444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific air-insulated switchgear market represents one of the most dynamic and rapidly expanding segments within the global electrical infrastructure industry. This comprehensive market encompasses a diverse range of electrical switching, protection, and control equipment that utilizes air as the primary insulating medium. Market growth is being driven by unprecedented urbanization, industrial expansion, and the region’s commitment to modernizing electrical grid infrastructure across multiple countries.

Regional dynamics indicate that the Asia-Pacific region accounts for approximately 45% of global switchgear consumption, making it the largest market worldwide. The market is characterized by robust demand from emerging economies, particularly China, India, and Southeast Asian nations, where rapid industrialization and infrastructure development are creating substantial opportunities for air-insulated switchgear deployment. Growth projections suggest the market will expand at a compound annual growth rate of 6.8% through the forecast period.

Technology adoption patterns across the region show increasing preference for advanced air-insulated switchgear solutions that offer enhanced reliability, improved safety features, and greater operational efficiency. The market is experiencing significant transformation as utilities and industrial facilities upgrade aging infrastructure and implement smart grid technologies. Investment trends indicate that renewable energy integration and grid modernization initiatives are becoming primary drivers of market expansion.

The Asia-Pacific air-insulated switchgear market refers to the comprehensive ecosystem of electrical equipment manufacturing, distribution, and deployment across the Asia-Pacific region, where air serves as the primary insulating and arc-quenching medium in high and medium voltage applications. This market encompasses various switchgear configurations including metal-clad, metal-enclosed, and pad-mounted units designed for power generation, transmission, distribution, and industrial applications.

Air-insulated switchgear represents a critical component of electrical infrastructure that enables safe and reliable control of electrical circuits through switching, protection, and isolation functions. Unlike gas-insulated alternatives, these systems utilize atmospheric air as the insulating medium, making them cost-effective and environmentally friendly solutions for a wide range of voltage applications. The technology provides essential electrical protection through circuit breakers, disconnect switches, and protective relays integrated within robust enclosures.

Market scope includes both indoor and outdoor installations across voltage ranges from medium voltage applications starting at 1kV up to high voltage systems exceeding 800kV. The regional market encompasses diverse applications spanning utility substations, industrial facilities, commercial buildings, renewable energy installations, and transportation infrastructure throughout the Asia-Pacific region.

Strategic analysis reveals that the Asia-Pacific air-insulated switchgear market is positioned for sustained growth driven by multiple converging factors including rapid urbanization, industrial expansion, and grid modernization initiatives. The market demonstrates strong fundamentals with increasing demand from both traditional utility applications and emerging sectors such as renewable energy and electric vehicle charging infrastructure.

Key market drivers include government infrastructure investments, with public sector spending on electrical grid upgrades accounting for approximately 35% of total market demand. Industrial expansion, particularly in manufacturing and data center sectors, represents another significant growth catalyst. The market is also benefiting from the region’s transition toward cleaner energy sources, with renewable energy integration projects driving 28% of new switchgear installations.

Competitive dynamics show a mix of established global manufacturers and emerging regional players competing across different market segments. Technology innovation focuses on digitalization, remote monitoring capabilities, and enhanced safety features. Market consolidation trends are evident as companies seek to expand their regional presence and technological capabilities through strategic partnerships and acquisitions.

Future outlook indicates continued market expansion supported by ongoing infrastructure development, smart grid implementations, and the region’s growing electricity consumption. Regulatory frameworks promoting grid reliability and environmental sustainability are expected to further accelerate market growth throughout the forecast period.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the Asia-Pacific air-insulated switchgear market. These insights provide strategic guidance for industry participants and stakeholders seeking to capitalize on emerging opportunities.

Infrastructure development stands as the primary catalyst driving the Asia-Pacific air-insulated switchgear market forward. Massive government investments in electrical grid expansion and modernization across emerging economies are creating unprecedented demand for reliable switchgear solutions. Countries throughout the region are implementing ambitious infrastructure programs to support growing urban populations and expanding industrial sectors.

Urbanization trends represent another fundamental driver, with rapid city growth requiring extensive electrical infrastructure development. The region’s urban population is expanding at an accelerated pace, necessitating new substations, distribution networks, and commercial electrical systems. This urban expansion creates consistent demand for medium and high voltage switchgear across residential, commercial, and industrial applications.

Industrial expansion continues to fuel market growth as manufacturing sectors across Asia-Pacific countries experience robust development. New industrial facilities, manufacturing plants, and processing centers require sophisticated electrical infrastructure with reliable switchgear systems. The growth of energy-intensive industries such as steel, aluminum, chemicals, and semiconductors particularly drives demand for high-capacity switchgear solutions.

Renewable energy integration is emerging as a significant growth driver as countries pursue clean energy objectives. Solar, wind, and hydroelectric projects require specialized switchgear for grid connection and power conditioning. The region’s commitment to renewable energy targets is creating substantial opportunities for switchgear manufacturers specializing in renewable energy applications.

Grid modernization initiatives are accelerating across the region as utilities upgrade aging infrastructure and implement smart grid technologies. These modernization efforts require advanced switchgear with digital monitoring capabilities, remote control functions, and enhanced reliability features. Government mandates for grid reliability and efficiency are driving systematic infrastructure upgrades.

High capital costs represent a significant barrier to market expansion, particularly for smaller utilities and industrial facilities with limited budgets. Air-insulated switchgear systems require substantial upfront investments, and the total cost of ownership including installation, commissioning, and ongoing maintenance can be prohibitive for some market segments. This cost sensitivity is particularly evident in price-conscious emerging markets.

Technical complexity poses challenges for market penetration in regions with limited technical expertise and infrastructure support. Modern switchgear systems require skilled personnel for installation, operation, and maintenance. The shortage of qualified technicians and engineers in some Asia-Pacific markets creates barriers to adoption and can limit market growth potential.

Space constraints in densely populated urban areas limit the deployment of air-insulated switchgear, which typically requires more physical space compared to gas-insulated alternatives. Urban substations and industrial facilities often face land availability challenges that favor more compact switchgear solutions. This spatial limitation particularly affects high-voltage applications in metropolitan areas.

Environmental concerns related to SF6 gas usage in some switchgear components are creating regulatory pressures and market uncertainties. While air-insulated switchgear primarily uses air as the insulating medium, some components may still utilize SF6 gas, which has high global warming potential. Increasing environmental regulations are driving demand for completely SF6-free solutions.

Supply chain disruptions have emerged as a significant constraint, particularly following global events that have affected manufacturing and logistics networks. Raw material shortages, component availability issues, and transportation delays can impact project timelines and increase costs. These supply chain challenges are particularly acute for complex, customized switchgear solutions.

Smart grid development presents substantial opportunities for advanced air-insulated switchgear solutions equipped with digital monitoring, communication, and control capabilities. The region’s utilities are increasingly investing in intelligent grid infrastructure that requires sophisticated switchgear with IoT connectivity, predictive maintenance features, and remote operation capabilities. This technological evolution creates premium market segments with higher value propositions.

Renewable energy expansion offers significant growth potential as Asia-Pacific countries accelerate their clean energy transitions. Solar and wind power installations require specialized switchgear for grid integration, power conditioning, and protection. The region’s ambitious renewable energy targets create sustained demand for switchgear solutions optimized for variable renewable energy sources.

Industrial automation trends are driving demand for intelligent switchgear systems that integrate with industrial control networks and provide enhanced operational visibility. Manufacturing facilities are increasingly adopting Industry 4.0 technologies that require sophisticated electrical infrastructure with advanced monitoring and control capabilities. This industrial digitalization creates opportunities for high-value switchgear solutions.

Electric vehicle infrastructure development represents an emerging opportunity as countries invest in charging networks and supporting electrical infrastructure. EV charging stations, battery storage systems, and grid integration facilities require reliable switchgear solutions. The rapid growth of electric vehicle adoption across the region is creating new market segments for specialized switchgear applications.

Data center expansion continues to drive demand for reliable, high-capacity switchgear solutions as digital transformation accelerates across the region. Cloud computing, 5G networks, and digital services require robust electrical infrastructure with uninterrupted power supply capabilities. The growing data center market represents a premium segment with stringent reliability requirements and willingness to invest in advanced switchgear technologies.

Supply-demand equilibrium in the Asia-Pacific air-insulated switchgear market reflects the complex interplay between rapid infrastructure development and manufacturing capacity expansion. The market demonstrates strong demand fundamentals driven by urbanization, industrialization, and grid modernization initiatives. However, supply chain constraints and manufacturing bottlenecks occasionally create temporary imbalances that affect pricing and delivery timelines.

Technological evolution is reshaping market dynamics as digitalization transforms traditional switchgear into intelligent systems with advanced monitoring and control capabilities. According to MarkWide Research analysis, digital switchgear adoption is accelerating, with smart features becoming standard requirements rather than premium options. This technological shift is creating new competitive dynamics and value propositions.

Competitive intensity varies across different market segments, with established global manufacturers competing alongside emerging regional players. Price competition is particularly intense in standard product categories, while technology differentiation provides competitive advantages in premium segments. Market consolidation trends are evident as companies seek scale advantages and expanded regional presence.

Regulatory influences are becoming increasingly important as governments implement stricter safety, environmental, and performance standards. These regulatory requirements drive product innovation and can create barriers to entry for manufacturers lacking compliance capabilities. Environmental regulations particularly favor air-insulated solutions over gas-insulated alternatives in certain applications.

Investment cycles in the electrical infrastructure sector create periodic fluctuations in demand patterns. Government infrastructure spending, utility investment programs, and industrial expansion cycles all influence market dynamics. Understanding these cyclical patterns is crucial for strategic planning and capacity management.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporates quantitative analysis, qualitative assessments, and industry expert consultations to provide a holistic view of the Asia-Pacific air-insulated switchgear market.

Primary research activities included extensive interviews with industry stakeholders across the value chain, including manufacturers, distributors, system integrators, end-users, and industry associations. These interviews provided valuable insights into market trends, competitive dynamics, technology developments, and future growth prospects. Survey methodologies were employed to gather quantitative data on market preferences, purchasing behaviors, and investment priorities.

Secondary research encompassed comprehensive analysis of industry reports, government publications, regulatory documents, company financial statements, and technical literature. This secondary research provided historical market data, regulatory frameworks, technology trends, and competitive intelligence. Patent analysis and technology roadmap studies were conducted to understand innovation trends and future technology directions.

Data validation processes were implemented to ensure research accuracy and reliability. Multiple data sources were cross-referenced to verify market statistics and trends. Industry expert reviews and stakeholder feedback sessions were conducted to validate research findings and conclusions. Statistical analysis techniques were applied to identify significant trends and correlations within the market data.

Market modeling techniques were employed to develop growth projections and scenario analyses. Econometric models incorporating macroeconomic factors, industry drivers, and historical trends were used to forecast market development. Sensitivity analysis was conducted to assess the impact of various factors on market growth trajectories.

China dominates the Asia-Pacific air-insulated switchgear market, representing the largest single country market with extensive manufacturing capabilities and massive infrastructure investments. The Chinese market benefits from government-led infrastructure programs, rapid urbanization, and substantial industrial expansion. Domestic manufacturers have established strong positions while international companies maintain significant presence through local partnerships and manufacturing facilities.

India represents the second-largest market opportunity with robust growth prospects driven by government infrastructure initiatives, industrial development, and rural electrification programs. The Indian market demonstrates strong demand for cost-effective switchgear solutions while increasingly adopting advanced technologies. Local manufacturing capabilities are expanding, supported by government policies promoting domestic production.

Japan maintains a mature market characterized by technology leadership, high-quality standards, and focus on grid reliability and efficiency. The Japanese market emphasizes advanced switchgear technologies, digital solutions, and earthquake-resistant designs. Replacement and modernization of aging infrastructure represent primary growth drivers in this developed market.

South Korea demonstrates strong market fundamentals with emphasis on smart grid technologies, renewable energy integration, and industrial automation. The Korean market shows preference for advanced switchgear solutions with digital capabilities and high reliability standards. Government support for clean energy and smart infrastructure drives market development.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Malaysia show rapid growth potential driven by infrastructure development, industrial expansion, and urbanization. These emerging markets demonstrate increasing demand for reliable switchgear solutions while developing local manufacturing and technical capabilities. Regional market share distribution shows Thailand leading with 8% of regional demand, followed by Indonesia and Vietnam.

Australia and New Zealand represent developed markets with focus on grid modernization, renewable energy integration, and mining industry applications. These markets emphasize high-quality, reliable switchgear solutions with advanced monitoring and control capabilities.

Market leadership in the Asia-Pacific air-insulated switchgear market is distributed among several global and regional manufacturers, each with distinct competitive advantages and market positioning strategies. The competitive environment demonstrates a mix of established multinational corporations and emerging regional players competing across different market segments and applications.

Competitive strategies focus on technology differentiation, local manufacturing capabilities, comprehensive service offerings, and strategic partnerships with utilities and system integrators. Companies are investing heavily in digital technologies, IoT integration, and predictive maintenance capabilities to differentiate their offerings in an increasingly competitive market.

Market consolidation trends are evident as companies pursue acquisitions and partnerships to expand their regional presence, technology capabilities, and market access. Strategic alliances between global manufacturers and local partners are common approaches to navigate regulatory requirements and customer preferences in different countries.

Voltage classification represents the primary segmentation criterion for the Asia-Pacific air-insulated switchgear market, with distinct market dynamics and applications across different voltage ranges. Each voltage segment demonstrates unique growth patterns, competitive dynamics, and technology requirements.

By Voltage Range:

By Application:

By Installation Type:

By End-User Industry:

Medium voltage switchgear dominates the Asia-Pacific market in terms of unit volumes and represents the most dynamic growth segment. This category benefits from extensive distribution network expansion, industrial facility development, and commercial building construction across the region. Technology trends in medium voltage switchgear focus on compact designs, digital monitoring capabilities, and enhanced safety features.

High voltage switchgear represents the premium market segment with emphasis on reliability, performance, and advanced features. This category serves critical transmission infrastructure, large industrial facilities, and utility substations where system reliability is paramount. Innovation drivers include digital protection systems, remote monitoring capabilities, and predictive maintenance features.

Utility applications continue to represent the largest market category, driven by grid expansion, modernization projects, and renewable energy integration. Utility customers prioritize reliability, long-term performance, and comprehensive service support. Procurement patterns in the utility segment often involve long-term contracts and standardized specifications.

Industrial applications demonstrate strong growth potential as manufacturing sectors expand across the region. Industrial customers require customized solutions that integrate with process control systems and provide enhanced operational visibility. Market trends show increasing demand for switchgear with industrial communication protocols and automation integration.

Digital switchgear solutions are emerging as a distinct category with advanced monitoring, communication, and control capabilities. This category appeals to customers seeking enhanced operational efficiency, predictive maintenance capabilities, and integration with smart grid systems. Adoption rates for digital switchgear are accelerating as utilities and industrial customers recognize the value proposition of intelligent electrical infrastructure.

Manufacturers benefit from the expanding Asia-Pacific air-insulated switchgear market through increased sales volumes, market share growth opportunities, and technology leadership positions. The growing market provides platforms for innovation, product development, and competitive differentiation. Revenue diversification across multiple countries and applications reduces market risks and provides stable growth foundations.

Utilities gain significant advantages from advanced air-insulated switchgear including improved grid reliability, enhanced operational efficiency, and reduced maintenance costs. Modern switchgear solutions provide better protection capabilities, faster fault detection, and remote monitoring functions that improve overall system performance. Operational benefits include reduced outage durations, improved safety, and enhanced asset management capabilities.

Industrial end-users benefit from reliable electrical infrastructure that supports continuous operations, improves process efficiency, and reduces downtime risks. Advanced switchgear solutions provide better integration with industrial control systems and offer enhanced monitoring capabilities for predictive maintenance. Cost benefits include reduced energy losses, lower maintenance requirements, and improved operational visibility.

System integrators and engineering companies benefit from growing project opportunities, technology partnerships, and service revenue streams. The expanding market creates demand for specialized expertise in switchgear design, installation, and commissioning. Business opportunities include comprehensive service offerings, maintenance contracts, and technology consulting services.

Government stakeholders benefit from improved electrical infrastructure that supports economic development, enhances energy security, and enables clean energy transitions. Reliable switchgear infrastructure supports industrial growth, urban development, and quality of life improvements. Strategic benefits include enhanced grid resilience, reduced environmental impact, and improved energy efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation represents the most significant trend reshaping the Asia-Pacific air-insulated switchgear market. MWR data indicates that digital switchgear adoption is accelerating rapidly as utilities and industrial customers seek enhanced operational visibility and predictive maintenance capabilities. This trend encompasses IoT connectivity, cloud-based monitoring systems, and artificial intelligence integration for advanced analytics.

Sustainability focus is driving demand for environmentally friendly switchgear solutions that minimize environmental impact throughout their lifecycle. Manufacturers are developing SF6-free alternatives, improving energy efficiency, and implementing circular economy principles in product design. This sustainability trend is particularly strong in developed markets where environmental regulations are stringent.

Modular design approaches are gaining popularity as customers seek flexible, scalable switchgear solutions that can adapt to changing requirements. Modular switchgear systems enable easier expansion, maintenance, and technology upgrades while reducing initial capital investments. This trend supports the growing preference for phased infrastructure development.

Service integration is becoming increasingly important as customers seek comprehensive solutions that include installation, commissioning, maintenance, and lifecycle support. Manufacturers are expanding their service capabilities and developing long-term service partnerships that provide predictable revenue streams and stronger customer relationships.

Regional manufacturing expansion continues as companies establish local production capabilities to serve growing regional demand while reducing costs and delivery times. This trend is supported by government policies promoting local manufacturing and the need for customized solutions that meet regional requirements and standards.

Smart grid integration is driving demand for switchgear with advanced communication capabilities, remote control functions, and grid optimization features. This trend aligns with utility modernization initiatives and government smart grid development programs across the region.

Technology innovations continue to drive industry evolution with manufacturers introducing advanced digital switchgear solutions that integrate IoT sensors, predictive analytics, and remote monitoring capabilities. Recent developments include AI-powered fault detection systems, blockchain-based asset management platforms, and augmented reality maintenance tools that enhance operational efficiency and reduce costs.

Strategic partnerships between global manufacturers and regional companies are accelerating market development and technology transfer. These partnerships enable international companies to access local markets while providing regional partners with advanced technology and global expertise. Recent partnership announcements demonstrate the industry’s commitment to collaborative growth strategies.

Manufacturing investments across the region are expanding production capacity and establishing local supply chains to serve growing market demand. Major manufacturers have announced significant facility expansions and new production lines focused on digital switchgear and renewable energy applications. These investments demonstrate confidence in long-term market growth prospects.

Regulatory developments are shaping market dynamics through updated safety standards, environmental regulations, and grid code requirements. Recent regulatory changes emphasize grid resilience, cybersecurity, and environmental sustainability, driving demand for advanced switchgear solutions that meet these evolving requirements.

Acquisition activities in the industry reflect ongoing consolidation trends as companies seek to expand their market presence, technology capabilities, and customer base. Recent acquisitions have focused on digital technology companies, regional manufacturers, and service providers that complement existing capabilities.

Research and development investments are accelerating as companies develop next-generation switchgear technologies including solid-state switching devices, advanced materials, and integrated energy storage systems. These R&D initiatives position companies for future market opportunities and technology leadership.

Market entry strategies should focus on establishing local partnerships and manufacturing capabilities to effectively compete in the Asia-Pacific air-insulated switchgear market. Companies entering the market should prioritize understanding regional requirements, regulatory frameworks, and customer preferences while building relationships with key stakeholders including utilities, system integrators, and government agencies.

Technology investment priorities should emphasize digital capabilities, IoT integration, and predictive maintenance features that provide clear value propositions to customers. Companies should develop comprehensive digital strategies that encompass product development, service offerings, and customer engagement platforms. Investment in cybersecurity capabilities is essential as switchgear becomes increasingly connected.

Service expansion represents a critical success factor as customers increasingly seek comprehensive solutions that include lifecycle support, maintenance services, and performance optimization. Companies should develop service capabilities that provide recurring revenue streams and strengthen customer relationships. Digital service platforms can enhance service delivery efficiency and customer satisfaction.

Regional customization is essential for success in diverse Asia-Pacific markets with varying technical standards, regulatory requirements, and customer preferences. Companies should develop flexible product platforms that can be adapted to local requirements while maintaining cost efficiency and quality standards. Local engineering and technical support capabilities are crucial for market success.

Sustainability initiatives should be integrated into product development and business strategies as environmental considerations become increasingly important to customers and regulators. Companies should focus on developing SF6-free alternatives, improving energy efficiency, and implementing circular economy principles in their operations.

Partnership strategies should leverage local expertise, market access, and regulatory knowledge while providing technology and global best practices. Strategic partnerships can accelerate market entry, reduce risks, and provide sustainable competitive advantages in complex regional markets.

Growth trajectory for the Asia-Pacific air-insulated switchgear market remains positive with sustained demand driven by infrastructure development, industrial expansion, and grid modernization initiatives. The market is expected to maintain robust growth momentum supported by government infrastructure investments, urbanization trends, and renewable energy integration requirements throughout the forecast period.

Technology evolution will continue to reshape the market as digital capabilities become standard features rather than premium options. Future switchgear systems will incorporate advanced analytics, artificial intelligence, and autonomous operation capabilities that enhance reliability and reduce operational costs. The integration of energy storage and renewable energy systems will create new market segments and applications.

Market consolidation trends are expected to continue as companies seek scale advantages, technology capabilities, and expanded market presence. Strategic acquisitions and partnerships will reshape the competitive landscape while driving innovation and market development. Regional manufacturers will play increasingly important roles as local capabilities expand.

Regulatory evolution will drive continued innovation in safety, environmental performance, and grid integration capabilities. Future regulations are likely to emphasize cybersecurity, grid resilience, and environmental sustainability, creating opportunities for companies with advanced technology capabilities. Standardization efforts will facilitate market development and technology adoption.

Investment opportunities will emerge in smart grid infrastructure, renewable energy integration, and industrial automation applications. The growing emphasis on energy efficiency and sustainability will create premium market segments for advanced switchgear solutions. Data center expansion and electric vehicle infrastructure development represent emerging growth opportunities.

Regional dynamics will continue to evolve as emerging markets mature and developed markets focus on modernization and replacement applications. China and India will remain primary growth drivers while Southeast Asian markets offer significant expansion potential. Technology transfer and local capability development will accelerate across the region.

The Asia-Pacific air-insulated switchgear market represents a dynamic and rapidly expanding sector within the global electrical infrastructure industry, characterized by strong fundamentals, diverse growth drivers, and significant future potential. The market benefits from unprecedented urbanization, industrial expansion, and government infrastructure investments across the region, creating sustained demand for reliable switchgear solutions.

Technology transformation is reshaping market dynamics as digitalization, IoT integration, and smart grid capabilities become essential features rather than optional enhancements. This technological evolution creates new value propositions, competitive advantages, and market opportunities for companies that successfully integrate advanced capabilities into their product offerings and service strategies.

Regional diversity provides both opportunities and challenges as companies navigate different regulatory frameworks, technical standards, and customer preferences across multiple countries. Success in this complex market requires local partnerships, customized solutions, and comprehensive understanding of regional dynamics while maintaining global technology leadership and operational efficiency.

Competitive dynamics will continue to evolve as established global manufacturers compete with emerging regional players across different market segments and applications. Companies that successfully combine technology innovation, local market knowledge, comprehensive service capabilities, and strategic partnerships will be best positioned for long-term success in this expanding market.

Future growth prospects remain highly positive supported by continued infrastructure development, renewable energy integration, and industrial automation trends. The market’s evolution toward intelligent, connected, and sustainable solutions creates significant opportunities for companies that align their strategies with these transformative trends while maintaining focus on reliability, performance, and customer value creation.

What is Air-Insulated Switchgear?

Air-Insulated Switchgear (AIS) refers to a type of electrical switchgear that uses air as the insulating medium. It is commonly used in substations and industrial applications for controlling and protecting electrical equipment.

What are the key players in the Asia-Pacific Air-Insulated Switchgear Market?

Key players in the Asia-Pacific Air-Insulated Switchgear Market include Siemens AG, Schneider Electric, ABB Ltd., and General Electric, among others.

What are the growth factors driving the Asia-Pacific Air-Insulated Switchgear Market?

The growth of the Asia-Pacific Air-Insulated Switchgear Market is driven by increasing demand for electricity, the expansion of renewable energy sources, and the need for modernizing aging electrical infrastructure.

What challenges does the Asia-Pacific Air-Insulated Switchgear Market face?

Challenges in the Asia-Pacific Air-Insulated Switchgear Market include high initial installation costs, competition from alternative technologies, and regulatory hurdles in different countries.

What opportunities exist in the Asia-Pacific Air-Insulated Switchgear Market?

Opportunities in the Asia-Pacific Air-Insulated Switchgear Market include the increasing adoption of smart grid technologies, investments in urban infrastructure, and the growing focus on energy efficiency.

What trends are shaping the Asia-Pacific Air-Insulated Switchgear Market?

Trends in the Asia-Pacific Air-Insulated Switchgear Market include the integration of digital technologies for monitoring and control, the shift towards eco-friendly materials, and the rise of modular switchgear solutions.

Asia-Pacific Air-Insulated Switchgear Market

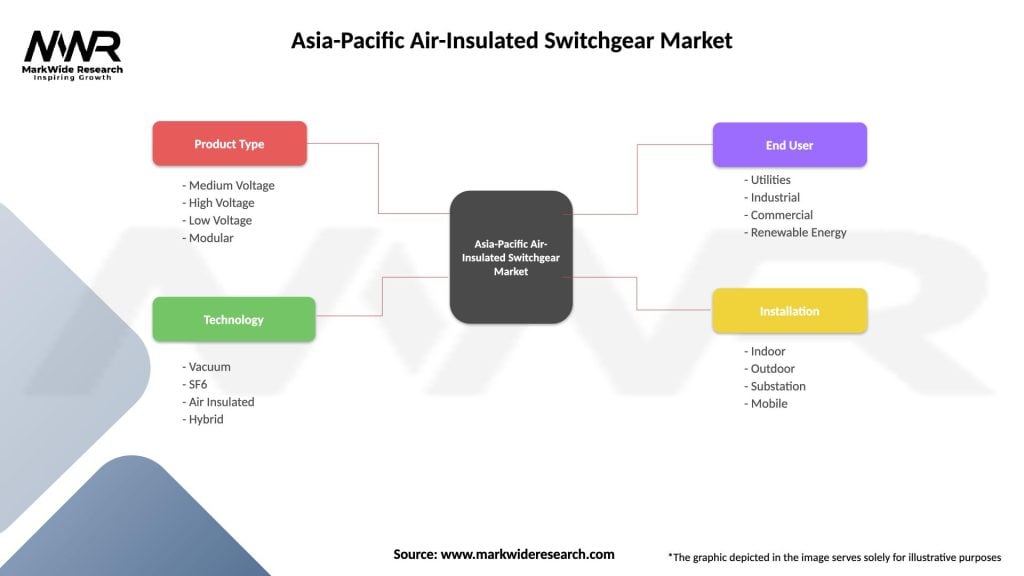

| Segmentation Details | Description |

|---|---|

| Product Type | Medium Voltage, High Voltage, Low Voltage, Modular |

| Technology | Vacuum, SF6, Air Insulated, Hybrid |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Installation | Indoor, Outdoor, Substation, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Air-Insulated Switchgear Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at