444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC pet insurance market represents one of the fastest-growing segments within the broader insurance industry across Asia-Pacific regions. Pet ownership trends have experienced remarkable transformation throughout countries including Australia, Japan, South Korea, Singapore, and emerging markets like India and Thailand. The market demonstrates exceptional growth potential driven by increasing pet humanization, rising veterinary costs, and growing awareness of comprehensive pet healthcare coverage.

Market dynamics indicate that pet insurance adoption rates have surged by approximately 23% annually across major APAC markets, with Australia and Japan leading penetration rates. The region’s diverse economic landscapes create unique opportunities for insurance providers to develop tailored products addressing varying consumer needs and spending capabilities. Digital transformation has particularly accelerated market expansion, enabling insurers to reach previously underserved segments through innovative online platforms and mobile applications.

Regional variations significantly influence market development patterns, with developed economies showing higher premium pet insurance adoption while emerging markets demonstrate rapid growth in basic coverage options. The market encompasses various product categories including accident-only policies, comprehensive health coverage, and specialized wellness plans designed to meet diverse pet owner preferences and financial constraints.

The APAC pet insurance market refers to the comprehensive ecosystem of insurance products and services designed to provide financial protection for pet-related medical expenses across Asia-Pacific countries. This market encompasses various coverage options including accident protection, illness treatment, preventive care, and specialized veterinary procedures for companion animals primarily dogs and cats.

Pet insurance products function through premium-based models where pet owners pay monthly or annual fees in exchange for coverage of qualifying veterinary expenses. The market includes traditional indemnity plans, direct payment arrangements with veterinary clinics, and innovative subscription-based wellness programs. Coverage scope varies significantly across different policy types, ranging from basic accident protection to comprehensive health plans including hereditary conditions, behavioral therapy, and alternative treatments.

Market participants include established insurance companies, specialized pet insurance providers, insurtech startups, and technology platforms facilitating policy distribution and claims processing. The ecosystem also encompasses veterinary networks, pet retailers, and digital platforms that serve as distribution channels for insurance products throughout the APAC region.

Strategic market analysis reveals that the APAC pet insurance sector is experiencing unprecedented expansion driven by fundamental shifts in pet ownership attitudes and veterinary care accessibility. Key growth drivers include increasing pet humanization trends, rising disposable incomes in emerging markets, and growing awareness of preventive pet healthcare benefits.

Market penetration rates vary dramatically across the region, with Australia achieving approximately 35% pet insurance adoption while emerging markets like India and Thailand maintain single-digit penetration levels, indicating substantial growth opportunities. Digital innovation has emerged as a critical differentiator, with insurtech companies leveraging artificial intelligence, telemedicine integration, and streamlined claims processing to enhance customer experiences.

Competitive landscape dynamics showcase a mix of established insurance giants expanding into pet coverage and specialized providers focusing exclusively on animal health insurance. The market demonstrates strong potential for consolidation as larger players acquire innovative startups to enhance their digital capabilities and market reach across diverse APAC economies.

Fundamental market insights reveal several critical trends shaping the APAC pet insurance landscape:

Primary market drivers propelling APAC pet insurance growth encompass demographic, economic, and cultural factors that fundamentally reshape pet ownership paradigms. Pet humanization trends represent the most significant driver, with pet owners increasingly viewing their animals as family members deserving comprehensive healthcare coverage similar to human insurance benefits.

Rising veterinary costs across the region create compelling value propositions for insurance coverage, particularly as advanced treatments including oncology, orthopedic surgery, and diagnostic imaging become more accessible. Economic prosperity in emerging markets enables middle-class families to allocate discretionary spending toward pet care, while established economies show willingness to invest in premium coverage options.

Demographic shifts including urbanization, delayed parenthood, and aging populations contribute to increased pet adoption rates and emotional attachment levels. Digital connectivity facilitates insurance education and comparison shopping, while social media influences create awareness of pet healthcare importance and insurance benefits among younger demographics.

Regulatory support in several APAC countries encourages responsible pet ownership through insurance incentives and veterinary industry development. Veterinary infrastructure expansion increases treatment accessibility, creating demand for financial protection against unexpected medical expenses that can reach significant amounts for complex procedures.

Significant market restraints continue to limit pet insurance penetration across various APAC markets, with price sensitivity representing the primary barrier for potential customers. Many pet owners perceive insurance premiums as unnecessary expenses, particularly in markets where veterinary costs remain relatively low compared to developed economies.

Limited awareness about pet insurance benefits and coverage options restricts market expansion, especially in emerging economies where insurance education remains insufficient. Complex policy terms and exclusions create confusion among potential customers, while lengthy claims processing times in some markets damage consumer confidence and satisfaction levels.

Regulatory challenges vary significantly across APAC countries, with some markets lacking specific frameworks for pet insurance products, creating uncertainty for providers and consumers. Veterinary network limitations in rural areas restrict policy utility, while inconsistent treatment standards across different regions complicate coverage standardization efforts.

Cultural factors in certain markets view pet insurance as unnecessary luxury rather than essential protection, while economic volatility in some regions affects discretionary spending on non-essential insurance products. Pre-existing condition exclusions and age limitations further restrict market accessibility for older pets and those with health histories.

Substantial market opportunities exist across the APAC pet insurance landscape, particularly in underserved emerging markets where pet ownership rates continue climbing while insurance penetration remains minimal. Product innovation opportunities include developing affordable basic coverage plans tailored to price-sensitive segments and comprehensive premium options for affluent pet owners.

Technology integration presents significant opportunities for market expansion through artificial intelligence-powered underwriting, blockchain-based claims processing, and Internet of Things devices for pet health monitoring. Partnership opportunities with veterinary clinics, pet retailers, and digital platforms can expand distribution reach while reducing customer acquisition costs.

Cross-selling opportunities with existing insurance customers demonstrate potential for portfolio expansion, while corporate partnerships can introduce pet insurance as employee benefits packages. Specialized coverage areas including exotic pets, working animals, and breeding operations represent niche markets with premium pricing potential.

Regional expansion opportunities exist for established providers to enter emerging markets through local partnerships or acquisitions. Digital-first strategies can capture younger demographics while educational initiatives can build market awareness and acceptance in traditionally conservative insurance markets throughout the region.

Complex market dynamics shape the APAC pet insurance ecosystem through interconnected forces affecting supply, demand, and competitive positioning. Supply-side dynamics include increasing insurer participation, product diversification, and distribution channel expansion, while demand-side factors encompass growing pet ownership, rising healthcare awareness, and evolving customer expectations.

Competitive dynamics intensify as traditional insurers compete with specialized pet insurance providers and insurtech startups, driving innovation in product features, pricing models, and customer experience. MarkWide Research analysis indicates that market consolidation trends may accelerate as larger players acquire innovative companies to enhance their technological capabilities and market presence.

Regulatory dynamics vary significantly across APAC markets, with some countries developing specific pet insurance frameworks while others apply general insurance regulations. Economic dynamics including currency fluctuations, inflation rates, and disposable income changes directly impact premium affordability and market growth potential across different countries.

Technology dynamics drive transformation through digital platforms, mobile applications, and data analytics capabilities that enhance underwriting accuracy and customer engagement. Social dynamics including changing lifestyle patterns, urbanization trends, and generational attitudes toward pet care continue reshaping market demand patterns and product preferences.

Comprehensive research methodology employed for APAC pet insurance market analysis incorporates multiple data collection and validation approaches to ensure accuracy and reliability. Primary research includes extensive surveys of pet owners, insurance providers, veterinary professionals, and industry stakeholders across major APAC markets to gather firsthand insights on market trends, preferences, and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic studies related to pet insurance and animal healthcare trends. Quantitative analysis utilizes statistical modeling to project market growth patterns, penetration rates, and competitive dynamics across different regional segments and product categories.

Qualitative research methods include in-depth interviews with industry executives, focus groups with pet owners, and expert consultations with veterinary professionals to understand market nuances and emerging trends. Data triangulation ensures research findings accuracy through cross-validation of information from multiple independent sources and methodologies.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct customer groups and their insurance preferences. Competitive intelligence gathering includes analysis of product offerings, pricing strategies, marketing approaches, and technological capabilities of major market participants throughout the APAC region.

Regional market analysis reveals significant variations in pet insurance adoption, regulatory environments, and growth potential across APAC countries. Australia maintains the most mature market with approximately 35% penetration rate among pet owners, driven by established veterinary infrastructure, high pet ownership rates, and consumer awareness of insurance benefits.

Japan represents the second-largest market with unique characteristics including preference for comprehensive coverage plans and strong integration with veterinary clinic networks. South Korea demonstrates rapid growth potential with increasing pet humanization trends and rising disposable incomes supporting premium insurance product adoption.

Singapore and Hong Kong showcase high-value markets with affluent pet owners willing to invest in comprehensive coverage options, while emerging markets including India, Thailand, and Vietnam present substantial long-term opportunities despite current low penetration rates. China represents the largest potential market with growing middle class and increasing pet ownership rates, though regulatory complexity and market entry barriers remain challenging.

Regional growth patterns indicate that developed markets focus on product sophistication and customer experience enhancement, while emerging markets prioritize affordability and basic coverage accessibility. Cross-border opportunities exist for regional expansion strategies and standardized product offerings adapted to local market conditions and regulatory requirements.

Dynamic competitive landscape encompasses diverse player categories including multinational insurance companies, regional specialists, and innovative insurtech startups competing across different market segments and geographic regions. Market leaders demonstrate competitive advantages through established distribution networks, comprehensive product portfolios, and strong financial capabilities.

Key market participants include:

Competitive strategies focus on product differentiation, technology integration, distribution channel expansion, and customer experience enhancement. Innovation areas include artificial intelligence-powered underwriting, telemedicine integration, and blockchain-based claims processing to improve operational efficiency and customer satisfaction.

Market segmentation analysis reveals distinct categories based on coverage type, pet species, distribution channel, and customer demographics. By Coverage Type, the market divides into accident-only policies, comprehensive health plans, wellness programs, and specialized coverage options for specific conditions or treatments.

By Pet Species:

By Distribution Channel:

By Customer Demographics, segmentation includes millennials and Gen Z pet owners driving digital adoption, affluent households seeking premium coverage, and price-sensitive segments requiring basic protection options.

Comprehensive category analysis provides detailed insights into specific market segments and their unique characteristics, growth patterns, and competitive dynamics. Accident-Only Coverage represents the entry-level segment attracting price-sensitive customers seeking basic protection against unexpected injuries and emergency treatments.

Comprehensive Health Plans demonstrate the highest growth potential with coverage including illnesses, hereditary conditions, and chronic disease management. These policies typically command premium pricing but offer superior customer retention rates and lifetime value. Wellness Programs integrate preventive care including vaccinations, routine checkups, and dental cleaning, appealing to proactive pet owners focused on long-term health maintenance.

Specialized Coverage Categories include breeding insurance for professional breeders, working animal coverage for service dogs, and exotic pet policies addressing unique healthcare requirements. Digital-First Products leverage technology for streamlined enrollment, claims processing, and customer communication, particularly appealing to younger demographics.

Premium vs. Basic Tiers create distinct value propositions with premium options offering unlimited coverage, specialist treatments, and additional benefits, while basic tiers focus on essential protection at affordable price points. Corporate Programs represent emerging categories where employers offer pet insurance as employee benefits, driving group enrollment and reduced acquisition costs.

Industry participants across the APAC pet insurance ecosystem realize significant benefits through market participation and strategic positioning. Insurance Providers benefit from diversified revenue streams, reduced correlation with traditional insurance lines, and opportunities for customer lifetime value expansion through cross-selling additional products and services.

Veterinary Professionals gain advantages through improved client relationships, reduced payment collection challenges, and enhanced treatment options when cost barriers are eliminated through insurance coverage. Pet Owners receive financial protection against unexpected veterinary expenses, access to better healthcare options, and peace of mind regarding their pets’ wellbeing.

Technology Partners benefit from growing demand for digital solutions including mobile applications, claims processing platforms, and data analytics tools that enhance operational efficiency and customer experience. Distribution Partners including pet retailers and online platforms generate additional revenue streams while strengthening customer relationships through value-added services.

Regulatory Bodies achieve improved animal welfare outcomes, reduced burden on public animal services, and enhanced consumer protection through standardized insurance products. Economic Benefits include job creation in insurance, technology, and veterinary sectors, while promoting responsible pet ownership and reducing abandonment rates due to financial constraints.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends reshape the APAC pet insurance landscape through technological innovation, changing consumer preferences, and evolving industry practices. Digital-First Strategies dominate market development with insurers prioritizing mobile-optimized platforms, artificial intelligence-powered customer service, and streamlined digital claims processing to meet modern consumer expectations.

Preventive Care Integration emerges as a key differentiator with wellness-focused policies incorporating routine veterinary care, vaccinations, and health monitoring services. MWR analysis indicates that preventive care policies demonstrate 45% higher customer satisfaction rates compared to traditional accident-only coverage options.

Telemedicine Adoption accelerates across the region with virtual veterinary consultations becoming standard coverage components, reducing costs while improving accessibility for routine health inquiries. Personalization Trends drive development of customized coverage options based on pet breed, age, lifestyle, and owner preferences through advanced data analytics and risk modeling.

Sustainability Focus influences product development with eco-friendly policies supporting sustainable veterinary practices and environmentally conscious pet care options. Corporate Benefits Integration expands as employers recognize pet insurance as valuable employee benefits that enhance retention and workplace satisfaction.

Significant industry developments demonstrate the dynamic nature of the APAC pet insurance market through strategic initiatives, technological advancements, and regulatory changes. Merger and Acquisition Activity intensifies as established insurers acquire specialized pet insurance providers and insurtech startups to enhance their market position and technological capabilities.

Technology Partnerships proliferate between insurance companies and veterinary software providers, creating integrated platforms that streamline claims processing and improve customer experience. Regulatory Developments in several APAC countries establish specific frameworks for pet insurance products, providing clarity for providers and enhanced consumer protection.

Product Launch Initiatives focus on innovative coverage options including breed-specific policies, senior pet programs, and comprehensive wellness plans that address evolving customer needs. Distribution Channel Expansion includes partnerships with major pet retail chains, online marketplaces, and veterinary clinic networks to increase market reach and accessibility.

International Expansion strategies see established providers entering new APAC markets through local partnerships, acquisitions, or direct market entry to capitalize on growing opportunities. Investment Activity increases with venture capital and private equity firms recognizing the sector’s growth potential and supporting innovative companies with funding for expansion and technology development.

Strategic recommendations for market participants focus on addressing key challenges while capitalizing on emerging opportunities throughout the APAC pet insurance landscape. Market Education Initiatives should prioritize consumer awareness campaigns highlighting insurance benefits and addressing common misconceptions about coverage limitations and claim processes.

Product Development Strategies should emphasize affordable entry-level options for price-sensitive segments while maintaining comprehensive premium offerings for affluent customers. Technology Investment remains critical for competitive positioning, particularly in artificial intelligence-powered underwriting, mobile applications, and integrated veterinary clinic payment systems.

Partnership Development with veterinary clinics, pet retailers, and digital platforms can significantly expand distribution reach while reducing customer acquisition costs. Regional Expansion strategies should prioritize emerging markets with growing middle-class populations and increasing pet ownership rates, while adapting products to local market conditions and regulatory requirements.

Customer Experience Enhancement through simplified enrollment processes, transparent policy terms, and efficient claims handling will drive customer satisfaction and retention. Data Analytics Utilization can improve risk assessment accuracy, enable personalized pricing, and identify cross-selling opportunities for enhanced customer lifetime value.

Future market prospects for APAC pet insurance demonstrate exceptional growth potential driven by fundamental demographic and economic trends supporting increased pet ownership and healthcare spending. Market expansion is projected to accelerate with penetration rates expected to reach 15-20% across major markets within the next decade, representing substantial growth from current levels.

Technology integration will continue transforming the industry through artificial intelligence, blockchain applications, and Internet of Things devices that enable real-time health monitoring and predictive analytics. Product innovation will focus on personalized coverage options, preventive care integration, and specialized policies addressing emerging pet healthcare trends and treatments.

Regional development patterns suggest that emerging markets will experience the highest growth rates as economic prosperity increases and pet ownership becomes more prevalent among middle-class households. Regulatory evolution across APAC countries will likely establish more standardized frameworks supporting market development and consumer protection.

Competitive landscape consolidation may accelerate as larger players acquire innovative companies to enhance their technological capabilities and market reach. MarkWide Research projections indicate that the market will continue evolving toward digital-first models with enhanced customer experience and streamlined operations driving sustainable growth across the region.

The APAC pet insurance market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by increasing pet ownership, rising healthcare awareness, and technological innovation. Market fundamentals remain strong across the region, with diverse opportunities for established insurers, specialized providers, and innovative startups to capture market share through differentiated products and superior customer experiences.

Key success factors include effective market education, affordable product offerings, technology integration, and strategic partnerships that expand distribution reach while reducing operational costs. Regional variations require tailored approaches that address local market conditions, regulatory requirements, and customer preferences while maintaining operational efficiency and profitability.

Future growth prospects depend on continued investment in technology, product innovation, and market development initiatives that address current barriers while capitalizing on emerging opportunities. The market’s transformation from a niche specialty product to mainstream insurance coverage reflects broader societal changes in pet ownership attitudes and healthcare priorities throughout the Asia-Pacific region.

What is Pet Insurance?

Pet insurance is a type of insurance policy that covers veterinary expenses for pets, including dogs and cats. It helps pet owners manage the costs associated with unexpected illnesses, accidents, and routine care.

What are the key players in the APAC Pet Insurance Market?

Key players in the APAC Pet Insurance Market include companies like Petplan, Allianz, and Figo Pet Insurance, which offer various coverage options for pet owners. These companies are known for their innovative policies and customer service, among others.

What are the growth factors driving the APAC Pet Insurance Market?

The growth of the APAC Pet Insurance Market is driven by increasing pet ownership, rising awareness of pet health, and the growing trend of pet humanization. Additionally, advancements in veterinary care and the introduction of diverse insurance products contribute to market expansion.

What challenges does the APAC Pet Insurance Market face?

Challenges in the APAC Pet Insurance Market include a lack of awareness among pet owners about insurance benefits and the complexity of policy terms. Additionally, varying regulations across countries can hinder market growth and consumer trust.

What opportunities exist in the APAC Pet Insurance Market?

Opportunities in the APAC Pet Insurance Market include the potential for product innovation, such as wellness plans and telemedicine services. Furthermore, expanding into emerging markets with increasing disposable incomes presents significant growth potential.

What trends are shaping the APAC Pet Insurance Market?

Trends shaping the APAC Pet Insurance Market include the rise of digital platforms for policy management and claims processing, as well as the increasing popularity of customizable insurance plans. Additionally, there is a growing focus on preventive care and wellness coverage.

APAC Pet Insurance Market

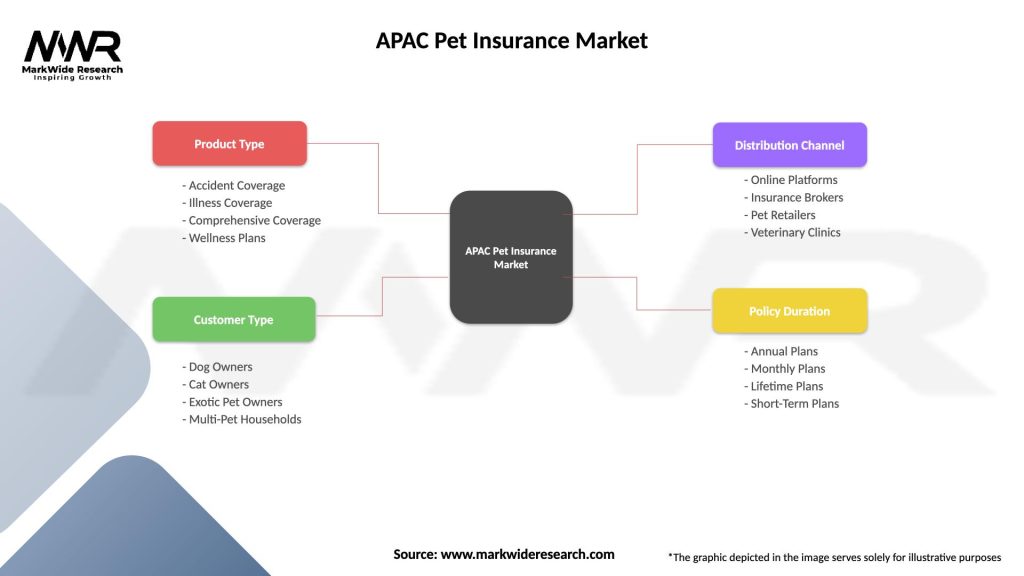

| Segmentation Details | Description |

|---|---|

| Product Type | Accident Coverage, Illness Coverage, Comprehensive Coverage, Wellness Plans |

| Customer Type | Dog Owners, Cat Owners, Exotic Pet Owners, Multi-Pet Households |

| Distribution Channel | Online Platforms, Insurance Brokers, Pet Retailers, Veterinary Clinics |

| Policy Duration | Annual Plans, Monthly Plans, Lifetime Plans, Short-Term Plans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Pet Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at