444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC shrimp market represents one of the most dynamic and rapidly expanding segments within the global aquaculture industry. Asia-Pacific dominates global shrimp production, accounting for approximately 85% of worldwide shrimp farming activities. The region’s favorable climatic conditions, extensive coastlines, and established aquaculture infrastructure have positioned it as the epicenter of commercial shrimp cultivation and processing.

Market dynamics in the APAC region are characterized by increasing consumer demand for premium seafood products, technological advancements in aquaculture practices, and growing export opportunities to international markets. Countries such as China, India, Thailand, Vietnam, and Indonesia lead the regional production landscape, collectively contributing to the majority of global shrimp supply.

Growth trajectories indicate robust expansion driven by rising protein consumption, urbanization trends, and increasing disposable incomes across emerging economies. The market demonstrates significant potential for continued growth, with industry projections suggesting a compound annual growth rate of 6.2% through the forecast period. Sustainable aquaculture practices and technological innovations continue to reshape production methodologies, enhancing both yield efficiency and environmental responsibility.

The APAC shrimp market refers to the comprehensive ecosystem encompassing the cultivation, processing, distribution, and consumption of shrimp species across the Asia-Pacific region. This market includes both wild-caught and farm-raised shrimp varieties, with aquaculture representing the dominant production method accounting for over 75% of total regional output.

Commercial shrimp farming involves the controlled cultivation of various shrimp species, primarily Litopenaeus vannamei (Pacific white shrimp) and Penaeus monodon (black tiger shrimp), in managed aquatic environments. The market encompasses the entire value chain from hatchery operations and grow-out farming to processing facilities, cold chain logistics, and retail distribution networks.

Regional significance extends beyond mere production volumes, as the APAC shrimp market serves as a critical economic driver for coastal communities, providing employment opportunities and foreign exchange earnings through international trade. The market’s scope includes fresh, frozen, and processed shrimp products destined for both domestic consumption and global export markets.

Strategic positioning of the APAC shrimp market reflects its dominance in global seafood trade, with the region maintaining leadership across production, processing, and export capabilities. Market fundamentals remain strong, supported by consistent demand growth from both regional and international consumers seeking high-quality protein sources.

Production efficiency continues to improve through adoption of advanced aquaculture technologies, including automated feeding systems, water quality monitoring, and disease prevention protocols. These innovations have contributed to productivity increases of approximately 15% over recent years while simultaneously reducing environmental impact through sustainable farming practices.

Export performance demonstrates the region’s competitive advantage, with APAC countries collectively accounting for over 70% of global shrimp exports. Key destination markets include North America, Europe, and Japan, where premium shrimp products command favorable pricing and consistent demand. Value-added processing capabilities have expanded significantly, enabling producers to capture higher margins through product differentiation and quality enhancement.

Future prospects remain optimistic, driven by expanding middle-class populations, increasing health consciousness, and growing preference for sustainable seafood options. Investment flows into modernization projects and capacity expansion initiatives continue to strengthen the region’s competitive position in global markets.

Production leadership across the APAC region demonstrates remarkable concentration, with the top five producing countries representing significant market share. Key insights reveal several critical trends shaping market development:

Consumer behavior patterns indicate growing sophistication in shrimp product preferences, with increasing demand for traceable, sustainably-produced options. Market segmentation reveals distinct opportunities across fresh, frozen, and processed categories, each requiring tailored marketing and distribution strategies.

Primary growth drivers propelling the APAC shrimp market forward encompass both demand-side and supply-side factors that create favorable conditions for sustained expansion. Consumer demand represents the most significant driver, fueled by rising protein consumption and increasing awareness of shrimp’s nutritional benefits.

Economic prosperity across emerging APAC economies has elevated disposable incomes, enabling consumers to purchase premium seafood products more frequently. Urbanization trends contribute to changing dietary patterns, with urban populations demonstrating higher consumption rates of processed and convenience seafood products.

Health consciousness among consumers drives preference for lean protein sources, positioning shrimp as an attractive alternative to traditional meat products. Nutritional advantages including high protein content, omega-3 fatty acids, and low saturated fat levels align with contemporary wellness trends.

Export opportunities continue expanding as international markets recognize APAC shrimp quality and competitive pricing. Trade agreements and reduced tariff barriers facilitate market access, while improved cold chain infrastructure ensures product quality during transportation.

Technological advancement in aquaculture practices enables higher production yields and improved cost efficiency. Innovation adoption includes automated feeding systems, water quality monitoring, and genetic improvement programs that enhance overall productivity and sustainability.

Operational challenges within the APAC shrimp market create headwinds that industry participants must navigate carefully. Disease outbreaks represent the most significant constraint, with viral infections capable of devastating entire production cycles and causing substantial economic losses.

Environmental concerns surrounding intensive aquaculture practices have prompted stricter regulatory oversight and compliance requirements. Water pollution and habitat degradation issues necessitate substantial investments in environmental management systems and sustainable production technologies.

Climate variability poses increasing risks to production stability, with extreme weather events, temperature fluctuations, and changing precipitation patterns affecting farming operations. Seasonal variations in water quality and availability can disrupt production schedules and impact yield consistency.

Regulatory complexity across different APAC countries creates compliance challenges for producers operating in multiple jurisdictions. Food safety standards and certification requirements continue evolving, demanding continuous investment in quality assurance systems and documentation processes.

Market price volatility affects profitability planning and investment decisions, with shrimp prices subject to supply-demand imbalances, currency fluctuations, and international trade dynamics. Input cost inflation for feed, energy, and labor further pressures profit margins across the value chain.

Emerging opportunities within the APAC shrimp market present significant potential for industry growth and diversification. Value-added processing represents a particularly attractive avenue, with consumers increasingly seeking convenient, ready-to-cook shrimp products that command premium pricing.

Sustainable aquaculture initiatives offer competitive differentiation opportunities, as environmentally conscious consumers and retailers prioritize responsibly-produced seafood. Certification programs such as ASC (Aquaculture Stewardship Council) and BAP (Best Aquaculture Practices) enable premium market positioning.

Technology integration creates opportunities for efficiency improvements and cost reduction through automation, artificial intelligence, and IoT applications. Smart farming systems can optimize feeding schedules, monitor water quality, and predict potential issues before they impact production.

Export market expansion into emerging economies presents growth potential, particularly in regions experiencing rising middle-class populations and increasing protein consumption. Product innovation in packaging, processing, and flavor profiles can capture new consumer segments and usage occasions.

Vertical integration opportunities allow companies to capture additional value chain margins while improving quality control and supply chain reliability. Strategic partnerships with retailers, foodservice operators, and international distributors can accelerate market penetration and brand development.

Complex interactions between supply and demand factors create dynamic market conditions that require continuous monitoring and strategic adaptation. Production cycles in shrimp farming typically span 3-4 months, creating inherent supply timing challenges that influence market pricing and availability.

Seasonal demand patterns vary significantly across different markets, with peak consumption periods during holidays and special occasions driving temporary price premiums. Consumer preferences continue evolving toward larger-sized shrimp and value-added products, influencing production planning and processing investments.

International trade dynamics significantly impact regional market conditions, with currency exchange rates, trade policies, and global economic conditions affecting export competitiveness. Supply chain efficiency improvements through cold chain infrastructure development and logistics optimization continue enhancing market access and product quality.

Competitive intensity among regional producers drives continuous improvement in production efficiency, quality standards, and cost management. Market consolidation trends are creating larger, more integrated operations capable of achieving economies of scale and improved bargaining power.

Regulatory evolution toward stricter environmental and food safety standards is reshaping operational practices and investment priorities across the industry. Innovation adoption rates vary significantly among producers, creating competitive advantages for early technology adopters.

Comprehensive analysis of the APAC shrimp market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, including producers, processors, distributors, and retailers across major regional markets.

Secondary research encompasses analysis of government statistics, industry association reports, trade publications, and academic studies related to aquaculture and seafood markets. Data triangulation methods verify information consistency across multiple sources and identify potential discrepancies requiring further investigation.

Market sizing methodologies utilize production statistics, trade data, and consumption surveys to develop comprehensive market assessments. Forecasting models incorporate historical trends, economic indicators, and industry expert opinions to project future market development scenarios.

Qualitative analysis techniques include focus groups with consumers and in-depth interviews with industry executives to understand market dynamics, competitive positioning, and emerging trends. Quantitative analysis employs statistical modeling and regression analysis to identify correlation patterns and market drivers.

Field research activities include visits to production facilities, processing plants, and retail outlets to observe operational practices and market conditions firsthand. Expert validation processes ensure research findings align with industry knowledge and practical market realities.

China dominates the APAC shrimp market with approximately 35% of regional production, leveraging extensive coastal aquaculture areas and advanced processing capabilities. Chinese operations benefit from integrated value chains, government support programs, and substantial export infrastructure targeting international markets.

India represents the second-largest regional producer, contributing roughly 25% of APAC shrimp output through both traditional and intensive farming systems. Indian producers focus heavily on export markets, particularly the United States and Europe, where Indian shrimp commands premium pricing due to quality reputation.

Thailand maintains significant market presence with approximately 15% regional market share, emphasizing value-added processing and product innovation. Thai companies have developed strong brand recognition in international markets through consistent quality and reliable supply chain management.

Vietnam contributes approximately 12% of regional production, with rapid expansion in both farming capacity and processing infrastructure. Vietnamese operations benefit from favorable production costs and increasing integration with global supply chains.

Indonesia accounts for roughly 8% of regional output, with substantial potential for expansion given extensive coastal resources and growing investment in aquaculture development. Indonesian producers are increasingly focusing on sustainable farming practices and international certification compliance.

Other regional markets including Malaysia, Philippines, and Bangladesh collectively represent the remaining market share, each developing specialized niches and competitive advantages within the broader APAC landscape.

Market leadership within the APAC shrimp industry is distributed among several major integrated companies and numerous smaller specialized producers. Competitive dynamics emphasize production efficiency, quality consistency, and supply chain reliability as key differentiating factors.

Competitive strategies increasingly emphasize sustainability credentials, technological innovation, and vertical integration to achieve cost advantages and quality differentiation. Market positioning varies from commodity producers focused on volume and cost efficiency to premium brands emphasizing quality, traceability, and environmental responsibility.

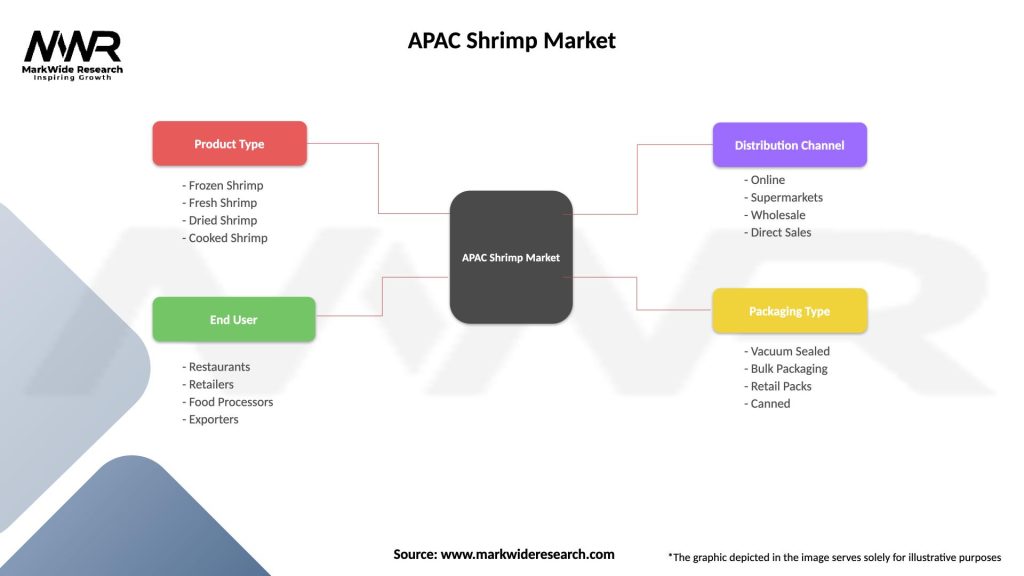

Product segmentation within the APAC shrimp market reflects diverse consumer preferences and application requirements across different market channels. Primary categories include fresh, frozen, and processed shrimp products, each serving distinct market segments with specific quality and convenience requirements.

By Product Type:

By Size Grade:

By Distribution Channel:

Fresh shrimp category commands premium pricing but faces logistical challenges due to limited shelf life and cold chain requirements. Market dynamics favor producers located near major consumption centers, with transportation costs and time constraints limiting market reach for distant producers.

Frozen shrimp segment represents the largest volume category, benefiting from extended storage capability and global shipping feasibility. Quality maintenance during freezing and storage processes requires significant investment in processing equipment and cold storage infrastructure.

Processed shrimp products demonstrate the highest growth potential, driven by consumer demand for convenience and ready-to-cook options. Value addition through processing enables producers to capture higher margins while differentiating products in competitive markets.

Size-based segmentation reveals distinct market dynamics, with larger shrimp commanding premium pricing but requiring longer growing periods and higher production costs. Market preferences vary significantly across different regions and consumer segments.

Export-oriented production focuses on meeting international quality standards and certification requirements, while domestic market production may emphasize cost efficiency and local taste preferences. Channel strategies require different approaches to product positioning, packaging, and marketing communications.

Producers benefit from expanding market opportunities, technological advancement access, and improved production efficiency through industry development initiatives. Economies of scale achieved through market growth enable cost reduction and competitive advantage enhancement.

Processors gain from increased raw material availability, supply chain optimization opportunities, and access to diverse product development possibilities. Value addition capabilities allow capture of higher margins and market differentiation through product innovation.

Distributors enjoy expanded product portfolios, improved supply reliability, and access to growing consumer markets seeking quality seafood products. Logistics efficiency improvements reduce operational costs and enhance service quality for downstream customers.

Retailers benefit from consistent product availability, quality assurance programs, and consumer demand growth for premium seafood offerings. Category management opportunities enable optimized shelf space utilization and improved profit margins.

Consumers receive enhanced product quality, greater variety, competitive pricing, and improved food safety through industry advancement and regulatory compliance. Nutritional benefits and convenience options align with evolving lifestyle preferences and health consciousness.

Communities gain from employment opportunities, economic development, and foreign exchange earnings generated by shrimp industry activities. Infrastructure development supporting aquaculture operations benefits broader regional economic growth and modernization efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the APAC shrimp market, with producers increasingly adopting environmentally responsible practices and seeking third-party certifications. Consumer awareness of environmental issues drives demand for traceable, sustainably-produced shrimp products.

Technology integration accelerates across production operations, with automated feeding systems, water quality monitoring, and data analytics improving efficiency and reducing operational risks. Digital transformation enables real-time monitoring and predictive management of farming operations.

Value-added processing expansion continues as producers seek higher margins and market differentiation through product innovation. Convenience products including pre-cooked, seasoned, and ready-to-eat options capture growing consumer demand for time-saving meal solutions.

Vertical integration strategies gain momentum as companies seek greater control over quality, costs, and supply chain reliability. Consolidation activities create larger, more efficient operations capable of achieving economies of scale and improved market positioning.

Export diversification efforts target emerging markets beyond traditional destinations, reducing dependence on established markets and capturing growth opportunities in developing economies. Product customization for specific regional preferences enhances market penetration and customer loyalty.

Health positioning emphasizes shrimp’s nutritional benefits, including high protein content, omega-3 fatty acids, and low calorie density. Marketing communications increasingly highlight health advantages to capture health-conscious consumer segments.

Recent developments within the APAC shrimp market demonstrate accelerating innovation and strategic positioning for future growth. Investment activities focus on capacity expansion, technology upgrades, and sustainability initiatives to maintain competitive advantages.

Genetic improvement programs advance through collaboration between research institutions and commercial producers, developing disease-resistant and fast-growing shrimp varieties. Breeding innovations promise significant improvements in production efficiency and survival rates.

Processing facility modernization incorporates advanced automation, quality control systems, and food safety protocols to meet evolving international standards. Capacity expansions in key producing countries support growing export demand and domestic market development.

Sustainability certifications achieve broader adoption as producers recognize market premiums and consumer preferences for responsibly-produced seafood. Environmental management systems implementation demonstrates industry commitment to sustainable development.

Strategic partnerships between producers, technology providers, and international buyers create integrated value chains and improved market access. Joint ventures facilitate knowledge transfer and capital investment in emerging production regions.

Regulatory developments across APAC countries strengthen food safety standards, environmental protection requirements, and international trade compliance. Policy support for aquaculture development includes infrastructure investment and research funding initiatives.

Strategic recommendations for APAC shrimp market participants emphasize sustainable growth, operational efficiency, and market diversification to navigate evolving industry dynamics. MarkWide Research analysis indicates several priority areas for industry focus and investment.

Sustainability investment should receive immediate priority, with producers implementing comprehensive environmental management systems and pursuing internationally recognized certifications. Long-term competitiveness increasingly depends on demonstrable environmental responsibility and traceability capabilities.

Technology adoption requires accelerated implementation of automation, monitoring systems, and data analytics to improve production efficiency and risk management. Digital transformation investments will differentiate leaders from followers in operational performance and cost competitiveness.

Value chain integration opportunities should be evaluated for potential margin improvement and quality control enhancement. Vertical integration strategies can provide competitive advantages through improved supply chain coordination and customer relationship management.

Market diversification efforts should target emerging consumer segments and geographic markets to reduce dependence on traditional channels. Product innovation in processing and packaging can capture premium pricing opportunities and enhance brand differentiation.

Risk management systems require strengthening to address disease prevention, climate variability, and market volatility challenges. Operational resilience through diversified production locations and robust biosecurity protocols will support business continuity and growth sustainability.

Long-term prospects for the APAC shrimp market remain highly favorable, driven by fundamental demand growth, technological advancement, and expanding international trade opportunities. Market evolution toward premium, sustainable products aligns with global consumer trends and regulatory developments.

Production capacity is expected to expand significantly over the forecast period, with new farming areas development and intensive system adoption supporting output growth. Efficiency improvements through technology integration will enable higher yields per unit area while reducing environmental impact.

Export growth projections indicate continued expansion into emerging markets, with Asia-Pacific producers maintaining competitive advantages in cost, quality, and supply reliability. Trade relationships are expected to strengthen through bilateral agreements and reduced trade barriers.

Innovation acceleration will drive development of new products, production technologies, and sustainability solutions. Research investment in genetics, nutrition, and disease prevention will yield significant improvements in production efficiency and product quality.

Market consolidation trends are likely to continue, creating larger, more integrated operations capable of achieving economies of scale and improved bargaining power. Industry structure evolution will favor companies with strong financial resources and strategic vision.

Regulatory environment development will emphasize environmental protection, food safety, and international trade compliance. Industry adaptation to evolving standards will require continuous investment in systems and processes to maintain market access and competitive positioning.

The APAC shrimp market stands as a cornerstone of the global seafood industry, demonstrating remarkable resilience and growth potential despite facing various operational and environmental challenges. Regional dominance in production, processing, and export capabilities positions APAC countries as indispensable players in meeting worldwide shrimp demand.

Sustainable development emerges as the defining characteristic of future market success, with environmental responsibility and social accountability becoming essential competitive requirements rather than optional considerations. Industry transformation toward sustainable practices will determine long-term viability and market access opportunities.

Technology integration continues accelerating operational efficiency improvements while addressing traditional challenges such as disease management, production optimization, and quality assurance. Digital innovation adoption will separate market leaders from followers in the increasingly competitive global marketplace.

Market opportunities remain abundant across value-added processing, export diversification, and premium product segments, providing multiple pathways for growth and profitability enhancement. Strategic positioning through sustainability credentials, quality differentiation, and operational excellence will capture these emerging opportunities effectively.

Future success in the APAC shrimp market will require balanced focus on production efficiency, environmental stewardship, and market responsiveness to evolving consumer preferences and regulatory requirements. Companies that successfully navigate this complex landscape will benefit from sustained growth and enhanced competitive positioning in the dynamic global seafood market.

What is Shrimp?

Shrimp are small, aquatic crustaceans that are widely consumed as seafood. They are known for their high protein content and are a popular ingredient in various cuisines across the Asia-Pacific region.

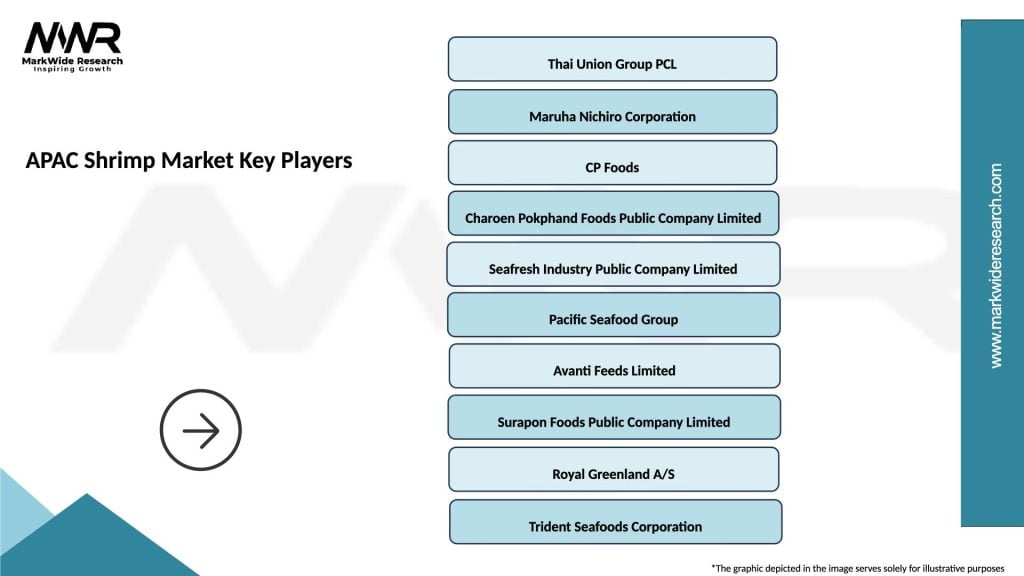

Who are the key players in the APAC Shrimp Market?

Key players in the APAC Shrimp Market include Thai Union Group, Maruha Nichiro Corporation, and Charoen Pokphand Foods, among others. These companies are involved in shrimp farming, processing, and distribution.

What are the main drivers of the APAC Shrimp Market?

The main drivers of the APAC Shrimp Market include increasing consumer demand for seafood, rising health consciousness, and the growth of aquaculture practices in the region. Additionally, the expansion of export markets contributes to market growth.

What challenges does the APAC Shrimp Market face?

The APAC Shrimp Market faces challenges such as environmental concerns related to shrimp farming, disease outbreaks affecting shrimp populations, and fluctuating prices due to market competition. These factors can impact production and profitability.

What opportunities exist in the APAC Shrimp Market?

Opportunities in the APAC Shrimp Market include the development of sustainable farming practices, increasing demand for value-added shrimp products, and potential growth in emerging markets. Innovations in aquaculture technology also present new avenues for expansion.

What trends are shaping the APAC Shrimp Market?

Trends shaping the APAC Shrimp Market include a shift towards organic and sustainably sourced shrimp, the rise of online seafood retail, and increasing consumer interest in shrimp-based health products. These trends reflect changing consumer preferences and market dynamics.

APAC Shrimp Market

| Segmentation Details | Description |

|---|---|

| Product Type | Frozen Shrimp, Fresh Shrimp, Dried Shrimp, Cooked Shrimp |

| End User | Restaurants, Retailers, Food Processors, Exporters |

| Distribution Channel | Online, Supermarkets, Wholesale, Direct Sales |

| Packaging Type | Vacuum Sealed, Bulk Packaging, Retail Packs, Canned |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Shrimp Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at