444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific continuous glucose monitoring (CGM) market represents one of the most dynamic and rapidly expanding segments within the global healthcare technology landscape. This sophisticated medical device market encompasses advanced glucose monitoring systems that provide real-time glucose level readings for individuals managing diabetes and other glucose-related conditions. The region’s market demonstrates exceptional growth potential, driven by increasing diabetes prevalence, rising healthcare awareness, and technological advancements in medical device manufacturing.

Market dynamics in the Asia Pacific region reflect a compelling combination of demographic trends, economic development, and healthcare infrastructure improvements. Countries such as China, Japan, India, South Korea, and Australia are experiencing significant adoption rates of continuous glucose monitoring technologies, with growth rates reaching 12.5% CAGR across key market segments. The region’s diverse healthcare systems and varying regulatory environments create unique opportunities for market expansion and product innovation.

Healthcare digitization trends across Asia Pacific nations are accelerating the integration of continuous glucose monitoring systems into routine diabetes management protocols. The market benefits from increasing government healthcare investments, growing middle-class populations with enhanced purchasing power, and expanding insurance coverage for diabetes management technologies. Regional manufacturers and international companies are establishing strategic partnerships to capitalize on the market’s substantial growth trajectory.

The Asia Pacific continuous glucose monitoring market refers to the comprehensive ecosystem of medical devices, technologies, and services that enable continuous, real-time monitoring of glucose levels in blood or interstitial fluid across the Asia Pacific region. These sophisticated systems utilize advanced sensor technology, wireless connectivity, and data analytics to provide patients and healthcare providers with actionable insights for diabetes management and glucose control optimization.

CGM systems consist of several integrated components including glucose sensors, transmitters, receivers or smartphone applications, and data management platforms. The technology enables users to track glucose trends, receive alerts for dangerous glucose levels, and make informed decisions about insulin administration, dietary choices, and lifestyle modifications. This market encompasses both prescription-based medical devices and emerging over-the-counter glucose monitoring solutions.

Regional market characteristics include diverse regulatory frameworks, varying healthcare reimbursement policies, and distinct cultural approaches to diabetes management. The Asia Pacific CGM market serves multiple stakeholder groups including diabetes patients, healthcare providers, hospitals, clinics, and home healthcare services, creating a complex but lucrative market environment with significant growth opportunities.

Strategic market analysis reveals that the Asia Pacific continuous glucose monitoring market is positioned for exceptional growth driven by demographic shifts, technological innovation, and healthcare system modernization. The region’s large diabetic population, estimated at over 160 million individuals, creates substantial demand for advanced glucose monitoring solutions that improve patient outcomes and reduce healthcare costs.

Key market drivers include rising diabetes prevalence rates of 8.2% annually across major Asia Pacific countries, increasing healthcare spending, and growing adoption of digital health technologies. Government initiatives promoting diabetes awareness and prevention, combined with expanding healthcare infrastructure, are creating favorable market conditions for CGM technology deployment and widespread adoption.

Competitive landscape dynamics feature a mix of established international medical device companies and emerging regional manufacturers developing innovative, cost-effective glucose monitoring solutions. Market leaders are focusing on product localization, strategic partnerships with healthcare providers, and development of culturally appropriate diabetes management programs to capture market share in diverse Asia Pacific markets.

Future market projections indicate sustained growth momentum with expanding applications beyond traditional diabetes management, including pre-diabetes monitoring, gestational diabetes management, and wellness applications for health-conscious consumers seeking proactive glucose management solutions.

Market intelligence from comprehensive regional analysis reveals several critical insights shaping the Asia Pacific continuous glucose monitoring landscape:

Market segmentation analysis indicates that real-time CGM systems dominate the market, while flash glucose monitoring systems are gaining traction among cost-conscious consumers seeking affordable diabetes management solutions.

Diabetes prevalence escalation serves as the primary market driver, with the Asia Pacific region experiencing the world’s highest concentration of diabetic individuals. Countries like China and India account for significant portions of the global diabetic population, creating enormous demand for effective glucose monitoring solutions that enable better disease management and complication prevention.

Healthcare system modernization across the region is accelerating adoption of digital health technologies, including continuous glucose monitoring systems. Government initiatives promoting preventive healthcare, telemedicine integration, and chronic disease management are creating supportive policy environments that encourage CGM technology deployment in clinical and home settings.

Technological advancement in sensor accuracy, device miniaturization, and smartphone integration is making CGM systems more accessible and user-friendly for diverse patient populations. Improvements in sensor longevity, calibration requirements, and data analytics capabilities are enhancing the value proposition for both patients and healthcare providers.

Economic development in emerging Asia Pacific markets is expanding the middle-class population with sufficient purchasing power to invest in premium healthcare technologies. Rising healthcare expenditure, improved insurance coverage, and growing awareness of diabetes complications are driving market demand for continuous glucose monitoring solutions.

Healthcare provider adoption is increasing as clinical evidence demonstrates the effectiveness of CGM systems in improving patient outcomes, reducing hospitalizations, and optimizing treatment protocols. Medical professionals are increasingly recommending continuous monitoring for patients with complex diabetes management needs.

Cost considerations remain a significant barrier to widespread CGM adoption, particularly in price-sensitive markets where patients must bear substantial out-of-pocket expenses for devices and ongoing sensor replacements. Limited insurance reimbursement coverage in many Asia Pacific countries restricts access to continuous glucose monitoring technologies for middle and lower-income patient populations.

Regulatory complexity across diverse Asia Pacific markets creates challenges for manufacturers seeking regional expansion. Varying approval processes, clinical trial requirements, and quality standards necessitate significant investments in regulatory compliance and market-specific product modifications that can delay market entry and increase costs.

Healthcare infrastructure limitations in rural and remote areas of developing countries restrict access to CGM technologies and supporting healthcare services. Limited internet connectivity, inadequate healthcare provider training, and insufficient technical support networks hinder effective deployment and utilization of continuous glucose monitoring systems.

Cultural barriers and traditional healthcare practices in some regions may limit acceptance of advanced medical technologies. Patient preferences for conventional glucose monitoring methods, concerns about device reliability, and resistance to lifestyle changes required for effective CGM utilization can slow market adoption rates.

Technical challenges including sensor accuracy variations, calibration requirements, and device compatibility issues may impact user experience and clinical effectiveness. Data privacy concerns and cybersecurity risks associated with connected medical devices also create hesitation among some patients and healthcare providers.

Emerging market expansion presents substantial opportunities as developing Asia Pacific countries invest in healthcare infrastructure modernization and diabetes prevention programs. Countries like Vietnam, Thailand, and Indonesia offer significant growth potential as economic development increases healthcare spending and diabetes awareness among growing populations.

Technology integration opportunities exist for combining CGM systems with artificial intelligence, machine learning, and predictive analytics to create comprehensive diabetes management platforms. Integration with telemedicine services, electronic health records, and mobile health applications can enhance value propositions and create new revenue streams.

Product innovation potential includes development of non-invasive glucose monitoring technologies, extended sensor wear time, and specialized solutions for pediatric and geriatric populations. Customization for regional preferences, local language support, and culturally appropriate design elements can differentiate products in competitive markets.

Partnership opportunities with local healthcare providers, pharmaceutical companies, and technology firms can accelerate market penetration and reduce entry barriers. Collaborative approaches to product development, distribution, and patient education can create sustainable competitive advantages in diverse regional markets.

Government initiative alignment with national diabetes prevention and management programs creates opportunities for public-private partnerships, bulk procurement contracts, and subsidized patient access programs that can drive large-scale CGM adoption across the region.

Supply chain dynamics in the Asia Pacific CGM market reflect a complex interplay of global manufacturing capabilities, regional distribution networks, and local regulatory requirements. Major device manufacturers are establishing regional production facilities to reduce costs, improve supply chain resilience, and enhance responsiveness to local market demands.

Competitive dynamics feature intense rivalry between established international brands and emerging regional players developing innovative, cost-effective solutions. Market leaders are investing heavily in research and development, strategic acquisitions, and partnership formation to maintain competitive positions in rapidly evolving market segments.

Demand dynamics are influenced by demographic trends, healthcare policy changes, and economic conditions across diverse Asia Pacific markets. Patient adoption rates vary significantly between countries, with developed markets showing 45% higher penetration rates compared to emerging economies, creating opportunities for targeted market development strategies.

Innovation dynamics drive continuous product improvement and feature enhancement as manufacturers respond to evolving patient needs and clinical requirements. According to MarkWide Research analysis, technological advancement cycles are accelerating, with new product introductions occurring at 18-month intervals compared to previous 24-month cycles.

Regulatory dynamics continue evolving as governments balance patient safety requirements with innovation promotion and market access facilitation. Harmonization efforts across regional regulatory frameworks are gradually reducing compliance complexity and accelerating product approval timelines.

Comprehensive market research methodology employed for this analysis incorporates multiple data collection and validation approaches to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with key industry stakeholders, healthcare providers, and patient advocacy groups across major Asia Pacific markets.

Secondary research components encompass analysis of government healthcare statistics, regulatory filings, company financial reports, and clinical research publications. Industry databases, trade association reports, and healthcare policy documents provide additional context for market trend identification and validation.

Data triangulation methods combine quantitative market sizing models with qualitative trend analysis to develop comprehensive market understanding. Cross-validation of findings through multiple independent sources ensures research reliability and reduces potential bias in market projections and competitive assessments.

Regional market analysis utilizes country-specific research approaches that account for local healthcare systems, cultural factors, and economic conditions. Expert interviews with regional healthcare professionals and industry executives provide insights into market dynamics that may not be apparent through secondary research alone.

Forecasting methodologies employ statistical modeling techniques that incorporate historical market data, demographic projections, and healthcare spending trends to develop realistic growth scenarios and market opportunity assessments for strategic planning purposes.

China market dynamics represent the largest opportunity within the Asia Pacific region, driven by massive diabetic population, government healthcare initiatives, and rapidly expanding middle class. The market demonstrates strong growth potential with 15.2% annual growth rates in major urban centers, supported by increasing healthcare digitization and telemedicine adoption.

Japan market characteristics reflect mature healthcare infrastructure, aging population demographics, and high technology adoption rates. Premium CGM systems gain significant traction among tech-savvy consumers, while healthcare providers increasingly integrate continuous monitoring into standard diabetes care protocols.

India market potential showcases enormous growth opportunities despite current infrastructure limitations. Rising diabetes prevalence, expanding healthcare access, and growing awareness of preventive care create favorable conditions for CGM market development, particularly in urban and semi-urban areas.

South Korea advancement demonstrates rapid market maturation with strong government support for digital health initiatives and high smartphone penetration rates facilitating CGM technology adoption. The market benefits from advanced healthcare infrastructure and favorable reimbursement policies.

Australia and New Zealand markets exhibit high adoption rates and mature regulatory frameworks that support innovation and patient access. These markets serve as testing grounds for new technologies and regulatory approaches that may be replicated across the broader Asia Pacific region.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia present diverse opportunities with varying healthcare development levels and economic conditions. Market penetration rates currently reach 12% in developed areas with significant expansion potential as healthcare infrastructure improves.

Market leadership in the Asia Pacific CGM market is characterized by intense competition between established global medical device companies and innovative regional manufacturers developing specialized solutions for local markets.

Competitive strategies focus on product innovation, strategic partnerships with healthcare providers, and development of cost-effective solutions tailored to regional market requirements. Companies are investing in local manufacturing capabilities, regulatory expertise, and distribution networks to capture market share in high-growth segments.

Market differentiation occurs through sensor accuracy improvements, extended wear time, smartphone integration capabilities, and comprehensive diabetes management platforms that combine monitoring with treatment optimization and patient education components.

By Product Type:

By Component:

By End User:

By Demographics:

Real-time CGM category dominates the market with advanced features including continuous glucose readings, customizable alerts, and comprehensive trend analysis capabilities. This segment attracts patients requiring intensive glucose management and healthcare providers seeking detailed patient monitoring data for treatment optimization.

Flash glucose monitoring segment demonstrates rapid growth among cost-conscious consumers seeking affordable alternatives to traditional blood glucose testing. The category appeals to patients preferring on-demand glucose checking without continuous monitoring requirements, particularly in emerging markets with price sensitivity.

Sensor technology categories vary significantly in accuracy, wear time, and calibration requirements. Advanced sensors offering 14-day wear time and factory calibration are gaining market preference, while emerging non-invasive technologies represent future growth opportunities with potential for broader market adoption.

Integration categories combining CGM with insulin delivery systems, smartphone applications, and telemedicine platforms create comprehensive diabetes management ecosystems. These integrated solutions demonstrate superior patient outcomes and healthcare provider satisfaction compared to standalone monitoring devices.

Demographic categories require specialized product features and marketing approaches. Pediatric CGM systems emphasize safety, durability, and parent-friendly interfaces, while geriatric solutions focus on simplicity, large displays, and minimal technical complexity for effective utilization by elderly patients.

Patient benefits from continuous glucose monitoring include improved glucose control, reduced hypoglycemic episodes, enhanced quality of life, and decreased long-term diabetes complications. Patients gain valuable insights into glucose patterns, dietary impacts, and lifestyle factors affecting their diabetes management effectiveness.

Healthcare provider advantages encompass enhanced patient monitoring capabilities, improved treatment decision-making, reduced clinic visits, and better patient engagement in diabetes self-management. CGM data enables personalized treatment optimization and proactive intervention to prevent diabetes-related complications.

Healthcare system benefits include reduced hospitalization rates, decreased emergency department visits, improved resource allocation, and enhanced chronic disease management efficiency. MWR data indicates that comprehensive CGM programs can reduce diabetes-related healthcare costs by 23% annually through improved patient outcomes.

Industry participant opportunities feature expanding market demand, recurring revenue from sensor replacements, partnership potential with healthcare providers, and innovation opportunities in adjacent market segments including pre-diabetes monitoring and wellness applications.

Economic stakeholder benefits include job creation in manufacturing and healthcare services, reduced healthcare expenditure burden, improved population health outcomes, and enhanced competitiveness in medical technology sectors across Asia Pacific markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend as CGM systems incorporate machine learning algorithms for predictive glucose forecasting, personalized treatment recommendations, and automated insulin delivery optimization. AI-powered analytics enhance clinical decision-making and patient self-management capabilities.

Smartphone connectivity expansion continues driving market growth as manufacturers develop comprehensive mobile applications offering glucose data visualization, trend analysis, and healthcare provider communication features. Mobile integration improves patient engagement and treatment adherence rates significantly.

Non-invasive technology development emerges as a key innovation trend with companies investing in optical, electromagnetic, and other sensing technologies that eliminate needle-based glucose monitoring. These breakthrough technologies could dramatically expand market accessibility and patient acceptance.

Telemedicine integration accelerates as healthcare systems embrace remote patient monitoring and virtual care delivery models. CGM systems increasingly connect with telemedicine platforms, enabling remote diabetes management and reducing healthcare system burden.

Personalized medicine approaches utilize CGM data for individualized treatment protocols, dietary recommendations, and lifestyle interventions. Advanced analytics identify patient-specific glucose patterns and optimize treatment strategies for improved outcomes.

Wellness market expansion extends CGM applications beyond diabetes management to include fitness monitoring, dietary optimization, and general health awareness among non-diabetic consumers seeking proactive health management tools.

Regulatory milestone achievements include streamlined approval processes in major Asia Pacific markets, enabling faster product launches and reduced time-to-market for innovative CGM technologies. Regulatory harmonization efforts facilitate multi-country product registration and market expansion strategies.

Strategic partnership formations between international CGM manufacturers and regional healthcare providers create comprehensive diabetes management programs combining technology deployment with clinical support services. These partnerships enhance market penetration and patient access to advanced monitoring solutions.

Manufacturing capacity expansion across the region reduces supply chain dependencies and improves cost competitiveness for CGM systems. Local production facilities enable customization for regional preferences and regulatory requirements while reducing product costs.

Clinical evidence generation through large-scale studies demonstrates CGM effectiveness in diverse Asia Pacific populations, supporting reimbursement approval and healthcare provider adoption. Real-world evidence validates technology benefits and drives policy support for expanded patient access.

Technology breakthrough announcements include next-generation sensors with improved accuracy, extended wear time, and reduced calibration requirements. Innovation in sensor materials, wireless connectivity, and data analytics capabilities enhances product value propositions.

Market consolidation activities feature strategic acquisitions and mergers as companies seek to expand regional presence, acquire innovative technologies, and strengthen competitive positions in high-growth market segments.

Market entry strategies should prioritize partnership development with established healthcare providers and distribution networks to accelerate market penetration and reduce entry barriers. Companies should invest in local regulatory expertise and cultural adaptation to navigate diverse Asia Pacific markets effectively.

Product development focus should emphasize cost-effective solutions tailored to regional economic conditions while maintaining clinical effectiveness and user experience quality. Developing tiered product portfolios can address diverse market segments from premium to value-conscious consumers.

Investment priorities should include manufacturing localization, regulatory compliance capabilities, and customer education programs that build market awareness and drive adoption among healthcare providers and patients. Long-term success requires sustained commitment to market development and relationship building.

Innovation opportunities exist in non-invasive monitoring technologies, AI-powered analytics, and integrated diabetes management platforms that combine monitoring with treatment optimization and patient support services. Companies should explore adjacent market applications beyond traditional diabetes management.

Risk mitigation strategies should address regulatory complexity through expert partnerships, economic uncertainty through flexible pricing models, and competition through differentiated value propositions and strong customer relationships. Diversification across multiple markets reduces concentration risk.

Long-term market projections indicate sustained growth momentum driven by demographic trends, technology advancement, and healthcare system evolution across the Asia Pacific region. The market is expected to maintain robust growth rates exceeding 11% CAGR through the next decade as diabetes prevalence continues rising and healthcare infrastructure expands.

Technology evolution will likely focus on non-invasive monitoring solutions, artificial intelligence integration, and comprehensive diabetes management platforms that combine monitoring with treatment optimization and patient education. MarkWide Research projects that next-generation CGM systems will achieve 95% accuracy rates while reducing costs by 40% compared to current technologies.

Market expansion patterns will extend beyond traditional diabetes management into pre-diabetes monitoring, gestational diabetes care, and wellness applications for health-conscious consumers. Adjacent market opportunities could represent 25% of total market potential within the next five years.

Healthcare integration will deepen as CGM systems become standard components of diabetes care protocols, telemedicine platforms, and electronic health record systems. Integration with healthcare infrastructure will drive sustained demand and improve patient outcomes across the region.

Competitive landscape evolution will feature increased collaboration between technology companies, healthcare providers, and government agencies to develop comprehensive diabetes management ecosystems. Market consolidation may accelerate as companies seek scale advantages and technological capabilities to compete effectively in mature market segments.

The Asia Pacific continuous glucose monitoring market represents an exceptional growth opportunity driven by compelling demographic trends, technological innovation, and healthcare system modernization across the region. With diabetes prevalence continuing to rise and healthcare infrastructure expanding rapidly, the market is positioned for sustained growth that will benefit patients, healthcare providers, and industry participants alike.

Strategic market dynamics favor companies that can successfully navigate regulatory complexity, develop cost-effective solutions, and build strong partnerships with healthcare stakeholders. The combination of large addressable markets, supportive government policies, and advancing technology creates favorable conditions for market expansion and innovation.

Future success in this dynamic market will require sustained investment in product development, regulatory compliance, and market education to build awareness and drive adoption among diverse patient populations. Companies that can effectively balance innovation with affordability while maintaining clinical effectiveness will capture significant market share in this rapidly evolving healthcare technology segment.

What is Continuous Glucose Monitoring (CGM)?

Continuous Glucose Monitoring (CGM) refers to a method of tracking glucose levels in real-time using a small sensor placed under the skin. This technology is primarily used by individuals with diabetes to manage their blood sugar levels effectively.

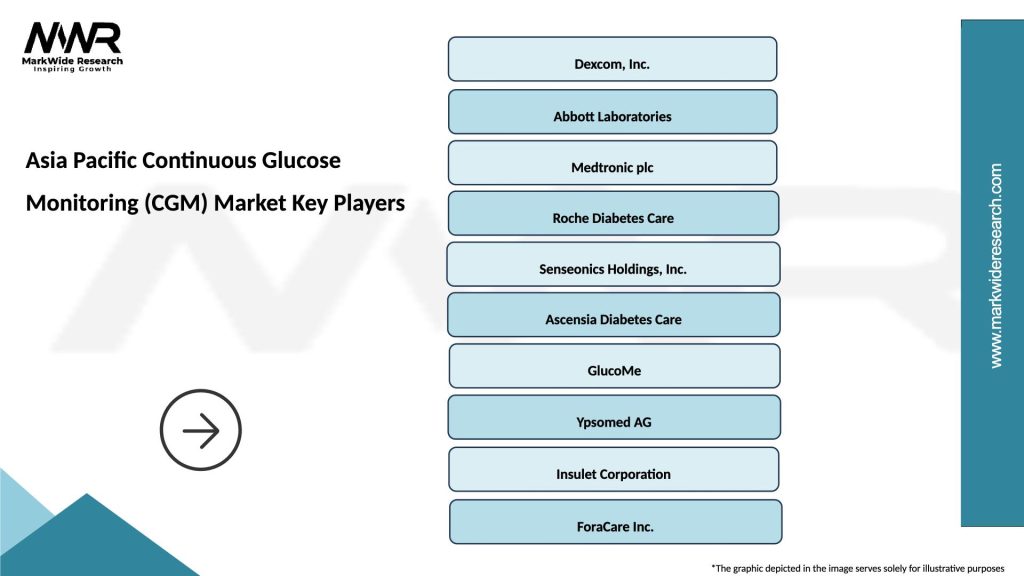

What are the key players in the Asia Pacific Continuous Glucose Monitoring (CGM) Market?

Key players in the Asia Pacific Continuous Glucose Monitoring (CGM) Market include Abbott Laboratories, Dexcom, Medtronic, and Roche, among others.

What are the growth factors driving the Asia Pacific Continuous Glucose Monitoring (CGM) Market?

The growth of the Asia Pacific Continuous Glucose Monitoring (CGM) Market is driven by the increasing prevalence of diabetes, advancements in CGM technology, and rising awareness about diabetes management among patients.

What challenges does the Asia Pacific Continuous Glucose Monitoring (CGM) Market face?

Challenges in the Asia Pacific Continuous Glucose Monitoring (CGM) Market include high costs of devices, limited reimbursement policies, and the need for user training to effectively utilize CGM systems.

What opportunities exist in the Asia Pacific Continuous Glucose Monitoring (CGM) Market?

Opportunities in the Asia Pacific Continuous Glucose Monitoring (CGM) Market include the development of innovative CGM technologies, increasing government initiatives to support diabetes care, and expanding distribution networks for better accessibility.

What trends are shaping the Asia Pacific Continuous Glucose Monitoring (CGM) Market?

Trends in the Asia Pacific Continuous Glucose Monitoring (CGM) Market include the integration of CGM with mobile health applications, the rise of personalized medicine, and the growing demand for non-invasive glucose monitoring solutions.

Asia Pacific Continuous Glucose Monitoring (CGM) Market

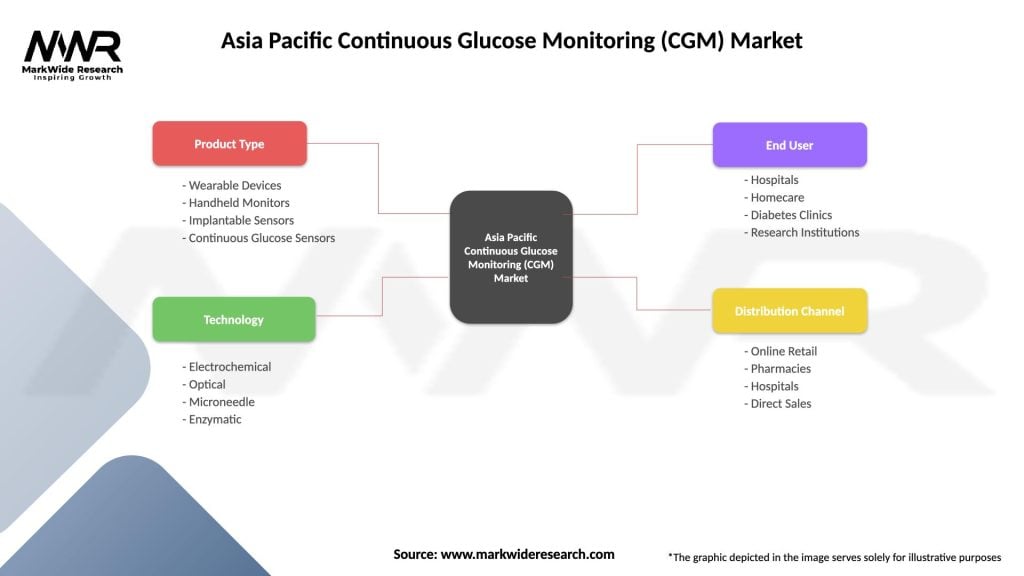

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Handheld Monitors, Implantable Sensors, Continuous Glucose Sensors |

| Technology | Electrochemical, Optical, Microneedle, Enzymatic |

| End User | Hospitals, Homecare, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Continuous Glucose Monitoring (CGM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at