444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC pharmaceutical warehousing market represents a rapidly expanding sector driven by increasing healthcare demands, regulatory compliance requirements, and technological advancements across the Asia-Pacific region. This specialized warehousing segment focuses on the storage, handling, and distribution of pharmaceutical products, including prescription medications, over-the-counter drugs, vaccines, and medical devices. The market encompasses various stakeholders including pharmaceutical manufacturers, third-party logistics providers, cold chain specialists, and healthcare distributors operating across diverse geographical territories from Japan and South Korea to emerging markets in Southeast Asia and India.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate of 8.2% driven by expanding pharmaceutical manufacturing capabilities, rising healthcare expenditure, and increasing demand for specialized storage solutions. The region’s pharmaceutical warehousing infrastructure has evolved significantly to accommodate stringent regulatory requirements, temperature-controlled environments, and advanced inventory management systems essential for maintaining drug efficacy and safety standards.

Regional diversity characterizes the APAC pharmaceutical warehousing landscape, with developed markets like Japan and Australia leading in automation and compliance standards, while emerging economies such as India, China, and Vietnam focus on capacity expansion and infrastructure development. This heterogeneous market structure creates unique opportunities for specialized warehousing solutions tailored to local regulatory frameworks and operational requirements.

The APAC pharmaceutical warehousing market refers to the comprehensive ecosystem of specialized storage and distribution facilities designed to handle pharmaceutical products across the Asia-Pacific region while maintaining strict quality, safety, and regulatory compliance standards. This market encompasses temperature-controlled storage solutions, automated inventory management systems, and specialized handling procedures required for pharmaceutical products throughout their supply chain journey.

Pharmaceutical warehousing differs significantly from general warehousing due to stringent regulatory requirements, including Good Distribution Practice (GDP) guidelines, temperature monitoring protocols, and traceability systems. These facilities must maintain precise environmental conditions, implement robust security measures, and ensure complete documentation of product handling from receipt to dispatch.

Key components of pharmaceutical warehousing include climate-controlled storage areas, specialized handling equipment, inventory tracking systems, quality control laboratories, and secure packaging facilities. The market also encompasses value-added services such as product labeling, serialization, kitting, and reverse logistics for expired or recalled products.

Strategic positioning within the APAC pharmaceutical warehousing market reveals significant growth opportunities driven by expanding healthcare infrastructure, increasing pharmaceutical production, and rising demand for specialized storage solutions. The market benefits from favorable demographic trends, including aging populations, growing middle-class segments, and increased healthcare awareness across the region.

Technology adoption represents a critical success factor, with 65% of leading facilities implementing advanced warehouse management systems, automated storage solutions, and IoT-enabled monitoring technologies. These technological investments enhance operational efficiency, reduce human error, and improve compliance with regulatory requirements while supporting scalable growth strategies.

Regulatory compliance remains paramount, with facilities investing heavily in GDP certification, temperature validation protocols, and comprehensive documentation systems. The market demonstrates strong resilience through diversified service offerings, strategic partnerships with pharmaceutical manufacturers, and continuous adaptation to evolving regulatory landscapes across different APAC countries.

Competitive dynamics favor companies with strong technological capabilities, regulatory expertise, and regional presence. Market leaders leverage economies of scale, advanced automation technologies, and comprehensive service portfolios to maintain competitive advantages while serving diverse customer segments from multinational pharmaceutical companies to local healthcare distributors.

Market segmentation reveals diverse opportunities across multiple dimensions, with specialized storage requirements driving demand for tailored warehousing solutions. The following key insights shape market development:

Pharmaceutical manufacturing expansion across the APAC region serves as a primary market driver, with countries like India, China, and South Korea establishing themselves as global pharmaceutical production hubs. This manufacturing growth creates substantial demand for specialized warehousing facilities capable of handling diverse product portfolios while maintaining strict quality standards and regulatory compliance.

Healthcare infrastructure development throughout emerging APAC markets drives increased demand for pharmaceutical distribution capabilities. Government initiatives to improve healthcare access, expand insurance coverage, and develop medical facilities create sustained growth in pharmaceutical consumption, requiring robust warehousing and distribution networks to ensure reliable product availability.

Regulatory harmonization efforts across APAC countries promote standardized warehousing practices and facilitate cross-border pharmaceutical trade. These regulatory developments encourage investment in compliant facilities while creating opportunities for regional consolidation and economies of scale in pharmaceutical distribution operations.

Cold chain requirements continue expanding with the growth of biologics, vaccines, and temperature-sensitive medications. The increasing prevalence of chronic diseases requiring specialized medications drives demand for sophisticated cold storage facilities with precise temperature control, monitoring systems, and backup power capabilities to ensure product integrity throughout the supply chain.

E-commerce penetration in pharmaceutical distribution creates new warehousing requirements for direct-to-consumer delivery, smaller package handling, and last-mile distribution capabilities. This trend particularly impacts markets like China and India, where online pharmacy platforms require specialized fulfillment centers with pharmaceutical-grade storage and handling capabilities.

High capital requirements for establishing compliant pharmaceutical warehousing facilities present significant barriers to market entry. The substantial investments required for temperature-controlled infrastructure, specialized equipment, validation processes, and ongoing compliance maintenance limit market participation to well-capitalized organizations with long-term strategic commitments.

Regulatory complexity across diverse APAC markets creates operational challenges for companies seeking regional expansion. Varying GDP requirements, import/export regulations, and local compliance standards necessitate significant investments in regulatory expertise and facility customization, potentially limiting scalability and operational efficiency.

Skilled workforce shortages in pharmaceutical logistics and warehousing operations constrain market growth, particularly in emerging economies. The specialized knowledge required for pharmaceutical handling, quality control, and regulatory compliance creates recruitment challenges and increases operational costs for facility operators.

Infrastructure limitations in certain APAC regions, including unreliable power supply, inadequate transportation networks, and limited cold chain capabilities, restrict market development and increase operational risks. These infrastructure challenges particularly impact rural and remote areas, limiting pharmaceutical access and distribution efficiency.

Economic volatility and currency fluctuations across APAC markets create financial uncertainties for pharmaceutical warehousing investments. Exchange rate variations, inflation pressures, and economic instability can impact operational costs, customer demand, and investment returns, requiring robust risk management strategies.

Digital transformation initiatives present substantial opportunities for pharmaceutical warehousing providers to differentiate their services and improve operational efficiency. Implementation of advanced analytics, artificial intelligence, and machine learning technologies can optimize inventory management, predict demand patterns, and enhance quality control processes while reducing operational costs and improving customer satisfaction.

Strategic partnerships with pharmaceutical manufacturers, healthcare providers, and technology companies create opportunities for integrated service offerings and market expansion. These collaborations can facilitate access to new customer segments, enable service innovation, and provide competitive advantages through comprehensive supply chain solutions.

Sustainability initiatives offer opportunities to reduce operational costs while meeting increasing environmental requirements from customers and regulators. Green warehousing technologies, renewable energy systems, and sustainable packaging solutions can create competitive differentiation while supporting corporate social responsibility objectives.

Market consolidation opportunities exist as smaller operators seek partnerships or acquisition by larger organizations with superior resources and capabilities. This consolidation trend can create economies of scale, improve service quality, and enhance market coverage while providing growth opportunities for well-positioned companies.

Emerging market penetration in countries like Vietnam, Thailand, and Indonesia presents significant growth potential as these economies develop their pharmaceutical sectors and healthcare infrastructure. Early market entry can establish competitive advantages and capture market share in rapidly growing pharmaceutical markets.

Supply chain evolution within the APAC pharmaceutical warehousing market reflects broader trends toward specialization, automation, and integration. Traditional warehousing models are transforming into comprehensive logistics solutions that encompass inventory management, quality control, regulatory compliance, and value-added services tailored to pharmaceutical industry requirements.

Customer expectations continue evolving toward higher service levels, greater transparency, and enhanced reliability in pharmaceutical distribution. Healthcare providers and pharmaceutical companies increasingly demand real-time visibility, proactive quality management, and flexible service options that support their operational objectives and patient care responsibilities.

Technology integration accelerates across the market, with warehouse management systems achieving 92% penetration among leading facilities. These technological investments enable improved inventory accuracy, enhanced traceability, and automated compliance reporting while supporting scalable operations and customer service excellence.

Competitive intensity increases as market participants invest in facility expansion, technology upgrades, and service enhancement to capture growing market opportunities. This competition drives innovation, improves service quality, and creates pressure for operational efficiency while potentially impacting profit margins and market consolidation trends.

Regulatory evolution continues shaping market dynamics as governments across the APAC region strengthen pharmaceutical distribution requirements and harmonize standards with international best practices. These regulatory changes create both compliance challenges and opportunities for differentiation through superior regulatory expertise and facility capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the APAC pharmaceutical warehousing market. Primary research activities include structured interviews with industry executives, facility operators, pharmaceutical manufacturers, and regulatory officials across key APAC markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses extensive analysis of industry reports, regulatory publications, company financial statements, and trade association data to validate primary research findings and provide comprehensive market context. This research approach ensures thorough coverage of market segments, competitive dynamics, and regional variations across the diverse APAC landscape.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and employing statistical analysis techniques to ensure research accuracy and reliability. Market sizing and forecasting methodologies incorporate historical trend analysis, economic indicators, and industry-specific growth drivers to develop realistic market projections.

Expert consultation with industry specialists, regulatory consultants, and technology providers enhances research quality and provides specialized insights into technical requirements, compliance standards, and emerging market trends. These expert perspectives inform strategic recommendations and market opportunity assessments.

China dominates the APAC pharmaceutical warehousing market with 38% regional market share, driven by massive pharmaceutical manufacturing capabilities, large domestic healthcare demand, and significant government investments in healthcare infrastructure. The country’s pharmaceutical warehousing sector benefits from advanced automation technologies, extensive distribution networks, and growing export capabilities to serve global pharmaceutical markets.

India represents the second-largest market with 22% regional share, supported by its position as a global pharmaceutical manufacturing hub and rapidly expanding domestic healthcare market. Indian pharmaceutical warehousing facilities focus on cost-effective operations, regulatory compliance, and capacity expansion to serve both domestic and export markets while maintaining competitive pricing structures.

Japan maintains a 15% market share characterized by highly sophisticated warehousing operations, advanced automation technologies, and stringent quality standards. Japanese facilities emphasize precision, reliability, and technological innovation while serving a mature pharmaceutical market with demanding regulatory requirements and high service expectations.

South Korea accounts for 8% of the regional market, with facilities focusing on high-tech solutions, biologics handling, and export-oriented operations. The country’s pharmaceutical warehousing sector benefits from strong technology capabilities, government support for pharmaceutical innovation, and strategic location for serving Northeast Asian markets.

Australia and Southeast Asian markets collectively represent the remaining 17% market share, with Australia leading in regulatory compliance and service quality while Southeast Asian countries like Thailand, Vietnam, and Indonesia focus on capacity expansion and infrastructure development to support growing pharmaceutical sectors.

Market leadership in the APAC pharmaceutical warehousing sector is characterized by a mix of global logistics providers, regional specialists, and pharmaceutical company-owned facilities. The competitive landscape reflects diverse strategies ranging from technology-focused differentiation to cost leadership and specialized service offerings.

Leading market participants include:

Competitive strategies focus on technology investment, regulatory expertise, geographic expansion, and service diversification. Market leaders leverage economies of scale, advanced automation systems, and comprehensive service portfolios to maintain competitive advantages while serving diverse customer segments across the APAC region.

By Storage Type:

By Service Type:

By End User:

By Geography:

Cold Chain Storage emerges as the fastest-growing category within the APAC pharmaceutical warehousing market, driven by increasing vaccine distribution requirements, biologics growth, and temperature-sensitive medication handling. This segment demands sophisticated refrigeration systems, continuous temperature monitoring, and backup power capabilities to ensure product integrity throughout storage and distribution processes.

Automated Storage Solutions gain significant traction across the region, with facilities investing in robotic systems, automated guided vehicles, and advanced warehouse management technologies. These automation investments improve operational efficiency, reduce human error, and enhance compliance with pharmaceutical handling requirements while supporting scalable growth strategies.

Value-Added Services represent a high-growth category as pharmaceutical companies seek comprehensive logistics solutions beyond basic storage. Services including serialization, track-and-trace implementation, kitting, and reverse logistics create additional revenue streams while strengthening customer relationships and competitive positioning.

Cross-Border Distribution capabilities become increasingly important as pharmaceutical companies expand regional operations and seek integrated supply chain solutions. Facilities with customs clearance expertise, regulatory compliance capabilities, and multi-country operations provide significant value to pharmaceutical manufacturers pursuing regional growth strategies.

Specialized Handling for high-value and controlled substances requires enhanced security measures, specialized personnel training, and comprehensive documentation systems. This category commands premium pricing while serving critical pharmaceutical distribution requirements for narcotics, biologics, and investigational drugs.

Pharmaceutical Manufacturers benefit from specialized warehousing solutions that ensure product quality, regulatory compliance, and efficient distribution while allowing focus on core competencies. Outsourced warehousing provides access to advanced technologies, regulatory expertise, and scalable capacity without significant capital investments in facility infrastructure.

Healthcare Distributors gain competitive advantages through partnerships with specialized pharmaceutical warehousing providers, enabling expanded service offerings, improved operational efficiency, and enhanced customer satisfaction. These partnerships provide access to advanced technologies and compliance capabilities that may be cost-prohibitive to develop independently.

Healthcare Providers benefit from reliable pharmaceutical supply chains that ensure medication availability, quality assurance, and cost-effective procurement. Specialized warehousing solutions support just-in-time inventory management, reduce carrying costs, and minimize stockout risks while maintaining patient care standards.

Logistics Providers create differentiated service offerings and premium pricing opportunities through pharmaceutical warehousing specialization. This market segment offers stable, long-term customer relationships, recurring revenue streams, and opportunities for value-added service development that enhance profitability and competitive positioning.

Technology Vendors find substantial opportunities in providing specialized solutions for pharmaceutical warehousing operations, including warehouse management systems, temperature monitoring technologies, and automation equipment. The sector’s emphasis on compliance and quality creates sustained demand for advanced technological solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration transforms pharmaceutical warehousing operations across the APAC region, with facilities implementing robotic picking systems, automated guided vehicles, and AI-powered inventory management. These technological investments improve accuracy, reduce labor costs, and enhance compliance while supporting scalable growth strategies in response to increasing pharmaceutical distribution demands.

Cold chain expansion reflects growing requirements for temperature-sensitive pharmaceutical products, including vaccines, biologics, and specialty medications. Facilities invest in advanced refrigeration systems, continuous monitoring technologies, and backup power capabilities to ensure product integrity while meeting stringent regulatory requirements for temperature-controlled distribution.

Sustainability initiatives gain prominence as pharmaceutical companies and logistics providers prioritize environmental responsibility. Green warehousing practices include energy-efficient lighting systems, solar power installation, optimized HVAC systems, and sustainable packaging solutions that reduce environmental impact while potentially lowering operational costs.

Digital integration encompasses comprehensive technology adoption including IoT sensors, blockchain tracking, artificial intelligence, and advanced analytics. These digital solutions enable real-time monitoring, predictive maintenance, demand forecasting, and enhanced traceability while supporting regulatory compliance and operational optimization.

Service consolidation trends toward comprehensive logistics solutions that integrate warehousing, transportation, quality control, and value-added services. Customers increasingly prefer single-source providers capable of managing entire pharmaceutical supply chains while maintaining quality standards and regulatory compliance across multiple markets.

Regulatory harmonization efforts across APAC countries promote standardized pharmaceutical distribution practices and facilitate cross-border trade. Recent developments include mutual recognition agreements, standardized GDP guidelines, and coordinated inspection protocols that reduce compliance complexity while maintaining quality standards.

Technology partnerships between warehousing providers and technology companies accelerate innovation in pharmaceutical logistics. Recent collaborations focus on developing AI-powered inventory optimization, blockchain-based traceability systems, and IoT-enabled quality monitoring solutions that enhance operational efficiency and regulatory compliance.

Facility expansion projects across major APAC markets reflect growing demand for specialized pharmaceutical warehousing capacity. Recent investments include state-of-the-art automated facilities in China, cold chain expansion in India, and technology upgrades in Japan that enhance regional distribution capabilities.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand geographic coverage, enhance service capabilities, and achieve economies of scale. Recent transactions demonstrate industry consolidation trends and the importance of regional presence in serving diverse pharmaceutical markets.

Sustainability certifications become increasingly important as facilities pursue green building standards, carbon neutrality goals, and environmental compliance certifications. These initiatives reflect growing environmental awareness and customer requirements for sustainable supply chain practices.

MarkWide Research recommends that pharmaceutical warehousing providers prioritize technology investments to maintain competitive advantages and operational efficiency. Advanced automation systems, IoT monitoring capabilities, and AI-powered analytics represent critical success factors for capturing market opportunities while meeting evolving customer requirements and regulatory standards.

Geographic diversification strategies should focus on emerging APAC markets with strong pharmaceutical growth potential, including Vietnam, Indonesia, and Thailand. Early market entry in these developing economies can establish competitive positioning and capture market share as healthcare infrastructure expands and pharmaceutical consumption increases.

Service portfolio expansion through value-added offerings creates differentiation opportunities and revenue growth potential. Companies should consider developing capabilities in serialization, track-and-trace implementation, regulatory consulting, and specialized packaging to enhance customer relationships and competitive positioning.

Partnership strategies with pharmaceutical manufacturers, technology providers, and regional logistics companies can accelerate market expansion while sharing investment risks and operational expertise. Strategic alliances enable access to new customer segments, technological capabilities, and geographic markets while maintaining capital efficiency.

Sustainability initiatives should be integrated into long-term strategic planning as environmental requirements and customer expectations continue evolving. Green warehousing investments can reduce operational costs, enhance corporate reputation, and meet increasing sustainability requirements from pharmaceutical industry customers.

Market expansion prospects remain robust across the APAC pharmaceutical warehousing sector, with projected growth rates of 8.5% annually driven by continued healthcare infrastructure development, pharmaceutical manufacturing growth, and increasing demand for specialized storage solutions. The market benefits from favorable demographic trends, rising healthcare expenditure, and expanding pharmaceutical access across diverse regional economies.

Technology evolution will continue transforming pharmaceutical warehousing operations through advanced automation, artificial intelligence, and digital integration. Future developments include fully automated facilities, predictive analytics for demand forecasting, and blockchain-based traceability systems that enhance operational efficiency while ensuring regulatory compliance and product quality.

Regulatory convergence across APAC markets will simplify compliance requirements while maintaining quality standards, creating opportunities for regional consolidation and operational standardization. Harmonized regulations will facilitate cross-border pharmaceutical distribution while reducing compliance costs and operational complexity for multi-country operations.

Service innovation will focus on comprehensive supply chain solutions that integrate warehousing, transportation, quality control, and regulatory compliance. Future service offerings may include real-time inventory optimization, predictive maintenance, and integrated healthcare logistics solutions that support pharmaceutical manufacturers’ strategic objectives.

MWR analysis indicates that successful pharmaceutical warehousing providers will differentiate through technology leadership, regulatory expertise, and comprehensive service portfolios while maintaining operational excellence and customer satisfaction. Market leaders will leverage economies of scale, strategic partnerships, and continuous innovation to capture growing opportunities across the dynamic APAC pharmaceutical landscape.

The APAC pharmaceutical warehousing market presents substantial growth opportunities driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing, and rising demand for specialized storage solutions across diverse regional economies. Market success requires strategic investments in technology, regulatory compliance, and service innovation while maintaining operational excellence and customer satisfaction.

Key success factors include advanced automation capabilities, comprehensive regulatory expertise, geographic diversification, and value-added service development. Companies that effectively combine these elements while maintaining cost competitiveness and service quality will capture the most significant market opportunities in this dynamic and growing sector.

Future market development will be shaped by continued technology adoption, regulatory harmonization, sustainability initiatives, and service consolidation trends. Organizations that proactively address these market dynamics while building scalable, compliant, and technologically advanced operations will establish sustainable competitive advantages in the expanding APAC pharmaceutical warehousing market.

What is Pharmaceutical Warehousing?

Pharmaceutical warehousing refers to the storage and management of pharmaceutical products, ensuring they are kept in optimal conditions to maintain their efficacy and safety. This includes temperature control, inventory management, and compliance with regulatory standards.

What are the key players in the APAC Pharmaceutical Warehousing Market?

Key players in the APAC Pharmaceutical Warehousing Market include DHL Supply Chain, Kuehne + Nagel, and DB Schenker, among others. These companies provide specialized logistics and warehousing solutions tailored to the pharmaceutical industry.

What are the main drivers of the APAC Pharmaceutical Warehousing Market?

The main drivers of the APAC Pharmaceutical Warehousing Market include the increasing demand for pharmaceuticals due to rising healthcare needs, the growth of e-commerce in healthcare, and the need for efficient supply chain management to ensure timely delivery of products.

What challenges does the APAC Pharmaceutical Warehousing Market face?

Challenges in the APAC Pharmaceutical Warehousing Market include stringent regulatory requirements, the need for advanced technology to manage inventory, and the high costs associated with maintaining temperature-controlled environments.

What opportunities exist in the APAC Pharmaceutical Warehousing Market?

Opportunities in the APAC Pharmaceutical Warehousing Market include the expansion of biopharmaceuticals, the integration of automation and AI in warehousing processes, and the increasing focus on sustainability in logistics operations.

What trends are shaping the APAC Pharmaceutical Warehousing Market?

Trends shaping the APAC Pharmaceutical Warehousing Market include the adoption of smart warehousing technologies, increased collaboration between manufacturers and logistics providers, and a growing emphasis on cold chain logistics to ensure product integrity.

APAC Pharmaceutical Warehousing Market

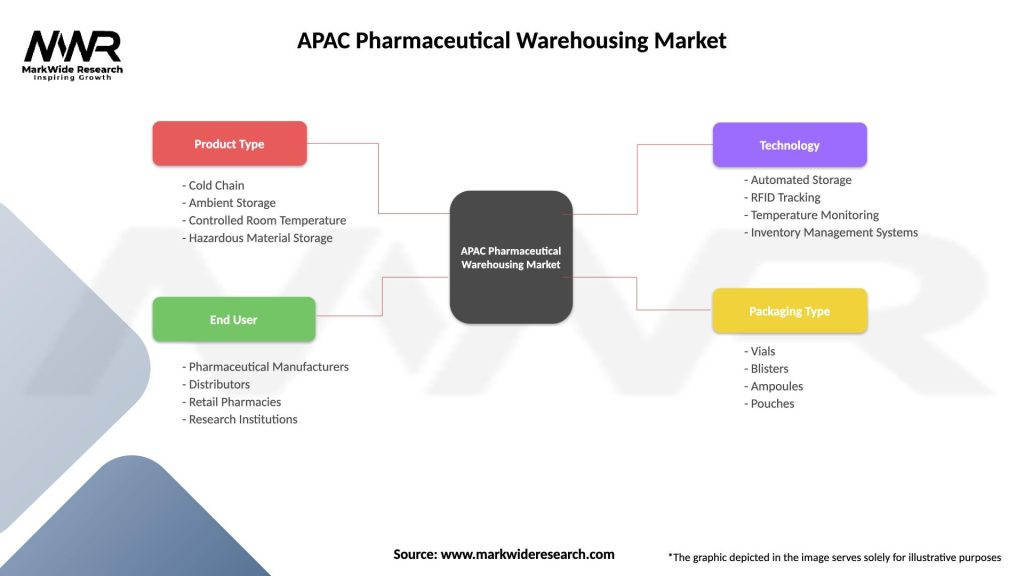

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Chain, Ambient Storage, Controlled Room Temperature, Hazardous Material Storage |

| End User | Pharmaceutical Manufacturers, Distributors, Retail Pharmacies, Research Institutions |

| Technology | Automated Storage, RFID Tracking, Temperature Monitoring, Inventory Management Systems |

| Packaging Type | Vials, Blisters, Ampoules, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Pharmaceutical Warehousing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at