444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC plant protein ingredients market represents a transformative segment within the Asia-Pacific food and beverage industry, experiencing unprecedented growth driven by evolving consumer preferences and sustainability concerns. This dynamic market encompasses a diverse range of protein-rich ingredients derived from various plant sources, including legumes, grains, nuts, and seeds, catering to the region’s increasing demand for alternative protein solutions.

Regional dynamics indicate that the APAC plant protein ingredients market is expanding at a robust CAGR of 8.2%, reflecting the growing consumer awareness about health benefits and environmental sustainability. The market spans across key countries including China, India, Japan, South Korea, Australia, and Southeast Asian nations, each contributing unique consumption patterns and manufacturing capabilities to the overall market landscape.

Consumer behavior shifts across the Asia-Pacific region demonstrate a significant transition toward plant-based nutrition, with 62% of consumers actively seeking protein alternatives to traditional animal-based sources. This trend is particularly pronounced among urban populations and younger demographics who prioritize health-conscious choices and environmental responsibility in their dietary decisions.

Manufacturing capabilities within the region have evolved substantially, with local producers developing sophisticated extraction and processing technologies to meet the growing demand for high-quality plant protein ingredients. The market benefits from abundant agricultural resources and established supply chains that support cost-effective production and distribution across diverse geographic markets.

The APAC plant protein ingredients market refers to the comprehensive ecosystem of protein-rich components extracted from various plant sources and utilized in food, beverage, and nutritional supplement applications across the Asia-Pacific region. These ingredients serve as functional alternatives to animal-derived proteins, offering comparable nutritional profiles while addressing sustainability and ethical consumption concerns.

Plant protein ingredients encompass a wide spectrum of products including protein isolates, concentrates, hydrolysates, and textured proteins derived from sources such as soy, pea, rice, wheat, hemp, and various legumes. These ingredients undergo specialized processing techniques to enhance their functional properties, including solubility, emulsification, gelation, and foaming capabilities, making them suitable for diverse food applications.

Market scope extends beyond traditional protein supplementation to include applications in meat alternatives, dairy substitutes, bakery products, beverages, snacks, and functional foods. The ingredients serve multiple purposes including nutritional enhancement, texture modification, flavor improvement, and shelf-life extension in various food formulations.

Regional significance stems from the Asia-Pacific region’s unique position as both a major producer and consumer of plant-based ingredients, leveraging traditional agricultural practices and modern processing technologies to create innovative protein solutions that cater to local taste preferences and international market demands.

Market momentum in the APAC plant protein ingredients sector reflects a fundamental shift in consumer preferences toward sustainable and health-conscious food choices. The region’s diverse agricultural landscape provides abundant raw materials for protein extraction, while advanced processing technologies enable the production of high-quality ingredients that meet international standards and local market requirements.

Key growth drivers include increasing health awareness, rising disposable incomes, urbanization trends, and government initiatives promoting sustainable agriculture and food security. The market benefits from strong demand across multiple application segments, with 45% of growth attributed to the expanding meat alternatives sector and dairy substitute applications.

Technological advancements in protein extraction and purification methods have significantly improved the functional properties and cost-effectiveness of plant-based ingredients. Innovation in processing techniques has enabled manufacturers to develop products with enhanced nutritional profiles, improved taste characteristics, and better texture properties that closely mimic traditional animal proteins.

Competitive landscape features a mix of established multinational corporations and emerging regional players, each contributing unique capabilities and market insights. Strategic partnerships between ingredient suppliers and food manufacturers have accelerated product development and market penetration across diverse application segments.

Future prospects indicate continued expansion driven by evolving consumer preferences, regulatory support for sustainable food systems, and ongoing innovation in plant protein technology. The market is positioned for sustained growth as manufacturers continue to develop more sophisticated and versatile plant-based protein solutions.

Consumer adoption patterns reveal significant variations across different APAC countries, with developed markets showing higher penetration rates while emerging economies demonstrate rapid growth potential. Understanding these regional nuances is crucial for market participants developing targeted strategies and product offerings.

Health consciousness represents the primary driver propelling the APAC plant protein ingredients market forward. Consumers across the region increasingly recognize the health benefits associated with plant-based nutrition, including reduced risk of cardiovascular disease, improved digestive health, and better weight management outcomes. This awareness has translated into active ingredient scrutiny and preference for products containing plant-derived proteins.

Environmental sustainability concerns have gained significant traction among APAC consumers, particularly in urban areas where environmental awareness is heightened. The lower carbon footprint and reduced water consumption associated with plant protein production compared to animal agriculture resonates strongly with environmentally conscious consumers who view their food choices as contributing to global sustainability efforts.

Demographic shifts including urbanization, rising disposable incomes, and changing lifestyle patterns have created favorable conditions for plant protein adoption. Urban consumers demonstrate greater willingness to experiment with alternative protein sources and pay premium prices for products that align with their health and sustainability values.

Government initiatives across various APAC countries supporting sustainable agriculture, food security, and public health have created a conducive regulatory environment for plant protein development. Policy measures promoting agricultural diversification and sustainable food systems have encouraged investment in plant protein infrastructure and research.

Food industry innovation has accelerated the development of appealing plant protein applications, overcoming traditional barriers related to taste, texture, and functionality. Advanced processing technologies and formulation expertise have enabled the creation of plant protein products that closely match consumer expectations for conventional food experiences.

Cost considerations remain a significant challenge for widespread plant protein adoption, particularly in price-sensitive markets across the APAC region. The higher production costs associated with specialized extraction and processing technologies often result in premium pricing that limits accessibility for budget-conscious consumers and mass-market applications.

Functional limitations of certain plant proteins compared to animal-derived alternatives continue to pose challenges for food manufacturers. Issues related to solubility, emulsification properties, heat stability, and flavor profiles require ongoing research and development investment to achieve optimal performance in various food applications.

Consumer perception barriers persist in some APAC markets where traditional dietary patterns strongly favor animal proteins. Cultural preferences, taste expectations, and skepticism about plant protein nutritional adequacy create resistance to adoption among certain consumer segments, particularly in rural and traditional communities.

Supply chain complexities associated with sourcing, processing, and distributing plant protein ingredients across diverse APAC markets present logistical challenges. Variations in agricultural practices, quality standards, and regulatory requirements across countries complicate efficient supply chain management and cost optimization.

Technical challenges in achieving consistent quality and functionality across different plant protein sources require sophisticated processing capabilities and quality control systems. Variability in raw material characteristics and seasonal availability can impact product consistency and reliability for food manufacturers.

Emerging applications in functional foods and nutraceuticals present substantial growth opportunities for plant protein ingredients. The increasing focus on preventive healthcare and personalized nutrition creates demand for specialized protein formulations targeting specific health conditions and demographic groups, opening new market segments for innovative ingredient suppliers.

Technology advancement opportunities in protein extraction, purification, and modification techniques offer potential for developing superior plant protein ingredients with enhanced functionality and cost-effectiveness. Investment in research and development can lead to breakthrough innovations that address current limitations and expand application possibilities.

Market penetration potential in underserved APAC regions and consumer segments represents significant expansion opportunities. Rural markets, emerging economies, and traditional consumer groups present untapped potential for plant protein adoption through targeted product development and education initiatives.

Partnership opportunities between ingredient suppliers, food manufacturers, and technology providers can accelerate market development and innovation. Collaborative approaches to product development, market entry, and consumer education can leverage complementary strengths and resources for mutual benefit.

Export potential from APAC manufacturing bases to global markets offers opportunities for regional producers to expand their market reach and achieve economies of scale. The region’s competitive manufacturing costs and growing technical expertise position it favorably for international market expansion.

Supply-demand equilibrium in the APAC plant protein ingredients market reflects the complex interplay between growing consumer demand and evolving production capabilities. The market experiences periodic supply constraints due to agricultural seasonality and processing capacity limitations, while demand continues to grow steadily across multiple application segments.

Price dynamics are influenced by raw material costs, processing technology investments, and competitive pressures from both plant-based and animal protein alternatives. Market participants must balance cost optimization with quality maintenance to remain competitive while meeting evolving consumer expectations for premium plant protein products.

Innovation cycles drive continuous market evolution as companies invest in research and development to create differentiated products and improve existing offerings. The rapid pace of technological advancement creates both opportunities for market leaders and challenges for companies struggling to keep pace with innovation requirements.

Regulatory evolution across APAC countries continues to shape market dynamics as governments develop frameworks for plant protein ingredient approval, labeling, and safety standards. Harmonization efforts and regulatory clarity support market growth while ensuring consumer protection and fair competition.

Consumer education plays a crucial role in market dynamics as awareness and understanding of plant protein benefits influence adoption rates and purchasing decisions. Educational initiatives by industry associations, manufacturers, and health organizations contribute to market expansion by addressing misconceptions and highlighting benefits.

Comprehensive market analysis for the APAC plant protein ingredients market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. The methodology encompasses quantitative and qualitative research techniques designed to capture market dynamics, consumer behavior patterns, and industry trends across diverse geographic and demographic segments.

Primary research activities include extensive interviews with industry executives, manufacturers, suppliers, distributors, and end-users across key APAC markets. These interactions provide firsthand insights into market challenges, opportunities, competitive dynamics, and future growth prospects from various stakeholder perspectives.

Secondary research leverages authoritative industry publications, government databases, trade association reports, and academic studies to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments and geographic regions while maintaining research objectivity and accuracy.

Data validation processes employ triangulation techniques comparing multiple data sources and research methods to ensure consistency and reliability. Cross-verification of findings through different research channels helps eliminate potential biases and provides confidence in market projections and trend analysis.

Market modeling utilizes sophisticated analytical techniques to project future market scenarios based on historical data, current trends, and identified growth drivers. The modeling approach considers various factors including economic conditions, regulatory changes, technological developments, and consumer behavior evolution to provide realistic market forecasts.

China dominates the APAC plant protein ingredients market with approximately 35% market share, driven by its massive consumer base, established agricultural infrastructure, and growing health consciousness among urban populations. The country’s strong manufacturing capabilities and government support for sustainable food systems position it as both a major consumer and producer of plant protein ingredients.

India represents the second-largest market with 22% market share, benefiting from traditional vegetarian dietary patterns and abundant legume production. The country’s growing middle class and increasing awareness of protein nutrition create substantial opportunities for market expansion, particularly in urban centers and among health-conscious consumers.

Japan and South Korea collectively account for 18% market share, characterized by high consumer sophistication and willingness to pay premium prices for quality plant protein products. These markets drive innovation in functional and specialty applications, with strong demand for clean-label and minimally processed ingredients.

Southeast Asian markets including Thailand, Vietnam, Malaysia, and Indonesia represent 15% market share with rapid growth potential driven by economic development and changing dietary patterns. These markets benefit from abundant agricultural resources and growing food processing industries that support local plant protein production.

Australia and New Zealand contribute 10% market share with mature markets characterized by high awareness of plant protein benefits and strong regulatory frameworks supporting product innovation. These markets serve as testing grounds for new products and technologies before broader APAC market introduction.

Market leadership in the APAC plant protein ingredients sector is distributed among several key players, each bringing unique strengths and capabilities to the competitive landscape. The market features a combination of established multinational corporations and emerging regional specialists, creating a dynamic competitive environment that drives innovation and market expansion.

Competitive strategies focus on product innovation, capacity expansion, strategic partnerships, and market penetration through localized production and distribution capabilities. Companies invest heavily in research and development to create differentiated products that address specific market needs and consumer preferences.

Market consolidation trends include strategic acquisitions and partnerships as companies seek to expand their capabilities, geographic reach, and product portfolios. These activities create synergies and enable more comprehensive market coverage while accelerating innovation and market development.

By Source: The APAC plant protein ingredients market demonstrates diverse sourcing patterns reflecting regional agricultural strengths and consumer preferences. Soy proteins maintain the largest market share due to established production infrastructure and functional versatility, while pea proteins experience rapid growth driven by allergen-free positioning and superior nutritional profiles.

By Type: Product type segmentation reflects varying functional requirements and application needs across different food categories. Protein isolates command premium pricing due to high protein content and superior functionality, while concentrates offer cost-effective solutions for mass-market applications.

By Application: Application diversity demonstrates the versatility of plant protein ingredients across multiple food categories. Food and beverage applications dominate market demand, while nutritional supplements represent a high-growth segment driven by health and wellness trends.

Food Applications represent the largest category within the APAC plant protein ingredients market, encompassing diverse product segments including meat alternatives, dairy substitutes, bakery products, and processed foods. This category benefits from growing consumer acceptance of plant-based foods and continuous innovation in product formulations that improve taste, texture, and nutritional profiles.

Beverage Applications demonstrate strong growth potential as manufacturers develop protein-enriched drinks targeting health-conscious consumers and active lifestyle segments. Plant protein ingredients offer functional benefits including improved nutritional profiles, clean-label positioning, and allergen-free formulations that appeal to diverse consumer preferences.

Nutritional Supplements category experiences robust growth driven by increasing health awareness and fitness trends across APAC markets. Plant protein powders and specialized formulations cater to athletes, fitness enthusiasts, and health-conscious consumers seeking convenient and effective protein supplementation options.

Animal Feed Applications represent an emerging category as livestock producers seek sustainable and cost-effective protein sources for animal nutrition. Plant protein ingredients offer environmental benefits and potential cost advantages while maintaining nutritional adequacy for various animal species.

Industrial Applications include non-food uses of plant proteins in cosmetics, pharmaceuticals, and technical applications. This category demonstrates the versatility of plant protein ingredients beyond traditional food applications and creates additional market opportunities for ingredient suppliers.

Manufacturers benefit from plant protein ingredients through product differentiation opportunities, access to growing market segments, and alignment with sustainability trends that enhance brand reputation. These ingredients enable the development of innovative products that meet evolving consumer demands while potentially reducing production costs compared to animal protein alternatives.

Retailers gain advantages through expanded product portfolios that cater to health-conscious and environmentally aware consumers. Plant protein products often command premium pricing and generate higher margins while attracting new customer segments and increasing basket sizes through cross-selling opportunities.

Consumers receive multiple benefits including improved nutritional options, environmental sustainability contributions, and often cost-effective alternatives to animal proteins. Plant protein ingredients provide flexibility for various dietary preferences and restrictions while supporting health and wellness goals.

Investors find attractive opportunities in the growing plant protein sector with strong growth prospects, innovation potential, and alignment with global sustainability trends. The market offers diverse investment options across the value chain from agricultural production to finished product manufacturing.

Agricultural Producers benefit from new market opportunities for traditional crops and incentives to diversify production into high-value protein crops. Plant protein demand creates stable markets for agricultural products while supporting rural economic development and sustainable farming practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement continues to gain momentum across APAC markets as consumers increasingly scrutinize ingredient lists and prefer products with simple, recognizable components. This trend drives demand for minimally processed plant protein ingredients and encourages manufacturers to develop cleaner extraction and processing methods that maintain functionality while reducing chemical inputs.

Functional Enhancement represents a major trend as ingredient suppliers invest in technologies that improve the functional properties of plant proteins. Innovations in protein modification, encapsulation, and formulation techniques enable the development of ingredients with enhanced solubility, neutral taste profiles, and superior performance characteristics in various food applications.

Personalized Nutrition trends are creating opportunities for specialized plant protein formulations targeting specific demographic groups, health conditions, and lifestyle preferences. Customized protein blends and functional ingredients cater to individual nutritional needs while supporting the growing personalized health and wellness market segment.

Sustainability Integration has become a core consideration in product development and marketing strategies as consumers increasingly evaluate the environmental impact of their food choices. Companies emphasize sustainable sourcing, carbon footprint reduction, and circular economy principles in their plant protein operations and communications.

Technology Convergence brings together advances in biotechnology, food science, and processing equipment to create more efficient and effective plant protein solutions. Emerging technologies including fermentation, enzymatic processing, and precision agriculture contribute to improved ingredient quality and production efficiency.

Capacity Expansion initiatives across the APAC region reflect strong market confidence and growing demand for plant protein ingredients. Major manufacturers are investing in new production facilities and upgrading existing operations to increase capacity, improve efficiency, and enhance product quality to meet evolving market requirements.

Strategic Partnerships between ingredient suppliers, food manufacturers, and technology providers are accelerating innovation and market development. These collaborations leverage complementary strengths and resources to develop new products, enter new markets, and create competitive advantages in the rapidly evolving plant protein landscape.

Technology Investments focus on improving extraction efficiency, enhancing functional properties, and reducing production costs. Companies are adopting advanced processing technologies, automation systems, and quality control measures to maintain competitiveness and meet growing quality expectations from food manufacturers and consumers.

Regulatory Developments across APAC countries are creating more favorable environments for plant protein ingredient development and commercialization. Governments are establishing clearer guidelines for product approval, labeling requirements, and safety standards while supporting sustainable food system development through policy initiatives.

Market Consolidation activities include strategic acquisitions and mergers as companies seek to expand capabilities, geographic reach, and market share. These transactions create synergies and enable more comprehensive market coverage while accelerating innovation and operational efficiency improvements.

Investment Prioritization should focus on technology development and capacity expansion in high-growth markets while maintaining quality standards and cost competitiveness. Companies should evaluate opportunities for vertical integration and strategic partnerships that enhance supply chain control and market access capabilities.

Product Development strategies should emphasize functional improvement and application diversification to address current limitations and expand market opportunities. MarkWide Research analysis indicates that companies investing in taste improvement and texture enhancement achieve 25% higher market acceptance rates compared to those focusing solely on nutritional benefits.

Market Entry approaches should consider regional preferences, regulatory requirements, and competitive dynamics when developing expansion strategies. Localized production capabilities and partnerships with established distributors can accelerate market penetration while reducing operational risks and costs.

Consumer Education initiatives should address misconceptions about plant protein nutrition and functionality while highlighting environmental and health benefits. Educational marketing campaigns and partnerships with health professionals can accelerate consumer adoption and market growth.

Sustainability Integration should become a core component of business strategy as environmental considerations increasingly influence purchasing decisions. Companies should develop comprehensive sustainability programs covering sourcing, production, packaging, and distribution to meet evolving stakeholder expectations.

Market trajectory for the APAC plant protein ingredients market indicates sustained growth driven by fundamental shifts in consumer behavior, technological advancement, and regulatory support. The market is expected to maintain strong momentum with projected growth rates of 8.5% CAGR over the next five years, reflecting continued expansion across multiple application segments and geographic regions.

Innovation acceleration will drive significant improvements in plant protein functionality, cost-effectiveness, and application versatility. Breakthrough technologies in protein extraction, modification, and formulation are expected to address current limitations and create new market opportunities, particularly in premium and specialized application segments.

Geographic expansion will see increased market penetration in underserved regions and consumer segments as awareness grows and product availability improves. Rural markets and traditional consumer groups represent significant untapped potential for plant protein adoption through targeted product development and education initiatives.

Application diversification will extend plant protein use beyond traditional food applications into functional foods, nutraceuticals, cosmetics, and industrial applications. This diversification creates multiple revenue streams and reduces market concentration risks while supporting overall market growth and stability.

Competitive evolution will feature increased consolidation, strategic partnerships, and technology licensing as companies seek to enhance capabilities and market positions. MWR projections suggest that market leaders will achieve 40% higher growth rates through strategic acquisitions and technology investments compared to companies relying solely on organic growth strategies.

The APAC plant protein ingredients market represents a dynamic and rapidly evolving sector with substantial growth potential driven by changing consumer preferences, technological advancement, and sustainability imperatives. The market benefits from the region’s abundant agricultural resources, established manufacturing capabilities, and growing consumer acceptance of plant-based nutrition solutions.

Key success factors for market participants include investment in technology and innovation, development of high-quality products that meet functional requirements, and strategic positioning to capture growth opportunities across diverse application segments and geographic markets. Companies that successfully address current limitations while leveraging emerging opportunities will achieve sustainable competitive advantages.

Market outlook remains highly positive with continued expansion expected across all major segments and regions. The convergence of health consciousness, environmental awareness, and technological capability creates a favorable environment for sustained market growth and innovation. Strategic investments in capacity, technology, and market development will be crucial for capturing the significant opportunities presented by this evolving market landscape.

What is Plant Protein Ingredients?

Plant Protein Ingredients refer to protein sources derived from plants, commonly used in food and beverage products, dietary supplements, and animal feed. These ingredients are valued for their nutritional benefits and versatility in various applications.

What are the key players in the APAC Plant Protein Ingredients Market?

Key players in the APAC Plant Protein Ingredients Market include companies like DuPont, ADM, and Cargill, which are known for their extensive portfolios in plant-based proteins. These companies focus on innovation and sustainability in their product offerings, among others.

What are the main drivers of growth in the APAC Plant Protein Ingredients Market?

The growth of the APAC Plant Protein Ingredients Market is driven by increasing consumer demand for plant-based diets, rising health consciousness, and the expansion of vegan and vegetarian food options. Additionally, the trend towards sustainable food sources is contributing to market expansion.

What challenges does the APAC Plant Protein Ingredients Market face?

Challenges in the APAC Plant Protein Ingredients Market include the high cost of production, limited availability of raw materials, and consumer perception issues regarding taste and texture of plant-based proteins. These factors can hinder market growth and adoption.

What opportunities exist in the APAC Plant Protein Ingredients Market?

Opportunities in the APAC Plant Protein Ingredients Market include the development of innovative products that cater to diverse dietary needs and preferences, as well as the potential for expansion into emerging markets. Collaborations with food manufacturers can also enhance product offerings.

What trends are shaping the APAC Plant Protein Ingredients Market?

Trends shaping the APAC Plant Protein Ingredients Market include the rise of clean label products, increased investment in research and development for new protein sources, and the growing popularity of alternative protein formats such as snacks and ready-to-eat meals. These trends reflect changing consumer preferences.

APAC Plant Protein Ingredients Market

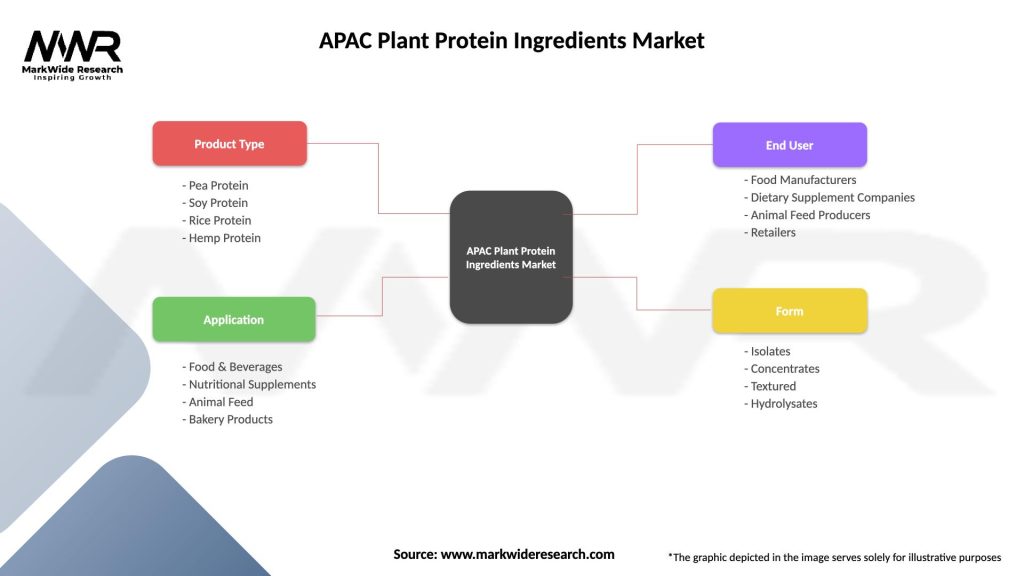

| Segmentation Details | Description |

|---|---|

| Product Type | Pea Protein, Soy Protein, Rice Protein, Hemp Protein |

| Application | Food & Beverages, Nutritional Supplements, Animal Feed, Bakery Products |

| End User | Food Manufacturers, Dietary Supplement Companies, Animal Feed Producers, Retailers |

| Form | Isolates, Concentrates, Textured, Hydrolysates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Plant Protein Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at