444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific car loan market represents one of the most dynamic and rapidly expanding automotive financing sectors globally. This comprehensive market encompasses diverse financing solutions including traditional bank loans, dealer financing, peer-to-peer lending platforms, and innovative digital lending services across major economies such as China, India, Japan, South Korea, Australia, and Southeast Asian nations. Market dynamics are driven by rising disposable incomes, urbanization trends, expanding middle-class populations, and increasing vehicle ownership aspirations throughout the region.

Regional growth patterns indicate substantial expansion opportunities, with the market experiencing robust growth at approximately 8.5% CAGR over recent years. Digital transformation initiatives have revolutionized traditional lending processes, enabling faster loan approvals, streamlined documentation, and enhanced customer experiences. The market benefits from supportive government policies promoting automotive sector development, infrastructure investments, and financial inclusion initiatives across emerging economies.

Consumer preferences are evolving toward flexible financing options, competitive interest rates, and seamless digital application processes. The integration of advanced technologies including artificial intelligence, machine learning, and blockchain solutions is transforming risk assessment methodologies and operational efficiencies within the car loan ecosystem.

The Asia-Pacific car loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through various lending mechanisms across the Asia-Pacific region. This market encompasses traditional automotive financing solutions, innovative digital lending platforms, and specialized financial products tailored to diverse consumer segments and vehicle categories.

Core components include new vehicle financing, used car loans, refinancing options, lease-to-own programs, and commercial vehicle financing solutions. The market operates through multiple channels including banks, non-banking financial companies, automotive dealerships, online lending platforms, and peer-to-peer financing networks. Regulatory frameworks vary across different countries, creating unique market dynamics and opportunities for financial service providers.

Market participants range from established banking institutions to emerging fintech companies, each offering distinct value propositions and targeting specific customer segments. The ecosystem supports various stakeholders including borrowers, lenders, automotive manufacturers, dealers, insurance providers, and technology solution providers.

Strategic analysis reveals the Asia-Pacific car loan market as a high-growth sector characterized by increasing digitalization, expanding customer base, and evolving regulatory landscapes. Key market drivers include rising vehicle ownership rates, growing consumer confidence, supportive government policies, and technological innovations transforming traditional lending processes.

Market penetration varies significantly across different countries, with developed markets like Japan and Australia showing mature lending ecosystems, while emerging markets including India, Vietnam, and Indonesia present substantial growth opportunities. Digital adoption rates have accelerated dramatically, with approximately 72% of loan applications now initiated through digital channels.

Competitive dynamics are intensifying as traditional banks face competition from fintech companies, automotive manufacturers expanding into financial services, and technology giants entering the lending space. Customer expectations continue evolving toward faster processing times, transparent pricing, personalized offerings, and seamless integration with vehicle purchase processes.

Future prospects indicate continued expansion driven by urbanization trends, infrastructure development, electric vehicle adoption, and increasing financial inclusion across emerging economies throughout the Asia-Pacific region.

Fundamental market insights reveal several critical trends shaping the Asia-Pacific car loan landscape:

Market maturity levels vary considerably, with developed economies showing sophisticated lending ecosystems while emerging markets present opportunities for innovative financial products and services tailored to local consumer needs and preferences.

Economic prosperity across the Asia-Pacific region serves as a fundamental driver, with rising disposable incomes enabling increased vehicle ownership aspirations. Urbanization trends continue accelerating, creating demand for personal transportation solutions and supporting automotive financing growth across major metropolitan areas.

Government initiatives promoting automotive sector development, infrastructure investments, and financial inclusion programs provide substantial market support. Regulatory frameworks are becoming increasingly favorable, with authorities recognizing the importance of accessible automotive financing for economic development and consumer welfare.

Technological advancement enables lenders to offer improved customer experiences, faster processing times, and more accurate risk assessment capabilities. Digital infrastructure development across emerging markets facilitates online lending platforms and mobile-first financial services, expanding market reach and accessibility.

Demographic transitions including growing middle-class populations, changing lifestyle preferences, and increasing consumer confidence in financing solutions drive sustained market expansion. Automotive industry growth supported by local manufacturing capabilities, competitive pricing, and diverse vehicle options creates favorable conditions for financing demand.

Financial sector evolution with increased competition, product innovation, and customer-centric approaches enhances market dynamics and growth prospects throughout the region.

Economic volatility and currency fluctuations across different Asia-Pacific markets create challenges for lenders in managing risk exposure and maintaining consistent profitability. Regulatory complexity varies significantly between countries, requiring substantial compliance investments and limiting cross-border expansion opportunities for financial service providers.

Credit risk management remains challenging in emerging markets with limited credit history data, inadequate credit bureau systems, and varying income documentation standards. Interest rate sensitivity among consumers affects loan demand, particularly during periods of monetary policy tightening or economic uncertainty.

Infrastructure limitations in rural and remote areas restrict market penetration and service delivery capabilities for digital lending platforms. Cultural preferences for cash transactions and traditional banking relationships in certain markets slow adoption of innovative financing solutions.

Competition intensity from multiple market participants creates pricing pressures and margin compression challenges for established lenders. Technology investment requirements for digital transformation initiatives represent significant capital commitments, particularly for smaller financial institutions.

Fraud prevention and cybersecurity concerns require continuous investments in security infrastructure and risk management systems, increasing operational costs and complexity.

Emerging market expansion presents substantial opportunities as countries like Vietnam, Indonesia, Philippines, and Bangladesh experience rapid economic growth and increasing vehicle ownership rates. Digital lending platforms can capture significant market share by offering superior customer experiences and reaching underserved consumer segments.

Electric vehicle financing represents a high-growth opportunity as governments promote sustainable transportation solutions through incentives and supportive policies. Commercial vehicle financing benefits from e-commerce growth, logistics sector expansion, and infrastructure development projects across the region.

Partnership opportunities between traditional lenders, fintech companies, automotive manufacturers, and technology providers enable innovative product development and market expansion strategies. Alternative credit scoring using artificial intelligence and big data analytics can unlock financing opportunities for previously underserved customer segments.

Cross-selling opportunities including insurance products, extended warranties, and maintenance services create additional revenue streams and enhanced customer relationships. Refinancing services for existing vehicle owners provide opportunities to capture market share from competitors and improve customer retention rates.

Rural market penetration through mobile technology and agent-based distribution models can significantly expand addressable customer bases across emerging economies throughout the Asia-Pacific region.

Competitive landscapes are rapidly evolving as traditional banks face increasing pressure from fintech disruptors, automotive manufacturers entering financial services, and technology giants leveraging their digital ecosystems. Customer acquisition costs are rising due to increased competition, requiring lenders to develop more efficient marketing strategies and value propositions.

Regulatory environments continue evolving with authorities balancing consumer protection, financial stability, and market development objectives. Technology adoption rates vary significantly across different markets, with approximately 85% of urban consumers now comfortable with digital loan applications compared to 45% in rural areas.

Interest rate cycles significantly impact loan demand and profitability, requiring lenders to develop flexible pricing strategies and risk management frameworks. Economic cycles affect consumer confidence, employment levels, and repayment capabilities, influencing overall market performance and growth trajectories.

Supply chain dynamics in the automotive industry, including semiconductor shortages and manufacturing disruptions, create temporary impacts on vehicle availability and financing demand patterns. Consumer behavior shifts toward online research, comparison shopping, and digital engagement require lenders to adapt their marketing and service delivery approaches.

Partnership ecosystems are becoming increasingly important as market participants seek to leverage complementary capabilities and expand their service offerings through strategic collaborations.

Comprehensive research approach combines primary and secondary data collection methodologies to ensure accurate market analysis and insights. Primary research includes structured interviews with industry executives, lending institution representatives, automotive dealers, technology providers, and consumer focus groups across major Asia-Pacific markets.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, market databases, and government statistics from relevant authorities. Data validation processes involve cross-referencing multiple sources, expert consultations, and statistical verification to ensure information accuracy and reliability.

Market sizing methodologies utilize bottom-up and top-down approaches, incorporating loan origination data, market penetration rates, and demographic analysis. Forecasting models consider historical trends, economic indicators, regulatory changes, and industry developments to project future market scenarios.

Regional analysis covers major markets including China, India, Japan, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, and Vietnam. Segmentation analysis examines various dimensions including loan types, customer segments, distribution channels, and technology platforms.

Quality assurance procedures include peer review processes, expert validation, and continuous monitoring of market developments to maintain research accuracy and relevance throughout the analysis period.

China dominates the Asia-Pacific car loan market with approximately 42% market share, driven by massive automotive production, growing consumer wealth, and supportive government policies. Digital lending platforms have achieved remarkable penetration, with major technology companies offering integrated automotive financing solutions.

India represents the fastest-growing market with exceptional expansion potential, supported by rising middle-class populations, urbanization trends, and increasing vehicle affordability. Fintech innovation is particularly strong, with numerous startups developing solutions for underserved customer segments.

Japan maintains a mature market characterized by sophisticated lending products, established customer relationships, and high penetration rates. Innovation focus centers on digital transformation, customer experience enhancement, and sustainable financing solutions for electric vehicles.

South Korea demonstrates advanced technology adoption with approximately 78% of loan applications processed through digital channels. Market consolidation trends are evident as traditional banks acquire fintech companies to enhance their digital capabilities.

Australia and New Zealand show stable growth patterns with emphasis on regulatory compliance, consumer protection, and competitive pricing strategies. Southeast Asian markets including Indonesia, Thailand, Malaysia, and Philippines present significant opportunities driven by economic development and increasing vehicle ownership aspirations.

Market leadership is distributed among various player categories, creating a dynamic competitive environment with opportunities for different strategic approaches:

Competitive strategies focus on digital innovation, customer experience enhancement, risk management optimization, and strategic partnerships. Market consolidation trends include acquisitions, joint ventures, and technology licensing agreements to accelerate capabilities development.

Differentiation factors include processing speed, interest rates, customer service quality, digital platform capabilities, and integrated value-added services such as insurance and maintenance programs.

By Loan Type:

By Customer Segment:

By Distribution Channel:

New Vehicle Financing continues dominating market volumes, benefiting from manufacturer incentives, promotional interest rates, and integrated dealer relationships. Processing efficiency has improved significantly with approximately 68% of applications receiving approval decisions within 24 hours through digital platforms.

Used Vehicle Loans are experiencing rapid growth as consumers seek affordable transportation options and lenders develop sophisticated valuation and risk assessment capabilities. Market expansion is particularly strong in emerging economies where used vehicle markets are well-established and growing.

Commercial Vehicle Financing benefits from e-commerce growth, logistics sector expansion, and infrastructure development projects. Specialized products include flexible repayment schedules aligned with business cash flows and seasonal revenue patterns.

Electric Vehicle Financing represents the fastest-growing category with government incentives, environmental consciousness, and improving vehicle technology driving adoption. Green financing products offer preferential rates and terms to encourage sustainable transportation choices.

Refinancing Services provide opportunities for customer retention and market share capture from competitors. Digital platforms enable quick rate comparisons and seamless switching processes for qualified borrowers.

Financial Institutions benefit from diversified revenue streams, improved risk-adjusted returns, and enhanced customer relationships through automotive financing services. Digital transformation enables operational efficiency improvements, cost reduction, and scalable growth opportunities across multiple markets.

Automotive Manufacturers leverage financing partnerships to increase vehicle sales, improve customer affordability, and strengthen dealer relationships. Integrated solutions provide competitive advantages and enhanced customer experiences throughout the vehicle purchase journey.

Technology Providers capitalize on growing demand for digital lending platforms, risk assessment tools, and customer engagement solutions. Innovation opportunities include artificial intelligence applications, blockchain implementations, and mobile-first service delivery platforms.

Consumers gain access to competitive financing options, streamlined application processes, and flexible repayment terms. Digital convenience enables quick comparisons, transparent pricing, and efficient service delivery through preferred channels.

Dealers and Distributors enhance their value propositions through integrated financing solutions, improved customer conversion rates, and additional revenue opportunities. Partnership benefits include training support, marketing assistance, and technology platform access.

Regulatory Authorities achieve policy objectives including financial inclusion, consumer protection, and economic development through well-functioning automotive financing markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Lending has become the dominant trend with approximately 76% of consumers preferring online application processes. Mobile optimization is critical as smartphone penetration continues expanding across Asia-Pacific markets, enabling convenient access to financing services.

Artificial Intelligence Integration is transforming risk assessment, fraud detection, and customer service capabilities. Machine learning algorithms enable more accurate credit scoring and personalized product recommendations, improving both approval rates and portfolio performance.

Sustainable Financing gains momentum as environmental consciousness increases and governments implement supportive policies for electric and hybrid vehicles. Green loan products offer preferential terms and contribute to corporate sustainability objectives.

Ecosystem Integration involves partnerships between lenders, automotive manufacturers, technology companies, and service providers to create comprehensive customer experiences. Platform approaches enable one-stop solutions for vehicle purchase, financing, insurance, and maintenance services.

Alternative Credit Scoring utilizes non-traditional data sources including social media activity, mobile phone usage patterns, and transaction histories to assess creditworthiness. Financial inclusion benefits as previously underserved segments gain access to automotive financing.

Regulatory Technology adoption helps lenders manage compliance requirements more efficiently while reducing operational costs and risks associated with regulatory violations.

Strategic partnerships between traditional banks and fintech companies are accelerating digital transformation initiatives. MarkWide Research analysis indicates that such collaborations have increased by 45% over the past two years, enabling faster innovation and market expansion capabilities.

Regulatory harmonization efforts across ASEAN countries are creating opportunities for cross-border lending and standardized compliance frameworks. Government initiatives promoting electric vehicle adoption include preferential financing terms and tax incentives for both lenders and borrowers.

Technology investments in blockchain applications for loan documentation, smart contracts, and fraud prevention are gaining traction among leading market participants. Open banking initiatives enable better data sharing and risk assessment capabilities.

Market consolidation activities include acquisitions of fintech companies by traditional lenders and automotive manufacturers expanding their financial services capabilities. International expansion by regional players is creating more integrated Asia-Pacific automotive financing ecosystems.

Product innovation includes flexible repayment options, usage-based financing models, and integrated mobility solutions combining vehicle loans with ride-sharing and subscription services.

Digital transformation acceleration should remain the top priority for traditional lenders seeking to maintain competitive positions. Investment recommendations include customer experience platforms, artificial intelligence capabilities, and mobile-first service delivery systems.

Market expansion strategies should focus on underserved segments including rural customers, small business owners, and first-time vehicle buyers. Partnership development with automotive dealers, technology providers, and alternative distribution channels can enhance market reach and operational efficiency.

Risk management enhancement through advanced analytics, alternative credit scoring, and real-time monitoring systems is essential for sustainable growth. Regulatory compliance investments should anticipate evolving requirements and cross-border expansion opportunities.

Product diversification beyond traditional loans to include insurance, maintenance, and mobility services can improve customer retention and revenue per customer. Sustainability initiatives including green financing products align with regulatory trends and consumer preferences.

Talent acquisition in technology, data analytics, and digital marketing capabilities is crucial for successful transformation and competitive differentiation. Customer education programs can accelerate adoption of digital services and improve overall market penetration rates.

Growth projections indicate continued market expansion with emerging economies driving the majority of new opportunities. MWR forecasts suggest that digital lending platforms will capture approximately 65% market share within the next five years as consumer preferences shift toward online services.

Technology evolution will enable more sophisticated risk assessment, personalized customer experiences, and operational automation. Artificial intelligence and machine learning applications will become standard capabilities rather than competitive differentiators.

Regulatory developments are expected to focus on consumer protection, data privacy, and financial stability while supporting innovation and market development. Cross-border harmonization efforts may create opportunities for regional expansion and standardized service offerings.

Market consolidation will likely continue as smaller players seek scale advantages and larger institutions acquire specialized capabilities. Ecosystem integration between automotive, financial, and technology sectors will create more comprehensive customer solutions.

Sustainability focus will intensify with electric vehicle financing becoming a significant growth driver. Alternative mobility models including subscription services and shared ownership may create new financing product categories and business models.

The Asia-Pacific car loan market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by economic development, technological innovation, and changing consumer preferences. Digital transformation has fundamentally altered competitive dynamics, customer expectations, and operational capabilities throughout the region.

Market participants must navigate diverse regulatory environments, varying economic conditions, and intense competition while capitalizing on emerging opportunities in electric vehicle financing, underserved customer segments, and cross-border expansion. Success factors include digital capabilities, risk management expertise, strategic partnerships, and customer-centric service delivery.

Future growth will be driven by continued urbanization, rising disposable incomes, supportive government policies, and technological advancement across emerging Asia-Pacific economies. The market’s evolution toward integrated ecosystem solutions, sustainable financing options, and enhanced customer experiences positions it as a critical component of the region’s economic development and transportation infrastructure advancement.

What is Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which they then repay over time with interest. This financial product is commonly used by consumers in various regions, including the Asia-Pacific region, to facilitate vehicle ownership.

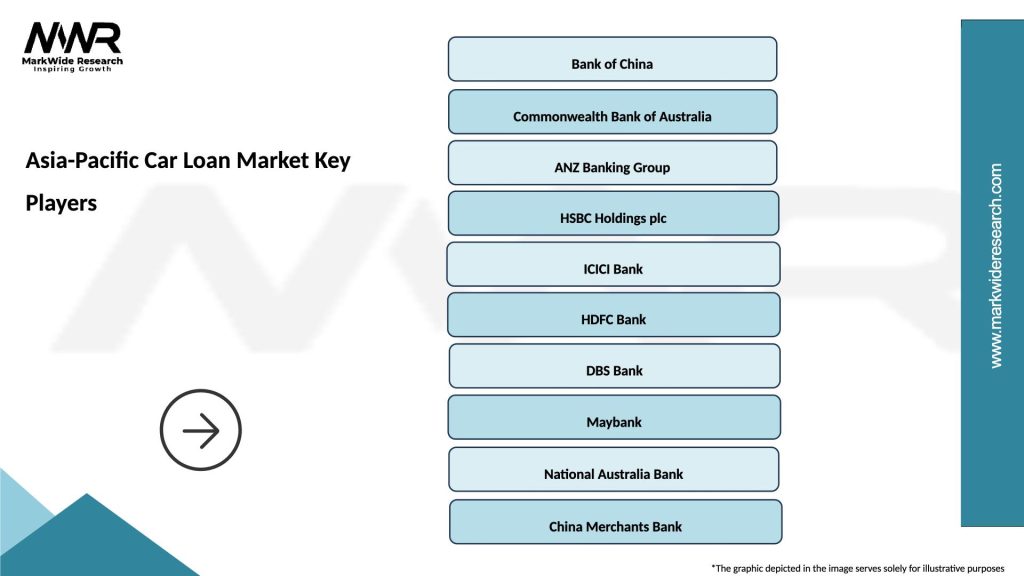

What are the key players in the Asia-Pacific Car Loan Market?

Key players in the Asia-Pacific Car Loan Market include major financial institutions such as Toyota Financial Services, Honda Financial Services, and HDFC Bank, among others. These companies offer a range of car loan products tailored to meet the needs of consumers and businesses.

What are the growth factors driving the Asia-Pacific Car Loan Market?

The Asia-Pacific Car Loan Market is driven by factors such as increasing disposable incomes, a growing middle class, and rising demand for personal vehicles. Additionally, favorable financing options and competitive interest rates contribute to market growth.

What challenges does the Asia-Pacific Car Loan Market face?

Challenges in the Asia-Pacific Car Loan Market include regulatory changes, fluctuating interest rates, and economic uncertainties that can affect consumer confidence. Additionally, the rise of alternative transportation options may impact traditional car ownership.

What opportunities exist in the Asia-Pacific Car Loan Market?

Opportunities in the Asia-Pacific Car Loan Market include the expansion of digital lending platforms and the increasing adoption of electric vehicles. Financial institutions can leverage technology to enhance customer experience and offer innovative loan products.

What trends are shaping the Asia-Pacific Car Loan Market?

Trends in the Asia-Pacific Car Loan Market include the growing popularity of online loan applications and the integration of artificial intelligence in credit assessments. Additionally, there is a shift towards more flexible repayment options to accommodate diverse consumer needs.

Asia-Pacific Car Loan Market

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, Luxury Cars |

| Customer Type | Individual Buyers, Corporate Clients, Fleet Operators, Dealerships |

| Loan Type | Secured Loans, Unsecured Loans, Fixed Rate Loans, Variable Rate Loans |

| Repayment Period | Short-Term, Medium-Term, Long-Term, Flexible Terms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at