444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The APAC Safety Instrumented Systems (SIS) market is witnessing significant growth and is expected to thrive in the coming years. Safety Instrumented Systems play a crucial role in industries that involve hazardous processes, ensuring the safety of personnel, equipment, and the environment. These systems are designed to detect hazardous conditions and initiate a safe shutdown or mitigation process, preventing accidents and minimizing the associated risks.

Meaning

Safety Instrumented Systems are engineering systems that are implemented to safeguard industrial processes from potential dangers. They are a combination of hardware and software elements that monitor and control various parameters, such as temperature, pressure, and flow, to maintain safe operational conditions. By continuously monitoring critical process variables, SIS can initiate appropriate actions to prevent accidents and protect assets.

Executive Summary

The APAC Safety Instrumented Systems market is experiencing robust growth due to the increasing focus on industrial safety and the implementation of stringent regulations. The region’s booming industrial sector, particularly in countries like China, India, and Japan, is driving the demand for safety solutions to ensure operational efficiency and protect human life. The market is witnessing a steady influx of advanced technologies and solutions to cater to the diverse safety requirements of industries.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

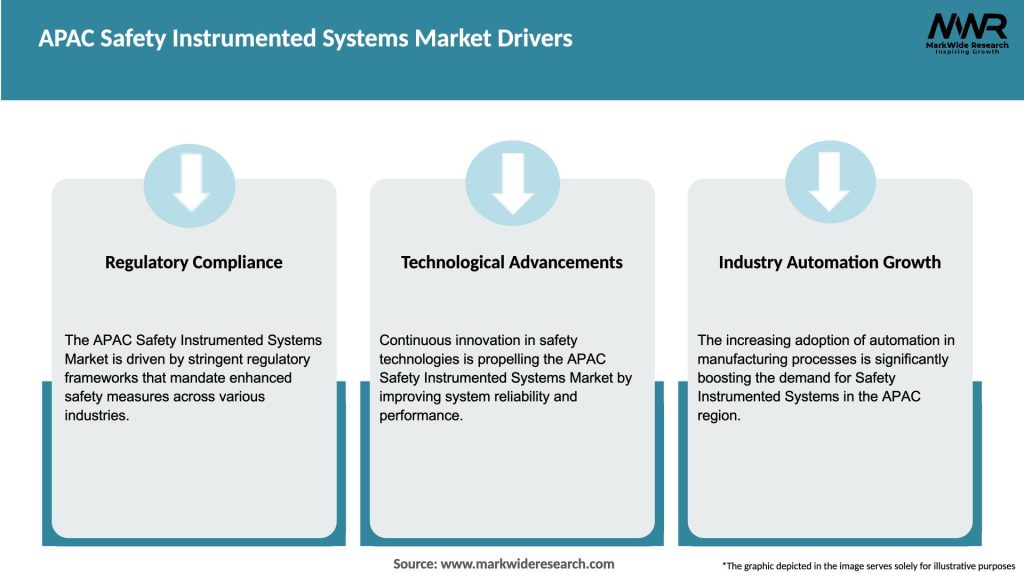

The APAC Safety Instrumented Systems market is driven by a combination of factors, including regulatory compliance, industrial growth, technological advancements, and changing safety standards. As industries continue to prioritize safety and risk mitigation, the demand for Safety Instrumented Systems is expected to witness a steady increase. However, challenges such as high implementation costs, skill shortages, and complex integration processes need to be addressed to fully harness the market’s potential.

Regional Analysis

The APAC Safety Instrumented Systems market is segmented into several key regions, including China, Japan, India, South Korea, Australia, and others. China holds a significant share in the market due to its rapid industrialization and substantial investments in infrastructure development. Japan and South Korea are also major contributors, driven by their advanced manufacturing capabilities and stringent safety regulations. India’s expanding industrial sector presents significant growth opportunities, while Australia’s focus on resource extraction necessitates robust safety measures.

Competitive Landscape

Leading Companies in the APAC Safety Instrumented Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

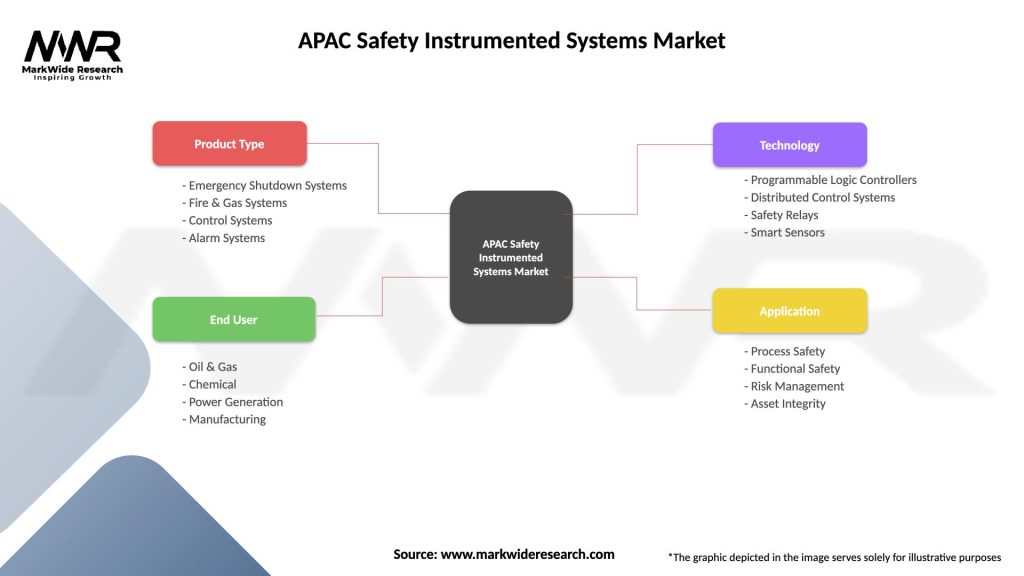

Segmentation

The APAC Safety Instrumented Systems market can be segmented based on the type of system, end-user industry, and geographic regions. By system type, the market can be categorized into emergency shutdown systems (ESD), fire and gas systems (FGS), burner management systems (BMS), and high-integrity pressure protection systems (HIPPS). The end-user industries include oil and gas, chemical, pharmaceutical, power generation, pulp and paper, food and beverage, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market KeyTrends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the APAC Safety Instrumented Systems market. The initial phase of the pandemic resulted in disruptions to industrial activities, as many industries had to halt or reduce operations. This led to a temporary decline in the demand for safety systems.

However, as industries resumed operations and adapted to the new normal, the focus on safety and risk mitigation increased. The pandemic highlighted the importance of robust safety measures and contingency plans, driving the demand for Safety Instrumented Systems. Industries prioritized the implementation of safety systems to ensure business continuity and protect their workforce.

Moreover, the pandemic also accelerated the adoption of digital technologies in safety systems. Remote monitoring and control capabilities gained prominence as industries sought to minimize on-site personnel and enable remote operations. The need for contactless solutions and advanced analytics further contributed to the adoption of technology-driven Safety Instrumented Systems.

Key Industry Developments

Analyst Suggestions

Future Outlook

The APAC Safety Instrumented Systems market is poised for significant growth in the foreseeable future. The increasing focus on industrial safety, stringent regulations, and rapid industrialization in the region will continue to drive the demand for safety systems. Technological advancements, such as the integration of AI, ML, and wireless connectivity, will further enhance the capabilities and efficiency of Safety Instrumented Systems.

As industries adopt Industry 4.0 and automation technologies, the demand for integrated safety solutions will rise. The expansion of the oil and gas, chemical, and renewable energy sectors will present lucrative opportunities for safety system manufacturers. Collaboration between industry players, government bodies, and technology providers will play a crucial role in driving innovation and meeting industry-specific safety requirements.

Conclusion

The APAC Safety Instrumented Systems market is witnessing robust growth driven by increasing industrialization, stringent safety regulations, and a growing emphasis on risk reduction. Safety Instrumented Systems are crucial in ensuring operational integrity, protecting personnel, and mitigating potential hazards in industries. The market offers significant opportunities for manufacturers and service providers to cater to the diverse safety needs of industries across the APAC region.

To fully leverage the market potential, industry players should focus on technological advancements, collaboration, customer education, and streamlined integration processes. By embracing emerging technologies, developing skilled workforce, and expanding their presence in emerging markets, companies can position themselves as leading providers of comprehensive safety solutions in the APAC Safety Instrumented Systems market.

What is Safety Instrumented Systems?

Safety Instrumented Systems (SIS) are engineered systems designed to prevent hazardous events by automatically taking control actions when predetermined conditions are met. They are critical in industries such as oil and gas, chemical processing, and manufacturing to ensure operational safety.

What are the key players in the APAC Safety Instrumented Systems Market?

Key players in the APAC Safety Instrumented Systems Market include Honeywell International Inc., Siemens AG, Schneider Electric, and Yokogawa Electric Corporation, among others.

What are the growth factors driving the APAC Safety Instrumented Systems Market?

The growth of the APAC Safety Instrumented Systems Market is driven by increasing industrial automation, stringent safety regulations, and the rising need for risk management in various sectors such as petrochemicals and pharmaceuticals.

What challenges does the APAC Safety Instrumented Systems Market face?

Challenges in the APAC Safety Instrumented Systems Market include high implementation costs, the complexity of system integration, and the need for skilled personnel to manage and maintain these systems effectively.

What opportunities exist in the APAC Safety Instrumented Systems Market?

Opportunities in the APAC Safety Instrumented Systems Market include the growing adoption of IoT technologies, advancements in sensor technologies, and the increasing focus on process safety management across various industries.

What trends are shaping the APAC Safety Instrumented Systems Market?

Trends shaping the APAC Safety Instrumented Systems Market include the integration of artificial intelligence for predictive maintenance, the shift towards cloud-based solutions, and the emphasis on cybersecurity measures to protect safety systems.

APAC Safety Instrumented Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Emergency Shutdown Systems, Fire & Gas Systems, Control Systems, Alarm Systems |

| End User | Oil & Gas, Chemical, Power Generation, Manufacturing |

| Technology | Programmable Logic Controllers, Distributed Control Systems, Safety Relays, Smart Sensors |

| Application | Process Safety, Functional Safety, Risk Management, Asset Integrity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the APAC Safety Instrumented Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at