444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina nutraceutical market represents a dynamic and rapidly evolving sector within the country’s healthcare and wellness industry. Nutraceuticals in Argentina encompass a broad spectrum of products including dietary supplements, functional foods, medicinal foods, and nutritional beverages that provide health benefits beyond basic nutrition. The market has experienced substantial growth driven by increasing health consciousness among consumers, rising disposable incomes, and growing awareness of preventive healthcare approaches.

Market dynamics indicate that Argentina’s nutraceutical sector is benefiting from demographic shifts, including an aging population seeking health maintenance solutions and younger consumers adopting wellness-focused lifestyles. The market demonstrates robust expansion with a projected compound annual growth rate of 8.2% CAGR through the forecast period, reflecting strong consumer demand and favorable regulatory developments.

Consumer preferences in Argentina are increasingly shifting toward natural and organic nutraceutical products, with 65% of consumers expressing preference for plant-based supplements and functional foods. This trend is supported by growing scientific research validating the efficacy of natural compounds and traditional medicinal ingredients native to South America.

The Argentina nutraceutical market refers to the comprehensive ecosystem of products, services, and stakeholders involved in the development, manufacturing, distribution, and consumption of nutritional products that provide health benefits beyond basic nutritional value. Nutraceuticals combine the concepts of nutrition and pharmaceuticals, offering consumers scientifically-backed health solutions through food-derived compounds, dietary supplements, and functional ingredients.

Market scope encompasses various product categories including vitamins and minerals, herbal and botanical supplements, amino acids, probiotics, omega fatty acids, and specialized nutritional formulations. The sector serves diverse consumer segments ranging from health-conscious individuals seeking preventive care to patients requiring targeted nutritional support for specific health conditions.

Regulatory framework in Argentina governs nutraceutical products through the National Administration of Medicines, Food and Medical Technology (ANMAT), ensuring product safety, quality standards, and appropriate labeling requirements. This regulatory oversight provides consumer confidence while enabling market growth through clear compliance pathways for manufacturers and distributors.

Argentina’s nutraceutical market demonstrates exceptional growth potential driven by evolving consumer health priorities and expanding product innovation. The market benefits from a favorable demographic profile with increasing health awareness across all age groups, particularly among urban populations in Buenos Aires, Córdoba, and other major metropolitan areas.

Key market drivers include rising prevalence of lifestyle-related health conditions, growing elderly population requiring nutritional support, and increasing consumer education about preventive healthcare benefits. The market shows strong penetration of dietary supplements with 42% adoption rate among adults aged 25-55, indicating substantial consumer acceptance of nutraceutical products.

Product diversification remains a critical success factor, with manufacturers expanding portfolios to include specialized formulations for immune support, digestive health, cardiovascular wellness, and cognitive enhancement. The market demonstrates particular strength in herbal and botanical supplements, leveraging Argentina’s rich biodiversity and traditional medicine knowledge.

Distribution channels are evolving rapidly, with e-commerce platforms gaining significant market share alongside traditional pharmacy and health food store networks. This multi-channel approach enables broader market reach and improved consumer accessibility to nutraceutical products across Argentina’s diverse geographic regions.

Consumer behavior analysis reveals several critical insights shaping Argentina’s nutraceutical market landscape:

Primary growth drivers propelling Argentina’s nutraceutical market include demographic transitions, lifestyle changes, and evolving healthcare paradigms. The country’s aging population, with 15.8% of citizens over age 60, creates substantial demand for age-related nutritional support products including bone health supplements, cardiovascular support formulations, and cognitive enhancement products.

Healthcare cost management serves as a significant market driver, as consumers and healthcare systems increasingly recognize the economic benefits of preventive nutrition over reactive medical treatments. This shift toward preventive healthcare approaches encourages adoption of nutraceutical products as cost-effective health maintenance strategies.

Urbanization trends contribute to market growth as city dwellers face increased exposure to environmental stressors, processed foods, and sedentary lifestyles. These factors create nutritional gaps that nutraceutical products effectively address, particularly in areas of immune support, stress management, and metabolic health.

Scientific advancement in nutritional research provides credibility and validation for nutraceutical products, encouraging consumer confidence and adoption. Growing body of clinical evidence supporting specific ingredients and formulations strengthens market acceptance and drives product innovation.

Regulatory improvements create favorable market conditions through clearer guidelines, streamlined approval processes, and enhanced consumer protection measures. These developments encourage investment in product development and market expansion while building consumer trust in nutraceutical products.

Economic volatility represents a significant challenge for Argentina’s nutraceutical market, with currency fluctuations and inflation affecting consumer purchasing power and import costs for raw materials. These economic pressures can limit market growth and force consumers to prioritize essential purchases over discretionary health products.

Regulatory complexity poses challenges for market participants, particularly smaller manufacturers lacking resources to navigate comprehensive compliance requirements. Lengthy approval processes and changing regulations can delay product launches and increase operational costs for nutraceutical companies.

Consumer skepticism regarding product efficacy and safety claims remains a market restraint, particularly among older demographics less familiar with nutraceutical concepts. This skepticism requires significant investment in consumer education and scientific validation to overcome resistance to product adoption.

Competition from pharmaceuticals creates market challenges as traditional medicine maintains strong influence in Argentina’s healthcare system. Some consumers and healthcare providers may prefer conventional pharmaceutical approaches over nutraceutical alternatives, limiting market penetration in certain segments.

Supply chain limitations affect product availability and pricing, particularly for specialized ingredients requiring international sourcing. Import restrictions, logistics challenges, and quality control requirements can create bottlenecks that impact market growth and product accessibility.

Export potential presents significant opportunities for Argentina’s nutraceutical market, leveraging the country’s agricultural strengths and unique botanical resources. South American medicinal plants and traditional ingredients offer competitive advantages in global markets seeking natural and authentic nutraceutical products.

Digital transformation creates opportunities for market expansion through e-commerce platforms, telemedicine integration, and personalized nutrition services. Online channels enable broader geographic reach and improved consumer engagement while reducing distribution costs and barriers to market entry.

Partnership opportunities with healthcare providers, fitness centers, and wellness clinics offer pathways for market growth through professional recommendations and integrated health programs. These collaborations enhance product credibility and expand consumer access points.

Innovation in product formulations presents opportunities for market differentiation through specialized products targeting specific health conditions, age groups, or lifestyle needs. Advanced delivery systems, combination formulations, and personalized nutrition solutions represent high-growth market segments.

Rural market penetration offers untapped growth potential as improved infrastructure and digital connectivity expand access to nutraceutical products in previously underserved regions. Rural populations often have strong connections to traditional medicine, creating natural affinity for herbal and botanical nutraceuticals.

Supply and demand dynamics in Argentina’s nutraceutical market reflect complex interactions between consumer needs, regulatory requirements, and industry capabilities. Demand patterns show seasonal variations with increased supplement consumption during winter months and higher functional food sales during summer wellness periods.

Competitive dynamics involve both international brands and domestic manufacturers competing across price points and product categories. Local companies leverage cost advantages and cultural understanding while international players bring advanced research capabilities and established brand recognition.

Innovation cycles drive market evolution through continuous product development, ingredient research, and formulation improvements. Companies investing in research and development demonstrate 23% higher growth rates compared to those focusing solely on existing product lines.

Distribution dynamics are shifting toward omnichannel approaches combining traditional retail, pharmacy networks, and digital platforms. This evolution enables better consumer reach while optimizing inventory management and reducing distribution costs.

Pricing dynamics reflect balance between affordability and quality, with premium products commanding higher margins while mass-market segments drive volume growth. Economic conditions significantly influence pricing strategies and consumer purchasing decisions across different market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Argentina’s nutraceutical market. Primary research includes structured interviews with industry stakeholders, consumer surveys, and expert consultations with healthcare professionals, manufacturers, and regulatory officials.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and company financial statements to provide comprehensive market understanding. Data triangulation ensures accuracy and reliability of market insights and projections.

Quantitative analysis utilizes statistical modeling, trend analysis, and market sizing methodologies to project growth patterns and identify key market drivers. Advanced analytics help identify correlations between demographic factors, economic indicators, and market performance.

Qualitative research explores consumer motivations, purchasing behaviors, and brand preferences through focus groups, in-depth interviews, and observational studies. This approach provides deeper understanding of market dynamics and consumer decision-making processes.

Market validation involves cross-referencing multiple data sources, expert reviews, and stakeholder feedback to ensure research accuracy and relevance. Continuous monitoring and updates maintain research currency and reliability for strategic decision-making.

Buenos Aires metropolitan area dominates Argentina’s nutraceutical market, accounting for approximately 45% of total consumption due to higher disposable incomes, greater health awareness, and superior distribution infrastructure. The region demonstrates strong preference for premium and imported nutraceutical products.

Córdoba province represents the second-largest regional market, driven by significant university population and growing middle class. The region shows particular strength in sports nutrition and functional foods, reflecting active lifestyle preferences among younger demographics.

Mendoza region demonstrates unique market characteristics with strong preference for natural and organic products, influenced by the area’s agricultural heritage and wine industry culture. Local consumers show higher acceptance of herbal supplements and botanical formulations.

Northern provinces including Salta and Tucumán represent emerging markets with growing potential as economic development and urbanization increase consumer purchasing power. These regions maintain strong connections to traditional medicine, creating opportunities for culturally-relevant nutraceutical products.

Patagonian regions show distinct consumption patterns influenced by outdoor lifestyle preferences and seasonal population variations. Tourism industry creates additional demand for portable and convenient nutraceutical products during peak seasons.

Market leadership in Argentina’s nutraceutical sector involves diverse players ranging from multinational corporations to specialized local manufacturers. The competitive environment encourages innovation and consumer-focused product development.

Product-based segmentation reveals diverse market categories serving different consumer needs and preferences:

By Product Type:

By Application:

By Distribution Channel:

Vitamins and minerals represent the largest product category, driven by widespread consumer awareness of nutritional deficiencies and preventive health benefits. Vitamin D supplements show particularly strong growth due to increased understanding of deficiency prevalence and immune system support benefits.

Herbal and botanical supplements demonstrate exceptional growth potential, leveraging Argentina’s rich biodiversity and traditional medicine heritage. Products featuring native South American plants like yerba mate, maca, and ginkgo biloba show strong consumer acceptance and market differentiation opportunities.

Probiotics and digestive health products represent rapidly expanding categories driven by growing understanding of gut health’s impact on overall wellness. Consumer education about microbiome benefits drives 18% annual growth in probiotic supplement sales.

Sports nutrition products target active consumers and fitness enthusiasts with specialized formulations for performance enhancement and recovery support. This category benefits from growing fitness culture and increased participation in recreational sports activities.

Functional foods offer significant growth opportunities through integration of nutritional benefits into everyday food products. Fortified beverages, nutritional bars, and enhanced dairy products appeal to consumers seeking convenient wellness solutions.

Manufacturers benefit from Argentina’s nutraceutical market through access to growing consumer base, favorable regulatory environment, and opportunities for product innovation. Local production capabilities enable cost advantages while international partnerships provide access to advanced technologies and global distribution networks.

Distributors and retailers gain from expanding product categories, higher margin opportunities, and increased consumer traffic driven by health and wellness trends. Nutraceutical products often demonstrate strong customer loyalty and repeat purchase patterns.

Healthcare providers benefit through enhanced patient care options, preventive health tools, and opportunities for integrated wellness programs. Nutraceutical products complement traditional medical treatments while supporting patient health maintenance goals.

Consumers receive access to scientifically-backed health solutions, preventive care options, and personalized nutrition approaches. Market competition drives product innovation, quality improvements, and competitive pricing across all product categories.

Investors find attractive opportunities in a growing market with strong demographic drivers, increasing consumer acceptance, and potential for significant returns through strategic positioning and product innovation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends are reshaping Argentina’s nutraceutical market as consumers seek customized solutions based on individual health profiles, genetic factors, and lifestyle needs. Advanced testing technologies and data analytics enable more targeted product recommendations and formulations.

Natural and organic preferences continue strengthening, with consumers increasingly demanding products free from artificial additives, synthetic ingredients, and chemical preservatives. This trend drives innovation in natural extraction methods and organic certification processes.

Convenience-focused products gain popularity as busy lifestyles drive demand for easy-to-consume formats including gummies, powders, and ready-to-drink formulations. Packaging innovations improve portability and dosage accuracy for on-the-go consumption.

Scientific validation emphasis increases as educated consumers demand evidence-based products supported by clinical research and peer-reviewed studies. Companies investing in research and development gain competitive advantages through credible efficacy claims.

Sustainability considerations influence purchasing decisions as environmentally-conscious consumers prefer products with sustainable sourcing, eco-friendly packaging, and responsible manufacturing practices. This trend creates opportunities for companies emphasizing environmental stewardship.

Regulatory modernization initiatives by ANMAT streamline approval processes for nutraceutical products while maintaining safety standards. These improvements reduce time-to-market for new products and encourage innovation investment by manufacturers.

Technology integration advances include blockchain supply chain tracking, artificial intelligence for personalized recommendations, and mobile applications for health monitoring and product selection. These developments enhance consumer experience and operational efficiency.

Strategic partnerships between international brands and local distributors expand market access while leveraging regional expertise and established networks. These collaborations accelerate market penetration and reduce entry barriers for global companies.

Research investments by leading companies focus on clinical studies validating product efficacy and safety. MarkWide Research indicates that companies with robust research programs demonstrate 35% higher consumer trust ratings compared to those without scientific validation.

Manufacturing capacity expansion by domestic producers reduces import dependence while improving cost competitiveness. Local production facilities enable faster response to market demands and customization for Argentine consumer preferences.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution networks. Companies entering Argentina’s nutraceutical market benefit from partnerships with established local players who provide market knowledge and operational expertise.

Product development focus should emphasize natural ingredients, scientific validation, and culturally-relevant formulations. Products incorporating traditional South American botanicals or addressing region-specific health concerns demonstrate higher market acceptance rates.

Distribution optimization requires multi-channel approaches combining traditional retail, pharmacy networks, and digital platforms. E-commerce investments are particularly important for reaching younger demographics and expanding geographic coverage.

Consumer education initiatives should address knowledge gaps about nutraceutical benefits while building trust through transparent communication about ingredients, sourcing, and manufacturing processes. Educational marketing approaches prove more effective than purely promotional strategies.

Pricing strategies must balance quality positioning with economic accessibility, considering Argentina’s economic volatility and diverse income levels. Tiered product offerings enable market coverage across different consumer segments while maintaining profitability.

Long-term growth prospects for Argentina’s nutraceutical market remain highly positive, driven by demographic trends, increasing health awareness, and expanding product innovation. MWR projections indicate sustained growth momentum with the market expected to maintain robust expansion rates exceeding regional averages.

Technology integration will accelerate market evolution through personalized nutrition platforms, advanced delivery systems, and digital health monitoring integration. These innovations will enhance consumer engagement while improving product efficacy and convenience.

Regulatory harmonization with international standards will facilitate trade and investment while maintaining consumer protection. Improved regulatory clarity will encourage innovation and market entry by international companies seeking growth opportunities.

Export development represents significant future opportunity as Argentina leverages unique botanical resources and traditional medicine knowledge to compete in global markets. International demand for authentic South American ingredients creates competitive advantages for local producers.

Market maturation will drive consolidation among smaller players while creating opportunities for specialized niche products and premium positioning. Companies with strong research capabilities, brand recognition, and distribution networks will capture disproportionate market share growth.

Argentina’s nutraceutical market presents compelling opportunities for growth and investment, supported by favorable demographic trends, increasing health consciousness, and expanding consumer acceptance of nutritional supplementation. The market demonstrates resilience despite economic challenges, reflecting the fundamental importance consumers place on health and wellness.

Strategic success factors include understanding local consumer preferences, navigating regulatory requirements effectively, and building strong distribution networks across diverse geographic regions. Companies that invest in research, education, and quality assurance will establish competitive advantages in this dynamic market environment.

Future market evolution will be shaped by technological innovation, regulatory modernization, and changing consumer expectations for personalized, scientifically-validated products. The integration of traditional South American botanical knowledge with modern nutritional science creates unique opportunities for market differentiation and global expansion.

Market participants who adopt comprehensive strategies addressing product innovation, consumer education, and operational excellence will capture the significant growth potential offered by Argentina’s expanding nutraceutical market. The sector’s positive trajectory reflects broader global trends toward preventive healthcare and wellness-focused consumer behavior.

What is Nutraceutical?

Nutraceuticals are products derived from food sources that offer health benefits, including the prevention and treatment of diseases. They encompass a wide range of products such as dietary supplements, functional foods, and herbal products.

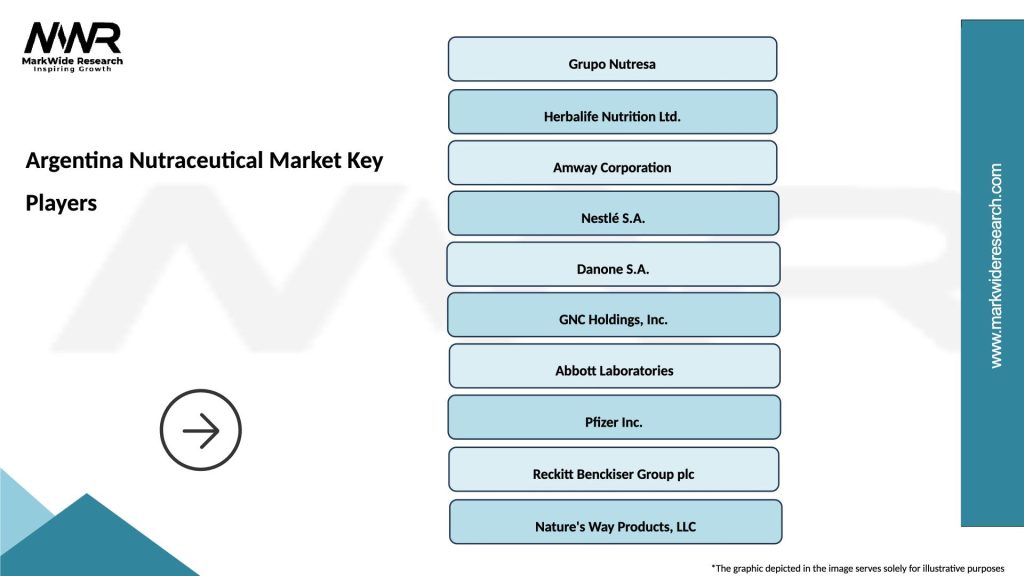

What are the key players in the Argentina Nutraceutical Market?

Key players in the Argentina Nutraceutical Market include companies like Grupo Nutresa, Herbalife, and GNC, which offer a variety of nutraceutical products ranging from vitamins and minerals to herbal supplements, among others.

What are the growth factors driving the Argentina Nutraceutical Market?

The Argentina Nutraceutical Market is driven by increasing health awareness among consumers, a growing aging population, and rising demand for preventive healthcare solutions. Additionally, the trend towards natural and organic products is boosting market growth.

What challenges does the Argentina Nutraceutical Market face?

Challenges in the Argentina Nutraceutical Market include regulatory hurdles, the need for scientific validation of health claims, and competition from unregulated products. These factors can hinder market growth and consumer trust.

What opportunities exist in the Argentina Nutraceutical Market?

Opportunities in the Argentina Nutraceutical Market include the expansion of e-commerce platforms for product distribution, increasing investment in research and development, and the potential for innovative product formulations targeting specific health concerns.

What trends are shaping the Argentina Nutraceutical Market?

Trends in the Argentina Nutraceutical Market include a rise in plant-based supplements, personalized nutrition, and the integration of technology in product development. Consumers are increasingly seeking products that align with their health goals and lifestyles.

Argentina Nutraceutical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Supplements, Probiotics |

| Form | Tablets, Capsules, Powders, Liquids |

| End User | Health-conscious Consumers, Athletes, Elderly, Children |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Nutraceutical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at