444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina crop protection market represents one of South America’s most dynamic agricultural sectors, driven by the country’s position as a global agricultural powerhouse. Argentina’s agricultural landscape encompasses vast expanses of fertile farmland, making it a critical player in global food production and export markets. The crop protection industry in Argentina has experienced robust growth over recent years, with adoption rates increasing by approximately 8.2% annually as farmers seek to maximize yields and protect their investments against various threats.

Market dynamics in Argentina’s crop protection sector are influenced by several key factors, including the country’s extensive cultivation of soybeans, corn, wheat, and other major crops. The market encompasses a comprehensive range of products including herbicides, insecticides, fungicides, and biological control agents. Technological advancement has played a crucial role in shaping market trends, with precision agriculture and integrated pest management systems gaining significant traction among Argentine farmers.

Regional distribution across Argentina shows concentrated activity in the Pampas region, which accounts for approximately 75% of total crop protection usage. The market’s evolution reflects broader agricultural trends, including sustainable farming practices and environmental stewardship initiatives that are increasingly important to both domestic and international stakeholders.

The Argentina crop protection market refers to the comprehensive ecosystem of agricultural chemicals, biological agents, and integrated solutions designed to safeguard crops from pests, diseases, and weeds throughout the country’s diverse agricultural regions. This market encompasses the development, manufacturing, distribution, and application of various protective products that enable farmers to maintain crop health and optimize agricultural productivity.

Crop protection solutions in Argentina include traditional chemical pesticides, modern biological control agents, and innovative precision application technologies. The market serves multiple agricultural sectors, from large-scale commercial farming operations to smaller family-owned farms, providing tailored solutions that address specific regional challenges and crop requirements.

Market participants include multinational agrochemical companies, local manufacturers, distributors, and service providers who collectively support Argentina’s agricultural sector. The market’s scope extends beyond product sales to include technical advisory services, application equipment, and comprehensive farm management solutions that help optimize crop protection strategies.

Argentina’s crop protection market stands as a cornerstone of the country’s agricultural economy, supporting one of the world’s most productive farming sectors. The market has demonstrated consistent expansion driven by increasing agricultural intensification, expanding cultivated areas, and growing adoption of modern farming practices. Key market drivers include rising global food demand, climate change challenges, and the need for sustainable agricultural solutions.

Market segmentation reveals herbicides as the dominant category, representing approximately 62% of total market share, followed by insecticides and fungicides. The biological crop protection segment has emerged as a rapidly growing category, with adoption rates increasing by 15.3% annually as farmers embrace sustainable alternatives to conventional chemicals.

Competitive landscape features a mix of global agrochemical leaders and regional players, with innovation focusing on precision agriculture technologies, biological solutions, and integrated pest management systems. Future prospects remain positive, supported by Argentina’s strategic importance in global food production and ongoing investments in agricultural technology and infrastructure.

Strategic insights into Argentina’s crop protection market reveal several critical trends shaping industry development. The market benefits from Argentina’s position as the world’s third-largest soybean producer and a major exporter of agricultural commodities, creating substantial demand for effective crop protection solutions.

Primary market drivers propelling Argentina’s crop protection market include the country’s expanding agricultural production and increasing focus on yield optimization. Global food security concerns have intensified demand for agricultural products, positioning Argentina as a critical supplier and driving investments in crop protection technologies.

Agricultural intensification represents a major growth driver, as farmers seek to maximize productivity from existing farmland. This trend has led to increased adoption of comprehensive crop protection programs that integrate multiple products and technologies. Climate change impacts are also driving market growth, as changing weather patterns create new pest and disease pressures that require innovative solutions.

Economic factors contribute significantly to market expansion, including favorable commodity prices and government support for agricultural development. The Argentine government’s focus on agricultural exports as a source of foreign currency has created a supportive environment for crop protection investments. Technological advancement continues to drive market evolution, with precision agriculture tools enabling more efficient and effective crop protection applications.

Environmental awareness is increasingly influencing market dynamics, driving demand for sustainable crop protection solutions that minimize environmental impact while maintaining agricultural productivity. This trend has accelerated development of biological control agents and integrated pest management systems.

Market challenges facing Argentina’s crop protection sector include regulatory complexities and increasing scrutiny of chemical pesticide use. Environmental concerns have led to stricter regulations governing pesticide registration and application, potentially limiting market access for certain products and increasing compliance costs for manufacturers and users.

Economic volatility presents ongoing challenges, with currency fluctuations and inflation affecting input costs and farmer purchasing power. Import dependencies for certain active ingredients and formulation components expose the market to supply chain disruptions and cost variations that can impact product availability and pricing.

Resistance development in target pests and weeds poses a significant long-term challenge, requiring continuous innovation and product rotation strategies. This biological challenge necessitates ongoing research and development investments while potentially reducing the effectiveness of existing products over time.

Social acceptance issues surrounding pesticide use continue to influence market dynamics, with increasing public awareness of environmental and health concerns affecting product acceptance and regulatory approaches. Technical expertise requirements for modern crop protection systems can also limit adoption among smaller farmers who may lack access to specialized knowledge and equipment.

Significant opportunities exist within Argentina’s crop protection market, particularly in the development of sustainable and precision agriculture solutions. Biological crop protection represents a rapidly expanding opportunity, with growing farmer interest in environmentally friendly alternatives that can complement or replace traditional chemical approaches.

Digital agriculture integration offers substantial growth potential, as farmers increasingly adopt data-driven approaches to crop management. Opportunities exist for companies that can effectively combine crop protection products with digital platforms, sensors, and analytics tools to provide comprehensive farm management solutions.

Export market expansion presents opportunities for Argentine crop protection companies to leverage domestic expertise and regulatory knowledge to serve other Latin American markets. Regional specialization opportunities exist for companies that can develop products specifically tailored to Argentina’s unique agricultural conditions and crop varieties.

Partnership opportunities with research institutions and agricultural cooperatives can accelerate innovation and market penetration. Sustainable agriculture initiatives supported by international organizations and certification programs create opportunities for companies focused on environmentally responsible crop protection solutions.

Market dynamics in Argentina’s crop protection sector reflect the complex interplay between agricultural production needs, environmental considerations, and technological innovation. Supply and demand patterns are heavily influenced by seasonal agricultural cycles, with peak demand occurring during planting and growing seasons.

Competitive dynamics feature intense rivalry among global agrochemical companies and emerging local players, driving continuous innovation and competitive pricing strategies. Market consolidation trends have created larger, more integrated companies capable of offering comprehensive crop protection solutions and technical support services.

Regulatory dynamics play a crucial role in shaping market structure and product availability, with evolving environmental and safety standards influencing product development priorities and market access strategies. Technology adoption cycles demonstrate varying rates of acceptance across different farm sizes and regions, with larger operations typically leading in adoption of advanced solutions.

Price dynamics reflect global commodity markets, currency fluctuations, and local economic conditions, creating both opportunities and challenges for market participants. Innovation cycles continue to drive market evolution, with research and development investments focusing on biological solutions, precision application technologies, and integrated pest management systems.

Comprehensive research methodology employed in analyzing Argentina’s crop protection market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, including farmers, distributors, manufacturers, and regulatory officials, providing firsthand insights into market conditions and trends.

Secondary research encompasses analysis of government agricultural statistics, industry reports, trade publications, and academic studies to establish market context and validate primary findings. Market sizing methodologies utilize production data, consumption patterns, and trade statistics to develop comprehensive market assessments.

Regional analysis incorporates detailed examination of Argentina’s diverse agricultural regions, accounting for variations in crop types, farming practices, and market conditions. Competitive intelligence gathering includes analysis of company financial reports, product portfolios, and strategic initiatives to understand market positioning and competitive dynamics.

Trend analysis employs longitudinal data examination to identify emerging patterns and project future market developments. Validation processes include cross-referencing multiple data sources and expert review to ensure research accuracy and reliability.

Regional distribution across Argentina reveals distinct patterns in crop protection market development, with the Pampas region dominating market activity due to its concentration of large-scale agricultural operations and favorable growing conditions. This region accounts for approximately 75% of national crop protection usage, reflecting its importance in Argentina’s agricultural economy.

Buenos Aires Province represents the largest regional market, driven by extensive soybean and corn production areas that require comprehensive crop protection programs. Córdoba Province follows as a significant market, with diverse crop production including soybeans, corn, and wheat creating demand for varied crop protection solutions.

Santa Fe Province demonstrates strong market growth, particularly in biological crop protection adoption, with farmers increasingly embracing sustainable agriculture practices. Northern regions including Salta and Tucumán show growing market potential, driven by expanding agricultural development and diversification into specialty crops.

Regional specialization patterns reflect local crop preferences and growing conditions, with different provinces showing varying adoption rates for specific crop protection technologies. Market penetration rates vary significantly across regions, with more developed agricultural areas showing higher adoption of advanced crop protection solutions compared to emerging agricultural regions.

Competitive landscape in Argentina’s crop protection market features a dynamic mix of multinational corporations and regional players, each contributing unique strengths and market approaches. Market leadership is distributed among several key players who have established strong positions through product innovation, distribution networks, and technical support services.

Competitive strategies focus on product differentiation, technical support services, and strategic partnerships with local distributors and agricultural cooperatives. Innovation investments emphasize development of biological solutions, precision application technologies, and integrated pest management systems.

Market segmentation analysis reveals distinct categories within Argentina’s crop protection market, each characterized by specific product types, applications, and growth patterns. Product-based segmentation provides insights into the relative importance and growth potential of different crop protection categories.

By Product Type:

By Crop Type:

By Application Method:

Herbicide category maintains market dominance due to Argentina’s extensive cultivation of genetically modified crops that require specific weed management programs. Glyphosate-based products continue to represent a significant portion of herbicide usage, though resistance management concerns are driving diversification toward alternative active ingredients and application strategies.

Insecticide segment shows dynamic growth patterns influenced by pest pressure variations and regulatory changes affecting product availability. Biological insecticides are gaining market share as farmers seek sustainable alternatives that maintain efficacy while addressing environmental concerns.

Fungicide category demonstrates steady growth driven by increasing disease pressure and expanding cultivation of susceptible crop varieties. Preventive application strategies are becoming more common as farmers recognize the economic benefits of proactive disease management.

Biological products category represents the fastest-growing segment, with microorganism-based solutions and natural compounds gaining acceptance among environmentally conscious farmers. This category benefits from regulatory support and consumer demand for sustainable agricultural practices.

Adjuvant and tank-mix products form an important supporting category that enhances the effectiveness of primary crop protection products while enabling more efficient application practices.

Industry participants in Argentina’s crop protection market enjoy numerous benefits from the sector’s robust growth and strategic importance. Manufacturers benefit from access to one of South America’s largest agricultural markets, providing opportunities for significant revenue generation and market expansion.

Distributors and retailers benefit from consistent demand patterns and opportunities to provide value-added services including technical support and application guidance. Service providers including custom applicators and agricultural consultants benefit from increasing demand for specialized expertise and precision application services.

Farmers and agricultural producers benefit from access to advanced crop protection technologies that enable higher yields, improved crop quality, and reduced production risks. Research institutions benefit from collaboration opportunities with industry partners and access to funding for agricultural innovation projects.

Government stakeholders benefit from the sector’s contribution to agricultural productivity, export earnings, and rural economic development. Environmental organizations benefit from increasing industry focus on sustainable solutions and reduced environmental impact technologies.

Financial institutions benefit from investment opportunities in a strategically important sector with strong growth prospects and established market demand patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable agriculture practices represent the most significant trend shaping Argentina’s crop protection market, with farmers increasingly adopting integrated pest management systems and biological control agents. Precision agriculture adoption continues accelerating, with GPS-guided application systems and variable-rate technology becoming standard practices among larger operations.

Digital transformation is revolutionizing crop protection decision-making, with farmers utilizing smartphone applications, satellite imagery, and predictive analytics to optimize application timing and product selection. Resistance management has become a critical focus, driving adoption of product rotation strategies and combination treatments.

Regulatory evolution toward more stringent environmental and safety standards is influencing product development priorities and market access strategies. Biological product integration is expanding beyond standalone applications to include tank-mix combinations with conventional products.

Supply chain optimization trends include development of regional distribution centers and direct-to-farm delivery services that improve product availability and reduce costs. Technical service enhancement is becoming a key competitive differentiator, with companies investing in agronomist networks and farmer education programs.

Climate adaptation strategies are driving development of products specifically designed for extreme weather conditions and changing pest pressure patterns.

Recent industry developments highlight the dynamic nature of Argentina’s crop protection market and ongoing innovation efforts. Product launches have focused on biological solutions and precision application technologies that address farmer needs for sustainable and efficient crop protection options.

Strategic partnerships between multinational companies and local distributors have expanded market reach and improved technical support capabilities. Manufacturing investments include new production facilities and capacity expansions that strengthen local supply chains and reduce import dependencies.

Regulatory approvals for new active ingredients and biological products have expanded farmer options while maintaining safety and environmental standards. Technology acquisitions by major players have accelerated development of digital agriculture platforms and precision application systems.

Research collaborations between industry and academic institutions have advanced understanding of resistance management and sustainable agriculture practices. Market consolidation activities have created larger, more integrated companies capable of providing comprehensive crop protection solutions.

Sustainability initiatives including stewardship programs and environmental impact reduction efforts have enhanced industry reputation and regulatory relationships. Export expansion activities have opened new markets for Argentine crop protection expertise and products.

Market analysis conducted by MarkWide Research suggests several strategic priorities for industry participants seeking to capitalize on growth opportunities in Argentina’s crop protection market. Innovation investment should focus on biological solutions and precision agriculture technologies that address farmer demands for sustainable and efficient crop protection options.

Distribution network optimization represents a critical success factor, with companies needing to ensure product availability across Argentina’s vast agricultural regions while providing technical support services. Regulatory compliance capabilities must be strengthened to navigate evolving environmental and safety standards effectively.

Partnership strategies should emphasize collaboration with local distributors, agricultural cooperatives, and research institutions to enhance market penetration and technical capabilities. Digital transformation investments should focus on developing integrated platforms that combine crop protection products with data analytics and decision support tools.

Sustainability positioning will become increasingly important as environmental concerns and regulatory requirements continue evolving. Market diversification strategies should consider expansion into specialty crops and emerging agricultural regions to reduce dependence on traditional market segments.

Talent development in technical services and agronomy will be essential for maintaining competitive advantage in an increasingly complex market environment.

Future prospects for Argentina’s crop protection market remain highly positive, supported by the country’s strategic importance in global food production and ongoing agricultural development initiatives. Market growth is expected to continue at a robust pace, driven by expanding cultivated areas, agricultural intensification, and increasing adoption of advanced crop protection technologies.

Biological solutions are projected to capture an increasing market share, with adoption rates potentially reaching 25% of total market volume within the next five years. Precision agriculture integration will accelerate, with digital tools becoming standard components of crop protection programs across larger farming operations.

Regulatory evolution will continue shaping market dynamics, with environmental and safety standards becoming more stringent while creating opportunities for innovative companies that can meet these requirements. Climate change adaptation will drive demand for resilient crop protection solutions capable of performing under increasingly variable weather conditions.

Market consolidation trends are expected to continue, creating larger, more integrated companies capable of providing comprehensive agricultural solutions. Export opportunities will expand as Argentine companies leverage domestic expertise to serve other Latin American markets.

Investment in research and development will remain critical for long-term success, with focus areas including biological products, precision application technologies, and sustainable agriculture solutions that meet evolving farmer and regulatory requirements.

Argentina’s crop protection market represents a dynamic and strategically important sector within the country’s agricultural economy, characterized by robust growth prospects and ongoing innovation. The market’s strength derives from Argentina’s position as a global agricultural leader, extensive cultivated areas, and sophisticated farming practices that create substantial demand for effective crop protection solutions.

Key success factors for market participants include innovation capabilities, distribution network strength, regulatory compliance, and ability to provide comprehensive technical support services. The growing emphasis on sustainable agriculture practices and biological solutions presents significant opportunities for companies that can develop and deliver environmentally responsible crop protection technologies.

Market outlook remains highly positive, supported by expanding agricultural production, increasing technology adoption, and growing global food demand. Strategic priorities for industry participants should focus on innovation investment, partnership development, and sustainability positioning to capitalize on emerging opportunities while addressing evolving market challenges. The continued evolution toward precision agriculture and integrated pest management systems will drive market development and create new opportunities for growth and differentiation in Argentina’s vibrant crop protection market.

What is Crop Protection?

Crop protection refers to the methods and practices used to safeguard crops from pests, diseases, and environmental factors. This includes the use of pesticides, herbicides, and integrated pest management strategies to enhance agricultural productivity.

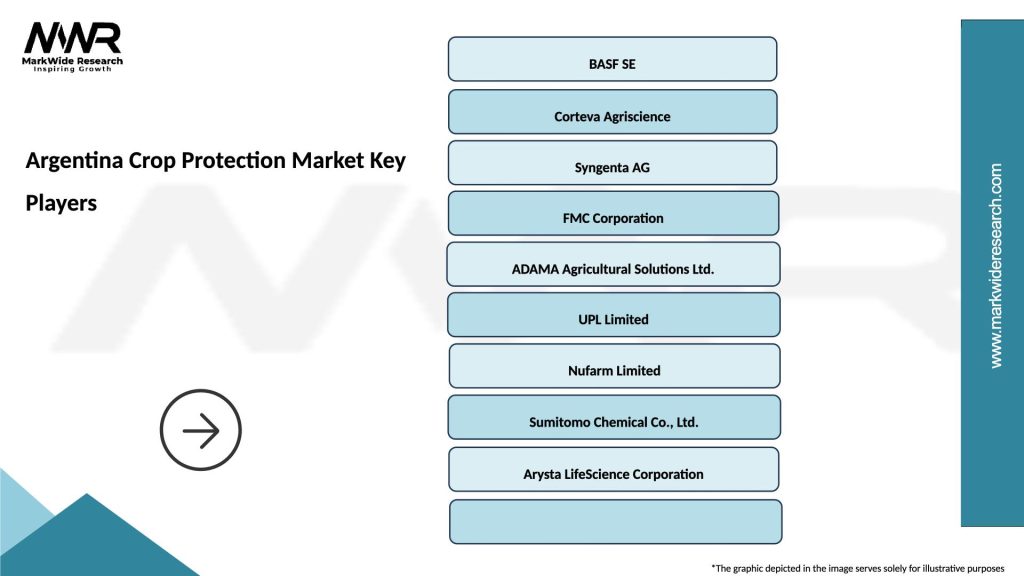

What are the key players in the Argentina Crop Protection Market?

Key players in the Argentina Crop Protection Market include companies like Syngenta, BASF, and Bayer, which provide a range of crop protection products and solutions. These companies focus on innovation and sustainability to meet the needs of local farmers and agricultural practices.

What are the main drivers of the Argentina Crop Protection Market?

The main drivers of the Argentina Crop Protection Market include the increasing demand for food production, the rise in pest resistance, and the adoption of advanced agricultural technologies. These factors contribute to the growth of crop protection solutions in the region.

What challenges does the Argentina Crop Protection Market face?

The Argentina Crop Protection Market faces challenges such as regulatory hurdles, environmental concerns regarding pesticide use, and the need for sustainable practices. These challenges can impact the development and adoption of crop protection products.

What opportunities exist in the Argentina Crop Protection Market?

Opportunities in the Argentina Crop Protection Market include the development of biopesticides, precision agriculture technologies, and sustainable farming practices. These innovations can help address environmental concerns while improving crop yields.

What trends are shaping the Argentina Crop Protection Market?

Trends shaping the Argentina Crop Protection Market include the increasing focus on organic farming, the integration of digital technologies in agriculture, and the growing demand for environmentally friendly pest control solutions. These trends reflect a shift towards more sustainable agricultural practices.

Argentina Crop Protection Market

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Insecticides, Fungicides, Biopesticides |

| Application | Crops, Vegetables, Fruits, Turf |

| End User | Agricultural Producers, Farmers, Distributors, Retailers |

| Distribution Channel | Online, Retail Stores, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Crop Protection Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at