444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia Pacific Cloud Infrastructure Testing Services market is experiencing significant growth and is expected to continue its upward trajectory in the coming years. With the rapid adoption of cloud computing solutions across various industries, the demand for robust and reliable cloud infrastructure testing services has surged.

Meaning

Cloud infrastructure testing services refer to the process of evaluating and validating the performance, security, scalability, and reliability of cloud-based infrastructure components. These services are crucial for organizations as they ensure that their cloud environments are optimized and capable of handling peak workloads while maintaining data integrity and availability.

Executive Summary

The Asia Pacific Cloud Infrastructure Testing Services market has witnessed substantial growth due to the increasing reliance on cloud computing technologies. Organizations are increasingly migrating their applications and data to the cloud to leverage its scalability, cost-effectiveness, and flexibility. This has created a need for comprehensive testing services to validate the performance and security of cloud infrastructure.

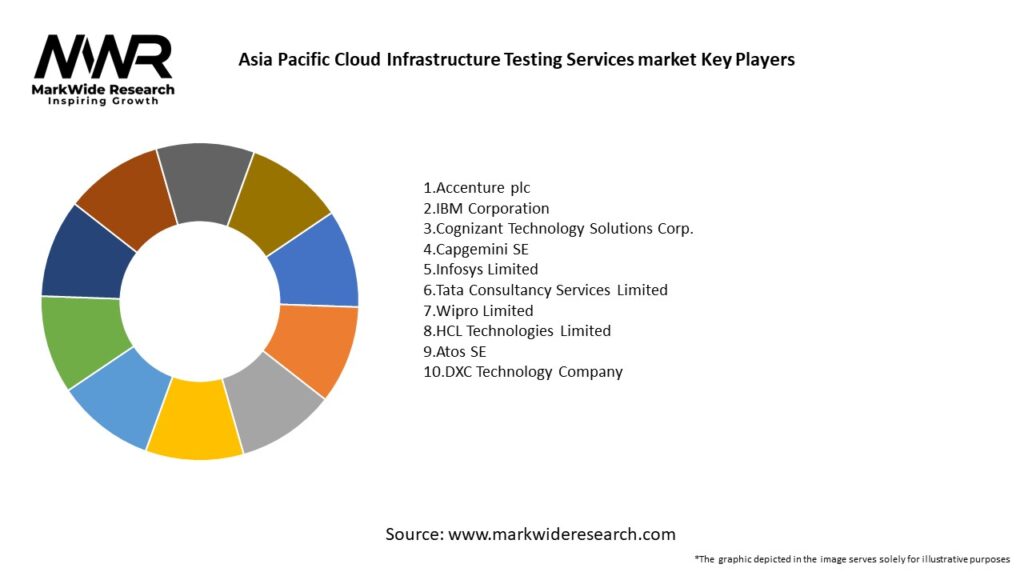

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Rapid Cloud Adoption: Over 70% of enterprises in Asia Pacific plan to move at least half of their workloads to the cloud by 2026, driving demand for end-to-end infrastructure testing services.

Security & Compliance Focus: With stringent data-protection laws in APAC (e.g., India’s PDPB, Australia’s Notifiable Data Breaches scheme), vulnerability assessments and compliance testing are among the fastest-growing service lines.

Automation & AI Integration: More than 60% of providers have integrated AI/ML into test orchestration platforms, accelerating test-case generation, anomaly detection, and root-cause analysis.

Multi-Cloud Complexity: Over 50% of large enterprises in the region operate in multi-cloud or hybrid environments, necessitating cross-platform interoperability testing and governance validation.

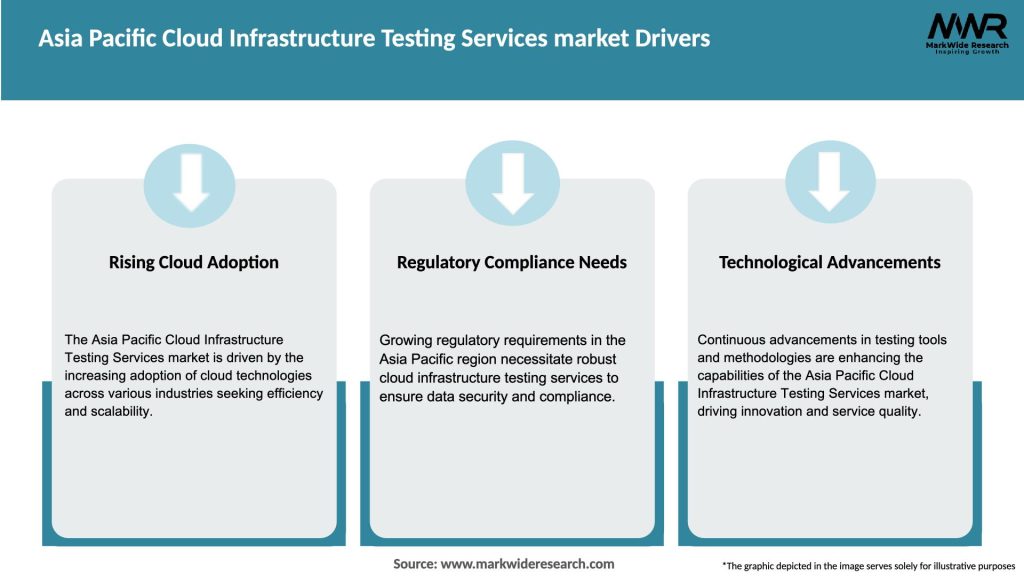

Market Drivers

Digital Transformation Initiatives: Governments and enterprises in China, India, Southeast Asia, and Australia are investing heavily in cloud-first strategies to modernize legacy systems and enhance service delivery.

Regulatory & Security Requirements: Compliance with industry-specific regulations (e.g., APAC financial services standards, healthcare privacy rules) demands rigorous security testing and continuous compliance validation.

DevOps & Shift-Left Testing: The rise of DevSecOps practices pushes testing earlier into development cycles, requiring infrastructure testing services that integrate seamlessly with CI/CD pipelines.

Performance & Reliability Expectations: Consumer-facing applications (e-commerce, digital payments) require near-zero downtime; load, stress, and chaos-engineering testing ensure resilience under peak traffic.

Edge & IoT Deployments: As 5G rollouts enable edge computing, testing of distributed microservices, low-latency networks, and device-to-cloud interactions becomes critical to application performance and security.

Market Restraints

Skill Shortages: Limited availability of cloud-native testing engineers and DevSecOps specialists in certain APAC markets slows adoption and project delivery.

Legacy System Integration: Many enterprises maintain hybrid environments with on-premises systems that complicate end-to-end testing and toolchain standardization.

Toolchain Fragmentation: Proliferation of testing frameworks and cloud provider-specific tools introduces complexity in selecting and integrating optimal testing solutions.

Budget Constraints: Small and medium enterprises (SMEs) may lack the budget for comprehensive testing as they prioritize migration costs and subscription fees.

Data Sovereignty Concerns: Cross-border data flow restrictions in countries like China and Indonesia hinder centralized testing platforms and necessitate localized testing infrastructure.

Market Opportunities

Managed Testing Services: Outsourcing end-to-end cloud infrastructure testing to managed service providers (MSPs) helps organizations overcome skill gaps and rapidly scale testing capabilities.

Platform-Based Testing Offerings: Cloud-agnostic testing platforms that support AWS, Azure, GCP, and private clouds can capture market share among multi-cloud adopters.

Security Testing as a Service (STaaS): Subscription-based vulnerability and penetration testing services tailored to cloud environments meet ongoing compliance requirements cost-effectively.

Edge Testing Solutions: Specialized testing frameworks for edge nodes and IoT gateways address emerging needs in manufacturing, retail, and smart city projects.

AI-Driven Test Optimization: Continuous investment in AI/ML for predictive test-case prioritization, self-healing test scripts, and automated anomaly detection enhances service differentiation.

Market Dynamics

Consolidation Among Providers: M&A activity is rising as larger IT services firms acquire niche testing specialists to bolster cloud-native and security testing capabilities.

Partnerships with Hyperscalers: Authorized testing partners for AWS, Azure, and Google Cloud gain preferential access to new service previews, fostering co-innovation in testing methodologies.

Shift-Left & Shift-Right Testing: A balanced focus on early integration testing and production monitoring/chaos testing ensures applications remain resilient throughout their lifecycle.

DevSecOps Integration: Testing services increasingly embed security and compliance checks directly into pipelines, aligning with organizational policies and reducing time to remediation.

Pay-As-You-Use Models: Flexible, consumption-based pricing for testing platforms and services aligns with cloud-native economics, lowering entry barriers for SMEs.

Regional Analysis

China: Rapid growth in cloud usage by digital natives and state enterprises fuels demand for localized testing centers and compliance-focused services.

India: A booming IT services sector and government “Digital India” initiatives drive both domestic and export-oriented testing projects, with Bengaluru and Hyderabad as testing hubs.

Southeast Asia: Emerging markets such as Indonesia, Malaysia, and Vietnam prioritize cloud migration for financial inclusion and e-commerce; local testing providers are expanding.

Australia & New Zealand: Mature cloud adoption and stringent privacy laws spur advanced security and compliance testing services, with strong uptake of managed offerings.

Japan & South Korea: High enterprise spending on IoT and edge computing leads to specialized testing for 5G-enabled industrial applications and consumer electronics.

Competitive Landscape

Leading Companies in Asia Pacific Cloud Infrastructure Testing Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

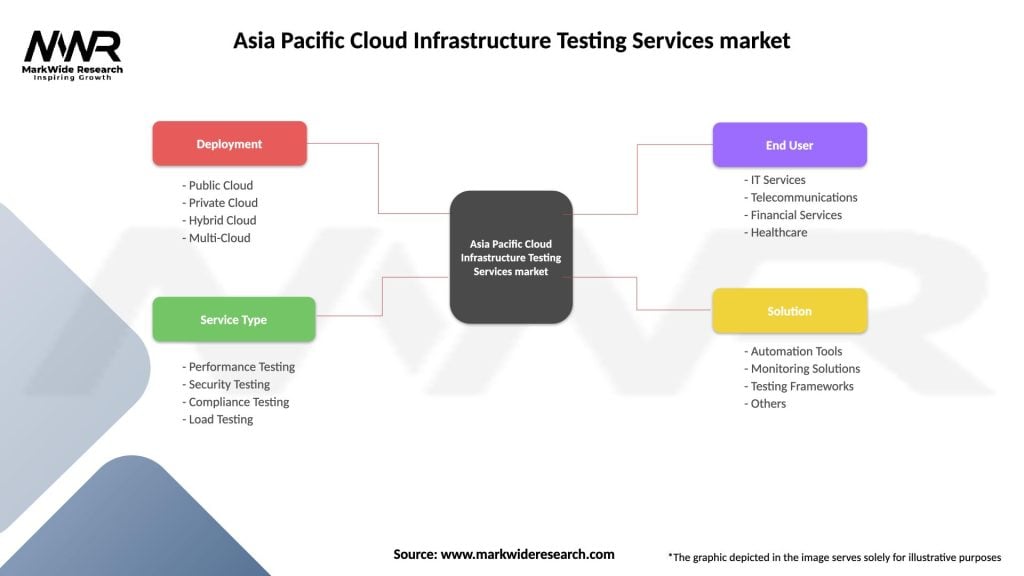

Segmentation

The Asia Pacific Cloud Infrastructure Testing Services market can be segmented based on various parameters such as service type, deployment model, organization size, and vertical. By service type, the market can be categorized into performance testing, security testing, scalability testing, and others. Based on the deployment model, the market can be classified into public cloud, private cloud, and hybrid cloud. Organization size segmentation includes small and medium-sized enterprises (SMEs) and large enterprises.

Category-wise Insights

Functional Testing: Ensures that cloud services and APIs function correctly, with increasing use of AI to generate test scenarios and maintain evolving API contracts.

Performance & Load Testing: Simulates peak traffic and workload spikes, critical for digital-commerce platforms and OTT media services in high-traffic APAC markets.

Security & Vulnerability Testing: Emphasizes container and serverless security scanning, IAM policy validation, and continuous penetration testing to meet regional cybersecurity regulations.

Compliance & Regulatory Testing: Validates adherence to local data-protection laws and industry standards (e.g., PCI DSS for payments, HIPAA for healthcare in NZ/AU).

Disaster Recovery & Resilience Testing: Regular DR drills and failover testing across multi-region cloud deployments ensure business continuity for critical government and financial applications.

Chaos Engineering: Intentional fault-injection practices to uncover hidden failure modes in distributed microservices architectures, gaining traction in APAC’s large e-commerce and fintech firms.

Key Benefits for Industry Participants and Stakeholders

Risk Mitigation: Early identification of performance bottlenecks and security vulnerabilities reduces the risk of costly outages and data breaches.

Faster Time to Market: Automated, integrated testing pipelines accelerate release cycles, supporting agile development and continuous delivery.

Cost Optimization: Identifying inefficiencies in resource usage—through performance and load testing—enables right-sizing of cloud infrastructure, avoiding overprovisioning.

Regulatory Confidence: Demonstrable compliance testing builds trust with regulators and customers, especially in highly regulated sectors like BFSI and healthcare.

Operational Resilience: Ongoing resilience testing and DR validation improve uptime and service reliability, safeguarding reputation and revenue.

SWOT Analysis

Strengths:

Highly distributed delivery models with regional testing centers and global talent pools.

Mature automation tool ecosystems that support major cloud platforms.

Growing emphasis on security and compliance as stand-alone service lines.

Weaknesses:

Skill shortages in advanced cloud-native testing disciplines (e.g., chaos engineering, API security testing).

Fragmented toolchain landscape requiring significant integration effort.

Perception of high testing costs among SMEs.

Opportunities:

Expansion of managed testing services targeting mid-market and SME segments.

Development of pre-built test accelerators and templates for common APAC regulatory frameworks.

Growth in edge-to-cloud testing services for 5G and IoT-driven use cases.

Threats:

Emergence of embedded testing capabilities from major cloud providers reducing third-party testing demand.

Rapid evolution of cloud services outpacing testing tool updates and expertise development.

Economic slowdowns potentially delaying discretionary testing investments.

Market Key Trends

Shift-Left & Shift-Right Convergence: End-to-end testing strategies combining early integration tests with production monitoring and chaos engineering.

AI/ML Test Automation: AI-driven test-case generation, self-healing scripts, and anomaly detection integrated into testing platforms.

Cloud Provider Collaboration: Joint solution offerings by testing vendors and hyperscalers to provide optimized, validated testing toolchains.

Container-Native Testing: Emergence of Kubernetes-aware testing frameworks that validate pod-level performance, network policies, and service meshes.

Testing as Code: Infrastructure-as-code validation tools that test Terraform, CloudFormation, and ARM templates as part of CI pipelines.

Covid-19 Impact

The pandemic accelerated cloud migration and remote work, sharply increasing demand for robust cloud testing services to ensure application resilience and security. Many organizations fast-tracked testing modernization, adopting CI/CD pipelines and remote-friendly testing platforms. While initial budget constraints slowed some projects, overall investment in cloud assurance rebounded strongly in 2021–22, with lasting emphasis on automation and self-service testing.

Key Industry Developments

Launch of Cloud-Native Testing Suites: Major testing vendors unveiled integrated suites supporting serverless, containers, and edge workloads, pre-certified for leading cloud platforms.

Partnerships with Hyperscalers: Companies like Infosys and TCS deepened alliances with AWS, Azure, and Google Cloud to co-develop testing accelerators and frameworks.

Acquisition of Niche Players: Large IT services firms acquired specialized testing boutiques—focused on IoT and chaos engineering—to broaden their cloud-testing portfolios.

Analyst Suggestions

Broaden Managed Offerings: Develop tiered managed testing services—covering basic health checks to full DevSecOps integration—to capture the full spectrum of buyers.

Invest in Skill Development: Establish regional training academies and certifications for cloud-native testing disciplines to address talent shortages.

Enhance SME Accessibility: Introduce consumption-based pricing models and automated self-service portals to engage small and medium enterprises.

Strengthen Toolchain Partnerships: Collaborate with leading CI/CD, security-scanning, and observability platforms to deliver end-to-end, best-of-breed testing solutions.

Future Outlook

The future of the Asia Pacific Cloud Infrastructure Testing Services market looks promising. The increasing adoption of cloud computing technologies, the demand for robust testing services, and the evolving regulatory landscape will continue to drive market growth. The market is expected to witness technological advancements, such as the integration of AI and machine learning in testing processes, as well as the development of standardized testing methodologies, enabling organizations to leverage cloud infrastructure more effectively.

Conclusion

The Asia Pacific Cloud Infrastructure Testing Services market is experiencing rapid growth, driven by the widespread adoption of cloud computing technologies across various industries. The market offers significant opportunities for testing service providers to cater to the increasing demand for performance, security, and scalability testing. By leveraging technological advancements and focusing on innovation, market players can position themselves for success in this dynamic and competitive landscape.

What is Cloud Infrastructure Testing Services?

Cloud Infrastructure Testing Services refer to the processes and methodologies used to evaluate the performance, security, and reliability of cloud infrastructure systems. These services are essential for ensuring that cloud-based applications and services operate efficiently and meet user expectations.

What are the key players in the Asia Pacific Cloud Infrastructure Testing Services market?

Key players in the Asia Pacific Cloud Infrastructure Testing Services market include companies like IBM, Microsoft, and Amazon Web Services. These companies provide a range of testing services that help organizations optimize their cloud infrastructure, among others.

What are the growth factors driving the Asia Pacific Cloud Infrastructure Testing Services market?

The growth of the Asia Pacific Cloud Infrastructure Testing Services market is driven by the increasing adoption of cloud computing, the need for enhanced security measures, and the demand for improved application performance. Additionally, the rise of digital transformation initiatives across various industries is contributing to market expansion.

What challenges does the Asia Pacific Cloud Infrastructure Testing Services market face?

The Asia Pacific Cloud Infrastructure Testing Services market faces challenges such as data privacy concerns, the complexity of cloud environments, and the shortage of skilled professionals. These factors can hinder the effective implementation of testing services and impact overall service quality.

What opportunities exist in the Asia Pacific Cloud Infrastructure Testing Services market?

Opportunities in the Asia Pacific Cloud Infrastructure Testing Services market include the growing demand for automated testing solutions, the expansion of cloud services among small and medium-sized enterprises, and the increasing focus on compliance with regulatory standards. These factors present avenues for innovation and growth.

What trends are shaping the Asia Pacific Cloud Infrastructure Testing Services market?

Trends shaping the Asia Pacific Cloud Infrastructure Testing Services market include the rise of artificial intelligence and machine learning in testing processes, the shift towards DevOps practices, and the increasing emphasis on continuous testing. These trends are enhancing the efficiency and effectiveness of cloud infrastructure testing.

Asia Pacific Cloud Infrastructure Testing Services market

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Service Type | Performance Testing, Security Testing, Compliance Testing, Load Testing |

| End User | IT Services, Telecommunications, Financial Services, Healthcare |

| Solution | Automation Tools, Monitoring Solutions, Testing Frameworks, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Asia Pacific Cloud Infrastructure Testing Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at