444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific aircraft engine market refers to the market for engines used in aircraft across the Asia-Pacific region. Aircraft engines are critical components that power the propulsion system of an aircraft, enabling it to generate thrust and propel through the air. The Asia-Pacific region has witnessed significant growth in the aviation sector, leading to an increased demand for aircraft engines. This market overview provides valuable insights into the current state of the Asia-Pacific aircraft engine market, including key market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and more.

Meaning

The Asia-Pacific aircraft engine market encompasses the production, sales, and distribution of various types of aircraft engines, including turbofan engines, turboprop engines, turboshaft engines, and piston engines, among others. These engines are used in a wide range of aircraft, such as commercial airliners, regional jets, business jets, military aircraft, helicopters, and general aviation aircraft. The market also includes engine maintenance, repair, and overhaul (MRO) services, which are essential for ensuring the optimal performance and safety of aircraft engines throughout their operational lifespan.

Executive Summary

The executive summary of the Asia-Pacific aircraft engine market provides a concise overview of the market’s key highlights, including market size, growth rate, major players, and key trends. It summarizes the comprehensive analysis of the market, highlighting the significant factors influencing its growth and offering a snapshot of the market’s current and projected future state.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Fleet Expansion: Asia-Pacific airlines have more than 16,000 aircraft on order through 2040, representing over 40% of global deliveries; demand for engines mirrors this growth.

Aftermarket Services: Engine MRO revenue in the region is set to exceed USD 15 billion by 2030, as aging fleets require scheduled overhauls and component exchanges.

Green Technology: Engine programs such as Pratt & Whitney’s GTF™ and CFM’s LEAP® lead in fuel burn reductions (15–20%), aligning with regional CO₂ emissions goals.

Regional OEM Partnerships: Engine manufacturers are deepening collaborations with local partners—e.g., GE China, P&W’s joint ventures in Singapore—to secure long-term market access.

Digitalization: Health-monitoring platforms and predictive maintenance tools are being deployed widely, reducing unscheduled removals by up to 30%.

Market Drivers

Air Traffic Growth: Rising middle-class incomes and e-commerce expansion are propelling passenger and cargo flights, requiring additional aircraft and engines.

Fleet Modernization: Airlines are retiring older, less efficient engines in favor of new high-bypass turbofans that offer 15–20% lower fuel burn and reduced noise footprints.

MRO Capacity Expansion: Investments in state-of-the-art overhaul centers in Singapore, Malaysia, and India are improving turnaround times and cost competitiveness.

Regulatory Pressure: ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and regional emissions trading systems are accelerating adoption of next-generation engines.

Defense Modernization: Growing defense budgets in India, South Korea, and Australia are driving demand for military turbine engines and helicopter powerplants.

Market Restraints

High Development Costs: R&D for new engine architectures, materials, and combustion technologies runs into billions of dollars, slowing program launches.

Supply Chain Vulnerabilities: Disruptions in titanium, nickel-alloy, and composite part supplies can delay engine production and MRO services.

Skilled Workforce Shortage: A dearth of certified engine mechanics and digital-systems specialists constrains MRO facility expansion.

Economic Volatility: Currency fluctuations and geopolitical tensions can impact airline profitability and capital spending on new engines.

Emerging Competition: Regional engine start-ups and Russian-built powerplants introduce alternative options, pressuring OEM margins.

Market Opportunities

Sustainable Aviation Fuels (SAF) Compatibility: Engines certified for higher SAF blends can capture new retrofit and renewal business from airlines pursuing net-zero targets.

Component Repair Innovations: Additive-manufactured hot-section parts and new coating technologies extend time-on-wing and reduce overhaul costs.

Digital MRO Platforms: Cloud-native analytics and IoT sensors in Asian overhaul centers can drive predictive maintenance and service-agreement growth.

Regional MRO Hubs: Strategic development of low-cost hubs in India and Vietnam can attract cross-border engine repair work from global carriers.

Next-Gen Engine Programs: Participation in development of open-rotor, hybrid-electric, and hydrogen-capable engines can position OEMs for future fleet needs.

Market Dynamics

OEM–Airline Partnerships: Long-term service agreements (e.g., power-by-the-hour) align OEM revenue with engine health management and operational performance.

Government Incentives: Tax breaks, grants, and infrastructure support—particularly in India’s Regional Connectivity Scheme—encourage MRO investments.

Technology Localization: Transfer of engine assembly and maintenance technologies to local entities reduces costs and compliance barriers.

Consolidation Trends: MRO consolidation among independent companies and airline-owned workshops is optimizing capacity utilization.

Innovation Ecosystems: Collaboration among universities, research institutes, and OEM centers of excellence—especially in Singapore and Japan—accelerates engine-technology breakthroughs.

Regional Analysis

China: Largest single-market demand for new engine deliveries; rapid rise of low-cost carriers and regional jets fuels growth in small-thrust turbofans and turboprops.

India: Emerging as a key MRO hub with government support; regional connectivity push is driving turboprop engine demand for short-haul routes.

Southeast Asia: Singapore and Malaysia lead in MRO capacity; Indonesia and Vietnam are growing OEM assembly and overhaul partnerships.

Australia & New Zealand: Stable demand for defense engine upgrades and general-aviation turboprops, with strong aftermarket services for resource-industry helicopters.

Rest of Asia: Markets such as South Korea and Japan focus on domestic defense engine programs and selective commercial engine overhauls.

Competitive Landscape

Leading Companies in the Asia-Pacific Aircraft Engine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

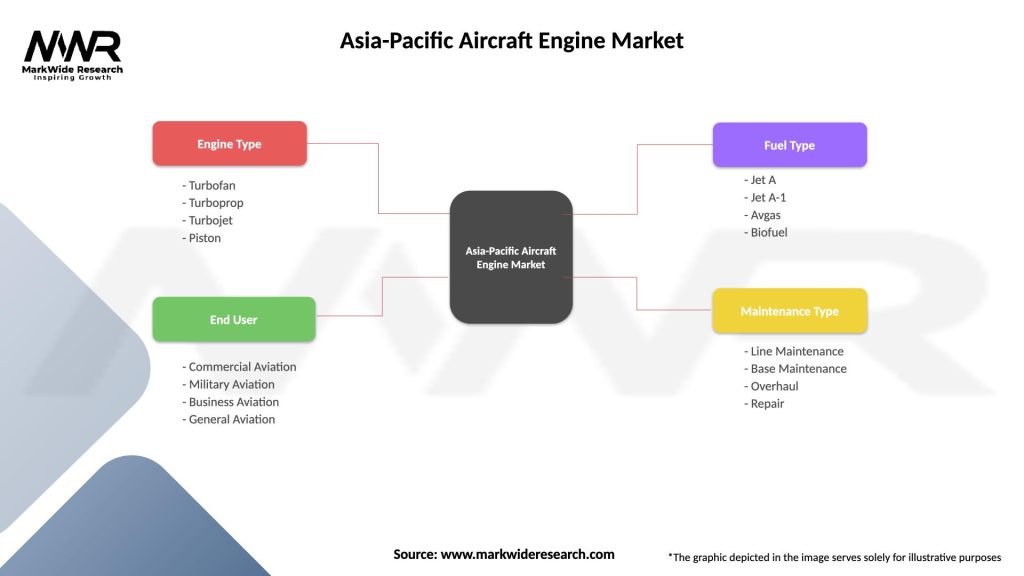

Segmentation

The Asia-Pacific aircraft engine market can be segmented based on various factors, including engine type, aircraft type, end-user, and geography. Engine type segmentation includes turbofan engines, turboprop engines, turboshaft engines, and piston engines. Aircraft type segmentation comprises commercial aircraft, regional aircraft, business jets, military aircraft, helicopters, and general aviation aircraft. End-user segmentation considers airlines, defense organizations, and general aviation operators. Geographically, the market can be segmented into key countries and regions within the Asia-Pacific region.

Category-wise Insights

Turbofan Engines: Largest revenue share; next-generation high-bypass engines deliver 15–20% fuel savings and lower noise levels, critical for congested Asian airports.

Turboprop Engines: Growing appeal for short, thin routes in Indonesia archipelago and rural India under regional connectivity mandates.

Turboshaft Engines: Helideck and offshore resource exploration drive demand for high-reliability turboshafts in the Gulf of Carpentaria and South China Sea regions.

APUs: Increasing retrofit demand in humid tropical climates accelerates APU exchanges and component maintenance cycles.

Key Benefits for Industry Participants and Stakeholders

Cost Predictability: Power-by-the-hour and flat-rate programs help airlines manage engine maintenance budgets amid fuel and currency volatility.

Enhanced Dispatch Reliability: Digital health-monitoring reduces unscheduled engine removals, improving on-time performance.

Local Job Creation: MRO hub development generates skilled employment and upskills local workforces in advanced aviation technologies.

Environmental Compliance: Newer engines reduce CO₂ and NOₓ emissions, helping carriers meet regional and global environmental targets.

Technology Transfer: Partnerships drive technology inflow, accelerating domestic aerospace capabilities development.

SWOT Analysis

Strengths:

Asia-Pacific’s unparalleled air traffic growth trajectory.

Strong regional MRO investments reducing lead times.

OEM commitment to localized production and service networks.

Weaknesses:

Dependence on imported R&D and core engine technologies.

Inconsistent regulatory frameworks across countries.

Limited skilled-labor availability in certain low-cost markets.

Opportunities:

Expansion of SAF-capable engine retrofit programs.

Growth of business-jet and helicopter fleets in emerging markets.

Adoption of predictive maintenance across all engine types.

Threats:

Geopolitical tensions and trade restrictions impacting OEM-country partnerships.

Volatile fuel prices affecting airline CapEx budgets.

Competition from alternative propulsion research (electric and hybrid).

Market Key Trends

Digital Twin Implementation: Creation of real-time virtual replicas of engine fleets to optimize maintenance intervals and performance.

Hybrid-Electric Demonstrators: Early-stage flight tests of hybrid-electric propulsion systems in regional aircraft prototypes across Japan and China.

Advanced Materials Adoption: Expanded use of ceramic matrix composites (CMCs) and additive-manufactured hot-section components for weight and temperature gains.

Standardized MRO Platforms: Emergence of unified IT platforms across MRO centers for seamless data sharing and process benchmarking.

Circular MRO Economy: Engine part pooling and life-extension programs to reduce downtime and inventory carrying costs.

Covid-19 Impact

The pandemic led to a temporary contraction in Asia-Pacific air traffic and deferred engine purchases and overhauls in 2020–21. However, government relief packages and cargo demand recovery sustained MRO activities for freighter conversions. Since 2022, rapid rebound in passenger traffic—particularly domestic—and pent-up replacement cycles have driven accelerated engine deliveries and aftermarket service bookings. Remote diagnostics adoption surged as travel restrictions limited on-site inspections.

Key Industry Developments

GE’s GEnx™ CFM56 Transition: GE advanced plans to shift Chinese CFMI assembly lines from CFM56 to LEAP and GEnx to meet regional order backlogs.

Pratt & Whitney GTF™ India Facility: Announced a new GTF MRO plant in Nagpur to support narrow-body engine fleets of Indian carriers.

Rolls-Royce Singapore Component Repair: Expanded its Trent engine compressor repair cell in Seletar Aerospace Park, enhancing turnaround times for Asia-Pacific operators.

Analyst Suggestions

Deepen Local Partnerships: OEMs should seek equity-based joint ventures with leading MRO groups to secure market share and align incentives.

Scale Predictive Maintenance: Airlines and MROs must integrate real-time engine health data with AI-driven analytics for optimized overhaul planning.

Invest in Workforce Development: Collaborative training programs with technical institutions will address critical skill gaps in engine mechanics and data science.

Diversify Fuel-Flexibility: Accelerate certification of engines for varied SAF blends to future-proof investments against evolving environmental regulations.

Future Outlook

The Asia-Pacific Aircraft Engine market is set to maintain its leadership in global engine demand, driven by continuous network expansion, fleet renewals, and MRO capacity growth. Emerging propulsion technologies—hybrid-electric and hydrogen-capable engines—will begin entering demonstrator phases, positioning the region at the forefront of sustainable aviation adoption. MRO consolidation and digital-service proliferation will underpin aftermarket revenue, while OEM localization strategies will deepen regional aerospace ecosystems and resilience.

Conclusion

In conclusion, the Asia-Pacific Aircraft Engine market reflects the broader dynamism of regional aviation: rapid growth, technology adoption, and evolving service paradigms. Stakeholders—from OEMs and airlines to MRO providers and regulatory bodies—must collaborate on digitalization, workforce development, and sustainability initiatives to harness the region’s unparalleled expansion. By aligning engine innovation with local market needs and global environmental imperatives, the Asia-Pacific aviation ecosystem is poised for a new era of efficiency, connectivity, and growth.

What is Aircraft Engine?

Aircraft engines are machines designed to propel aircraft by converting fuel into mechanical energy. They are critical components in aviation, powering various types of aircraft, including commercial airliners, military jets, and helicopters.

What are the key players in the Asia-Pacific Aircraft Engine Market?

Key players in the Asia-Pacific Aircraft Engine Market include General Electric, Rolls-Royce, Pratt & Whitney, and Safran, among others. These companies are involved in the design, manufacturing, and maintenance of aircraft engines for various applications.

What are the growth factors driving the Asia-Pacific Aircraft Engine Market?

The growth of the Asia-Pacific Aircraft Engine Market is driven by increasing air travel demand, expansion of airline fleets, and advancements in engine technology. Additionally, the rise in cargo transportation and military aviation also contribute to market growth.

What challenges does the Asia-Pacific Aircraft Engine Market face?

The Asia-Pacific Aircraft Engine Market faces challenges such as stringent environmental regulations, high manufacturing costs, and supply chain disruptions. These factors can impact production timelines and overall market stability.

What opportunities exist in the Asia-Pacific Aircraft Engine Market?

Opportunities in the Asia-Pacific Aircraft Engine Market include the development of more fuel-efficient engines, the rise of electric and hybrid propulsion systems, and increasing investments in aerospace infrastructure. These trends can lead to innovative solutions and market expansion.

What are the current trends in the Asia-Pacific Aircraft Engine Market?

Current trends in the Asia-Pacific Aircraft Engine Market include a focus on sustainability, with manufacturers exploring alternative fuels and eco-friendly technologies. Additionally, digital transformation and predictive maintenance are becoming increasingly important in engine management.

Asia-Pacific Aircraft Engine Market

| Segmentation Details | Description |

|---|---|

| Engine Type | Turbofan, Turboprop, Turbojet, Piston |

| End User | Commercial Aviation, Military Aviation, Business Aviation, General Aviation |

| Fuel Type | Jet A, Jet A-1, Avgas, Biofuel |

| Maintenance Type | Line Maintenance, Base Maintenance, Overhaul, Repair |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Aircraft Engine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at