444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN construction equipment market represents one of the most dynamic and rapidly evolving sectors in Southeast Asia’s industrial landscape. This comprehensive market encompasses a diverse range of heavy machinery, tools, and specialized equipment essential for construction, infrastructure development, and urban expansion across the ten member nations of the Association of Southeast Asian Nations. Market dynamics indicate robust growth driven by unprecedented urbanization rates, government infrastructure initiatives, and increasing foreign direct investment in construction projects.

Regional development patterns show that countries like Thailand, Indonesia, Malaysia, and Vietnam are leading the charge in construction equipment adoption, with growth rates exceeding 8.5% annually in key segments. The market encompasses various equipment categories including excavators, bulldozers, cranes, concrete mixers, and specialized machinery for road construction and building development. Infrastructure modernization across ASEAN nations has created substantial demand for advanced construction equipment, particularly in urban centers experiencing rapid population growth.

Investment flows from both domestic and international sources continue to fuel market expansion, with particular emphasis on sustainable construction practices and energy-efficient equipment. The integration of digital technologies and IoT capabilities in construction equipment has emerged as a significant trend, with adoption rates reaching 35% among major construction companies across the region.

The ASEAN construction equipment market refers to the comprehensive ecosystem of heavy machinery, tools, and specialized equipment utilized in construction, infrastructure development, and related activities across the ten Southeast Asian nations comprising ASEAN. This market encompasses the manufacturing, distribution, rental, and servicing of construction equipment ranging from basic hand tools to sophisticated heavy machinery used in large-scale infrastructure projects.

Market scope includes various equipment categories such as earthmoving machinery, material handling equipment, concrete and road construction machinery, and specialized tools for building construction. The market serves diverse end-users including construction contractors, infrastructure developers, government agencies, and private construction companies engaged in residential, commercial, and industrial projects across the region.

Economic significance of this market extends beyond equipment sales to encompass rental services, maintenance and repair operations, parts distribution, and technology integration services. The market plays a crucial role in supporting ASEAN’s ambitious infrastructure development goals and urbanization initiatives, making it a cornerstone of regional economic growth and development strategies.

Market performance in the ASEAN construction equipment sector demonstrates exceptional resilience and growth potential, driven by sustained infrastructure investment and rapid urbanization across member nations. The market has experienced consistent expansion with growth rates averaging 7.2% annually over the past five years, supported by government initiatives and private sector investment in construction projects.

Key market drivers include massive infrastructure development programs, increasing urbanization rates exceeding 65% in major cities, and growing demand for modern construction techniques. The market benefits from favorable government policies promoting infrastructure development, foreign investment incentives, and regional economic integration initiatives that facilitate cross-border construction projects.

Technology adoption has emerged as a critical differentiator, with smart construction equipment and digital integration gaining traction among forward-thinking contractors. The rental equipment segment has shown particularly strong growth, accounting for approximately 42% of total market activity, reflecting changing business models and cost optimization strategies among construction companies.

Competitive dynamics feature a mix of international manufacturers, regional players, and local distributors, creating a diverse and competitive marketplace. Market consolidation trends and strategic partnerships are reshaping the competitive landscape, with companies focusing on comprehensive service offerings and technological innovation to maintain market position.

Infrastructure investment across ASEAN nations continues to drive substantial demand for construction equipment, with governments allocating significant budgets for transportation, utilities, and urban development projects. The market demonstrates strong correlation with GDP growth rates and urbanization trends, indicating sustainable long-term growth potential.

Market segmentation reveals distinct patterns across different equipment categories, with earthmoving equipment maintaining the largest market share at approximately 38% of total demand. Regional variations in equipment preferences reflect local construction practices, terrain characteristics, and infrastructure development priorities specific to each ASEAN member nation.

Infrastructure development initiatives represent the primary catalyst for construction equipment market growth across ASEAN nations. Government-led projects including highway construction, airport expansion, port development, and urban transit systems create substantial demand for specialized construction equipment. These initiatives are supported by significant budget allocations and international development funding, ensuring sustained market growth.

Rapid urbanization across the region drives continuous demand for residential and commercial construction projects. Urban population growth rates exceeding 4.5% annually in major cities create ongoing requirements for housing developments, office buildings, shopping centers, and supporting infrastructure. This urbanization trend necessitates modern construction equipment capable of handling complex urban construction challenges.

Foreign direct investment in construction and infrastructure projects brings international standards and advanced construction methodologies to the region. International contractors and developers often require specific equipment types and performance standards, driving demand for high-quality, technologically advanced construction equipment. This investment also facilitates technology transfer and knowledge sharing within the industry.

Economic growth and increasing disposable income levels across ASEAN nations support expanded construction activity in both public and private sectors. Growing middle-class populations drive demand for improved housing, commercial facilities, and infrastructure services, creating a robust foundation for sustained construction equipment market growth.

Government policy support through infrastructure investment programs, tax incentives, and regulatory frameworks favorable to construction industry development provides strong market fundamentals. Many ASEAN governments have established long-term infrastructure development plans with specific equipment requirements and performance standards.

High capital costs associated with construction equipment acquisition represent a significant barrier for many construction companies, particularly small and medium-sized enterprises. The substantial initial investment required for modern construction equipment can strain financial resources and limit market accessibility for smaller players in the construction industry.

Economic volatility and currency fluctuations across ASEAN nations can impact equipment pricing and financing availability. Exchange rate instability affects import costs for international equipment brands and can create uncertainty in investment decisions for construction companies planning equipment purchases.

Skilled operator shortage poses challenges for equipment utilization and productivity optimization. The complexity of modern construction equipment requires specialized training and certification, creating a skills gap that limits effective equipment deployment and operational efficiency across construction projects.

Regulatory compliance requirements including emission standards, safety regulations, and import restrictions can increase equipment costs and limit product availability. Varying regulatory frameworks across ASEAN member nations create complexity for equipment manufacturers and distributors operating across multiple markets.

Infrastructure limitations in some regions, including inadequate transportation networks and service facilities, can restrict equipment deployment and maintenance capabilities. These limitations particularly affect remote construction projects and can increase operational costs for equipment users.

Digital transformation in construction presents significant opportunities for equipment manufacturers and service providers to develop innovative solutions incorporating IoT, artificial intelligence, and predictive maintenance capabilities. The integration of digital technologies can enhance equipment performance, reduce operational costs, and improve project management efficiency.

Sustainable construction practices create demand for environmentally friendly equipment featuring reduced emissions, improved fuel efficiency, and sustainable materials. Growing environmental awareness and regulatory requirements drive opportunities for manufacturers developing green construction equipment solutions.

Equipment-as-a-Service models offer opportunities to expand market reach through flexible rental and leasing arrangements. These service models can make advanced construction equipment more accessible to smaller construction companies while providing steady revenue streams for equipment providers.

Regional integration initiatives under ASEAN economic cooperation frameworks facilitate cross-border equipment trade and service provision. Harmonized standards and reduced trade barriers create opportunities for market expansion and operational efficiency improvements across member nations.

Smart city development projects across ASEAN nations require specialized construction equipment for complex urban infrastructure projects. These initiatives present opportunities for advanced equipment solutions supporting intelligent transportation systems, green buildings, and integrated urban infrastructure.

Emerging market segments including renewable energy construction, water management infrastructure, and disaster-resilient construction create new demand categories for specialized equipment. These segments offer growth opportunities for manufacturers developing niche equipment solutions.

Supply chain dynamics in the ASEAN construction equipment market reflect a complex interplay of international manufacturers, regional distributors, and local service providers. The market structure emphasizes the importance of comprehensive distribution networks and after-sales support capabilities for successful market penetration and customer retention.

Demand patterns show seasonal variations aligned with construction activity cycles and weather patterns across different ASEAN regions. Peak demand periods typically coincide with dry seasons and government budget cycles, creating predictable market rhythms that influence inventory management and production planning strategies.

Competitive intensity varies across equipment categories and regional markets, with established international brands competing against emerging regional manufacturers and specialized niche players. Market share distribution reflects brand reputation, product quality, service capabilities, and pricing strategies tailored to local market conditions.

Technology adoption rates demonstrate accelerating integration of digital capabilities, with approximately 28% of new equipment featuring advanced telematics and connectivity features. This technological evolution drives equipment replacement cycles and influences purchasing decisions across the construction industry.

Price dynamics reflect raw material costs, currency fluctuations, and competitive pressures, with market participants adapting pricing strategies to maintain competitiveness while preserving profit margins. Value-based pricing models emphasizing total cost of ownership are gaining traction among sophisticated buyers.

Primary research for this comprehensive market analysis involved extensive interviews with industry stakeholders including construction equipment manufacturers, distributors, rental companies, construction contractors, and government officials across ASEAN member nations. These interviews provided valuable insights into market trends, challenges, and opportunities from multiple industry perspectives.

Secondary research encompassed analysis of government statistics, industry reports, trade association data, and company financial statements to establish market baselines and validate primary research findings. This research included examination of construction industry trends, infrastructure investment data, and economic indicators affecting equipment demand.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing equipment sales data, rental market activity, and construction project pipelines to develop comprehensive market estimates. Cross-validation techniques ensured accuracy and reliability of market size calculations and growth projections.

Competitive analysis involved detailed examination of major market participants, their product portfolios, market positioning, and strategic initiatives. This analysis included assessment of market share distribution, competitive advantages, and strategic partnerships shaping the competitive landscape.

Regional analysis considered country-specific factors including economic conditions, infrastructure development priorities, regulatory environments, and market maturity levels across all ASEAN member nations. This approach ensured comprehensive coverage of regional market dynamics and growth opportunities.

Thailand maintains a leading position in the ASEAN construction equipment market, accounting for approximately 22% of regional demand. The country’s mature construction industry, extensive infrastructure projects, and established distribution networks create a robust market environment. Government investment in transportation infrastructure and urban development projects drives consistent equipment demand.

Indonesia represents the largest growth opportunity with rapid infrastructure development and urbanization driving substantial equipment demand. The country’s vast geography and diverse construction requirements create opportunities for various equipment categories, from heavy earthmoving machinery to specialized urban construction equipment.

Vietnam demonstrates exceptional growth potential with expanding manufacturing sector and infrastructure modernization initiatives. The country’s construction equipment market benefits from foreign investment in industrial development and government infrastructure programs supporting economic growth objectives.

Malaysia features a sophisticated construction equipment market with emphasis on advanced technology and sustainable construction practices. The country’s focus on smart city development and green building initiatives creates demand for innovative equipment solutions and digital integration capabilities.

Singapore serves as a regional hub for equipment distribution and services, with market focus on high-tech solutions and urban construction challenges. Despite limited domestic construction activity, Singapore’s role as a regional business center influences equipment standards and technology adoption across ASEAN.

Philippines shows strong growth potential driven by infrastructure development programs and urbanization trends. The country’s construction equipment market benefits from government initiatives promoting infrastructure investment and private sector construction activity in major urban centers.

Market leadership in the ASEAN construction equipment sector features a diverse mix of international manufacturers and regional players, each leveraging distinct competitive advantages to capture market share and serve customer needs effectively.

Competitive strategies focus on comprehensive service offerings, technology integration, and localized support capabilities. Market leaders emphasize dealer network development, parts availability, and technical training programs to maintain competitive advantages in this relationship-driven industry.

By Equipment Type:

By Application:

By End-User:

Earthmoving Equipment dominates the ASEAN construction equipment market with robust demand across all construction sectors. Excavators lead this category with advanced hydraulic systems and fuel-efficient engines meeting diverse application requirements. Market trends favor compact and mid-size equipment suitable for urban construction environments and infrastructure projects with space constraints.

Material Handling Equipment experiences strong growth driven by increasing construction project complexity and logistics requirements. Tower cranes and mobile cranes show particular strength in urban construction markets, while rough terrain cranes serve infrastructure and industrial construction applications. Technology integration including load monitoring and safety systems enhances equipment value propositions.

Concrete Equipment benefits from expanding building construction activity and infrastructure development across ASEAN nations. Concrete pumps and mixers show consistent demand growth, with market preference shifting toward mobile and versatile equipment solutions. Environmental regulations drive adoption of equipment featuring reduced emissions and noise levels.

Road Construction Equipment aligns with substantial government investment in transportation infrastructure across the region. Asphalt pavers and soil compactors experience strong demand from highway construction projects, while road maintenance equipment serves growing infrastructure maintenance requirements. GPS and automated grade control systems enhance equipment productivity and accuracy.

Specialized Equipment serves niche applications including tunneling, foundation work, and demolition projects. This category shows strong growth potential as construction projects become more complex and specialized. Market opportunities exist for equipment manufacturers developing solutions for specific regional construction challenges and requirements.

Equipment Manufacturers benefit from expanding market opportunities across diverse ASEAN economies with varying development stages and construction requirements. The regional market provides platforms for technology demonstration, product development, and market expansion strategies supporting global growth objectives.

Construction Companies gain access to advanced equipment solutions enhancing project efficiency, safety, and profitability. Modern construction equipment enables contractors to undertake more complex projects, improve productivity, and meet stringent quality and timeline requirements demanded by clients and regulatory authorities.

Equipment Dealers and distributors benefit from growing market demand and opportunities to expand service offerings including rental, maintenance, and financing solutions. Strong dealer networks provide competitive advantages and support long-term customer relationships in this relationship-driven industry.

Financial Institutions find opportunities in equipment financing, leasing, and insurance services supporting construction industry growth. The substantial equipment investments required by construction companies create demand for flexible financing solutions and risk management services.

Government Agencies achieve infrastructure development objectives more efficiently through access to advanced construction equipment and technology solutions. Modern equipment supports faster project completion, improved quality standards, and enhanced safety performance in public infrastructure projects.

Technology Providers benefit from increasing demand for digital solutions, IoT integration, and automation capabilities in construction equipment. The market provides opportunities for software developers, sensor manufacturers, and system integrators serving the construction industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and Connectivity represent transformative trends reshaping the construction equipment landscape across ASEAN markets. Equipment manufacturers increasingly integrate IoT sensors, GPS tracking, and telematics systems enabling real-time monitoring, predictive maintenance, and operational optimization. This digital transformation enhances equipment productivity while reducing operational costs and downtime.

Sustainability and Environmental Compliance drive significant changes in equipment design and performance standards. Construction companies prioritize fuel-efficient equipment meeting stringent emission requirements, with hybrid and electric equipment gaining traction in urban construction applications. Environmental regulations across ASEAN nations continue tightening, accelerating adoption of cleaner equipment technologies.

Equipment Rental Growth reflects changing business models in the construction industry, with rental services accounting for approximately 42% of equipment utilization across the region. This trend enables construction companies to access advanced equipment without substantial capital investment while providing flexibility for project-specific requirements.

Automation and Autonomous Operation emerge as significant trends with equipment manufacturers developing semi-autonomous and fully autonomous construction equipment. These technologies promise improved safety, precision, and productivity while addressing skilled operator shortages affecting the construction industry.

Modular and Versatile Equipment designs gain popularity as construction companies seek equipment capable of multiple applications and easy transportation between project sites. This trend supports equipment utilization optimization and reduces total cost of ownership for construction companies.

Integrated Service Solutions become increasingly important as equipment manufacturers expand beyond product sales to offer comprehensive service packages including maintenance, training, financing, and technology support. These integrated solutions strengthen customer relationships and provide recurring revenue streams.

Technology Partnerships between construction equipment manufacturers and technology companies accelerate innovation in digital solutions and automation capabilities. These collaborations focus on developing advanced control systems, artificial intelligence applications, and data analytics platforms enhancing equipment performance and operational efficiency.

Manufacturing Localization initiatives by international equipment manufacturers establish production facilities within ASEAN nations to reduce costs, improve supply chain efficiency, and better serve regional markets. These investments demonstrate long-term commitment to the regional market and support local economic development.

Dealer Network Expansion continues as equipment manufacturers strengthen distribution capabilities and after-sales support across ASEAN markets. Enhanced dealer networks improve market coverage, customer service quality, and parts availability supporting equipment reliability and customer satisfaction.

Sustainability Initiatives include development of electric and hybrid construction equipment, implementation of circular economy principles in manufacturing, and introduction of equipment recycling programs. These initiatives respond to growing environmental awareness and regulatory requirements across ASEAN nations.

Digital Platform Development enables equipment manufacturers to offer enhanced customer services including remote monitoring, predictive maintenance, and operational optimization through cloud-based platforms. These digital solutions create new value propositions and strengthen customer relationships.

Strategic Acquisitions and partnerships reshape the competitive landscape as companies seek to expand market presence, acquire technology capabilities, and strengthen regional operations. These transactions reflect industry consolidation trends and strategic positioning for future growth opportunities.

Market Entry Strategies for new participants should emphasize local partnerships, comprehensive service capabilities, and technology differentiation to compete effectively in established markets. MarkWide Research analysis indicates that successful market entry requires substantial investment in distribution networks and after-sales support infrastructure.

Technology Investment priorities should focus on digitalization, automation, and sustainability features that align with evolving customer requirements and regulatory standards. Companies investing in advanced technology capabilities position themselves advantageously for long-term market success and differentiation.

Service Excellence becomes increasingly critical as customers evaluate total cost of ownership and operational support quality. Equipment manufacturers should prioritize comprehensive service offerings, parts availability, and technical training programs to maintain competitive advantages in relationship-driven markets.

Regional Customization strategies should address specific market requirements, regulatory standards, and customer preferences across different ASEAN nations. Successful companies adapt product offerings and service approaches to local market conditions while maintaining operational efficiency.

Partnership Development with local dealers, service providers, and technology companies enhances market penetration and customer service capabilities. Strategic partnerships provide market knowledge, distribution channels, and service infrastructure essential for sustainable market success.

Sustainability Leadership positions companies favorably as environmental regulations tighten and customer awareness increases. Early adoption of sustainable practices and clean technology solutions creates competitive advantages and supports long-term market positioning.

Market growth prospects remain robust with construction equipment demand expected to maintain strong momentum driven by sustained infrastructure investment and urbanization trends across ASEAN nations. MarkWide Research projections indicate continued market expansion with growth rates averaging 6.8% annually over the next five years, supported by government infrastructure programs and private sector construction activity.

Technology evolution will accelerate with increased integration of artificial intelligence, machine learning, and autonomous operation capabilities in construction equipment. These technological advances promise enhanced productivity, improved safety, and reduced operational costs, driving equipment replacement cycles and market growth.

Sustainability requirements will intensify as environmental regulations become more stringent and customer awareness increases. Equipment manufacturers must continue investing in clean technology solutions, fuel efficiency improvements, and sustainable manufacturing practices to maintain market competitiveness.

Market consolidation trends may accelerate as companies seek scale advantages, technology capabilities, and expanded market presence through strategic acquisitions and partnerships. This consolidation could reshape competitive dynamics and create opportunities for market leaders to strengthen positions.

Service transformation will continue evolving toward comprehensive solutions encompassing equipment, technology, financing, and operational support. Companies successfully developing integrated service capabilities will capture greater value and strengthen customer relationships in increasingly competitive markets.

Regional integration under ASEAN economic cooperation frameworks will facilitate market expansion and operational efficiency improvements. Harmonized standards and reduced trade barriers create opportunities for equipment manufacturers and service providers to optimize regional operations and market strategies.

The ASEAN construction equipment market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by sustained infrastructure investment, urbanization trends, and technological advancement across Southeast Asian nations. Market fundamentals remain strong with robust demand across diverse equipment categories and applications, supported by government infrastructure programs and private sector construction activity.

Competitive dynamics feature established international manufacturers competing alongside emerging regional players, creating a diverse marketplace emphasizing innovation, service excellence, and customer relationships. Technology integration, sustainability focus, and comprehensive service capabilities emerge as critical success factors for market participants seeking long-term competitive advantages.

Future market development will be shaped by continued digitalization, environmental compliance requirements, and evolving customer expectations for integrated solutions and operational support. Companies successfully adapting to these trends while maintaining operational excellence and customer focus will capture the substantial opportunities presented by this growing and dynamic market across the ASEAN region.

What is Construction Equipment?

Construction equipment refers to heavy machinery and vehicles used for construction activities, including excavation, lifting, and transportation. Common types include bulldozers, cranes, and excavators, which are essential for various construction projects.

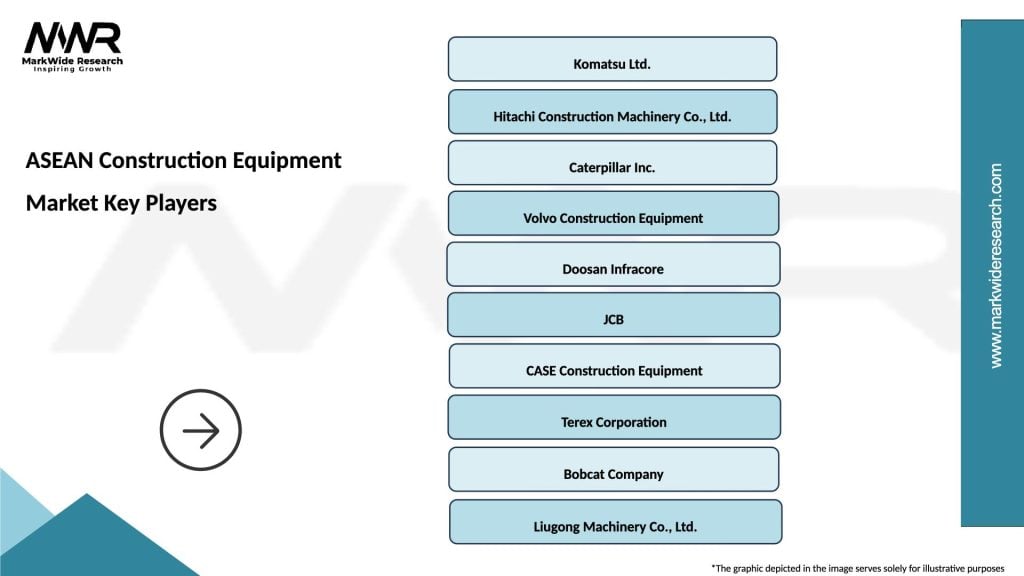

What are the key players in the ASEAN Construction Equipment Market?

Key players in the ASEAN Construction Equipment Market include Caterpillar, Komatsu, and Hitachi Construction Machinery. These companies are known for their innovative machinery and extensive service networks, catering to the growing construction needs in the region, among others.

What are the growth factors driving the ASEAN Construction Equipment Market?

The ASEAN Construction Equipment Market is driven by rapid urbanization, increased infrastructure development, and government investments in public works. Additionally, the rise in residential and commercial construction projects contributes significantly to market growth.

What challenges does the ASEAN Construction Equipment Market face?

Challenges in the ASEAN Construction Equipment Market include fluctuating raw material prices, regulatory compliance issues, and the need for skilled operators. These factors can hinder the growth and efficiency of construction projects across the region.

What opportunities exist in the ASEAN Construction Equipment Market?

Opportunities in the ASEAN Construction Equipment Market include the adoption of advanced technologies such as automation and telematics. Additionally, the increasing focus on sustainable construction practices presents avenues for growth and innovation.

What trends are shaping the ASEAN Construction Equipment Market?

Trends in the ASEAN Construction Equipment Market include the rise of electric and hybrid machinery, which aims to reduce emissions and improve efficiency. Furthermore, the integration of smart technologies for better project management and equipment monitoring is becoming increasingly prevalent.

ASEAN Construction Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Loaders, Cranes, Bulldozers |

| Technology | Hydraulic, Electric, Pneumatic, Mechanical |

| End User | Construction Firms, Government Projects, Infrastructure Developers, Mining Companies |

| Application | Road Construction, Site Preparation, Demolition, Material Handling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at