444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN chemical logistics market represents a dynamic and rapidly evolving sector that serves as the backbone of chemical transportation and distribution across Southeast Asia. This specialized logistics ecosystem encompasses the complex movement of hazardous and non-hazardous chemical products through sophisticated supply chain networks spanning ten member countries. Market dynamics indicate robust growth driven by expanding manufacturing capabilities, increasing industrial chemical demand, and strategic geographic positioning as a global trade hub.

Regional integration has significantly enhanced cross-border chemical transportation efficiency, with logistics providers developing specialized infrastructure to handle diverse chemical categories. The market demonstrates substantial growth potential with chemical logistics operations expanding at approximately 8.2% annually, reflecting the region’s industrial transformation and increasing chemical production capacity.

Infrastructure development across ASEAN nations has created comprehensive logistics networks supporting chemical manufacturers, distributors, and end-users. Advanced warehousing facilities, specialized transportation fleets, and integrated digital platforms enable seamless chemical supply chain management. Regulatory harmonization efforts have streamlined cross-border chemical logistics operations, reducing compliance complexities and enhancing operational efficiency across member states.

The ASEAN chemical logistics market refers to the comprehensive ecosystem of transportation, warehousing, distribution, and supply chain management services specifically designed for chemical products across the Association of Southeast Asian Nations region. This specialized logistics sector encompasses the safe handling, storage, and movement of various chemical categories including petrochemicals, specialty chemicals, agrochemicals, and industrial chemicals through integrated supply chain networks.

Chemical logistics operations involve sophisticated processes requiring specialized equipment, trained personnel, and compliance with stringent safety regulations. The market encompasses multiple service segments including freight forwarding, warehousing, inventory management, customs clearance, and last-mile delivery solutions tailored for chemical products. Regulatory compliance remains paramount, with logistics providers maintaining adherence to international safety standards and local chemical handling regulations.

Digital transformation has revolutionized chemical logistics operations through advanced tracking systems, predictive analytics, and automated inventory management platforms. These technological innovations enhance supply chain visibility, optimize transportation routes, and ensure regulatory compliance throughout the chemical distribution process.

Market expansion in the ASEAN chemical logistics sector reflects the region’s growing importance as a global chemical manufacturing and distribution hub. The market benefits from strategic geographic positioning, enabling efficient connectivity between major chemical producing regions and emerging markets. Industrial growth across member nations has created substantial demand for specialized chemical logistics services, with approximately 72% of chemical manufacturers relying on third-party logistics providers for distribution operations.

Technological advancement drives operational efficiency improvements, with digital platforms enhancing supply chain transparency and reducing logistics costs. Advanced warehouse management systems, IoT-enabled tracking solutions, and automated handling equipment have transformed traditional chemical logistics operations. Sustainability initiatives are increasingly important, with logistics providers implementing eco-friendly transportation solutions and energy-efficient warehousing facilities.

Regulatory developments continue shaping market dynamics, with harmonized safety standards and streamlined customs procedures facilitating cross-border chemical trade. The market demonstrates resilience through diversified service offerings and adaptive operational strategies addressing evolving customer requirements and regulatory changes.

Strategic positioning of ASEAN nations as chemical manufacturing hubs drives substantial logistics demand across the region. The market exhibits strong fundamentals supported by expanding industrial capacity and increasing chemical consumption across diverse end-use sectors.

Industrial expansion across ASEAN member countries serves as the primary catalyst for chemical logistics market growth. Rapid industrialization in manufacturing sectors including automotive, electronics, textiles, and construction creates substantial demand for chemical raw materials and finished products. Manufacturing growth has increased chemical consumption by approximately 15% annually in key industrial sectors, driving corresponding logistics service requirements.

Strategic geographic positioning enables ASEAN nations to serve as critical logistics hubs connecting major chemical producing regions with emerging markets. The region’s extensive coastline, modern port facilities, and developing inland transportation networks facilitate efficient chemical distribution across Asia-Pacific markets. Trade facilitation initiatives have reduced logistics costs and improved supply chain efficiency.

Regulatory harmonization efforts across member nations have streamlined chemical logistics operations, reducing compliance complexities and enabling seamless cross-border transportation. Standardized safety protocols, unified documentation requirements, and mutual recognition agreements enhance operational efficiency. Digital transformation initiatives drive automation and optimization across chemical supply chains, improving service quality and reducing operational costs.

Investment attraction in chemical manufacturing facilities creates substantial logistics infrastructure demand. Foreign direct investment in chemical production capacity generates corresponding requirements for specialized logistics services, warehousing facilities, and distribution networks supporting new manufacturing operations.

Regulatory complexity remains a significant challenge despite harmonization efforts, with varying safety standards and documentation requirements across different member nations creating operational complications. Chemical logistics providers must navigate diverse regulatory frameworks while maintaining compliance with international safety standards. Compliance costs can represent substantial operational expenses, particularly for smaller logistics service providers.

Infrastructure limitations in certain regions constrain market expansion, with inadequate transportation networks and limited specialized warehousing facilities restricting chemical logistics capabilities. Rural and remote areas often lack appropriate infrastructure for safe chemical storage and transportation. Investment requirements for infrastructure development can be substantial, limiting market entry for new participants.

Safety concerns associated with chemical transportation and handling create operational challenges requiring specialized equipment, trained personnel, and comprehensive insurance coverage. Accidents or safety incidents can result in significant liability exposure and regulatory penalties. Risk management requirements increase operational complexity and associated costs.

Economic volatility in global chemical markets affects logistics demand patterns, with price fluctuations and supply chain disruptions impacting transportation volumes. Currency fluctuations and trade policy changes can create uncertainty in cross-border chemical logistics operations.

Digital transformation presents substantial opportunities for chemical logistics providers to enhance operational efficiency and service quality through advanced technology adoption. Implementation of IoT sensors, AI-powered optimization algorithms, and blockchain-based tracking systems can revolutionize supply chain management. Technology integration enables predictive maintenance, route optimization, and automated inventory management, creating competitive advantages.

Sustainability initiatives create opportunities for logistics providers to develop environmentally responsible transportation solutions and energy-efficient warehousing facilities. Growing corporate sustainability commitments drive demand for green logistics services, including electric vehicle fleets and renewable energy-powered facilities. Carbon footprint reduction programs can differentiate service providers and attract environmentally conscious customers.

Value-added services expansion enables logistics providers to capture additional revenue streams through specialized offerings including chemical blending, repackaging, labeling, and quality testing services. Integration of manufacturing support services creates comprehensive supply chain solutions. Service diversification enhances customer relationships and improves profit margins.

Regional integration deepening creates opportunities for expanded cross-border chemical logistics operations as trade barriers continue reducing and economic cooperation strengthens. Development of integrated logistics networks spanning multiple ASEAN countries can capture economies of scale and improve service efficiency.

Supply chain evolution in the ASEAN chemical logistics market reflects changing customer requirements, technological advancement, and regulatory developments. Traditional logistics models are transforming into integrated supply chain solutions providing comprehensive chemical handling capabilities. Customer expectations for transparency, reliability, and sustainability drive continuous service innovation and operational improvements.

Competitive dynamics intensify as global logistics providers expand regional operations while local companies enhance service capabilities through technology adoption and strategic partnerships. Market consolidation through mergers and acquisitions creates larger, more capable logistics networks. Service differentiation becomes increasingly important as providers seek competitive advantages through specialized capabilities and value-added offerings.

Technology adoption accelerates across the chemical logistics sector, with digital platforms enabling enhanced supply chain visibility and operational optimization. Advanced analytics, machine learning algorithms, and automated systems improve decision-making and reduce operational costs. Innovation cycles continue shortening as technology providers develop increasingly sophisticated logistics solutions.

Regulatory evolution shapes market dynamics through updated safety standards, environmental regulations, and trade facilitation measures. Logistics providers must continuously adapt operations to maintain compliance while optimizing efficiency. Regulatory alignment across ASEAN member nations creates opportunities for standardized operational procedures and reduced compliance costs.

Comprehensive analysis of the ASEAN chemical logistics market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, logistics service providers, chemical manufacturers, and regulatory officials across member nations. Data collection encompasses quantitative and qualitative information gathering through structured surveys and in-depth discussions.

Secondary research involves systematic analysis of industry reports, government publications, trade association data, and company financial statements. Market sizing and forecasting utilize statistical modeling techniques incorporating historical trends, economic indicators, and industry growth drivers. MarkWide Research methodology ensures comprehensive coverage of market segments and geographic regions.

Industry validation processes include expert panel reviews, stakeholder consultations, and cross-verification of research findings through multiple independent sources. Data triangulation techniques confirm accuracy and reliability of market insights and projections. Quality assurance protocols ensure research methodology adherence and data integrity throughout the analysis process.

Market segmentation analysis employs detailed categorization frameworks examining service types, chemical categories, transportation modes, and geographic regions. Competitive landscape assessment includes comprehensive profiling of major logistics providers and emerging market participants.

Singapore maintains its position as the leading chemical logistics hub in ASEAN, accounting for approximately 28% of regional logistics operations. The city-state’s strategic location, advanced port facilities, and sophisticated regulatory framework attract major chemical logistics providers. Infrastructure excellence and business-friendly policies create competitive advantages for chemical supply chain operations.

Thailand represents a significant chemical logistics market driven by substantial petrochemical manufacturing capacity and growing industrial demand. The country’s central location within ASEAN and developing transportation infrastructure support expanding logistics operations. Government initiatives promoting industrial development create additional logistics demand across chemical sectors.

Malaysia demonstrates strong chemical logistics growth supported by expanding petrochemical production and strategic port locations. The country’s diverse chemical manufacturing base creates substantial logistics requirements across multiple product categories. Investment attraction in chemical facilities drives corresponding logistics infrastructure development.

Indonesia shows substantial potential for chemical logistics expansion given its large domestic market and growing industrial capacity. The archipelago nation’s geographic complexity creates unique logistics challenges and opportunities. Infrastructure development programs aim to improve connectivity and reduce logistics costs across the country.

Vietnam emerges as a rapidly growing chemical logistics market supported by expanding manufacturing sector and increasing foreign investment. The country’s long coastline and developing port facilities enhance chemical import and export capabilities. Economic growth drives increasing chemical consumption and corresponding logistics demand.

Market leadership in the ASEAN chemical logistics sector features a combination of global logistics giants and specialized regional providers offering comprehensive chemical handling capabilities. Competition intensifies as providers expand service offerings and geographic coverage to capture market share.

Strategic partnerships between global and local logistics providers create comprehensive service networks spanning multiple ASEAN countries. Technology collaboration and infrastructure sharing enable enhanced service capabilities and operational efficiency.

Service type segmentation reveals diverse chemical logistics offerings addressing specific customer requirements and chemical categories. Transportation services represent the largest segment, encompassing road, rail, sea, and air freight solutions for chemical products.

By Service Type:

By Chemical Type:

By Transportation Mode:

Petrochemical logistics represents the largest category within the ASEAN chemical logistics market, driven by substantial regional production capacity and growing downstream demand. Specialized infrastructure including chemical tankers, storage terminals, and pipeline networks support efficient petrochemical distribution. Bulk handling capabilities and economies of scale create competitive advantages for major logistics providers.

Specialty chemical logistics demonstrates strong growth potential as manufacturers increasingly focus on high-value products requiring specialized handling and storage conditions. Temperature-controlled warehousing, contamination prevention protocols, and quality assurance systems are essential for specialty chemical supply chains. Service differentiation through specialized capabilities creates premium pricing opportunities.

Agrochemical logistics shows seasonal demand patterns aligned with agricultural cycles across ASEAN countries. Specialized storage facilities, regulatory compliance expertise, and rural distribution networks are critical success factors. Market expansion in agricultural sectors drives increasing agrochemical logistics demand.

Industrial chemical logistics serves diverse manufacturing sectors with varying requirements for chemical raw materials and processing chemicals. Just-in-time delivery capabilities and inventory management services support manufacturing efficiency. Customer relationships and supply chain integration create competitive advantages in this segment.

Chemical manufacturers benefit from specialized logistics services that ensure product integrity, regulatory compliance, and efficient distribution to end markets. Professional logistics providers offer expertise in chemical handling, safety protocols, and regulatory requirements, reducing operational risks and costs. Supply chain optimization through professional logistics services enables manufacturers to focus on core production activities.

Logistics service providers capture substantial revenue opportunities through specialized chemical logistics offerings that command premium pricing compared to general freight services. Investment in specialized equipment and facilities creates competitive barriers and customer loyalty. Market expansion opportunities exist through geographic coverage extension and service diversification.

End-user industries benefit from reliable chemical supply chains ensuring consistent raw material availability and quality. Professional logistics services reduce supply chain risks and enable efficient inventory management. Cost optimization through outsourced logistics services allows companies to focus resources on core business activities.

Government stakeholders benefit from economic development, employment creation, and tax revenue generation from expanding chemical logistics operations. Professional logistics services enhance safety standards and environmental compliance in chemical transportation. Trade facilitation through efficient logistics networks supports economic growth and regional integration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration transforms chemical logistics operations through advanced technology adoption including IoT sensors, AI-powered optimization, and blockchain-based tracking systems. Real-time supply chain visibility and predictive analytics enhance operational efficiency and customer service quality. Technology integration enables automated inventory management and optimized transportation routing.

Sustainability focus drives adoption of environmentally responsible logistics practices including electric vehicle fleets, renewable energy-powered facilities, and carbon footprint reduction programs. Corporate sustainability commitments create demand for green logistics solutions. Environmental compliance becomes increasingly important for logistics service providers.

Service integration trends toward comprehensive supply chain solutions combining transportation, warehousing, and value-added services. Customers prefer single-source logistics providers offering end-to-end chemical supply chain management. Partnership strategies enable logistics providers to offer expanded service capabilities.

Safety enhancement through advanced monitoring systems, specialized training programs, and improved safety protocols reduces risks associated with chemical transportation and handling. Regulatory requirements drive continuous safety improvements. Risk management capabilities become key differentiators for logistics providers.

Regional consolidation accelerates through mergers, acquisitions, and strategic partnerships creating larger, more capable logistics networks. Market consolidation enables economies of scale and enhanced service capabilities. Network expansion strategies focus on comprehensive geographic coverage across ASEAN countries.

Infrastructure investments across ASEAN member nations enhance chemical logistics capabilities through new port facilities, specialized warehouses, and transportation networks. Government initiatives support logistics infrastructure development to attract chemical manufacturing investments. Public-private partnerships accelerate infrastructure development and improve logistics efficiency.

Technology partnerships between logistics providers and technology companies drive innovation in chemical supply chain management. Advanced analytics platforms, IoT solutions, and automation systems improve operational efficiency and service quality. Digital transformation initiatives create competitive advantages for early adopters.

Regulatory harmonization efforts continue advancing with standardized safety protocols, unified documentation requirements, and mutual recognition agreements. Cross-border trade facilitation measures reduce logistics costs and improve supply chain efficiency. MWR analysis indicates that regulatory alignment could improve logistics efficiency by approximately 18% across the region.

Sustainability initiatives gain momentum with logistics providers implementing carbon reduction programs, energy-efficient facilities, and environmentally responsible transportation solutions. Corporate sustainability commitments drive demand for green logistics services. Environmental standards increasingly influence logistics provider selection decisions.

Market consolidation accelerates through strategic acquisitions and partnerships creating integrated logistics networks spanning multiple ASEAN countries. Global logistics providers expand regional operations while local companies enhance capabilities through technology adoption and strategic alliances.

Technology investment should be prioritized by chemical logistics providers to enhance operational efficiency and service quality. Implementation of IoT sensors, AI-powered optimization algorithms, and blockchain-based tracking systems can create competitive advantages. Digital transformation initiatives should focus on supply chain visibility and automated operations.

Safety enhancement through specialized training programs, advanced monitoring systems, and improved safety protocols is essential for sustainable growth in chemical logistics operations. Investment in safety infrastructure and personnel training reduces operational risks and regulatory compliance costs. Risk management capabilities should be continuously enhanced.

Service diversification through value-added offerings including chemical blending, repackaging, and quality testing services can improve profit margins and customer relationships. Integration of manufacturing support services creates comprehensive supply chain solutions. Customer-centric approaches should guide service development strategies.

Regional expansion strategies should focus on comprehensive geographic coverage across ASEAN countries to capture cross-border trade opportunities. Strategic partnerships and acquisitions can accelerate market entry and capability development. Network integration enables economies of scale and improved service efficiency.

Sustainability initiatives should be integrated into operational strategies to meet growing customer demand for environmentally responsible logistics solutions. Investment in green transportation and energy-efficient facilities creates differentiation opportunities. Carbon footprint reduction programs can attract environmentally conscious customers.

Market expansion prospects remain robust for the ASEAN chemical logistics sector, driven by continued industrial growth, increasing chemical consumption, and expanding manufacturing capacity across member nations. MarkWide Research projects sustained growth momentum with logistics operations expanding at approximately 9.1% annually over the next five years, reflecting strong underlying market fundamentals.

Technology transformation will continue reshaping chemical logistics operations through advanced automation, artificial intelligence, and digital platform integration. Smart logistics solutions enabling predictive maintenance, route optimization, and automated inventory management will become standard operational tools. Innovation cycles will accelerate as technology providers develop increasingly sophisticated logistics solutions.

Sustainability requirements will increasingly influence logistics provider selection and operational strategies. Environmental compliance standards will tighten while corporate sustainability commitments drive demand for green logistics solutions. Carbon neutrality goals will require significant investment in clean transportation and renewable energy systems.

Regional integration deepening will create expanded opportunities for cross-border chemical logistics operations as economic cooperation strengthens and trade barriers continue reducing. Harmonized regulations and streamlined procedures will facilitate efficient chemical supply chain management across ASEAN countries. Market consolidation will continue creating larger, more capable logistics networks.

Service evolution toward integrated supply chain solutions will accelerate as customers seek comprehensive chemical logistics partnerships. Value-added services and manufacturing support capabilities will become increasingly important for competitive differentiation. Customer relationships will deepen through expanded service offerings and supply chain integration.

The ASEAN chemical logistics market represents a dynamic and rapidly expanding sector positioned for sustained growth driven by industrial development, technological advancement, and regional economic integration. Strategic geographic positioning, expanding manufacturing capacity, and improving infrastructure create substantial opportunities for logistics service providers across the region.

Market fundamentals remain strong with growing chemical consumption, increasing cross-border trade, and continuous investment in logistics infrastructure supporting long-term expansion prospects. Technology adoption and sustainability initiatives will shape competitive dynamics while regulatory harmonization facilitates efficient cross-border operations.

Success factors for chemical logistics providers include specialized capabilities, safety excellence, technology integration, and comprehensive service offerings addressing evolving customer requirements. Strategic partnerships and regional expansion strategies will be essential for capturing market opportunities and achieving sustainable growth in this competitive and rapidly evolving sector.

What is Chemical Logistics?

Chemical logistics refers to the specialized transportation, storage, and distribution of chemical products. This includes managing hazardous materials, ensuring compliance with safety regulations, and optimizing supply chain processes for various chemical industries.

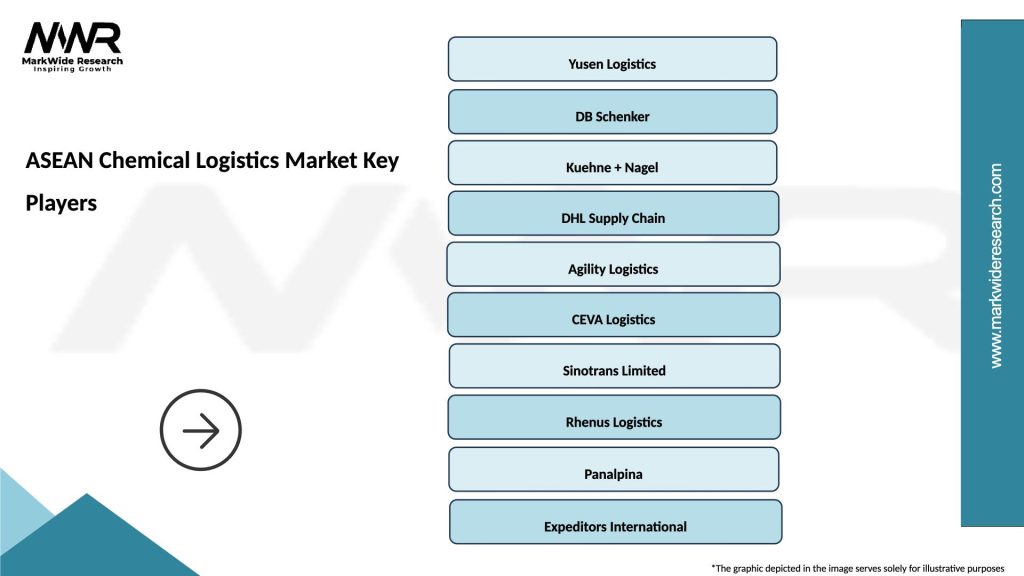

What are the key players in the ASEAN Chemical Logistics Market?

Key players in the ASEAN Chemical Logistics Market include companies like DHL Supply Chain, Kuehne + Nagel, and DB Schenker, which provide tailored logistics solutions for chemical products. These companies focus on safety, efficiency, and regulatory compliance in their operations, among others.

What are the growth factors driving the ASEAN Chemical Logistics Market?

The ASEAN Chemical Logistics Market is driven by increasing demand for chemicals in industries such as agriculture, pharmaceuticals, and manufacturing. Additionally, the growth of e-commerce and the need for efficient supply chain management are contributing to market expansion.

What challenges does the ASEAN Chemical Logistics Market face?

Challenges in the ASEAN Chemical Logistics Market include stringent regulatory requirements, the need for specialized handling of hazardous materials, and fluctuating transportation costs. These factors can complicate logistics operations and impact service delivery.

What opportunities exist in the ASEAN Chemical Logistics Market?

Opportunities in the ASEAN Chemical Logistics Market include the adoption of advanced technologies such as IoT and automation to enhance supply chain efficiency. Additionally, the growing focus on sustainability and green logistics presents new avenues for innovation and growth.

What trends are shaping the ASEAN Chemical Logistics Market?

Trends in the ASEAN Chemical Logistics Market include increasing digitalization of logistics processes, the rise of third-party logistics providers, and a growing emphasis on sustainability practices. These trends are reshaping how chemical logistics companies operate and serve their clients.

ASEAN Chemical Logistics Market

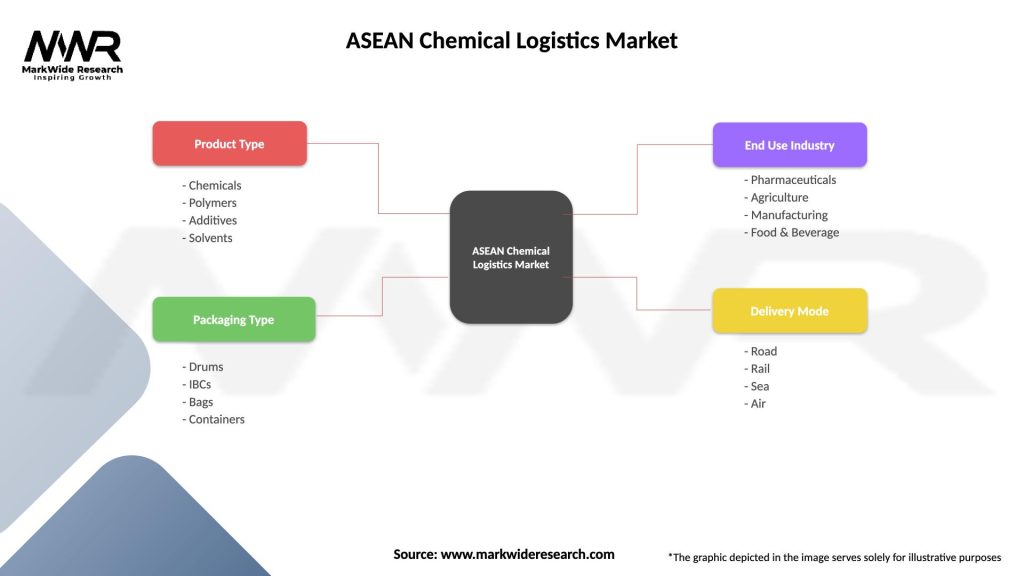

| Segmentation Details | Description |

|---|---|

| Product Type | Chemicals, Polymers, Additives, Solvents |

| Packaging Type | Drums, IBCs, Bags, Containers |

| End Use Industry | Pharmaceuticals, Agriculture, Manufacturing, Food & Beverage |

| Delivery Mode | Road, Rail, Sea, Air |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Chemical Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at