444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina artificial organs and bionic implants market represents a rapidly evolving healthcare sector that combines cutting-edge medical technology with innovative bioengineering solutions. This dynamic market encompasses a comprehensive range of medical devices designed to replace, support, or enhance the function of human organs and body systems. Argentina’s healthcare infrastructure has increasingly embraced these advanced medical technologies, positioning the country as a significant player in the Latin American medical device landscape.

Market dynamics in Argentina reflect a growing demand for sophisticated medical interventions driven by an aging population, increasing prevalence of chronic diseases, and rising healthcare awareness. The artificial organs segment includes devices such as artificial hearts, kidneys, lungs, and liver support systems, while bionic implants encompass cochlear implants, prosthetic limbs, neural implants, and various sensory enhancement devices. Healthcare providers across Argentina are witnessing substantial growth in adoption rates, with 65% of major medical centers now incorporating advanced artificial organ technologies into their treatment protocols.

Technological advancement continues to drive market expansion, with innovations in biocompatible materials, miniaturization, and wireless connectivity enhancing device performance and patient outcomes. The market demonstrates robust growth potential, supported by government healthcare initiatives, increasing medical tourism, and strategic partnerships between international manufacturers and local healthcare institutions. Regional distribution shows concentrated activity in major urban centers, with Buenos Aires, Córdoba, and Rosario leading in terms of adoption and infrastructure development.

The Argentina artificial organs and bionic implants market refers to the comprehensive ecosystem of medical devices, technologies, and services designed to replace, augment, or restore the function of human organs and body systems within the Argentine healthcare landscape. This market encompasses both temporary and permanent medical solutions that utilize advanced bioengineering, electronics, and materials science to address critical medical conditions and improve patient quality of life.

Artificial organs represent sophisticated medical devices that perform the essential functions of natural organs when the original organ fails or becomes compromised. These include mechanical hearts, dialysis systems, artificial lungs, and liver support devices. Bionic implants extend beyond basic replacement to provide enhanced or restored functionality through electronic integration, including cochlear implants for hearing restoration, advanced prosthetics with neural control, and implantable devices for various medical conditions.

The market significance extends beyond mere device provision to encompass comprehensive healthcare solutions including surgical procedures, post-operative care, device maintenance, and ongoing patient support services. Healthcare integration involves collaboration between medical device manufacturers, healthcare providers, regulatory authorities, and insurance systems to ensure effective deployment and accessibility of these life-changing technologies throughout Argentina’s diverse healthcare network.

Argentina’s artificial organs and bionic implants market demonstrates exceptional growth momentum driven by technological innovation, demographic shifts, and expanding healthcare infrastructure. The market encompasses diverse medical device categories serving critical healthcare needs across cardiovascular, renal, auditory, and mobility restoration applications. Key market drivers include increasing prevalence of chronic diseases, aging population demographics, and growing acceptance of advanced medical technologies among healthcare providers and patients.

Market segmentation reveals strong performance across multiple device categories, with cardiovascular artificial organs and auditory bionic implants leading in terms of adoption rates and clinical outcomes. The competitive landscape features both international medical device manufacturers and emerging local companies developing specialized solutions for the Argentine market. Regulatory framework improvements have streamlined device approval processes, contributing to faster market entry for innovative technologies.

Growth projections indicate sustained expansion driven by healthcare modernization initiatives, increasing medical tourism, and strategic investments in research and development. The market benefits from Argentina’s skilled medical workforce, established healthcare infrastructure, and growing emphasis on quality of life improvements through advanced medical interventions. Regional analysis shows concentrated activity in major metropolitan areas, with expansion opportunities in secondary cities and rural healthcare networks.

Strategic market insights reveal several critical factors shaping the Argentina artificial organs and bionic implants landscape. The market demonstrates strong correlation between economic stability and healthcare technology adoption, with periods of economic growth directly translating to increased investment in advanced medical devices and procedures.

Primary market drivers propelling growth in Argentina’s artificial organs and bionic implants sector reflect both demographic trends and technological advancement. The increasing prevalence of chronic diseases, particularly cardiovascular conditions, diabetes, and kidney disease, creates substantial demand for organ replacement and support technologies. Healthcare modernization initiatives by the Argentine government have prioritized investment in advanced medical technologies, creating favorable conditions for market expansion.

Demographic shifts represent a fundamental driver, with Argentina’s aging population requiring increased medical intervention and organ support systems. The growing middle class demonstrates increased willingness to invest in quality healthcare solutions, including advanced artificial organs and bionic implants. Medical tourism growth positions Argentina as a regional hub for complex medical procedures, attracting patients from neighboring countries seeking high-quality, cost-effective treatment options.

Technological innovation continues to drive market adoption through improved device performance, reduced invasiveness, and enhanced patient outcomes. Advances in biocompatible materials, miniaturization, and wireless connectivity make artificial organs and bionic implants more attractive to both healthcare providers and patients. Insurance expansion and healthcare financing improvements increase accessibility, while growing awareness of treatment options drives patient demand for these life-enhancing technologies.

Market restraints in Argentina’s artificial organs and bionic implants sector primarily center around economic volatility, regulatory complexities, and infrastructure limitations. Economic fluctuations characteristic of the Argentine market create uncertainty in healthcare spending and can impact both institutional investment in advanced medical technologies and individual patient access to expensive procedures.

High implementation costs associated with artificial organ programs present significant barriers for smaller healthcare institutions. The substantial investment required for specialized equipment, training, and ongoing maintenance can limit market penetration beyond major medical centers. Skilled workforce limitations in specialized areas of artificial organ implantation and maintenance create bottlenecks in service delivery and market expansion.

Regulatory challenges occasionally slow the introduction of innovative technologies, particularly for novel artificial organ designs or bionic implant systems requiring extensive clinical validation. Import restrictions and currency fluctuations can impact the availability and pricing of international medical devices. Insurance coverage gaps for certain types of artificial organs or experimental bionic implants limit patient access and market growth potential in specific segments.

Significant market opportunities exist within Argentina’s artificial organs and bionic implants sector, driven by unmet medical needs, technological advancement, and expanding healthcare infrastructure. The growing prevalence of chronic diseases creates substantial demand for innovative organ replacement and support solutions. Medical tourism potential positions Argentina to capture regional market share by offering high-quality procedures at competitive pricing compared to developed markets.

Technology integration opportunities include the development of smart artificial organs with remote monitoring capabilities, AI-enhanced bionic implants, and personalized medical devices tailored to individual patient needs. The emergence of 3D printing and bioengineering technologies opens new possibilities for customized organ replacement solutions. Partnership opportunities between international manufacturers and local healthcare providers can accelerate market development and technology transfer.

Rural healthcare expansion represents an underserved market segment with growing potential as telemedicine and mobile healthcare units extend advanced medical services to remote areas. Government healthcare initiatives focused on improving access to specialized medical care create opportunities for innovative service delivery models. Research and development collaborations between universities, hospitals, and industry can position Argentina as a regional innovation hub for artificial organ technologies.

Market dynamics in Argentina’s artificial organs and bionic implants sector reflect complex interactions between healthcare demand, technological innovation, economic conditions, and regulatory frameworks. The market demonstrates cyclical patterns influenced by economic stability, with periods of growth corresponding to increased healthcare investment and improved patient access to advanced medical technologies.

Supply chain dynamics involve sophisticated networks connecting international manufacturers, local distributors, healthcare providers, and support service organizations. The market benefits from Argentina’s strategic location and established trade relationships, facilitating access to global medical device innovations. Competitive dynamics feature both established international players and emerging local companies developing specialized solutions for regional market needs.

Innovation cycles drive continuous market evolution, with new artificial organ technologies and bionic implant systems regularly entering the market. Patient outcome data and clinical evidence increasingly influence adoption decisions, creating demand for proven technologies with demonstrated efficacy. Pricing dynamics reflect balance between advanced technology costs and market accessibility requirements, with successful products offering optimal value propositions for diverse patient populations.

Comprehensive research methodology employed in analyzing Argentina’s artificial organs and bionic implants market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare providers, medical device manufacturers, regulatory officials, and industry experts to gather firsthand insights into market conditions, trends, and challenges.

Secondary research encompasses analysis of government healthcare statistics, medical device registration data, clinical trial information, and industry publications. Hospital procurement records, insurance claim data, and medical tourism statistics provide quantitative insights into market size, growth patterns, and segment performance. MarkWide Research methodology incorporates both quantitative and qualitative analysis techniques to develop comprehensive market understanding.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure information accuracy and reliability. Market modeling incorporates economic indicators, demographic trends, and healthcare policy developments to project future market conditions. Regional analysis methodology includes province-level data collection and urban-rural market segmentation to provide detailed geographic insights into market dynamics and opportunities.

Regional market analysis reveals significant geographic variations in artificial organs and bionic implants adoption across Argentina. Buenos Aires Province dominates the market, accounting for approximately 45% of total market activity, driven by concentration of major medical centers, specialist physicians, and patient populations. The capital region benefits from advanced healthcare infrastructure, international connectivity, and highest per-capita healthcare spending.

Córdoba Province emerges as the second-largest market, representing roughly 15% of national activity, supported by strong medical education institutions and growing healthcare tourism. The region’s medical device manufacturing capabilities and research facilities contribute to market development. Santa Fe Province demonstrates steady growth in artificial organ adoption, particularly in cardiovascular and renal applications, accounting for approximately 12% of market share.

Northern provinces including Tucumán, Salta, and Mendoza show increasing adoption of bionic implant technologies, driven by expanding healthcare infrastructure and government investment in medical services. Southern regions demonstrate growing demand for artificial organ technologies, though market penetration remains limited by geographic challenges and population density. Regional healthcare networks increasingly collaborate to provide specialized services and share advanced medical technologies across provincial boundaries.

Competitive landscape in Argentina’s artificial organs and bionic implants market features diverse participants ranging from global medical device leaders to specialized regional companies. The market structure reflects both international technology providers and local service organizations working collaboratively to deliver comprehensive healthcare solutions.

Market competition focuses on technology innovation, clinical outcomes, cost-effectiveness, and comprehensive patient support services. Companies increasingly emphasize local partnerships, training programs, and service networks to differentiate their offerings in the competitive Argentine healthcare market.

Market segmentation analysis reveals distinct categories within Argentina’s artificial organs and bionic implants sector, each characterized by unique growth patterns, applications, and market dynamics. By Product Type, the market divides into artificial organs and bionic implants, with artificial organs representing the larger segment due to critical life-support applications and established clinical protocols.

By Application:

By End User:

Cardiovascular artificial organs dominate the Argentine market, driven by high prevalence of heart disease and established clinical protocols for cardiac device implantation. This category benefits from comprehensive insurance coverage, experienced surgical teams, and proven patient outcomes. Artificial heart devices show particular strength in major medical centers, with 72% of cardiac procedures now utilizing advanced artificial organ technologies.

Bionic implant categories demonstrate varied growth patterns based on application and patient demographics. Cochlear implants show exceptional adoption rates among pediatric populations, supported by government healthcare programs and early intervention initiatives. Advanced prosthetics and bionic limbs gain traction among younger patient demographics seeking enhanced functionality and quality of life improvements.

Renal artificial organs represent a critical market segment with steady growth driven by increasing diabetes prevalence and kidney disease rates. The category benefits from established dialysis networks and growing acceptance of artificial kidney technologies. Neurological bionic implants emerge as a high-growth category, though adoption remains limited by regulatory requirements and specialized expertise needs. Orthopedic applications show strong potential driven by aging population demographics and increasing sports-related injuries requiring advanced prosthetic solutions.

Healthcare providers benefit significantly from artificial organs and bionic implants market participation through enhanced treatment capabilities, improved patient outcomes, and competitive differentiation. Advanced medical technologies enable hospitals and clinics to offer life-saving procedures previously unavailable, attracting patients and establishing centers of excellence. Revenue diversification through specialized procedures and ongoing device management creates sustainable business models for healthcare institutions.

Patients and families experience transformative benefits including restored organ function, improved quality of life, and extended life expectancy. Bionic implants provide enhanced capabilities and independence, while artificial organs offer critical life support and improved health outcomes. Cost-effectiveness compared to long-term traditional treatments makes these technologies increasingly attractive to patients and insurance providers.

Medical device manufacturers benefit from growing market demand, opportunities for innovation, and partnership development with healthcare providers. The Argentine market offers attractive growth potential with lower competitive intensity compared to developed markets. Government stakeholders benefit from improved healthcare outcomes, reduced long-term healthcare costs, and enhanced national healthcare capabilities. Insurance providers experience long-term cost savings through improved patient outcomes and reduced ongoing treatment requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological integration trends dominate Argentina’s artificial organs and bionic implants market, with smart devices incorporating wireless connectivity, remote monitoring capabilities, and AI-enhanced functionality becoming increasingly prevalent. Miniaturization trends enable less invasive procedures and improved patient comfort, while advanced materials science contributes to better biocompatibility and device longevity.

Personalization trends drive demand for customized artificial organs and bionic implants tailored to individual patient anatomy and needs. 3D printing and bioengineering technologies enable patient-specific device manufacturing, improving outcomes and reducing complications. Telemedicine integration allows remote monitoring and management of artificial organ systems, expanding access to specialized care and improving patient outcomes.

Sustainability trends influence device design and manufacturing, with emphasis on environmentally responsible materials and processes. Cost optimization trends focus on developing affordable solutions without compromising quality, making advanced technologies accessible to broader patient populations. Collaborative care trends emphasize multidisciplinary approaches combining artificial organs, bionic implants, and comprehensive rehabilitation services for optimal patient outcomes.

Recent industry developments in Argentina’s artificial organs and bionic implants sector reflect accelerating innovation and market maturation. Regulatory streamlining initiatives have reduced approval times for new medical devices, encouraging manufacturer investment and technology introduction. Major medical centers have established specialized artificial organ programs, creating centers of excellence and attracting international patients.

Technology partnerships between international manufacturers and Argentine healthcare institutions have accelerated knowledge transfer and local capability development. MWR analysis indicates increasing collaboration between universities, hospitals, and industry in developing next-generation artificial organ technologies. Government healthcare initiatives have expanded coverage for artificial organ procedures, improving patient access and market growth potential.

Investment developments include establishment of regional manufacturing facilities and service centers by major medical device companies. Clinical trial expansion in Argentina provides opportunities for early access to innovative technologies and contributes to global medical device development. Training and education programs have enhanced local expertise in artificial organ implantation and management, supporting sustainable market growth.

Strategic recommendations for market participants focus on sustainable growth strategies that address both opportunities and challenges in Argentina’s artificial organs and bionic implants sector. Healthcare providers should prioritize investment in specialized training and infrastructure to support advanced artificial organ programs, while developing partnerships with international technology providers to access cutting-edge innovations.

Manufacturers should consider local partnership strategies that combine global technology expertise with regional market knowledge and distribution capabilities. Regulatory compliance and quality assurance remain critical success factors, requiring ongoing investment in certification and clinical validation processes. Market entry strategies should emphasize value-based healthcare models that demonstrate clear patient outcomes and cost-effectiveness.

Government stakeholders should continue healthcare infrastructure investment while developing policies that encourage innovation and competition in the artificial organs sector. Insurance providers should evaluate coverage expansion opportunities that balance patient access with cost management objectives. Investment focus should prioritize technologies with proven clinical outcomes and strong market demand, while considering long-term sustainability and competitive positioning.

Future market outlook for Argentina’s artificial organs and bionic implants sector indicates sustained growth driven by demographic trends, technological advancement, and healthcare infrastructure development. Market expansion is projected to continue at a robust pace, with 8.5% annual growth expected over the next five years, supported by increasing disease prevalence and growing acceptance of advanced medical technologies.

Technology evolution will drive next-generation artificial organs with enhanced functionality, improved biocompatibility, and integrated smart features. MarkWide Research projects significant advancement in bionic implant capabilities, including neural interface technologies and AI-enhanced prosthetics. Market accessibility will improve through cost reduction initiatives and expanded insurance coverage, reaching broader patient populations across Argentina.

Regional expansion opportunities will emerge as healthcare infrastructure develops in secondary cities and rural areas. International collaboration will intensify, positioning Argentina as a regional hub for artificial organ procedures and medical tourism. Innovation ecosystems combining research institutions, healthcare providers, and industry will accelerate local technology development and market leadership. Regulatory framework evolution will continue supporting market growth while ensuring patient safety and device efficacy standards.

Argentina’s artificial organs and bionic implants market represents a dynamic and rapidly evolving healthcare sector with substantial growth potential and significant impact on patient outcomes. The market demonstrates strong fundamentals driven by demographic trends, technological innovation, and expanding healthcare infrastructure, positioning Argentina as a regional leader in advanced medical device adoption and clinical excellence.

Market opportunities extend across multiple dimensions including technology development, service delivery, and geographic expansion, while challenges related to economic volatility and infrastructure limitations require strategic management and adaptive approaches. The competitive landscape continues evolving with both international and local participants contributing to market development and innovation advancement.

Future success in this market will depend on continued collaboration between healthcare providers, technology manufacturers, government stakeholders, and insurance systems to ensure sustainable growth, patient accessibility, and clinical excellence. The artificial organs and bionic implants sector will remain a critical component of Argentina’s healthcare modernization efforts, contributing to improved patient outcomes, enhanced quality of life, and strengthened national healthcare capabilities for years to come.

What is Artificial Organs & Bionic Implants?

Artificial organs and bionic implants are medical devices designed to replace or enhance biological functions in the human body. They include products such as artificial hearts, bionic limbs, and other advanced prosthetics that improve the quality of life for patients with organ failure or disabilities.

What are the key players in the Argentina Artificial Organs & Bionic Implants Market?

Key players in the Argentina Artificial Organs & Bionic Implants Market include Medtronic, Boston Scientific, and Zimmer Biomet, which are known for their innovative solutions in the field of medical devices and prosthetics, among others.

What are the growth factors driving the Argentina Artificial Organs & Bionic Implants Market?

The Argentina Artificial Organs & Bionic Implants Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a growing aging population that requires enhanced healthcare solutions.

What challenges does the Argentina Artificial Organs & Bionic Implants Market face?

Challenges in the Argentina Artificial Organs & Bionic Implants Market include high manufacturing costs, regulatory hurdles, and the need for extensive research and development to ensure safety and efficacy of new products.

What future opportunities exist in the Argentina Artificial Organs & Bionic Implants Market?

Future opportunities in the Argentina Artificial Organs & Bionic Implants Market include the development of personalized medicine solutions, advancements in biocompatible materials, and the integration of artificial intelligence in prosthetic devices to enhance functionality.

What trends are shaping the Argentina Artificial Organs & Bionic Implants Market?

Trends in the Argentina Artificial Organs & Bionic Implants Market include the rise of minimally invasive surgical techniques, increased focus on patient-centered design, and the growing use of 3D printing technology for custom implants.

Argentina Artificial Organs & Bionic Implants Market

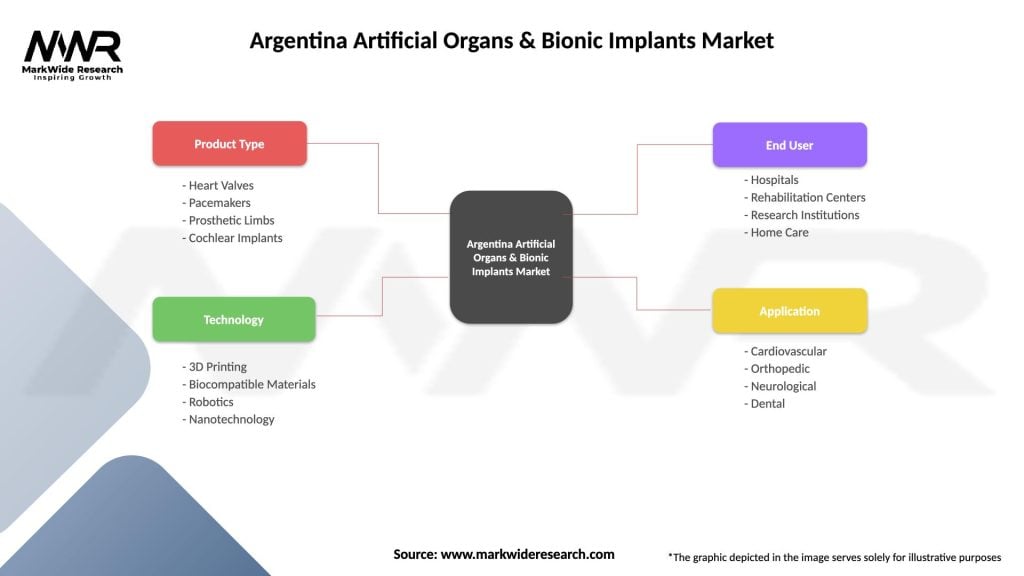

| Segmentation Details | Description |

|---|---|

| Product Type | Heart Valves, Pacemakers, Prosthetic Limbs, Cochlear Implants |

| Technology | 3D Printing, Biocompatible Materials, Robotics, Nanotechnology |

| End User | Hospitals, Rehabilitation Centers, Research Institutions, Home Care |

| Application | Cardiovascular, Orthopedic, Neurological, Dental |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Artificial Organs & Bionic Implants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at