444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN domestic courier market represents a dynamic and rapidly evolving sector within Southeast Asia’s logistics ecosystem. This market encompasses comprehensive last-mile delivery services, express shipping solutions, and integrated logistics operations across ten member nations including Indonesia, Thailand, Vietnam, Malaysia, Singapore, Philippines, Cambodia, Laos, Myanmar, and Brunei. The region’s domestic courier services have experienced unprecedented growth, driven by explosive e-commerce expansion, urbanization trends, and evolving consumer expectations for faster delivery times.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 12.5% over recent years. The integration of advanced technologies, including artificial intelligence, route optimization systems, and real-time tracking capabilities, has transformed traditional courier operations into sophisticated logistics networks. Digital transformation initiatives have enabled courier companies to enhance operational efficiency while meeting increasing demand for same-day and next-day delivery services across urban and rural areas.

Regional characteristics vary significantly across ASEAN markets, with developed economies like Singapore and Malaysia demonstrating mature courier infrastructure, while emerging markets such as Cambodia and Myanmar present substantial growth opportunities. The market’s evolution reflects broader economic development patterns, with cross-border integration becoming increasingly important as regional trade agreements facilitate seamless logistics operations throughout Southeast Asia.

The ASEAN domestic courier market refers to the comprehensive network of express delivery services, parcel transportation, and last-mile logistics solutions operating within individual Southeast Asian nations. This market encompasses traditional postal services, private courier companies, and integrated logistics providers offering time-definite delivery services for documents, packages, and e-commerce shipments across urban and rural destinations within national boundaries.

Service categories within this market include same-day delivery, next-day express services, standard ground transportation, specialized handling for fragile or valuable items, and cash-on-delivery solutions. The market integrates various transportation modes including motorcycles, vans, trucks, and increasingly, drone technology for specific delivery scenarios. Technology integration has become fundamental, with mobile applications, GPS tracking, digital payment systems, and automated sorting facilities defining modern courier operations.

Market participants range from international logistics giants establishing regional operations to local courier companies with deep understanding of specific market conditions. The sector serves diverse customer segments including individual consumers, small and medium enterprises, large corporations, and government institutions requiring reliable domestic shipping solutions.

Strategic positioning within the ASEAN domestic courier market reveals a sector characterized by intense competition, technological innovation, and expanding service capabilities. The market has demonstrated remarkable resilience and adaptability, particularly during global disruptions that accelerated e-commerce adoption and highlighted the critical importance of reliable domestic logistics infrastructure.

Key performance indicators show that urban delivery services account for approximately 75% of total courier volumes, while rural and remote area deliveries represent growing opportunities for market expansion. The integration of sustainable delivery practices has gained momentum, with electric vehicle adoption increasing by 35% annually among leading courier operators seeking to reduce environmental impact while managing operational costs.

Competitive landscape features both established international players and agile local operators, each leveraging unique strengths to capture market share. Technology adoption rates vary significantly across the region, with advanced markets demonstrating 85% digital integration in courier operations, while developing markets present opportunities for technological leapfrogging through mobile-first solutions.

Future trajectory indicates continued expansion driven by e-commerce growth, urbanization trends, and evolving consumer expectations for faster, more reliable delivery services. The market’s evolution toward integrated logistics ecosystems suggests increasing consolidation and strategic partnerships among key players.

Fundamental market drivers reveal several critical insights shaping the ASEAN domestic courier landscape:

E-commerce expansion serves as the primary catalyst driving ASEAN domestic courier market growth. The region’s digital economy has experienced explosive growth, with online retail penetration increasing significantly across all member nations. This digital transformation has created insatiable demand for reliable, fast, and cost-effective delivery services, positioning courier companies as critical infrastructure for digital commerce success.

Urbanization trends continue accelerating across Southeast Asia, concentrating populations in metropolitan areas while creating complex logistics challenges. Urban consumers demonstrate increasing expectations for same-day and next-day delivery services, driving courier companies to invest in sophisticated distribution networks, micro-fulfillment centers, and advanced routing technologies to meet these demanding service requirements.

Smartphone penetration and mobile internet adoption have revolutionized courier service accessibility and customer engagement. Mobile applications enable seamless booking, real-time tracking, flexible delivery scheduling, and digital payment processing, creating more convenient and transparent courier experiences that drive increased utilization and customer loyalty.

Government infrastructure investments in transportation networks, digital connectivity, and logistics facilities have created enabling environments for courier market expansion. Improved road networks, enhanced telecommunications infrastructure, and streamlined regulatory frameworks facilitate more efficient courier operations while reducing operational costs and delivery times.

Small business growth throughout the region has generated substantial demand for reliable domestic shipping solutions. Micro, small, and medium enterprises increasingly rely on courier services to reach customers across national markets, creating steady demand for cost-effective, flexible delivery options that support business expansion and market access.

Infrastructure limitations in certain ASEAN markets present significant challenges for courier service expansion, particularly in rural and remote areas. Inadequate road networks, limited telecommunications coverage, and insufficient logistics facilities constrain service quality and increase operational costs, limiting market penetration in underserved regions.

Regulatory complexities across different ASEAN member states create operational challenges for courier companies seeking regional expansion. Varying customs procedures, licensing requirements, and service regulations necessitate significant compliance investments while potentially limiting cross-border service integration and operational efficiency.

Labor shortages and high employee turnover rates affect courier service quality and operational stability. The physically demanding nature of delivery work, combined with competitive labor markets in urban areas, creates ongoing challenges in maintaining adequate staffing levels while controlling labor costs.

Traffic congestion in major metropolitan areas significantly impacts delivery efficiency and operational costs. Urban traffic conditions increase delivery times, fuel consumption, and vehicle maintenance requirements, forcing courier companies to invest in alternative transportation modes and advanced routing technologies to maintain service standards.

Price sensitivity among consumers and small businesses limits pricing flexibility for courier services. Intense competition and customer expectations for low-cost delivery options constrain profit margins while requiring continuous operational efficiency improvements to maintain financial sustainability.

Rural market expansion presents substantial growth opportunities as courier companies develop innovative solutions for serving underserved areas. Advanced routing technologies, partnership models with local businesses, and alternative delivery methods can unlock significant market potential while supporting rural economic development and digital inclusion initiatives.

Technology integration offers numerous opportunities for service enhancement and operational optimization. Artificial intelligence, machine learning, Internet of Things sensors, and drone technology can revolutionize courier operations, enabling predictive analytics, automated sorting, optimized routing, and innovative last-mile delivery solutions.

Sustainable logistics initiatives create competitive advantages while addressing environmental concerns. Electric vehicle adoption, carbon-neutral delivery options, and eco-friendly packaging solutions appeal to environmentally conscious consumers while potentially reducing long-term operational costs through improved efficiency and regulatory compliance.

Value-added services expansion enables courier companies to diversify revenue streams and strengthen customer relationships. Services such as warehousing, inventory management, cash collection, and reverse logistics create additional value propositions while increasing customer dependency and switching costs.

Cross-border integration opportunities emerge as ASEAN economic integration deepens. Seamless domestic-to-international courier services, regional logistics networks, and harmonized service standards can create competitive advantages while supporting regional trade growth and economic development.

Competitive intensity within the ASEAN domestic courier market has reached unprecedented levels as established players and new entrants compete for market share. This competition drives continuous innovation in service offerings, pricing strategies, and operational efficiency, ultimately benefiting consumers through improved service quality and competitive pricing structures.

Technology disruption continues reshaping traditional courier operations through automation, artificial intelligence, and digital platform integration. Companies investing in advanced technologies demonstrate operational efficiency improvements of 40% while enhancing customer satisfaction through superior service reliability and transparency.

Customer expectations evolution demands increasingly sophisticated service capabilities including real-time tracking, flexible delivery options, and seamless digital experiences. MarkWide Research analysis indicates that customer satisfaction directly correlates with technology adoption levels, with digitally advanced courier services achieving customer retention rates exceeding 85%.

Partnership ecosystems are becoming critical success factors as courier companies collaborate with e-commerce platforms, financial service providers, and technology companies. These strategic alliances enable comprehensive service offerings while sharing infrastructure costs and expanding market reach through integrated customer experiences.

Regulatory evolution across ASEAN markets increasingly supports courier market development through streamlined licensing procedures, standardized service requirements, and enhanced consumer protection frameworks. These regulatory improvements create more stable operating environments while facilitating cross-border service integration and regional market expansion.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the ASEAN domestic courier market. Primary research included extensive interviews with industry executives, operational managers, and key stakeholders across all ASEAN member nations to gather firsthand insights into market conditions, competitive dynamics, and future trends.

Secondary research encompassed detailed analysis of industry reports, government statistics, company financial statements, and regulatory documents to establish quantitative market foundations and validate primary research findings. This approach ensured comprehensive coverage of market segments, geographic regions, and competitive landscapes.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key informants, and employing statistical analysis techniques to ensure data accuracy and reliability. Market sizing methodologies utilized bottom-up and top-down approaches to establish consistent and credible market assessments.

Expert consultations with logistics industry specialists, technology providers, and regulatory experts provided additional validation and insights into market trends, technological developments, and regulatory impacts affecting courier market evolution across the ASEAN region.

Indonesia represents the largest domestic courier market within ASEAN, driven by its massive population, extensive archipelago geography, and rapidly growing e-commerce sector. The market demonstrates strong growth potential despite infrastructure challenges, with courier companies investing heavily in technology and logistics networks to serve diverse urban and rural communities across thousands of islands.

Thailand showcases a mature courier market with sophisticated logistics infrastructure and high technology adoption rates. The country’s strategic location and well-developed transportation networks position it as a regional logistics hub, with domestic courier services benefiting from advanced operational capabilities and strong e-commerce integration.

Vietnam exhibits exceptional growth momentum with annual expansion rates exceeding 15% driven by rapid economic development and digital transformation. The market demonstrates increasing sophistication in service offerings while maintaining competitive pricing structures that support continued expansion across urban and rural markets.

Malaysia presents a technologically advanced courier market with high penetration of digital services and sustainable logistics practices. The country’s developed infrastructure and educated workforce support sophisticated courier operations while serving as a model for technology adoption across the region.

Singapore leads in courier service innovation and operational efficiency, despite its small geographic size. The city-state’s advanced technology infrastructure and regulatory framework create an ideal environment for testing new courier technologies and service models that subsequently expand throughout the region.

Philippines demonstrates significant growth potential with its large population and increasing internet penetration. The archipelago geography creates unique logistics challenges while presenting opportunities for innovative delivery solutions including drone technology and inter-island courier networks.

Market leadership within the ASEAN domestic courier sector features a diverse mix of international logistics giants, regional specialists, and local market leaders, each leveraging unique competitive advantages to capture market share and serve specific customer segments effectively.

Competitive strategies vary significantly among market participants, with international players emphasizing service reliability and global integration, while regional and local operators focus on cost competitiveness, local market knowledge, and specialized service offerings tailored to specific customer needs and geographic requirements.

By Service Type:

By Customer Segment:

By Geographic Coverage:

E-commerce Logistics represents the fastest-growing segment within the ASEAN domestic courier market, driven by explosive online retail expansion and changing consumer shopping behaviors. This category demands sophisticated last-mile delivery capabilities, flexible return services, and integrated technology platforms that seamlessly connect courier operations with e-commerce platforms and customer management systems.

Document Delivery maintains steady demand despite digital transformation trends, particularly for legal documents, contracts, and official correspondence requiring physical delivery and signature confirmation. This segment emphasizes security, reliability, and audit trail capabilities while adapting to reduced volumes through premium service positioning and specialized handling procedures.

Healthcare Logistics emerges as a specialized high-growth category requiring temperature-controlled transportation, secure handling protocols, and time-sensitive delivery capabilities. The segment includes pharmaceutical distribution, medical device delivery, and laboratory sample transportation, demanding specialized equipment and trained personnel to ensure product integrity and regulatory compliance.

Automotive Parts delivery represents a significant B2B segment requiring reliable supply chain support for manufacturing operations and aftermarket services. This category demands precise inventory management, just-in-time delivery capabilities, and specialized handling for various part sizes and weights while maintaining cost-effective service pricing.

Food and Beverage delivery has expanded beyond traditional restaurant delivery to include grocery, specialty foods, and meal kit services. This segment requires temperature-controlled transportation, rapid delivery times, and specialized packaging solutions while navigating complex food safety regulations and customer quality expectations.

Courier Companies benefit from expanding market opportunities, technology-enabled operational efficiency improvements, and diversified revenue streams through value-added services. The growing market provides platforms for scaling operations, implementing advanced technologies, and developing competitive advantages through specialized service offerings and strategic partnerships.

E-commerce Businesses gain access to reliable logistics infrastructure that enables market expansion, improved customer satisfaction, and reduced operational complexity. Integrated courier services provide seamless order fulfillment capabilities while offering flexible delivery options that enhance customer experiences and support business growth objectives.

Consumers enjoy improved convenience, faster delivery times, and enhanced service transparency through real-time tracking and flexible delivery options. The competitive market environment drives service quality improvements and competitive pricing while expanding delivery coverage to previously underserved areas.

Small and Medium Enterprises access professional logistics capabilities that enable market expansion beyond local boundaries. Courier services provide cost-effective shipping solutions that support business growth while offering professional service levels that enhance customer relationships and brand reputation.

Government Agencies benefit from improved logistics infrastructure that supports economic development, enhances public service delivery, and facilitates regulatory compliance through professional courier services for official documents and communications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation continues accelerating across the ASEAN domestic courier market, with companies investing heavily in mobile applications, artificial intelligence, and automated sorting systems. These technological advances enable improved operational efficiency, enhanced customer experiences, and data-driven decision making that supports strategic planning and competitive positioning.

Sustainability Initiatives gain momentum as courier companies adopt electric vehicles, optimize delivery routes, and implement eco-friendly packaging solutions. MWR research indicates that sustainable delivery options are becoming increasingly important to consumers, with 60% of customers willing to pay premium prices for environmentally responsible courier services.

Last-Mile Innovation drives development of creative delivery solutions including drone technology, autonomous vehicles, and micro-fulfillment centers. These innovations address urban congestion challenges while improving delivery speed and cost-effectiveness, particularly for high-density metropolitan areas with complex logistics requirements.

Partnership Ecosystems expand as courier companies collaborate with e-commerce platforms, financial service providers, and technology companies to create integrated service offerings. These strategic alliances enable comprehensive customer solutions while sharing infrastructure investments and expanding market reach through complementary capabilities.

Rural Expansion strategies focus on developing cost-effective solutions for serving underserved areas through innovative delivery models, local partnerships, and alternative transportation methods. This trend addresses social inclusion objectives while unlocking significant market potential in previously inaccessible regions.

Technology Partnerships between courier companies and software providers have accelerated implementation of advanced routing algorithms, predictive analytics, and customer relationship management systems. These collaborations enable smaller courier operators to access sophisticated technologies while technology providers gain market insights and implementation experience.

Acquisition Activity has intensified as larger courier companies seek to expand geographic coverage, acquire specialized capabilities, and achieve operational synergies. Strategic acquisitions enable rapid market entry while providing acquired companies with resources for technology investment and service expansion.

Government Initiatives across ASEAN markets increasingly support courier industry development through infrastructure investments, regulatory streamlining, and digital economy promotion. These policy developments create more favorable operating environments while facilitating cross-border service integration and regional market expansion.

Sustainability Programs implementation has accelerated with major courier companies committing to carbon neutrality goals and implementing comprehensive environmental management systems. These initiatives include electric vehicle fleets, renewable energy adoption, and circular economy practices that reduce environmental impact while potentially lowering operational costs.

Innovation Centers establishment by leading courier companies focuses on developing next-generation logistics technologies and service models. These research and development facilities concentrate on autonomous delivery systems, artificial intelligence applications, and sustainable logistics solutions that will define future market evolution.

Technology Investment should remain a top priority for courier companies seeking competitive advantages in the evolving ASEAN market. Companies should focus on mobile platform development, artificial intelligence implementation, and automated sorting systems that improve operational efficiency while enhancing customer experiences through superior service reliability and transparency.

Rural Market Strategy development requires innovative approaches that balance service quality with cost-effectiveness. Courier companies should explore partnership models with local businesses, alternative transportation methods, and technology solutions that enable profitable service expansion into underserved areas while supporting rural economic development.

Sustainability Integration should become a core business strategy rather than a peripheral consideration. Companies implementing comprehensive environmental programs can achieve competitive advantages through operational cost reductions, regulatory compliance, and enhanced brand reputation among environmentally conscious consumers and business customers.

Partnership Development with e-commerce platforms, technology providers, and financial service companies can create integrated service offerings that increase customer value while reducing operational costs through shared infrastructure and complementary capabilities. Strategic alliances enable market expansion while mitigating individual company risks.

Talent Development programs should address labor shortage challenges through comprehensive training, career advancement opportunities, and competitive compensation packages. Companies investing in workforce development can achieve superior service quality while reducing turnover costs and maintaining operational stability.

Market expansion projections indicate continued robust growth across the ASEAN domestic courier market, with compound annual growth rates expected to maintain double-digit levels driven by sustained e-commerce expansion, urbanization trends, and technology adoption. The market’s evolution toward integrated logistics ecosystems suggests increasing sophistication in service offerings and operational capabilities.

Technology integration will accelerate with artificial intelligence, machine learning, and Internet of Things applications becoming standard operational tools rather than competitive differentiators. MarkWide Research analysis suggests that technology adoption rates will reach 95% penetration among leading courier operators within the next five years, fundamentally transforming industry operational standards.

Sustainability requirements will become mandatory rather than optional as environmental regulations tighten and consumer preferences shift toward eco-friendly services. Electric vehicle adoption, carbon-neutral delivery options, and circular economy practices will transition from competitive advantages to basic market requirements for continued operation.

Regional integration opportunities will expand as ASEAN economic cooperation deepens, creating seamless domestic-to-international courier service transitions and harmonized regulatory frameworks. This integration will enable more efficient cross-border operations while supporting regional trade growth and economic development objectives.

Service diversification will continue as courier companies expand into warehousing, fulfillment, and integrated logistics solutions. This evolution toward comprehensive logistics service providers will create additional revenue streams while increasing customer dependency and competitive barriers for new market entrants.

The ASEAN domestic courier market stands at a pivotal juncture characterized by unprecedented growth opportunities, technological transformation, and evolving customer expectations. This dynamic sector has demonstrated remarkable resilience and adaptability while serving as critical infrastructure for the region’s digital economy expansion and economic development objectives.

Market fundamentals remain exceptionally strong with sustained e-commerce growth, urbanization trends, and technology adoption driving continued expansion across all ASEAN member nations. The sector’s evolution from traditional delivery services toward integrated logistics ecosystems reflects broader economic transformation while creating substantial value for businesses, consumers, and regional development initiatives.

Strategic success in this competitive environment requires balanced focus on technology investment, operational efficiency, customer service excellence, and sustainable business practices. Companies that successfully integrate these elements while maintaining cost competitiveness and service reliability will capture disproportionate market share and establish lasting competitive advantages.

The future trajectory of the ASEAN domestic courier market promises continued innovation, expansion, and sophistication as regional integration deepens and technology capabilities advance. This evolution will create enhanced value propositions for all stakeholders while supporting broader economic development and digital transformation objectives throughout Southeast Asia.

What is ASEAN Domestic Courier?

ASEAN Domestic Courier refers to the services that facilitate the transportation of parcels and documents within the member countries of the ASEAN region. This includes various delivery options, such as same-day delivery, express services, and standard shipping, catering to both businesses and individual consumers.

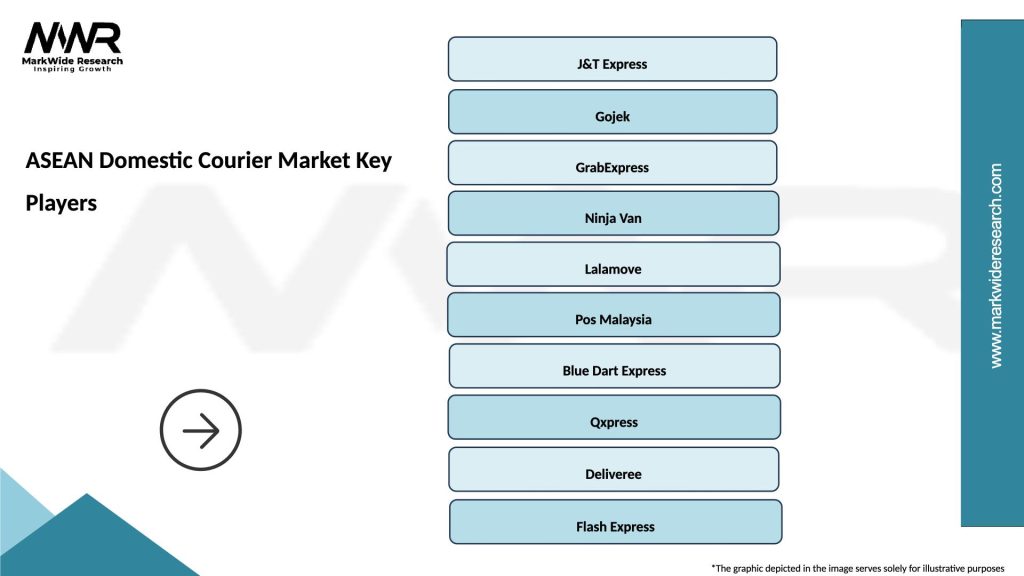

What are the key players in the ASEAN Domestic Courier Market?

Key players in the ASEAN Domestic Courier Market include companies like Ninja Van, Lalamove, and J&T Express, which provide a range of logistics and delivery services. These companies compete on factors such as delivery speed, service reliability, and customer service, among others.

What are the growth factors driving the ASEAN Domestic Courier Market?

The ASEAN Domestic Courier Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and the expansion of logistics infrastructure in the region. Additionally, the growing trend of online shopping has significantly boosted parcel volumes.

What challenges does the ASEAN Domestic Courier Market face?

Challenges in the ASEAN Domestic Courier Market include regulatory hurdles, competition from informal delivery services, and issues related to last-mile delivery efficiency. These factors can impact service quality and operational costs for courier companies.

What opportunities exist in the ASEAN Domestic Courier Market?

Opportunities in the ASEAN Domestic Courier Market include the potential for technological advancements in logistics, such as automation and tracking systems, and the growing demand for sustainable delivery solutions. Companies can also explore partnerships with e-commerce platforms to enhance service offerings.

What trends are shaping the ASEAN Domestic Courier Market?

Trends in the ASEAN Domestic Courier Market include the increasing adoption of mobile apps for booking and tracking deliveries, the rise of same-day delivery services, and a focus on eco-friendly packaging solutions. These trends reflect changing consumer preferences and the need for efficient logistics solutions.

ASEAN Domestic Courier Market

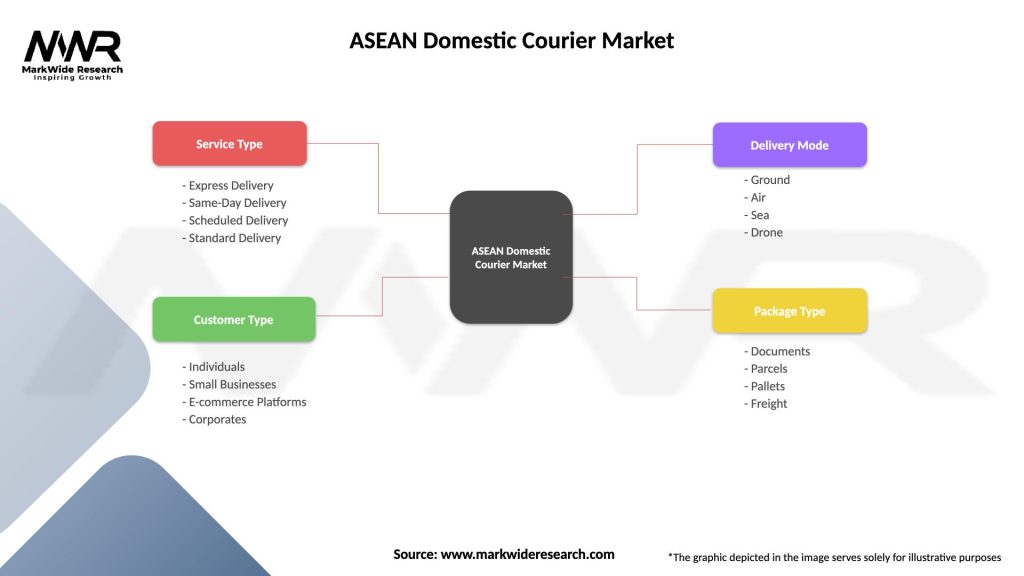

| Segmentation Details | Description |

|---|---|

| Service Type | Express Delivery, Same-Day Delivery, Scheduled Delivery, Standard Delivery |

| Customer Type | Individuals, Small Businesses, E-commerce Platforms, Corporates |

| Delivery Mode | Ground, Air, Sea, Drone |

| Package Type | Documents, Parcels, Pallets, Freight |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Domestic Courier Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at