analysis indicates that successful market penetration requires significant investment in consumer education, professional channel development, and digital marketing capabilities.

Product development focus should emphasize efficacy validation, safety testing, and formulation optimization for Asian skin types and environmental conditions. Innovation investments in personalization technologies, sustainable formulations, and advanced delivery systems will drive competitive differentiation and market success.

Distribution strategy optimization should leverage multiple channels including professional partnerships, premium retail placement, and e-commerce platforms. Digital marketing capabilities are essential for reaching target demographics and building brand awareness in increasingly competitive markets.

Regulatory compliance requires dedicated resources and expertise to navigate diverse requirements across Asia Pacific countries. Quality assurance systems and clinical validation protocols are essential for maintaining product integrity and consumer confidence.

Partnership opportunities with local distributors, professional practitioners, and technology providers can accelerate market entry and growth. Strategic alliances enable access to local market knowledge, distribution networks, and regulatory expertise while sharing investment risks and operational complexities.

Long-term growth prospects for the Asia Pacific cosmeceuticals market remain exceptionally positive, with continued expansion expected across all major market segments. Demographic trends including aging populations in developed markets and rising middle classes in emerging economies will sustain demand growth. The market is projected to maintain robust growth rates of 7-9% annually over the next decade.

Technology integration will accelerate, with artificial intelligence, augmented reality, and biotechnology playing increasingly important roles in product development, customer engagement, and personalization services. Digital transformation will continue reshaping how consumers discover, evaluate, and purchase cosmeceutical products.

Innovation trajectories point toward more sophisticated formulations incorporating nanotechnology, bioengineered ingredients, and precision delivery systems. Personalization capabilities will become standard offerings, with brands providing customized solutions based on genetic profiles, environmental factors, and lifestyle considerations.

Market consolidation is expected to continue, with larger corporations acquiring innovative smaller brands and technology companies to enhance their competitive positioning. Cross-border expansion will accelerate as regulatory harmonization efforts progress and digital platforms facilitate international market access.

Sustainability requirements will become increasingly important, driving innovation in packaging, formulation, and manufacturing processes. Consumer expectations for transparency, efficacy, and environmental responsibility will continue shaping product development and marketing strategies across the cosmeceutical industry.

The Asia Pacific cosmeceuticals market represents one of the most dynamic and promising segments within the global beauty industry, characterized by robust growth, continuous innovation, and evolving consumer sophistication. Market fundamentals remain strong, supported by favorable demographic trends, rising disposable incomes, and increasing awareness of skin health and preventive care across the region.

Strategic opportunities abound for companies willing to invest in understanding local market dynamics, regulatory requirements, and consumer preferences. The successful navigation of this complex but rewarding market requires comprehensive strategies encompassing product innovation, distribution optimization, digital engagement, and professional partnerships. MWR analysis indicates that companies with strong research capabilities, flexible market approaches, and commitment to quality and efficacy will thrive in this competitive environment.

The future of the Asia Pacific cosmeceuticals market will be shaped by technological advancement, personalization trends, sustainability requirements, and continued consumer education about the benefits of scientifically-backed skincare solutions. Companies that can successfully balance innovation with accessibility, efficacy with safety, and global expertise with local relevance will capture the substantial growth opportunities this market presents.

What is Cosmeceuticals?

Cosmeceuticals are products that blend cosmetic and pharmaceutical properties, often used for skin care, anti-aging, and therapeutic benefits. They typically contain active ingredients that provide more than just aesthetic benefits, targeting specific skin concerns.

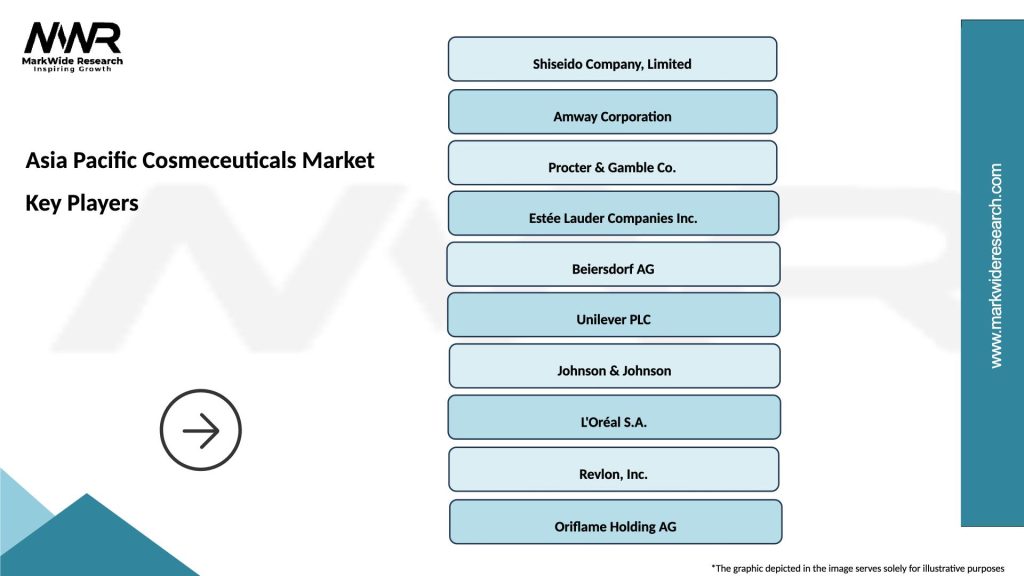

What are the key players in the Asia Pacific Cosmeceuticals Market?

Key players in the Asia Pacific Cosmeceuticals Market include companies like L’Oréal, Estée Lauder, Shiseido, and Amway, which are known for their innovative product offerings and strong market presence, among others.

What are the main drivers of growth in the Asia Pacific Cosmeceuticals Market?

The growth of the Asia Pacific Cosmeceuticals Market is driven by increasing consumer awareness of skin health, rising demand for anti-aging products, and the growing trend of natural and organic ingredients in personal care products.

What challenges does the Asia Pacific Cosmeceuticals Market face?

Challenges in the Asia Pacific Cosmeceuticals Market include regulatory hurdles, the need for extensive research and development, and competition from traditional cosmetics that may not require the same level of scrutiny.

What opportunities exist in the Asia Pacific Cosmeceuticals Market?

Opportunities in the Asia Pacific Cosmeceuticals Market include the expansion of e-commerce platforms, increasing investment in research for innovative formulations, and the rising popularity of personalized skincare solutions.

What trends are shaping the Asia Pacific Cosmeceuticals Market?

Trends in the Asia Pacific Cosmeceuticals Market include the growing focus on sustainability, the incorporation of biotechnology in product development, and the increasing popularity of multifunctional products that cater to diverse consumer needs.

Asia Pacific Cosmeceuticals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skin Care, Hair Care, Oral Care, Nail Care |

| Application | Anti-Aging, Skin Brightening, Acne Treatment, Moisturizing |

| End User | Women, Men, Teens, Professionals |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Cosmeceuticals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at