444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN satellite communications market represents one of the most dynamic and rapidly evolving sectors in Southeast Asia’s telecommunications landscape. This comprehensive market encompasses satellite-based communication services, infrastructure, and technologies across the ten member nations of the Association of Southeast Asian Nations. Market dynamics indicate robust growth driven by increasing demand for broadband connectivity, maritime communications, and disaster management solutions throughout the region.

Regional expansion has been particularly notable in countries like Indonesia, Thailand, Malaysia, and the Philippines, where geographical challenges and archipelagic structures create unique opportunities for satellite communication solutions. The market demonstrates significant growth potential with projected expansion at a compound annual growth rate of 8.2% through the forecast period, reflecting strong demand across both commercial and government sectors.

Technology advancement continues to reshape the market landscape, with next-generation satellite constellations, high-throughput satellites, and software-defined satellite systems gaining traction. The integration of 5G networks with satellite communications creates new opportunities for hybrid connectivity solutions, particularly in remote and underserved areas across the ASEAN region.

The ASEAN satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, infrastructure, and technologies operating within the ten Southeast Asian nations that comprise ASEAN. This market encompasses various satellite communication applications including broadband internet services, maritime communications, broadcasting, emergency communications, and government services across member countries.

Satellite communications in the ASEAN context involves the use of artificial satellites to provide communication links between different points on Earth, enabling voice, data, and video transmission across vast distances and challenging geographical terrains. The market includes both geostationary and low Earth orbit satellite systems, ground infrastructure, user terminals, and associated services.

Regional significance stems from ASEAN’s unique geographical characteristics, including numerous island nations, remote areas, and challenging terrestrial infrastructure deployment conditions. Satellite communications serve as critical enablers for digital connectivity, economic development, and disaster preparedness across the region’s diverse landscape.

Market momentum in the ASEAN satellite communications sector reflects strong underlying demand drivers and favorable regulatory environments across member nations. The market benefits from increasing digitalization initiatives, growing maritime activities, and expanding requirements for reliable communication infrastructure in remote and underserved areas.

Key growth factors include rising internet penetration rates, expanding e-commerce activities, and increasing adoption of satellite-based services for both consumer and enterprise applications. Government initiatives promoting digital transformation and smart city development contribute significantly to market expansion, with public sector adoption representing approximately 35% of total market demand.

Technology evolution plays a crucial role in market development, with high-throughput satellites, software-defined networking, and integrated terrestrial-satellite networks driving innovation. The emergence of new space economy initiatives and increasing private sector participation create additional growth opportunities across the region.

Competitive dynamics feature both established international satellite operators and emerging regional players, creating a diverse ecosystem that serves various market segments. Strategic partnerships between satellite operators, telecommunications companies, and government agencies facilitate market development and service expansion.

Strategic insights reveal several critical factors shaping the ASEAN satellite communications market landscape:

Primary growth drivers propelling the ASEAN satellite communications market include increasing demand for broadband connectivity in remote areas where terrestrial infrastructure deployment remains challenging or economically unfeasible. The region’s unique geographical characteristics, including thousands of islands and extensive maritime territories, create natural demand for satellite-based solutions.

Digital economy initiatives across ASEAN member nations significantly contribute to market expansion. Government programs promoting digital transformation, smart city development, and Industry 4.0 adoption require robust communication infrastructure that satellite systems can effectively provide. These initiatives demonstrate consistent annual growth of approximately 12% in government technology spending.

Maritime sector growth represents another crucial driver, with ASEAN’s strategic location along major shipping routes creating substantial demand for maritime satellite communications. The region handles approximately 25% of global maritime trade, necessitating reliable communication systems for vessel tracking, safety, and operational efficiency.

Disaster management requirements drive significant investment in satellite communication infrastructure. ASEAN countries frequently experience natural disasters, making resilient communication networks essential for emergency response, coordination, and recovery efforts. This creates sustained demand for satellite-based emergency communication solutions.

Cost considerations present significant challenges for market expansion, particularly regarding initial infrastructure investment and ongoing operational expenses. High capital requirements for satellite deployment and ground infrastructure development can limit market accessibility for smaller operators and developing regions within ASEAN.

Regulatory complexities across different ASEAN member nations create operational challenges for satellite service providers. Varying licensing requirements, spectrum allocation policies, and cross-border service regulations can complicate market entry and expansion strategies for both domestic and international operators.

Technical limitations including latency issues with geostationary satellites and weather-related signal interference affect service quality and user experience. These technical constraints can limit adoption in applications requiring real-time communication or consistent high-performance connectivity.

Competition from terrestrial networks intensifies as fiber optic and mobile network infrastructure expands across the region. Improving terrestrial connectivity options may reduce demand for satellite services in certain market segments, particularly in urban and semi-urban areas where alternative solutions become more cost-effective.

Emerging opportunities in the ASEAN satellite communications market include the development of next-generation satellite constellations offering improved coverage, reduced latency, and enhanced service capabilities. Low Earth orbit satellite systems present particular opportunities for providing high-speed internet services to underserved areas across the region.

5G network integration creates substantial opportunities for hybrid communication solutions that combine satellite and terrestrial technologies. This convergence enables comprehensive coverage solutions that address both urban and remote connectivity requirements, potentially capturing significant market share growth of approximately 15% annually.

Internet of Things applications represent expanding opportunities as smart agriculture, environmental monitoring, and industrial automation initiatives gain traction across ASEAN countries. Satellite communications provide essential connectivity for IoT devices in remote locations where terrestrial networks remain unavailable.

Space economy development initiatives across several ASEAN nations create opportunities for regional satellite manufacturing, launch services, and space technology development. These initiatives support market growth while building local capabilities and reducing dependence on foreign satellite services.

Dynamic market forces shaping the ASEAN satellite communications landscape include rapid technological advancement, evolving regulatory frameworks, and changing customer requirements. The interplay between these factors creates both challenges and opportunities for market participants across different segments and geographical areas.

Technology convergence between satellite and terrestrial networks drives innovation in hybrid communication solutions. Software-defined networking, edge computing, and artificial intelligence integration enhance satellite system capabilities and operational efficiency, contributing to improved service quality and cost optimization of approximately 20%.

Competitive intensity increases as new market entrants, including both regional and international players, seek to capitalize on growing demand. This competition drives innovation, service improvement, and pricing optimization while expanding market accessibility across different customer segments.

Customer expectations continue evolving toward higher bandwidth, lower latency, and more cost-effective solutions. These changing requirements drive continuous innovation and service enhancement initiatives among satellite operators and service providers throughout the region.

Comprehensive research approach employed for analyzing the ASEAN satellite communications market combines primary and secondary research methodologies to ensure accurate and reliable market insights. The methodology encompasses quantitative and qualitative analysis techniques to provide holistic market understanding.

Primary research activities include structured interviews with industry executives, satellite operators, government officials, and end-users across ASEAN member nations. These interviews provide firsthand insights into market trends, challenges, opportunities, and strategic priorities from key stakeholders’ perspectives.

Secondary research involves extensive analysis of industry reports, government publications, regulatory documents, and company financial statements. This research provides historical market data, regulatory framework analysis, and competitive landscape assessment across different market segments and geographical regions.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert consultations, and statistical analysis techniques. MarkWide Research employs rigorous quality control measures to maintain high standards of research reliability and market insight accuracy.

Indonesia dominates the ASEAN satellite communications market, representing approximately 30% of regional demand due to its vast archipelagic geography and large population. The country’s extensive maritime territories and remote island communities create substantial opportunities for satellite-based connectivity solutions across both commercial and government sectors.

Thailand and Malaysia collectively account for approximately 25% of market share, driven by strong economic development, expanding digital infrastructure initiatives, and growing maritime activities. Both countries demonstrate robust demand for satellite communications in sectors including telecommunications, broadcasting, and government services.

Philippines and Vietnam represent rapidly growing markets with significant potential for satellite communication expansion. These countries benefit from increasing foreign investment, expanding telecommunications infrastructure, and growing demand for broadband connectivity in remote and underserved areas.

Singapore serves as a regional hub for satellite operations and services, despite its smaller geographical size. The country’s strategic location, advanced telecommunications infrastructure, and favorable regulatory environment make it an important center for satellite service providers and technology companies.

Emerging markets including Cambodia, Laos, and Myanmar present substantial growth opportunities as these countries develop their telecommunications infrastructure and expand digital connectivity initiatives. Government programs promoting digital transformation create increasing demand for satellite communication solutions.

Market leadership in the ASEAN satellite communications sector features a diverse mix of international satellite operators, regional service providers, and emerging technology companies. The competitive landscape reflects both established market presence and dynamic new entrant activity.

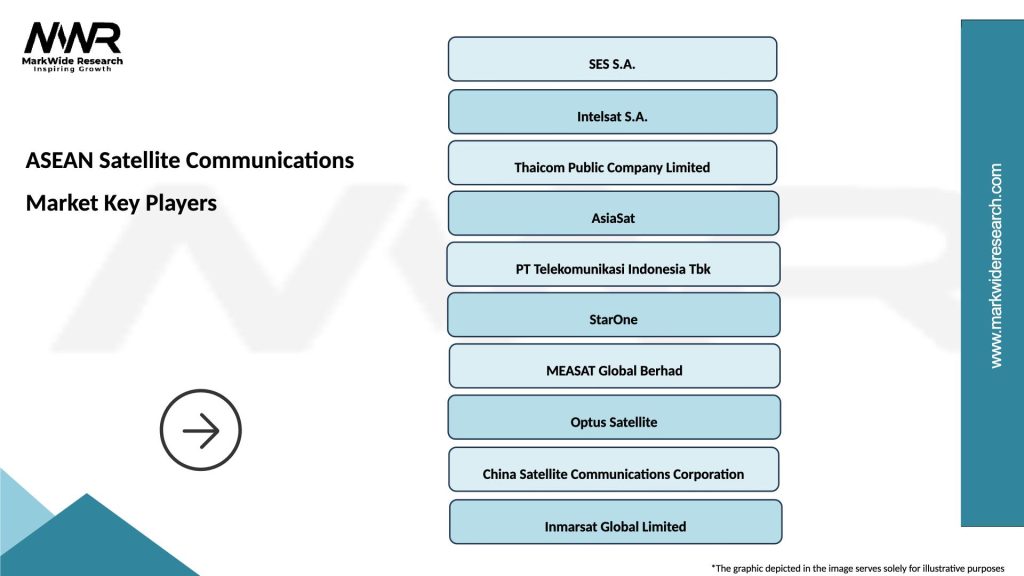

Major international players include:

Competitive strategies focus on service differentiation, technology innovation, strategic partnerships, and market expansion initiatives. Companies invest significantly in next-generation satellite technologies, ground infrastructure development, and customer service enhancement to maintain competitive advantages.

Strategic alliances between satellite operators, telecommunications companies, and government agencies facilitate market development and service expansion. These partnerships enable comprehensive solution delivery and market penetration across diverse customer segments and geographical areas.

Market segmentation analysis reveals diverse applications and service categories within the ASEAN satellite communications market. Segmentation by application, technology, end-user, and geography provides comprehensive understanding of market dynamics and growth opportunities.

By Application:

By Technology:

Broadband services represent the largest and fastest-growing category within the ASEAN satellite communications market. This segment benefits from increasing demand for high-speed internet connectivity in remote areas where terrestrial infrastructure deployment remains challenging or economically unfeasible.

Maritime communications demonstrate consistent growth driven by ASEAN’s strategic location along major shipping routes and extensive maritime activities. The region’s position as a global maritime hub creates sustained demand for vessel communication, tracking, and safety services with annual growth rates exceeding 10%.

Government applications show strong expansion as ASEAN countries invest in digital transformation initiatives, smart city development, and disaster preparedness programs. Government demand for satellite communications includes emergency response, rural connectivity, and secure communication requirements.

Broadcasting services maintain stable market presence despite increasing competition from internet-based content delivery. Direct-to-home satellite television services continue serving areas with limited terrestrial broadcasting infrastructure, particularly in remote and rural regions.

Enterprise communications expand as multinational companies operating across ASEAN require reliable communication solutions for remote operations, backup connectivity, and business continuity applications. This segment demonstrates steady growth of approximately 8% annually.

Satellite operators benefit from expanding market opportunities across diverse applications and geographical areas within ASEAN. The region’s unique characteristics create natural demand for satellite services while government digitalization initiatives provide additional growth drivers and revenue opportunities.

Telecommunications companies gain access to comprehensive coverage solutions that complement terrestrial networks and enable service expansion into previously unserved areas. Satellite communications provide backup connectivity, rural coverage extension, and hybrid network solutions that enhance overall service capabilities.

Government agencies achieve improved connectivity for rural and remote areas, enhanced disaster preparedness capabilities, and reliable communication infrastructure for public services. Satellite communications support digital inclusion initiatives and economic development programs across ASEAN member nations.

Enterprise customers obtain reliable communication solutions for remote operations, business continuity planning, and global connectivity requirements. Satellite services provide backup connectivity, temporary communication solutions, and coverage in areas where terrestrial networks remain unavailable or unreliable.

End users access high-speed internet services, entertainment content, and communication capabilities regardless of geographical location. Satellite communications enable digital inclusion and economic participation for communities in remote and underserved areas throughout the ASEAN region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence emerges as a dominant trend, with satellite and terrestrial networks increasingly integrated to provide comprehensive connectivity solutions. This convergence enables hybrid networks that optimize coverage, performance, and cost-effectiveness across diverse geographical and application requirements.

Low Earth orbit satellite deployment accelerates across the region as next-generation satellite constellations offer improved performance characteristics including reduced latency and enhanced throughput capabilities. These systems address traditional satellite communication limitations while expanding service possibilities.

Software-defined networking adoption increases among satellite operators seeking improved operational flexibility and service customization capabilities. SDN technologies enable dynamic resource allocation, service optimization, and rapid service deployment across different market segments and customer requirements.

Edge computing integration with satellite networks enhances service capabilities and reduces latency for time-sensitive applications. This trend supports emerging applications including autonomous systems, real-time analytics, and industrial automation across the ASEAN region.

Sustainability focus drives development of environmentally responsible satellite systems and operations. MarkWide Research analysis indicates increasing emphasis on sustainable space practices, debris mitigation, and energy-efficient satellite technologies among industry participants.

Regulatory harmonization efforts across ASEAN member nations aim to facilitate cross-border satellite services and reduce operational complexity for service providers. These initiatives support market integration and enable more efficient service delivery across the region.

Public-private partnerships expand as governments collaborate with satellite operators to develop national broadband infrastructure and digital connectivity initiatives. These partnerships leverage private sector expertise while addressing public policy objectives for digital inclusion and economic development.

Technology innovation programs emerge across several ASEAN countries, focusing on satellite technology development, space industry capabilities, and local manufacturing initiatives. These programs aim to reduce dependence on foreign satellite systems while building regional expertise and capabilities.

Investment acceleration from both domestic and international sources supports market expansion and infrastructure development. Venture capital, private equity, and government funding contribute to satellite operator expansion and technology innovation initiatives throughout the region.

Service diversification trends see satellite operators expanding beyond traditional communication services to include earth observation, navigation services, and specialized applications for various industry sectors including agriculture, maritime, and disaster management.

Strategic recommendations for market participants include focusing on hybrid network solutions that combine satellite and terrestrial technologies to address diverse connectivity requirements across ASEAN’s varied geographical landscape. This approach enables comprehensive coverage while optimizing cost-effectiveness and service quality.

Technology investment priorities should emphasize next-generation satellite systems, software-defined networking capabilities, and edge computing integration. These technologies provide competitive advantages and enable new service offerings that address evolving customer requirements and market opportunities.

Partnership development represents a critical success factor, with recommendations for satellite operators to establish strategic alliances with telecommunications companies, government agencies, and technology providers. These partnerships facilitate market access, service integration, and customer acquisition across different segments.

Market expansion strategies should prioritize underserved geographical areas and emerging application segments including IoT, smart agriculture, and environmental monitoring. These areas offer substantial growth potential while aligning with regional development priorities and government initiatives.

Regulatory engagement remains essential for successful market participation, with recommendations for active involvement in policy development, spectrum allocation processes, and cross-border service facilitation initiatives. Proactive regulatory engagement supports favorable operating environments and market access.

Market trajectory for the ASEAN satellite communications sector indicates continued robust growth driven by expanding digitalization, infrastructure development, and emerging technology applications. The market demonstrates resilience and adaptability to changing technological and economic conditions while maintaining strong fundamentals.

Technology evolution will significantly shape future market development, with low Earth orbit satellite constellations, 5G integration, and artificial intelligence applications creating new service possibilities and market opportunities. These technological advances address current limitations while enabling innovative applications and services.

Regional integration efforts will facilitate market consolidation and service standardization across ASEAN member nations. Harmonized regulations, cross-border service agreements, and regional cooperation initiatives support market efficiency and expansion opportunities for service providers.

Investment outlook remains positive with continued capital flows from both public and private sources supporting infrastructure development and technology innovation. MWR projections indicate sustained investment growth of approximately 12% annually in satellite communication infrastructure across the region.

Emerging applications including autonomous systems, smart cities, and environmental monitoring will drive additional market demand and create new revenue opportunities for satellite operators and service providers throughout the ASEAN region.

The ASEAN satellite communications market represents a dynamic and rapidly evolving sector with substantial growth potential driven by unique geographical characteristics, expanding digitalization initiatives, and increasing demand for reliable connectivity solutions. The market benefits from strong fundamentals including government support, economic growth, and technological advancement across member nations.

Strategic opportunities abound for market participants willing to invest in next-generation technologies, develop strategic partnerships, and address evolving customer requirements across diverse applications and geographical areas. The convergence of satellite and terrestrial networks creates particularly compelling opportunities for comprehensive connectivity solutions.

Future success in the ASEAN satellite communications market will depend on technology innovation, regulatory adaptation, and strategic positioning to capitalize on emerging opportunities while addressing traditional market challenges. Companies that effectively navigate these dynamics while maintaining focus on customer value creation are positioned for sustained growth and market leadership in this expanding sector.

What is ASEAN Satellite Communications?

ASEAN Satellite Communications refers to the use of satellite technology to provide communication services across the ASEAN region, facilitating data transmission, broadcasting, and telecommunication services for various applications.

What are the key players in the ASEAN Satellite Communications Market?

Key players in the ASEAN Satellite Communications Market include companies like SES S.A., Intelsat, and Thaicom, which provide satellite services for broadcasting, internet connectivity, and telecommunications, among others.

What are the main drivers of growth in the ASEAN Satellite Communications Market?

The main drivers of growth in the ASEAN Satellite Communications Market include the increasing demand for high-speed internet, the expansion of mobile communication networks, and the rising need for reliable communication in remote areas.

What challenges does the ASEAN Satellite Communications Market face?

Challenges in the ASEAN Satellite Communications Market include regulatory hurdles, high operational costs, and competition from terrestrial communication technologies, which can limit market growth.

What opportunities exist in the ASEAN Satellite Communications Market?

Opportunities in the ASEAN Satellite Communications Market include advancements in satellite technology, the potential for new applications in IoT and smart cities, and increasing investments in infrastructure development.

What trends are shaping the ASEAN Satellite Communications Market?

Trends shaping the ASEAN Satellite Communications Market include the growing adoption of high-throughput satellites, the integration of satellite and terrestrial networks, and the increasing focus on sustainability and environmental impact in satellite operations.

ASEAN Satellite Communications Market

| Segmentation Details | Description |

|---|---|

| Service Type | Broadcast, Broadband, Mobile, Fixed |

| End User | Government, Telecommunications, Maritime, Aviation |

| Technology | Geostationary, Low Earth Orbit, Medium Earth Orbit, Hybrid |

| Application | Television, Internet Access, Disaster Management, Remote Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Satellite Communications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at