444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The AR automation market represents a transformative convergence of augmented reality technology and industrial automation systems, creating unprecedented opportunities for enhanced operational efficiency and workforce productivity. This rapidly evolving sector encompasses the integration of AR visualization technologies with automated manufacturing processes, warehouse operations, and maintenance procedures across diverse industries.

Market dynamics indicate robust growth driven by increasing demand for smart manufacturing solutions and the need for improved operational visibility. The sector is experiencing significant expansion as organizations recognize the potential of AR-enabled automation to reduce human error, accelerate training processes, and optimize complex industrial workflows. Current adoption rates show 42% of manufacturing companies actively exploring AR automation implementations.

Technology advancement in AR hardware and software platforms continues to drive market evolution, with enhanced processing capabilities and improved user interfaces making AR automation more accessible to mid-market enterprises. The integration of artificial intelligence and machine learning algorithms with AR systems is creating sophisticated automation solutions that can adapt to changing operational requirements in real-time.

Regional distribution shows North America leading adoption with approximately 38% market share, followed by Europe and Asia-Pacific regions demonstrating accelerating implementation rates. The automotive, aerospace, and electronics manufacturing sectors represent the primary growth drivers, collectively accounting for over 60% of current AR automation deployments.

The AR automation market refers to the comprehensive ecosystem of technologies, solutions, and services that combine augmented reality capabilities with automated industrial processes to enhance operational efficiency, reduce errors, and improve workforce productivity across manufacturing, logistics, and maintenance applications.

Core components of AR automation include specialized hardware devices such as smart glasses, tablets, and projection systems, integrated with sophisticated software platforms that overlay digital information onto physical environments. These systems enable workers to receive real-time guidance, access technical documentation, and interact with automated machinery through intuitive visual interfaces.

Functional applications span across multiple operational domains, including assembly line guidance, quality control inspections, predictive maintenance procedures, and complex troubleshooting scenarios. The technology enables seamless integration between human operators and automated systems, creating hybrid workflows that leverage both human expertise and machine precision.

Value proposition centers on the ability to bridge the gap between digital automation systems and human operators, providing contextual information and guidance that enhances decision-making capabilities while maintaining operational continuity. This integration results in reduced training time, improved safety protocols, and enhanced overall equipment effectiveness.

Strategic positioning of the AR automation market reflects a critical inflection point where traditional industrial automation converges with next-generation visualization technologies. Organizations across manufacturing, logistics, and maintenance sectors are increasingly recognizing AR automation as a fundamental component of their digital transformation initiatives.

Growth trajectory demonstrates sustained momentum with projected compound annual growth rates exceeding 25% over the next five years. This expansion is primarily driven by increasing labor shortages in skilled manufacturing roles and the corresponding need for technology solutions that can accelerate workforce development and operational efficiency.

Technology maturation has reached a critical threshold where AR automation solutions deliver measurable return on investment through reduced error rates, decreased training costs, and improved operational throughput. Early adopters report productivity improvements of 30-45% in specific use cases, validating the commercial viability of these integrated solutions.

Market consolidation trends indicate increasing collaboration between traditional automation providers and AR technology specialists, creating comprehensive solution portfolios that address end-to-end operational requirements. This convergence is accelerating market adoption by reducing implementation complexity and improving solution reliability.

Operational transformation through AR automation is fundamentally changing how organizations approach workforce training, maintenance procedures, and quality control processes. The technology enables unprecedented levels of operational visibility and control, creating new paradigms for human-machine collaboration.

Labor shortage challenges across skilled manufacturing and maintenance roles are creating urgent demand for AR automation solutions that can accelerate workforce development and reduce dependency on specialized expertise. Organizations are increasingly investing in technology solutions that can bridge skill gaps while maintaining operational continuity.

Digital transformation initiatives within manufacturing and industrial sectors are driving systematic adoption of AR automation technologies as organizations seek to modernize legacy operations and improve competitive positioning. The integration of AR capabilities with existing automation infrastructure represents a natural evolution of smart manufacturing strategies.

Operational efficiency requirements continue to intensify as organizations face pressure to reduce costs while maintaining quality standards. AR automation delivers measurable improvements in productivity, error reduction, and operational throughput, making it an attractive investment for performance-focused organizations.

Technology accessibility improvements in AR hardware and software platforms are reducing implementation barriers and making AR automation solutions viable for mid-market organizations. Decreasing hardware costs and improved user interfaces are expanding the addressable market significantly.

Regulatory compliance requirements in industries such as aerospace, automotive, and pharmaceuticals are driving adoption of AR automation systems that can provide comprehensive documentation and traceability capabilities. These solutions help organizations maintain compliance while improving operational efficiency.

Implementation complexity remains a significant barrier for organizations considering AR automation adoption, particularly those with legacy infrastructure and limited technical expertise. The integration of AR systems with existing automation platforms requires specialized knowledge and careful planning to ensure successful deployment.

Initial investment requirements for comprehensive AR automation solutions can be substantial, particularly for organizations requiring custom development or extensive system integration. The total cost of ownership includes hardware, software, training, and ongoing maintenance expenses that may challenge budget constraints.

Technology maturity concerns persist among conservative organizations that prefer proven solutions over emerging technologies. Some decision-makers remain cautious about AR automation reliability and long-term viability, preferring to wait for further market validation before committing to implementation.

Workforce resistance to new technology adoption can impede AR automation implementation, particularly in organizations with established operational procedures and experienced personnel who may be reluctant to change existing workflows. Change management becomes critical for successful adoption.

Cybersecurity considerations related to AR automation systems create additional complexity for organizations with strict security requirements. The integration of AR devices with industrial networks raises concerns about potential vulnerabilities and data protection requirements.

Emerging market expansion presents significant growth opportunities as developing economies invest in manufacturing infrastructure and seek to leapfrog traditional automation approaches through advanced AR integration. These markets offer substantial potential for AR automation solution providers.

Industry vertical diversification beyond traditional manufacturing applications is creating new market segments for AR automation technologies. Healthcare, construction, energy, and logistics sectors are beginning to explore AR automation applications, expanding the total addressable market considerably.

Small and medium enterprise adoption represents an underserved market segment with significant growth potential as AR automation solutions become more accessible and cost-effective. Cloud-based platforms and subscription models are making these technologies viable for smaller organizations.

Integration partnerships between AR technology providers and established automation companies create opportunities for comprehensive solution development and market expansion. These collaborations can accelerate technology adoption and improve solution reliability.

Advanced analytics integration with AR automation systems opens new possibilities for predictive insights and operational optimization. The combination of AR visualization with artificial intelligence and machine learning capabilities creates powerful decision-support tools.

Competitive landscape evolution reflects increasing convergence between traditional automation providers and AR technology specialists, creating a dynamic ecosystem of partnerships, acquisitions, and strategic alliances. This consolidation is accelerating innovation while improving solution comprehensiveness.

Technology standardization efforts are beginning to emerge as the market matures, with industry organizations working to establish common protocols and interfaces for AR automation systems. These standards will facilitate interoperability and reduce implementation complexity.

Customer expectations are evolving rapidly as early adopters demonstrate the potential of AR automation solutions. Organizations are increasingly demanding integrated platforms that can address multiple use cases rather than point solutions for specific applications.

Investment patterns show increasing venture capital and private equity interest in AR automation companies, providing funding for research and development activities that are accelerating technology advancement. According to MarkWide Research analysis, investment in AR automation startups has increased by 180% over the past two years.

Regulatory environment development is creating both opportunities and challenges as governments establish guidelines for AR technology use in industrial applications. These regulations will shape market development and influence adoption patterns across different regions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into AR automation market dynamics. Primary research activities include extensive interviews with industry executives, technology providers, and end-user organizations across diverse vertical markets.

Data collection processes incorporate both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, and focus group discussions with key market participants. This multi-faceted approach ensures comprehensive coverage of market trends, challenges, and opportunities.

Industry expert consultation involves engagement with leading technology researchers, automation specialists, and AR development professionals to validate findings and provide additional context for market analysis. These consultations help ensure accuracy and relevance of research conclusions.

Secondary research integration includes analysis of industry publications, patent filings, regulatory documents, and company financial reports to supplement primary research findings. This comprehensive approach provides a complete picture of market dynamics and competitive positioning.

Market modeling techniques utilize advanced statistical analysis and forecasting methodologies to project market growth trends and identify emerging opportunities. These models incorporate multiple variables and scenarios to provide robust market projections.

North American market leadership reflects the region’s advanced manufacturing infrastructure and early adoption of emerging technologies. The United States and Canada demonstrate the highest concentration of AR automation implementations, driven by automotive, aerospace, and electronics manufacturing sectors.

European market development shows strong growth momentum, particularly in Germany, United Kingdom, and France, where Industry 4.0 initiatives are driving systematic adoption of AR automation technologies. The region accounts for approximately 32% of global AR automation deployments, with emphasis on precision manufacturing and automotive applications.

Asia-Pacific expansion represents the fastest-growing regional market, with China, Japan, and South Korea leading adoption efforts. Manufacturing-intensive economies in this region are investing heavily in AR automation to maintain competitive advantages and address labor shortage challenges. Growth rates in this region exceed 35% annually.

Latin American emergence shows increasing interest in AR automation technologies, particularly in Brazil and Mexico, where manufacturing sectors are modernizing operations to compete in global markets. Government initiatives supporting digital transformation are accelerating adoption in this region.

Middle East and Africa development remains in early stages but shows promising growth potential as oil and gas, mining, and manufacturing sectors explore AR automation applications for operational efficiency and safety improvements.

Market leadership is distributed among several categories of companies, including established automation providers, AR technology specialists, and emerging integrated solution providers. The competitive dynamics reflect ongoing consolidation and partnership formation across the ecosystem.

Technology segmentation encompasses multiple AR automation approaches, each addressing specific operational requirements and use cases across different industries and applications.

By Technology Type:

By Application:

By Industry Vertical:

Manufacturing automation integration represents the largest application category, where AR technologies enhance traditional automation systems by providing visual guidance and real-time feedback to human operators. This integration improves overall equipment effectiveness while reducing training requirements.

Maintenance and service applications demonstrate significant growth potential as organizations seek to optimize asset utilization and reduce unplanned downtime. AR automation enables predictive maintenance strategies and improves first-time fix rates for complex equipment repairs.

Training and workforce development applications are gaining traction as organizations address skill shortages and need to accelerate employee onboarding. AR automation provides immersive learning experiences that improve knowledge retention and reduce training time by 40-50%.

Quality control enhancement through AR automation delivers measurable improvements in defect detection and compliance verification. These applications combine automated inspection systems with AR visualization to provide comprehensive quality assurance capabilities.

Remote assistance capabilities enable expert knowledge sharing across distributed operations, reducing travel costs and improving response times for critical maintenance and troubleshooting scenarios. This category shows particular strength in industries with geographically dispersed assets.

Operational efficiency improvements through AR automation deliver measurable benefits across multiple performance metrics, including reduced error rates, improved productivity, and enhanced safety compliance. Organizations report significant improvements in overall equipment effectiveness and operational throughput.

Workforce development acceleration enables organizations to address skill shortages and reduce training costs while improving employee engagement and job satisfaction. AR automation provides intuitive interfaces that make complex procedures more accessible to workers with varying skill levels.

Cost reduction opportunities span across multiple operational areas, including reduced travel expenses for expert support, decreased training costs, and improved first-time fix rates for maintenance activities. These benefits contribute to improved return on investment for AR automation implementations.

Competitive advantage creation through early AR automation adoption enables organizations to differentiate their operations and improve market positioning. Early adopters often achieve sustainable competitive advantages through improved operational capabilities and enhanced customer service.

Risk mitigation benefits include improved safety compliance, reduced human error, and enhanced operational visibility. AR automation systems provide comprehensive documentation and traceability capabilities that support regulatory compliance and quality management requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration with AR automation systems is creating more sophisticated solutions that can adapt to changing conditions and provide predictive insights. This convergence enables autonomous decision-making capabilities and improved operational optimization.

Cloud-based AR platforms are making AR automation more accessible to organizations with limited IT infrastructure, enabling subscription-based models and reducing implementation complexity. This trend is particularly important for small and medium enterprises seeking to adopt AR automation technologies.

5G connectivity enhancement is enabling more responsive and capable AR automation applications, particularly for remote assistance and real-time collaboration scenarios. Improved bandwidth and reduced latency support more sophisticated AR experiences and better integration with cloud-based systems.

Industry-specific solutions are emerging as AR automation providers develop specialized applications tailored to specific vertical markets. This specialization improves solution effectiveness and reduces implementation time for industry-focused deployments.

Collaborative robotics integration combines AR interfaces with collaborative robot systems, creating hybrid automation solutions that leverage both human expertise and robotic precision. This trend represents a significant evolution in human-machine collaboration approaches.

Strategic partnerships between major automation providers and AR technology companies are accelerating solution development and market adoption. These collaborations combine established automation expertise with innovative AR capabilities to create comprehensive industrial solutions.

Technology standardization initiatives are beginning to establish common protocols and interfaces for AR automation systems, facilitating interoperability and reducing integration complexity. Industry organizations are working to develop standards that will support broader market adoption.

Investment acceleration in AR automation startups and established companies reflects growing market confidence and recognition of commercial potential. MWR data indicates venture capital investment in AR automation companies has increased substantially over recent years.

Regulatory framework development is creating clearer guidelines for AR automation implementation in regulated industries, reducing uncertainty and facilitating adoption in sectors such as aerospace, automotive, and pharmaceuticals.

Academic research expansion in AR automation applications is contributing to technology advancement and workforce development, with universities establishing specialized programs and research centers focused on industrial AR applications.

Implementation strategy recommendations emphasize the importance of starting with pilot projects that demonstrate clear value propositions before scaling to enterprise-wide deployments. Organizations should focus on use cases with measurable benefits and manageable complexity for initial implementations.

Technology selection should prioritize solutions that integrate well with existing automation infrastructure and provide clear upgrade paths for future capability enhancement. Organizations should evaluate vendors based on long-term viability and ecosystem support rather than just current feature sets.

Change management becomes critical for successful AR automation adoption, requiring comprehensive training programs and stakeholder engagement strategies. Organizations should invest in workforce development and communication programs to ensure smooth technology transitions.

Partnership evaluation should consider both technology capabilities and implementation support when selecting AR automation providers. Organizations benefit from vendors that provide comprehensive services including training, support, and ongoing system optimization.

ROI measurement frameworks should establish clear metrics for evaluating AR automation success, including productivity improvements, error reduction, and training cost savings. Regular assessment enables optimization and justification for continued investment.

Market evolution projections indicate continued strong growth as AR automation technologies mature and become more accessible to diverse organizations. The convergence of AR with artificial intelligence and machine learning will create increasingly sophisticated automation solutions.

Technology advancement expectations include improved AR hardware with longer battery life, better processing capabilities, and more intuitive user interfaces. These improvements will reduce implementation barriers and expand the addressable market significantly.

Industry adoption is expected to accelerate across new vertical markets as success stories from early adopters demonstrate clear value propositions. Healthcare, construction, and logistics sectors represent significant growth opportunities for AR automation expansion.

Geographic expansion will continue as developing economies invest in manufacturing infrastructure and seek competitive advantages through advanced automation technologies. Asia-Pacific and Latin American markets show particular promise for rapid growth.

Integration sophistication will increase as AR automation systems become more seamlessly integrated with enterprise software platforms and industrial automation systems. This integration will enable more comprehensive operational optimization and decision-making capabilities.

Market transformation through AR automation represents a fundamental shift in how organizations approach industrial operations, workforce development, and operational optimization. The convergence of augmented reality technologies with traditional automation systems is creating unprecedented opportunities for efficiency improvements and competitive advantage.

Growth momentum continues to build as technology maturation, cost reduction, and proven value propositions drive broader market adoption across diverse industries and geographic regions. The AR automation market demonstrates strong fundamentals with sustained investment, innovation, and expanding application areas supporting long-term growth prospects.

Strategic importance of AR automation will continue to increase as organizations recognize its potential to address critical challenges including labor shortages, operational complexity, and competitive pressure. Early adopters are establishing sustainable advantages through improved operational capabilities and enhanced workforce productivity that will be difficult for competitors to replicate.

What is AR Automation?

AR Automation refers to the integration of augmented reality technologies with automation processes to enhance operational efficiency, improve training, and facilitate remote assistance in various industries.

What are the key players in the AR Automation Market?

Key players in the AR Automation Market include companies like PTC, Microsoft, and Vuforia, which are known for their innovative AR solutions and automation technologies, among others.

What are the main drivers of growth in the AR Automation Market?

The main drivers of growth in the AR Automation Market include the increasing demand for enhanced training solutions, the need for improved operational efficiency, and the rising adoption of AR technologies in manufacturing and logistics.

What challenges does the AR Automation Market face?

Challenges in the AR Automation Market include high implementation costs, the need for skilled personnel to manage AR systems, and potential resistance to change from traditional operational practices.

What opportunities exist in the AR Automation Market?

Opportunities in the AR Automation Market include the expansion of AR applications in sectors like healthcare, retail, and education, as well as advancements in AR hardware and software that enhance user experience.

What trends are shaping the AR Automation Market?

Trends shaping the AR Automation Market include the increasing use of AI in AR applications, the development of more user-friendly AR interfaces, and the growing interest in remote collaboration tools that leverage AR technology.

AR Automation Market

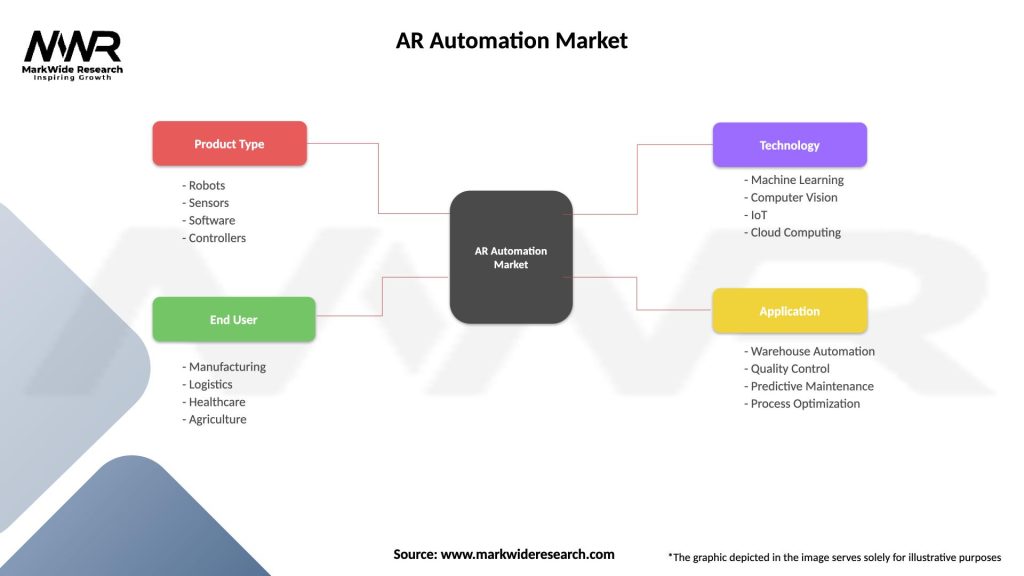

| Segmentation Details | Description |

|---|---|

| Product Type | Robots, Sensors, Software, Controllers |

| End User | Manufacturing, Logistics, Healthcare, Agriculture |

| Technology | Machine Learning, Computer Vision, IoT, Cloud Computing |

| Application | Warehouse Automation, Quality Control, Predictive Maintenance, Process Optimization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the AR Automation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at