444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific capital exchange ecosystem market represents a dynamic and rapidly evolving financial landscape that encompasses traditional stock exchanges, alternative trading systems, and emerging digital asset platforms. This comprehensive ecosystem facilitates the trading of equities, bonds, derivatives, commodities, and increasingly, digital assets across diverse economies including China, Japan, India, South Korea, Australia, and Southeast Asian nations. Market dynamics indicate substantial growth momentum driven by technological innovation, regulatory modernization, and increasing investor participation across retail and institutional segments.

Regional diversification characterizes this market, with established financial centers like Hong Kong, Singapore, and Tokyo coexisting alongside emerging markets experiencing rapid digitalization. The ecosystem demonstrates remarkable resilience and adaptability, with trading volumes showing consistent growth patterns despite global economic uncertainties. Technology integration has become a defining feature, with artificial intelligence, blockchain technology, and cloud computing reshaping traditional trading paradigms.

Cross-border connectivity initiatives have strengthened regional integration, enabling seamless capital flows and enhanced market access for international investors. The ecosystem benefits from supportive regulatory frameworks that balance innovation encouragement with investor protection, creating an environment conducive to sustainable growth and market development.

The Asia Pacific capital exchange ecosystem market refers to the comprehensive network of financial markets, trading platforms, regulatory frameworks, and supporting infrastructure that facilitate the exchange of capital instruments across the Asia Pacific region. This ecosystem encompasses primary and secondary markets for various asset classes including equities, fixed income securities, derivatives, commodities, and digital assets, supported by advanced technology platforms and regulatory oversight mechanisms.

Ecosystem components include traditional stock exchanges, electronic communication networks, dark pools, over-the-counter markets, and emerging decentralized finance platforms. The market serves multiple stakeholders including retail investors, institutional investors, corporations seeking capital, market makers, and regulatory authorities, creating a complex but efficient capital allocation mechanism.

Integration aspects involve cross-border trading mechanisms, currency exchange facilities, settlement systems, and risk management frameworks that enable seamless capital flows across different jurisdictions while maintaining market integrity and investor protection standards.

Strategic positioning of the Asia Pacific capital exchange ecosystem reflects the region’s growing economic prominence and increasing integration with global financial markets. The ecosystem demonstrates robust growth trajectories supported by technological advancement, regulatory harmonization, and expanding investor bases across diverse market segments. Digital transformation initiatives have accelerated market efficiency and accessibility, attracting both domestic and international participants.

Key performance indicators reveal strong momentum across multiple dimensions including trading volume growth, market capitalization expansion, and technology adoption rates. The ecosystem benefits from favorable demographic trends, rising wealth levels, and increasing financial literacy among retail investors. Institutional participation has intensified with pension funds, insurance companies, and sovereign wealth funds increasing their regional allocations.

Competitive dynamics showcase healthy rivalry among exchanges and trading platforms, driving innovation in product offerings, technology capabilities, and service quality. The market demonstrates resilience through economic cycles while maintaining growth orientation supported by structural economic trends and policy initiatives promoting financial market development.

Market intelligence reveals several critical insights shaping the Asia Pacific capital exchange ecosystem landscape:

Economic growth across Asia Pacific economies serves as a fundamental driver, creating wealth generation opportunities and increasing demand for capital market services. Rising disposable incomes, expanding middle-class populations, and urbanization trends contribute to growing investor participation rates. Corporate expansion activities require sophisticated capital raising mechanisms, driving demand for diverse financial instruments and trading platforms.

Technological advancement enables market democratization through improved accessibility, reduced costs, and enhanced user experiences. Cloud computing, artificial intelligence, and mobile technology have transformed traditional trading paradigms, attracting new investor segments and increasing trading frequency. Regulatory modernization creates supportive frameworks that balance innovation promotion with investor protection, encouraging market development and international participation.

Demographic trends favor long-term market growth with younger populations demonstrating higher technology adoption rates and investment interest. Educational initiatives and financial literacy programs expand the potential investor base, while aging populations create demand for retirement planning and wealth management services. Regional integration initiatives facilitate cross-border investment flows and enhance market liquidity through expanded participant bases.

Regulatory complexity presents challenges as different jurisdictions maintain varying compliance requirements, creating barriers for cross-border operations and increasing operational costs. Regulatory uncertainty regarding emerging technologies and digital assets can limit innovation and market development in certain segments. Market volatility concerns may discourage retail investor participation during uncertain economic periods, affecting overall market liquidity and growth momentum.

Technology risks including cybersecurity threats, system failures, and data privacy concerns require substantial investments in security infrastructure and risk management systems. Legacy system integration challenges can limit the pace of technological advancement and create operational inefficiencies. Competition intensity among exchanges and trading platforms may compress profit margins and require continuous investment in technology and service enhancement.

Economic uncertainties including geopolitical tensions, trade disputes, and currency fluctuations can impact investor confidence and cross-border capital flows. Market concentration risks in certain economies may limit diversification benefits and increase systemic risk exposure for market participants.

Digital transformation opportunities abound as emerging technologies create new market segments and trading mechanisms. Blockchain technology applications in settlement systems, smart contracts, and tokenized assets present significant growth potential. Artificial intelligence integration can enhance risk management, market making, and personalized investment services, creating competitive advantages for early adopters.

Sustainable finance represents a rapidly expanding opportunity as environmental and social considerations gain prominence among investors and corporations. Green bonds, sustainability-linked instruments, and ESG-focused investment products offer substantial growth potential. Financial inclusion initiatives can expand market reach to underserved populations through mobile technology and simplified investment products.

Cross-border expansion opportunities exist through strategic partnerships, technology sharing agreements, and regulatory cooperation initiatives. Product innovation in areas such as structured products, alternative investments, and digital assets can attract new investor segments and increase market share. According to MarkWide Research analysis, emerging market segments present particularly attractive growth prospects for innovative market operators.

Supply-demand dynamics in the Asia Pacific capital exchange ecosystem reflect complex interactions between capital seekers, investors, and intermediaries. Growing corporate financing needs drive demand for primary market services, while expanding investor bases create liquidity for secondary market trading. Technology disruption continues reshaping traditional market structures, with new entrants challenging established players through innovative service offerings and cost-effective solutions.

Competitive forces intensify as traditional exchanges face competition from alternative trading systems, fintech platforms, and international market operators. This competition drives innovation in product development, technology infrastructure, and customer service quality. Regulatory evolution influences market dynamics through policy changes affecting market access, product approval processes, and operational requirements.

Investor behavior patterns show increasing sophistication and demand for diverse investment options, real-time information access, and integrated financial services. Market makers and liquidity providers adapt to changing trading patterns and technology requirements, while maintaining profitability through operational efficiency improvements. Economic cycles continue influencing market dynamics, with resilient operators demonstrating adaptability through various market conditions.

Comprehensive analysis of the Asia Pacific capital exchange ecosystem market employs multiple research methodologies to ensure accuracy and reliability. Primary research involves extensive interviews with exchange executives, regulatory officials, institutional investors, and technology providers across major markets. Secondary research encompasses analysis of regulatory filings, exchange statistics, industry reports, and academic publications to validate findings and identify trends.

Quantitative analysis utilizes statistical modeling techniques to analyze trading volumes, market capitalization data, and performance metrics across different market segments and time periods. Data collection covers major exchanges including those in China, Japan, India, South Korea, Australia, Hong Kong, and Singapore. Qualitative assessment involves expert interviews and focus group discussions to understand market dynamics, competitive positioning, and future development prospects.

Market segmentation analysis examines different asset classes, investor types, and geographic regions to identify growth patterns and opportunities. Cross-validation techniques ensure data accuracy and reliability, while scenario analysis explores potential future developments under different economic and regulatory conditions.

China dominates the regional landscape with the world’s second-largest equity market and rapidly expanding bond markets. Shanghai and Shenzhen exchanges demonstrate strong growth momentum supported by domestic economic expansion and gradual market opening initiatives. Technology integration advances rapidly with mobile trading platforms achieving widespread adoption among retail investors.

Japan maintains its position as a mature and sophisticated market with the Tokyo Stock Exchange serving as a regional hub for international investors. Market reforms and corporate governance improvements enhance attractiveness for foreign investment. India represents one of the fastest-growing markets with expanding retail participation and strong economic fundamentals supporting long-term growth prospects.

South Korea demonstrates high technology adoption rates and active retail investor participation, while Australia provides a stable and well-regulated market environment attracting international investors. Southeast Asian markets including Singapore, Thailand, Malaysia, and Indonesia show promising growth potential supported by economic development and increasing financial market sophistication. MWR data indicates that emerging markets within the region are experiencing particularly strong growth in retail investor participation, with adoption rates increasing by 52% annually in key markets.

Market leadership is distributed among several major exchange operators and technology providers, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on technology innovation, product diversification, international expansion, and strategic partnerships to enhance market position and service capabilities.

By Asset Class:

By Investor Type:

By Technology Platform:

Equity Markets continue dominating trading volumes with strong retail investor participation and increasing institutional allocation. Technology stocks and growth companies attract significant investor interest, while dividend-paying stocks appeal to income-focused investors. Market capitalization expansion reflects both price appreciation and new listing activity across major exchanges.

Fixed Income Markets experience growing sophistication with diverse product offerings including green bonds, sukuk, and structured notes. Government bond markets provide benchmark pricing and risk-free investment options, while corporate bonds offer yield premiums for credit risk assumption. Interest rate environments significantly influence trading patterns and investor preferences.

Derivatives Markets provide essential risk management tools for institutional investors and speculation opportunities for active traders. Index futures and options demonstrate high liquidity, while commodity derivatives gain popularity amid inflation concerns. Regulatory frameworks continue evolving to accommodate market development while maintaining systemic risk controls.

Digital Asset Integration progresses at varying speeds across different jurisdictions, with some markets embracing innovation while others maintain cautious approaches. Regulatory clarity remains crucial for sustainable market development in this emerging segment.

Exchange Operators benefit from expanding market opportunities, technology advancement capabilities, and diversified revenue streams through multiple asset classes and service offerings. Operational efficiency improvements and economies of scale enhance profitability while regulatory compliance frameworks provide operational certainty.

Investors gain access to diverse investment opportunities, improved market liquidity, and enhanced price discovery mechanisms. Technology advancement reduces transaction costs and improves execution quality, while regulatory protection frameworks provide confidence in market integrity. Portfolio diversification opportunities expand through cross-border access and alternative asset classes.

Corporations access efficient capital raising mechanisms, improved valuation transparency, and enhanced corporate governance standards. Public listing opportunities provide growth capital and liquidity for existing shareholders, while bond markets offer flexible financing alternatives. Market visibility enhances corporate reputation and stakeholder engagement.

Regulatory Authorities achieve improved market oversight capabilities, enhanced systemic risk monitoring, and better investor protection mechanisms. Technology integration facilitates real-time surveillance and compliance monitoring, while international cooperation frameworks strengthen market integrity across borders.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization Acceleration transforms traditional market operations with artificial intelligence, machine learning, and automation technologies improving efficiency and reducing costs. Mobile-first strategies dominate retail investor engagement, while institutional investors demand sophisticated API-based solutions for algorithmic trading and portfolio management.

Sustainable Finance Integration gains momentum as environmental and social considerations become mainstream investment criteria. Green bonds, sustainability-linked loans, and ESG-focused equity indices attract increasing investor attention and regulatory support. Climate risk assessment becomes integral to investment decision-making processes.

Cross-Border Connectivity initiatives strengthen regional market integration through trading links, mutual recognition agreements, and harmonized regulatory standards. International investor access improves through simplified onboarding processes and enhanced market data availability. Currency hedging solutions facilitate cross-border investment flows.

Alternative Asset Adoption expands beyond traditional securities to include real estate investment trusts, infrastructure funds, and commodity-linked instruments. Digital asset integration progresses in supportive regulatory environments, while traditional assets undergo tokenization for improved accessibility and liquidity.

Technology Infrastructure investments accelerate across major exchanges with cloud computing adoption, artificial intelligence implementation, and blockchain technology pilots. Market data services expand to include real-time analytics, sentiment analysis, and predictive modeling capabilities. Cybersecurity enhancements receive priority attention amid increasing digital threats.

Regulatory Harmonization efforts progress through bilateral and multilateral agreements facilitating cross-border market access and operational efficiency. Digital asset regulations evolve to provide clarity while maintaining investor protection standards. Market surveillance capabilities improve through technology integration and international cooperation.

Product Innovation continues with new instrument development including structured products, alternative risk premia strategies, and thematic investment vehicles. Exchange-traded funds expand rapidly with diverse underlying assets and investment strategies. Derivative products evolve to meet sophisticated risk management and investment needs.

Strategic Partnerships form between exchanges, technology providers, and financial institutions to enhance service capabilities and market reach. International alliances facilitate knowledge sharing and best practice adoption across different markets.

Technology Investment should remain a priority for market operators seeking competitive advantages and operational efficiency improvements. Cloud computing adoption, artificial intelligence integration, and mobile platform enhancement require sustained investment commitment. Cybersecurity measures must evolve continuously to address emerging threats and maintain market confidence.

Regulatory Engagement becomes crucial as policy frameworks continue evolving to accommodate innovation while maintaining market integrity. Proactive participation in regulatory consultations and standard-setting initiatives can influence favorable policy development. Compliance capabilities should be strengthened to manage increasing regulatory complexity.

Market Expansion strategies should focus on underserved segments including retail investors in emerging markets and institutional investors seeking alternative assets. Cross-border expansion opportunities require careful regulatory analysis and strategic partnership development. Product diversification can reduce revenue concentration risks and capture emerging market trends.

Sustainable Finance integration should accelerate given growing investor demand and regulatory support for ESG-focused investments. MarkWide Research projections indicate that sustainable finance products could represent 40% of new product launches within the next three years, making early positioning advantageous for market participants.

Long-term growth prospects for the Asia Pacific capital exchange ecosystem remain positive, supported by favorable demographic trends, economic development, and technology advancement. Regional integration initiatives will likely strengthen cross-border connectivity and enhance market efficiency. Digital transformation will continue reshaping market structures and participant experiences.

Technology evolution will drive further innovation in trading systems, risk management, and investor services. Artificial intelligence and machine learning applications will become more sophisticated, while blockchain technology may transform settlement and clearing processes. Mobile technology will remain central to retail investor engagement strategies.

Regulatory frameworks are expected to achieve greater harmonization across the region, facilitating market access and operational efficiency. Digital asset regulations will likely mature, providing clarity for market development while maintaining appropriate investor protections. Sustainable finance regulations will strengthen, supporting market growth in ESG-focused investment products.

Market structure evolution will continue with new entrants challenging traditional operators and driving innovation. Competition will intensify, requiring continuous adaptation and investment in technology and service quality. Investor sophistication will increase, demanding more diverse products and enhanced service capabilities from market operators.

The Asia Pacific capital exchange ecosystem market represents a dynamic and rapidly evolving landscape characterized by strong growth momentum, technological innovation, and increasing regional integration. Market fundamentals remain robust, supported by favorable economic trends, expanding investor participation, and supportive regulatory frameworks that balance innovation promotion with investor protection.

Technology transformation continues driving market evolution, with mobile platforms, artificial intelligence, and blockchain technology reshaping traditional market structures and participant experiences. The ecosystem demonstrates remarkable adaptability and resilience, positioning it well for sustained growth despite global economic uncertainties and competitive pressures.

Strategic opportunities abound for market participants willing to invest in technology advancement, product innovation, and cross-border expansion. Sustainable finance integration and digital asset development present particularly attractive growth prospects, while regulatory harmonization efforts will likely enhance operational efficiency and market access capabilities. The region’s commitment to financial market development and international integration ensures continued evolution and expansion of this vital economic infrastructure.

What is Capital Exchange Ecosystem?

The Capital Exchange Ecosystem refers to the interconnected network of financial markets, institutions, and participants that facilitate the exchange of capital in various forms, including equity, debt, and derivatives. It encompasses stock exchanges, investment banks, and regulatory bodies that play a crucial role in capital allocation and market efficiency.

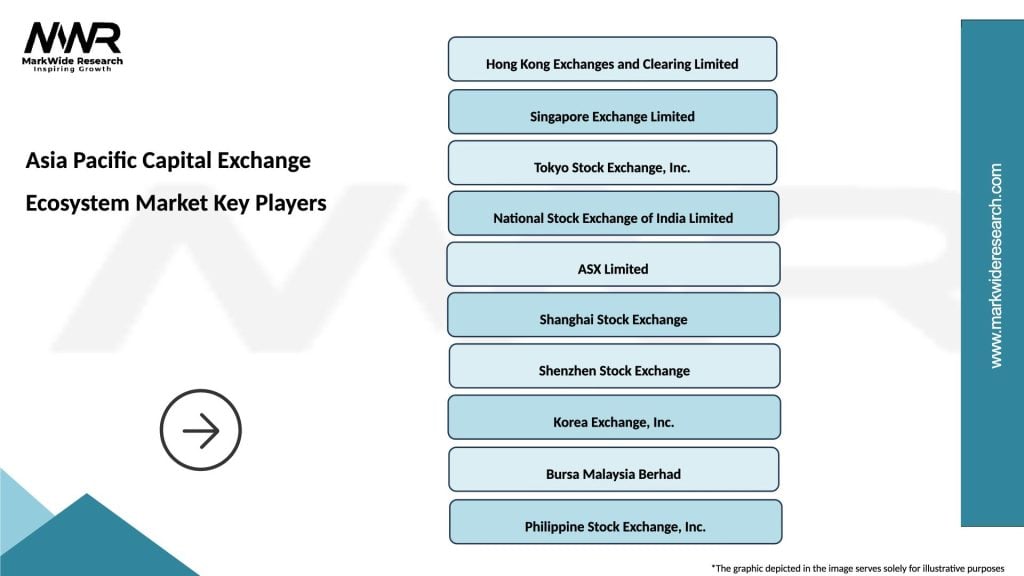

What are the key players in the Asia Pacific Capital Exchange Ecosystem Market?

Key players in the Asia Pacific Capital Exchange Ecosystem Market include major stock exchanges like the Hong Kong Stock Exchange and the Tokyo Stock Exchange, as well as investment firms such as Nomura and Macquarie Group. These entities drive market activities and influence capital flows in the region, among others.

What are the growth factors driving the Asia Pacific Capital Exchange Ecosystem Market?

The Asia Pacific Capital Exchange Ecosystem Market is driven by factors such as increasing foreign investment, the rise of fintech innovations, and the growing demand for diversified investment products. Additionally, regulatory reforms aimed at enhancing market transparency contribute to its growth.

What challenges does the Asia Pacific Capital Exchange Ecosystem Market face?

Challenges in the Asia Pacific Capital Exchange Ecosystem Market include regulatory compliance issues, market volatility, and geopolitical tensions that can affect investor confidence. These factors can hinder market stability and growth potential.

What opportunities exist in the Asia Pacific Capital Exchange Ecosystem Market?

Opportunities in the Asia Pacific Capital Exchange Ecosystem Market include the expansion of digital trading platforms, the integration of blockchain technology for transaction efficiency, and the increasing focus on sustainable investment options. These trends are likely to reshape the market landscape.

What trends are shaping the Asia Pacific Capital Exchange Ecosystem Market?

Trends shaping the Asia Pacific Capital Exchange Ecosystem Market include the rise of ESG (Environmental, Social, and Governance) investing, the adoption of artificial intelligence in trading strategies, and the growing popularity of exchange-traded funds (ETFs). These trends reflect changing investor preferences and technological advancements.

Asia Pacific Capital Exchange Ecosystem Market

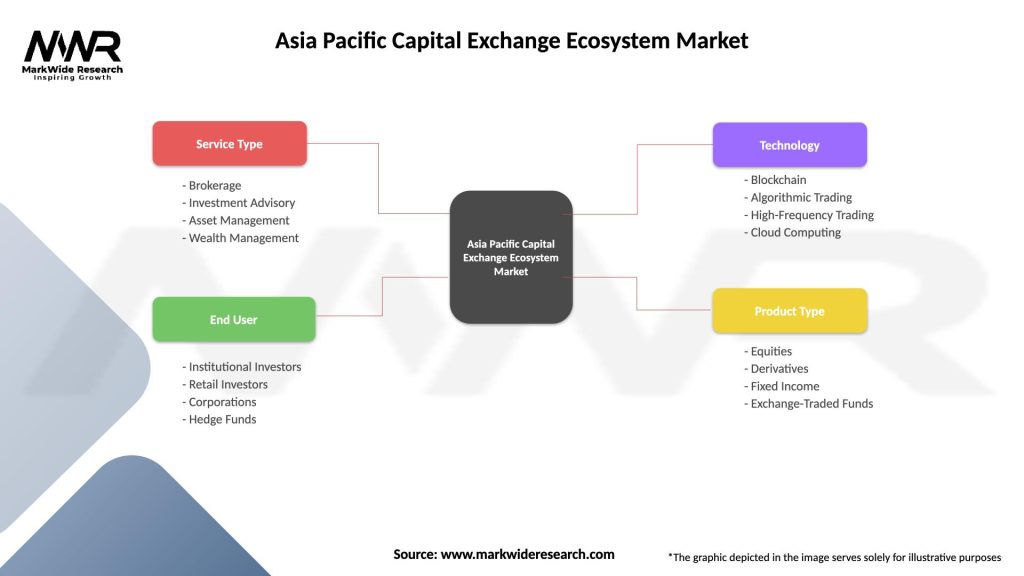

| Segmentation Details | Description |

|---|---|

| Service Type | Brokerage, Investment Advisory, Asset Management, Wealth Management |

| End User | Institutional Investors, Retail Investors, Corporations, Hedge Funds |

| Technology | Blockchain, Algorithmic Trading, High-Frequency Trading, Cloud Computing |

| Product Type | Equities, Derivatives, Fixed Income, Exchange-Traded Funds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Capital Exchange Ecosystem Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at