444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN inland waterway freight transport market represents a critical component of Southeast Asia’s integrated logistics infrastructure, facilitating the movement of goods across rivers, canals, and inland water bodies throughout the region. This transportation mode leverages the extensive network of waterways that naturally connect major economic centers across ASEAN member states, providing cost-effective and environmentally sustainable freight solutions. The market encompasses various vessel types, cargo categories, and operational models that serve diverse industrial sectors including manufacturing, agriculture, mining, and consumer goods distribution.

Regional dynamics indicate that inland waterway freight transport is experiencing renewed interest as governments and private sector stakeholders recognize its potential to alleviate road congestion, reduce transportation costs, and support sustainable development goals. The market benefits from significant geographical advantages, with major river systems like the Mekong, Chao Phraya, and numerous Indonesian waterways providing natural transportation corridors. Current growth trends show increasing adoption rates of 12-15% annually across key ASEAN markets, driven by infrastructure investments and policy support for multimodal transportation networks.

Market participants include government-owned port authorities, private logistics companies, shipping operators, and specialized inland waterway transport providers. The sector is characterized by a mix of traditional operators using conventional vessels and modern companies implementing advanced technologies for fleet management, cargo tracking, and route optimization. Infrastructure development remains a key focus area, with ongoing projects to improve waterway depth, construct modern terminals, and enhance connectivity between inland ports and major seaports.

The ASEAN inland waterway freight transport market refers to the commercial movement of goods and cargo using rivers, canals, lakes, and other inland water bodies within the Association of Southeast Asian Nations region. This transportation mode utilizes various types of vessels including barges, tugboats, cargo ships, and specialized carriers to transport bulk commodities, containerized goods, and project cargo between inland origins and destinations or to connect with seaports for international trade.

Operational scope encompasses both domestic transportation within individual ASEAN countries and cross-border movements that leverage shared waterway systems. The market includes various service categories such as bulk cargo transport for commodities like coal, grain, and petroleum products, containerized freight for manufactured goods, and specialized transport for oversized or heavy cargo. Infrastructure components supporting this market include inland ports, loading terminals, maintenance facilities, and navigational aids that ensure safe and efficient waterway operations.

Economic significance extends beyond simple transportation services to include value-added logistics activities such as warehousing, cargo consolidation, customs clearance, and intermodal connections. The market serves as a vital link in regional supply chains, particularly for industries that require cost-effective movement of large volumes or heavy cargo where road and rail alternatives may be less economical or practical.

Strategic positioning of the ASEAN inland waterway freight transport market reflects its growing importance in regional logistics networks, with increasing recognition from governments and private sector stakeholders as a sustainable and cost-effective transportation alternative. The market demonstrates strong fundamentals driven by geographical advantages, supportive policy frameworks, and rising demand for efficient freight solutions across diverse industrial sectors.

Growth trajectory indicates robust expansion potential, with infrastructure investment increases of 18-22% supporting market development across key corridors. Major growth drivers include government initiatives to develop multimodal transportation networks, private sector investments in modern vessel fleets, and increasing environmental awareness that favors waterway transport over road-based alternatives. The market benefits from natural competitive advantages including lower fuel consumption, reduced carbon emissions, and capacity to handle large cargo volumes efficiently.

Competitive landscape features a diverse mix of established operators and emerging service providers, with increasing consolidation and strategic partnerships aimed at expanding service coverage and operational capabilities. Technology adoption is accelerating, with companies implementing digital solutions for fleet management, cargo tracking, and route optimization to improve service quality and operational efficiency.

Future prospects remain positive, supported by ongoing infrastructure development projects, favorable regulatory environments, and growing recognition of inland waterway transport as an essential component of sustainable logistics networks. Market expansion is expected to accelerate as connectivity improvements and capacity enhancements enable more efficient and reliable service offerings across the region.

Market dynamics reveal several critical insights that shape the ASEAN inland waterway freight transport landscape and influence strategic decision-making for industry participants:

Infrastructure investment represents the primary driver propelling ASEAN inland waterway freight transport market growth, with governments across the region allocating substantial resources to improve waterway infrastructure, construct modern terminals, and enhance navigational capabilities. These investments create direct opportunities for freight transport operators while improving overall system efficiency and reliability.

Environmental sustainability concerns are increasingly influencing transportation mode selection, with inland waterway freight transport offering significant environmental advantages including lower carbon emissions, reduced air pollution, and minimal noise impact compared to road and rail alternatives. Companies seeking to meet sustainability targets and comply with environmental regulations are actively exploring waterway transport options for their freight requirements.

Cost optimization pressures across various industries are driving increased adoption of inland waterway freight transport, particularly for bulk commodities and long-distance movements where waterway transport can deliver substantial cost savings. The ability to transport large volumes efficiently makes waterway transport particularly attractive for industries such as mining, agriculture, and manufacturing.

Regional integration initiatives within ASEAN are facilitating cross-border freight movements and creating larger market opportunities for waterway transport operators. Harmonized regulations, simplified customs procedures, and improved connectivity between national waterway systems are reducing barriers to regional freight transport and expanding market potential.

Technology advancement is enabling more efficient and reliable waterway freight operations through improved vessel designs, advanced navigation systems, and digital logistics platforms. These technological improvements are addressing traditional limitations of waterway transport such as scheduling flexibility and cargo tracking capabilities.

Infrastructure limitations continue to constrain market development in certain regions, with inadequate waterway depth, limited terminal facilities, and insufficient maintenance creating operational challenges for freight transport operators. These infrastructure gaps can result in service disruptions, increased costs, and reduced competitiveness compared to alternative transportation modes.

Seasonal variations in water levels and weather conditions can significantly impact waterway freight transport operations, creating reliability concerns for shippers who require consistent service levels throughout the year. Drought conditions, flooding, and monsoon seasons can disrupt transportation schedules and affect cargo handling capabilities.

Regulatory complexity across different ASEAN member states can create administrative burdens and compliance challenges for operators seeking to provide cross-border waterway freight services. Varying regulations, documentation requirements, and approval processes can increase operational costs and limit market expansion opportunities.

Limited cargo diversity represents another constraint, as waterway transport is traditionally most suitable for bulk commodities and may not be optimal for time-sensitive or high-value cargo that requires faster transit times and more flexible scheduling options available through other transportation modes.

Competition from alternative modes including road, rail, and air transport can limit market share growth, particularly for cargo types where speed and flexibility are prioritized over cost considerations. Well-developed road networks and improving rail infrastructure in some ASEAN countries provide competitive alternatives for freight transport.

Digital transformation presents significant opportunities for inland waterway freight transport operators to enhance service offerings through advanced technologies including IoT sensors, artificial intelligence, and blockchain solutions for cargo tracking and supply chain visibility. These technologies can address traditional limitations and create competitive advantages in the logistics market.

Green logistics initiatives are creating new market opportunities as companies and governments prioritize environmentally sustainable transportation solutions. Waterway freight transport’s inherent environmental advantages position it favorably to capture market share from more carbon-intensive transportation modes.

Infrastructure development programs across ASEAN countries are creating opportunities for public-private partnerships and private sector investments in waterway freight transport infrastructure. These programs can provide platforms for operators to expand their service networks and improve operational capabilities.

Regional trade growth is generating increased demand for efficient freight transport solutions, with inland waterway transport well-positioned to serve growing trade volumes between ASEAN member states and with major trading partners including China and India.

Multimodal integration opportunities allow waterway freight transport operators to develop comprehensive logistics solutions that combine waterway transport with road, rail, and air transport to provide door-to-door services and compete more effectively with integrated logistics providers.

Specialized cargo segments including project cargo, oversized equipment, and hazardous materials present opportunities for operators to develop niche service offerings that command premium pricing and create differentiated market positions.

Supply and demand dynamics in the ASEAN inland waterway freight transport market are influenced by multiple factors including industrial production levels, commodity prices, infrastructure capacity, and seasonal variations. The market demonstrates cyclical patterns related to agricultural harvests, mining production, and manufacturing activity that create fluctuating demand for freight transport services.

Competitive dynamics are evolving as traditional operators face increasing competition from modern logistics companies that leverage technology and integrated service offerings to capture market share. This competition is driving innovation and service improvements across the market while potentially pressuring profit margins for operators who fail to adapt to changing customer expectations.

Regulatory dynamics play a crucial role in shaping market development, with government policies regarding infrastructure investment, environmental standards, and cross-border trade directly impacting market growth potential. Recent policy initiatives supporting sustainable transportation and regional integration are creating favorable conditions for market expansion.

Technology dynamics are transforming operational capabilities and service offerings, with digital adoption rates increasing by 20-25% annually among leading operators. Advanced fleet management systems, predictive maintenance technologies, and automated cargo handling equipment are improving efficiency and reliability while reducing operational costs.

Economic dynamics including GDP growth, trade volumes, and industrial development across ASEAN countries directly influence freight transport demand and market expansion opportunities. Economic integration initiatives and trade facilitation measures are creating additional growth drivers for the waterway freight transport market.

Primary research methodology employed for analyzing the ASEAN inland waterway freight transport market includes comprehensive interviews with industry executives, government officials, port authorities, and logistics service providers across key ASEAN member states. These interviews provide insights into market trends, operational challenges, investment priorities, and future development plans that shape market dynamics.

Secondary research encompasses analysis of government publications, industry reports, trade statistics, and regulatory documents to establish market context and validate primary research findings. This research approach ensures comprehensive coverage of market segments, geographical regions, and stakeholder perspectives.

Data collection processes involve systematic gathering of operational statistics, financial performance data, infrastructure development information, and regulatory updates from authoritative sources including government agencies, industry associations, and international organizations. MarkWide Research employs rigorous data validation procedures to ensure accuracy and reliability of market intelligence.

Analytical framework utilizes quantitative and qualitative research methods to assess market size, growth trends, competitive positioning, and future prospects. Statistical analysis techniques are applied to identify correlations, trends, and patterns that inform market projections and strategic recommendations.

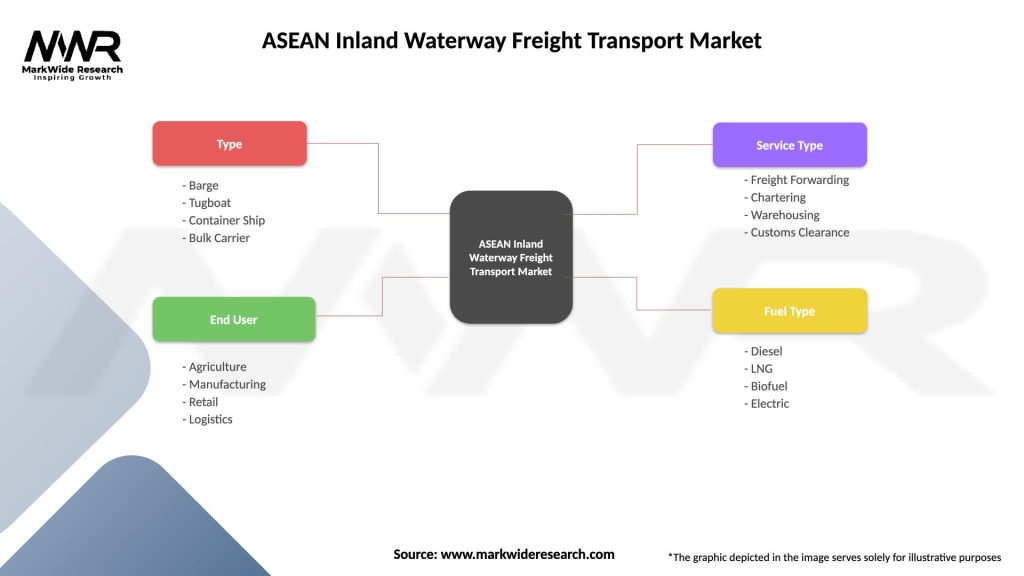

Market segmentation analysis examines various dimensions including cargo types, vessel categories, geographical regions, and service models to provide detailed insights into market structure and growth opportunities. This segmentation approach enables targeted analysis of specific market niches and customer segments.

Thailand represents a leading market for inland waterway freight transport, leveraging its extensive river network including the Chao Phraya River system to connect major industrial centers with seaports. The country demonstrates market leadership with approximately 35-40% regional market share, supported by well-developed infrastructure and government initiatives to promote waterway transport as part of multimodal logistics networks.

Vietnam shows strong growth potential with its Mekong Delta region and Red River system providing natural transportation corridors for agricultural products, manufactured goods, and bulk commodities. Government investments in waterway infrastructure and port development are enhancing the country’s position in the regional market.

Indonesia presents significant opportunities given its archipelagic geography and extensive river systems, particularly in Kalimantan and Sumatra. The country’s focus on developing inland waterway connections to support economic development in remote regions is creating new market opportunities for freight transport operators.

Malaysia demonstrates steady market development with waterway freight transport serving key industrial areas and connecting inland production centers with major ports. The country’s strategic location and well-developed logistics infrastructure support its role in regional freight transport networks.

Philippines shows emerging potential with government initiatives to develop inland waterway transport as part of comprehensive infrastructure improvement programs. The country’s island geography creates unique opportunities for inter-island freight transport using inland waterway connections.

Cambodia and Laos represent developing markets with significant growth potential, particularly for cross-border freight movements using the Mekong River system. These countries are benefiting from regional integration initiatives and infrastructure development programs supported by international development organizations.

Market structure in the ASEAN inland waterway freight transport sector features a diverse mix of operators ranging from large integrated logistics companies to specialized waterway transport providers and government-owned enterprises. The competitive landscape is characterized by both horizontal and vertical integration trends as companies seek to expand service offerings and geographical coverage.

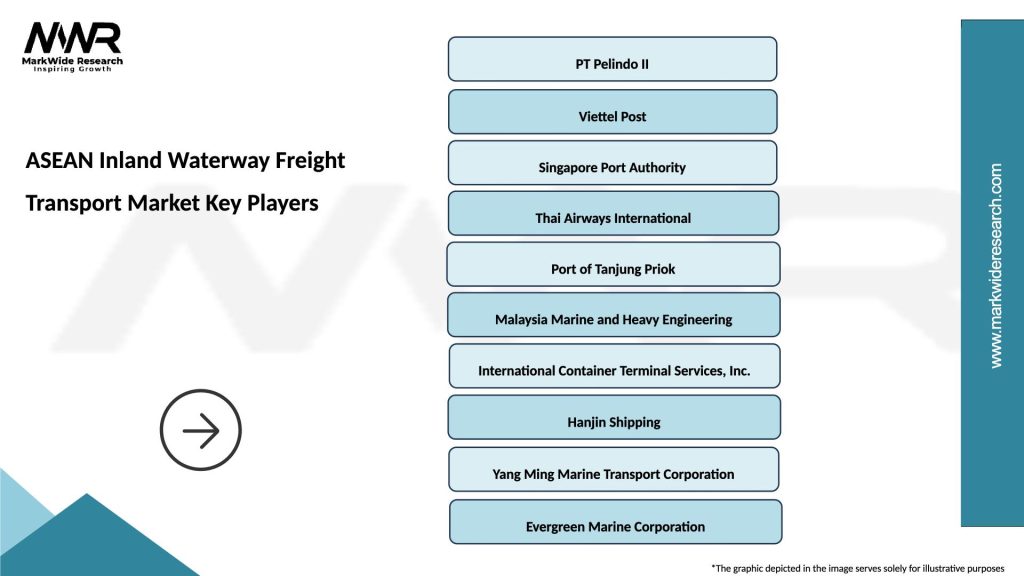

Leading operators in the market include:

Competitive strategies focus on fleet modernization, technology adoption, service diversification, and strategic partnerships to enhance market position and operational capabilities. Companies are investing in advanced vessel designs, digital logistics platforms, and integrated service offerings to differentiate their market positioning.

Market consolidation trends are emerging as larger operators acquire smaller companies to expand geographical coverage and service capabilities, while strategic alliances are being formed to provide comprehensive regional freight transport solutions.

By Cargo Type:

By Vessel Type:

By Service Model:

Bulk commodities represent the largest segment in the ASEAN inland waterway freight transport market, accounting for approximately 55-60% of total cargo volume. This segment benefits from waterway transport’s inherent advantages for moving large quantities of homogeneous cargo over long distances at competitive costs. Key commodities include coal for power generation, agricultural products for export, and raw materials for manufacturing industries.

Containerized cargo shows the fastest growth rate among market segments, driven by increasing trade volumes and the development of container handling facilities at inland ports. This segment benefits from standardized handling procedures, improved cargo security, and compatibility with multimodal transport networks that connect waterway transport with road and rail systems.

Project cargo represents a high-value niche segment where waterway transport provides unique advantages for moving oversized or heavy equipment that cannot be efficiently transported by road or rail. This segment includes power plant equipment, industrial machinery, and infrastructure components that require specialized handling capabilities.

Agricultural products form a traditional strength of inland waterway freight transport, particularly in countries like Thailand and Vietnam where river systems connect major agricultural production areas with processing facilities and export ports. This segment demonstrates seasonal patterns related to harvest cycles and commodity price fluctuations.

Cross-border transport is emerging as a growth segment, facilitated by regional integration initiatives and improved connectivity between national waterway systems. This segment benefits from cost advantages for international trade and reduced border crossing complexities compared to road transport alternatives.

Cost advantages represent the primary benefit for shippers utilizing inland waterway freight transport, with potential savings of 25-40% compared to road transport for suitable cargo types and routes. These cost benefits are particularly significant for bulk commodities and long-distance movements where waterway transport’s economies of scale can be fully realized.

Environmental benefits provide important advantages for companies seeking to reduce their carbon footprint and meet sustainability targets. Waterway freight transport typically generates 60-70% lower carbon emissions per ton-kilometer compared to road transport, making it an attractive option for environmentally conscious shippers and logistics providers.

Capacity advantages enable efficient movement of large cargo volumes that would require multiple truck movements if transported by road. Single barge operations can carry cargo equivalent to dozens of trucks, reducing traffic congestion and infrastructure wear while improving overall logistics efficiency.

Reliability benefits include reduced exposure to road traffic congestion, weather-related delays, and vehicle breakdowns that can disrupt supply chains. Waterway transport operations are generally less affected by peak traffic periods and can provide more predictable transit times for planned cargo movements.

Safety advantages encompass reduced accident risks, lower cargo damage rates, and improved security for valuable or hazardous cargo. Waterway transport’s inherent stability and controlled operating environment contribute to superior safety performance compared to road transport alternatives.

Network connectivity benefits enable access to inland production areas and distribution centers that may not be efficiently served by other transportation modes. Waterway transport can provide direct connections between remote locations and major ports or urban centers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping the ASEAN inland waterway freight transport market through implementation of advanced technologies including GPS tracking, automated cargo handling systems, and digital booking platforms. These technologies are improving operational efficiency, enhancing customer service, and enabling better integration with broader logistics networks.

Sustainability focus is driving increased adoption of waterway freight transport as companies and governments prioritize environmentally responsible transportation solutions. This trend is supported by carbon reduction targets, environmental regulations, and corporate sustainability initiatives that favor lower-emission transportation modes.

Infrastructure modernization represents a key trend with governments across the region investing in waterway improvements, terminal upgrades, and navigational enhancements. These investments are improving service reliability, increasing capacity, and enabling larger vessels to operate on inland waterway networks.

Multimodal integration is becoming increasingly important as logistics providers develop comprehensive solutions that combine waterway transport with road, rail, and air transport to provide door-to-door services. This integration trend is improving service flexibility and expanding market opportunities for waterway transport operators.

Regional connectivity initiatives are facilitating cross-border freight movements through harmonized regulations, simplified procedures, and improved physical connections between national waterway systems. These developments are creating larger market opportunities and enabling more efficient regional trade flows.

Fleet modernization trends include adoption of more efficient vessel designs, alternative fuel systems, and advanced propulsion technologies that reduce operating costs and environmental impact while improving cargo handling capabilities.

Infrastructure investments across ASEAN countries are creating significant developments in the inland waterway freight transport sector. Recent projects include waterway deepening programs in Thailand, new inland port construction in Vietnam, and terminal modernization initiatives in Indonesia that are expanding operational capabilities and improving service quality.

Technology partnerships between waterway transport operators and technology providers are accelerating digital transformation initiatives. These partnerships are resulting in implementation of advanced fleet management systems, automated cargo tracking solutions, and predictive maintenance technologies that improve operational efficiency.

Regulatory harmonization efforts among ASEAN member states are simplifying cross-border freight transport procedures and reducing administrative barriers. Recent agreements on mutual recognition of vessel certifications and standardized documentation requirements are facilitating regional market integration.

Private sector investments in modern vessel fleets and terminal facilities are expanding market capacity and improving service capabilities. Major logistics companies are acquiring specialized waterway transport assets and developing integrated service offerings that combine multiple transportation modes.

Environmental initiatives including adoption of cleaner fuel technologies and implementation of emission reduction programs are positioning the waterway freight transport sector as a sustainable logistics solution. These initiatives are supported by government incentives and industry sustainability commitments.

Strategic alliances between waterway transport operators, port authorities, and logistics providers are creating comprehensive service networks that improve connectivity and expand market reach. These partnerships are enabling smaller operators to access broader markets while providing customers with integrated logistics solutions.

Infrastructure investment should remain a top priority for both government and private sector stakeholders, with focus on addressing capacity constraints and improving connectivity between inland waterways and major ports. MWR analysis indicates that strategic infrastructure improvements can generate efficiency gains of 15-20% while expanding market opportunities for freight transport operators.

Technology adoption represents a critical success factor for waterway freight transport operators seeking to compete effectively with alternative transportation modes. Companies should prioritize implementation of digital solutions for fleet management, cargo tracking, and customer service to improve operational efficiency and service quality.

Service diversification strategies should focus on developing multimodal logistics capabilities that combine waterway transport with complementary services including warehousing, customs clearance, and last-mile delivery. This approach can create competitive advantages and generate additional revenue streams.

Regional expansion opportunities should be pursued through strategic partnerships and cross-border service development that leverage improving connectivity between ASEAN waterway systems. Companies with strong domestic positions should consider regional expansion to capture growth opportunities in emerging markets.

Sustainability positioning should be emphasized in marketing and business development efforts, highlighting waterway transport’s environmental advantages to attract environmentally conscious customers and align with corporate sustainability initiatives.

Capacity optimization through improved vessel utilization, route planning, and cargo consolidation can enhance profitability while providing competitive pricing for customers. Operators should invest in analytical capabilities to optimize operations and improve asset utilization rates.

Growth prospects for the ASEAN inland waterway freight transport market remain positive, supported by continued infrastructure development, favorable government policies, and increasing recognition of waterway transport’s advantages for sustainable logistics. Market expansion is expected to accelerate as connectivity improvements and capacity enhancements enable more efficient and reliable service offerings.

Technology integration will continue transforming operational capabilities and service offerings, with digital adoption rates projected to increase by 25-30% over the next five years. Advanced technologies including artificial intelligence, IoT sensors, and blockchain solutions will enable improved efficiency, transparency, and customer service across the market.

Regional integration initiatives will create larger market opportunities and facilitate cross-border freight movements through continued harmonization of regulations and improvement of physical connectivity between national waterway systems. These developments will enable operators to develop regional service networks and capture economies of scale.

Environmental regulations and sustainability requirements will increasingly favor waterway freight transport over more carbon-intensive alternatives, creating competitive advantages for operators who position themselves as sustainable logistics providers. This trend will be supported by carbon pricing mechanisms and corporate sustainability commitments.

Infrastructure development programs will continue expanding operational capabilities and improving service reliability, with particular focus on addressing capacity constraints and enhancing connectivity with other transportation modes. These improvements will enable the market to capture larger shares of regional freight transport demand.

Market consolidation trends are expected to continue as larger operators acquire smaller companies and form strategic partnerships to expand geographical coverage and service capabilities. This consolidation will create more comprehensive service networks while potentially improving operational efficiency across the market.

The ASEAN inland waterway freight transport market represents a strategically important and rapidly evolving sector within the region’s logistics infrastructure, offering significant opportunities for sustainable and cost-effective freight transportation solutions. The market benefits from strong fundamentals including extensive natural waterway networks, supportive government policies, and growing recognition of environmental advantages that position waterway transport favorably against alternative transportation modes.

Market dynamics indicate robust growth potential driven by infrastructure investments, technology adoption, and regional integration initiatives that are expanding operational capabilities and creating new market opportunities. The sector’s ability to provide cost-effective solutions for bulk commodities while supporting sustainability objectives positions it well to capture increasing market share in the evolving logistics landscape.

Strategic positioning of market participants will be critical for success, with emphasis on technology adoption, service diversification, and regional expansion strategies that leverage improving connectivity and growing demand for integrated logistics solutions. Companies that successfully combine operational excellence with sustainable practices and customer-focused service offerings will be best positioned to capitalize on market growth opportunities and establish competitive advantages in this dynamic and promising sector.

What is ASEAN Inland Waterway Freight Transport?

ASEAN Inland Waterway Freight Transport refers to the movement of goods and cargo via rivers, canals, and other inland waterways within the ASEAN region. This mode of transport is crucial for connecting various economic zones and facilitating trade among member countries.

What are the key players in the ASEAN Inland Waterway Freight Transport Market?

Key players in the ASEAN Inland Waterway Freight Transport Market include companies like Sembcorp Marine, Pacific International Lines, and APL Logistics, which provide various logistics and transportation services. These companies are involved in enhancing the efficiency and capacity of inland waterway transport, among others.

What are the growth factors driving the ASEAN Inland Waterway Freight Transport Market?

The growth of the ASEAN Inland Waterway Freight Transport Market is driven by increasing trade activities, the need for cost-effective transportation solutions, and government initiatives to improve infrastructure. Additionally, the rising demand for sustainable transport options is also contributing to market expansion.

What challenges does the ASEAN Inland Waterway Freight Transport Market face?

The ASEAN Inland Waterway Freight Transport Market faces challenges such as inadequate infrastructure, seasonal variations affecting water levels, and regulatory hurdles. These factors can hinder the efficiency and reliability of inland waterway transport services.

What opportunities exist in the ASEAN Inland Waterway Freight Transport Market?

Opportunities in the ASEAN Inland Waterway Freight Transport Market include the potential for public-private partnerships to enhance infrastructure, the integration of technology for better logistics management, and the growing emphasis on eco-friendly transport solutions. These factors can lead to improved service offerings and increased market participation.

What trends are shaping the ASEAN Inland Waterway Freight Transport Market?

Trends shaping the ASEAN Inland Waterway Freight Transport Market include the adoption of digital technologies for tracking and managing shipments, increased collaboration among ASEAN member states for seamless transport, and a focus on sustainability in logistics practices. These trends are expected to enhance operational efficiency and reduce environmental impact.

ASEAN Inland Waterway Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Type | Barge, Tugboat, Container Ship, Bulk Carrier |

| End User | Agriculture, Manufacturing, Retail, Logistics |

| Service Type | Freight Forwarding, Chartering, Warehousing, Customs Clearance |

| Fuel Type | Diesel, LNG, Biofuel, Electric |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Inland Waterway Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at