444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN EV battery pack market represents one of the most dynamic and rapidly evolving sectors within Southeast Asia’s automotive industry. This comprehensive market encompasses the development, manufacturing, and distribution of advanced battery systems specifically designed for electric vehicles across the ten-member Association of Southeast Asian Nations. Market dynamics indicate unprecedented growth driven by government initiatives, environmental consciousness, and technological advancements in energy storage solutions.

Regional governments across ASEAN countries have implemented ambitious electrification targets, with several nations committing to phase out internal combustion engines by 2040. The market demonstrates remarkable momentum with annual growth rates exceeding 25% in key segments, particularly in Thailand, Indonesia, and Vietnam. Battery technology innovations, including lithium-ion, solid-state, and next-generation chemistries, are reshaping the competitive landscape and driving substantial investments from both domestic and international players.

Manufacturing capabilities within the region are expanding rapidly, with major automotive hubs establishing dedicated EV battery production facilities. The integration of renewable energy sources with battery manufacturing processes has become a critical differentiator, enabling companies to offer more sustainable solutions while reducing production costs. Supply chain optimization remains a key focus area, with regional players working to establish robust networks that can support the anticipated surge in electric vehicle adoption across Southeast Asia.

The ASEAN EV battery pack market refers to the comprehensive ecosystem encompassing the design, production, distribution, and servicing of battery systems specifically engineered for electric vehicles within the Association of Southeast Asian Nations region. This market includes various battery technologies, from traditional lithium-ion systems to cutting-edge solid-state batteries, all designed to power the growing fleet of electric cars, motorcycles, buses, and commercial vehicles across Southeast Asia.

Battery pack systems represent sophisticated assemblies that combine multiple battery cells, thermal management systems, battery management systems (BMS), and safety components into integrated units capable of delivering reliable power for electric vehicle operations. These systems must meet stringent performance criteria including energy density, charging speed, thermal stability, and longevity while adapting to the unique climatic and operational conditions prevalent across ASEAN countries.

Market scope extends beyond simple battery manufacturing to encompass research and development, raw material sourcing, recycling programs, and comprehensive after-sales support services. The definition also includes emerging technologies such as battery-as-a-service models, swappable battery systems, and integrated energy storage solutions that serve dual purposes for both transportation and grid stabilization applications.

Strategic analysis reveals that the ASEAN EV battery pack market is experiencing transformational growth driven by convergent factors including regulatory support, technological advancement, and shifting consumer preferences toward sustainable transportation solutions. The market landscape features a diverse mix of established international players and emerging regional manufacturers, all competing to capture market share in this rapidly expanding sector.

Key market drivers include government incentives promoting electric vehicle adoption, declining battery costs, and increasing environmental awareness among consumers. Regional manufacturing capacity is expanding significantly, with production capabilities growing by approximately 40% annually across major ASEAN economies. Thailand and Indonesia have emerged as regional manufacturing hubs, while Singapore and Malaysia focus on high-value research and development activities.

Technology trends indicate a shift toward higher energy density solutions, faster charging capabilities, and improved thermal management systems designed specifically for tropical climates. The market demonstrates strong potential for continued expansion, supported by substantial investments in charging infrastructure, favorable regulatory frameworks, and increasing collaboration between automotive manufacturers and battery technology providers throughout the region.

Market intelligence reveals several critical insights that define the current state and future trajectory of the ASEAN EV battery pack market:

Government initiatives across ASEAN countries represent the primary catalyst driving market expansion, with comprehensive policy frameworks supporting electric vehicle adoption through financial incentives, tax reductions, and regulatory mandates. Thailand’s EV 30@30 policy aims to achieve 30% electric vehicle production by 2030, while Indonesia’s ambitious electrification program targets substantial reductions in transportation emissions through battery electric vehicle promotion.

Environmental consciousness among consumers is intensifying, driven by increasing awareness of air quality issues and climate change impacts. Urban populations across major ASEAN cities are demonstrating growing preference for sustainable transportation solutions, creating substantial demand for high-performance EV battery systems. Corporate sustainability commitments from major fleet operators and logistics companies are further accelerating market growth through large-scale electric vehicle procurement programs.

Technological advancement continues to drive market expansion through improved battery performance, enhanced safety features, and reduced manufacturing costs. Energy density improvements of approximately 8-10% annually are making electric vehicles more practical for consumers, while faster charging technologies are addressing range anxiety concerns. Manufacturing scale economies are enabling cost reductions that make electric vehicles increasingly competitive with traditional internal combustion engine vehicles across price-sensitive ASEAN markets.

High initial costs continue to present significant barriers to widespread EV battery pack adoption across ASEAN markets, particularly in price-sensitive segments where consumers remain focused on upfront purchase prices rather than total cost of ownership. Limited charging infrastructure in rural and suburban areas constrains market expansion, as consumers require confidence in charging accessibility before committing to electric vehicle purchases.

Raw material dependencies create supply chain vulnerabilities, with critical battery materials including lithium, cobalt, and rare earth elements subject to price volatility and geopolitical risks. Technical challenges related to battery performance in tropical climates require specialized solutions that may increase costs and complexity. Thermal management becomes particularly critical in high-temperature, high-humidity environments typical of Southeast Asian conditions.

Regulatory inconsistencies across ASEAN member countries create market fragmentation challenges for manufacturers seeking to achieve regional scale economies. Skills shortages in specialized areas including battery technology, thermal management, and electric vehicle servicing limit the pace of market development. Consumer education requirements remain substantial, as many potential buyers lack familiarity with electric vehicle technology and maintenance requirements.

Regional manufacturing expansion presents substantial opportunities for companies seeking to establish production capabilities closer to end markets while benefiting from competitive labor costs and favorable investment incentives. Government support programs across ASEAN countries offer attractive opportunities for partnerships, joint ventures, and technology transfer arrangements that can accelerate market entry and expansion strategies.

Two-wheeler electrification represents a particularly compelling opportunity given the massive installed base of motorcycles and scooters across Southeast Asian markets. Battery swapping technologies offer innovative solutions for addressing charging infrastructure limitations while creating new business models around battery-as-a-service offerings. Commercial vehicle applications including buses, delivery vehicles, and logistics fleets present substantial growth opportunities driven by corporate sustainability commitments and operational cost advantages.

Energy storage integration creates opportunities for dual-purpose battery systems that serve both transportation and grid stabilization functions, particularly valuable in regions with developing electrical infrastructure. Recycling and circular economy initiatives present emerging opportunities for companies developing sustainable battery lifecycle management solutions. Technology localization offers opportunities for regional players to develop specialized solutions optimized for tropical operating conditions and local market requirements.

Competitive dynamics within the ASEAN EV battery pack market reflect a complex interplay between established international manufacturers, emerging regional players, and technology innovators. Market consolidation trends are becoming apparent as companies seek to achieve scale economies necessary for sustainable profitability in this capital-intensive industry. Strategic partnerships between automotive manufacturers and battery suppliers are reshaping traditional supply chain relationships.

Technology evolution continues at an accelerated pace, with battery energy density improvements of approximately 12% annually driving enhanced vehicle performance and consumer acceptance. Manufacturing automation is reducing production costs while improving quality consistency, enabling more competitive pricing strategies across diverse market segments. Supply chain localization efforts are intensifying as companies seek to reduce dependencies on distant suppliers and improve responsiveness to regional market demands.

Investment flows into the sector remain robust, with both private equity and strategic investors recognizing the long-term growth potential of electric vehicle adoption across ASEAN markets. Regulatory evolution continues to shape market dynamics, with governments refining policies to balance environmental objectives with economic development goals. Consumer behavior shifts toward sustainability and technology adoption are creating new market segments and application opportunities beyond traditional automotive uses.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and completeness of findings regarding the ASEAN EV battery pack market. Primary research included extensive interviews with industry executives, government officials, technology developers, and end-users across all major ASEAN markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed detailed analysis of government publications, industry reports, academic studies, and corporate financial statements to establish baseline market data and validate primary research findings. Quantitative analysis utilized statistical modeling techniques to project market trends and growth trajectories based on historical data and identified market drivers. Qualitative assessment provided deeper understanding of market dynamics, competitive positioning, and strategic implications for industry participants.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews to clarify findings, and applying sensitivity analysis to test the robustness of projections under different scenario assumptions. Regional expertise was leveraged through collaboration with local market specialists in each ASEAN country to ensure cultural and regulatory nuances were properly incorporated into the analysis. Technology assessment involved consultation with battery technology experts and automotive engineers to evaluate technical feasibility and market readiness of emerging solutions.

Thailand has emerged as the regional leader in EV battery pack manufacturing and adoption, benefiting from comprehensive government support policies and established automotive manufacturing infrastructure. Thai market share represents approximately 35% of regional production capacity, with major international manufacturers establishing significant production facilities to serve both domestic and export markets. Investment incentives and streamlined regulatory processes have attracted substantial foreign direct investment in battery technology and manufacturing capabilities.

Indonesia presents the largest potential market for EV battery packs given its substantial population and growing middle class, though adoption rates remain in early stages compared to regional leaders. Government initiatives including the national electric vehicle program are beginning to drive market development, with projected growth rates exceeding 30% annually over the next five years. Local manufacturing capabilities are expanding rapidly, supported by abundant mineral resources including nickel deposits critical for battery production.

Vietnam demonstrates strong growth momentum driven by rapid economic development and increasing environmental awareness among urban consumers. Manufacturing partnerships with international technology providers are establishing Vietnam as an important production hub for both domestic consumption and regional export. Singapore and Malaysia focus primarily on high-value research and development activities, technology innovation, and regional headquarters functions rather than large-scale manufacturing operations.

Market leadership in the ASEAN EV battery pack sector is distributed among several categories of players, each bringing distinct competitive advantages and strategic approaches to market development:

Competitive strategies increasingly emphasize local manufacturing capabilities, technology localization, and partnerships with regional automotive manufacturers to establish sustainable market positions.

By Battery Type:

By Vehicle Type:

By Application:

Passenger vehicle batteries represent the most technologically advanced segment, with manufacturers focusing on achieving optimal balance between energy density, charging speed, and cost effectiveness. Premium passenger vehicles typically utilize high-nickel content NMC batteries offering superior range and performance characteristics, while mass market vehicles increasingly adopt LFP chemistry to achieve competitive pricing without compromising safety or reliability.

Two-wheeler battery systems present unique design challenges requiring compact form factors, lightweight construction, and cost optimization for price-sensitive markets. Swappable battery technologies are gaining particular traction in this segment, enabling rapid energy replenishment without requiring extensive charging infrastructure investments. Battery standardization initiatives across manufacturers are facilitating interoperability and reducing consumer concerns about technology lock-in.

Commercial vehicle applications prioritize total cost of ownership optimization, durability, and operational reliability over maximum performance characteristics. Fleet operators demonstrate increasing sophistication in evaluating battery lifecycle costs, including energy efficiency, maintenance requirements, and end-of-life value recovery. Heavy-duty applications are driving development of specialized battery systems capable of supporting high-power demands while maintaining thermal stability under demanding operating conditions.

Manufacturers benefit from expanding market opportunities driven by supportive government policies, growing consumer acceptance, and improving technology cost-effectiveness. Production scale economies enable cost reductions that improve competitive positioning while maintaining healthy profit margins. Technology leadership provides sustainable competitive advantages through intellectual property development and manufacturing process optimization.

Automotive OEMs gain access to advanced battery technologies that enable competitive electric vehicle offerings while benefiting from local supply chain development that reduces costs and improves supply security. Partnership opportunities with battery manufacturers facilitate technology sharing and joint development programs that accelerate innovation cycles. Market differentiation becomes possible through exclusive technology arrangements and customized battery solutions.

Consumers benefit from improving battery performance, declining costs, and expanding charging infrastructure that makes electric vehicle ownership more practical and economical. Government stakeholders achieve environmental and energy security objectives while supporting economic development through manufacturing investment and job creation. Investors participate in a high-growth market with substantial long-term potential supported by favorable regulatory trends and technological advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Battery chemistry evolution continues toward higher energy density solutions with improved safety characteristics, particularly solid-state technologies that promise significant performance advantages over current lithium-ion systems. Manufacturing localization is accelerating as companies establish regional production capabilities to serve growing ASEAN markets while reducing supply chain risks and transportation costs.

Circular economy principles are gaining prominence with increasing focus on battery recycling, second-life applications, and sustainable material sourcing throughout the supply chain. Digital integration is transforming battery management systems with advanced monitoring, predictive maintenance, and optimization capabilities that enhance performance and extend operational life. Modular design approaches are enabling more flexible battery configurations that can be optimized for specific vehicle applications and market requirements.

Partnership strategies are evolving toward deeper collaboration between automotive manufacturers, battery suppliers, and technology developers to accelerate innovation and market development. Standardization initiatives are progressing to improve interoperability, reduce costs, and facilitate market expansion through common technical specifications and testing protocols. Sustainability focus is intensifying with carbon footprint reductions of 25-30% becoming standard targets for battery manufacturing processes across the region.

Major manufacturing investments across ASEAN countries are establishing the region as a significant global production hub for EV battery packs. Thailand’s Eastern Economic Corridor has attracted substantial investments from leading battery manufacturers, while Indonesia’s battery industry development leverages abundant nickel resources to create integrated supply chains from raw materials to finished products.

Technology partnerships between international battery manufacturers and regional automotive companies are accelerating knowledge transfer and capability development. Research and development centers established by major players are focusing on tropical climate optimization and cost reduction strategies specifically relevant to ASEAN markets. Government initiatives including battery testing facilities and certification programs are supporting industry development and quality assurance.

Infrastructure development projects are expanding charging networks across major urban centers, with charging station deployment rates increasing by 55% annually in key markets. Battery swapping networks for two-wheelers and commercial vehicles are gaining traction as alternative solutions for addressing charging infrastructure limitations. Recycling facility development is beginning to address end-of-life battery management requirements as the installed base of electric vehicles grows.

MarkWide Research analysis indicates that companies seeking success in the ASEAN EV battery pack market should prioritize local manufacturing capabilities to achieve cost competitiveness and supply chain resilience. Strategic partnerships with regional automotive manufacturers and government agencies provide essential market access and regulatory support for sustainable growth strategies.

Technology localization represents a critical success factor, with companies needing to develop solutions specifically optimized for tropical operating conditions and regional market requirements. Investment in research and development capabilities within ASEAN countries demonstrates long-term commitment while accessing local talent and government support programs. Sustainability initiatives including recycling programs and carbon footprint reduction should be integrated into business strategies to align with regional environmental objectives.

Market entry strategies should consider the diverse regulatory environments across ASEAN countries, with phased expansion approaches allowing companies to optimize operations in lead markets before broader regional deployment. Customer education programs remain essential for accelerating market adoption, particularly in segments where electric vehicle technology awareness remains limited. Supply chain diversification strategies should be implemented to reduce dependencies on single sources for critical materials and components.

Long-term projections indicate sustained high growth rates for the ASEAN EV battery pack market, driven by continued government support, improving technology cost-effectiveness, and expanding charging infrastructure. Market maturation is expected to occur gradually across different segments, with two-wheelers and urban passenger vehicles leading adoption curves while commercial applications follow as total cost of ownership advantages become more apparent.

Technology advancement will continue to drive market evolution, with solid-state batteries expected to achieve commercial viability within the next decade, offering significant performance improvements over current lithium-ion systems. Manufacturing capacity is projected to expand substantially, with regional production capabilities growing by approximately 45% annually through 2030 as companies establish local operations to serve growing demand.

Market consolidation trends are likely to intensify as the industry matures, with successful companies achieving scale economies while smaller players either exit the market or find specialized niches. Integration opportunities between battery manufacturing and renewable energy systems will create new value propositions and business models. Regulatory harmonization across ASEAN countries may facilitate regional market integration and reduce compliance complexities for manufacturers operating across multiple jurisdictions.

The ASEAN EV battery pack market represents one of the most compelling growth opportunities in the global electric vehicle ecosystem, characterized by strong government support, expanding manufacturing capabilities, and substantial untapped market potential. Regional dynamics favor continued rapid expansion, with supportive policy frameworks, improving technology cost-effectiveness, and growing environmental consciousness driving sustained demand growth across diverse market segments.

Success factors for market participants include establishing local manufacturing presence, developing technology solutions optimized for regional conditions, and building strategic partnerships with automotive manufacturers and government stakeholders. MWR analysis suggests that companies positioning themselves early in this market development cycle will benefit from first-mover advantages and scale economy benefits as the market matures.

The convergence of favorable regulatory trends, technological advancement, and changing consumer preferences creates a robust foundation for sustained market growth. Investment opportunities remain substantial across the entire value chain, from raw material processing through manufacturing, distribution, and recycling services. As the ASEAN EV battery pack market continues its rapid evolution, stakeholders who adapt quickly to changing market conditions while maintaining focus on sustainability and local market requirements will be best positioned to capture the significant value creation opportunities ahead.

What is EV Battery Pack?

EV Battery Pack refers to a collection of battery cells that are assembled together to store energy for electric vehicles. These packs are crucial for powering electric vehicles, providing the necessary energy for propulsion and other electrical systems.

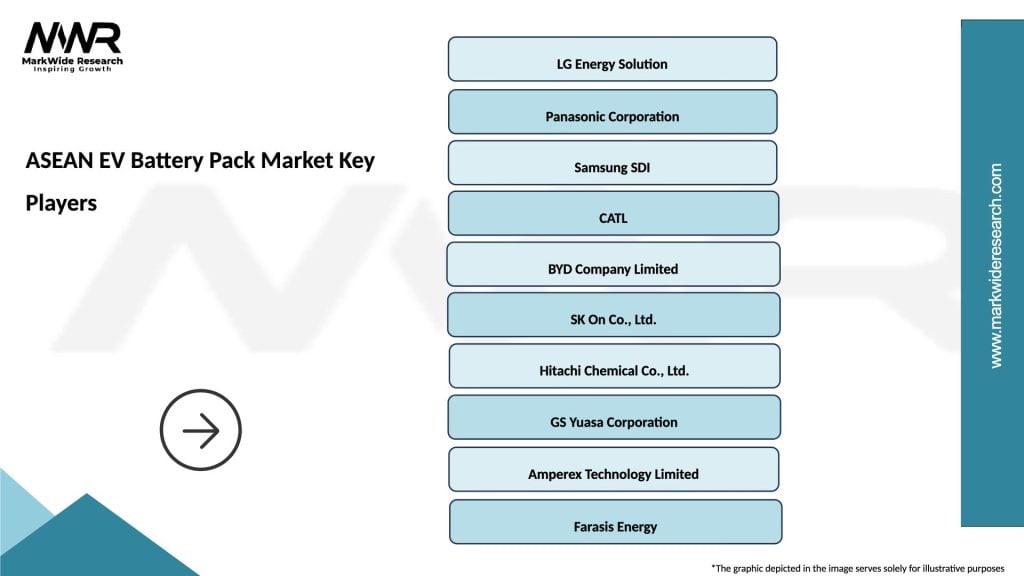

What are the key players in the ASEAN EV Battery Pack Market?

Key players in the ASEAN EV Battery Pack Market include companies like LG Chem, Panasonic, and Samsung SDI, which are known for their advanced battery technologies and significant market presence, among others.

What are the main drivers of the ASEAN EV Battery Pack Market?

The main drivers of the ASEAN EV Battery Pack Market include the increasing demand for electric vehicles, government incentives for EV adoption, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the ASEAN EV Battery Pack Market face?

Challenges in the ASEAN EV Battery Pack Market include supply chain disruptions, high production costs, and the need for extensive charging infrastructure to support widespread EV adoption.

What opportunities exist in the ASEAN EV Battery Pack Market?

Opportunities in the ASEAN EV Battery Pack Market include the potential for innovation in battery recycling technologies, the growth of renewable energy integration, and the expansion of electric vehicle models across various segments.

What trends are shaping the ASEAN EV Battery Pack Market?

Trends shaping the ASEAN EV Battery Pack Market include the shift towards solid-state batteries, increased focus on sustainability and eco-friendly materials, and the rise of battery-as-a-service models that enhance consumer accessibility.

ASEAN EV Battery Pack Market

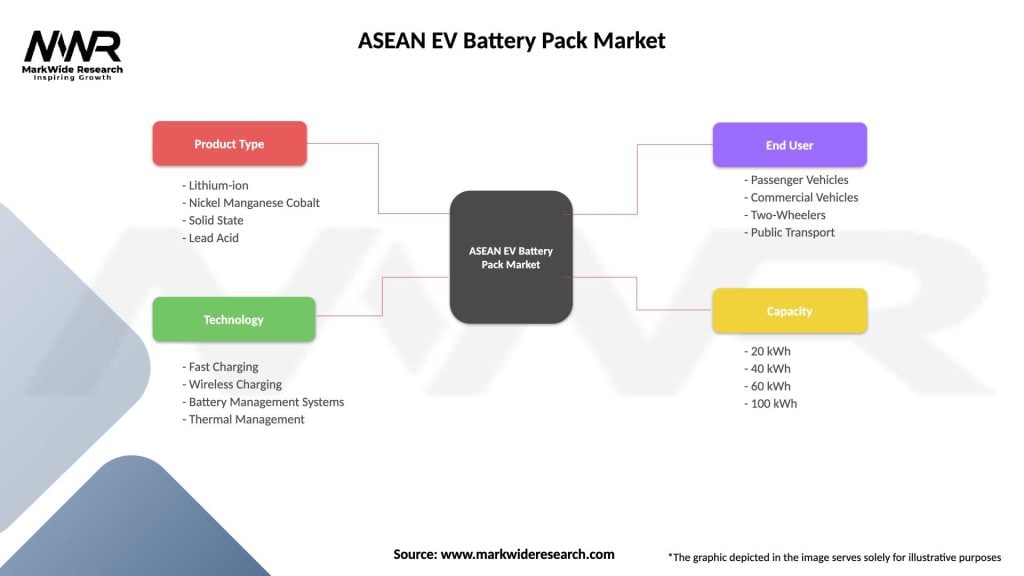

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel Manganese Cobalt, Solid State, Lead Acid |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| End User | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Public Transport |

| Capacity | 20 kWh, 40 kWh, 60 kWh, 100 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN EV Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at