444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC ready-to-drink coffee market represents one of the most dynamic and rapidly expanding beverage segments across the Asia-Pacific region. This comprehensive market encompasses a diverse range of cold brew coffee, iced coffee beverages, coffee-based energy drinks, and premium bottled coffee products that cater to the evolving preferences of consumers across major economies including Japan, South Korea, China, Australia, and Southeast Asian nations.

Market dynamics indicate that the region is experiencing unprecedented growth in ready-to-drink coffee consumption, driven by urbanization, changing lifestyle patterns, and increasing disposable income among millennials and Gen Z consumers. The market is characterized by intense competition among both international beverage giants and local manufacturers who are continuously innovating to capture market share in this lucrative segment.

Regional consumption patterns show significant variation, with Japan leading in premium RTD coffee adoption at approximately 42% market penetration, while emerging markets like Vietnam and Thailand are experiencing rapid growth rates exceeding 15% annually. The market’s expansion is further supported by robust distribution networks, innovative packaging solutions, and strategic partnerships between coffee producers and retail chains across the region.

Product innovation continues to drive market evolution, with manufacturers introducing functional coffee beverages, plant-based coffee alternatives, and sustainable packaging solutions to meet diverse consumer demands. The integration of traditional Asian flavors with Western coffee culture has created unique product offerings that resonate strongly with local consumer preferences while maintaining international appeal.

The APAC ready-to-drink coffee market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and consumption of pre-prepared coffee beverages that require no additional brewing or preparation by consumers across Asia-Pacific countries. This market segment includes various product categories ranging from cold brew concentrates and iced coffee drinks to coffee-flavored milk beverages and premium artisanal coffee products packaged in convenient, portable containers.

Market definition extends beyond traditional coffee beverages to include hybrid products that combine coffee with other functional ingredients such as vitamins, minerals, probiotics, and natural energy enhancers. The segment encompasses both shelf-stable products that can be stored at room temperature and refrigerated beverages that require cold chain distribution to maintain quality and freshness.

Consumer accessibility represents a fundamental aspect of this market, with products designed for immediate consumption through various retail channels including convenience stores, supermarkets, vending machines, and online platforms. The market serves diverse consumer segments from busy professionals seeking convenient caffeine solutions to health-conscious individuals looking for premium, organic, or specialty coffee experiences.

Strategic market analysis reveals that the APAC ready-to-drink coffee market is positioned for sustained expansion, driven by fundamental shifts in consumer behavior, technological advancement in beverage production, and increasing penetration of modern retail formats across the region. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating challenges related to supply chain disruptions, raw material price volatility, and evolving regulatory requirements.

Key performance indicators highlight the market’s robust growth trajectory, with premium product segments experiencing particularly strong demand growth of approximately 18% annually. The market’s competitive landscape is characterized by strategic consolidation, with major players acquiring local brands to strengthen their regional presence while emerging companies leverage innovative product formulations and targeted marketing strategies to capture niche market segments.

Market segmentation analysis indicates that convenience-focused products account for the largest market share, while health and wellness-oriented beverages represent the fastest-growing category. Regional preferences vary significantly, with Japanese consumers favoring sophisticated flavor profiles, Chinese consumers embracing functional benefits, and Southeast Asian markets showing strong preference for value-oriented products with local flavor adaptations.

Future market projections suggest continued expansion across all major product categories, with particular strength expected in sustainable packaging solutions, plant-based alternatives, and premium artisanal offerings. The market’s evolution is increasingly influenced by digital commerce platforms, social media marketing, and direct-to-consumer distribution models that enable brands to build stronger relationships with their target audiences.

Consumer behavior analysis reveals several critical insights that are shaping the APAC ready-to-drink coffee market’s development trajectory:

Market intelligence indicates that successful brands are those that effectively balance these diverse consumer insights while maintaining consistent product quality and strategic market positioning across multiple regional markets with varying cultural preferences and economic conditions.

Urbanization acceleration across APAC countries serves as a primary market driver, with rapid urban population growth creating dense consumer markets with high demand for convenient beverage solutions. Urban consumers demonstrate significantly higher ready-to-drink coffee consumption rates, with metropolitan areas showing consumption levels approximately 65% higher than rural regions, creating substantial market opportunities for manufacturers and distributors.

Lifestyle transformation represents another crucial driver, as changing work patterns, longer commuting times, and increased participation in outdoor activities create consistent demand for portable caffeine solutions. The rise of flexible work arrangements and remote work culture has further expanded consumption occasions beyond traditional morning routines, with afternoon and evening consumption showing notable growth across all age demographics.

Economic prosperity in key APAC markets has elevated consumer purchasing power, enabling greater experimentation with premium coffee products and specialty beverages. Rising middle-class populations in countries like China, India, and Indonesia are driving demand for international coffee brands and premium product categories that were previously considered luxury items, creating substantial market expansion opportunities.

Retail infrastructure development continues to enhance market accessibility, with modern convenience store chains, supermarket networks, and vending machine installations providing extensive distribution coverage across urban and suburban areas. The proliferation of 24-hour retail formats and automated vending solutions has made ready-to-drink coffee products available to consumers at virtually any time and location, significantly expanding consumption opportunities.

Technology integration in both production and distribution processes has improved product quality, extended shelf life, and reduced costs, making ready-to-drink coffee products more accessible to broader consumer segments. Advanced cold brewing technologies, aseptic packaging systems, and supply chain optimization have enabled manufacturers to deliver consistent quality while expanding their geographic reach across diverse regional markets.

Raw material price volatility presents significant challenges for market participants, with coffee bean prices subject to weather conditions, geopolitical factors, and global supply chain disruptions. These price fluctuations directly impact production costs and profit margins, forcing manufacturers to implement complex pricing strategies and supply chain risk management systems to maintain market competitiveness while preserving product quality standards.

Regulatory complexity across different APAC countries creates substantial compliance burdens, with varying food safety standards, labeling requirements, and import regulations requiring significant investment in regulatory expertise and documentation systems. The complexity is particularly challenging for companies seeking to expand across multiple regional markets simultaneously, as each country maintains distinct regulatory frameworks for beverage manufacturing and food safety protocols.

Cultural resistance in certain markets where traditional tea consumption remains deeply embedded in cultural practices presents market penetration challenges. Some consumer segments demonstrate strong preference for traditional hot beverages and resistance to Western-style coffee products, requiring extensive marketing investment and cultural adaptation strategies to achieve meaningful market acceptance and sustained growth.

Intense competition from both international beverage giants and local manufacturers creates pricing pressure and market share fragmentation. The presence of well-established competitors with substantial marketing budgets and distribution networks makes it challenging for new entrants to achieve significant market penetration without substantial investment in brand building and consumer education initiatives.

Supply chain complexity across diverse geographic regions with varying infrastructure capabilities creates logistical challenges and cost pressures. Maintaining cold chain integrity for refrigerated products, ensuring consistent product availability across remote locations, and managing inventory levels across multiple markets require sophisticated supply chain management systems and significant operational investment.

Emerging market penetration presents substantial growth opportunities, particularly in countries like Vietnam, Philippines, and Indonesia where coffee consumption is rapidly increasing but ready-to-drink market penetration remains relatively low. These markets offer significant potential for companies that can effectively adapt their products to local taste preferences while maintaining competitive pricing strategies that appeal to price-sensitive consumer segments.

Product innovation opportunities continue to expand, with growing consumer interest in functional beverages that combine coffee with health-enhancing ingredients such as adaptogens, probiotics, collagen, and plant-based proteins. The development of specialty coffee blends featuring unique regional flavors, organic certifications, and sustainable sourcing credentials represents another significant opportunity for market differentiation and premium positioning.

Digital commerce expansion offers new distribution channels and direct consumer engagement opportunities, with e-commerce platforms and subscription services enabling brands to build stronger customer relationships while reducing distribution costs. The integration of mobile payment systems and smart vending technologies creates additional convenience factors that can drive increased consumption frequency and customer loyalty.

Sustainability positioning represents a growing opportunity as environmentally conscious consumers increasingly seek brands that demonstrate commitment to sustainable sourcing practices, recyclable packaging materials, and carbon footprint reduction. Companies that successfully communicate their environmental credentials while maintaining product quality and competitive pricing can capture significant market share among younger consumer demographics.

Partnership opportunities with local food service chains, convenience store networks, and workplace catering services provide scalable distribution channels that can rapidly increase market presence. Strategic alliances with coffee shop chains, hotel networks, and transportation hubs create additional touchpoints for consumer engagement and brand exposure across diverse consumption occasions.

Supply and demand equilibrium in the APAC ready-to-drink coffee market demonstrates remarkable dynamism, with seasonal fluctuations, regional preferences, and economic conditions creating complex market interactions. Demand patterns show strong correlation with temperature variations, with hot weather periods driving consumption increases of approximately 25-30% in tropical regions, while temperate climates maintain more consistent year-round consumption levels.

Competitive dynamics continue to evolve as international brands expand their regional presence while local manufacturers leverage cultural insights and cost advantages to compete effectively. The market demonstrates increasing consolidation among major players, with strategic acquisitions and joint ventures becoming common strategies for achieving scale economies and market penetration across diverse regional markets.

Innovation cycles are accelerating, with product development timelines shortening as companies respond more rapidly to emerging consumer trends and competitive pressures. The integration of consumer feedback systems and social media monitoring enables manufacturers to identify market opportunities and adjust product formulations more quickly than traditional market research methods allowed.

Distribution evolution reflects changing consumer shopping behaviors, with traditional retail channels adapting to compete with online platforms and direct-to-consumer models. The emergence of hybrid distribution strategies that combine physical retail presence with digital engagement creates new opportunities for brand building and customer relationship management across multiple touchpoints.

Price dynamics remain influenced by raw material costs, competitive positioning, and consumer price sensitivity, with successful brands demonstrating ability to maintain pricing power through effective value proposition communication and brand differentiation strategies. Market leaders are increasingly focusing on premium product segments where higher margins can be sustained through quality positioning and brand loyalty development.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the APAC ready-to-drink coffee market dynamics. Primary research activities included extensive consumer surveys across major regional markets, in-depth interviews with industry executives, and focus group discussions with target demographic segments to understand consumption patterns, preference drivers, and purchase decision factors.

Secondary research components encompassed analysis of industry reports, government statistics, trade association data, and company financial statements to establish market sizing, competitive positioning, and growth trend analysis. MarkWide Research analysts conducted systematic review of regulatory frameworks, import/export statistics, and economic indicators across key APAC countries to assess market accessibility and growth potential.

Data validation processes included cross-referencing multiple information sources, statistical analysis of survey responses, and verification of market estimates through industry expert consultations. The research methodology incorporated both quantitative analysis of market metrics and qualitative assessment of consumer behavior patterns to provide comprehensive market understanding.

Geographic coverage encompassed detailed analysis of major APAC markets including Japan, South Korea, China, Australia, India, Thailand, Vietnam, Indonesia, Philippines, and Singapore. Regional analysis considered local market conditions, cultural factors, regulatory environments, and competitive landscapes to provide market-specific insights and recommendations.

Temporal analysis examined historical market performance, current market conditions, and future growth projections using statistical modeling and trend analysis techniques. The research incorporated seasonal adjustment factors, economic cycle considerations, and demographic trend analysis to provide accurate market forecasting and strategic planning insights.

Japan market leadership continues to define industry standards and innovation trends, with the country maintaining the highest per-capita consumption rates and most sophisticated product offerings in the region. Japanese consumers demonstrate strong preference for premium quality products and are willing to pay higher prices for superior taste, packaging design, and brand reputation. The market shows approximately 38% preference for imported coffee brands, while domestic manufacturers focus on unique flavor innovations and convenience features.

China’s rapid expansion represents the largest growth opportunity in the region, with urbanization and rising disposable incomes driving substantial market development. The Chinese market demonstrates strong preference for functional coffee beverages with health benefits, while younger consumers show increasing adoption of Western coffee culture. Market penetration in tier-one cities reaches approximately 55%, while tier-two and tier-three cities offer significant expansion potential.

South Korea’s innovation focus has established the country as a key market for premium and specialty coffee products, with consumers demonstrating sophisticated taste preferences and strong brand loyalty. The market shows particular strength in cold brew categories and artisanal coffee products, with local brands successfully competing against international competitors through unique flavor profiles and cultural marketing approaches.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Philippines show rapid growth potential, with increasing urbanization and economic development driving market expansion. These markets demonstrate strong price sensitivity while showing growing interest in premium product categories. Local flavor adaptations and culturally relevant marketing strategies prove essential for market success in these diverse regional markets.

Australia and New Zealand maintain mature markets with sophisticated consumer preferences for specialty coffee products and sustainable sourcing practices. These markets show strong preference for local and regional brands, with consumers willing to pay premium prices for products that demonstrate environmental responsibility and community support initiatives.

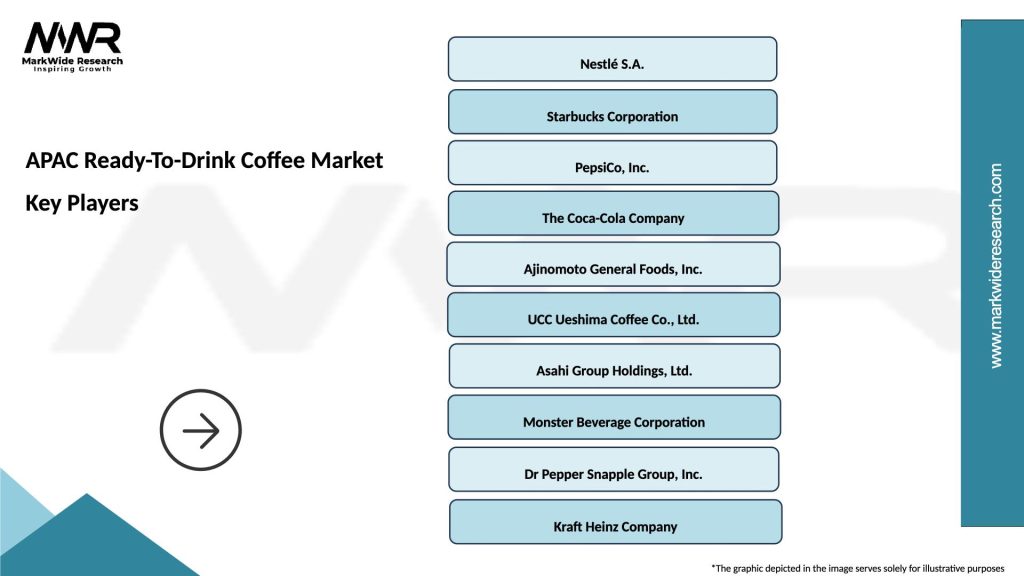

Market leadership in the APAC ready-to-drink coffee segment is characterized by intense competition among established international beverage companies and innovative local manufacturers. The competitive environment demonstrates increasing consolidation as major players seek to achieve scale economies and market penetration across diverse regional markets.

Key market participants include:

Competitive strategies focus on product innovation, brand building, distribution expansion, and strategic partnerships to achieve market differentiation and sustainable competitive advantages. Companies are increasingly investing in sustainable sourcing initiatives, digital marketing capabilities, and direct-to-consumer distribution models to strengthen their market positions.

Market consolidation trends indicate continued merger and acquisition activity as companies seek to achieve scale economies, expand geographic presence, and acquire specialized capabilities in areas such as cold brew technology, functional ingredient formulation, and sustainable packaging solutions.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer appeal:

Packaging format analysis shows consumer preferences varying by consumption occasion and regional market characteristics:

Distribution channel segmentation reflects diverse consumer shopping behaviors and accessibility requirements:

Premium coffee segment demonstrates the strongest growth momentum, with consumers increasingly willing to pay higher prices for superior quality ingredients, authentic coffee flavors, and sophisticated packaging design. This category shows particular strength in developed markets like Japan, South Korea, and Australia, where consumers have established appreciation for specialty coffee culture and demonstrate strong brand loyalty for products that deliver consistent quality experiences.

Functional coffee beverages represent the fastest-growing category, with products incorporating vitamins, minerals, probiotics, and natural energy enhancers appealing to health-conscious consumers across all age demographics. The category shows approximately 22% annual growth in key markets, driven by increasing consumer awareness of health and wellness benefits combined with the convenience of ready-to-drink formats.

Traditional iced coffee products maintain significant market share through competitive pricing and widespread availability, particularly in price-sensitive markets across Southeast Asia. These products serve as entry-level offerings that introduce consumers to ready-to-drink coffee consumption while providing manufacturers with volume-based revenue streams and market penetration opportunities.

Specialty flavor variants incorporating local taste preferences show strong regional performance, with products featuring Asian-inspired flavors such as matcha, taro, coconut, and tropical fruits resonating particularly well with local consumers. These products demonstrate successful cultural adaptation strategies while maintaining coffee as the primary flavor component.

Sustainable and organic categories are experiencing rapid growth among environmentally conscious consumers, with products featuring certified organic ingredients, fair trade sourcing, and recyclable packaging commanding premium pricing and strong brand loyalty. This category shows particular strength among younger consumer demographics who prioritize environmental responsibility in their purchasing decisions.

Manufacturers benefit from expanding market opportunities across diverse regional markets with varying consumer preferences and economic conditions. The market’s growth trajectory provides sustainable revenue streams while product innovation opportunities enable premium positioning and margin improvement. Scale economies achieved through regional expansion create competitive advantages in raw material procurement, production efficiency, and distribution cost optimization.

Retailers gain from high-margin product categories that generate strong consumer traffic and repeat purchases. Ready-to-drink coffee products offer excellent inventory turnover rates and require minimal storage space while providing attractive profit margins compared to many other beverage categories. The products’ convenience positioning drives impulse purchases and increases average transaction values across retail formats.

Distributors enjoy stable demand patterns and expanding market coverage opportunities as consumption grows across urban and suburban markets. The products’ shelf-stable characteristics reduce logistics complexity while growing market demand supports route expansion and delivery frequency optimization. Strategic partnerships with manufacturers provide access to marketing support and promotional programs that drive sales growth.

Consumers receive convenient access to high-quality coffee experiences without the time and equipment requirements of traditional brewing methods. The market’s product diversity ensures options for varying taste preferences, dietary requirements, and budget considerations while maintaining consistent quality standards across different brands and price points.

Coffee producers benefit from expanded market channels that provide additional revenue streams beyond traditional hot coffee markets. The ready-to-drink segment’s growth creates increased demand for specialty coffee beans and premium ingredients while enabling direct relationships with beverage manufacturers that can provide more stable pricing and volume commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration represents the most significant trend shaping market development, with consumers increasingly seeking coffee products that provide additional health benefits beyond caffeine content. Products incorporating adaptogens, probiotics, collagen, and plant-based proteins are experiencing rapid adoption, particularly among health-conscious millennials and Gen Z consumers who view beverages as functional nutrition sources rather than simple refreshment options.

Sustainability consciousness continues to influence purchasing decisions, with consumers demonstrating strong preference for brands that communicate clear environmental commitments through sustainable sourcing practices, recyclable packaging materials, and carbon footprint reduction initiatives. This trend is driving innovation in packaging design and supply chain management while creating competitive advantages for companies that successfully integrate sustainability into their brand positioning.

Premium quality focus shows consumers increasingly willing to pay higher prices for products that deliver superior taste experiences, authentic coffee flavors, and sophisticated packaging design. The trend toward artisanal coffee appreciation is expanding beyond traditional hot coffee consumption into ready-to-drink formats, creating opportunities for premium product positioning and margin improvement across the market.

Cultural fusion innovation demonstrates successful integration of local flavor preferences with international coffee culture, creating unique product offerings that resonate with regional consumer tastes while maintaining broad market appeal. Products featuring Asian-inspired flavors and traditional ingredients are showing strong performance across diverse market segments.

Digital engagement expansion reflects changing consumer behavior patterns, with social media influence, online reviews, and digital marketing significantly impacting purchase decisions. Brands are investing heavily in digital marketing capabilities and direct-to-consumer platforms to build stronger customer relationships and reduce dependence on traditional retail channels.

Strategic acquisitions continue to reshape the competitive landscape, with major international beverage companies acquiring local brands to strengthen their regional market presence and gain access to specialized product formulations and distribution networks. Recent acquisition activity demonstrates the industry’s focus on achieving scale economies while maintaining local market expertise and cultural relevance.

Technology advancement in production processes has enabled significant improvements in product quality, shelf life extension, and cost efficiency. Innovations in cold brewing technology, aseptic packaging systems, and flavor preservation techniques are allowing manufacturers to deliver consistent quality while expanding their geographic reach and reducing production costs.

Sustainability initiatives are becoming increasingly important competitive differentiators, with companies investing in renewable packaging materials, carbon-neutral production processes, and direct trade relationships with coffee farmers. These initiatives respond to growing consumer environmental consciousness while creating long-term supply chain stability and brand loyalty advantages.

Product line extensions demonstrate companies’ efforts to capture broader market segments through diversified product portfolios that address varying consumer preferences, dietary requirements, and price sensitivity levels. The introduction of plant-based alternatives, sugar-free formulations, and functional ingredient combinations reflects market responsiveness to evolving consumer demands.

Distribution partnerships with major retail chains, convenience store networks, and food service operators are expanding market accessibility while reducing distribution costs and improving inventory management efficiency. Strategic partnerships enable brands to achieve broader market coverage while leveraging established retail relationships and consumer traffic patterns.

Market entry strategies should prioritize understanding local consumer preferences and cultural factors that influence coffee consumption patterns across different regional markets. MWR analysis indicates that successful market penetration requires significant investment in consumer research, product adaptation, and culturally relevant marketing approaches that resonate with local taste preferences while maintaining brand consistency.

Product development focus should emphasize functional benefits, premium quality positioning, and sustainable packaging solutions that address evolving consumer priorities. Companies should invest in innovation capabilities that enable rapid response to emerging trends while maintaining consistent quality standards and cost competitiveness across diverse market segments.

Distribution strategy optimization requires multi-channel approaches that combine traditional retail presence with digital commerce capabilities and direct-to-consumer engagement. The integration of online platforms, subscription services, and mobile payment systems creates additional convenience factors that can drive increased consumption frequency and customer loyalty.

Brand positioning strategies should emphasize unique value propositions that differentiate products from competitive offerings while addressing specific consumer needs and preferences. Successful brands demonstrate clear communication of quality credentials, health benefits, and sustainability commitments that resonate with target demographic segments.

Partnership development with local distributors, retail chains, and food service operators provides scalable market entry opportunities while reducing investment requirements and operational complexity. Strategic alliances enable companies to leverage established market relationships and distribution infrastructure while focusing resources on product development and brand building activities.

Market expansion projections indicate continued robust growth across all major APAC markets, with emerging economies offering particularly strong potential as urbanization accelerates and disposable incomes increase. The market is expected to maintain its growth trajectory driven by fundamental demographic trends, lifestyle changes, and increasing consumer acceptance of ready-to-drink coffee as a convenient beverage option.

Innovation acceleration will likely focus on functional ingredients, sustainable packaging solutions, and personalized nutrition approaches that address individual consumer health and wellness goals. The integration of advanced brewing technologies, natural preservation methods, and smart packaging systems will enable new product categories and enhanced consumer experiences.

Market consolidation trends suggest continued merger and acquisition activity as companies seek to achieve scale economies, expand geographic presence, and acquire specialized capabilities in areas such as sustainable sourcing, functional ingredient formulation, and digital commerce platforms. This consolidation will likely result in stronger market leaders with enhanced competitive capabilities.

Consumer behavior evolution indicates increasing sophistication in taste preferences, growing health consciousness, and stronger environmental awareness that will drive demand for premium, functional, and sustainable product offerings. The market will need to adapt to these evolving preferences while maintaining accessibility and value propositions across diverse consumer segments.

Technology integration will continue to transform production processes, distribution systems, and consumer engagement methods, creating opportunities for improved efficiency, enhanced quality, and stronger customer relationships. The adoption of artificial intelligence, IoT systems, and blockchain technology will enable more sophisticated supply chain management and consumer insights generation.

The APAC ready-to-drink coffee market represents one of the most dynamic and promising beverage segments in the global marketplace, characterized by sustained growth momentum, continuous innovation, and expanding consumer acceptance across diverse regional markets. The market’s evolution reflects fundamental changes in consumer lifestyle patterns, urbanization trends, and economic development that create substantial opportunities for manufacturers, retailers, and distributors who can effectively navigate the complex regional landscape.

Strategic success factors in this market require deep understanding of local consumer preferences, investment in product innovation capabilities, and development of flexible distribution strategies that can adapt to varying market conditions and competitive environments. Companies that successfully balance global brand consistency with local market adaptation while maintaining focus on quality, convenience, and value creation are positioned to capture significant market share and achieve sustainable competitive advantages.

What is Ready-To-Drink Coffee?

Ready-To-Drink Coffee refers to pre-packaged coffee beverages that are ready for consumption without the need for brewing. These products are popular for their convenience and variety, catering to different consumer preferences and lifestyles.

What are the key players in the APAC Ready-To-Drink Coffee Market?

Key players in the APAC Ready-To-Drink Coffee Market include Nestlé, Coca-Cola, and Starbucks, among others. These companies are known for their innovative product offerings and extensive distribution networks.

What are the main drivers of the APAC Ready-To-Drink Coffee Market?

The main drivers of the APAC Ready-To-Drink Coffee Market include the growing demand for convenient beverage options, increasing coffee consumption among younger consumers, and the rise of on-the-go lifestyles.

What challenges does the APAC Ready-To-Drink Coffee Market face?

Challenges in the APAC Ready-To-Drink Coffee Market include intense competition among brands, fluctuating coffee prices, and changing consumer preferences towards healthier beverage options.

What opportunities exist in the APAC Ready-To-Drink Coffee Market?

Opportunities in the APAC Ready-To-Drink Coffee Market include the potential for product innovation, such as the introduction of functional beverages, and expanding distribution channels to reach untapped markets.

What trends are shaping the APAC Ready-To-Drink Coffee Market?

Trends shaping the APAC Ready-To-Drink Coffee Market include the increasing popularity of cold brew coffee, the rise of plant-based alternatives, and a growing focus on sustainable packaging solutions.

APAC Ready-To-Drink Coffee Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chilled Coffee, Iced Coffee, Cold Brew, Espresso |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Cafés |

| End User | Office Workers, Students, Health Enthusiasts, Travelers |

| Packaging Type | Cans, Bottles, Tetra Packs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Ready-To-Drink Coffee Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at