444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN travel accommodation market represents one of the most dynamic and rapidly evolving hospitality sectors in the global tourism industry. Spanning across ten Southeast Asian nations, this market encompasses diverse accommodation types ranging from luxury resorts and boutique hotels to budget hostels and alternative lodging options. Market dynamics indicate robust growth driven by increasing intraregional travel, rising disposable incomes, and expanding digital booking platforms.

Regional integration has significantly enhanced cross-border tourism flows, with the ASEAN region experiencing a 12.5% annual growth in international visitor arrivals over recent years. The accommodation sector has responded with innovative service offerings, sustainable practices, and technology-driven guest experiences. Digital transformation has revolutionized booking processes, with online reservations accounting for approximately 68% of total bookings across major ASEAN destinations.

Infrastructure development continues to support market expansion, particularly in emerging destinations within Cambodia, Laos, and Myanmar. The sector benefits from government initiatives promoting tourism as a key economic driver, with several countries implementing favorable policies for hospitality investments. Sustainability trends are increasingly influencing accommodation choices, with eco-friendly properties gaining 23% higher occupancy rates compared to conventional establishments.

The ASEAN travel accommodation market refers to the comprehensive ecosystem of lodging facilities, services, and related hospitality offerings across the Association of Southeast Asian Nations member countries. This market encompasses traditional hotels, resorts, serviced apartments, vacation rentals, hostels, and emerging accommodation formats that cater to diverse traveler segments within the region.

Market scope includes both leisure and business travel accommodations, ranging from luxury five-star properties to budget-friendly options. The sector integrates various stakeholders including international hotel chains, local operators, online travel agencies, property management companies, and technology service providers. Service integration extends beyond basic lodging to include dining, entertainment, wellness, and experiential offerings that enhance guest satisfaction.

Geographic coverage spans Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam, each contributing unique cultural elements and market characteristics. The market operates within a framework of regional cooperation initiatives, standardized quality certifications, and cross-border tourism promotion programs that facilitate seamless travel experiences across ASEAN destinations.

Strategic positioning of the ASEAN travel accommodation market reflects its emergence as a global tourism powerhouse, driven by cultural diversity, competitive pricing, and enhanced connectivity. The sector demonstrates remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities in sustainable tourism and digital innovation.

Market performance indicators reveal strong fundamentals with occupancy rates averaging 72% across major destinations and revenue per available room showing consistent improvement. The rise of alternative accommodation platforms has introduced new competitive dynamics, with traditional hotels adapting through enhanced service differentiation and loyalty programs. Investment flows continue to strengthen market infrastructure, particularly in secondary cities and emerging destinations.

Technology adoption has accelerated significantly, with properties implementing contactless services, artificial intelligence for personalized experiences, and data analytics for operational optimization. The market benefits from favorable demographic trends, including a growing middle class, increased urbanization, and changing travel preferences among younger generations. Sustainability initiatives are becoming increasingly important, with 45% of travelers actively seeking environmentally responsible accommodation options.

Fundamental market insights reveal several critical trends shaping the ASEAN travel accommodation landscape:

Market segmentation reveals distinct preferences across traveler categories, with business travelers prioritizing connectivity and efficiency while leisure guests seek unique experiences and cultural immersion. The emergence of hybrid travel combining business and leisure elements has created new accommodation requirements and service expectations.

Economic prosperity across ASEAN nations serves as a primary market driver, with rising disposable incomes enabling increased domestic and regional travel. The expanding middle class demonstrates growing appetite for leisure travel and premium accommodation experiences. Infrastructure development including new airports, improved road networks, and enhanced digital connectivity facilitates easier access to previously remote destinations.

Government initiatives promoting tourism through visa facilitation, marketing campaigns, and investment incentives create favorable operating environments for accommodation providers. Regional cooperation agreements streamline cross-border travel procedures, encouraging intraregional tourism growth. Cultural exchange programs and educational tourism initiatives generate consistent demand for accommodation services.

Demographic trends including urbanization, changing lifestyle preferences, and increased leisure time allocation support sustained market growth. The rise of experience-oriented travel, particularly among younger demographics, drives demand for unique and authentic accommodation options. Digital transformation enables more efficient booking processes, personalized service delivery, and enhanced guest engagement throughout the travel journey.

Regulatory complexities across different ASEAN jurisdictions create operational challenges for accommodation providers, particularly those seeking to establish multi-country presence. Varying building codes, safety standards, and licensing requirements necessitate significant compliance investments. Labor shortages in hospitality sectors affect service quality and operational efficiency, particularly in skilled positions requiring language capabilities and cultural sensitivity.

Infrastructure limitations in emerging destinations constrain accommodation development and guest satisfaction levels. Inadequate transportation links, unreliable utilities, and limited telecommunications infrastructure impact property viability and operational costs. Environmental concerns including water scarcity, waste management challenges, and climate change impacts require substantial investments in sustainable technologies and practices.

Economic volatility and currency fluctuations affect international visitor flows and accommodation pricing strategies. Political instability in certain regions creates uncertainty for long-term investment planning and tourism promotion efforts. Competition intensity from alternative accommodation platforms and sharing economy models pressures traditional hospitality operators to adapt business models and pricing structures.

Emerging destinations within ASEAN present significant expansion opportunities for accommodation providers willing to invest in infrastructure development and market education. Secondary cities and rural tourism areas offer potential for authentic cultural experiences and sustainable tourism models. Technology integration creates opportunities for innovative service delivery, operational efficiency improvements, and enhanced guest personalization.

Sustainable tourism trends open markets for eco-friendly accommodation concepts, renewable energy implementations, and community-based tourism initiatives. The growing awareness of environmental responsibility among travelers creates competitive advantages for properties demonstrating genuine sustainability commitments. Wellness tourism expansion provides opportunities for specialized accommodation offerings focusing on health, relaxation, and personal well-being.

Corporate travel recovery and the rise of bleisure travel create demand for flexible accommodation solutions combining business amenities with leisure experiences. Digital nomad trends generate opportunities for extended-stay properties offering work-friendly environments and community spaces. The integration of local cultural elements and authentic experiences provides differentiation opportunities in increasingly competitive markets.

Competitive dynamics within the ASEAN travel accommodation market reflect a complex interplay between international hotel chains, local operators, and emerging platform-based providers. Traditional hospitality companies are adapting to changing consumer preferences through service innovation, technology adoption, and sustainability initiatives. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding geographic coverage and service capabilities.

Consumer behavior evolution demonstrates increasing sophistication in accommodation selection criteria, with travelers prioritizing authentic experiences, environmental responsibility, and value optimization. The influence of social media and online reviews significantly impacts booking decisions and property reputation management. Pricing strategies have become more dynamic, incorporating real-time demand fluctuations, competitive positioning, and seasonal variations.

Technology disruption continues reshaping operational models, guest service delivery, and market competition structures. Artificial intelligence applications in revenue management, customer service, and operational optimization provide competitive advantages for early adopters. Regulatory evolution across ASEAN countries increasingly focuses on consumer protection, environmental standards, and fair competition practices, influencing market development trajectories.

Comprehensive research methodology employed for analyzing the ASEAN travel accommodation market incorporates multiple data collection approaches and analytical frameworks. Primary research involves extensive interviews with industry stakeholders including hotel operators, tourism boards, technology providers, and consumer segments across all ASEAN member countries. Secondary research encompasses analysis of government tourism statistics, industry reports, financial statements, and regulatory documentation.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources, expert consultations, and statistical verification procedures. Market sizing calculations utilize bottom-up and top-down approaches, incorporating accommodation capacity data, occupancy statistics, and revenue performance indicators. Qualitative analysis examines market trends, competitive positioning, and strategic developments through structured interviews and focus group discussions.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessments, and scenario planning methodologies to evaluate market dynamics and future prospects. Regional analysis incorporates country-specific factors including economic conditions, regulatory environments, and cultural characteristics affecting accommodation market development. Forecasting models utilize historical performance data, economic indicators, and industry expert insights to project market evolution trajectories.

Thailand dominates the regional accommodation market with approximately 28% market share, leveraging its established tourism infrastructure, diverse destination portfolio, and strong international brand recognition. The country benefits from well-developed transportation networks, comprehensive accommodation options ranging from luxury resorts to budget hostels, and effective tourism marketing strategies. Bangkok and Phuket serve as primary accommodation hubs, while emerging destinations like Chiang Mai and Koh Samui demonstrate strong growth potential.

Indonesia represents the second-largest market with 22% regional share, driven by domestic tourism growth and increasing international visitor arrivals to Bali, Jakarta, and Yogyakarta. The archipelago nation offers diverse accommodation experiences from beachfront resorts to cultural heritage properties. Malaysia contributes approximately 18% market share, with Kuala Lumpur serving as a major business travel hub and coastal destinations attracting leisure travelers.

Singapore maintains a premium market position despite its small size, accounting for 12% regional share through high-value business and luxury leisure segments. The city-state’s strategic location and world-class infrastructure support premium accommodation offerings. Philippines and Vietnam collectively represent 15% market share, demonstrating rapid growth in accommodation capacity and service quality improvements. Emerging markets including Cambodia, Laos, and Myanmar contribute the remaining 5% share but show significant growth potential as infrastructure development progresses.

Market leadership within the ASEAN travel accommodation sector reflects a diverse ecosystem of international hotel chains, regional operators, and local hospitality providers. The competitive environment demonstrates increasing sophistication in service delivery, technology adoption, and market positioning strategies.

Competitive strategies increasingly emphasize digital transformation, sustainability initiatives, and localized service offerings. Traditional hotel operators are adapting to competition from alternative accommodation platforms through enhanced loyalty programs, unique experience offerings, and operational efficiency improvements.

By Accommodation Type:

By Traveler Segment:

By Price Category:

Luxury accommodation segment demonstrates resilience and growth potential, driven by increasing affluence among regional travelers and demand for exclusive experiences. High-end properties are investing in personalized services, unique design elements, and sustainable luxury concepts. Premium positioning requires continuous innovation in amenities, technology integration, and cultural authenticity to justify pricing premiums.

Mid-scale properties represent the largest accommodation category, serving diverse traveler needs through balanced service offerings and competitive pricing. This segment benefits from standardized quality expectations while maintaining flexibility for local market adaptations. Operational efficiency and technology adoption are critical success factors for maintaining profitability in this competitive category.

Budget accommodation sector experiences rapid transformation through technology platforms and standardized service models. Traditional budget properties face competition from sharing economy platforms and technology-enabled budget chains offering improved quality standards. Value optimization requires careful balance between cost control and service quality to meet evolving consumer expectations.

Alternative accommodations including vacation rentals and unique properties gain market share through authentic experiences and competitive pricing. This category appeals to travelers seeking local immersion and flexible accommodation arrangements. Regulatory adaptation and quality standardization remain key challenges for sustainable growth in this emerging segment.

Hotel operators benefit from expanding market opportunities, diverse revenue streams, and operational scale advantages across multiple ASEAN destinations. Regional presence enables portfolio diversification, risk mitigation, and enhanced brand recognition among frequent travelers. Technology investments provide competitive advantages through improved operational efficiency, guest satisfaction, and revenue optimization capabilities.

Investors gain exposure to one of the world’s fastest-growing tourism regions with favorable demographic trends and economic development trajectories. Real estate appreciation potential, stable cash flows from accommodation operations, and portfolio diversification benefits attract both domestic and international investment capital. Government partnerships and tourism promotion initiatives provide additional value creation opportunities.

Local communities benefit from employment generation, skills development, and economic multiplier effects from accommodation sector growth. Cultural preservation initiatives and community-based tourism programs create sustainable development opportunities. Supply chain integration with local providers generates additional economic benefits and authentic guest experiences.

Technology providers find expanding markets for hospitality solutions including property management systems, booking platforms, and guest experience technologies. The region’s rapid digital adoption creates opportunities for innovative service delivery models and operational optimization tools. Partnership opportunities with accommodation providers enable customized solution development and market expansion strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with accommodation providers implementing comprehensive environmental programs, renewable energy systems, and waste reduction initiatives. Properties demonstrating genuine sustainability commitments achieve higher guest satisfaction scores and premium pricing capabilities. Green certifications and eco-friendly practices become standard competitive requirements rather than optional differentiators.

Technology convergence transforms guest experiences through artificial intelligence, Internet of Things applications, and mobile-first service delivery models. Smart room technologies, contactless services, and personalized recommendations enhance operational efficiency while improving guest satisfaction. Data analytics enable sophisticated revenue management, predictive maintenance, and customized marketing strategies.

Experiential focus shifts accommodation positioning from basic lodging toward comprehensive destination experiences. Properties integrate local cultural elements, authentic dining options, and immersive activity programs to differentiate service offerings. Community partnerships create unique experiences while supporting local economic development and cultural preservation initiatives.

Flexible accommodation models respond to changing travel patterns including extended stays, remote work requirements, and multi-generational travel preferences. Properties adapt space configurations, service offerings, and pricing structures to accommodate diverse guest needs. Hybrid concepts combining accommodation with co-working spaces, wellness facilities, and social environments gain popularity among younger demographics.

Strategic partnerships between international hotel chains and local operators accelerate market expansion while preserving cultural authenticity. These collaborations combine global operational expertise with local market knowledge, creating competitive advantages in service delivery and guest satisfaction. MarkWide Research analysis indicates that such partnerships achieve 15% higher occupancy rates compared to standalone operations.

Technology platform integration revolutionizes booking processes, guest services, and operational management across the accommodation sector. Major operators invest in comprehensive digital transformation initiatives including mobile applications, artificial intelligence systems, and data analytics capabilities. Investment levels in hospitality technology reach unprecedented levels as properties seek competitive differentiation through enhanced guest experiences.

Sustainability certifications become increasingly important for market positioning and guest attraction. Properties pursue internationally recognized environmental standards while implementing local sustainability initiatives. Regulatory developments in several ASEAN countries introduce mandatory environmental compliance requirements for accommodation providers, accelerating industry-wide sustainability adoption.

Market consolidation continues through strategic acquisitions, management contract expansions, and franchise development programs. Regional hospitality companies strengthen market positions through geographic expansion and brand portfolio diversification. Investment flows from international sources support infrastructure development and service quality improvements across emerging destinations.

Strategic positioning recommendations emphasize the importance of authentic cultural integration while maintaining international service standards. Accommodation providers should develop unique value propositions that leverage local heritage, natural attractions, and community partnerships. Differentiation strategies must balance global brand recognition with authentic local experiences to attract diverse traveler segments.

Technology investment priorities should focus on guest experience enhancement, operational efficiency improvements, and data-driven decision making capabilities. Properties must evaluate technology solutions based on return on investment potential and guest satisfaction impact. Digital transformation initiatives require comprehensive staff training and change management programs to ensure successful implementation.

Sustainability commitments should extend beyond marketing initiatives to encompass genuine operational improvements and community impact programs. Accommodation providers must develop measurable sustainability goals and transparent reporting mechanisms to build credible environmental credentials. Long-term planning should incorporate climate change adaptation strategies and resource conservation measures.

Market expansion strategies should prioritize emerging destinations with strong infrastructure development potential and government support for tourism initiatives. Risk assessment frameworks must evaluate political stability, regulatory environments, and economic conditions before committing significant investment resources. Partnership approaches often provide lower-risk entry strategies for new market development.

Growth trajectory for the ASEAN travel accommodation market remains positive, supported by favorable demographic trends, infrastructure development, and regional economic integration. MWR projections indicate sustained expansion driven by increasing domestic tourism, growing middle-class prosperity, and enhanced regional connectivity. The market is expected to maintain a compound annual growth rate of 8.2% over the next five years.

Technology adoption will accelerate across all accommodation categories, with artificial intelligence, automation, and data analytics becoming standard operational tools. Smart building technologies, sustainable energy systems, and integrated guest experience platforms will define competitive advantages. Digital natives among both travelers and hospitality professionals will drive continued innovation in service delivery models.

Sustainability requirements will evolve from optional initiatives to mandatory operational standards, influenced by regulatory developments and consumer preferences. Properties demonstrating genuine environmental responsibility will achieve premium market positioning and enhanced profitability. Climate adaptation strategies will become essential for long-term viability, particularly for coastal and island destinations.

Market maturation in established destinations will drive expansion toward secondary cities and emerging tourism areas. Infrastructure development programs and government tourism promotion initiatives will create new accommodation opportunities. Regional integration will facilitate seamless travel experiences and cross-border tourism growth, benefiting accommodation providers with multi-country presence.

The ASEAN travel accommodation market represents a dynamic and rapidly evolving sector with substantial growth potential driven by regional economic development, increasing tourism demand, and technological innovation. The market’s diversity across ten member countries creates numerous opportunities for accommodation providers willing to adapt to local preferences while maintaining international service standards.

Strategic success factors include authentic cultural integration, comprehensive sustainability programs, and advanced technology adoption to enhance guest experiences and operational efficiency. The competitive landscape continues evolving through market consolidation, strategic partnerships, and innovative service delivery models that respond to changing traveler expectations and preferences.

Future market development will be shaped by continued infrastructure improvements, regulatory harmonization efforts, and growing emphasis on sustainable tourism practices. Accommodation providers that successfully balance global operational expertise with local market knowledge and cultural sensitivity will achieve sustainable competitive advantages in this expanding market. The sector’s resilience and adaptability position it well for continued growth and evolution in the global hospitality industry.

What is ASEAN Travel Accommodation?

ASEAN Travel Accommodation refers to the various lodging options available for travelers within the ASEAN region, including hotels, hostels, guesthouses, and serviced apartments, catering to diverse preferences and budgets.

What are the key players in the ASEAN Travel Accommodation Market?

Key players in the ASEAN Travel Accommodation Market include Marriott International, AccorHotels, Hilton Worldwide, and OYO Rooms, among others.

What are the main drivers of growth in the ASEAN Travel Accommodation Market?

The growth of the ASEAN Travel Accommodation Market is driven by increasing tourism, rising disposable incomes, and the expansion of low-cost airlines, which enhance accessibility to various destinations.

What challenges does the ASEAN Travel Accommodation Market face?

Challenges in the ASEAN Travel Accommodation Market include intense competition, fluctuating demand due to seasonal travel patterns, and regulatory hurdles that can impact operations.

What opportunities exist in the ASEAN Travel Accommodation Market?

Opportunities in the ASEAN Travel Accommodation Market include the rise of eco-friendly accommodations, the growth of digital booking platforms, and the increasing popularity of experiential travel among tourists.

What trends are shaping the ASEAN Travel Accommodation Market?

Trends in the ASEAN Travel Accommodation Market include the integration of technology for enhanced guest experiences, a focus on sustainability, and the growing demand for unique and localized lodging options.

ASEAN Travel Accommodation Market

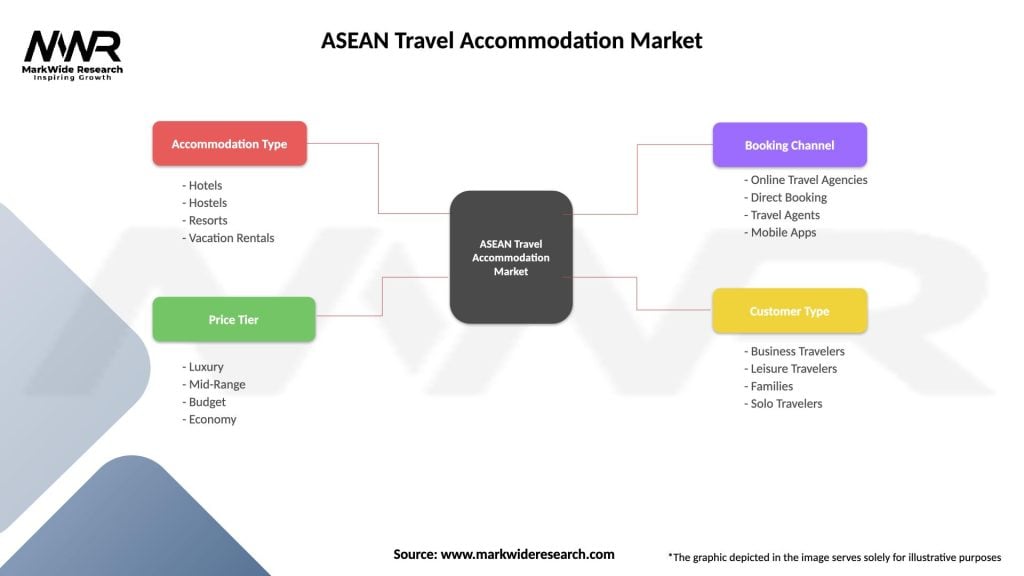

| Segmentation Details | Description |

|---|---|

| Accommodation Type | Hotels, Hostels, Resorts, Vacation Rentals |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

| Booking Channel | Online Travel Agencies, Direct Booking, Travel Agents, Mobile Apps |

| Customer Type | Business Travelers, Leisure Travelers, Families, Solo Travelers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Travel Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at