444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina snacks bars market represents a dynamic and rapidly evolving segment within the country’s broader food and beverage industry. Consumer preferences are shifting toward convenient, nutritious, and portable snacking options, driving significant growth in this sector. The market encompasses various product categories including protein bars, granola bars, energy bars, cereal bars, and fruit bars, each catering to different consumer needs and lifestyle preferences.

Market dynamics indicate robust expansion driven by increasing health consciousness, busy lifestyles, and growing awareness of nutritional benefits. The sector is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting strong consumer demand and market penetration. Urban populations particularly demonstrate high adoption rates, with convenience stores, supermarkets, and online retail channels serving as primary distribution points.

Innovation trends within the Argentina snacks bars market focus on natural ingredients, reduced sugar content, and functional benefits such as protein enrichment and vitamin fortification. Local manufacturers are increasingly competing with international brands by developing products that cater to regional taste preferences while maintaining global quality standards. The market shows 65% penetration in major metropolitan areas, with significant growth potential in secondary cities and rural regions.

The Argentina snacks bars market refers to the commercial ecosystem encompassing the production, distribution, and retail of portable, ready-to-eat bar-shaped snack products within Argentina’s national boundaries. This market includes various subcategories of nutritional and convenience bars designed for on-the-go consumption, meal replacement, or supplemental nutrition.

Market participants include domestic and international manufacturers, distributors, retailers, and service providers who contribute to the value chain. The sector encompasses both mass-market products available in conventional retail channels and premium offerings targeting health-conscious consumers through specialized distribution networks.

Product categories within this market range from traditional cereal-based bars to innovative protein-enriched options, organic variants, and functional bars containing specific nutrients or supplements. Consumer segments include fitness enthusiasts, busy professionals, students, and health-conscious individuals seeking convenient nutritional solutions that align with their dietary preferences and lifestyle requirements.

Strategic analysis reveals the Argentina snacks bars market as a high-growth sector characterized by evolving consumer preferences and increasing market sophistication. Key growth drivers include urbanization, rising disposable incomes, health awareness campaigns, and the expansion of modern retail infrastructure throughout the country.

Market segmentation shows protein bars capturing 32% market share, followed by granola bars at 28%, and energy bars at 22%. The remaining segments include cereal bars, fruit bars, and specialty dietary bars. Distribution channels demonstrate strong performance across supermarkets, convenience stores, pharmacies, and emerging e-commerce platforms.

Competitive landscape features a mix of established international brands and emerging local players, with innovation focusing on clean labels, sustainable packaging, and functional ingredients. Consumer trends indicate growing demand for plant-based options, reduced sugar formulations, and products addressing specific dietary requirements such as gluten-free and keto-friendly alternatives.

Future projections suggest continued market expansion driven by product innovation, channel diversification, and increasing consumer education about nutritional benefits. Investment opportunities exist in premium product development, sustainable packaging solutions, and digital marketing strategies targeting younger demographics.

Consumer behavior analysis reveals significant shifts in snacking patterns, with Argentina consumers increasingly prioritizing nutritional value alongside convenience. Purchase decisions are influenced by ingredient transparency, brand reputation, and perceived health benefits, creating opportunities for companies that effectively communicate product value propositions.

Health and wellness trends serve as primary catalysts for market growth, with consumers increasingly seeking nutritious alternatives to traditional snacks. Lifestyle changes associated with urbanization and professional demands create sustained demand for convenient, portable nutrition solutions that support active lifestyles.

Economic factors including rising disposable incomes and expanding middle-class demographics contribute to market expansion. Consumer spending patterns show increased allocation toward premium food products, particularly those offering perceived health benefits and convenience value propositions.

Retail infrastructure development enhances product accessibility through expanded distribution networks. Modern trade channels including supermarket chains, convenience stores, and online platforms provide improved product visibility and consumer reach, facilitating market penetration in previously underserved regions.

Marketing initiatives and educational campaigns by manufacturers and health organizations increase consumer awareness of nutritional benefits associated with snack bars. Fitness culture growth and sports participation rates drive demand for protein-enriched and energy-boosting products among active consumer segments.

Innovation in product development creates new market categories and expands consumer appeal through improved taste profiles, texture enhancements, and functional ingredient incorporation. Regulatory support for nutritional labeling and health claims provides framework for effective product positioning and consumer communication.

Price sensitivity among certain consumer segments limits market penetration, particularly in price-conscious demographics where traditional snacks maintain competitive advantages. Economic volatility and inflation pressures can impact consumer spending on premium snack products, affecting overall market growth rates.

Competition from alternative snacking options including fresh fruits, nuts, and traditional confectionery products creates market share challenges. Consumer skepticism regarding health claims and processed food ingredients may limit adoption among certain demographic groups prioritizing whole food consumption.

Supply chain complexities related to ingredient sourcing, particularly for specialty components like organic materials or imported nutrients, can impact product availability and pricing strategies. Regulatory compliance requirements for nutritional claims and labeling standards create operational challenges for smaller manufacturers.

Seasonal demand variations create inventory management challenges and impact revenue predictability for manufacturers and retailers. Distribution limitations in rural areas and smaller cities restrict market reach and growth potential in certain geographic segments.

Brand loyalty challenges in a crowded marketplace require significant marketing investments to establish consumer recognition and preference. Shelf life constraints for natural and organic products create logistical complexities and potential waste issues throughout the supply chain.

Product innovation opportunities exist in developing bars targeting specific dietary requirements such as diabetic-friendly, keto-compatible, and allergen-free formulations. Functional ingredients including probiotics, adaptogens, and specialized vitamins present avenues for premium product development and market differentiation.

Geographic expansion into underserved regions offers significant growth potential, particularly through strategic partnerships with local distributors and retailers. E-commerce channel development provides opportunities to reach consumers directly and build brand relationships while expanding market reach beyond traditional retail limitations.

Sustainability initiatives including eco-friendly packaging and ethical sourcing practices can create competitive advantages and appeal to environmentally conscious consumers. Private label partnerships with major retailers offer opportunities for market entry and volume growth while leveraging established distribution networks.

Cross-category innovation combining snack bars with other product formats or creating hybrid products can capture new consumer occasions and expand market boundaries. Digital marketing strategies leveraging social media influencers and targeted advertising can effectively reach younger demographics and build brand awareness.

Export opportunities to neighboring countries can leverage Argentina’s manufacturing capabilities and create additional revenue streams for successful domestic brands. Partnership opportunities with fitness centers, schools, and workplace cafeterias can establish new distribution channels and consumption occasions.

Supply and demand equilibrium in the Argentina snacks bars market reflects growing consumer acceptance balanced against expanding production capacity. Market maturation varies significantly across different product categories, with protein bars showing rapid growth while traditional cereal bars maintain stable demand patterns.

Competitive intensity continues increasing as new entrants recognize market opportunities and established players expand product portfolios. Innovation cycles are accelerating, with companies introducing new formulations and flavors at quarterly intervals to maintain consumer interest and market relevance.

Price dynamics show upward pressure due to ingredient cost inflation and premium positioning strategies, while value-oriented segments maintain competitive pricing to preserve market share. Consumer loyalty patterns indicate brand switching rates of approximately 35%, suggesting opportunities for effective marketing and product differentiation.

Seasonal fluctuations create predictable demand patterns, with peak sales occurring during January-March coinciding with fitness resolutions and summer preparation. Distribution channel evolution shows growing importance of online sales, which now represent 18% of total market volume.

Regulatory environment continues evolving with enhanced focus on nutritional labeling accuracy and health claim substantiation. Technology adoption in manufacturing processes enables improved product consistency and cost efficiency, supporting market expansion and profitability improvement.

Comprehensive market analysis employed multiple research methodologies to ensure data accuracy and insight reliability. Primary research included consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand market intelligence and validate secondary data sources.

Secondary research encompassed industry reports, trade publications, government statistics, and company financial disclosures to establish market baseline and historical trends. Data triangulation methods verified information consistency across multiple sources and identified potential discrepancies requiring additional investigation.

Consumer behavior studies utilized focus groups and online surveys to understand purchase motivations, consumption patterns, and brand preferences across different demographic segments. Retail channel analysis examined distribution patterns, pricing strategies, and promotional activities through store audits and sales data review.

Expert interviews with industry professionals, nutritionists, and retail executives provided qualitative insights into market trends and future development prospects. Competitive intelligence gathering included product analysis, pricing comparisons, and marketing strategy evaluation across key market participants.

Statistical analysis employed regression modeling and trend analysis to project market growth rates and identify key performance indicators. Quality assurance protocols ensured data accuracy through multiple validation checkpoints and peer review processes throughout the research timeline.

Buenos Aires metropolitan area dominates the Argentina snacks bars market, accounting for 42% of national consumption due to high population density, elevated income levels, and advanced retail infrastructure. Consumer sophistication in this region drives demand for premium and innovative products, making it a key testing ground for new product launches.

Córdoba province represents the second-largest market segment with 15% market share, characterized by strong university populations and growing health consciousness. Regional preferences show higher demand for energy bars and protein-enriched products, reflecting active lifestyle patterns among younger demographics.

Santa Fe region demonstrates steady growth with 12% market representation, supported by industrial development and rising urban populations. Distribution networks in this area are expanding rapidly, with new retail formats entering previously underserved markets.

Mendoza province shows unique consumption patterns influenced by wine industry culture and outdoor recreation activities. Market penetration reaches 8% of national volume, with particular strength in natural and organic product categories appealing to health-conscious consumers.

Northern provinces including Salta and Tucumán represent emerging opportunities with combined market share of 11%. Growth potential remains significant as retail modernization and income growth create favorable conditions for market expansion. Southern regions contribute 12% of market volume, with seasonal variations reflecting tourism patterns and outdoor activity levels.

Market leadership is distributed among several key players, with no single company dominating more than 25% market share. Competitive strategies focus on product innovation, brand building, and distribution network expansion to capture market opportunities and defend existing positions.

Innovation competition drives continuous product development, with companies investing in research and development to create differentiated offerings. Marketing investments focus on digital channels and influencer partnerships to reach target demographics effectively.

Product-based segmentation reveals distinct market categories with varying growth trajectories and consumer appeal. Protein bars lead market share due to fitness trend adoption and meal replacement convenience, while granola bars maintain strong positions through family-friendly positioning and taste appeal.

By Product Type:

By Distribution Channel:

Protein bars category demonstrates exceptional growth momentum, driven by increasing gym memberships and fitness awareness campaigns. Consumer preferences favor products containing 20-25 grams of protein per serving, with chocolate and vanilla flavors showing strongest market appeal. Premium pricing acceptance enables higher profit margins for manufacturers focusing on quality ingredients and effective marketing.

Granola bars segment benefits from established consumer familiarity and broad demographic appeal spanning children to seniors. Innovation opportunities exist in reducing sugar content while maintaining taste satisfaction, with several brands successfully launching reduced-sugar variants. Family pack formats drive volume sales through bulk purchasing behavior.

Energy bars category targets specific use occasions including pre-workout consumption, outdoor activities, and afternoon energy boosts. Caffeine-containing variants show growing popularity among professional consumers seeking productivity enhancement. Seasonal demand patterns peak during summer months and fitness-focused periods.

Cereal bars market emphasizes breakfast replacement and children’s nutrition, with fortification strategies adding vitamins and minerals to enhance nutritional profiles. School distribution programs create volume opportunities while building brand awareness among younger consumers.

Fruit bars segment appeals to consumers seeking natural alternatives, with organic certification providing premium positioning opportunities. Ingredient transparency and minimal processing claims resonate strongly with health-conscious demographics prioritizing clean eating principles.

Manufacturers benefit from expanding market opportunities and consumer willingness to pay premium prices for innovative products. Production scalability enables efficient capacity utilization while meeting growing demand across multiple product categories and distribution channels.

Retailers gain from high-margin product categories that generate strong consumer traffic and repeat purchases. Category management opportunities allow strategic shelf space allocation and promotional planning to maximize revenue per square meter and customer satisfaction.

Distributors capitalize on growing market volumes and expanding geographic reach requirements. Logistics efficiency improvements through consolidated shipments and route optimization reduce operational costs while improving service levels to retail partners.

Consumers receive convenient nutrition solutions that support busy lifestyles and health objectives. Product variety ensures options for different dietary requirements, taste preferences, and consumption occasions, enhancing overall market satisfaction and loyalty.

Suppliers of ingredients benefit from increased demand for specialized components including proteins, natural sweeteners, and functional additives. Innovation partnerships with manufacturers create opportunities for co-development and long-term supply relationships.

Investment community recognizes attractive growth prospects and stable demand patterns supporting portfolio diversification strategies. Market resilience during economic fluctuations provides defensive characteristics while maintaining growth potential during favorable conditions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement drives demand for products with recognizable, natural ingredients and minimal processing. Consumer scrutiny of ingredient lists increases, creating opportunities for brands that prioritize transparency and simplicity in formulation strategies.

Personalized nutrition trends encourage development of products targeting specific dietary needs and health objectives. Customization options including protein content variations and flavor profiles enable brands to address diverse consumer preferences and build stronger market positions.

Sustainability focus influences packaging decisions and ingredient sourcing practices. Environmental consciousness among consumers creates competitive advantages for brands demonstrating commitment to sustainable business practices and ethical sourcing standards.

Digital engagement transforms marketing approaches, with social media influencers and online communities driving brand awareness and purchase decisions. Content marketing strategies emphasizing lifestyle integration and health benefits resonate strongly with target demographics.

Functional ingredients including probiotics, adaptogens, and specialized vitamins create premium product categories. Science-backed benefits enable effective marketing claims and justify higher price points among health-conscious consumers seeking specific nutritional outcomes.

Convenience packaging innovations improve portability and consumption experience. Resealable formats and portion control features address consumer preferences for flexibility and waste reduction while maintaining product freshness and quality.

Manufacturing capacity expansion by leading companies indicates confidence in long-term market growth prospects. Investment announcements include new production facilities and equipment upgrades to meet increasing demand and improve operational efficiency.

Strategic partnerships between manufacturers and retailers create exclusive product launches and enhanced distribution opportunities. Collaboration initiatives focus on category management, promotional planning, and consumer education to drive mutual business growth.

Acquisition activity consolidates market positions as larger companies acquire innovative smaller brands to expand product portfolios and access new consumer segments. Integration strategies leverage existing distribution networks and marketing capabilities to accelerate acquired brand growth.

Technology adoption in manufacturing processes improves product consistency and reduces production costs. Automation investments enable scalability while maintaining quality standards and supporting competitive pricing strategies in mass market segments.

Regulatory developments enhance consumer protection through improved labeling requirements and health claim substantiation. Industry compliance initiatives establish best practices and quality standards that benefit consumer confidence and market credibility.

Export initiatives by Argentine manufacturers target regional markets and create additional revenue opportunities. Trade promotion activities supported by government agencies facilitate market entry and brand establishment in neighboring countries.

Product innovation should focus on addressing specific consumer needs including dietary restrictions, functional benefits, and taste preferences. Research and development investments in natural ingredients and clean label formulations will create competitive advantages and support premium positioning strategies.

Distribution strategy expansion should prioritize e-commerce channel development and partnerships with emerging retail formats. Omnichannel approaches integrating online and offline touchpoints will maximize market reach and provide comprehensive consumer engagement opportunities.

Marketing investments should emphasize digital channels and influencer partnerships to reach younger demographics effectively. Content strategies highlighting lifestyle integration and health benefits will resonate with target consumers and build brand loyalty over time.

Geographic expansion into underserved regions should follow systematic market entry strategies with local partnership considerations. MarkWide Research analysis suggests focusing on secondary cities with growing middle-class populations and improving retail infrastructure.

Sustainability initiatives including eco-friendly packaging and ethical sourcing practices will create differentiation opportunities and appeal to environmentally conscious consumers. Corporate responsibility programs can enhance brand reputation and support long-term market positioning.

Price positioning strategies should balance premium product development with value-oriented options to capture diverse market segments. Portfolio diversification across price points will maximize market penetration while maintaining profitability objectives.

Market expansion is projected to continue at robust rates driven by sustained consumer interest in health and convenience. Growth projections indicate the market will maintain strong momentum with CAGR exceeding 8% over the next five years, supported by favorable demographic trends and lifestyle changes.

Innovation acceleration will create new product categories and expand market boundaries through functional ingredients and specialized formulations. Technology integration in manufacturing and marketing will improve operational efficiency and consumer engagement effectiveness.

Channel evolution will see continued growth in e-commerce and direct-to-consumer sales, with online penetration expected to reach 25% within three years. Retail partnerships will become increasingly strategic as companies seek to optimize distribution efficiency and market coverage.

Consumer sophistication will drive demand for transparency, sustainability, and personalized nutrition solutions. Brand differentiation will increasingly depend on authentic storytelling and demonstrated commitment to consumer values beyond basic product functionality.

Competitive landscape will see continued consolidation as successful brands scale operations and acquire complementary capabilities. Market leadership will favor companies that effectively balance innovation, distribution excellence, and consumer engagement strategies.

Export opportunities will expand as Argentine manufacturers develop competitive capabilities and regional market knowledge. MWR projections suggest significant potential for cross-border expansion within South American markets over the medium term.

The Argentina snacks bars market represents a compelling growth opportunity characterized by favorable consumer trends, expanding distribution networks, and continuous innovation potential. Market fundamentals including health consciousness, convenience requirements, and lifestyle changes provide sustainable demand drivers supporting long-term expansion prospects.

Strategic success in this market requires balanced approaches combining product innovation, effective distribution, and consumer-centric marketing strategies. Companies that prioritize quality ingredients, transparent communication, and sustainable practices will be best positioned to capture market opportunities and build lasting competitive advantages.

Future development will favor organizations that can effectively navigate evolving consumer preferences while maintaining operational efficiency and profitability. Investment in capabilities spanning research and development, digital marketing, and supply chain optimization will determine market leadership positions in this dynamic and growing sector.

What is Snacks Bars?

Snacks bars are convenient food products that typically combine various ingredients such as grains, nuts, fruits, and sweeteners, designed for on-the-go consumption. They are popular for their portability and nutritional benefits, often marketed as healthy snack options.

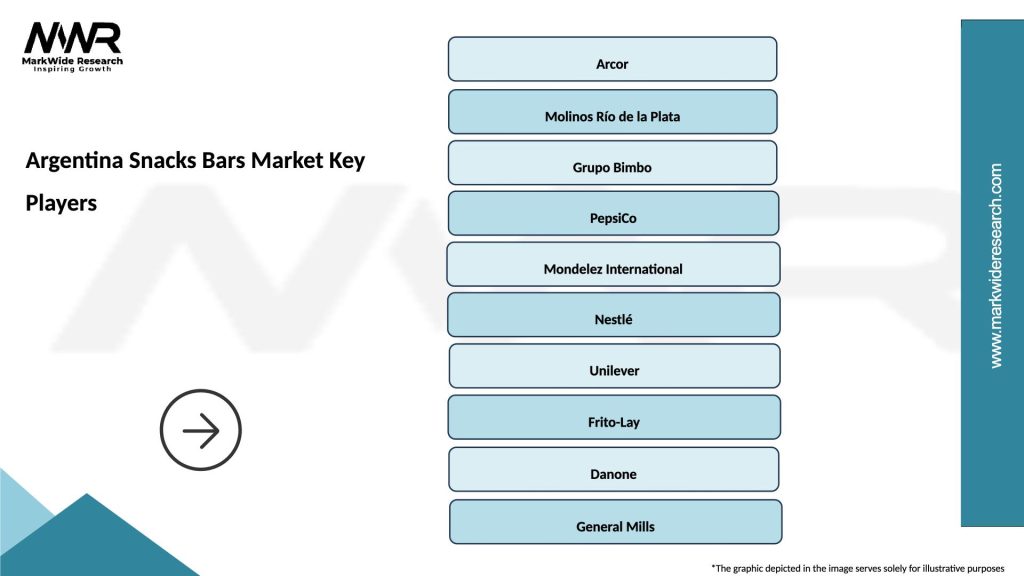

What are the key players in the Argentina Snacks Bars Market?

Key players in the Argentina Snacks Bars Market include companies like Arcor, Mondelez International, and Nestlé, which offer a variety of snack bar products catering to different consumer preferences, among others.

What are the growth factors driving the Argentina Snacks Bars Market?

The growth of the Argentina Snacks Bars Market is driven by increasing health consciousness among consumers, the demand for convenient snack options, and the rise in on-the-go lifestyles. Additionally, innovations in flavors and ingredients are attracting more consumers.

What challenges does the Argentina Snacks Bars Market face?

The Argentina Snacks Bars Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards healthier options. These factors can impact profitability and market share.

What opportunities exist in the Argentina Snacks Bars Market?

Opportunities in the Argentina Snacks Bars Market include the potential for product diversification, such as organic and gluten-free options, and expanding distribution channels through e-commerce. Additionally, targeting niche markets can enhance growth prospects.

What trends are shaping the Argentina Snacks Bars Market?

Trends in the Argentina Snacks Bars Market include a growing preference for plant-based ingredients, increased focus on sustainability in packaging, and the introduction of functional snacks that offer health benefits. These trends reflect changing consumer demands and lifestyle choices.

Argentina Snacks Bars Market

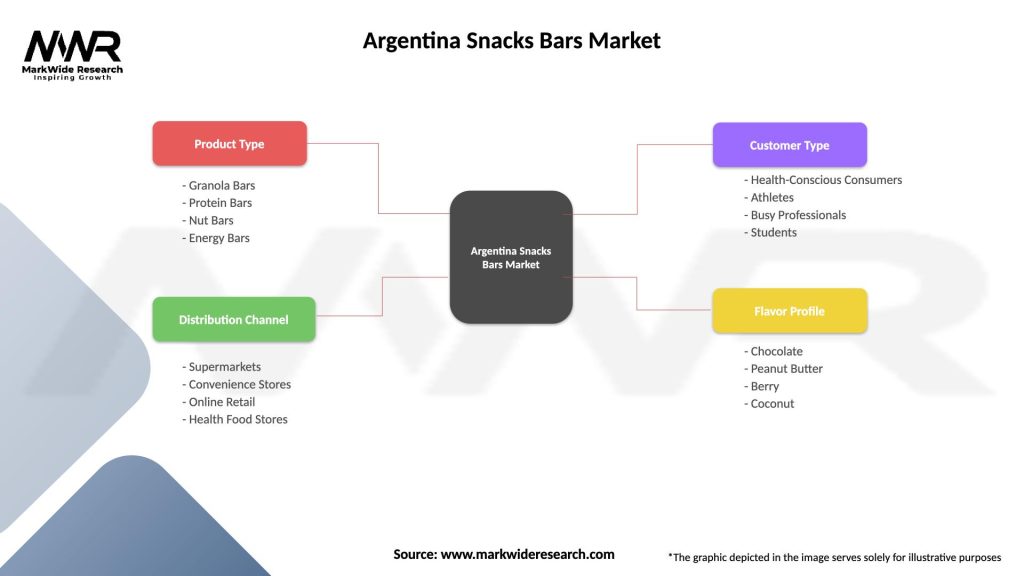

| Segmentation Details | Description |

|---|---|

| Product Type | Granola Bars, Protein Bars, Nut Bars, Energy Bars |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Health Food Stores |

| Customer Type | Health-Conscious Consumers, Athletes, Busy Professionals, Students |

| Flavor Profile | Chocolate, Peanut Butter, Berry, Coconut |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Snacks Bars Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at