444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific automotive plastics market represents one of the most dynamic and rapidly evolving segments within the global automotive industry. This expansive market encompasses a diverse range of plastic materials and components utilized across various automotive applications, from interior trim and dashboard components to exterior body panels and under-the-hood applications. The region’s automotive plastics sector is experiencing unprecedented growth, driven by increasing vehicle production, rising consumer demand for lightweight materials, and stringent fuel efficiency regulations across major automotive manufacturing hubs.

Market dynamics in the Asia-Pacific region are particularly compelling, with countries like China, Japan, South Korea, and India serving as major automotive production centers. The market is characterized by robust growth rates, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory is supported by the region’s position as the world’s largest automotive manufacturing hub, accounting for approximately 58% of global vehicle production.

Technological advancement and innovation in automotive plastics are reshaping the industry landscape. Manufacturers are increasingly adopting advanced polymer technologies, including engineering plastics, bio-based materials, and recycled plastic compounds. The shift toward electric vehicles (EVs) and hybrid vehicles is creating new opportunities for specialized plastic applications, particularly in battery housings, charging infrastructure, and lightweight structural components.

The Asia-Pacific automotive plastics market refers to the comprehensive ecosystem of plastic materials, components, and systems specifically designed and manufactured for automotive applications within the Asia-Pacific geographical region. This market encompasses the production, distribution, and utilization of various plastic polymers including polypropylene, polyethylene, polyvinyl chloride, acrylonitrile butadiene styrene (ABS), polycarbonate, and advanced engineering plastics used in vehicle manufacturing and aftermarket applications.

Automotive plastics serve multiple critical functions in modern vehicles, including weight reduction, design flexibility, corrosion resistance, and cost-effectiveness. These materials are integral to achieving improved fuel efficiency, enhanced safety features, and superior aesthetic appeal in contemporary automotive designs. The market includes both thermoplastic and thermoset materials, ranging from commodity plastics used in high-volume applications to specialty engineering plastics employed in demanding automotive environments.

Strategic market positioning within the Asia-Pacific automotive plastics sector reveals a landscape characterized by intense competition, rapid technological evolution, and substantial growth opportunities. The market is experiencing significant expansion driven by increasing vehicle electrification, stringent emission regulations, and growing consumer preference for lightweight, fuel-efficient vehicles. Major automotive manufacturers are increasingly integrating plastic components to achieve weight reduction targets, with plastic content in vehicles reaching approximately 15-20% of total vehicle weight.

Key market drivers include the region’s dominant position in global automotive manufacturing, rising disposable incomes leading to increased vehicle ownership, and government initiatives promoting electric vehicle adoption. The market is witnessing substantial investments in research and development, with manufacturers focusing on developing advanced plastic formulations that meet evolving automotive requirements for durability, recyclability, and performance.

Competitive dynamics are intensifying as both established chemical companies and emerging regional players compete for market share. The market structure includes major international corporations alongside numerous regional manufacturers, creating a diverse and competitive ecosystem that drives innovation and cost optimization across the value chain.

Market segmentation analysis reveals several critical insights that define the Asia-Pacific automotive plastics landscape:

Automotive industry expansion across the Asia-Pacific region serves as the primary catalyst for market growth. The region’s position as the global automotive manufacturing hub, combined with increasing domestic vehicle demand, creates substantial opportunities for plastic component suppliers. Rising urbanization and improving economic conditions are driving vehicle ownership rates, particularly in emerging markets like India, Thailand, and Vietnam.

Regulatory compliance requirements are significantly influencing market dynamics. Stringent fuel efficiency standards and emission regulations are compelling automotive manufacturers to adopt lightweight materials, with plastics offering superior weight-to-strength ratios compared to traditional materials. Government initiatives promoting electric vehicle adoption are creating new application areas for specialized automotive plastics.

Technological advancement in plastic manufacturing processes is enabling the development of high-performance materials suitable for demanding automotive applications. Innovations in polymer chemistry, processing techniques, and additive technologies are expanding the application scope of automotive plastics while improving their performance characteristics.

Cost optimization pressures within the automotive industry are driving increased plastic adoption. Manufacturers are seeking cost-effective alternatives to traditional materials while maintaining quality and performance standards. Plastics offer significant advantages in terms of design flexibility, manufacturing efficiency, and lifecycle cost optimization.

Raw material price volatility represents a significant challenge for automotive plastic manufacturers. Fluctuations in crude oil prices directly impact the cost of petroleum-based polymers, creating uncertainty in pricing strategies and profit margins. This volatility affects long-term planning and investment decisions across the value chain.

Environmental concerns and sustainability pressures are creating challenges for traditional automotive plastics. Increasing awareness of plastic waste and environmental impact is driving demand for eco-friendly alternatives, requiring substantial investments in research and development of sustainable materials. Regulatory restrictions on certain plastic types are limiting application possibilities in some markets.

Technical limitations of certain plastic materials in high-temperature and high-stress automotive applications continue to restrict market expansion. While engineering plastics offer improved performance, their higher costs limit widespread adoption in cost-sensitive applications. Material compatibility issues and recycling challenges also pose constraints on market growth.

Supply chain complexities in the Asia-Pacific region, including logistics challenges, quality control variations, and regulatory differences across countries, create operational difficulties for market participants. Trade tensions and geopolitical factors can disrupt supply chains and impact market stability.

Electric vehicle revolution presents unprecedented opportunities for automotive plastic manufacturers. The transition to electric mobility requires specialized plastic components for battery housings, charging systems, and lightweight structural elements. This shift is creating new application areas and driving demand for high-performance engineering plastics with superior electrical insulation properties.

Sustainable material development offers significant growth potential as automotive manufacturers increasingly prioritize environmental responsibility. Bio-based plastics, recycled materials, and circular economy initiatives are creating new market segments and differentiation opportunities for innovative manufacturers.

Advanced manufacturing technologies including 3D printing, injection molding innovations, and automated production systems are enabling more efficient and cost-effective plastic component manufacturing. These technologies are reducing production costs while improving quality and customization capabilities.

Emerging market expansion in countries like India, Indonesia, and Vietnam presents substantial growth opportunities. Rising vehicle ownership rates, improving infrastructure, and government support for automotive manufacturing are creating new demand centers for automotive plastics.

Competitive intensity within the Asia-Pacific automotive plastics market is driving continuous innovation and efficiency improvements. Market participants are investing heavily in research and development to develop next-generation materials that meet evolving automotive requirements. The competitive landscape is characterized by both price competition and technology differentiation strategies.

Supply chain integration is becoming increasingly important as automotive manufacturers seek to optimize costs and ensure quality consistency. Vertical integration strategies and strategic partnerships between plastic suppliers and automotive OEMs are reshaping market relationships and creating competitive advantages.

Technology convergence between traditional automotive applications and emerging technologies like autonomous vehicles, connected cars, and shared mobility is creating new requirements for automotive plastics. These trends are driving demand for smart materials, sensor-integrated components, and advanced functional plastics.

Market consolidation trends are evident as larger companies acquire smaller specialized manufacturers to expand their technology portfolios and market reach. This consolidation is creating more integrated value chains while potentially reducing competition in certain market segments.

Comprehensive market analysis for the Asia-Pacific automotive plastics market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data analysis, qualitative insights from industry experts, and comprehensive market modeling to provide accurate and actionable intelligence.

Primary research activities include extensive interviews with key industry stakeholders, including automotive plastic manufacturers, automotive OEMs, suppliers, distributors, and end-users across major Asia-Pacific markets. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics.

Secondary research sources encompass industry reports, company financial statements, government publications, trade association data, and academic research papers. This comprehensive secondary research provides historical market data, regulatory information, and industry benchmarks essential for market analysis.

Data validation processes ensure accuracy and reliability through triangulation of information sources, expert review panels, and statistical verification methods. The research methodology adheres to international market research standards and best practices to deliver credible and actionable market intelligence.

China dominates the Asia-Pacific automotive plastics market, representing the largest regional segment with substantial manufacturing capacity and domestic demand. The country’s automotive industry growth, government support for electric vehicles, and expanding middle-class population drive significant market opportunities. Chinese manufacturers are increasingly focusing on high-value engineering plastics and sustainable materials.

Japan maintains its position as a technology leader in automotive plastics, with major chemical companies and automotive manufacturers driving innovation in advanced materials. The country’s focus on hybrid and electric vehicles, combined with stringent quality standards, creates demand for high-performance plastic components. Japanese companies are leading developments in bio-based and recycled automotive plastics.

South Korea’s automotive sector is experiencing robust growth, with major automotive manufacturers expanding production capacity and investing in electric vehicle technologies. The country’s strong chemical industry provides a solid foundation for automotive plastic manufacturing, with companies focusing on lightweight materials and advanced polymer technologies.

India represents a high-growth market with expanding automotive production and increasing domestic vehicle demand. The government’s focus on electric mobility and manufacturing initiatives creates opportunities for automotive plastic manufacturers. However, cost sensitivity and infrastructure challenges require tailored market approaches.

Southeast Asian markets including Thailand, Indonesia, and Vietnam are emerging as important automotive manufacturing hubs, driven by foreign investment and government incentives. These markets offer growth opportunities for automotive plastic suppliers, particularly in cost-effective applications and regional manufacturing strategies.

Market leadership in the Asia-Pacific automotive plastics sector is characterized by a mix of global chemical giants and regional specialists. The competitive environment is dynamic, with companies competing on technology innovation, cost efficiency, and customer relationships.

Competitive strategies focus on technology differentiation, strategic partnerships with automotive OEMs, and expansion into high-growth market segments. Companies are investing in sustainable materials development, advanced manufacturing capabilities, and regional market expansion to maintain competitive advantages.

By Material Type:

By Application:

By Vehicle Type:

Interior applications represent the largest category within the automotive plastics market, driven by extensive use in dashboard assemblies, door panels, seating components, and decorative trim. This segment benefits from continuous innovation in surface aesthetics, tactile properties, and functional integration. MarkWide Research analysis indicates that interior applications account for approximately 42% of total automotive plastic consumption in the region.

Engineering plastics category is experiencing the fastest growth rate due to increasing demand for high-performance applications. These materials offer superior mechanical properties, temperature resistance, and dimensional stability required for demanding automotive environments. Applications include structural components, bearing systems, and precision mechanical parts.

Sustainable materials category is emerging as a significant growth area, with bio-based plastics and recycled materials gaining traction among environmentally conscious automotive manufacturers. This category addresses growing sustainability requirements while maintaining performance standards required for automotive applications.

Electric vehicle applications represent a specialized category with unique requirements for electrical insulation, thermal management, and lightweight construction. This segment is driving demand for advanced polymer formulations and innovative component designs.

Automotive manufacturers benefit from plastic adoption through significant weight reduction, design flexibility, and cost optimization. Plastics enable complex geometries, integrated functionality, and reduced assembly complexity compared to traditional materials. The corrosion resistance and durability of automotive plastics contribute to improved vehicle longevity and reduced maintenance requirements.

Plastic suppliers gain access to a large and growing market with diverse application opportunities. The automotive industry’s emphasis on innovation creates demand for advanced materials and specialized solutions, enabling premium pricing for high-performance products. Long-term supply relationships with automotive OEMs provide stable revenue streams and growth opportunities.

End consumers benefit from improved vehicle fuel efficiency, enhanced safety features, and superior aesthetic appeal enabled by automotive plastics. Lightweight plastic components contribute to better vehicle performance while advanced materials provide improved comfort and functionality.

Environmental stakeholders benefit from the automotive industry’s increasing focus on sustainable materials and circular economy principles. Recycled plastics and bio-based materials contribute to reduced environmental impact while maintaining vehicle performance standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Lightweighting initiatives are driving increased adoption of advanced plastic materials across all vehicle segments. Automotive manufacturers are implementing comprehensive weight reduction strategies, with plastics playing a crucial role in achieving fuel efficiency targets and emission compliance. This trend is particularly pronounced in electric vehicles where weight reduction directly impacts battery range and performance.

Sustainable material adoption is accelerating as automotive manufacturers respond to environmental pressures and regulatory requirements. Bio-based plastics, recycled materials, and circular economy principles are becoming integral to automotive plastic strategies. Companies are investing in sustainable supply chains and developing closed-loop recycling systems.

Smart material integration represents an emerging trend where plastic components incorporate sensors, electronics, and functional capabilities. These smart plastics enable advanced vehicle features including structural health monitoring, user interface integration, and adaptive functionality.

Manufacturing digitalization is transforming plastic component production through Industry 4.0 technologies. Automated production systems, predictive maintenance, and quality control innovations are improving efficiency and reducing costs while enhancing product quality and consistency.

Strategic partnerships between automotive OEMs and plastic suppliers are intensifying, with companies forming long-term collaborations to develop next-generation materials and components. These partnerships enable joint research and development initiatives, shared investment in new technologies, and integrated supply chain optimization.

Manufacturing capacity expansion across the Asia-Pacific region is accelerating to meet growing demand. Major chemical companies are investing in new production facilities, particularly in emerging markets like India and Southeast Asia, to capture growth opportunities and serve regional automotive manufacturers.

Technology acquisitions and mergers are reshaping the competitive landscape as companies seek to expand their technology portfolios and market reach. These strategic moves enable access to specialized capabilities, innovative materials, and new customer relationships.

Regulatory compliance initiatives are driving industry-wide efforts to meet evolving environmental and safety standards. Companies are investing in sustainable material development, recycling technologies, and compliance systems to address regulatory requirements across different markets.

Investment prioritization should focus on sustainable material development and electric vehicle applications, as these segments offer the highest growth potential and competitive differentiation opportunities. Companies should allocate resources to bio-based plastics, recycled materials, and specialized EV components to capture emerging market opportunities.

Geographic expansion strategies should target high-growth emerging markets while maintaining strong positions in established markets. India, Southeast Asia, and other developing automotive markets offer substantial growth potential, but require tailored approaches considering local cost sensitivities and infrastructure constraints.

Technology partnerships with automotive OEMs, research institutions, and technology companies can accelerate innovation and market access. Collaborative approaches enable shared risk, faster development cycles, and access to complementary capabilities essential for success in the evolving automotive landscape.

Supply chain optimization should focus on resilience, sustainability, and cost efficiency. Companies should diversify supplier bases, invest in regional manufacturing capabilities, and implement circular economy principles to create competitive advantages and mitigate risks.

Market evolution over the next decade will be characterized by accelerating adoption of sustainable materials, increasing integration of smart technologies, and continued growth driven by electric vehicle expansion. MWR projections indicate that the market will maintain robust growth rates, with electric vehicle applications experiencing particularly strong expansion at compound annual growth rates exceeding 15%.

Technology advancement will focus on developing high-performance sustainable materials that meet stringent automotive requirements while addressing environmental concerns. Innovations in polymer chemistry, processing technologies, and recycling systems will enable new application possibilities and improved performance characteristics.

Regional dynamics will see continued dominance by China, Japan, and South Korea, while emerging markets gain increasing importance. India is expected to become a major growth driver, with automotive production and domestic demand creating substantial opportunities for plastic component suppliers.

Industry transformation toward electric mobility, autonomous vehicles, and shared transportation will create new requirements for automotive plastics. These trends will drive demand for specialized materials, smart components, and innovative solutions that address evolving automotive industry needs.

The Asia-Pacific automotive plastics market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by regional automotive industry expansion, technological innovation, and changing consumer preferences. The market’s strong fundamentals, including dominant manufacturing positions, growing vehicle demand, and increasing adoption of lightweight materials, provide a solid foundation for continued expansion.

Strategic success in this market requires focus on sustainable material development, electric vehicle applications, and emerging market expansion. Companies that invest in innovation, build strong partnerships with automotive manufacturers, and develop comprehensive sustainability strategies will be best positioned to capture growth opportunities and maintain competitive advantages.

Future market development will be shaped by the transition to electric mobility, increasing environmental consciousness, and continued technological advancement. The industry’s ability to address sustainability challenges while meeting performance requirements will determine long-term success and market positioning in the evolving automotive landscape.

What is Automotive Plastics?

Automotive Plastics refer to a range of plastic materials used in the manufacturing of vehicles, including components like dashboards, bumpers, and interior trims. These materials are favored for their lightweight properties, durability, and design flexibility.

What are the key players in the Asia-Pacific Automotive Plastics Market?

Key players in the Asia-Pacific Automotive Plastics Market include BASF, DuPont, and SABIC, which are known for their innovative plastic solutions tailored for automotive applications, among others.

What are the growth factors driving the Asia-Pacific Automotive Plastics Market?

The growth of the Asia-Pacific Automotive Plastics Market is driven by the increasing demand for lightweight materials to enhance fuel efficiency, the rise in electric vehicle production, and advancements in plastic recycling technologies.

What challenges does the Asia-Pacific Automotive Plastics Market face?

Challenges in the Asia-Pacific Automotive Plastics Market include stringent regulations regarding plastic waste management, competition from alternative materials, and fluctuating raw material prices that can impact production costs.

What opportunities exist in the Asia-Pacific Automotive Plastics Market?

Opportunities in the Asia-Pacific Automotive Plastics Market include the growing trend of electric vehicles, which require specialized lightweight components, and the increasing focus on sustainable materials that can reduce environmental impact.

What trends are shaping the Asia-Pacific Automotive Plastics Market?

Trends in the Asia-Pacific Automotive Plastics Market include the adoption of bio-based plastics, advancements in injection molding technologies, and the integration of smart materials that enhance vehicle functionality and safety.

Asia-Pacific Automotive Plastics Market

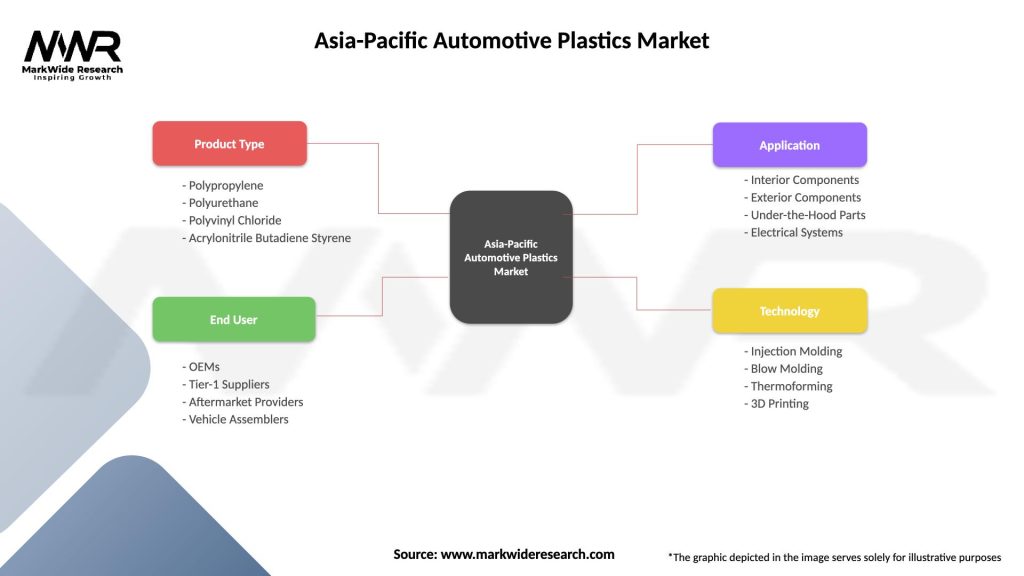

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyurethane, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Interior Components, Exterior Components, Under-the-Hood Parts, Electrical Systems |

| Technology | Injection Molding, Blow Molding, Thermoforming, 3D Printing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Automotive Plastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at