444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific airline catering services market represents one of the most dynamic and rapidly evolving segments within the global aviation industry. This comprehensive market encompasses the provision of in-flight meals, beverages, and related services to airlines operating across the diverse Asia Pacific region. Market dynamics indicate substantial growth potential driven by increasing air travel demand, rising passenger expectations, and the expansion of low-cost carriers throughout the region.

Regional characteristics define this market’s unique positioning, with countries like China, India, Japan, and Southeast Asian nations contributing significantly to overall market expansion. The market demonstrates remarkable resilience and adaptability, particularly following the aviation industry’s recovery from recent global disruptions. Growth trajectories suggest the market is experiencing robust expansion at approximately 8.2% CAGR, reflecting the region’s economic dynamism and increasing aviation connectivity.

Service diversification has become a hallmark of the Asia Pacific airline catering landscape, with providers expanding beyond traditional meal services to include specialized dietary options, premium culinary experiences, and innovative packaging solutions. The market’s evolution reflects broader trends in passenger preferences, sustainability concerns, and technological advancement in food preparation and logistics.

The Asia Pacific airline catering services market refers to the comprehensive ecosystem of companies and services dedicated to providing food, beverages, and related amenities to airlines operating within and through the Asia Pacific region. This market encompasses everything from meal preparation and packaging to logistics, delivery, and specialized dietary accommodations for passengers across various flight classes and durations.

Service scope extends beyond basic meal provision to include equipment supply, galley management, special dietary requirements, and innovative culinary solutions tailored to diverse cultural preferences across the region. The market serves commercial airlines, charter services, and private aviation, adapting to varying operational requirements and passenger expectations.

Operational complexity characterizes this market, involving sophisticated supply chain management, strict food safety protocols, and coordination with multiple stakeholders including airlines, airports, regulatory bodies, and suppliers. The market’s definition encompasses both traditional full-service carriers and the growing low-cost carrier segment, each requiring distinct catering approaches and service levels.

Market positioning within the Asia Pacific region demonstrates exceptional growth potential, driven by the region’s expanding middle class, increased business travel, and tourism growth. The airline catering services sector has evolved from basic meal provision to sophisticated culinary experiences that reflect local tastes while meeting international standards.

Key market drivers include the rapid expansion of airline routes, increasing passenger traffic volumes, and growing demand for premium in-flight dining experiences. The market benefits from approximately 12% annual growth in passenger traffic across major Asia Pacific aviation hubs, creating substantial opportunities for catering service providers.

Competitive landscape features a mix of international catering giants and regional specialists, each adapting their services to local preferences and regulatory requirements. The market’s fragmentation allows for specialized service providers to thrive alongside established global players, creating a dynamic and innovative environment.

Future prospects indicate continued expansion, with sustainability initiatives, technological integration, and premium service offerings driving market evolution. The sector’s resilience and adaptability position it well for sustained growth as Asia Pacific aviation markets continue their upward trajectory.

Strategic insights reveal several critical factors shaping the Asia Pacific airline catering services market landscape:

Passenger traffic growth serves as the primary catalyst for market expansion, with Asia Pacific aviation experiencing unprecedented growth rates. The region’s economic development, urbanization, and increasing disposable income contribute to rising air travel demand, directly impacting catering service requirements.

Tourism expansion across Southeast Asia, China, and India creates substantial opportunities for catering providers. Government initiatives promoting tourism, visa liberalization, and improved airport infrastructure support increased international and domestic travel, generating higher demand for quality in-flight services.

Business travel growth reflects the region’s economic integration and expanding trade relationships. Corporate travel policies increasingly emphasize employee comfort and experience, driving demand for premium catering services and specialized business-class offerings.

Airline competition intensifies focus on passenger experience differentiation, with catering services becoming a key competitive advantage. Airlines invest in unique culinary partnerships, celebrity chef collaborations, and regionally-inspired menus to attract and retain customers.

Cultural appreciation drives demand for authentic local cuisine options, requiring catering providers to develop expertise in diverse culinary traditions while maintaining international food safety standards. This trend creates opportunities for regional specialization and cultural authenticity in service offerings.

Operational complexity presents significant challenges for catering service providers, particularly in managing diverse regulatory requirements across multiple countries. Food safety standards, import restrictions, and certification requirements vary substantially across Asia Pacific markets, creating compliance burdens and operational inefficiencies.

Cost pressures from airlines seeking to optimize operational expenses impact catering service margins. The competitive airline industry’s focus on cost reduction often translates to pressure on catering providers to deliver services at lower prices while maintaining quality standards.

Supply chain vulnerabilities expose the market to disruptions from natural disasters, political instability, and global events. The region’s susceptibility to typhoons, earthquakes, and other natural phenomena can significantly impact food supply chains and operational continuity.

Infrastructure limitations in some emerging markets restrict service expansion and quality consistency. Inadequate cold chain facilities, limited airport infrastructure, and transportation challenges can constrain market growth in certain regions.

Labor shortages in skilled food preparation and logistics roles create operational challenges. The specialized nature of airline catering requires trained personnel familiar with aviation regulations, food safety protocols, and high-volume production techniques.

Premium service expansion offers substantial growth potential as Asia Pacific’s affluent population continues expanding. The growing demand for luxury travel experiences creates opportunities for high-end catering services, celebrity chef partnerships, and exclusive culinary offerings.

Sustainability initiatives present opportunities for innovative providers to differentiate through environmentally responsible practices. Sustainable packaging, local sourcing, and waste reduction programs align with growing environmental consciousness among passengers and airlines.

Technology integration enables operational efficiency improvements and enhanced customer experiences. Digital ordering systems, predictive analytics for demand forecasting, and automated food preparation technologies offer competitive advantages and cost optimization opportunities.

Regional cuisine specialization allows catering providers to develop unique market positions by focusing on authentic local flavors and traditional preparation methods. This approach can create strong partnerships with regional airlines and attract culturally-conscious travelers.

Low-cost carrier partnerships represent a rapidly growing market segment requiring innovative, cost-effective catering solutions. The expansion of budget airlines across Asia Pacific creates demand for streamlined, efficient catering services that maintain quality while controlling costs.

Competitive intensity characterizes the Asia Pacific airline catering services market, with established international players competing alongside regional specialists and emerging local providers. This competition drives innovation, service quality improvements, and pricing optimization across the market.

Consolidation trends are emerging as larger catering companies acquire regional players to expand geographic coverage and service capabilities. These strategic acquisitions enable comprehensive service offerings and improved operational efficiency through economies of scale.

Customer expectations continue evolving, with passengers increasingly demanding restaurant-quality meals, diverse dietary options, and culturally authentic cuisine. Airlines respond by partnering with renowned chefs and investing in premium catering services to enhance passenger satisfaction and brand differentiation.

Regulatory evolution impacts market operations as governments update food safety standards, environmental regulations, and import requirements. Catering providers must maintain agility to adapt to changing regulatory landscapes while ensuring consistent service quality.

Supply chain optimization becomes increasingly critical as providers seek to balance cost efficiency with quality maintenance. Advanced logistics systems, strategic supplier relationships, and inventory management technologies contribute to operational excellence and competitive positioning.

Comprehensive analysis of the Asia Pacific airline catering services market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive interviews with industry executives, airline catering managers, and key stakeholders across major Asia Pacific markets.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and trade association publications. This approach provides historical context, market sizing validation, and trend identification across the diverse regional landscape.

Market segmentation analysis examines the market across multiple dimensions including geography, service type, airline category, and customer segments. This detailed segmentation enables precise identification of growth opportunities and competitive dynamics within specific market niches.

Stakeholder engagement includes consultations with airline executives, catering service providers, airport authorities, and regulatory officials to gain comprehensive perspectives on market challenges, opportunities, and future trends.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis, and expert review. MarkWide Research employs rigorous quality control measures to maintain the highest standards of market intelligence and analytical precision.

China dominates the regional market with approximately 35% market share, driven by massive domestic aviation growth and increasing international connectivity. The country’s expanding middle class and business travel demand create substantial opportunities for both domestic and international catering providers.

India represents the fastest-growing market segment, with aviation growth rates exceeding 15% annually in major metropolitan areas. The country’s diverse culinary traditions and growing aviation infrastructure present unique opportunities for specialized catering services.

Japan maintains a mature, high-value market characterized by premium service expectations and sophisticated culinary standards. The market emphasizes quality, presentation, and cultural authenticity, creating opportunities for specialized providers focused on excellence.

Southeast Asia demonstrates remarkable diversity, with countries like Singapore, Thailand, and Malaysia serving as major aviation hubs. The region’s tourism focus and cultural diversity require flexible, culturally-sensitive catering approaches.

Australia and New Zealand represent developed markets with strong regulatory frameworks and established service providers. These markets emphasize sustainability, local sourcing, and premium service quality, setting regional standards for operational excellence.

Market leadership features a combination of global catering giants and regional specialists, each bringing unique strengths and market positioning strategies:

Competitive strategies focus on service differentiation, operational efficiency, and strategic partnerships with airlines. Providers invest in culinary innovation, sustainability initiatives, and technology integration to maintain competitive advantages in this dynamic market.

By Service Type:

By Airline Category:

By Geography:

Full-service catering represents the largest market segment, accounting for approximately 55% of total market activity. This category emphasizes comprehensive meal services, premium ingredients, and sophisticated presentation standards that align with traditional airline service expectations.

Economy catering solutions demonstrate rapid growth, driven by the expansion of low-cost carriers across the region. This segment requires innovative approaches to cost management while maintaining food safety standards and basic quality expectations.

Premium catering services show strong growth potential, particularly in markets with expanding affluent populations. This category focuses on restaurant-quality dining experiences, celebrity chef partnerships, and culturally-authentic cuisine offerings.

Specialty dietary services represent an emerging high-value segment, addressing increasing passenger awareness of dietary restrictions, health considerations, and cultural requirements. This category includes halal, kosher, vegetarian, vegan, and allergen-free meal options.

Regional cuisine specialization creates opportunities for providers to develop unique market positions by focusing on authentic local flavors and traditional preparation methods that appeal to both domestic and international travelers.

Airlines benefit from enhanced passenger satisfaction, competitive differentiation, and operational efficiency through strategic catering partnerships. Quality catering services contribute to brand reputation, customer loyalty, and premium pricing opportunities for upgraded service classes.

Catering providers gain access to stable, long-term revenue streams through airline partnerships while developing specialized expertise and operational scale. The market offers opportunities for geographic expansion, service diversification, and technology integration.

Passengers receive improved dining experiences, diverse menu options, and accommodation of dietary preferences and cultural requirements. Quality catering services enhance overall travel satisfaction and contribute to positive airline brand perception.

Airports benefit from increased commercial activity, job creation, and enhanced reputation as quality service destinations. Successful catering operations contribute to airport competitiveness and passenger satisfaction scores.

Supply chain partners including food producers, packaging companies, and logistics providers gain access to stable demand and opportunities for specialized product development tailored to aviation requirements.

Local economies benefit from job creation, supplier opportunities, and tourism support through quality catering services that enhance the overall travel experience and destination attractiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with catering providers implementing eco-friendly packaging, local sourcing initiatives, and waste reduction programs. Airlines increasingly prioritize environmental responsibility, creating demand for sustainable catering solutions that align with corporate sustainability goals.

Technology adoption accelerates across the market, with providers implementing digital ordering systems, predictive analytics, and automated food preparation technologies. These innovations improve operational efficiency, reduce costs, and enhance service consistency across multiple locations.

Premium experience focus drives investment in high-quality ingredients, celebrity chef partnerships, and restaurant-style presentation. Airlines compete on dining experience quality, creating opportunities for catering providers to develop sophisticated culinary offerings.

Health-conscious options gain prominence as passengers become more aware of nutrition and dietary requirements. Catering providers expand offerings to include organic ingredients, superfood options, and transparent nutritional information.

Cultural authenticity becomes increasingly important, with travelers seeking genuine local cuisine experiences. Catering providers invest in regional culinary expertise and traditional preparation methods to meet this demand for authentic cultural experiences.

Strategic partnerships between airlines and celebrity chefs create unique dining experiences that differentiate carrier brands. These collaborations result in exclusive menu development, premium ingredient sourcing, and enhanced passenger satisfaction through restaurant-quality in-flight dining.

Technology investments in automated food preparation, inventory management systems, and cold chain logistics improve operational efficiency and food safety standards. MarkWide Research indicates that technology adoption rates in the sector have increased by approximately 25% over recent years.

Sustainability initiatives gain momentum with providers implementing comprehensive environmental programs including biodegradable packaging, carbon footprint reduction, and sustainable sourcing practices. These initiatives respond to growing environmental consciousness among passengers and airlines.

Market consolidation continues as larger catering companies acquire regional players to expand geographic coverage and service capabilities. These strategic acquisitions enable comprehensive service offerings and improved operational efficiency through economies of scale.

Regulatory compliance improvements address evolving food safety standards and international certification requirements. Providers invest in quality management systems, staff training, and facility upgrades to maintain compliance across diverse regulatory environments.

Investment priorities should focus on technology integration, sustainability initiatives, and premium service capabilities to capitalize on market growth opportunities. Catering providers should prioritize digital transformation, environmental responsibility, and culinary excellence to maintain competitive advantages.

Geographic expansion strategies should target emerging markets with growing aviation sectors while maintaining service quality standards. Providers should consider strategic partnerships or acquisitions to enter new markets efficiently and establish local expertise.

Service diversification opportunities exist in specialty dietary services, premium catering experiences, and cultural cuisine specialization. Companies should develop expertise in niche segments that command premium pricing and create customer loyalty.

Operational efficiency improvements through supply chain optimization, technology adoption, and workforce development can enhance profitability and service consistency. Providers should invest in systems and processes that reduce costs while maintaining quality standards.

Partnership development with airlines, suppliers, and technology providers can create competitive advantages and market access opportunities. Strategic alliances enable resource sharing, risk mitigation, and enhanced service capabilities.

Market expansion prospects remain robust, with continued aviation growth across Asia Pacific driving sustained demand for catering services. The region’s economic development, urbanization trends, and increasing connectivity support long-term market growth projections of approximately 7.5% CAGR over the next decade.

Technology integration will accelerate, with artificial intelligence, automation, and digital platforms transforming operational efficiency and customer experiences. Providers that successfully implement technology solutions will gain significant competitive advantages in cost management and service quality.

Sustainability focus will intensify, with environmental considerations becoming central to service provider selection and operational practices. Companies that develop comprehensive sustainability programs will be better positioned for long-term success and partnership opportunities.

Premium service growth will continue as Asia Pacific’s affluent population expands and travel expectations evolve. The market for high-end catering experiences will grow significantly, creating opportunities for specialized providers and innovative service offerings.

Regional integration will increase as aviation markets become more connected and standardized. Catering providers with multi-country capabilities and cultural expertise will be well-positioned to serve the increasingly integrated Asia Pacific aviation market. MWR analysis suggests that regional service standardization will improve operational efficiency by approximately 20% over the forecast period.

The Asia Pacific airline catering services market presents exceptional growth opportunities driven by robust aviation expansion, evolving passenger expectations, and increasing focus on premium travel experiences. The market’s diversity, cultural richness, and economic dynamism create a complex but rewarding environment for service providers willing to invest in quality, innovation, and operational excellence.

Success factors in this market include cultural sensitivity, operational flexibility, technology adoption, and sustainability commitment. Providers that can navigate regulatory complexity while delivering consistent, high-quality services across diverse markets will capture the greatest share of growth opportunities.

Future prospects remain highly positive, with continued aviation growth, premium service demand, and technology integration driving market evolution. The sector’s resilience and adaptability position it well for sustained expansion as Asia Pacific continues its trajectory as the world’s most dynamic aviation region, offering substantial opportunities for stakeholders committed to excellence and innovation in airline catering services.

What is Airline Catering Services?

Airline Catering Services refer to the provision of food and beverage services to airlines for their passengers during flights. This includes meal preparation, packaging, and delivery to aircraft, as well as managing dietary requirements and preferences.

What are the key players in the Asia Pacific Airline Catering Services Market?

Key players in the Asia Pacific Airline Catering Services Market include LSG Sky Chefs, Gate Gourmet, and SATS Ltd, among others. These companies provide a range of catering solutions tailored to various airlines and passenger needs.

What are the growth factors driving the Asia Pacific Airline Catering Services Market?

The growth of the Asia Pacific Airline Catering Services Market is driven by increasing air travel demand, rising disposable incomes, and a growing focus on passenger experience. Additionally, the expansion of low-cost carriers is contributing to the market’s growth.

What challenges does the Asia Pacific Airline Catering Services Market face?

The Asia Pacific Airline Catering Services Market faces challenges such as fluctuating food prices, stringent regulations regarding food safety, and the need for sustainable practices. These factors can impact operational costs and service delivery.

What opportunities exist in the Asia Pacific Airline Catering Services Market?

Opportunities in the Asia Pacific Airline Catering Services Market include the introduction of innovative meal options, partnerships with local food suppliers, and the adoption of technology for better service efficiency. These trends can enhance customer satisfaction and operational effectiveness.

What trends are shaping the Asia Pacific Airline Catering Services Market?

Trends shaping the Asia Pacific Airline Catering Services Market include a growing emphasis on healthy and organic meal options, the use of technology for meal customization, and increased focus on sustainability in food sourcing and packaging. These trends reflect changing consumer preferences and environmental concerns.

Asia Pacific Airline Catering Services Market

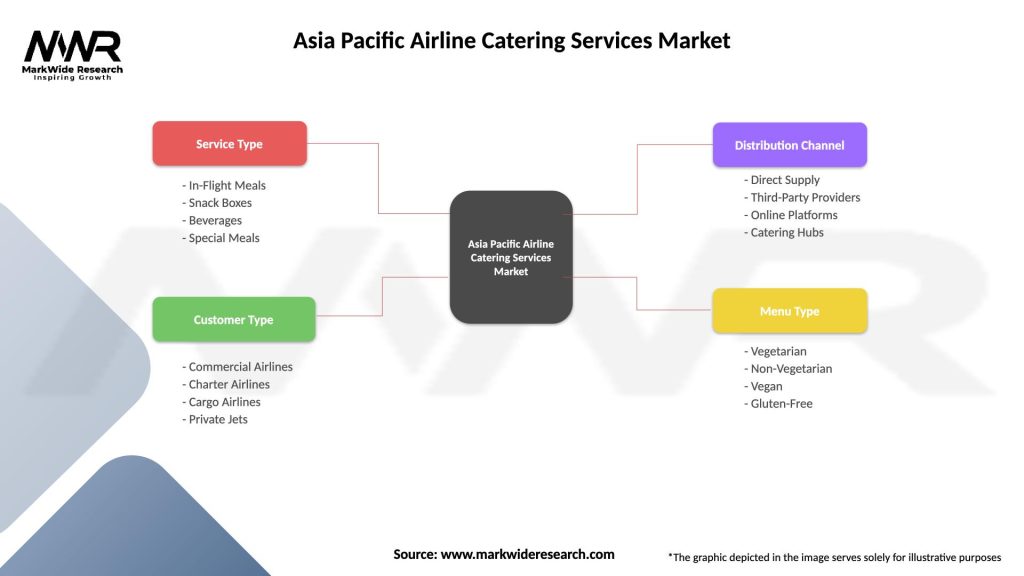

| Segmentation Details | Description |

|---|---|

| Service Type | In-Flight Meals, Snack Boxes, Beverages, Special Meals |

| Customer Type | Commercial Airlines, Charter Airlines, Cargo Airlines, Private Jets |

| Distribution Channel | Direct Supply, Third-Party Providers, Online Platforms, Catering Hubs |

| Menu Type | Vegetarian, Non-Vegetarian, Vegan, Gluten-Free |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Airline Catering Services Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at