444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific chromatography resins market is experiencing significant growth and is expected to continue expanding in the coming years. Chromatography resins are crucial components used in the separation and purification processes in various industries such as pharmaceuticals, biotechnology, food and beverages, and environmental analysis. These resins play a vital role in ensuring the high quality and purity of products.

Meaning

Chromatography resins are solid, porous materials designed to facilitate the separation of different components in a mixture based on their chemical properties. These resins possess unique surface properties that enable the selective adsorption or binding of specific molecules, allowing for their isolation or purification.

Executive Summary

The Asia-Pacific chromatography resins market is poised for substantial growth due to the rising demand for high-quality products in industries such as pharmaceuticals and biotechnology. The market is driven by advancements in chromatography techniques, increasing investments in research and development, and the growing need for efficient purification processes.

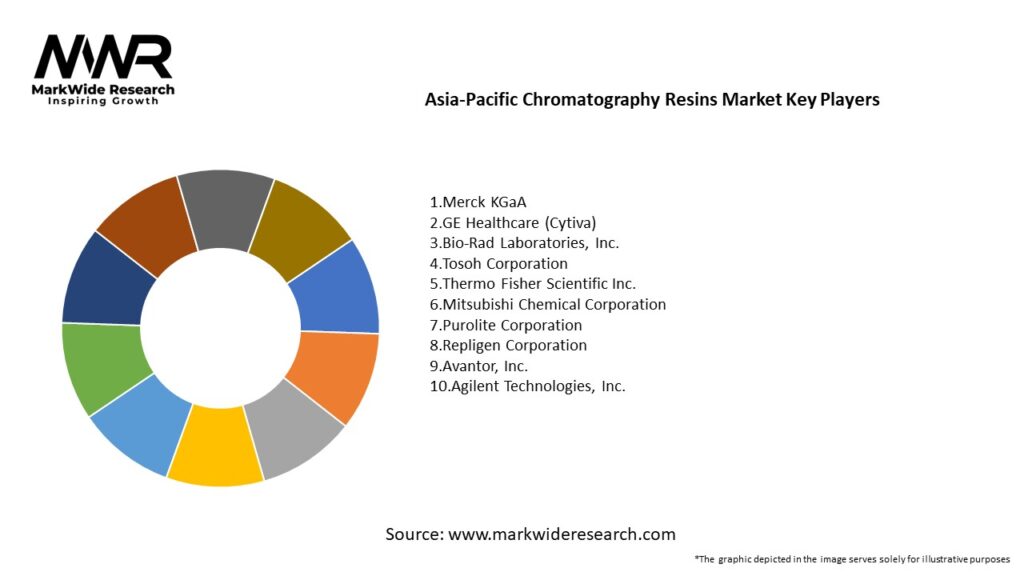

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific chromatography resins market is characterized by dynamic factors that influence its growth trajectory. The market dynamics are driven by factors such as technological advancements, regulatory frameworks, industry trends, and evolving customer demands.

Regional Analysis

The Asia-Pacific chromatography resins market is witnessing significant growth across the region, with several countries contributing to its expansion. The key countries driving market growth include China, Japan, India, South Korea, and Australia.

Competitive Landscape

Leading Companies in Asia-Pacific Chromatography Resins Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific chromatography resins market can be segmented based on resin type, application, and end-user industry.

Segmentation allows market players to target specific customer segments and tailor their offerings accordingly, maximizing their market share and profitability.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the chromatography resins market in the Asia-Pacific region. While the pharmaceutical and biotechnology industries experienced increased demand for drugs, vaccines, and diagnostics, other industries such as food and beverages faced challenges due to supply chain disruptions and reduced consumer spending.

During the pandemic, chromatography resins played a crucial role in the development and production ofvaccines, monoclonal antibodies, and other pharmaceutical products. The demand for chromatography resins used in the purification and analysis of biologics and therapeutics surged, supporting market growth.

However, the market also faced challenges such as disruptions in the supply chain, shortage of raw materials, and restrictions on manufacturing operations. The closure of laboratories and research facilities during lockdowns hampered the progress of R&D activities and product development.

The pandemic highlighted the importance of chromatography resins in ensuring the quality and safety of pharmaceutical products. It also accelerated the adoption of digitalization and remote monitoring solutions in chromatography processes, allowing for continuity in operations despite restrictions on physical presence.

As the region recovers from the pandemic, the demand for chromatography resins is expected to rebound. The ongoing efforts in vaccine development and the need for efficient purification processes will continue to drive market growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific chromatography resins market is poised for substantial growth in the coming years. Factors such as increasing investments in R&D, growing demand for high-quality pharmaceutical products, and expanding biotechnology sectors will drive market expansion.

Technological advancements, particularly in resin properties and chromatography techniques, will continue to shape the market landscape. The integration of chromatography with other analytical techniques, focus on sustainability, and the development of high-capacity resins will be key trends driving market growth.

Emerging economies, particularly China and India, will play a significant role in the market’s future, driven by their expanding industries and investments in research and development. Strategic partnerships, collaborations, and investments in emerging markets will provide growth opportunities for industry participants.

Despite challenges such as high production costs and environmental concerns,the market is expected to overcome these obstacles through technological advancements, cost optimization, and sustainable practices.

Conclusion

In conclusion, the Asia-Pacific chromatography resins market is poised for significant growth, driven by factors such as the increasing demand for high-quality products, technological advancements, and expanding industries. Companies need to focus on innovation, strengthen distribution networks, address environmental concerns, and foster collaborations to capitalize on market opportunities. With the ongoing advancements and evolving customer demands, the future outlook for the chromatography resins market in the Asia-Pacific region remains promising.

What is Chromatography Resins?

Chromatography resins are materials used in the separation and purification processes in various applications, including biopharmaceuticals, food and beverage, and environmental analysis. They play a crucial role in the chromatography technique, which is essential for isolating specific compounds from mixtures.

What are the key players in the Asia-Pacific Chromatography Resins Market?

Key players in the Asia-Pacific Chromatography Resins Market include companies like Merck KGaA, Thermo Fisher Scientific, and Tosoh Corporation. These companies are known for their innovative products and extensive portfolios in chromatography resins, among others.

What are the growth factors driving the Asia-Pacific Chromatography Resins Market?

The growth of the Asia-Pacific Chromatography Resins Market is driven by the increasing demand for biopharmaceuticals, advancements in chromatography techniques, and the rising focus on quality control in food and beverage industries. Additionally, the growing environmental concerns are pushing the need for effective separation technologies.

What challenges does the Asia-Pacific Chromatography Resins Market face?

The Asia-Pacific Chromatography Resins Market faces challenges such as high costs associated with advanced chromatography techniques and the need for skilled professionals to operate complex systems. Furthermore, regulatory hurdles in different countries can also impede market growth.

What opportunities exist in the Asia-Pacific Chromatography Resins Market?

Opportunities in the Asia-Pacific Chromatography Resins Market include the increasing investment in research and development for new applications, the expansion of the biopharmaceutical sector, and the growing trend towards automation in laboratory processes. These factors are likely to enhance the market landscape.

What trends are shaping the Asia-Pacific Chromatography Resins Market?

Trends shaping the Asia-Pacific Chromatography Resins Market include the development of eco-friendly resins, the integration of artificial intelligence in chromatography processes, and the increasing adoption of single-use technologies. These innovations are expected to improve efficiency and reduce environmental impact.

Asia-Pacific Chromatography Resins Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ion Exchange Resins, Affinity Resins, Size Exclusion Resins, Reverse Phase Resins |

| End User | Pharmaceuticals, Biotechnology, Food & Beverage, Environmental Testing |

| Application | Protein Purification, Water Treatment, Drug Development, Quality Control |

| Form | Granular, Powder, Bead, Liquid |

Leading Companies in Asia-Pacific Chromatography Resins Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at