444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina road freight transport market represents a critical component of the nation’s logistics infrastructure, serving as the backbone for domestic and international trade movements. Road freight transport dominates Argentina’s cargo movement landscape, accounting for approximately 85% of total freight transportation across the country. This sector encompasses various vehicle categories, from light commercial vehicles to heavy-duty trucks, facilitating the movement of goods across Argentina’s vast territorial expanse.

Market dynamics in Argentina’s road freight sector are influenced by the country’s agricultural export economy, manufacturing base, and strategic geographic position in South America. The industry demonstrates resilience despite economic volatility, with freight volumes showing consistent growth patterns aligned with GDP expansion and trade activities. Infrastructure development initiatives and government policies supporting logistics modernization contribute to market expansion opportunities.

Regional distribution patterns reveal concentration in key economic corridors, particularly the Buenos Aires metropolitan area, Córdoba industrial zone, and agricultural regions of the Pampas. The market exhibits seasonal variations corresponding to harvest cycles, with peak activity during grain export seasons. Technology adoption is gradually transforming traditional operations, introducing fleet management systems, GPS tracking, and digital logistics platforms.

The Argentina road freight transport market refers to the comprehensive ecosystem of commercial vehicle operations, logistics services, and transportation infrastructure dedicated to moving goods via roadways throughout Argentina. This market encompasses trucking companies, independent operators, freight forwarders, and supporting service providers that facilitate cargo movement from origin to destination points across the country.

Road freight transport includes various service categories such as full truckload (FTL), less-than-truckload (LTL), specialized cargo handling, refrigerated transport, and hazardous materials transportation. The market serves diverse industries including agriculture, manufacturing, retail, construction, and mining sectors. Operational scope extends from local distribution within urban areas to long-haul transportation connecting major cities and international border crossings.

Market participants range from large logistics corporations operating extensive fleet networks to small-scale owner-operators providing specialized services. The sector integrates with broader supply chain networks, connecting producers, distributors, retailers, and consumers through efficient road-based transportation solutions.

Argentina’s road freight transport market demonstrates robust fundamentals supported by the country’s position as a major agricultural exporter and regional manufacturing hub. The sector benefits from extensive road network coverage reaching remote agricultural areas and industrial centers. Market growth is driven by increasing domestic consumption, export activities, and e-commerce expansion requiring reliable last-mile delivery solutions.

Key performance indicators show steady improvement in operational efficiency, with average fleet utilization rates reaching 72% capacity during peak seasons. The market exhibits strong correlation with agricultural cycles, particularly soybean and wheat harvest periods that generate substantial freight volumes. Technology integration is accelerating, with approximately 40% of major operators implementing digital fleet management systems.

Competitive landscape features a mix of established logistics companies, regional carriers, and emerging technology-enabled service providers. Market consolidation trends are evident as larger operators acquire smaller firms to expand geographic coverage and service capabilities. Regulatory environment continues evolving with emphasis on safety standards, environmental compliance, and professional driver requirements.

Strategic insights reveal several critical factors shaping Argentina’s road freight transport market dynamics:

Primary growth drivers propelling Argentina’s road freight transport market include robust agricultural export activities that generate substantial cargo volumes throughout the year. The country’s position as a leading global producer of soybeans, wheat, and beef creates consistent demand for transportation services connecting rural production areas with port facilities and processing centers.

E-commerce expansion represents a significant market driver, with online retail growth requiring sophisticated last-mile delivery networks. Consumer expectations for rapid delivery times drive investment in urban distribution centers and specialized delivery vehicles. Manufacturing sector recovery contributes to increased freight movements between industrial zones and consumer markets.

Infrastructure development initiatives, including highway improvements and logistics park construction, enhance operational efficiency and reduce transportation costs. Government policies supporting domestic industry and export competitiveness create favorable conditions for freight transport demand growth. Regional trade integration through Mercosur agreements facilitates cross-border freight movements, expanding market opportunities for Argentine carriers.

Urbanization trends drive demand for efficient goods distribution systems serving growing metropolitan populations. Construction sector activity generates heavy freight requirements for building materials and equipment transportation. Mining operations in northern provinces create specialized transport demand for bulk commodities and mining equipment.

Economic volatility poses significant challenges for Argentina’s road freight transport market, with currency fluctuations affecting operational costs and investment planning. Inflation pressures impact fuel prices, vehicle maintenance costs, and driver wages, creating margin compression for transport operators. Regulatory complexity and frequent policy changes create uncertainty for long-term business planning.

Infrastructure limitations constrain market growth, particularly in rural areas where road quality affects vehicle maintenance costs and delivery reliability. Bridge weight restrictions and road capacity constraints limit efficient freight movement in certain corridors. Security concerns in specific regions increase operational costs through insurance requirements and security measures.

Labor market challenges include professional driver shortages and increasing wage demands that pressure operational costs. Strict labor regulations and social security requirements add complexity to fleet management operations. Environmental regulations require investments in cleaner vehicle technologies and compliance systems that increase capital requirements.

Competition from alternative transport modes, particularly rail freight for bulk commodities, limits market share in specific segments. Import restrictions on vehicles and spare parts create maintenance challenges and increase fleet renewal costs. Credit access limitations constrain small operators’ ability to modernize equipment and expand operations.

Digital transformation presents substantial opportunities for Argentina’s road freight transport market, with technology adoption enabling operational efficiency improvements and new service offerings. Fleet management systems integration can reduce fuel consumption by 15-20% while improving delivery reliability and customer satisfaction levels.

Logistics park development creates opportunities for specialized transport services and value-added logistics operations. Strategic locations near major cities and port facilities offer potential for multimodal transport integration and warehousing services. Cold chain logistics expansion supports agricultural export growth and domestic food distribution requirements.

Cross-border trade growth with Brazil, Chile, and other regional partners creates opportunities for international freight services. Mining sector expansion in northern provinces generates demand for specialized heavy-haul transportation and equipment moving services. E-commerce growth drives demand for urban delivery solutions and reverse logistics capabilities.

Sustainability initiatives create opportunities for operators investing in fuel-efficient vehicles and alternative fuel technologies. Government incentives for fleet modernization support equipment renewal and environmental compliance. Partnership opportunities with international logistics companies enable technology transfer and market expansion strategies.

Competitive dynamics in Argentina’s road freight transport market reflect a fragmented structure with numerous small and medium-sized operators competing alongside established logistics companies. Market concentration varies by segment, with larger companies dominating long-haul and specialized transport while smaller operators focus on regional and niche services.

Pricing dynamics are influenced by fuel costs, regulatory requirements, and competitive pressures. Freight rates demonstrate seasonal variations corresponding to agricultural cycles and economic activity levels. Service differentiation increasingly focuses on reliability, tracking capabilities, and value-added services rather than price competition alone.

Technology adoption is reshaping competitive dynamics, with early adopters gaining advantages through operational efficiency and customer service improvements. Consolidation trends are evident as larger operators acquire smaller firms to expand geographic coverage and service capabilities. Strategic partnerships between transport companies and technology providers create new competitive advantages.

Regulatory dynamics continue evolving with emphasis on safety standards, environmental compliance, and professional driver requirements. Customer expectations are rising for real-time tracking, delivery reliability, and integrated logistics solutions. Market dynamics favor operators capable of adapting to changing customer needs and regulatory requirements.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Argentina’s road freight transport market. Primary research included structured interviews with industry executives, transport operators, logistics managers, and regulatory officials to gather firsthand market intelligence and operational insights.

Secondary research encompassed analysis of government statistics, industry reports, trade publications, and regulatory documents to establish market context and historical trends. Data triangulation methods validated findings across multiple sources to ensure accuracy and reliability of market assessments.

Quantitative analysis utilized statistical modeling techniques to project market trends and growth patterns based on economic indicators, trade volumes, and industry performance metrics. Qualitative assessment incorporated expert opinions and industry knowledge to interpret market dynamics and competitive positioning factors.

Market segmentation analysis examined various dimensions including vehicle types, service categories, geographic regions, and end-user industries. Competitive intelligence gathered through company analysis, financial performance review, and strategic positioning assessment of key market participants.

Buenos Aires Province dominates Argentina’s road freight transport market, accounting for approximately 45% of total freight movements due to its concentration of population, industrial activity, and port facilities. The region benefits from extensive highway networks connecting the capital with interior provinces and neighboring countries. Metropolitan logistics operations focus on urban distribution and last-mile delivery services.

Córdoba Province represents the second-largest regional market, driven by automotive manufacturing, agricultural processing, and strategic geographic location. The province serves as a key logistics hub connecting northern and southern regions. Industrial freight movements dominate local transport demand, with strong connections to export corridors.

Santa Fe Province benefits from agricultural production and river port access, generating substantial grain and oilseed transportation volumes. Rosario logistics cluster serves as a critical node for agricultural exports and industrial distribution. The region demonstrates strong seasonal freight patterns aligned with harvest cycles.

Northern provinces including Salta, Tucumán, and Santiago del Estero show growing freight activity driven by mining operations, agricultural expansion, and cross-border trade with Bolivia and Paraguay. Infrastructure improvements in these regions support market growth and operational efficiency gains.

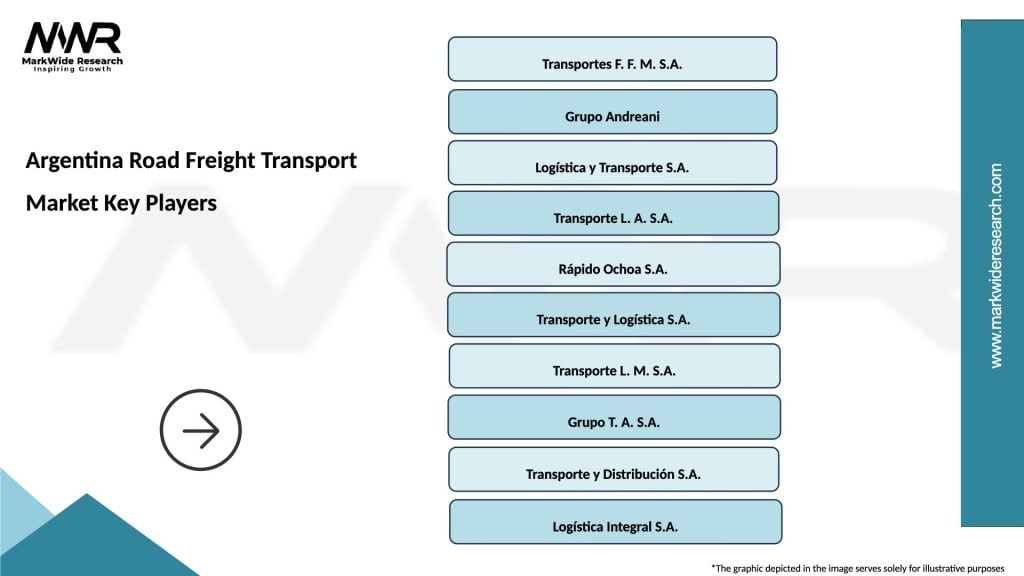

Market leadership in Argentina’s road freight transport sector is distributed among several categories of operators, each serving specific market segments and geographic regions:

Competitive strategies focus on service reliability, geographic coverage, specialized equipment capabilities, and technology integration. Market differentiation increasingly emphasizes value-added services, real-time tracking, and integrated logistics solutions rather than price competition alone.

By Vehicle Type:

By Service Type:

By End-User Industry:

Agricultural freight segment demonstrates strong seasonal patterns with peak activity during harvest periods from March to July. This category benefits from Argentina’s position as a major grain exporter, generating consistent long-haul freight demand from rural production areas to port facilities. Specialized equipment requirements include grain trailers, livestock transporters, and refrigerated vehicles for perishable products.

Manufacturing freight shows more stable year-round demand patterns, supporting industrial supply chains and finished goods distribution. The automotive sector generates substantial freight volumes through parts distribution networks and finished vehicle transportation. Just-in-time delivery requirements drive demand for reliable, time-sensitive transportation services.

E-commerce freight represents the fastest-growing category, with online retail expansion driving demand for urban delivery services and reverse logistics capabilities. Last-mile delivery optimization becomes increasingly important as consumer expectations for rapid delivery times continue rising. Technology integration is most advanced in this segment.

Cross-border freight benefits from regional trade agreements and Argentina’s strategic geographic position. International corridors to Brazil, Chile, and Paraguay generate premium freight rates and specialized service requirements. Customs clearance and documentation services add value to basic transportation offerings.

Transport operators benefit from diverse market opportunities across multiple industry segments and geographic regions. Revenue diversification through agricultural, manufacturing, and e-commerce freight reduces dependency on single market segments. Technology adoption enables operational efficiency improvements and competitive differentiation.

Shippers and consignees gain access to comprehensive transportation networks connecting production centers with distribution points and end markets. Service reliability improvements through professional operators and technology integration reduce supply chain risks and inventory requirements. Competitive pricing through market competition benefits freight buyers.

Economic stakeholders benefit from efficient freight transportation supporting trade competitiveness and economic growth. Employment generation throughout the logistics value chain contributes to regional economic development. Infrastructure utilization optimization reduces public investment requirements while supporting commerce.

Technology providers find growing market opportunities for fleet management systems, tracking solutions, and logistics software platforms. Innovation adoption by transport operators creates demand for advanced technologies and digital services. Partnership opportunities with established operators enable market entry and growth strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the dominant trend reshaping Argentina’s road freight transport market, with operators increasingly adopting fleet management systems, GPS tracking, and electronic documentation. Real-time visibility capabilities become standard customer expectations, driving investment in tracking technologies and communication systems.

Sustainability initiatives gain momentum as environmental regulations tighten and fuel efficiency becomes critical for cost management. Alternative fuel adoption including compressed natural gas (CNG) and biofuels shows growing interest among fleet operators. Vehicle modernization programs focus on emissions reduction and fuel economy improvements.

E-commerce logistics transformation drives demand for urban distribution centers, last-mile delivery optimization, and reverse logistics capabilities. Same-day delivery services expand in major metropolitan areas, requiring specialized vehicle fleets and routing optimization systems. Customer expectations for delivery tracking and flexibility continue rising.

Consolidation trends accelerate as larger operators acquire smaller firms to expand geographic coverage and service capabilities. Strategic partnerships between transport companies and technology providers create competitive advantages through innovation and operational efficiency. Market concentration increases in key segments while niche operators maintain specialized service focus.

Regulatory modernization initiatives include implementation of electronic logging devices for driver hours monitoring and digital documentation systems for freight operations. Safety standards enhancement through mandatory vehicle inspections and driver certification programs improves industry professionalism and operational reliability.

Infrastructure investments focus on highway improvements, logistics park development, and border crossing modernization to enhance freight movement efficiency. Public-private partnerships support major infrastructure projects including toll road improvements and multimodal transport hubs. According to MarkWide Research analysis, infrastructure improvements could enhance operational efficiency by 12-15% across major freight corridors.

Technology adoption accelerates through government incentive programs supporting fleet modernization and digital system implementation. Startup ecosystem development includes logistics technology companies offering innovative solutions for route optimization, load matching, and supply chain visibility.

International cooperation agreements with neighboring countries streamline cross-border freight procedures and reduce transit times. Trade facilitation measures include harmonized customs procedures and mutual recognition of vehicle standards. Regional integration initiatives support freight transport market expansion opportunities.

Strategic recommendations for market participants emphasize technology adoption as a critical success factor for competitive positioning and operational efficiency. Investment priorities should focus on fleet management systems, tracking capabilities, and customer communication platforms to meet evolving market expectations.

Geographic expansion strategies should consider regional economic development patterns and infrastructure improvement projects. Service diversification into specialized segments such as cold chain logistics, e-commerce delivery, and cross-border transport can provide revenue growth opportunities and market differentiation.

Partnership development with technology providers, logistics companies, and international operators can accelerate capability building and market access. Operational efficiency improvements through route optimization, fuel management, and maintenance scheduling can significantly impact profitability in competitive markets.

Risk management strategies should address economic volatility, regulatory changes, and operational challenges through diversification and flexible business models. Sustainability initiatives including fuel-efficient vehicles and environmental compliance can provide long-term competitive advantages and regulatory compliance benefits.

Market projections indicate continued growth for Argentina’s road freight transport sector, driven by economic recovery, agricultural export expansion, and e-commerce development. Technology integration will accelerate, with digital platforms becoming standard operational tools rather than competitive differentiators. MWR forecasts suggest technology adoption rates could reach 75% of major operators within the next five years.

Infrastructure development will support market expansion through improved road networks, logistics facilities, and border crossing efficiency. Regulatory evolution toward international standards will enhance operational professionalism and safety performance. Environmental regulations will drive fleet modernization and alternative fuel adoption.

Competitive landscape transformation will feature increased consolidation, strategic partnerships, and technology-enabled service differentiation. Customer expectations will continue evolving toward integrated logistics solutions, real-time visibility, and sustainable transportation options. Market leaders will emerge through operational excellence, technology adoption, and customer service innovation.

Regional integration will create expanded opportunities for cross-border freight services and international logistics operations. Economic stabilization will support long-term investment planning and market development strategies. The sector’s fundamental role in Argentina’s economy ensures continued importance and growth potential despite cyclical challenges.

Argentina’s road freight transport market demonstrates resilient fundamentals supported by the country’s agricultural export economy, manufacturing base, and strategic regional position. Despite economic challenges and infrastructure constraints, the sector continues evolving through technology adoption, service innovation, and operational efficiency improvements.

Growth opportunities emerge from e-commerce expansion, cross-border trade development, and digital transformation initiatives that enhance operational capabilities and customer service levels. Market participants positioned to leverage technology, expand service offerings, and adapt to changing customer needs will capture the greatest benefits from market evolution.

Strategic success in this dynamic market requires balanced approaches addressing operational efficiency, technology integration, and customer satisfaction while managing economic volatility and regulatory compliance requirements. The sector’s critical role in Argentina’s economy ensures continued importance and development potential for well-positioned market participants.

What is Road Freight Transport?

Road Freight Transport refers to the movement of goods and cargo via roadways using various types of vehicles. This mode of transport is crucial for logistics, enabling the delivery of products across cities and regions efficiently.

What are the key players in the Argentina Road Freight Transport Market?

Key players in the Argentina Road Freight Transport Market include companies like Andreani, TGS, and Grupo Sancor Seguros, which provide logistics and transportation services. These companies play a significant role in shaping the competitive landscape of the market.

What are the main drivers of the Argentina Road Freight Transport Market?

The main drivers of the Argentina Road Freight Transport Market include the growing e-commerce sector, increasing demand for efficient supply chain solutions, and the expansion of infrastructure. These factors contribute to the rising need for reliable road freight services.

What challenges does the Argentina Road Freight Transport Market face?

The Argentina Road Freight Transport Market faces challenges such as traffic congestion, regulatory hurdles, and fluctuating fuel prices. These issues can impact operational efficiency and cost management for transport companies.

What opportunities exist in the Argentina Road Freight Transport Market?

Opportunities in the Argentina Road Freight Transport Market include the adoption of technology for route optimization, the growth of cold chain logistics, and increased investment in infrastructure. These trends can enhance service delivery and operational efficiency.

What trends are shaping the Argentina Road Freight Transport Market?

Trends shaping the Argentina Road Freight Transport Market include the rise of digital freight platforms, sustainability initiatives, and the integration of IoT in logistics. These innovations are transforming how freight transport is managed and executed.

Argentina Road Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Trailers, Vans, Buses |

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Dedicated Freight |

| End User | Manufacturers, Retailers, Distributors, E-commerce |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Road Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at