444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC smart manufacturing market represents a transformative shift in industrial production across Asia-Pacific, encompassing advanced technologies that revolutionize traditional manufacturing processes. This dynamic market spans countries including China, Japan, South Korea, India, Australia, and Southeast Asian nations, where manufacturers are increasingly adopting Industry 4.0 technologies to enhance operational efficiency and competitiveness.

Smart manufacturing initiatives across the APAC region are experiencing unprecedented growth, driven by the integration of Internet of Things (IoT), artificial intelligence, machine learning, and advanced analytics into production environments. The market demonstrates robust expansion with a projected CAGR of 12.8% through the forecast period, reflecting the region’s commitment to digital transformation and manufacturing excellence.

Regional dynamics indicate that China leads the market adoption with approximately 45% market share, followed by Japan and South Korea as significant contributors to technological advancement. The proliferation of connected devices and automated systems has created an ecosystem where manufacturers can achieve real-time visibility, predictive maintenance, and optimized resource utilization across their operations.

Government initiatives across APAC countries, including China’s “Made in China 2025” strategy and Japan’s “Society 5.0” vision, are accelerating smart manufacturing adoption rates, with industrial digitization reaching 78% penetration in leading manufacturing hubs.

The APAC smart manufacturing market refers to the comprehensive ecosystem of interconnected technologies, systems, and processes that enable intelligent, data-driven production capabilities across Asia-Pacific manufacturing facilities. This market encompasses the integration of cyber-physical systems, IoT sensors, cloud computing, and advanced analytics to create autonomous and adaptive manufacturing environments.

Smart manufacturing in the APAC context involves the seamless connection of machines, systems, and human operators through digital networks that facilitate real-time data exchange and decision-making. The concept extends beyond traditional automation to include cognitive manufacturing capabilities that can learn, adapt, and optimize production processes continuously.

Key components of this market include industrial IoT platforms, edge computing solutions, digital twin technologies, predictive analytics software, and collaborative robotics systems. These technologies work synergistically to create manufacturing environments that can respond dynamically to changing market demands, supply chain disruptions, and quality requirements.

Market transformation across the APAC smart manufacturing landscape is characterized by rapid technological adoption and significant investment in digital infrastructure. The region’s manufacturing sector is experiencing a fundamental shift from traditional production methods to intelligent, connected systems that deliver enhanced productivity and operational excellence.

Technology integration rates have accelerated dramatically, with 85% of manufacturers in major APAC markets implementing at least one smart manufacturing technology. This widespread adoption is driven by the need to improve efficiency, reduce costs, and maintain competitive advantages in global markets.

Investment patterns reveal strong commitment to digital transformation, with manufacturers allocating substantial resources to IoT infrastructure, data analytics platforms, and workforce development programs. The focus on sustainable manufacturing practices has also emerged as a key driver, with smart technologies enabling 30% reduction in energy consumption and waste generation.

Market segmentation shows diverse applications across automotive, electronics, pharmaceuticals, food and beverage, and textile industries, each leveraging smart manufacturing technologies to address specific operational challenges and market requirements.

Strategic insights from the APAC smart manufacturing market reveal several critical trends shaping the industry’s future trajectory:

Emerging applications include predictive maintenance systems that reduce downtime by 25%, digital twin implementations for virtual prototyping, and autonomous quality control systems that eliminate human error in critical processes.

Primary drivers propelling the APAC smart manufacturing market include the urgent need for operational efficiency improvements and competitive differentiation in increasingly complex global markets. Manufacturers are responding to pressure for faster time-to-market, higher quality standards, and cost optimization through strategic technology adoption.

Labor shortage challenges across developed APAC markets, particularly in Japan and South Korea, are accelerating automation and smart manufacturing investments. The aging workforce and declining birth rates have created critical skill gaps that intelligent manufacturing systems can address through automated processes and enhanced human-machine collaboration.

Government support through policy initiatives, funding programs, and regulatory frameworks is significantly driving market growth. National strategies promoting digital transformation, such as India’s “Digital India” initiative and Singapore’s “Smart Nation” program, provide substantial incentives for manufacturers to adopt smart technologies.

Supply chain complexity and the need for greater visibility and control are compelling manufacturers to implement connected systems that provide real-time insights into production processes, inventory levels, and logistics operations. The COVID-19 pandemic highlighted vulnerabilities in traditional supply chains, accelerating smart manufacturing adoption as a resilience strategy.

Customer expectations for personalized products and shorter delivery times are driving manufacturers to implement flexible, responsive production systems capable of handling diverse product variations and rapid order changes without significant setup costs or delays.

Implementation challenges represent significant barriers to smart manufacturing adoption across APAC markets, particularly for small and medium-sized enterprises (SMEs) that may lack the technical expertise and financial resources required for comprehensive digital transformation initiatives.

Cybersecurity concerns continue to impede adoption rates, as manufacturers worry about potential vulnerabilities in connected systems and the risk of intellectual property theft or operational disruption through cyber attacks. The interconnected nature of smart manufacturing systems creates multiple entry points for potential security breaches.

Integration complexity with existing legacy systems poses substantial technical challenges, requiring significant time and resources to ensure seamless connectivity between new smart technologies and established manufacturing infrastructure. Many manufacturers struggle with the complexity of integrating diverse systems from multiple vendors.

Skills shortage in advanced manufacturing technologies limits implementation success, as organizations struggle to find qualified personnel capable of managing and maintaining sophisticated smart manufacturing systems. The rapid pace of technological change often outpaces workforce development efforts.

High initial investment requirements can deter manufacturers from pursuing comprehensive smart manufacturing transformations, particularly when return on investment timelines are uncertain or extended. The need for substantial upfront capital expenditure creates financial barriers for many organizations.

Emerging opportunities in the APAC smart manufacturing market are creating new avenues for growth and innovation, particularly in areas where traditional manufacturing approaches have proven inadequate or inefficient.

Artificial intelligence integration presents substantial opportunities for manufacturers to implement predictive analytics, autonomous decision-making systems, and intelligent process optimization. AI-powered manufacturing systems can analyze vast amounts of production data to identify patterns, predict failures, and optimize operations in real-time.

Edge computing adoption is creating opportunities for reduced latency, improved data security, and enhanced system reliability in manufacturing environments. By processing data closer to the source, manufacturers can achieve faster response times and reduce dependence on cloud connectivity.

Collaborative robotics represents a growing opportunity as manufacturers seek to combine human expertise with robotic precision and consistency. Cobots are becoming increasingly sophisticated and affordable, making them accessible to a broader range of manufacturing applications.

Sustainability initiatives are driving demand for smart manufacturing solutions that can monitor and optimize energy consumption, reduce waste, and improve resource efficiency. Environmental regulations and corporate sustainability commitments are creating market opportunities for green manufacturing technologies.

Digital twin technology offers opportunities for virtual prototyping, process simulation, and predictive modeling that can significantly reduce development costs and time-to-market for new products and processes.

Market dynamics in the APAC smart manufacturing sector are characterized by rapid technological evolution, shifting competitive landscapes, and evolving customer requirements that collectively drive continuous innovation and adaptation.

Technology convergence is reshaping market dynamics as previously separate technologies integrate to create comprehensive manufacturing solutions. The convergence of IoT, AI, robotics, and cloud computing is enabling new business models and value propositions that were previously impossible.

Competitive pressure from global manufacturers is intensifying the need for smart manufacturing adoption, as companies seek to maintain cost competitiveness while improving quality and flexibility. Manufacturers that fail to adopt smart technologies risk losing market share to more agile competitors.

Regulatory evolution is influencing market dynamics as governments implement new standards for data privacy, cybersecurity, and environmental compliance. These regulations are shaping technology development priorities and implementation strategies across the region.

Partnership ecosystems are becoming increasingly important as manufacturers collaborate with technology providers, system integrators, and research institutions to develop and implement smart manufacturing solutions. These partnerships are accelerating innovation and reducing implementation risks.

Data monetization opportunities are creating new revenue streams for manufacturers who can effectively collect, analyze, and leverage production data to improve operations and create value-added services for customers.

Comprehensive research methodology employed in analyzing the APAC smart manufacturing market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights and projections.

Primary research involves extensive interviews with industry executives, technology providers, system integrators, and end-users across major APAC markets. These interviews provide firsthand insights into market trends, challenges, and opportunities from key stakeholders actively involved in smart manufacturing implementation.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and academic research papers to gather comprehensive market data and validate primary research findings. This approach ensures broad market coverage and historical context.

Market modeling techniques utilize statistical analysis and forecasting methods to project market growth trends, segment performance, and regional dynamics. These models incorporate multiple variables including economic indicators, technology adoption rates, and industry-specific factors.

Expert validation processes involve review and verification of research findings by industry experts and thought leaders to ensure accuracy and relevance of market analysis and projections.

China dominates the APAC smart manufacturing market with approximately 45% regional market share, driven by massive government investment in Industry 4.0 initiatives and the world’s largest manufacturing base. Chinese manufacturers are rapidly adopting smart technologies across automotive, electronics, and heavy machinery sectors.

Japan represents the second-largest market with 22% market share, leveraging its advanced robotics capabilities and precision manufacturing expertise. Japanese companies are leading in collaborative robotics and AI-powered quality control systems, with particularly strong adoption in automotive and electronics manufacturing.

South Korea accounts for 15% market share, with strong government support through the “Korean New Deal” initiative promoting digital transformation. The country’s advanced semiconductor and shipbuilding industries are driving demand for sophisticated smart manufacturing solutions.

India is emerging as a significant growth market with 12% market share, supported by the “Make in India” initiative and increasing foreign investment in manufacturing. The country’s large textile, pharmaceutical, and automotive sectors are gradually adopting smart manufacturing technologies.

Southeast Asian markets collectively represent 6% market share, with countries like Thailand, Malaysia, and Vietnam experiencing rapid growth in smart manufacturing adoption, particularly in electronics assembly and food processing industries.

Market leadership in the APAC smart manufacturing sector is characterized by a diverse ecosystem of global technology giants, regional specialists, and emerging innovators competing across different technology segments and application areas.

Regional players are also gaining prominence, with companies like Foxconn in Taiwan and Tata Consultancy Services in India developing specialized smart manufacturing solutions tailored to local market needs and requirements.

Technology segmentation of the APAC smart manufacturing market reveals diverse adoption patterns across different technological categories and application areas:

By Technology:

By Industry:

Industrial IoT category represents the largest segment with 35% market share, driven by the fundamental need for connectivity and data collection in smart manufacturing environments. IoT sensors and platforms provide the foundation for all other smart manufacturing technologies.

Artificial intelligence applications are experiencing the fastest growth with 18.5% CAGR, as manufacturers increasingly recognize the value of predictive analytics, autonomous decision-making, and intelligent process optimization in improving operational efficiency.

Robotics segment maintains strong growth momentum, particularly in collaborative robotics applications where human-robot collaboration is becoming increasingly sophisticated and widespread across diverse manufacturing applications.

Digital twin technology is emerging as a high-value category, enabling manufacturers to create virtual replicas of physical systems for simulation, optimization, and predictive maintenance applications.

Industry-specific solutions are gaining traction as manufacturers seek tailored smart manufacturing platforms that address unique operational requirements and regulatory compliance needs in their respective sectors.

Manufacturers benefit from smart manufacturing implementation through significant operational improvements including 25% reduction in production costs, enhanced quality control, and improved supply chain visibility that enables more responsive and efficient operations.

Technology providers gain access to expanding market opportunities as manufacturers increasingly invest in digital transformation initiatives. The recurring revenue model from software subscriptions and maintenance services provides stable, long-term income streams.

System integrators benefit from growing demand for implementation services, customization, and ongoing support as manufacturers require specialized expertise to successfully deploy and maintain smart manufacturing systems.

Workers and employees benefit from enhanced job satisfaction and safety as smart manufacturing systems eliminate dangerous tasks and provide tools that augment human capabilities rather than replacing workers entirely.

Customers benefit from improved product quality, faster delivery times, and increased customization options as smart manufacturing enables more flexible and responsive production capabilities.

Governments benefit from increased industrial competitiveness, job creation in high-tech sectors, and improved environmental outcomes as smart manufacturing technologies enable more sustainable production practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing adoption is accelerating as manufacturers seek to reduce latency and improve system reliability by processing data closer to production equipment. This trend is enabling real-time decision-making and reducing dependence on cloud connectivity.

Collaborative robotics expansion continues to gain momentum as cobots become more sophisticated and affordable, enabling human-robot collaboration in diverse manufacturing applications from assembly to quality control.

Sustainability integration is becoming a central focus as manufacturers implement smart technologies to monitor and optimize energy consumption, reduce waste, and improve environmental compliance with 40% efficiency improvements in resource utilization.

Digital twin proliferation is expanding beyond individual machines to encompass entire production lines and facilities, enabling comprehensive virtual modeling and simulation capabilities for process optimization and predictive maintenance.

5G network deployment is enabling new smart manufacturing applications requiring high-speed, low-latency connectivity for real-time control and monitoring of production processes.

Artificial intelligence advancement is creating opportunities for autonomous manufacturing systems capable of self-optimization and adaptive responses to changing production requirements and market conditions.

Strategic partnerships between technology providers and manufacturers are accelerating smart manufacturing implementation through collaborative development of industry-specific solutions and shared risk models that reduce implementation barriers.

Government initiatives across APAC countries are providing substantial funding and policy support for smart manufacturing adoption, with programs like China’s “Made in China 2025” and Japan’s “Connected Industries” driving market growth.

Technology convergence is creating integrated platforms that combine IoT, AI, robotics, and analytics into comprehensive smart manufacturing ecosystems, according to MarkWide Research analysis of market developments.

Cybersecurity enhancements are addressing growing concerns about connected manufacturing systems through development of security-by-design approaches and advanced threat detection capabilities.

Workforce development programs are expanding to address skills gaps through partnerships between manufacturers, educational institutions, and government agencies focused on smart manufacturing competencies.

Standards development is progressing through industry collaboration on interoperability standards that enable seamless integration of diverse smart manufacturing technologies and systems.

Strategic recommendations for manufacturers considering smart manufacturing implementation include starting with pilot projects in specific production areas to demonstrate value and build organizational confidence before pursuing comprehensive transformation initiatives.

Technology selection should prioritize interoperability and scalability to ensure that initial investments can be expanded and integrated with future technology additions. Manufacturers should avoid vendor lock-in situations that limit future flexibility.

Workforce preparation requires immediate attention through training programs and change management initiatives that help employees adapt to new technologies and work processes. Successful implementation depends on human acceptance and capability development.

Cybersecurity planning must be integrated from the beginning of smart manufacturing initiatives rather than added as an afterthought. Security considerations should influence technology selection and implementation approaches.

Partnership strategies should leverage the expertise of system integrators and technology providers to accelerate implementation and reduce risks associated with complex technology deployments.

Performance measurement systems should be established to track the impact of smart manufacturing investments on key operational metrics including productivity, quality, and cost reduction to justify continued investment and expansion.

Market trajectory for APAC smart manufacturing indicates continued strong growth driven by technological advancement, government support, and increasing competitive pressure for operational excellence. MWR projections suggest sustained expansion across all major market segments and geographic regions.

Technology evolution will focus on increased automation, artificial intelligence integration, and autonomous manufacturing systems capable of self-optimization and adaptive responses to changing market conditions. The convergence of multiple technologies will create more comprehensive and capable manufacturing platforms.

Industry transformation will accelerate as successful early adopters demonstrate significant competitive advantages, compelling other manufacturers to pursue smart manufacturing initiatives to maintain market position and operational efficiency.

Regional development patterns suggest that emerging markets in Southeast Asia and India will experience rapid growth as manufacturing capacity expands and government support for digital transformation increases.

Investment trends indicate continued strong capital allocation to smart manufacturing technologies, with particular focus on AI-powered systems, collaborative robotics, and sustainable manufacturing solutions that address environmental compliance requirements.

Market maturation will bring standardization, improved interoperability, and reduced implementation costs, making smart manufacturing technologies accessible to a broader range of manufacturers including small and medium-sized enterprises.

The APAC smart manufacturing market represents a fundamental transformation in industrial production, driven by technological innovation, government support, and competitive necessity. The region’s manufacturing sector is experiencing unprecedented digitalization that promises to reshape global manufacturing competitiveness and operational excellence standards.

Market dynamics indicate robust growth prospects with expanding adoption across diverse industries and geographic regions. The convergence of IoT, AI, robotics, and analytics is creating comprehensive manufacturing ecosystems that deliver significant operational improvements and competitive advantages for early adopters.

Strategic implications for manufacturers include the urgent need to develop digital transformation roadmaps that balance immediate operational improvements with long-term technological evolution. Success requires careful planning, strategic partnerships, and commitment to workforce development and change management initiatives.

Future success in the APAC smart manufacturing market will depend on manufacturers’ ability to effectively integrate advanced technologies while maintaining focus on operational excellence, customer satisfaction, and sustainable business practices that create lasting competitive advantages in increasingly complex global markets.

What is Smart Manufacturing?

Smart Manufacturing refers to the use of advanced technologies and data analytics to optimize manufacturing processes, enhance productivity, and improve product quality. It encompasses automation, IoT, AI, and real-time data integration to create more efficient and flexible production systems.

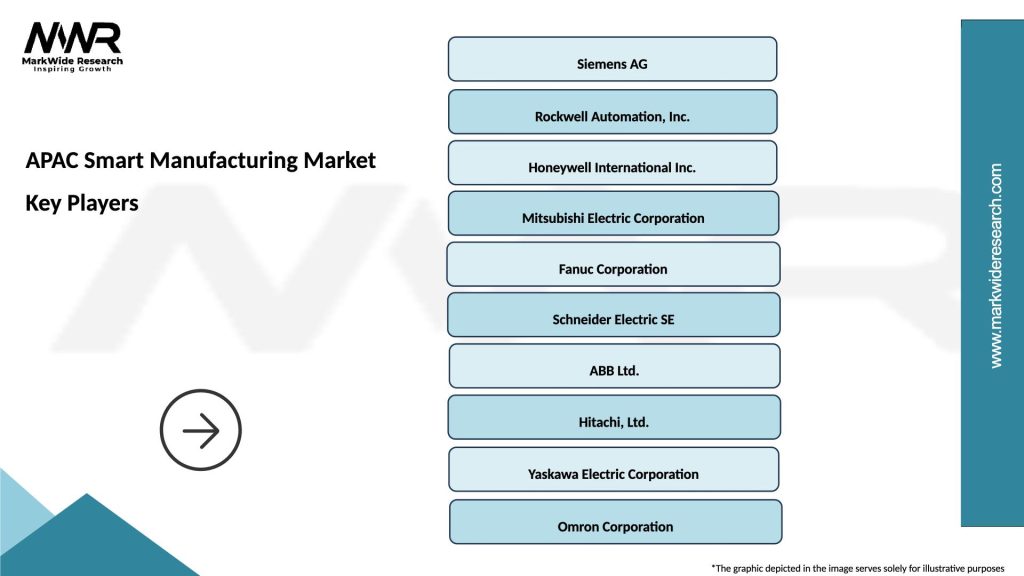

What are the key players in the APAC Smart Manufacturing Market?

Key players in the APAC Smart Manufacturing Market include Siemens AG, Mitsubishi Electric Corporation, and Rockwell Automation, among others. These companies are known for their innovative solutions in automation, robotics, and smart factory technologies.

What are the main drivers of the APAC Smart Manufacturing Market?

The main drivers of the APAC Smart Manufacturing Market include the increasing demand for operational efficiency, the rise of Industry Four Point Zero, and the growing adoption of IoT technologies. These factors are pushing manufacturers to invest in smart solutions to remain competitive.

What challenges does the APAC Smart Manufacturing Market face?

Challenges in the APAC Smart Manufacturing Market include high initial investment costs, a shortage of skilled workforce, and cybersecurity risks. These factors can hinder the adoption of smart manufacturing technologies across various industries.

What opportunities exist in the APAC Smart Manufacturing Market?

Opportunities in the APAC Smart Manufacturing Market include the expansion of smart factories, advancements in AI and machine learning, and the increasing focus on sustainability. These trends are likely to drive innovation and growth in the sector.

What trends are shaping the APAC Smart Manufacturing Market?

Trends shaping the APAC Smart Manufacturing Market include the integration of AI and machine learning for predictive maintenance, the rise of collaborative robots, and the emphasis on data-driven decision-making. These innovations are transforming traditional manufacturing practices.

APAC Smart Manufacturing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robotics, Automation Systems, Sensors, Control Systems |

| Technology | IoT, AI, Machine Learning, Cloud Computing |

| End User | Aerospace, Electronics, Food & Beverage, Pharmaceuticals |

| Application | Predictive Maintenance, Quality Control, Supply Chain Management, Production Optimization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Smart Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at