444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC wealth management market represents one of the most dynamic and rapidly evolving financial services sectors globally, driven by unprecedented economic growth, rising affluence, and demographic shifts across the Asia-Pacific region. Wealth management services in this region encompass a comprehensive range of financial advisory solutions, including investment management, financial planning, estate planning, tax optimization, and private banking services tailored to high-net-worth individuals and institutional clients.

Market dynamics indicate robust expansion across key economies including China, Japan, India, Australia, Singapore, and Hong Kong, with the sector experiencing significant growth at a compound annual growth rate (CAGR) of 8.2% over the forecast period. Digital transformation initiatives and technological innovations are reshaping traditional wealth management approaches, enabling firms to deliver personalized solutions and enhanced client experiences through advanced analytics and artificial intelligence.

Regional diversification patterns show varying levels of market maturity, with established markets like Japan and Australia demonstrating sophisticated wealth management ecosystems, while emerging economies such as India, Indonesia, and Vietnam present substantial growth opportunities driven by expanding middle-class populations and increasing disposable income levels.

The APAC wealth management market refers to the comprehensive ecosystem of financial services and advisory solutions designed to preserve, grow, and transfer wealth for affluent individuals, families, and institutions across the Asia-Pacific region. This market encompasses traditional investment advisory services, portfolio management, financial planning, and sophisticated wealth preservation strategies.

Wealth management in the APAC context involves a holistic approach to financial stewardship, integrating investment management with comprehensive financial planning services that address clients’ long-term objectives, risk tolerance, and legacy planning requirements. Service providers range from global investment banks and private wealth management firms to boutique advisory practices and emerging digital wealth platforms.

Market participants deliver value through personalized investment strategies, alternative investment access, tax-efficient structuring, and cross-border wealth planning solutions that cater to the unique regulatory environments and cultural preferences prevalent across different APAC jurisdictions.

Strategic analysis reveals that the APAC wealth management market is experiencing transformational growth driven by several converging factors including rapid economic development, demographic transitions, and evolving client expectations for sophisticated financial services. Market penetration rates vary significantly across the region, with mature markets achieving 65% penetration among high-net-worth segments while emerging markets present substantial untapped potential.

Technology adoption is accelerating across the sector, with digital wealth management platforms gaining 42% adoption rates among younger affluent demographics. Regulatory harmonization efforts and cross-border investment facilitation initiatives are creating new opportunities for wealth management firms to expand their service offerings and client base across multiple jurisdictions.

Competitive dynamics are intensifying as traditional wealth managers face increasing competition from fintech disruptors, robo-advisors, and technology-enabled advisory platforms that offer cost-effective solutions and enhanced accessibility. Client preferences are shifting toward integrated digital experiences, sustainable investing options, and personalized advisory relationships that combine human expertise with technological efficiency.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of wealth management services across the Asia-Pacific region:

Economic prosperity across the Asia-Pacific region continues to generate substantial wealth creation opportunities, with rapid GDP growth in emerging markets contributing to expanding high-net-worth populations. Urbanization trends and industrialization processes are creating new sources of wealth, particularly in technology, manufacturing, and services sectors that require sophisticated financial management solutions.

Demographic transitions represent a fundamental driver of market expansion, as aging populations in developed APAC markets require comprehensive retirement planning and wealth preservation strategies. Intergenerational wealth transfer is accelerating, with an estimated $15 trillion in assets expected to change hands over the next two decades, creating substantial opportunities for wealth management firms.

Digital transformation initiatives are enabling wealth managers to reach broader client segments through cost-effective delivery models and enhanced service accessibility. Regulatory reforms promoting financial market development and cross-border investment flows are expanding the scope of wealth management services and creating new business opportunities for innovative service providers.

Cultural shifts toward professional financial advice and sophisticated investment strategies are driving demand for comprehensive wealth management solutions among newly affluent populations who recognize the value of expert guidance in navigating complex financial markets and planning for long-term financial security.

Regulatory complexity across different APAC jurisdictions creates significant compliance challenges for wealth management firms seeking to operate across multiple markets. Varying regulatory standards and reporting requirements increase operational costs and limit the scalability of cross-border wealth management solutions.

Cultural barriers and traditional preferences for conservative investment approaches in certain markets may limit the adoption of sophisticated wealth management strategies and alternative investment solutions. Language diversity and local market knowledge requirements create additional challenges for international wealth management firms seeking to establish meaningful client relationships.

Economic volatility and market uncertainty can impact client confidence and reduce demand for discretionary wealth management services, particularly during periods of financial market stress. Talent shortage in specialized areas such as private banking, family office services, and alternative investments constrains the ability of firms to expand their service capabilities.

Technology infrastructure limitations in some emerging markets may restrict the deployment of advanced digital wealth management platforms and limit the effectiveness of technology-enabled service delivery models. Cybersecurity concerns and data protection requirements add complexity and cost to digital wealth management initiatives.

Emerging market expansion presents substantial growth opportunities as developing APAC economies continue to generate new wealth and expand their affluent populations. Digital wealth management platforms offer significant potential to serve underserved market segments through cost-effective and accessible advisory solutions.

Sustainable investing trends create opportunities for wealth managers to develop specialized ESG investment strategies and impact investing solutions that align with evolving client values and preferences. Family office services represent a high-growth segment as ultra-high-net-worth families seek comprehensive wealth management and family governance solutions.

Cross-border wealth planning services are increasingly important as APAC clients become more globally mobile and require sophisticated international tax planning and investment structuring solutions. Alternative investments access and private market opportunities offer wealth managers the potential to differentiate their service offerings and generate higher fee revenues.

Technology partnerships and fintech collaborations enable traditional wealth managers to enhance their digital capabilities and reach new client segments through innovative service delivery models. Regulatory harmonization initiatives across APAC markets may create opportunities for more efficient cross-border operations and expanded service offerings.

Competitive forces within the APAC wealth management market are intensifying as traditional players face increasing pressure from digital disruptors and technology-enabled advisory platforms. Client expectations are evolving rapidly, with demands for personalized service, transparent pricing, and integrated digital experiences driving innovation across the sector.

Market consolidation trends are evident as larger wealth management firms acquire specialized boutiques and technology platforms to enhance their service capabilities and expand their market reach. Partnership strategies between traditional wealth managers and fintech companies are becoming increasingly common as firms seek to leverage complementary strengths and capabilities.

Pricing pressure from low-cost digital platforms is forcing traditional wealth managers to demonstrate clear value propositions and justify premium pricing through superior service quality and specialized expertise. Regulatory changes continue to reshape market dynamics, with new rules affecting fee structures, fiduciary responsibilities, and cross-border operations.

Technology integration is becoming a critical success factor, with firms investing heavily in artificial intelligence, data analytics, and digital client engagement platforms to maintain competitive advantages and improve operational efficiency by 35% on average.

Comprehensive analysis of the APAC wealth management market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, wealth management professionals, and key stakeholders across major APAC markets.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and market data from reputable sources to validate findings and provide comprehensive market coverage. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify emerging opportunities.

Regional expertise is incorporated through collaboration with local market specialists and industry experts who provide insights into market-specific dynamics, regulatory environments, and cultural factors affecting wealth management adoption. Data validation processes ensure accuracy and consistency across all research findings and market projections.

Continuous monitoring of market developments, regulatory changes, and competitive dynamics enables real-time updates to market analysis and ensures relevance of research findings for strategic decision-making purposes.

China represents the largest and fastest-growing wealth management market in the APAC region, driven by rapid economic development and an expanding high-net-worth population. Market penetration rates are increasing rapidly, with 28% of affluent households now utilizing professional wealth management services, up from previous years.

Japan maintains a mature and sophisticated wealth management ecosystem, characterized by established private banking relationships and conservative investment preferences. Digital adoption is accelerating among younger demographics, with 45% of millennial investors utilizing technology-enabled advisory platforms.

India presents significant growth potential with its expanding middle class and increasing entrepreneurial wealth creation. Market development is supported by regulatory reforms and growing awareness of professional financial advisory services, with 18% annual growth in wealth management adoption rates.

Australia and Singapore serve as regional wealth management hubs, offering sophisticated financial services infrastructure and favorable regulatory environments for international wealth planning. Cross-border services account for 35% of total wealth management activities in these markets.

Southeast Asian markets including Indonesia, Thailand, and Vietnam are emerging as high-growth opportunities driven by economic development and increasing affluence among urban populations.

Market leadership in the APAC wealth management sector is characterized by a diverse mix of global investment banks, regional private banks, and emerging digital platforms competing across different client segments and service categories.

Competitive differentiation strategies focus on specialized expertise, technology integration, and personalized service delivery to attract and retain high-value clients in an increasingly competitive market environment.

By Client Segment:

By Service Type:

By Delivery Model:

Investment Management Services represent the largest category within the APAC wealth management market, driven by growing client sophistication and demand for professional portfolio management. Asset allocation strategies are becoming increasingly complex as clients seek diversification across traditional and alternative investment classes.

Financial Planning Services are experiencing rapid growth as clients recognize the value of comprehensive financial advice beyond investment management. Retirement planning is particularly important in aging APAC societies, with 72% of affluent clients prioritizing long-term financial security planning.

Private Banking Services cater to ultra-high-net-worth clients requiring exclusive banking relationships and specialized financial solutions. Credit facilities and structured products are key components of private banking offerings that generate significant revenue for wealth management firms.

Estate Planning Services are gaining importance as first-generation entrepreneurs and business owners prepare for wealth transfer to subsequent generations. Cross-border estate planning is particularly complex in the APAC region due to varying tax regimes and inheritance laws.

Digital Wealth Management platforms are disrupting traditional service delivery models by offering cost-effective solutions and enhanced accessibility. Robo-advisory services are gaining 25% annual adoption growth among younger demographics seeking efficient investment management solutions.

Wealth Management Firms benefit from expanding market opportunities, diversified revenue streams, and the potential for sustainable long-term client relationships that generate recurring fee income. Technology integration enables firms to improve operational efficiency and serve broader client segments through scalable service delivery models.

High-Net-Worth Clients gain access to sophisticated investment strategies, professional financial guidance, and comprehensive wealth planning solutions that help preserve and grow their assets over time. Personalized service and specialized expertise provide value that justifies premium pricing for wealth management services.

Financial Advisors benefit from enhanced career opportunities, access to advanced technology platforms, and the ability to serve affluent client segments through comprehensive wealth management solutions. Professional development opportunities in specialized areas create pathways for career advancement and increased compensation.

Technology Providers find significant opportunities to develop innovative solutions for wealth management firms seeking to enhance their digital capabilities and improve client experiences. Partnership opportunities with established wealth managers provide access to large client bases and recurring revenue streams.

Regulatory Authorities benefit from increased financial market development, enhanced investor protection, and improved capital market efficiency through professional wealth management services that promote sound investment practices and financial stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Approaches are transforming wealth management service delivery, with firms investing heavily in artificial intelligence, machine learning, and data analytics to provide personalized investment recommendations and enhance client engagement. Mobile-first platforms are becoming essential for reaching younger affluent demographics who expect seamless digital experiences.

Sustainable Investing Integration is gaining momentum as clients increasingly prioritize environmental, social, and governance factors in their investment decisions. ESG investment strategies are becoming mainstream offerings rather than niche products, with 58% of wealthy investors expressing interest in sustainable investment options.

Personalization at Scale represents a key trend as wealth managers leverage technology to deliver customized solutions while maintaining operational efficiency. Behavioral analytics and predictive modeling enable firms to anticipate client needs and provide proactive advisory services.

Alternative Investment Access is expanding as wealth managers seek to differentiate their offerings through exclusive investment opportunities in private equity, hedge funds, real estate, and other alternative asset classes previously available only to institutional investors.

Regulatory Technology (RegTech) adoption is accelerating as firms seek to manage compliance requirements more efficiently and reduce regulatory risks through automated monitoring and reporting solutions.

Strategic partnerships between traditional wealth managers and fintech companies are reshaping the competitive landscape, with established firms acquiring or partnering with technology providers to enhance their digital capabilities and reach new client segments.

Regulatory reforms across major APAC markets are creating new opportunities for cross-border wealth management services and improving market access for international firms. MarkWide Research analysis indicates that regulatory harmonization efforts are facilitating greater market integration and service standardization.

Technology investments in artificial intelligence, blockchain, and advanced analytics are enabling wealth managers to improve investment decision-making, enhance risk management, and provide more sophisticated client services. Digital transformation initiatives are becoming critical for competitive survival in the evolving market landscape.

Market consolidation activities include strategic acquisitions of boutique wealth management firms by larger institutions seeking to expand their geographic presence and specialized expertise. Talent acquisition strategies focus on recruiting experienced professionals with deep local market knowledge and client relationships.

Product innovation efforts are concentrated on developing new investment solutions, alternative asset access, and integrated financial planning tools that address evolving client needs and preferences in the dynamic APAC market environment.

Technology Integration should be a top priority for wealth management firms seeking to remain competitive in the evolving APAC market. Investment in digital platforms and data analytics capabilities will be essential for delivering personalized services and improving operational efficiency.

Market Expansion Strategies should focus on emerging APAC markets with growing affluent populations and underdeveloped wealth management infrastructure. Local partnerships and joint ventures can provide market access and regulatory expertise necessary for successful expansion.

Talent Development initiatives should prioritize recruiting and training wealth management professionals with specialized expertise in areas such as alternative investments, sustainable investing, and cross-border planning. Continuous education programs will be necessary to keep pace with evolving client needs and market developments.

Regulatory Compliance capabilities must be strengthened to navigate the complex and evolving regulatory environment across APAC markets. RegTech solutions and automated compliance monitoring systems can help manage regulatory risks and reduce operational costs.

Client Experience Enhancement through personalized service delivery and integrated digital experiences will be critical for client retention and acquisition. Omnichannel approaches that combine human expertise with digital efficiency will likely prove most effective in meeting diverse client preferences.

Long-term growth prospects for the APAC wealth management market remain highly favorable, supported by continued economic development, demographic trends, and increasing financial sophistication among affluent populations. Market expansion is expected to accelerate in emerging economies as regulatory frameworks mature and wealth creation continues.

Technology evolution will continue to reshape service delivery models, with artificial intelligence and machine learning becoming increasingly important for investment decision-making and client engagement. Digital-native platforms are projected to capture 40% market share among younger affluent demographics within the next decade.

Sustainable investing trends are expected to accelerate, with ESG considerations becoming integral to mainstream investment strategies rather than specialized offerings. Impact investing and climate-focused solutions will likely represent significant growth areas for innovative wealth managers.

Cross-border wealth management services will become increasingly important as APAC clients become more globally mobile and require sophisticated international planning solutions. Regulatory harmonization efforts may facilitate more efficient cross-border operations and expanded service offerings.

Market consolidation is likely to continue as smaller firms seek scale and resources to compete effectively, while larger institutions acquire specialized capabilities and market access through strategic acquisitions and partnerships. MWR projections suggest that market concentration will increase moderately while maintaining healthy competition levels.

The APAC wealth management market represents one of the most compelling growth opportunities in the global financial services sector, driven by robust economic development, favorable demographic trends, and increasing financial sophistication among affluent populations across the region. Market dynamics indicate sustained expansion potential, with emerging economies offering particularly attractive growth prospects for innovative service providers.

Technology integration and digital transformation initiatives are reshaping traditional wealth management models, enabling firms to deliver personalized solutions at scale while improving operational efficiency and client engagement. Sustainable investing trends and evolving client preferences are creating new opportunities for differentiation and value creation in an increasingly competitive market environment.

Strategic success in the APAC wealth management market will require firms to balance technological innovation with personalized service delivery, navigate complex regulatory environments, and develop deep local market expertise while maintaining global capabilities. Long-term prospects remain highly favorable for organizations that can effectively adapt to evolving market conditions and client expectations while building sustainable competitive advantages through specialized expertise and superior service quality.

What is Wealth Management?

Wealth management refers to a comprehensive financial service that combines investment management, financial planning, and advisory services tailored to high-net-worth individuals and families. It encompasses various aspects such as asset allocation, tax planning, and estate planning.

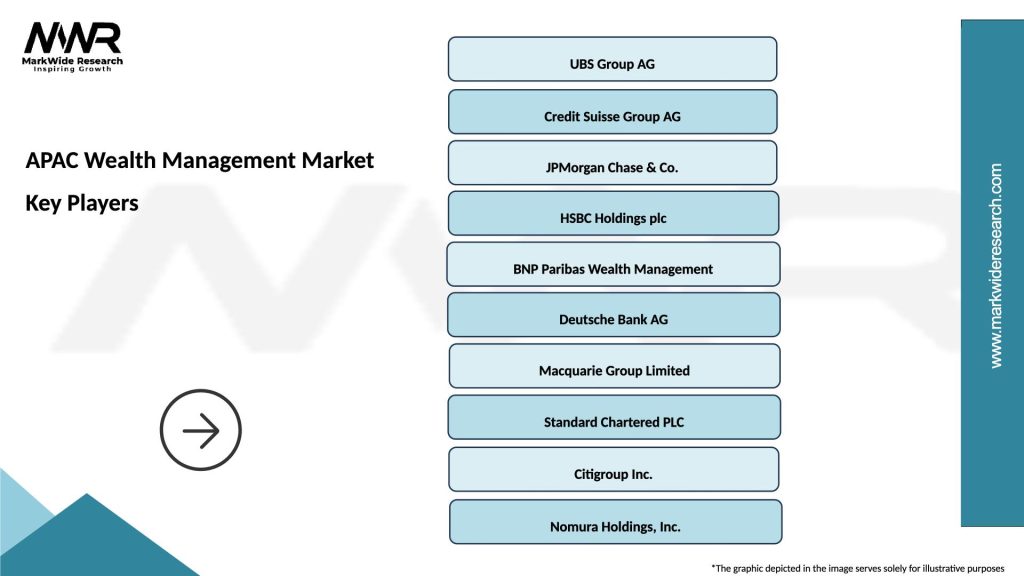

What are the key players in the APAC Wealth Management Market?

Key players in the APAC Wealth Management Market include UBS, Credit Suisse, and HSBC, which offer a range of services from investment advice to estate planning. These companies compete to attract affluent clients by providing personalized financial solutions and innovative investment strategies, among others.

What are the growth factors driving the APAC Wealth Management Market?

The APAC Wealth Management Market is driven by increasing disposable incomes, a growing number of high-net-worth individuals, and rising demand for personalized financial services. Additionally, the expansion of digital platforms is enhancing accessibility to wealth management services.

What challenges does the APAC Wealth Management Market face?

Challenges in the APAC Wealth Management Market include regulatory compliance, market volatility, and the need for firms to adapt to rapidly changing client expectations. These factors can impact service delivery and client retention in a competitive landscape.

What opportunities exist in the APAC Wealth Management Market?

Opportunities in the APAC Wealth Management Market include the increasing adoption of technology-driven solutions, such as robo-advisors, and the potential for expansion into emerging markets. Additionally, there is a growing focus on sustainable investing, which presents new avenues for wealth management firms.

What trends are shaping the APAC Wealth Management Market?

Trends in the APAC Wealth Management Market include the rise of digital wealth management platforms, a shift towards ESG (Environmental, Social, and Governance) investing, and an emphasis on holistic financial planning. These trends reflect changing client preferences and the evolving landscape of financial services.

APAC Wealth Management Market

| Segmentation Details | Description |

|---|---|

| Customer Type | High Net Worth Individuals, Ultra High Net Worth Individuals, Mass Affluent, Institutional Investors |

| Service Type | Investment Advisory, Wealth Planning, Tax Optimization, Estate Planning |

| Distribution Channel | Private Banks, Independent Financial Advisors, Online Platforms, Family Offices |

| Investment Strategy | Active Management, Passive Management, Alternative Investments, Sustainable Investing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Wealth Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at