444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN countries electric vehicle battery electrolyte market represents a rapidly expanding segment within the broader electric vehicle ecosystem across Southeast Asia. This dynamic market encompasses the production, distribution, and utilization of specialized chemical solutions that facilitate ion movement within electric vehicle batteries, enabling efficient energy storage and discharge processes. The region’s commitment to sustainable transportation and government initiatives promoting electric vehicle adoption have created substantial growth opportunities for battery electrolyte manufacturers and suppliers.

Market dynamics in ASEAN countries are characterized by increasing investments in electric vehicle infrastructure, growing environmental consciousness among consumers, and supportive regulatory frameworks. The electrolyte market serves as a critical component in the electric vehicle value chain, with demand driven by expanding automotive manufacturing capabilities across Thailand, Indonesia, Malaysia, Vietnam, and other member nations. Recent analysis indicates the market is experiencing robust growth rates exceeding 12% annually, reflecting the region’s transition toward sustainable mobility solutions.

Regional advantages include strategic geographic positioning, abundant natural resources for electrolyte production, and established manufacturing ecosystems that support automotive industry expansion. The ASEAN market benefits from proximity to major electric vehicle markets in China and Japan, facilitating technology transfer and supply chain integration. Additionally, favorable investment policies and economic incentives have attracted international players to establish production facilities and research centers throughout the region.

The ASEAN countries electric vehicle battery electrolyte market refers to the comprehensive ecosystem encompassing the development, manufacturing, and distribution of electrolyte solutions specifically designed for electric vehicle battery applications across the ten-member Association of Southeast Asian Nations. These electrolyte solutions serve as the medium through which ions move between the cathode and anode in lithium-ion batteries, enabling the electrochemical reactions necessary for energy storage and release in electric vehicles.

Electrolyte compositions typically include lithium salts dissolved in organic solvents, along with various additives that enhance performance characteristics such as conductivity, thermal stability, and cycle life. The market encompasses both liquid electrolytes, which remain the dominant technology, and emerging solid-state electrolyte solutions that promise improved safety and energy density. Manufacturing processes involve precise chemical formulation, quality control testing, and specialized packaging to ensure product integrity during transportation and storage.

Market participants include chemical manufacturers, battery producers, automotive companies, and specialized electrolyte suppliers operating across the ASEAN region. The ecosystem supports various stakeholders from raw material suppliers to end-users, creating a complex value chain that spans multiple countries and industrial sectors within Southeast Asia.

The ASEAN electric vehicle battery electrolyte market demonstrates exceptional growth potential driven by accelerating electric vehicle adoption, supportive government policies, and increasing investments in sustainable transportation infrastructure. The market benefits from the region’s strategic position as a manufacturing hub, abundant natural resources, and growing consumer awareness of environmental sustainability. Key growth drivers include expanding automotive production capabilities, technological advancements in battery chemistry, and regional initiatives promoting clean energy adoption.

Market segmentation reveals diverse applications across passenger vehicles, commercial transportation, and two-wheeler segments, with liquid electrolytes maintaining market dominance while solid-state technologies gain traction. The competitive landscape features both international players and emerging regional manufacturers, creating dynamic market conditions that foster innovation and competitive pricing. Thailand and Indonesia emerge as leading markets, supported by established automotive industries and favorable investment climates.

Future prospects indicate sustained growth momentum with projected annual growth rates approaching 15% over the next five years. Market expansion is supported by increasing electric vehicle production targets, infrastructure development initiatives, and growing consumer acceptance of electric mobility solutions. The market faces challenges including supply chain complexities, raw material price volatility, and the need for continuous technological advancement to meet evolving performance requirements.

Strategic market insights reveal several critical factors shaping the ASEAN electric vehicle battery electrolyte landscape:

Government policy support serves as the primary catalyst driving market expansion across ASEAN countries. National electric vehicle promotion strategies, including purchase incentives, tax benefits, and infrastructure development programs, create favorable conditions for electrolyte market growth. Countries like Thailand and Indonesia have established ambitious electric vehicle adoption targets, directly translating into increased demand for battery components including electrolytes.

Environmental consciousness among consumers and businesses drives the transition toward sustainable transportation solutions. Growing awareness of air pollution impacts and climate change concerns motivate both individual consumers and fleet operators to adopt electric vehicles, creating sustained demand for high-performance battery electrolytes. This environmental focus aligns with regional sustainability goals and international climate commitments.

Technological advancements in battery chemistry and electrolyte formulations enhance performance characteristics while reducing costs. Innovations in electrolyte composition improve energy density, charging speeds, and battery lifespan, making electric vehicles more attractive to consumers. Research and development investments by both international and regional players contribute to continuous product improvements and market expansion.

Manufacturing ecosystem development across ASEAN countries creates synergies that support electrolyte market growth. Established automotive manufacturing capabilities, skilled workforce availability, and supply chain infrastructure provide foundations for expanding electric vehicle production. The presence of major automotive manufacturers in the region creates demand for locally sourced components, including specialized electrolyte solutions.

Raw material supply challenges present significant constraints for electrolyte manufacturers in the ASEAN region. Limited domestic lithium resources require dependence on imports, creating supply chain vulnerabilities and cost pressures. Price volatility of key raw materials, including lithium salts and organic solvents, affects production costs and profit margins for electrolyte manufacturers.

Technical complexity in electrolyte formulation and manufacturing requires specialized expertise and advanced production facilities. The need for precise chemical composition control, quality assurance processes, and safety protocols creates barriers to entry for new market participants. Additionally, the requirement for continuous research and development to meet evolving performance standards demands significant investment commitments.

Infrastructure limitations in some ASEAN countries constrain electric vehicle adoption and, consequently, electrolyte demand. Inadequate charging infrastructure, limited service networks, and insufficient grid capacity in certain regions slow the transition to electric mobility. These infrastructure gaps create uncertainty about market growth timing and regional demand distribution.

Competitive pressure from established global players and emerging Chinese manufacturers creates pricing pressures and market share challenges for regional companies. International competitors often possess superior technological capabilities, larger production scales, and stronger financial resources, making it difficult for local players to compete effectively in certain market segments.

Regional integration initiatives create substantial opportunities for market expansion and operational efficiency improvements. ASEAN economic cooperation frameworks facilitate cross-border trade, technology transfer, and investment flows, enabling electrolyte manufacturers to optimize their regional strategies. Harmonized standards and regulations across member countries can reduce compliance costs and expand market access opportunities.

Emerging applications beyond traditional passenger vehicles present significant growth opportunities. The expanding electric two-wheeler market, commercial vehicle electrification, and stationary energy storage applications create diverse demand streams for specialized electrolyte solutions. Each application segment requires tailored electrolyte formulations, creating opportunities for product differentiation and premium pricing.

Technology partnerships with international players offer pathways for accessing advanced electrolyte technologies and manufacturing processes. Collaborative arrangements can accelerate technology transfer, reduce development costs, and enhance competitive positioning. Joint ventures and licensing agreements enable regional companies to leverage global expertise while maintaining local market advantages.

Circular economy initiatives present opportunities for developing sustainable electrolyte production and recycling capabilities. Growing emphasis on battery recycling and material recovery creates demand for electrolyte regeneration technologies and closed-loop manufacturing processes. Companies that develop comprehensive sustainability solutions can capture additional value streams while meeting environmental compliance requirements.

Supply chain dynamics in the ASEAN electric vehicle battery electrolyte market reflect complex interactions between global raw material suppliers, regional manufacturers, and local automotive producers. The market experiences seasonal fluctuations driven by automotive production cycles and varying electric vehicle adoption rates across different countries. MarkWide Research analysis indicates that supply chain optimization efforts have resulted in cost reductions of approximately 18% over the past two years.

Competitive dynamics feature intense rivalry between international corporations and emerging regional players, with market share distribution evolving rapidly as new entrants establish production capabilities. Price competition remains significant, particularly in commodity electrolyte segments, while premium applications offer opportunities for differentiation and higher margins. Strategic alliances and vertical integration initiatives reshape competitive relationships and market positioning.

Innovation dynamics drive continuous product development and process improvements, with companies investing heavily in research and development to maintain competitive advantages. Collaboration between electrolyte manufacturers, battery producers, and automotive companies accelerates innovation cycles and technology adoption. The focus on developing region-specific solutions optimized for tropical climates and local manufacturing capabilities creates unique market dynamics.

Regulatory dynamics influence market development through evolving safety standards, environmental regulations, and trade policies. Harmonization efforts across ASEAN countries aim to create consistent regulatory frameworks that facilitate regional trade and investment. However, varying implementation timelines and national priorities create complexity for companies operating across multiple markets within the region.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the ASEAN electric vehicle battery electrolyte market. Primary research activities include structured interviews with industry executives, technical experts, and key stakeholders across the value chain. These interviews provide firsthand insights into market trends, competitive dynamics, and future growth prospects from industry participants’ perspectives.

Secondary research components encompass extensive analysis of industry reports, government publications, academic studies, and company financial statements. This approach ensures comprehensive coverage of market segments, regional variations, and technological developments. Data validation processes involve cross-referencing multiple sources and conducting expert reviews to ensure accuracy and reliability of market insights.

Quantitative analysis utilizes statistical modeling techniques to project market growth trends, segment performance, and regional distribution patterns. Market sizing methodologies combine top-down and bottom-up approaches to ensure consistency and accuracy in market estimates. Sensitivity analysis examines various scenarios to understand potential market outcomes under different conditions.

Qualitative assessment focuses on understanding market dynamics, competitive strategies, and emerging trends that may not be captured through quantitative methods alone. Expert opinion surveys, focus group discussions, and industry roundtables provide valuable insights into market sentiment and future expectations. This qualitative dimension enhances the depth and context of market analysis.

Thailand emerges as the leading market within the ASEAN region, benefiting from established automotive manufacturing capabilities and supportive government policies. The country’s strategic position as a regional automotive hub attracts significant investments in electric vehicle production and component manufacturing. Thailand’s electrolyte market benefits from proximity to major automotive manufacturers and well-developed supply chain infrastructure, contributing to market share of approximately 40% within the ASEAN region.

Indonesia demonstrates substantial growth potential driven by its large domestic market and abundant natural resources. The country’s commitment to electric vehicle adoption, supported by government incentives and infrastructure development programs, creates favorable conditions for electrolyte market expansion. Indonesia’s growing automotive industry and strategic location make it an attractive destination for electrolyte manufacturing investments.

Malaysia and Vietnam represent emerging markets with significant growth opportunities. Malaysia’s focus on becoming a regional electric vehicle hub, combined with its established chemical industry capabilities, supports electrolyte market development. Vietnam’s rapidly growing automotive sector and increasing foreign investment create demand for locally produced battery components, including specialized electrolyte solutions.

Singapore and Philippines serve important roles as regional trading and logistics hubs, facilitating electrolyte distribution across the ASEAN market. Singapore’s advanced research capabilities and financial services support innovation and investment in electrolyte technologies. The Philippines’ growing automotive market and improving infrastructure create opportunities for electrolyte suppliers serving both domestic and export markets.

The competitive landscape features a diverse mix of international corporations, regional manufacturers, and specialized electrolyte suppliers competing across various market segments. Market leadership positions vary by country and application segment, with different players maintaining advantages in specific niches or geographic regions.

Competitive strategies emphasize technological innovation, cost optimization, and regional market penetration. Companies invest heavily in research and development to develop next-generation electrolyte formulations while establishing local manufacturing capabilities to serve regional demand efficiently. Strategic partnerships with automotive manufacturers and battery producers create competitive advantages and market access opportunities.

By Electrolyte Type:

By Vehicle Type:

By Battery Chemistry:

Liquid electrolyte category maintains market dominance due to established manufacturing processes, proven performance characteristics, and cost competitiveness. This category benefits from mature supply chains, extensive technical knowledge, and compatibility with existing battery manufacturing equipment. Continuous improvements in liquid electrolyte formulations enhance performance while maintaining cost advantages, supporting sustained market leadership.

Solid-state electrolyte category represents the future direction of battery technology, offering superior safety characteristics, higher energy density potential, and improved thermal stability. Despite current limitations including higher costs and manufacturing complexity, this category attracts significant research and development investments. Early adoption focuses on premium applications where performance advantages justify higher costs.

Passenger vehicle category drives the largest demand volume, supported by government incentives, improving charging infrastructure, and growing consumer acceptance. This category requires electrolytes optimized for daily driving patterns, fast charging capabilities, and long service life. Market growth in this category directly correlates with overall electric vehicle adoption rates across ASEAN countries.

Commercial vehicle category presents unique requirements including high-capacity batteries, rapid charging capabilities, and durability under demanding operating conditions. Electrolyte solutions for this category must withstand frequent charging cycles, temperature variations, and extended operational periods. The category benefits from fleet electrification initiatives and urban emission regulations.

Manufacturers benefit from expanding market opportunities, technological advancement possibilities, and regional integration advantages. The growing market provides revenue growth potential while regional manufacturing capabilities offer cost optimization opportunities. Access to skilled workforce, favorable investment policies, and proximity to key markets enhance operational efficiency and competitive positioning.

Automotive companies gain access to reliable electrolyte suppliers, technological innovation partnerships, and cost-effective component sourcing. Regional electrolyte production reduces supply chain risks, shortens lead times, and enables closer collaboration on product development. Local sourcing also supports sustainability goals and reduces transportation-related emissions.

Government stakeholders achieve economic development objectives through industrial growth, job creation, and technology transfer. The electrolyte industry supports broader electric vehicle ecosystem development, contributing to environmental goals and energy security objectives. Tax revenues, export earnings, and technological capabilities enhance national competitiveness in the global automotive industry.

Consumers benefit from improved electric vehicle performance, reduced costs, and enhanced product availability. Regional electrolyte production supports competitive pricing while technological advancements improve battery performance and reliability. Local manufacturing capabilities also ensure better after-sales support and service availability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state technology advancement represents the most significant technological trend shaping the future electrolyte market. Research and development investments focus on overcoming current limitations including manufacturing scalability and cost reduction. Early commercial applications target premium segments where performance advantages justify higher costs, with broader adoption expected as technology matures and costs decline.

Sustainability integration becomes increasingly important as companies develop environmentally friendly production processes and recycling capabilities. This trend includes reducing carbon footprint in manufacturing, developing bio-based electrolyte components, and establishing closed-loop recycling systems. MWR analysis indicates that sustainability initiatives have increased by 60% among regional electrolyte manufacturers over the past year.

Regional localization accelerates as companies establish manufacturing facilities closer to end markets to reduce costs and improve supply chain resilience. This trend includes technology transfer, local partnership development, and adaptation of products to regional requirements. Localization efforts also support government objectives for industrial development and technology advancement.

Application diversification expands beyond traditional automotive applications to include energy storage systems, industrial equipment, and consumer electronics. This diversification reduces market risk while creating new revenue opportunities. Different applications require specialized electrolyte formulations, driving innovation and product development activities.

Manufacturing capacity expansion initiatives across ASEAN countries demonstrate strong industry confidence in market growth prospects. Major international players have announced significant investments in regional production facilities, while local companies expand their capabilities through technology partnerships and capacity upgrades. These developments enhance regional supply security and reduce dependence on imports.

Technology collaboration agreements between international corporations and regional companies accelerate knowledge transfer and innovation. These partnerships combine global expertise with local market knowledge, creating competitive advantages for all participants. Joint research and development programs focus on developing region-specific solutions optimized for local conditions and requirements.

Regulatory harmonization efforts across ASEAN countries aim to create consistent standards and certification processes for electrolyte products. These initiatives reduce compliance costs, facilitate cross-border trade, and enhance market access for regional manufacturers. Standardization also improves product quality and safety across the region.

Sustainability certification programs gain prominence as companies seek to demonstrate environmental responsibility and meet customer requirements. These programs cover various aspects including carbon footprint reduction, responsible sourcing, and waste minimization. Certification becomes increasingly important for accessing premium market segments and meeting corporate sustainability goals.

Strategic positioning recommendations emphasize the importance of developing comprehensive regional strategies that leverage ASEAN integration opportunities while addressing local market requirements. Companies should focus on building strong partnerships with automotive manufacturers and battery producers to secure long-term demand and influence product development directions. Investment in local manufacturing capabilities provides cost advantages and supply chain resilience.

Technology investment priorities should balance current market demands with future technology trends. While liquid electrolytes remain dominant, companies must invest in solid-state technology development to maintain competitive positioning as the market evolves. Collaboration with research institutions and technology partners can accelerate development while sharing costs and risks.

Market entry strategies for new participants should consider regional variations in market maturity, competitive intensity, and regulatory requirements. Joint ventures with established local players provide market access and regulatory compliance advantages. Gradual market entry through specific segments or countries allows for learning and adaptation before broader expansion.

Sustainability integration becomes essential for long-term success as environmental regulations tighten and customer expectations evolve. Companies should develop comprehensive sustainability strategies covering production processes, supply chain management, and product lifecycle considerations. Early investment in sustainable technologies provides competitive advantages and regulatory compliance benefits.

Market growth trajectory indicates sustained expansion driven by accelerating electric vehicle adoption across ASEAN countries. Government commitments to carbon neutrality and sustainable transportation create long-term demand certainty for electrolyte manufacturers. The market is projected to maintain strong growth momentum with annual rates exceeding 14% over the next decade, supported by expanding automotive production and infrastructure development.

Technology evolution will reshape market dynamics as solid-state electrolytes gain commercial viability and market acceptance. This transition creates opportunities for companies that successfully develop and commercialize next-generation technologies while maintaining competitive positions in existing markets. The coexistence of multiple electrolyte technologies will create diverse market segments with varying requirements and value propositions.

Regional integration will deepen as ASEAN economic cooperation initiatives mature and trade barriers continue to diminish. This integration creates opportunities for operational optimization, market expansion, and technology sharing among regional participants. Companies that effectively leverage regional integration will achieve competitive advantages through scale economies and market access.

Competitive landscape evolution will feature increased consolidation as companies seek scale advantages and technological capabilities. Strategic partnerships, acquisitions, and joint ventures will reshape market structure while creating stronger competitors capable of serving regional and global markets. Success will depend on balancing global competitiveness with local market responsiveness and regulatory compliance.

The ASEAN countries electric vehicle battery electrolyte market presents exceptional growth opportunities driven by supportive government policies, expanding automotive manufacturing capabilities, and increasing environmental consciousness. The market benefits from strategic geographic positioning, cost competitiveness, and growing regional integration that creates synergies and operational efficiencies. While challenges exist including raw material dependencies and competitive pressures, the overall market outlook remains highly positive with sustained growth expected over the long term.

Success in this dynamic market requires strategic positioning that balances current market demands with future technology trends. Companies must invest in both established liquid electrolyte technologies and emerging solid-state solutions while building strong partnerships throughout the value chain. Regional manufacturing capabilities, sustainability initiatives, and technological innovation will determine competitive positioning and market success.

The future landscape will be shaped by continued electric vehicle adoption acceleration, technology advancement, and regional integration deepening. Market participants that effectively navigate these trends while maintaining operational excellence and customer focus will capture the substantial opportunities presented by this rapidly expanding market across the ASEAN region.

What is Electric Vehicle Battery Electrolyte?

Electric Vehicle Battery Electrolyte refers to the conductive medium used in batteries that facilitates the movement of ions between the anode and cathode, essential for energy storage and release in electric vehicles.

What are the key players in the ASEAN Countries Electric Vehicle Battery Electrolyte Market?

Key players in the ASEAN Countries Electric Vehicle Battery Electrolyte Market include LG Chem, Panasonic, and Samsung SDI, among others.

What are the growth factors driving the ASEAN Countries Electric Vehicle Battery Electrolyte Market?

The growth of the ASEAN Countries Electric Vehicle Battery Electrolyte Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation.

What challenges does the ASEAN Countries Electric Vehicle Battery Electrolyte Market face?

Challenges in the ASEAN Countries Electric Vehicle Battery Electrolyte Market include the high cost of raw materials, limited recycling infrastructure, and competition from alternative energy storage solutions.

What opportunities exist in the ASEAN Countries Electric Vehicle Battery Electrolyte Market?

Opportunities in the ASEAN Countries Electric Vehicle Battery Electrolyte Market include the potential for innovation in solid-state electrolytes, increasing investments in electric vehicle infrastructure, and the growing focus on renewable energy integration.

What trends are shaping the ASEAN Countries Electric Vehicle Battery Electrolyte Market?

Trends in the ASEAN Countries Electric Vehicle Battery Electrolyte Market include the shift towards more efficient and safer battery chemistries, the rise of electric vehicle adoption, and the development of sustainable manufacturing practices.

ASEAN Countries Electric Vehicle Battery Electrolyte Market

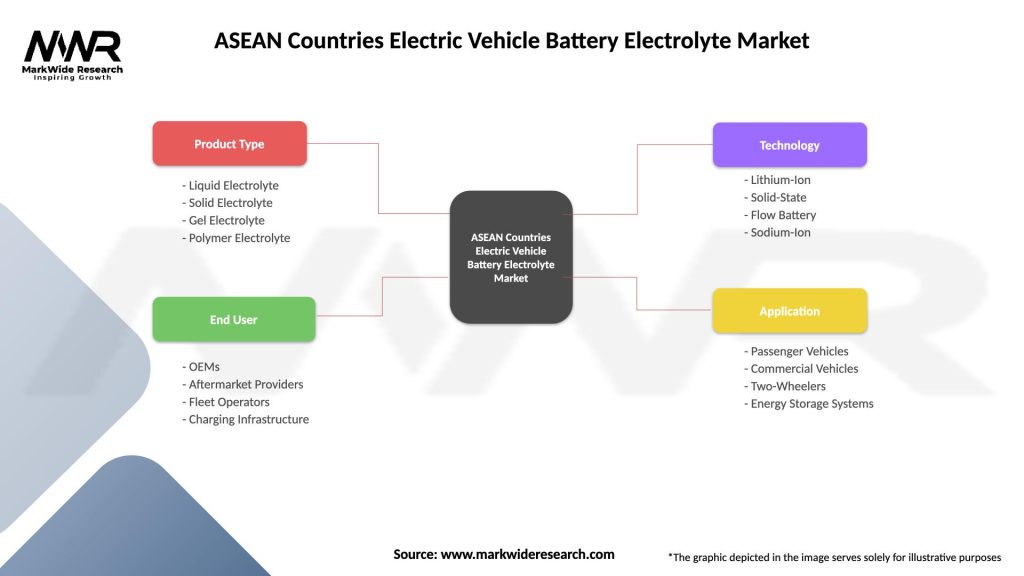

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Electrolyte, Solid Electrolyte, Gel Electrolyte, Polymer Electrolyte |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Charging Infrastructure |

| Technology | Lithium-Ion, Solid-State, Flow Battery, Sodium-Ion |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Countries Electric Vehicle Battery Electrolyte Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at